Business

With Zero Notice, U.K. Ferry Company Lays Off Hundreds of Workers Over Video

LONDON — A British ferry firm laid off 800 folks with fast impact on Thursday, a lot of them over video, resulting in worldwide journey disruptions and condemnation by authorities officers over its plan to chop service and change workers with cheaper labor.

On Friday, the corporate’s ferries have been at a standstill, with out workers to crew its ships. P&O Ferries, which is owned by DP World, a transport firm based mostly in Dubai, mentioned on its web site that there can be vital disruption to its companies over the subsequent few days because it turned “a extra aggressive and environment friendly operator.”

Staff, their households and group members attended protests on Friday within the English port cities of Hull, Dover and Liverpool and the Northern Irish port of Larne.

Mark Dickinson, the overall secretary of Nautilus Worldwide, a maritime employees’ commerce union, mentioned as he was leaving a protest of about 400 folks in Dover that he had by no means seen a second so low in his 40 years within the business.

“I simply suppose there’s been fairly a little bit of this hiring and firing currently, and that is the most recent instance,” he mentioned. “There’s weariness, and individuals are simply fed up.” In Britain, an island nation, seafarers should not considered important employees, despite the fact that they’ve labored all through the pandemic to convey meals, medication and different items to the nation, he mentioned.

Perceive the Provide Chain Disaster

He mentioned that P&O crew members obtained a discover early Thursday morning asking them to face by for an vital announcement, and that every one vessels had been referred to as to the port. A number of hours later, staff have been instructed over video by a human sources official that they have been dropping their jobs.

Ferries between England and France and the Netherlands have been canceled for the subsequent few days, P&O said on Twitter on Friday. The service disruption was prone to delay the motion of meals, medication and different items between Britain and the remainder of Europe, union officers mentioned.

In an e mail to workers members on Thursday, Peter Hebblethwaite, P&O’s chief govt, mentioned that the corporate was lowering its crewing prices by 50 % to set the enterprise up for progress. He mentioned that P&O Ferries had entered a brand new partnership with a world crewing firm, and that crew members from that firm would workers ships affected by the change.

In a press release on Friday, P&O acknowledged that “for our workers, this redundancy got here with out warning or prior session, and we totally perceive that this has brought about misery for them and their households.” The choice was “a final resort,” the corporate mentioned, including that the enterprise wouldn’t survive with out essentially modified crewing preparations.

The corporate mentioned that it had notified all affected crew members who have been engaged on Thursday in individual aboard their vessels, and that the video was used to tell 261 of the 800 staff who have been laid off.

Politicians expressed outrage in regards to the firings and got here underneath strain to withdraw authorities contracts with the agency. Robert Courts, the underneath secretary of state on the Division for Transport, mentioned in Parliament on Thursday that the way in which P&O had handled seafarers who had given years of service to the corporate was unacceptable.

“Studies of employees being given zero discover and escorted off their ships with fast impact, whereas being instructed cheaper alternate options would take up their roles, exhibits the insensitive means by which P&O has approached this situation — some extent I made crystal clear to P&O’s administration after I spoke to them earlier this afternoon,” he mentioned.

However opposition politicians mentioned phrases from the officers within the ruling Conservative Social gathering have been empty with out motion. Nicola Sturgeon, the chief of Scotland, tweeted that she had spoken immediately with the chief govt of P&O Ferries and expressed her “utter disgust at this appalling remedy of its employees.” She mentioned the Scottish authorities would do all the things it may to make sure their honest remedy.

“It’s a lot of the trendy administration method — to only deal with the work drive like scum on the expectation that you may get away with it,” he mentioned. “And that’s what occurred.”

Business

Supreme Court upholds a tax on corporate wealth held overseas

The Supreme Court on Thursday refused to put new limits on Congress’ power to tax wealth that is not paid out in annual dividends.

In a setback for anti-tax conservatives, the justices upheld a provision of a 2017 tax law that imposed a one-time levy on the profits of foreign corporations whose shares were owned by Americans.

In a 7-2 decision, the justices said Congress has the power to tax corporate shareholders based on the company’s “undistributed income.”

“This court has long upheld taxes of that kind, and we do the same today,” said Justice Brett M. Kavanaugh for the court.

The case came to the court as a test of whether the conservative majority would put constitutional limits on “wealth taxes.”

Instead, the justices upheld an income tax that is not based on annual dividends.

While the decision upheld a Trump-era tax, progressives and tax experts cheered the ruling.

“Today’s decision will allow Congress to continue to exercise its power to tax income to fund the government and to make sure that all taxpayers — including multinational corporations and wealthy taxpayers — pay their fair share,” said Chye-Ching Huang, executive director of the Tax Law Center at NYU Law.

Alexandra Thornton of the Center for American Progress said the ruling “means that wealthy people attempting to avoid taxes by offshoring their money have to pay their fair share, just like every other American. The court’s decision avoids an outcome that would have thrown the American tax system into disarray and put at risk other forms of taxation that raise billions of dollars in revenue.”

Some noted that the ruling was limited to an unusual tax provision.

“The court makes clear it is not opening the door to a wealth tax, which would still face constitutional problems as a tax on property,” said Joe Bishop-Henchman of the National Taxpayers Union.

Thursday’s decision did not resolve a persistent dispute over whether the Constitution’s approval of income taxes includes taxing shares of corporate stock, or instead is limited to “realized” gains, such as wages, stock sales and stock dividends.

“So the precise and narrow question that the court addresses today is whether Congress may attribute an entity’s realized and undistributed income to the entity’s shareholders or partners, and then tax the shareholders or partners on their portions of that income,” Kavanaugh wrote for the majority. “This court’s longstanding precedents, reflected in and reinforced by Congress’s longstanding practice, establish that the answer is yes.”

Justices Clarence Thomas and Neil M. Gorsuch dissented.

Thomas wrote that the 16th Amendment says income is “only income realized by the taxpayer. The text and history of the amendment make clear that it requires a distinction between ‘income’ and the ‘source’ from which that income is ‘derived.’ And, the only way to draw such a distinction is with a realization requirement.”

Some conservatives fear that a future Congress led by progressive Democrats would impose taxes on accumulated wealth.

They urged the court to hear the case of Moore vs. United States and to rule that Congress may not impose a tax on “property or wealth.”

At issue in the case was the meaning of the 16th Amendment, ratified in 1913. It says Congress has the power to “lay and collect taxes on incomes, from whatever source derived.”

A few years later, the Supreme Court said corporate shares held by taxpayers could not be taxed as income unless they were “realized or received” as income. That decision was generally understood to mean that the government may impose taxes on wages or stock dividends, but not necessarily on property or corporate wealth that grows in value. These are referred to as “unrealized gains.”

But many constitutional scholars and tax experts had questioned that interpretation of the 16th Amendment. And in recent decades, Congress has imposed taxes on individuals who are earning income in partnerships and have ownership shares in some corporations, even if dividends are not paid out each year.

The case of Charles and Kathleen Moore began when they received a $14,729 tax bill for their ownership shares of a company based in India.

The Moores, who are retired and live in Washington state, said they received no income or dividends from their investment in the company, which supplies equipment to small farmers. They sued, alleging the tax was unconstitutional under the 16th Amendment.

But a federal judge and the 9th Circuit Court of Appeals disagreed with them and upheld part of the 2017 tax bill passed by the Republican-controlled Congress and signed by President Trump. It imposed a one-time tax on Americans who owned shares in foreign corporations that gained in value. The tax measure included large tax breaks for the wealthy, but to offset those losses in tax revenue, lawmakers sought to recoup some profits that Americans held abroad.

With the backing of the U.S. Chamber of Commerce and other business groups, the Moores petitioned the court with the help of Washington attorney David B. Rivkin and urged the justices to strike down the tax on overseas profits.

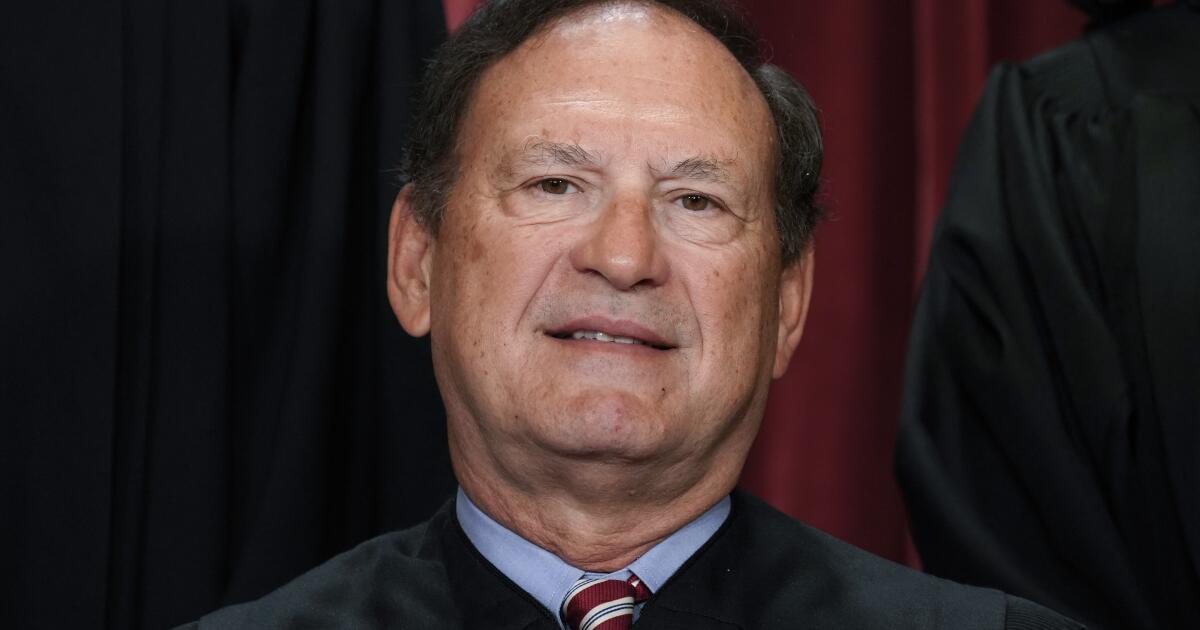

Some had called for Justice Samuel A. Alito Jr. to recuse himself from the matter.

Rivkin who helped write the appeal petition, interviewed Alito for two articles that appeared in the Wall Street Journal last year.

“There was no valid reason for my recusal in this case,” Alito wrote in response in September. “When Mr. Rivkin participated in the interviews and co-authored the articles, he did so as a journalist, not an advocate. The case in which he is involved was never mentioned; nor did we discuss any issue in that case either directly or indirectly.”

Alito concurred in the outcome Thursday.

Business

How Santa Clara chipmaker Nvidia became one of the world's most valuable companies in the AI boom

For more than a decade, with only a few interruptions, Apple held the title of the world’s most valuable company, becoming the first to top $3 trillion in market capitalization — mostly due to the iPhone, a device millions of investors use daily.

Recently, Apple was overtaken by Microsoft, and this week there was briefly a new king of Wall Street — once again a Bay Area company: Nvidia, which makes semiconductors in high demand for artificial intelligence applications. It’s the hottest stock around and the company has a market cap that tops $3.2 trillion.

Here’s what to know about the world’s leading AI chipmaker:

What role is Nvidia playing in the artificial intelligence industry?

Artificial intelligence programs are complex computer applications that rely on massive databases and processing power to produce their results. OpenAI’s ChatGPT-4, a much-talked about program released last year that generates text, is estimated to have 1.7 trillion “parameters,” or variables, about 10 times more than its 2020 predecessor — and the complexity is only growing. Nvidia makes a chip called the H100 accelerator that is able to process that data and is in high demand. This month it announced it is making an even more advanced chip.

Has Nvidia always made chips for artificial intelligence?

Nvidia went public in 1999 and for years was seen largely as a manufacturer of premium graphics cards sought after by gamers for their clarity in rendering high-speed visuals. The cards don’t come cheap, with Nvidia’s top-of-the-line GeForce RTX 4090 currently retailing around $1,700. But given its niche position in the industry, Nvidia stock lingered for years under $1 per share, adjusted for stock splits.

When did its fortunes improve?

During last decade’s crypto boom, its powerful chips were sought by “miners” of bitcoin, which employ computer banks to solve puzzles that reward them with cryptocurrency. The demand was so strong Nvidia launched a new chip specifically for miners as its stock surged from 87 cents in May 2016 to more than $7 in October 2018 — before the crypto bubble burst and shares fell under $4.

The fall prompted a shareholder lawsuit over accusations that the company hid how much revenue it was making on crypto-related sales. That suit is currently before the Supreme Court.

What happened after the collapse of the crypto boom?

Nvidia enjoyed a resurgence during the pandemic as Americans confined at home turned to their gaming computers. Its annual revenue shot up more than 50% to $16.7 billion in the fiscal year ending Jan. 31, 2021. The company’s cloud computing platform also grew as customers relied on the networks to handle the shift to remote work. Nvidia’s stock topped $19 a share in August 2022 before coming back to earth and trading below $12 later in the year as the pandemic waned.

When did the current stock surge begin?

Nvidia shares have been on a steady upswing since 2021 as the hype over artificial intelligence has become a frenzy — supported by the company’s strong sales growth. Nvidia’s revenue hit $60.9 billion in its fiscal year ending Jan. 31, 2024. Shares started the year at $48.17 and closed Tuesday at $135.58, a 180% gain that gave it a market value of about $3.34 trillion, briefly surpassing Microsoft.

Can the company keep it up?

Nvidia reported record fiscal fourth quarter revenue of $26 billion, up 262% from a year earlier, as demand for its chips grew beyond cloud-service providers to include consumer internet companies, governments and automotive and healthcare customers. The company’s revenue is projected to grow 44% annually in the near future, according to a FactSet survey of 60 analysts.

What other companies are benefiting from AI?

Microsoft has seen its own stock gain about 20% this year. That’s largely due to its partnership with OpenAI. Microsoft’s Bing browser now offers a chat function powered by Chat GPT-4 that can write emails and perform other tasks. Apple stock also hit a record high this week after it announced its Apple Intelligence platform, which will be integrated into its iPhone, iPad, and Mac lineups.

Is a lot of this just hype like crypto?

Many on Wall Street believe that artificial intelligence is in a different league than blockchain and cryptocurrency, with far more concrete applications. Advanced Micro Devices and Intel Corp. are rolling out new chips to counter Nvidia’s market dominance.

However, there are dissenting voices. Rob Arnott, founder of Newport Beach investment company Research Affiliates, has called Nvidia a great company but warned even last year that its stock performance is unsustainable.

“Overconfident markets paradoxically transform brilliant future business prospects into even more brilliant current stock price levels,” Arnott wrote in a research note. “Nvidia is today’s exemplar of that genre: a great company priced beyond perfection.”

Bloomberg News contributed to this report.

Business

State board approves protections for hot workplaces

Relief is on the horizon for California fast-food workers operating hot kitchen appliances, logistics workers in vast inland warehouses that lack cooling equipment and others laboring in hot indoor settings as a state agency Thursday approved new workplace protections against excessive heat.

A standards board at the California Division of Occupational Safety and Health voted unanimously to adopt safety measures that require employers to provide cooling areas and monitor workers for signs of heat illness when indoor workplaces temperatures reach or surpass 82 degrees.

If temperatures climb to 87 degrees, or workers are made to work near hot equipment, employers must take additional safety precautions by cooling the work site, allocating more breaks, rotating out workers or making other adjustments.

The new rules still must undergo a procedural legal review. If that review process is expedited the new rules could be in effect by late July or early August. Otherwise, they are likely to be in place by October.

Thursday’s vote marked the end of more than five years of delays in the effort to strengthen the state’s requirements for indoor working conditions. Most recently, a scheduled vote on the rules in March was cancelled after finance officials from Gov. Gavin Newsom’s administration raised last-minute concerns about the costs California prisons and other public entities would incur trying to adhere to the new rules.

In light of those concerns, the rules were amended to exclude state and local correctional facilities.

During a public comment period before the board voted, several people urged the board to pass the long-awaited measure.

Tim Shadix, legal director at Warehouse Worker, an advocacy group, said it “would be a tragedy,” if workers become sick from heat exposure this summer and hoped to see the rules in place “well before the end of summer.”

AnaStacia Nicol Wright, a policy manager at Worksafe, voiced concern about the decision to exclude correctional facilities, which employ tens of thousands of people in “archaic buildings with little protection from temperatures.”

Wright pressed the board should move swiftly to put pass separate protections for correctional staff and incarcerated workers.

California, in 2006, became the first state in the nation to implement heat standards for outdoor work, requiring employers to provide access to shade and water, and cool-down rests when workers need them. In high heat conditions, defined as temperatures of 95 degrees or higher, employers are required to remind workers of safe practices, encourage breaks and drinking water, and observe them for signs or symptoms of heat illness.

In 2016, the California Legislature turned its attention to indoor conditions, directing the Cal/OSHA to develop an indoor heat standard by 2019. The agency drafted a proposal mirroring the state regulations that protect outdoor workers, but the rule-making process moved slowly, blowing past the 2019 deadline.

Thursday’s vote came against the backdrop of recent shake-ups on the board that approved the rules.

Earlier this month, the Newsom administration removed worker safety expert Laura Stock and demoted David Thomas from his position as chair of the board after they criticized the 11th-hour decision to delay the vote in March.

Head of the California Labor Federation Lorena Gonzalez criticized the move, saying neither she nor other labor leaders had been consulted in advance.

“Obviously, we are disappointed. We think it’s a big loss for the board,” Gonzalez said. “We hope it’s not retribution for standing up for workers on heat standards.”

In recent years, as the state has experienced record-breaking heat waves, cooks, warehouse workers and delivery drivers have repeatedly raised concerns about high temperatures.

Victor Ramirez, who has worked in various warehouses in the Inland Empire over the past two decades, most recently at a facility in Fontana operated by Menasha Packaging, said many of the warehouses he’s worked in did not have air conditioning or fans. In recent years, fans and air conditioning have become more common, but they “aren’t very effective and those warehouses still feel hot,” he said.

“We need this rule in place right now. Workers need protections, they need training so they know the dangers of the job and working in heat,” Ramirez said. “It’s a basic right to work in a safe environment.”

-

Politics1 week ago

Politics1 week agoPresident Biden had front row seat to dog, Commander, repeatedly biting Secret Service agents: report

-

Politics1 week ago

Politics1 week agoBiden's attorney general is fighting back as the GOP-led House contemplates contempt

-

News1 week ago

News1 week ago171,000 Traveled for Abortions Last Year. See Where They Went.

-

Politics1 week ago

Politics1 week agoTrump travels to DC to meet with congressional Republicans, speak with nation's top business executives

-

Politics1 week ago

Politics1 week agoDurbin looks to force Supreme Court ethics bill vote amid Alito controversy

-

World1 week ago

World1 week agoThe far right will probably fall short in French legislative elections

-

World1 week ago

World1 week agoHezbollah rains rockets on Israel after senior commander killed

-

News1 week ago

News1 week agoPhotographer shares ‘magical’ photos of rare white bison calf at Yellowstone