Business

Tyrese Gibson sells Woodland Hills home — giant Transformer included

Some luxurious houses include a movie show. Others have a swimming pool. Tyrese Gibson’s place got here with a large yellow robotic.

The singer and actor from the “Transformers” and “Quick and Livid” franchises simply offered his Woodland Hills house for $2.4 million, and the sale worth included a duplicate of Bumblebee, the Transformer robotic from the blockbuster movie sequence.

That’s not the house’s solely odd amenity. Throughout his decadelong keep, Gibson added an out of doors movie show and occasion area with a recording studio, convention room, magnificence salon, rooftop spa and hibachi grill.

Guarded by gates and shaded by palm timber, the compound covers half an acre and makes probably the most of its area with a 5,414-square-foot foremost house and three,000 sq. ft of extra constructions.

The home begins off dramatically with a grand lobby, the place a sweeping staircase and crystal chandelier are topped by 25-foot ceilings. Tan-colored partitions combine with wooden and tile flooring within the residing areas.

Elsewhere are 5 bedrooms and 6 loos, together with a main suite with a non-public balcony. It overlooks the amenity-loaded yard full with a avenue signal marked with “Voltron Enterprises Pkwy,” the identify of Gibson’s restricted legal responsibility firm, in addition to a neon-lit signal of the corporate’s brand above the swimming pool.

Jason Oppenheim of the Oppenheim Group, who stars in Netflix’s “Promoting Sundown” and the spinoff sequence “Promoting the OC,” dealt with each ends of the deal.

A local of Watts, Gibson signed to RCA Information within the late Nineties and has launched six studio albums within the a long time since, together with 2015’s “Black Rose.” As an actor, he’s recognized for his roles as Robert Epps within the “Transformers” franchise and Roman Pearce within the “Quick and Livid” franchise.

Business

Dishwasher getting old? With Trump vowing tariffs, it might make sense to shop for new appliances now

Dear Liz: President-elect Donald Trump’s proposed tariffs have me wondering if now is the time to purchase new kitchen appliances, something I have long delayed doing. If he follows through on his plans, I don’t know how long it would be before the new tariffs take effect.

Answer: Tariffs of up to 100% on imported products could dramatically increase the cost of many consumer goods, including appliances and cars. But how, when or even whether these tariffs will be imposed is still unclear.

Given the political uncertainties, it probably doesn’t make sense to proactively replace appliances or cars that are still in good working order. If you’re planning to update anyway, however, doing so sooner rather than later may save you some money.

Does this church pastor need to confess to the IRS?

Dear Liz: As a recent member of our church board, I just discovered our church hasn’t been paying Social Security or Medicare taxes for our pastor. I checked with our pastor and he hasn’t been making any payments either. This has been going on for six years. How do we recover?

Answer: Clergy are generally exempt from having Social Security and Medicare taxes withheld from their wages, notes Mark Luscombe, principal analyst for Wolters Kluwer Tax & Accounting. However, clergy typically must pay self-employment taxes, which include Social Security and Medicare, unless an exemption has been approved by the IRS.

Normally, employers and employees each pay 7.65% of the employee’s wages to cover Social Security and Medicare taxes. Self-employed people typically must pay both the employer and employee shares, or a total of 15.3%.

If your pastor has been filing taxes as a self-employed person, then he probably has been paying the appropriate Social Security and Medicare taxes. If he hasn’t, however, he may owe a substantial tax bill and should consider hiring a tax pro to help him amend his returns.

Which Social Security benefit? It depends

Dear Liz: I am 61 and retired. My husband recently died at age 61 and he was still working at the time of his death. He’s always made more money than I did. I’ve been told that I can start getting Social Security after I turn 62 and when I turn 67 I can apply for survivor benefits. Is this correct?

Answer: You can start survivor benefits as early as age 60 and retirement benefits as early as age 62. Most people should delay their applications for Social Security benefits, because an early start typically means a smaller lifetime payout. You’re one of the exceptions since you’re allowed to switch between survivor benefits and your own.

Because the survivor benefit is much larger than your own, you’ll want to maximize your payout by not taking it early. That means waiting to start until your full retirement age. You can start your own benefit at 62 and switch to survivor benefits at 67.

An early start means being subject to the earnings test until full retirement age. If you’re not working, though, that’s a moot point.

Social Security is complicated and the right claiming strategy depends on the details of an individual’s situation. Consider using one of the paid Social Security claiming strategy sites, such as Maximize My Social Security or Social Security Solutions, to find the best approach.

Inheriting stocks after a parent’s death resets cost basis

Dear Liz: I am a beneficiary of my father’s brokerage account. Upon his death, the brokerage company closed his account and transferred all of the equities to me in a new account. How will I know the cost basis for capital gains purposes when I sell the stocks?

Answer: You will use the value of the stocks on the day of your father’s death as the new tax basis. This is known as a “step up” in basis, since typically the fair market value at death is higher than the original basis, or what your dad paid for the stocks. Any appreciation that occurred during his lifetime won’t be taxed, but you would be subject to capital gains tax on any appreciation that occurs after that date.

Liz Weston, Certified Financial Planner, is a personal finance columnist. Questions may be sent to her at 3940 Laurel Canyon Blvd., No. 238, Studio City, CA 91604, or by using the “Contact” form at asklizweston.com.

Business

Fresh Brothers pizza chain expanding beyond Southern California after sale to Craveworthy Brands

Fresh Brothers, the Southern California pizza chain, will expand into a national brand after being acquired this week by a Chicago-based company.

Founded in 2008, the popular pizza chain currently has 25 locations from Los Angeles to San Diego including shops in Manhattan Beach, Brentwood and Hollywood. The operation was appealing to Craveworthy Brands, which operates 15 restaurant brands with 225 locations nationally, said Chief Executive Gregg Majewski.

Majewski declined to disclose how much Craveworthy Brands paid to acquire Fresh Brothers. Under Craveworthy’s franchise model, new Fresh Brothers pizza locations will be independently owned, he said.

There are plans to open a Fresh Brothers in the Chicago area and begin franchising in other states by March, Majewski said. And while he eventually hopes to make some inroads in Florida and other states, Majewski said he doesn’t have plans to make an aggressive push into the Northeast.

“We’re going to work our way east from Los Angeles and west from Chicago, and we’ll meet somewhere in the middle when we’re done,” Majewski said.

He also plans to expand the Fresh Brothers footprint in California.

The restaurants’ affordable prices and use of higher-quality ingredients set Fresh Brothers apart in the crowded field of pizza chains, Majewski said.

“That’s a niche we want to be in,” he said. “We think Fresh Brothers is absolutely prime to be a higher level franchise concept in the pizza world.”

The expansion of Fresh Brothers is somewhat of an outlier in the fast-casual dining industry, where many chains have been struggling amid inflation and high labor costs. Average consumers are pulling back on discretionary spending, experts say, and may be frequenting their favorite restaurants less.

Mod Pizza, a fast-casual chain with more than 40 locations in California, was acquired by a Los Angeles-based restaurant group in July after teetering on the edge of bankruptcy. Popular burger joint Shake Shack closed nine locations in September, including five in the Los Angeles area.

But Majewski is optimistic about Fresh Brothers’ future and said the brand is a perfect fit for his restaurant platform.

“Backed by a deep understanding of market dynamics and a commitment to operational excellence, Craveworthy is uniquely positioned to guide Fresh Brothers’ journey from its Southern California foundation to nationwide expansion,” the company said in a statement.

Business

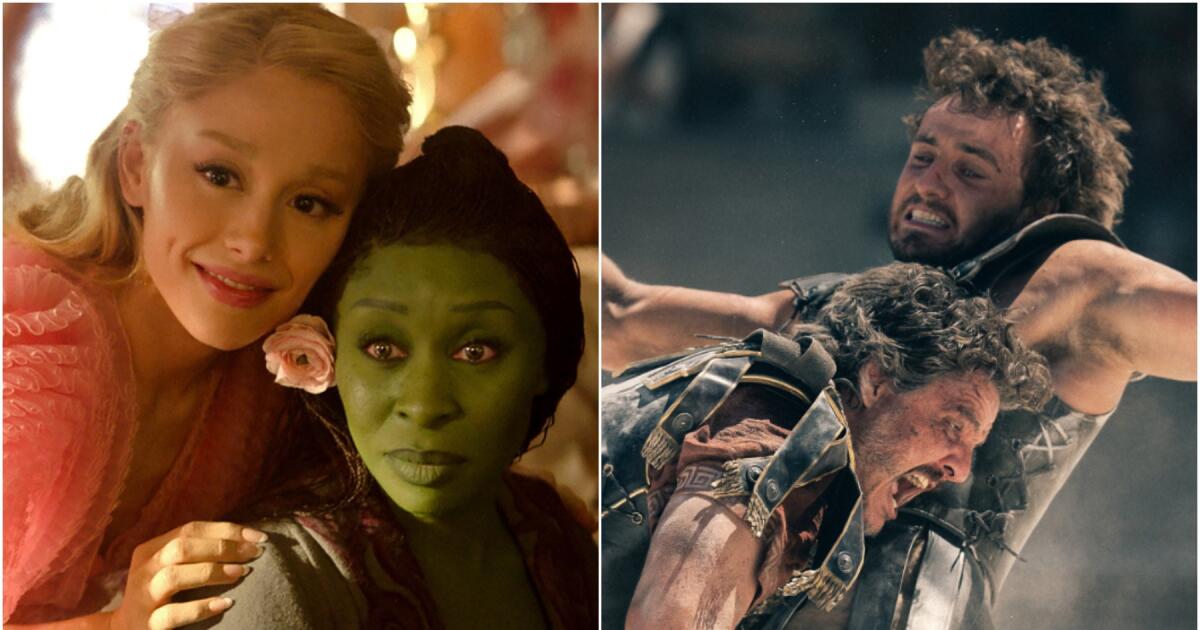

'Wicked' and 'Gladiator' set the stage for gravity-defying box office weekend

Universal Pictures’ “Wicked” and Paramount Pictures’ “Gladiator II” are expected to post gravity-defying numbers at the domestic box office this weekend.

On the heels of a solid summer (“Inside Out 2,” “Deadpool & Wolverine”) and a mildly disappointing fall (“Megalopolis,” “Joker: Folie à Deux”), the witches of Oz and the warriors of ancient Rome are joining forces to kick off the holiday movie season.

Each buoyed by star power, aggressive marketing and beloved intellectual property, “Gladiator II” is projected to launch somewhere between $65 million and $75 million, while “Wicked” is expected to conjure $120 million to $140 million in the United States and Canada, according to estimates from Boxoffice Pro.

Studio projections are lower, putting “Gladiator II” around $60 million and “Wicked” around $100 million.

“‘Wicked’ is the one that’s really moving up. ‘Gladiator II’ has been consistent,” said Daniel Loria, editorial director and senior vice president of content strategy at Boxoffice Pro.

“A lot of that is driven by a very healthy fan culture. This is a musical that has been around for a long time. People are familiar with it. I know musicals haven’t had the best track record at the box office, but ‘Wicked’ is the blockbuster musical of this generation.”

Theaters have been longing for a four-quadrant, double-feature moviegoing event since last year’s same-day release of Warner Bros.’ “Barbie” and Universal’s “Oppenheimer” created the global “Barbenheimer” sensation. Movie houses and entertainment companies have increasingly come to rely on movies that become viral, must-see cultural phenomena, a trend that accelerated after the COVID-19 pandemic scrambled audience behaviors and studio strategies.

“Wicked” and “Gladiator II” will be playing in thousands of theaters nationwide, with Disney’s highly anticipated “Moana 2” on the not-so-distant horizon, portending a much-needed period of healthy cinema attendance. Following multiple critical and commercial flops, morale is up among exhibitors betting on a strong end to 2024 and start to 2025.

A hat trick for “Gladiator II,” “Wicked” and “Moana 2” would be huge for the industry “coming off of the worst October of the post-pandemic era,” Loria said. Domestic box office so far this year is down 11% from the same span in 2023, and remains significantly lower than pre-pandemic levels, according to Comscore.

“I’m not sure this Venn diagram is going to be as big as the one we had for ‘Barbenheimer,’” Loria added. “But it’s another example of this industry responding to consumer demands and responding to the need for diversity … at the multiplex.”

Directed by Jon M. Chu, “Wicked” tells the origin story of Glinda, the Good Witch of the North, and Elphaba, the Wicked Witch of the West, before Dorothy arrived in Munchkinland and followed the yellow brick road. The long-awaited reframing of “The Wizard of Oz” — based on the hit Broadway musical of the same name — stars pop phenom Ariana Grande as Glinda and Tony Award winner Cynthia Erivo as Elphaba.

Universal has gone all out to promote the production, which cost an estimated $150 million to produce, not including marketing. The 2-hour, 40-minute film only covers the first act of the stage musical. Part two arrives in theaters next year.

Unlike the marketing around other films in the genre — such as Paramount Pictures’ “Mean Girls” and Warner Bros.’ “Wonka” — the “Wicked” campaign has not downplayed its musical elements. On the contrary, Grande and Erivo’s renditions of fan-favorite songs, from “Popular” to “Defying Gravity,” have featured prominently in trailers and TV spots promoting the movie.

“You couldn’t hide it if you wanted to,” said a studio source who was not authorized to comment.

But the “Wicked” marketing machine goes way beyond the music.

Universal partnered with 400 brands worldwide — including Starbucks, Ulta Beauty, Bloomingdale’s and Lexus — to douse retail shelves in pink and green, the signature colors of the movie’s leading sorceresses. There are “Wicked”-themed shoes, clothes, phone cases, laptop sleeves, luggage, candles, makeup palettes, jewelry, cups, office supplies, backpacks and hairdryers.

At least one of the brand collaborations drew unwanted attention. Mattel’s line of Glinda and Elphaba dolls made headlines recently when customers noticed that the packaging included the web address for a porn site instead of the movie’s official landing page. The toy company quickly apologized for the gaffe, calling the misprint an “unfortunate error.”

Unfortunate errors and all, Universal certainly has made a massive effort to live up to its source material’s fame with its ubiquitous rollout.

“Whenever you have a marketing campaign that can go to your exercise bike, that can go to your supermarket, that can really exit the theater and permeate the culture — that’s when you know the studio has really pulled out all the stops,” Loria said. “I’m not sure I can name a movie since ‘Barbie’ that has done that.”

The marketing team behind “Gladiator II” — director Ridley Scott’s lega-sequel to his early-aughts best picture winner, starring Paul Mescal, Pedro Pascal and Denzel Washington — has pulled out a few tricks as well.

For example: a Colosseum-shaped popcorn bucket with a virtual-reality twist and a controversial deal with Airbnb to bring Medieval Times-esque entertainment to the actual Colosseum in Rome.

“Gladiator II” cost an estimated $250 million to make, not including marketing costs.

Exhibitors are joining in on the fun too.

Look Cinemas — a dine-in theater chain with locations in Downey, Glendale, Monrovia and Redlands — has curated a special “Wickedator” menu with themed food and beverage items ranging from Arena Nachos (“Gladiator”) to Emerald City Sours (“Wicked”).

James Meredith, head of marketing and revenue at Look Cinemas, said the company has been preparing for this weekend for months, reserving premium screening rooms for both films, hosting advance screenings as early as Wednesday and expanding its showtimes and hours of operation to meet consumer demand reminiscent of the “Barbenheimer” craze.

“Our guests want to come in and escape for a while and have a big event or celebration around some of these popular movies,” Meredith said. “These types of movies … remind customers of how special the moviegoing experience is.”

-

Business1 week ago

Business1 week agoColumn: Molly White's message for journalists going freelance — be ready for the pitfalls

-

Science5 days ago

Science5 days agoTrump nominates Dr. Oz to head Medicare and Medicaid and help take on 'illness industrial complex'

-

Politics7 days ago

Politics7 days agoTrump taps FCC member Brendan Carr to lead agency: 'Warrior for Free Speech'

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg) Technology6 days ago

Technology6 days agoInside Elon Musk’s messy breakup with OpenAI

-

Lifestyle7 days ago

Lifestyle7 days agoSome in the U.S. farm industry are alarmed by Trump's embrace of RFK Jr. and tariffs

-

World7 days ago

World7 days agoProtesters in Slovakia rally against Robert Fico’s populist government

-

News6 days ago

News6 days agoThey disagree about a lot, but these singers figure out how to stay in harmony

-

News7 days ago

News7 days agoGaetz-gate: Navigating the President-elect's most baffling Cabinet pick