Business

Video: U.A.W. Calls for ‘Stand Up’ Strike

new video loaded: U.A.W. Calls for ‘Stand Up’ Strike

transcript

transcript

U.A.W. Calls for ‘Stand Up’ Strike

In Detroit, Shawn Fain, president of the United Auto Workers union, announced a strategy on Thursday calling on select facilities to strike in order to “keep the companies guessing.”

-

Tonight, for the first time in our history, we will strike all three of the Big Three at once. We are using a new strategy, the “stand up” strike. We will call on select facilities, locals or units to stand up and go on strike. This strategy will keep the companies guessing. It will give our national negotiators maximum leverage and flexibility in bargaining. And if we need to go all out, we will. This is our generation’s defining moment. The money is there. The cause is righteous. The world is watching. And the U.A.W. is ready to stand up. This is our defining moment. Thank you.

Recent episodes in Automobiles

Business

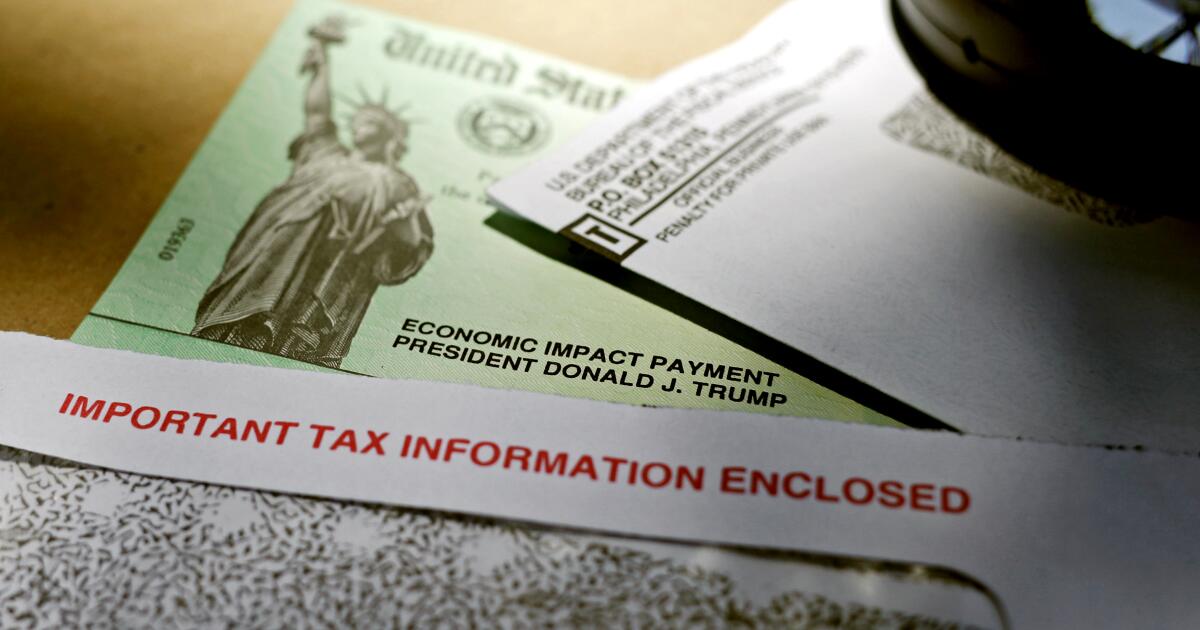

Santa, aka the IRS, might be dropping $1,400 into your stocking this year

Everyone’s favorite Christmas gift giver, the Internal Revenue Service, has announced that it will be doling out more than $2 billion in checks to Americans this month as part of its effort to make sure everyone received their stimulus payments from 2021.

The federal tax agency has announced that an internal review showed many Americans had never received their economic impact payments, which were supposed to go out following the filing of 2021 tax returns. Because of this, the agency is paying out the money they still owe Americans who never received their checks.

Although most eligible Americans received their stimulus payments, the checks will be sent to those who qualified but filed a 2021 tax return that left the space for recovery rebate credit blank.

Those people are eligible for up to $1,400 from the federal government. The payments should be received by late January 2025, at the latest.

“These payments are an example of our commitment to go the extra mile for taxpayers. Looking at our internal data, we realized that 1 million taxpayers overlooked claiming this complex credit when they were actually eligible,” said IRS Commissioner Danny Werfel. “To minimize headaches and get this money to eligible taxpayers, we’re making these payments automatic, meaning these people will not be required to go through the extensive process of filing an amended return to receive it.”

Stimulus payments of $1,400 were sent out to Americans as part of a $1.9-trillion COVID-19 relief bill. Millions of Americans were eligible for the payments.

To get a check, Americans were required to make less than $75,000 per year or under $150,000 as a household.

Business

Column: Trump-friendly billionaires are taking aim at the federal agencies that protect workers and consumers

“If the law is against you, talk about the evidence. If the evidence is against you, talk about the law, and, … if the law and the evidence are both against you, then pound on the table and yell like hell.”

Thus the poet Carl Sandburg’s version of an ancient lawyer’s adage in his epic poem, “The People, Yes.” It isn’t his fault that his rendering is incomplete, since he was writing in 1936 and the modern legal mind has cooked up a further advisory, applicable when the entity against you is a government agency: If pounding the table and yelling won’t succeed, then get your adversary declared unconstitutional.

That’s the weapon being wielded at this moment against the National Labor Relations Board and the Consumer Financial Protection Bureau. The first was created by Congress in 1935 to protect workers’ organizing and bargaining rights, the second in 2010 to protect consumers from ripoffs by financial service firms.

The NLRB and the courts have recognized for years that delay to a union certification and the bargaining process causes irreparable loss of support among employees.

— Teamster attorney Julie Gutman Dickinson

Those agencies are under assault by two of the richest men in the world: Elon Musk, who controls Tesla and SpaceX, among other enterprises, and Jeff Bezos, the founder and executive chair of Amazon. To put it succinctly, these are agencies devoted to serving the little guy by fighting battles against Big Business. Is there any mystery about why they’re targeted by billionaires?

I reported in January on the effort by SpaceX to persuade a federal judge to declare the NLRB unconstitutional.

Amazon is pursuing the same goal in its own fight with the NLRB, in which it’s trying to stave off an order that it enter into contract negotiations with 8,000 workers at a warehouse in Staten Island, N.Y. Amazon is also trying to overturn the victory in the workers’ 2022 vote by a union that subsequently affiliated with the Teamsters.

As for the CFPB, Musk on Nov. 26 tweeted, “Delete CFPB…. There are too many duplicative regulatory agencies.” He was responding to a fatuous spiel by venture investor Marc Andreessen, who in an appearance on Joe Rogan’s webcast called the CFPB “Elizabeth Warren’s personal agency, which she gets to control.” Sen. Warren (D-Mass.) conceived of the agency and pushed for its creation after the recession of 2008, but she has zero “control” over it.

As Helaine Olen of the American Economic Liberties Project has observed, what really sticks in Andreessen’s craw about the CFPB is that it has worked to protect consumers from financial services outfits, including fintech firms in which Andreessen, along with other Silicon Valley bros, has invested. (I asked Andreessen via his substack column to expand on his claims, but haven’t heard back.) Rogan, wearing his persona as a babe-in-the-woods naif, listened to this nonsense in slack-jawed stupefaction.

“Duplicative”? What makes the CFPB so important is that it’s virtually unique among federal agencies in possessing the explicit responsibility to protect ordinary Americans from the depredations of financial snake-oil sales forces.

In its more than 13 years of existence, the bureau has secured more than $17.5 billion in compensation and other relief for consumers mulcted by the financial services industry and built up a victims relief fund worth more than $4 billion.

Musk’s campaign against these two agencies warrants notice because of his elevated role within the coming Trump administration. Along with Vivek Ramaswamy, another right-wing activist, he has been anointed as head of a Department of Government Efficiency, with the goal of rooting out supposed sources of government waste. If Musk uses that perch to wage his personal campaign against the NLRB, that could make things, um, complicated for Trump’s nominee for Secretary of Labor, the pro-union Lori Chavez-DeRemer.

That brings us to the claims that the agencies are unconstitutional. I asked SpaceX and Amazon to comment on their lawsuits. SpaceX hasn’t replied. Amazon, through spokesperson Eileen Hards, said it filed its lawsuit raising the issue “because we believe the NLRB is acting beyond its mandate, including by having its Members serving as both prosecutors and judges on the same case. This is a clear violation of separation of powers, and furthermore, they feel emboldened to do so because they are unconstitutionally insulated from removal.”

The company said further that it doesn’t believe the “election process was fair, legitimate, or representative of what the majority of our team wants…. We’ll continue to use all legal avenues available to us as we believe the decision will be overturned when it’s reviewed by an unbiased court.”

The unconstitutionality charge was laid against the CFPB by payday lending firms, supported by credit unions, the U.S. Chamber of Commerce and a passel of right-wing legal organizations, which based their case on the fact that the bureau’s funding comes from the Federal Reserve rather than the U.S. Treasury.

The Supreme Court rejected that argument by a 7-2 vote in May.

The claims against the National Labor Relations Board are different. In separate lawsuits, SpaceX and Amazon assert that because the board members and the board’s administrative law judges are insulated from at-will removal by the president, it’s in violation of several constitutional principles and provisions.

SpaceX’s case arose from an NLRB accusation that it improperly fired nine employees in 2022 for publishing an open letter complaining about safety provisions at the company’s plants. union organizing activities, among other illegal acts. Its lawsuit has had a complicated procedural history.

SpaceX originally filed its lawsuit in federal court in Brownsville, Texas, where it had a 50-50 chance of drawing a Trump-appointed judge but where appeals go to the notably conservative 5th Circuit Court of Appeals, in what appeared to be a flagrant example of forum-shopping.

As it happened, the case came before Rolando Olvera, an Obama appointee. He didn’t think much of a Hawthorne-based company suing the NLRB, which is located in Washington, D.C., over the firings of employees who mostly worked in California. (The lone exception was an employee located in Washington but whose supervisors were in California.)

“It is undisputed that no party resides in the Southern District of Texas,” Olvera ruled. He ordered the case transferred to federal court in Los Angeles. SpaceX appealed to the 5th Circuit Court, which obligingly ordered the case returned to Texas. The case is currently held in abeyance while the appeals court ponders various issues.

Amazon filed its case against the NLRB in September in San Antonio federal court, where three of the five judges are Republican-appointees but appeals also go to the 5th Circuit, even though the company’s dispute with the NLRB involves Teamster-represented workers in Staten Island, N.Y. It was assigned to Xavier Rodriguez, an appointee of George W. Bush.

One can’t overstate the stakes in this battle for the company and the union. The Staten Island warehouse was the first Amazon facility to win a union representation campaign.

Amazon is seeking an injunction blocking the NLRB from “pursuing unconstitutional administrative proceedings,” asserting that the board members are “insulated from removal in contravention of Article II of the Constitution.” The NLRB’s structure, the company argues, “violates the constitutionally mandated separation of powers and Amazon’s due process rights.”

The Teamsters, which represents the Staten Island workers, sees the quest for an injunction as nothing but an effort to use the courts to delay the company’s obligation to meet the workers at the bargaining table.

“Granting the injunction would send the message to all these workers that it’s irrelevant that their bargaining representatives have been certified by the NLRB,” which creates a duty to start bargaining, Julie Gutman Dickinson, the Los Angeles labor attorney representing the Teamsters, told me.

“The NLRB and the courts have recognized for years that delay to a union certification and the bargaining process causes irreparable loss of support among employees,” Dickinson says. “The chilling effect goes far beyond the Amazon employees in the New York facility but extends to hundreds of thousands of employees across the country, many of whom are involved in organizing campaigns to seek union representation, who will see that the NLRB’s legal process is completely futile.”

Oral arguments in a second case, involving unionized drivers and dispatchers at a warehouse in Palmdale that the workers maintain is jointly operated by Amazon and a labor subcontractor, are scheduled for Dec. 18 in Los Angeles federal court.

The Teamsters argues that Amazon appears to be a recent convert to the idea that the NLRB is unconstitutional. For more than two years, or since the Staten island election, Amazon pursued the NLRB’s administrative process to overturn the vote.

“At no time did Amazon assert any constitutional claims or allege the NLRB or its processes were constitutionally deficient,” the union said in a legal filing. Not until September, when it was facing an order to explain why it hadn’t bargained with the union, did the company raise the constitutional question.

It’s worth noting that the constitutionality of the NLRB has already been reviewed by the Supreme Court. That happened in 1937, with a 5-4 vote (the minority votes came from the cadre of reactionary justices known then as the Four Horsemen).

The majority opinion by Chief Justice Charles Evans Hughes didn’t explicitly address the president’s authority to remove the board members at will, but he did find that the “procedural provisions” of the National Labor Relations Act, which created the NLRB, met constitutional muster.

Amazon may be right to believe that it will prevail before what it calls “an unbiased court.” If it’s referring to the Supreme Court, it’s in with a chance, given the overt hostility the current court majority has shown toward organized labor. But declaring the NLRB to be unconstitutional, some 90 years since it was created by Congress, would be a big step indeed.

Business

After decades on the San Pedro waterfront, famous fish market signs lease for decades more

Owners of the San Pedro Fish Market and Restaurant, a top-grossing restaurant that once sprawled across a wooden pier in the Port of Los Angeles, have signed a 49-year lease to rebuild at their historic waterfront home.

For decades the Fish Market was part of Ports O’Call, a tourist attraction that was razed in recent years to make way for a new regional attraction called West Harbor that is now under construction.

The restaurant built a loyal following of customers who spent about $30 million a year before the pandemic on its heaping trays of shrimp, lobster and other seafood shared at spare metal tables on the weathered pier.

Members of the Ungaro family, the restaurant’s owners, planned in 2021 to move the operation to another location in the port but have now committed to staying in West Harbor as an anchor tenant.

The restaurant will stand next to the new development’s amusement park, which will include a Ferris wheel that is expected to be as much as 50% higher than the Pacific Wheel at Pacific Park amusement center on Santa Monica Pier.

The Fish Market currently is operating with mobile kitchens in temporary outdoor quarters in the parking lot next to its former site, where it served 450,000 diners and grossed $16 million last year, according to Chief Executive Mike Ungaro.

Before moving into its new digs, the Fish Market will relocate to another temporary space on a part of the West Harbor site that is intended to eventually hold a hotel. It will operate there for about three years, serving 1,600 people at a time, while the market’s permanent home is built.

Eventually it will be one of the largest restaurants in the United States, Ungaro said, spanning 55,000 square feet and capable of serving 3,000 diners at a time — about the same capacity as its original location. Nearly 90% of the dining space will be on an outdoor patio overlooking the waterfront.

Planned features include event spaces, private dining options and areas for podcasters and other content creators to conduct live broadcasts, Ungaro said. The market has appeared on lists of the most Instagrammed restaurants in the U.S., with posts typically showing people tucking into mammoth trays of seafood.

“They’re an institution in San Pedro,” said Eric Johnson, senior project executive for the West Harbor development. “It’s really important that we’ve been able to provide them a long-term home.”

San Pedro Fish Market and Restaurant will have a long-term home next to the amusement park at West Harbor.

(Studio One Eleven)

The $155-million first phase of West Harbor, which will include restaurants, bars and shops, is set to open late next year. Its developers announced in October plans to expedite construction of the next phase, which calls for the amusement park, more food tenants and an array of outdoor pickleball and padel courts. The permanent home for the Fish Market will be part of the second phase.

The Fish Market also announced that it will open a 17,000-square-foot restaurant at Old Fisherman’s Wharf in Monterey in Northern California in 2026.

-

Politics1 week ago

Politics1 week agoCanadian premier threatens to cut off energy imports to US if Trump imposes tariff on country

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg) Technology1 week ago

Technology1 week agoOpenAI cofounder Ilya Sutskever says the way AI is built is about to change

-

Politics1 week ago

Politics1 week agoU.S. Supreme Court will decide if oil industry may sue to block California's zero-emissions goal

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg) Technology1 week ago

Technology1 week agoMeta asks the US government to block OpenAI’s switch to a for-profit

-

Business1 week ago

Business1 week agoFreddie Freeman's World Series walk-off grand slam baseball sells at auction for $1.56 million

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg) Technology1 week ago

Technology1 week agoMeta’s Instagram boss: who posted something matters more in the AI age

-

News1 week ago

East’s wintry mix could make travel dicey. And yes, that was a tornado in Calif.

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png) Technology2 days ago

Technology2 days agoGoogle’s counteroffer to the government trying to break it up is unbundling Android apps