Business

Trump Finally Has His Day in Court

Trump’s day in courtroom

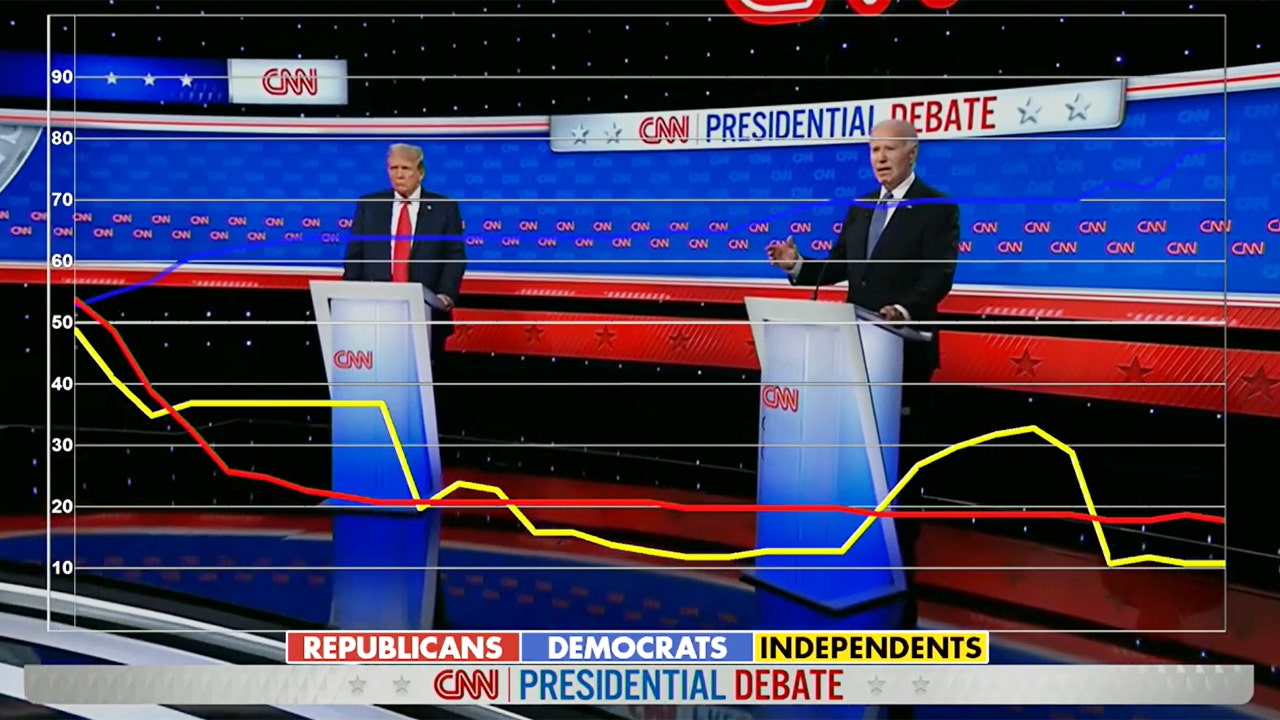

Prison fees are often kryptonite for a politician, however Donald Trump has up to now succeeded in reworking Tuesday’s arraignment in reference to hush-money fee to the porn star Stormy Daniels right into a platform to develop his energy base.

Round the clock media protection has been a fund-raising boon. Jason Miller, a Trump aide, tweeted that the previous president has raised a document $7 million for his re-election marketing campaign (a declare that has not been independently confirmed) since he was indicted final week.

However will big-money Republican donors again him? Some, akin to Ken Langone, the billionaire founding father of Residence Depot, the Citadel founder Ken Griffin and Steve Schwarzman of Blackstone have distanced themselves from Mr. Trump since 2020. There’s no signal but they’ve modified their stances.

Traders are flocking to Trump-related companies, too. Shares in Digital World Acquisition Corp., the particular objective acquisition firm looking for to merge with Trump’s media enterprise, have climbed greater than 20 p.c since he used his Reality Social platform to declare final month that his arrest was imminent. Traders appear unfazed by the various obstacles to the merger, which have to be consummated within the subsequent six months.

Mr. Trump’s standing within the Republican Social gathering appears to be enhancing. A couple of months in the past, the previous president was thought of a drag on the get together after its lackluster efficiency within the midterms. However the indictment has compelled Republicans to weigh in on Mr. Trump’s case — and most are publicly siding with him. Gov. Ron DeSantis of Florida, his greatest competitor for the Republican presidential nomination in 2024, and Jeb Bush, a rival he beat in 2016, have referred to as the Manhattan investigation a political sideshow and “un-American.”

The newest polls present Mr. Trump increasing his lead for the Republican primaries. He’s nonetheless effectively forward of the sector in New Hampshire, which votes early.

Right here’s what else you must learn about Tuesday’s historic arraignment:

-

TV cameras within the hall of the Manhattan courtroom will broadcast Mr. Trump’s give up, however none can be permitted within the courtroom, Choose Juan Merchan dominated final night time. Mr. Trump is scheduled to seem at 2:15 p.m. Jap.

-

Todd Blanche, a former federal prosecutor who has additionally labored on the agency Cadwalader, Wickersham & Taft, was added to Trump’s protection workforce.

HERE’S WHAT’S HAPPENING

Twitter has but to take away blue examine marks for many verified customers. Celebrities, distinguished figures and most media organizations (besides The New York Instances) nonetheless have verification marks on the platform, regardless that its proprietor, Elon Musk, repeatedly mentioned that they’d go on April 1.

Virgin Orbit recordsdata for Chapter 11 chapter. The satellite tv for pc launch firm backed by Richard Branson collapsed simply over a yr after going public, failing to lift new capital.

Britain’s privateness regulator fines TikTok. The U.Okay. Data Commissioner mentioned the social media app breached information safety legislation round dealing with youngsters’s information and levied a $16 million cost. The choice was introduced shortly after Australia grew to become the newest nation to ban the app on authorities units.

The F.T.C. orders Illumina to divest Grail, a cancer-test developer. Antitrust consultants say the choice is a take a look at of the company’s efforts to cease established firms — Illumina is a giant drive in DNA testing gear — from shopping for smaller rivals. The European Union’s competitors watchdog voted to dam the deal final autumn, and the activist investor Carl Icahn contends the acquisition was a mistake.

Jamie Dimon’s tackle the newest banking disaster

Jamie Dimon’s intently watched annual letter to shareholders was launched this morning and, unsurprisingly for a C.E.O. who corralled the $30 billion deal to avoid wasting First Republic, he devoted loads of ink to the regional banking disaster. The JPMorgan Chase boss warned that the turmoil “isn’t but over,” and opined on what induced the crash. He additionally weighed in why extra regulation isn’t essentially the treatment, and why it’ll have “repercussions” for years.

“A lot of the dangers have been hiding in plain sight,” Mr. Dimon mentioned of the troubles that introduced down Silicon Valley Financial institution. Chief amongst them: SVB’s company purchasers “have been managed by a small variety of enterprise capital firms and moved their deposits in lockstep.”

Mr. Dimon rejected ideas that Trump-era rollbacks of smaller financial institution regulation have been in charge for the disaster and cautioned towards “politically motivated responses.” President Biden has referred to as for elevated scrutiny of banks with between $100 billion and $250 billion in property, like SVB. Mr. Dimon mentioned any new rules, together with revamped stress assessments and leverage ratios, ought to bear in mind elements akin to buyer focus, uninsured deposits and attainable limitations on hold-to-maturity loans.

He referred to as for extra give attention to what occurs exterior regulated banks, from buying and selling to lending. “Amongst many questions that want definitive solutions, a number of huge ones could be: Would you like the mortgage enterprise, credit score and market-making, together with different important monetary companies, contained in the banking system or exterior of it?” he wrote. (Treasury Secretary Janet Yellen mentioned final month that the division was targeted on “new areas of threat,” a press release some took to imply nonbanks.)

Mr. Dimon additionally sounded a warning concerning the economic system. “The market’s odds of a recession have elevated,” he mentioned, noting that “whereas that is nothing like 2008, it’s not clear when this present disaster will finish.”

Disney vs DeSantis, redux

The battle between Disney and Gov. Ron DeSantis of Florida ratcheted up a notch on Monday, with either side exchanging blows in a dispute that exhibits little signal of being resolved shortly.

At Disney’s annual shareholder assembly, the C.E.O., Bob Iger, blasted Mr. DeSantis’s efforts to tear up the corporate’s phrases of operation within the state as “anti-business” and “anti-Florida.” He made the feedback shortly after the governor requested an investigation into how the corporate has maneuvered to retain management over the realm of Florida containing its Disney World resort.

The feud is technically a couple of particular tax district that provides Disney a excessive diploma of autonomy in operating its resort. Mr. DeSantis tried to do away with the district and when that failed, he urged the state legislature to provide him management of the board overseeing it. However earlier than the Disney-controlled board gave up their seats to DeSantis appointees, they pushed via a cope with the corporate that basically left their successors powerless.

Mr. Iger says it’s all about retaliation. Mr. DeSantis started working to limit Disney’s autonomy after the corporate, the state’s greatest personal employer and company taxpayer, publicly opposed a legislation critics have referred to as anti-gay. “An organization has a proper to freedom of speech similar to people do,” Mr. Iger mentioned in his first in-depth public feedback concerning the controversy since returning as C.E.O. late final yr. “The governor bought very indignant over the place Disney took and looks like he’s determined to retaliate towards us.” Mr. Iger added that Disney was planning to speculate $17 billion within the resort over the subsequent decade, creating about 13,000 jobs and hundreds extra not directly.

DeSantis accused the corporate of working exterior the legislation. “Disney is once more preventing to maintain its particular company advantages and dodge Florida legislation. We aren’t going to let that occur,” a spokesman for Mr. DeSantis instructed The Instances.

Credit score Suisse mourns itself

Greater than 1,700 Credit score Suisse shareholders gathered at an area in Zurich this morning for what quantities to a wake for his or her 167-year-old financial institution, which agreed final month to promote itself to its archrival, UBS, on the behest of presidency regulators. Executives acknowledged anger and disappointment on the financial institution’s destiny, which DealBook heard mirrored in sharp, usually emotional questions by a number of shareholders on the assembly.

“This can be our final strange basic assembly,” Ulrich Körner, Credit score Suisse’s C.E.O., instructed the gang. “I’m positive I don’t must inform you that I’m deeply saddened by this.”

In ready remarks, each Mr. Körner and Axel Lehmann, the financial institution’s chairman, acknowledged that Credit score Suisse was introduced down by a historical past of scandals and losses that sapped confidence amongst traders and purchasers. “There have been unhealthy developments, errant behaviors and unsuitable incentive programs,” Mr. Lehmann mentioned.

However the united statesdeal was the one resolution in the long run, they mentioned. By March 19, Credit score Suisse had two decisions: a fireplace sale to its chief competitor or chapter — and the latter, Lehmann mentioned, “would have led to the worst state of affairs, particularly a complete loss for shareholders, unpredictable dangers for purchasers, extreme penalties for the economic system and the worldwide monetary markets.”

That echoed current feedback by Martin Schlegel, the vice chairman of the Swiss central financial institution, that Credit score Suisse would have failed if UBS hadn’t purchased it.

What’s subsequent? Credit score Suisse in its present kind will stop to exist as soon as the deal closes, the lads acknowledged. However Mr. Körner added that placing it along with UBS would create “an excellent stronger international monetary companies agency.”

Massive cash flows into ladies’s soccer

The Nationwide Ladies’s Soccer League introduced on Tuesday a deal for a brand new workforce to be based mostly in California’s Bay Space at a document worth — a giant win for girls’s skilled sports activities.

The funding agency Sixth Avenue is main an possession group that plans to spend $125 million on the Bay Space franchise. That can embrace an “growth price” of roughly $53 million; three years in the past the going price was $3 million.

The workforce will embrace some huge names in enterprise and sports activities. A number of former U.S. nationwide workforce gamers can be on the board, together with Brandi Chastain, Leslie Osborne and Danielle Slaton, in addition to Aly Wagner as co-chair. Different traders embrace Sheryl Sandberg, the previous chief working officer of Meta, who can even be part of the board.

Ladies’s soccer is turning into an enormous attraction. The latest Ladies’s World Cup claimed a worldwide viewers of greater than 1.1 billion, and within the U.S., some 915,000 individuals watched the ultimate of the N.W.S.L. final yr.

However sponsorship and media offers lag behind. Apple lately signed a 10-year, $2.5 billion deal to broadcast most M.L.S. video games. The N.W.S.L.’s cope with CBS, signed in 2020, was price $4.5 million over three years.

“You’re at the start of an inflection level,” Alan Waxman, C.E.O. of Sixth Avenue, who will co-chair the brand new membership, instructed DealBook.

THE SPEED READ

Offers

Coverage

Better of the remainder

We’d like your suggestions! Please e mail ideas and ideas to dealbook@nytimes.com.

Business

In big win for business, Supreme Court dramatically limits rulemaking power of federal agencies

In a major victory for business, the Supreme Court on Friday gave judges more power to block new regulations if they are not explicitly authorized by federal law.

The court’s conservative majority overturned a 40-year-old rule that said judges should defer to agencies and their regulations if the law is not clear.

The vote was 6 to 3, with the liberal justices dissenting.

The decision signals a power shift in Washington away from agencies and in favor of the businesses and industries they regulate. It will give business lawyers a stronger hand in challenging new regulations.

At the same time, it deals a sharp setback to environmentalists, consumer advocates, unions and healthcare regulators. Along with the Biden administration, they argued that judges should defer to agency officials who are experts in their fields and have a duty to enforce the law.

This deference rule, known as the Chevron doctrine, had taken on extraordinary importance in recent decades because Congress has been divided and unable to pass new laws on pressing matters such as climate change, online commerce, hospitals and nursing care and workplace conditions.

Instead, new administrations, and in particular Democratic ones, sought to make change by adopting new regulations based on old laws. For example, the climate change regulations proposed by the Obama and Biden administrations were based on provisions of the Clean Air Act of 1970.

But that strategy depended on judges being willing to defer to the agencies and to reject challenges from businesses and others who maintained the regulations went beyond the law.

The court’s Republican appointees came to the case skeptical of the Chevron doctrine. They fretted about the “administrative state” and argued that unelected federal officials should not be afforded powers typically reserved for lawmakers.

“Chevron is overruled,” Chief Justice John G. Roberts Jr. wrote Friday for the majority. “Courts must exercise their independent judgment in deciding whether an agency has acted within its statutory authority.” Judges “may not defer to an agency interpretation of the law simply because a statute is ambiguous,” he added.

In dissent, Justice Elena Kagan said the Chevron rule was crucial “in supporting regulatory efforts of all kinds — to name a few, keeping air and water clean, food and drugs safe, and financial markets honest. And the rule is right,” she said. It now “falls victim to a bald assertion of judicial authority. The majority disdains restraint, and grasps for power.” Justices Sonia Sotomayor and Ketanji Brown Jackson agreed.

Senate Majority Leader Charles E. Schumer (D-N.Y.) voiced outrage. “In overruling Chevron, the Trump MAGA Supreme Court has once again sided with powerful special interests and giant corporations against the middle class and American families. Their headlong rush to overturn 40 years of precedent and impose their own radical views is appalling.”

Experts said the impact of the ruling may not be clear for some time.

Washington attorney Varu Chilakamarri said the ruling means “industry’s interpretation of the law will be viewed as just as valid as the agency’s. It will be some time before we see the effects of this decision on the lawmaking process, but going forward, agency action will be under even greater scrutiny and there will likely be more opportunities for the regulated community to challenge agency rules and adjudications.”

In decades past, the Chevron doctrine was supported by prominent conservatives, including the late Justice Antonin Scalia. In the 1980s, he believed it was better to entrust decisions about regulations to agency officials who worked for the president rather than to unelected judges. He was also reflecting an era when Republicans, from Richard Nixon and Gerald Ford to Ronald Reagan and George H.W. Bush, controlled the White House.

But since the 1990s, when Democrat Bill Clinton was president, conservatives have increasingly complained that judges were rubber-stamping new federal regulations.

Business lawyers went in search of an attractive case to challenge the Chevron doctrine, and they found it in the plight of four family-owned fishing boats in New Jersey.

Their case began with a 1976 law that seeks to conserve the stocks of fish. A regulation adopted by the National Marine Fishery Service in 2020 would have required some herring boats to not only carry a federal monitor on board, but also pay the salary of the monitor. Doing so was predicted to cost more than $700 a day, or about 20% of what the fishing boats earned on average.

The regulation had not taken effect, but it was upheld by a federal judge and the D.C. Circuit Court’s appellate judges who deferred to the agency’s interpretation of the law.

Business

State Farm seeks major rate hikes for California homeowners and renters

State Farm General is seeking to dramatically increase residential insurance rates for millions of Californians, a move that would deepen the state’s ongoing crisis over housing coverage.

In two filings with the state’s Department of Insurance on Thursday signaling financial trouble for the insurance giant, State Farm disclosed it is seeking a 30% rate increase for homeowners; a 36% increase for condo owners; and a 52% increase for renters.

“State Farm General’s latest rate filings raise serious questions about its financial condition,” Ricardo Lara, California’s insurance commissioner, said in a statement. “This has the potential to affect millions of California consumers and the integrity of our residential property insurance market.”

State Farm did not return requests for comment.

Lara noted that nothing immediately changes for policyholders as a result of the filings. His said his department would use all of its “investigatory tools to get to the bottom of State Farm’s financial situation,” including a rate hearing if necessary, before making a decision on whether to approve the requests.

That process could take months: The department is averaging 180 days for its reviews, and complex cases can take even longer, according to a department spokesperson.

The department has already approved recent State Farm requests for significant home insurance rate increases, including a 6.9% bump in January 2023 and a 20% hike that went into effect in March.

State Farm’s bid to sharply increase home insurance rates seeks to utilize a little-known and rarely used exception to the state’s usual insurance rate-making formula. Typically, such a move signals that an insurance provider is facing serious financial issues.

In one of the filings, State Farm General said the purpose of its request was to restore its financial condition. “If the variance is denied,” the insurer wrote, “further deterioration of surplus is anticipated.”

California is facing an insurance crisis as climate change and extreme weather contribute to catastrophic fires that have destroyed thousands of homes in recent years.

In March, State Farm announced that it wouldn’t renew 72,000 property owner policies statewide, joining Farmers, Allstate and other companies in either not writing or limiting new policies, or tightening underwriting standards.

The companies blamed wildfires, inflation that raised reconstruction costs, higher prices for reinsurance they buy to boost their balance sheets and protect themselves from catastrophes, as well as outdated state regulations — claims disputed by some consumer advocates.

As insurers have pulled back from the homeowners market, lawmakers in Sacramento are scrambling to make coverage available and affordable for residents living in high-risk areas.

Times staff writer Laurence Darmiento contributed to this report.

Business

High interest rates are hurting people. Here's why it's worse for Californians

By the numbers, the overall U.S. economy may look good, but down at the street level the view is a lot grimmer and grittier.

The surge in interest rates imposed by the Federal Reserve to slow inflation has closed like an acrid cloud over would-be homeowners, car buyers, growing families, and businesses new and old, large and small. It has meant missing opportunities, settling for less — and waiting and waiting and waiting.

It’s not that the average American is underwater. It’s that many feel that they’re struggling more than they anticipated and feel more constricted. In the American Dream, if you work hard, things are supposed to get better. Fairly or not, that may be a big part of why so many voters have expressed unhappiness with President Biden’s handling of the economy.

The cost of borrowing, whether for mortgages, credit cards or car loans, is the highest in more than two decades. And that is weighing especially hard on people in California, where housing, gas and many other things are more expensive than in most other states.

California’s economy also relies more on interest rate-sensitive sectors such as real estate and high tech, which helps explain why the state has been lagging in job growth and its unemployment rate is the highest in the nation.

Harder to budget

When interest rates rise, savers can earn more on their deposits. But in America’s consumer society, for most people higher rates mean that a lot of things cost a little (or a lot) more. That makes it harder to stretch an individual or family budget. It may mean giving up on the nicer car you had your heart set on, or settling for a smaller house, or a shorter, less glamorous vacation.

And with every uptick in interest rates, which is almost inevitably passed on to customers, some have had to give up on a purchase entirely.

Geovanny Panchame, a creative director at an advertising agency, knows these feelings all too well: He thinks often about what could have been if he and his wife had bought the starter home they were planning for in 2020.

Back then, they had been pre-approved at an interest rate of 3.1% — right around the national average — but were outbid several times. They figured they’d wait a few years to save more money for a nicer place.

Four years later, the couple are still renting an apartment in Culver City — and now they’re expecting their first child.

Pushing to buy a house and get settled before their son is born in December, they recently made an $885,000 offer for a three-bedroom, 1.5-bath home in Inglewood. They plan to put down 10%. At the current average mortgage interest rate of 7%, that would mean a monthly payment of about $5,300 — $1,900 more than if they had an interest rate of 3.1%.

The source of that increase is the Federal Reserve’s power to set basic interest rates, which determines the interest rates for almost everything else in the economy. The Fed’s benchmark rate went up rapidly, from near zero in early 2022 to a generational high of about 5.5%, where it has been for almost a year. The rate has been higher in the past, but after two decades in which it was mostly at rock bottom, most people had gotten used to both very low inflation and low interest rates.

“Clearly, we look back and we probably should have kept going and hopped into something,” Panchame, 39, said. “I’ve been really sacrificing a lot to get to this point to purchase a home and now I just feel like I got here but I didn’t work quick enough because interest rates have gotten the better of me.”

Add property taxes and home insurance, and it’s even more painful for home buyers because those costs have also risen sharply since the COVID-19 pandemic, along with housing prices themselves.

A typical buyer of a mid-tier home in California, priced at about $785,000 in the spring, was looking at a total housing payment of about $5,900 a month. That’s up from $3,250 in March of 2020 and almost $4,600 in March of 2022, when the Fed began raising interest rates, according to the California Legislative Analyst’s Office.

It wasn’t supposed to work like that: Lifting interest rates as fast and as high as the Fed did, in its effort to curb inflation, should have led to falling home prices.

But that didn’t happen, mainly because relatively few homes came on the market. Most existing homeowners had locked in lower mortgage rates before the surge; selling those houses once interest rates took off would have meant paying higher prices and interest rates on other homes, or bloated rents for apartments.

For most homeowners sitting on the low rates of the past, their financial well-being was further supported by low unemployment and incomes that generally remained on par with inflation or grew a little faster. And many had cushions of savings built up in early phases of the pandemic, thanks partly to government support.

All of which has kept the U.S. economy as a whole humming along, blunting the full effects of higher interest rates.

“Consumers are doing their job,” said Claire Li, senior analyst at Moody’s Investors Service, though she added that there are now signs of slower spending, evidenced by consumers cutting back on credit card purchases.

Unlike most home loans, credit card interest rates aren’t fixed. And today the average rate has bounced up to almost 22% from 14.6% in 2021, according to Fed data. That’s starting to squeeze more borrowers, adding to their unease.

Rising credit card debt

In California, the 30-day delinquency rate on credit cards is nearing 5% — something not seen since late 2009 around the end of the Great Recession, according to the California Policy Lab at UC Berkeley.

Lower-income and younger borrowers are more prone to falling behind on credit card, auto and other consumer loan payments than those with higher incomes. And it’s these groups that are feeling the effects of higher interest rates the most.

Christian Shorter, a self-employed tech serviceman who lives in Chino, just bought a used Volkswagen Jetta for $21,000. He put down $3,500 and financed the rest over 69 months at an annual interest rate of 24%. His monthly payment is more than $480, and by the end of the loan he will have paid about $15,000 in interest.

Shorter, 45, said he doesn’t have good credit. He plans to take out a personal loan when interest rates drop and pay off the car debt. “Definitely, definitely, they should lower interest rates,” he said of the Fed.

Between the jump in interest rates and prices of new vehicles, some auto buyers have downgraded to cheaper models. The biggest shift, though, especially in California, has been a move by more buyers to turn to electric vehicles to save on fuel costs, says Joseph Yoon, a consumer analyst at Edmunds, the car research and information firm in Santa Monica.

In May, he said, buyers on average financed about $41,000 on a new vehicle purchase at an interest rate of 7.3% (compared with 4.1% in December 2021). Over 69 months, that translates to a monthly payment of $745.

“For a big part of the population, they’re looking at this car market and saying, ‘I got to wait for something to break,’ like interest rates or dealer incentives,” Yoon said.

For a lot of small-business owners, who drive much of the economy in Los Angeles, they don’t have the luxury of waiting it out. They need funds to survive, or to expand when things are going well.

But many can’t qualify with traditional commercial lenders, and when they can they’re typically looking at interest rates of 9%; that’s more than double what they were before the Fed’s rate hikes, according to surveys by the National Federation of Independent Business.

One result: More and more people in Southern California are looking for help from lenders such as Brea-based Lendistry, one of the nation’s largest minority-led community development financial institutions.

From January to May, applications were up 21% and the dollar volume of loans rose 33% compared with a year earlier, said Everett Sands, Lendistry’s chief executive. Interest rates on his loans range from 7.5% to 14.5%.

“Business owners, they’re resilient, entrepreneurial, scrappy — they’ll figure out a way,” he said, adding that he sees many doing side jobs like driving for Uber or making Instacart deliveries at night.

Even so, Sands said, the higher borrowing costs inevitably mean less money spent on things like investing in new technology and software and bringing on additional staff, as well as delays in owners growing their businesses.

“Some of them lose out in progressing forward.”

‘When you put everything on the line, you get desperate.’

— Jurni Rayne, Gritz N Wafflez

Jurni Rayne, 42, started her brunch business, Gritz N Wafflez, as a ghost kitchen in February 2022, preparing food orders for delivery services. She financed that by maxing out her credit cards and getting a merchant cash advance, which is like a payday loan with super high interest rates. Her debts reached $70,000.

“When you put everything on the line, you get desperate,” said Rayne, a Dallas native who moved to Los Angeles a decade ago and has worked as a manager at California Pizza Kitchen and the Cheesecake Factory. “You don’t care about the interest rate, because it’s something like between passion and insanity.”

She has since paid off all the merchant loans. And her business has seen such strong growth that last year Rayne got out of the ghost kitchen and into a small spot in Pico-Union, starting with just three tables. She now has 17 tables and a staff of 14.

This fall she’ll be moving to a bigger location in Koreatown and has her sights on a second restaurant in South Los Angeles. But she frets that she could have expanded sooner if interest rates had been lower and she’d had more access to financing.

Economists call that an opportunity cost. For Rayne, it’s personal.

“Absolutely, lower interest rates would have helped me,” she said.

For many others, the wait for lower rates continues without the balm of intermediate success.

Lynn Miller, 60, began looking to buy a home in Orange County about a year ago, hoping to upgrade from her current 1,600-square-foot apartment.

“It’s not bad, it’s just not mine — the dishwasher is crappy, the washing machine is old,” she said of her rental in Corona del Mar. “I’m obviously not going to invest in these appliances. It’s just different not owning your own home.”

It’s been a discouraging process, she said, especially when she inputs her numbers into the mortgage calculators on Zillow and Realtor.com, which churn out estimates based on current interest rates.

“If you look at those monthly payment numbers, it’s shocking,” Miller, a marketing consultant, said. “It’ll get better, but it’s just not better right now.”

She’s continuing her house search — she’d love to buy a single-family, three-bedroom home with a backyard for a dog — but is holding off for now.

“I’m still waiting because I do think that interest rates are going to go down,” Miller said, although she knows it’s a guessing game. “I could end up waiting a long time.”

-

News1 week ago

News1 week agoRead the Ruling by the Virginia Court of Appeals

-

News1 week ago

News1 week agoTracking a Single Day at the National Domestic Violence Hotline

-

Fitness1 week ago

Fitness1 week agoWhat's the Least Amount of Exercise I Can Get Away With?

-

News1 week ago

News1 week agoSupreme Court upholds law barring domestic abusers from owning guns in major Second Amendment ruling | CNN Politics

-

Politics1 week ago

Politics1 week agoTrump classified docs judge to weigh alleged 'unlawful' appointment of Special Counsel Jack Smith

-

Politics1 week ago

Politics1 week agoSupreme Court upholds federal gun ban for those under domestic violence restraining orders

-

Politics1 week ago

Politics1 week agoNewsom seeks to restrict students' cellphone use in schools: 'Harming the mental health of our youth'

-

Politics1 week ago

Politics1 week agoTrump VP hopeful proves he can tap into billionaire GOP donors