Business

Who’s sending mystery Uber Eats orders to L.A. neighborhoods? The plot thickens

Separated by about 16 miles of traffic-snarled L.A. roads — and an earnings bracket or two — Westwood Hills and Highland Park might not look like they’ve so much in frequent.

However earlier this yr, the neighborhoods have been certain by an odd phenomenon: Days and days of undesirable meals deliveries from Uber Eats.

In Highland Park, the errant orders have been principally met with bemusement, as The Occasions beforehand reported. However in Westwood Hills, an prosperous neighborhood nestled between the UCLA campus and 405 Freeway, the free McNuggets have been hardly simply free McNuggets.

As deliveries from McDonald’s, Starbucks and different eating places piled up on folks’s doorsteps in late January, Terry Tegnazian, a member of the board of the Westwood Hills Property Homeowners Assn., started listening to from frightened neighbors, together with one man who thought there may very well be “one thing nefarious and felony happening.”

The resident, Tegnazian stated, puzzled whether or not the orders, which have been paid for and within the names of different folks, have been being despatched “as a method of casing homes, to see if anyone was dwelling for a attainable housebreaking.”

The speculation unfold rapidly, sparking alarm and main the householders group to report the matter to the Los Angeles Police Division. A Westwood Hills resident who requested that her identify not be disclosed over privateness considerations referred to as the handfuls of undesirable orders that she obtained “creepy and unnerving.”

“It felt invasive as a result of there was a revolving door of strangers dropping off meals,” she stated. “However is that what they have been actually doing?”

In the long run, although, no burglaries have been tied to the deliveries, which predated the same spate in Highland Park. Westwood Hills residents have been informed by Tegnazian in a Feb. 9 message on their non-public e mail community that the LAPD had “concluded that every one these deliveries will not be initiated by a housebreaking ring.” The LAPD didn’t reply to questions on its interplay with the householders group.

A spokesperson for Uber, the mother or father of Uber Eats, informed The Occasions that the San Francisco firm had been in touch with the LAPD, and there was no indication the undesirable deliveries have been immediately tied to any residential burglaries. The Uber consultant stated the corporate had banned some accounts from the platform and brought different unspecified steps to forestall misuse of the service.

“The studies of unsolicited deliveries are regarding,” the Uber spokesperson stated in an announcement. “We … won’t hesitate to take extra motion if the unsolicited orders proceed.”

Undesirable meals deliveries from Uber Eats accrued at a house in Westwood Hills on Feb. 2.

(Handout)

For a few of the armchair detectives in Westwood Hills and Highland Park who’ve concocted elaborate theories to clarify the avalanche of undesirable meals, the burglary-ring speculation appeared to be out, and it was again to the drafting board. However there was no scarcity of recent conjecture. Among the many explanations floated have been these centered on the deliveries being the product of a college psychology experiment, a GPS glitch, a advertising and marketing ploy and a phishing scheme concentrating on drivers.

Alhough attending to the underside of the Uber Eats thriller could seem unimportant — particularly given every part else that is occurring on the planet — the truth that the stakes are so low could also be what makes it such an irresistible matter of hypothesis. That is, in any case, a whodunit that’s centered on free meals. It’s “principally one thing that’s not terrifying,” stated sociologist Malka Older, creator of the science fiction novel “Infomocracy.”

“Anyone is doing one thing, and it’s laborious to clarify,” stated Older, a school affiliate at Arizona State College. “That’s why we learn thriller novels. Some sort of plot has occurred. There’s something happening right here that’s price one thing in both cash or satisfaction. That makes us curious.”

Good mysteries make good neighbors

The Westwood Hills deliveries had stopped by mid-February. And residents in Highland Park, the place the undesirable orders started arriving in late February, stated they’d obtained none since The Occasions wrote about that group’s ordeal March 15.

In contrast to in Westwood Hills, residents on Vary View Avenue in Highland Park — a hip neighborhood in style amongst artistic sorts — principally appeared puzzled by the deliveries. And in the event that they wished to pattern a free Shamrock shake or two, effectively, why not?

It’s a distinction famous by Vary View resident Will Neal, who stated he’d obtained about 40 of the Uber Eats deliveries.

“Westwood was fully positive it was folks attempting to hunt out their homes to burglarize them,” stated Neal, a documentary movie editor. “My neighborhood got here to the close to consensus that it was some kind of bizarre promotion for these [food] corporations.”

Undesirable orders from McDonald’s and Starbucks have been delivered to a Highland Park dwelling Feb. 28.

(Morgan Currier)

Older was additionally struck by the differing reactions.

“The elemental factor is … can we really feel threatened by something unknown?” she requested. “There are the people who find themselves sort of skilled [to say], ‘Yeah, after all they’re going to attempt to come get our stuff.’ And the individuals who [say], ‘Our stuff isn’t that nice — it’s wonderful — why would somebody need it badly?’”

Older additionally emphasised a constructive that had come out of the state of affairs for each Highland Park and Westwood Hills: the strengthening of neighborly bonds, one undesirable McDonald’s McCrispy at a time.

Certainly, a resident in Highland Park beforehand informed The Occasions that she and neighbors had contemplated “doing slightly podcast” concerning the episode. In Westwood Hills, in the meantime, there was a vigorous dialogue concerning the Uber Eats deliveries on the non-public e mail community. And neighbors additionally appeared out for each other. Tegnazian stated some residents would take away deliveries from the doorsteps of individuals they knew to be out of city in order that the meals wouldn’t pile up and level to the truth that these homes have been unoccupied.

“You had folks receiving this who have been truly forming group round it as a result of they have been speaking to one another about it,” Older stated.

The creator couldn’t assist riffing on the thriller. She joked that she might think about the saga as the topic of a procedural TV drama. “I can even image a chilly open to a type of reveals … it appears foolish after which there’s a physique in your McCrispy,” she stated.

An intriguing idea

Though the deliveries stopped in Highland Park, a brand new idea trying to clarify them has emerged in latest days. It facilities on a reasonably well-known phishing rip-off affecting Uber Eats drivers — one which’s been the topic of a number of information studies.

Right here’s the way it sometimes performs out, based on a handful of gig employees interviewed by The Occasions: First, a courier receives discover of an incoming order by way of Uber Eats’ cell app. After selecting up the meals from an eatery, she or he will get a message from the shopper canceling the supply. Then the courier will get a name from somebody purporting to be a consultant of Uber Eats, who claims to want the motive force’s login credentials to course of a credit score for the canceled order. With these particulars in hand, the scammer drains the funds from the courier’s Uber Eats account.

An order from McDonald’s delivered by Uber Eats sits in entrance of a house in Highland Park on Feb. 28. The resident didn’t order the meals.

(Morgan Currier)

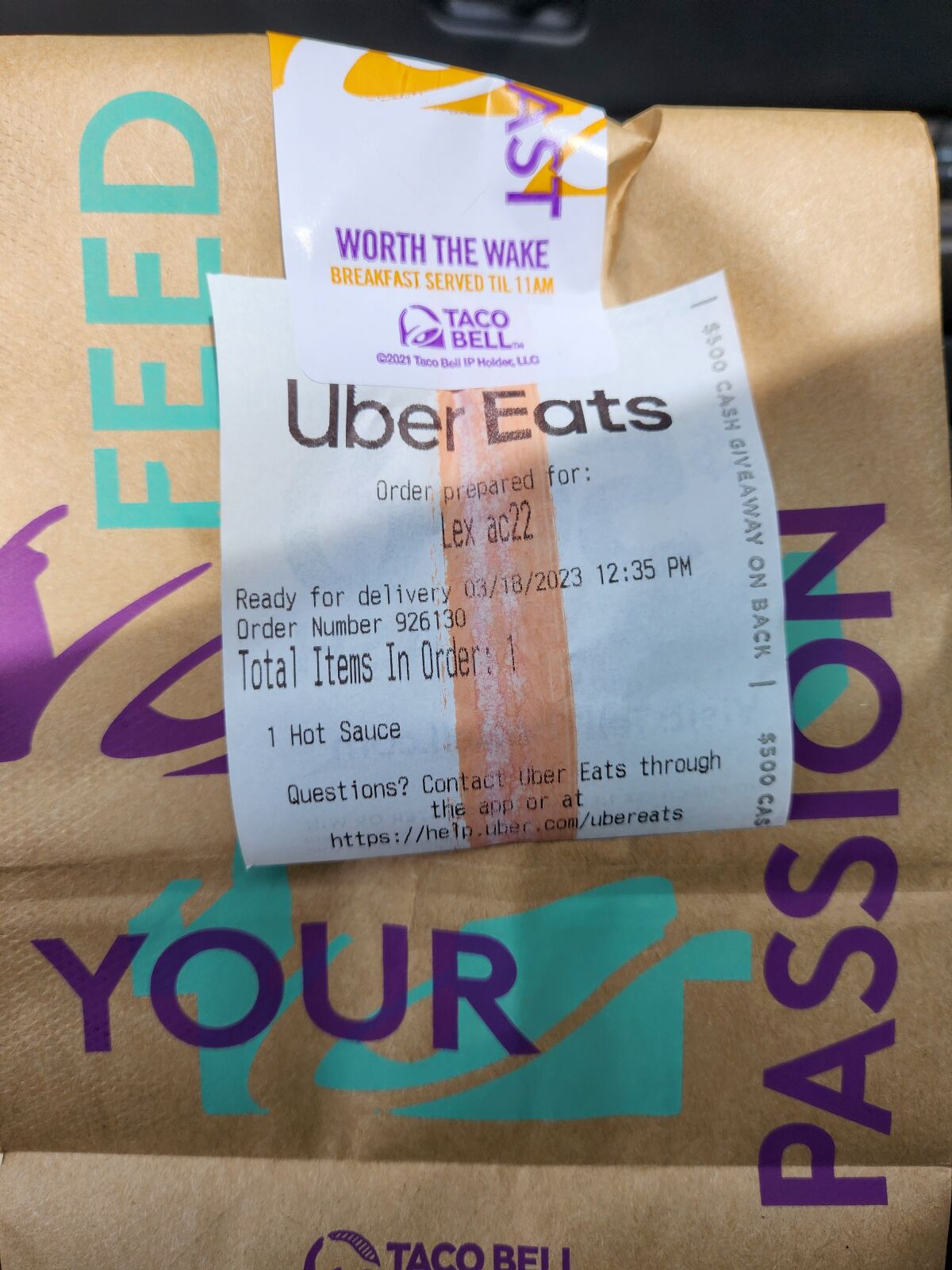

Uber Eats driver Guner Harris, 21, stated he skilled a model of the rip-off March 18 after agreeing to ship meals from a Taco Bell location in Clermont, Fla. He stated that the order he retrieved from the restaurant instantly drew his suspicion: It contained one scorching sauce packet — and nothing else.

As soon as the shopper canceled the supply, Harris stated, he acquired a name on his cell phone, which displayed “Uber” because the caller. When the individual requested Harris’ Uber Eats username and password to problem compensation, he refused, hung up and reported the incident to the corporate.

“They stated it was a rip-off — that they’ve gotten studies of individuals pretending to be Uber assist,” Harris stated, including that he believes the errant deliveries in L.A. bear the hallmarks of the kind of scheme he deflected.

Uber Eats driver Guner Harris obtained a request to ship a single packet of Taco Bell scorching sauce March 18 in Clermont, Fla.

(Guner Harris)

Uber’s spokesperson stated that the corporate had not seen exercise in its system that indicated a phishing rip-off was linked to the unsolicited deliveries in Highland Park and Westwood Hills. The corporate consultant additionally famous that it educates couriers about greatest practices to keep away from phishing makes an attempt, together with using two-factor authentication for logging into its system.

LAPD Capt. Kelly Muniz stated that the division didn’t “have something connecting” the undesirable deliveries in L.A. to a phishing scheme “as of now.”

A number of latest media studies have detailed variations of the canceled-order phishing scheme. A narrative printed by Marketwatch in July referred to as it one in every of “the most typical scams” affecting meals supply personnel. The article described the ordeal of an Uber Eats courier in New Mexico who misplaced greater than $300 to a scammer. Since 2021, comparable tales have been printed by Santa Clarita’s KHTS FM 98.1 radio station and KNBC-TV Channel 4, amongst others. Among the studies have centered on drivers for Postmates, which was acquired by Uber in 2020.

“It’s simply incorrect to do that to drivers — a few of us are working 60, 70, 80 hours per week,” stated Nicole Moore, a Lyft driver and president of Rideshare Drivers United, a labor advocacy group for Uber and Lyft drivers. “The scamming is ridiculous; it’s horrible. You’re not stealing from individuals who can afford it.”

Letting it go

Over in Westwood Hills, householders could be higher insulated from such financial woes — however that didn’t make them any much less cautious.

At one level, Tegnazian stated, she had requested the LAPD officer who liaises with Westwood Hills if the difficulty of the undesirable Uber Eats deliveries wanted to be escalated.

“I requested him if we should always contact the FBI for a attainable cybercrime,” she stated.

Quickly, although, the deliveries stopped coming.

It has been greater than six weeks since Westwood Hills was tormented by the errant orders. The specter of criminality not looms over the leafy group. Residents, Tegnazian stated, appear to have principally put aside worries that they have been the goal of an illegal scheme.

“We simply let it go,” she stated.

Occasions employees writers Suhauna Hussain and Richard Winton contributed to this report.

Business

In big win for business, Supreme Court dramatically limits rulemaking power of federal agencies

In a major victory for business, the Supreme Court on Friday gave judges more power to block new regulations if they are not explicitly authorized by federal law.

The court’s conservative majority overturned a 40-year-old rule that said judges should defer to agencies and their regulations if the law is not clear.

The vote was 6 to 3, with the liberal justices dissenting.

The decision signals a power shift in Washington away from agencies and in favor of the businesses and industries they regulate. It will give business lawyers a stronger hand in challenging new regulations.

At the same time, it deals a sharp setback to environmentalists, consumer advocates, unions and healthcare regulators. Along with the Biden administration, they argued that judges should defer to agency officials who are experts in their fields and have a duty to enforce the law.

This deference rule, known as the Chevron doctrine, had taken on extraordinary importance in recent decades because Congress has been divided and unable to pass new laws on pressing matters such as climate change, online commerce, hospitals and nursing care and workplace conditions.

Instead, new administrations, and in particular Democratic ones, sought to make change by adopting new regulations based on old laws. For example, the climate change regulations proposed by the Obama and Biden administrations were based on provisions of the Clean Air Act of 1970.

But that strategy depended on judges being willing to defer to the agencies and to reject challenges from businesses and others who maintained the regulations went beyond the law.

The court’s Republican appointees came to the case skeptical of the Chevron doctrine. They fretted about the “administrative state” and argued that unelected federal officials should not be afforded powers typically reserved for lawmakers.

“Chevron is overruled,” Chief Justice John G. Roberts Jr. wrote Friday for the majority. “Courts must exercise their independent judgment in deciding whether an agency has acted within its statutory authority.” Judges “may not defer to an agency interpretation of the law simply because a statute is ambiguous,” he added.

In dissent, Justice Elena Kagan said the Chevron rule was crucial “in supporting regulatory efforts of all kinds — to name a few, keeping air and water clean, food and drugs safe, and financial markets honest. And the rule is right,” she said. It now “falls victim to a bald assertion of judicial authority. The majority disdains restraint, and grasps for power.” Justices Sonia Sotomayor and Ketanji Brown Jackson agreed.

Senate Majority Leader Charles E. Schumer (D-N.Y.) voiced outrage. “In overruling Chevron, the Trump MAGA Supreme Court has once again sided with powerful special interests and giant corporations against the middle class and American families. Their headlong rush to overturn 40 years of precedent and impose their own radical views is appalling.”

Experts said the impact of the ruling may not be clear for some time.

Washington attorney Varu Chilakamarri said the ruling means “industry’s interpretation of the law will be viewed as just as valid as the agency’s. It will be some time before we see the effects of this decision on the lawmaking process, but going forward, agency action will be under even greater scrutiny and there will likely be more opportunities for the regulated community to challenge agency rules and adjudications.”

In decades past, the Chevron doctrine was supported by prominent conservatives, including the late Justice Antonin Scalia. In the 1980s, he believed it was better to entrust decisions about regulations to agency officials who worked for the president rather than to unelected judges. He was also reflecting an era when Republicans, from Richard Nixon and Gerald Ford to Ronald Reagan and George H.W. Bush, controlled the White House.

But since the 1990s, when Democrat Bill Clinton was president, conservatives have increasingly complained that judges were rubber-stamping new federal regulations.

Business lawyers went in search of an attractive case to challenge the Chevron doctrine, and they found it in the plight of four family-owned fishing boats in New Jersey.

Their case began with a 1976 law that seeks to conserve the stocks of fish. A regulation adopted by the National Marine Fishery Service in 2020 would have required some herring boats to not only carry a federal monitor on board, but also pay the salary of the monitor. Doing so was predicted to cost more than $700 a day, or about 20% of what the fishing boats earned on average.

The regulation had not taken effect, but it was upheld by a federal judge and the D.C. Circuit Court’s appellate judges who deferred to the agency’s interpretation of the law.

Business

State Farm seeks major rate hikes for California homeowners and renters

State Farm General is seeking to dramatically increase residential insurance rates for millions of Californians, a move that would deepen the state’s ongoing crisis over housing coverage.

In two filings with the state’s Department of Insurance on Thursday signaling financial trouble for the insurance giant, State Farm disclosed it is seeking a 30% rate increase for homeowners; a 36% increase for condo owners; and a 52% increase for renters.

“State Farm General’s latest rate filings raise serious questions about its financial condition,” Ricardo Lara, California’s insurance commissioner, said in a statement. “This has the potential to affect millions of California consumers and the integrity of our residential property insurance market.”

State Farm did not return requests for comment.

Lara noted that nothing immediately changes for policyholders as a result of the filings. His said his department would use all of its “investigatory tools to get to the bottom of State Farm’s financial situation,” including a rate hearing if necessary, before making a decision on whether to approve the requests.

That process could take months: The department is averaging 180 days for its reviews, and complex cases can take even longer, according to a department spokesperson.

The department has already approved recent State Farm requests for significant home insurance rate increases, including a 6.9% bump in January 2023 and a 20% hike that went into effect in March.

State Farm’s bid to sharply increase home insurance rates seeks to utilize a little-known and rarely used exception to the state’s usual insurance rate-making formula. Typically, such a move signals that an insurance provider is facing serious financial issues.

In one of the filings, State Farm General said the purpose of its request was to restore its financial condition. “If the variance is denied,” the insurer wrote, “further deterioration of surplus is anticipated.”

California is facing an insurance crisis as climate change and extreme weather contribute to catastrophic fires that have destroyed thousands of homes in recent years.

In March, State Farm announced that it wouldn’t renew 72,000 property owner policies statewide, joining Farmers, Allstate and other companies in either not writing or limiting new policies, or tightening underwriting standards.

The companies blamed wildfires, inflation that raised reconstruction costs, higher prices for reinsurance they buy to boost their balance sheets and protect themselves from catastrophes, as well as outdated state regulations — claims disputed by some consumer advocates.

As insurers have pulled back from the homeowners market, lawmakers in Sacramento are scrambling to make coverage available and affordable for residents living in high-risk areas.

Times staff writer Laurence Darmiento contributed to this report.

Business

High interest rates are hurting people. Here's why it's worse for Californians

By the numbers, the overall U.S. economy may look good, but down at the street level the view is a lot grimmer and grittier.

The surge in interest rates imposed by the Federal Reserve to slow inflation has closed like an acrid cloud over would-be homeowners, car buyers, growing families, and businesses new and old, large and small. It has meant missing opportunities, settling for less — and waiting and waiting and waiting.

It’s not that the average American is underwater. It’s that many feel that they’re struggling more than they anticipated and feel more constricted. In the American Dream, if you work hard, things are supposed to get better. Fairly or not, that may be a big part of why so many voters have expressed unhappiness with President Biden’s handling of the economy.

The cost of borrowing, whether for mortgages, credit cards or car loans, is the highest in more than two decades. And that is weighing especially hard on people in California, where housing, gas and many other things are more expensive than in most other states.

California’s economy also relies more on interest rate-sensitive sectors such as real estate and high tech, which helps explain why the state has been lagging in job growth and its unemployment rate is the highest in the nation.

Harder to budget

When interest rates rise, savers can earn more on their deposits. But in America’s consumer society, for most people higher rates mean that a lot of things cost a little (or a lot) more. That makes it harder to stretch an individual or family budget. It may mean giving up on the nicer car you had your heart set on, or settling for a smaller house, or a shorter, less glamorous vacation.

And with every uptick in interest rates, which is almost inevitably passed on to customers, some have had to give up on a purchase entirely.

Geovanny Panchame, a creative director at an advertising agency, knows these feelings all too well: He thinks often about what could have been if he and his wife had bought the starter home they were planning for in 2020.

Back then, they had been pre-approved at an interest rate of 3.1% — right around the national average — but were outbid several times. They figured they’d wait a few years to save more money for a nicer place.

Four years later, the couple are still renting an apartment in Culver City — and now they’re expecting their first child.

Pushing to buy a house and get settled before their son is born in December, they recently made an $885,000 offer for a three-bedroom, 1.5-bath home in Inglewood. They plan to put down 10%. At the current average mortgage interest rate of 7%, that would mean a monthly payment of about $5,300 — $1,900 more than if they had an interest rate of 3.1%.

The source of that increase is the Federal Reserve’s power to set basic interest rates, which determines the interest rates for almost everything else in the economy. The Fed’s benchmark rate went up rapidly, from near zero in early 2022 to a generational high of about 5.5%, where it has been for almost a year. The rate has been higher in the past, but after two decades in which it was mostly at rock bottom, most people had gotten used to both very low inflation and low interest rates.

“Clearly, we look back and we probably should have kept going and hopped into something,” Panchame, 39, said. “I’ve been really sacrificing a lot to get to this point to purchase a home and now I just feel like I got here but I didn’t work quick enough because interest rates have gotten the better of me.”

Add property taxes and home insurance, and it’s even more painful for home buyers because those costs have also risen sharply since the COVID-19 pandemic, along with housing prices themselves.

A typical buyer of a mid-tier home in California, priced at about $785,000 in the spring, was looking at a total housing payment of about $5,900 a month. That’s up from $3,250 in March of 2020 and almost $4,600 in March of 2022, when the Fed began raising interest rates, according to the California Legislative Analyst’s Office.

It wasn’t supposed to work like that: Lifting interest rates as fast and as high as the Fed did, in its effort to curb inflation, should have led to falling home prices.

But that didn’t happen, mainly because relatively few homes came on the market. Most existing homeowners had locked in lower mortgage rates before the surge; selling those houses once interest rates took off would have meant paying higher prices and interest rates on other homes, or bloated rents for apartments.

For most homeowners sitting on the low rates of the past, their financial well-being was further supported by low unemployment and incomes that generally remained on par with inflation or grew a little faster. And many had cushions of savings built up in early phases of the pandemic, thanks partly to government support.

All of which has kept the U.S. economy as a whole humming along, blunting the full effects of higher interest rates.

“Consumers are doing their job,” said Claire Li, senior analyst at Moody’s Investors Service, though she added that there are now signs of slower spending, evidenced by consumers cutting back on credit card purchases.

Unlike most home loans, credit card interest rates aren’t fixed. And today the average rate has bounced up to almost 22% from 14.6% in 2021, according to Fed data. That’s starting to squeeze more borrowers, adding to their unease.

Rising credit card debt

In California, the 30-day delinquency rate on credit cards is nearing 5% — something not seen since late 2009 around the end of the Great Recession, according to the California Policy Lab at UC Berkeley.

Lower-income and younger borrowers are more prone to falling behind on credit card, auto and other consumer loan payments than those with higher incomes. And it’s these groups that are feeling the effects of higher interest rates the most.

Christian Shorter, a self-employed tech serviceman who lives in Chino, just bought a used Volkswagen Jetta for $21,000. He put down $3,500 and financed the rest over 69 months at an annual interest rate of 24%. His monthly payment is more than $480, and by the end of the loan he will have paid about $15,000 in interest.

Shorter, 45, said he doesn’t have good credit. He plans to take out a personal loan when interest rates drop and pay off the car debt. “Definitely, definitely, they should lower interest rates,” he said of the Fed.

Between the jump in interest rates and prices of new vehicles, some auto buyers have downgraded to cheaper models. The biggest shift, though, especially in California, has been a move by more buyers to turn to electric vehicles to save on fuel costs, says Joseph Yoon, a consumer analyst at Edmunds, the car research and information firm in Santa Monica.

In May, he said, buyers on average financed about $41,000 on a new vehicle purchase at an interest rate of 7.3% (compared with 4.1% in December 2021). Over 69 months, that translates to a monthly payment of $745.

“For a big part of the population, they’re looking at this car market and saying, ‘I got to wait for something to break,’ like interest rates or dealer incentives,” Yoon said.

For a lot of small-business owners, who drive much of the economy in Los Angeles, they don’t have the luxury of waiting it out. They need funds to survive, or to expand when things are going well.

But many can’t qualify with traditional commercial lenders, and when they can they’re typically looking at interest rates of 9%; that’s more than double what they were before the Fed’s rate hikes, according to surveys by the National Federation of Independent Business.

One result: More and more people in Southern California are looking for help from lenders such as Brea-based Lendistry, one of the nation’s largest minority-led community development financial institutions.

From January to May, applications were up 21% and the dollar volume of loans rose 33% compared with a year earlier, said Everett Sands, Lendistry’s chief executive. Interest rates on his loans range from 7.5% to 14.5%.

“Business owners, they’re resilient, entrepreneurial, scrappy — they’ll figure out a way,” he said, adding that he sees many doing side jobs like driving for Uber or making Instacart deliveries at night.

Even so, Sands said, the higher borrowing costs inevitably mean less money spent on things like investing in new technology and software and bringing on additional staff, as well as delays in owners growing their businesses.

“Some of them lose out in progressing forward.”

‘When you put everything on the line, you get desperate.’

— Jurni Rayne, Gritz N Wafflez

Jurni Rayne, 42, started her brunch business, Gritz N Wafflez, as a ghost kitchen in February 2022, preparing food orders for delivery services. She financed that by maxing out her credit cards and getting a merchant cash advance, which is like a payday loan with super high interest rates. Her debts reached $70,000.

“When you put everything on the line, you get desperate,” said Rayne, a Dallas native who moved to Los Angeles a decade ago and has worked as a manager at California Pizza Kitchen and the Cheesecake Factory. “You don’t care about the interest rate, because it’s something like between passion and insanity.”

She has since paid off all the merchant loans. And her business has seen such strong growth that last year Rayne got out of the ghost kitchen and into a small spot in Pico-Union, starting with just three tables. She now has 17 tables and a staff of 14.

This fall she’ll be moving to a bigger location in Koreatown and has her sights on a second restaurant in South Los Angeles. But she frets that she could have expanded sooner if interest rates had been lower and she’d had more access to financing.

Economists call that an opportunity cost. For Rayne, it’s personal.

“Absolutely, lower interest rates would have helped me,” she said.

For many others, the wait for lower rates continues without the balm of intermediate success.

Lynn Miller, 60, began looking to buy a home in Orange County about a year ago, hoping to upgrade from her current 1,600-square-foot apartment.

“It’s not bad, it’s just not mine — the dishwasher is crappy, the washing machine is old,” she said of her rental in Corona del Mar. “I’m obviously not going to invest in these appliances. It’s just different not owning your own home.”

It’s been a discouraging process, she said, especially when she inputs her numbers into the mortgage calculators on Zillow and Realtor.com, which churn out estimates based on current interest rates.

“If you look at those monthly payment numbers, it’s shocking,” Miller, a marketing consultant, said. “It’ll get better, but it’s just not better right now.”

She’s continuing her house search — she’d love to buy a single-family, three-bedroom home with a backyard for a dog — but is holding off for now.

“I’m still waiting because I do think that interest rates are going to go down,” Miller said, although she knows it’s a guessing game. “I could end up waiting a long time.”

-

News1 week ago

News1 week agoRead the Ruling by the Virginia Court of Appeals

-

News1 week ago

News1 week agoTracking a Single Day at the National Domestic Violence Hotline

-

Fitness1 week ago

Fitness1 week agoWhat's the Least Amount of Exercise I Can Get Away With?

-

News1 week ago

News1 week agoSupreme Court upholds law barring domestic abusers from owning guns in major Second Amendment ruling | CNN Politics

-

Politics1 week ago

Politics1 week agoTrump classified docs judge to weigh alleged 'unlawful' appointment of Special Counsel Jack Smith

-

Politics1 week ago

Politics1 week agoSupreme Court upholds federal gun ban for those under domestic violence restraining orders

-

Politics1 week ago

Politics1 week agoNewsom seeks to restrict students' cellphone use in schools: 'Harming the mental health of our youth'

-

Politics1 week ago

Politics1 week agoTrump VP hopeful proves he can tap into billionaire GOP donors

/cdn.vox-cdn.com/uploads/chorus_asset/file/25510864/airgo_vision_3.jpg)