Business

This Week in Business: A Jobs Recovery

What’s Up? (March 27-April 2)

One other Sturdy Jobs Report

The March report continued the sturdy positive aspects of latest months, with U.S. employers including 431,000 jobs. The unemployment fee declined, and now, at 3.6 %, it’s only a contact larger than it was earlier than the pandemic. The financial system has recovered greater than 90 % of the 22 million jobs misplaced within the spring of 2020, far surpassing preliminary forecasts. March’s displaying might assist inform a narrative concerning the altering attitudes towards the coronavirus, notably as firms transfer forward with return-to-office plans — the share of workplace employees doing their jobs remotely fell to 10 % in March — and as tourism and in-person leisure have largely resumed. The general public “could also be transferring towards the concept that ‘the Covid period’ of the U.S. financial system is finished,” one economist stated.

A File Launch of Oil Reserves

In an effort to push down power costs which have skyrocketed since Russia went to struggle in Ukraine, President Biden stated Thursday that the US would launch as much as 180 million barrels of oil within the coming months from its strategic reserves. The announcement had the specified impact within the fast time period: Oil costs fell on Wednesday night time, when Mr. Biden’s plans had been first reported, and stayed decrease on Thursday after the president spoke concerning the document launch of crude. And on Friday, the Worldwide Vitality Company stated its 31 member nations had agreed to a brand new launch of emergency oil reserves. OPEC Plus, a bunch of oil producers that features Russia, stated it might keep on with its earlier plan for modest month-to-month will increase, nonetheless.

Provide Chain Gridlock for Vehicles

Toyota Motor stated its new car gross sales dropped 15 % within the first quarter as a chip scarcity continued and slowed manufacturing. This isn’t simply Toyota’s drawback: Basic Motors additionally introduced a big decline in gross sales, and different automakers had been additionally anticipated to report underwhelming numbers as they continued to face shortages due to tangled provide chains and new challenges from Russia’s invasion of Ukraine. However Toyota did see sturdy demand for its hybrid fashions, and stories which can be anticipated within the coming days from Tesla and Ford Motor may give a sign of whether or not 2022 will likely be a tipping level for electrical autos. Ford is amongst these making an attempt to compete with Tesla and diversify E.V. choices to enchantment to a broader swath of shoppers — Tesla’s minimalist aesthetics aren’t for everybody, one argument goes.

What’s Subsequent? (April 3-9)

A Union Victory

Employees at an enormous Amazon warehouse union on Staten Island voted to type a union in a historic victory for labor, turning into the primary Amazon location in the US to unionize. Workers forged 2,654 votes in help of the union and a pair of,131 in opposition to. The results of a union revote at one other Amazon warehouse, in Bessemer, Ala., remains to be pending, with a ultimate tally anticipated within the coming weeks. The union in Bessemer seems to be heading for a slim loss, however the election is far nearer than it was final yr, when employees opposed the union by a greater than 2-to-1 ratio. The surprising energy of union help in each elections foretells extra union battles for Amazon, as warehouse employees, like organizing Starbucks employees, could also be impressed to start out union campaigns at their very own areas.

A Attainable New Pause on Pupil Mortgage Funds

Dealing with stress from Democrats and warnings about losses within the midterm elections, President Biden might quickly announce one other extension of the pause on pupil mortgage funds. The pause started below President Donald J. Trump early within the pandemic and was prolonged a number of occasions throughout each Mr. Trump’s and Mr. Biden’s administrations. Mr. Biden final prolonged the pause in December amid a surge in coronavirus circumstances. In anticipation of the brand new Could 1 deadline, greater than 90 Democrats in Congress signed a letter urging Mr. Biden to push it again once more. Requires him to cancel pupil debt are additionally rising.

Fears of a Potential Recession

The Federal Reserve will launch minutes from its March coverage assembly this week, and Jerome H. Powell, the Fed chair, has advised that they’ll embody plans for the central financial institution to scale back its almost $9 trillion stability sheet. Generally known as quantitative tightening, it’s a maneuver the Fed might think about throughout occasions of low unemployment, rising wages and total progress. However the transfer, which may contain promoting off bonds, for instance, can drastically cut back cash provide, sending rates of interest up and dampening lending and funding. Together with the Fed’s projected fee will increase, the opportunity of a stability sheet discount is inflicting worries that the central financial institution will hit the brakes too exhausting and tip the nation right into a recession. Including to these fears is the bond market, which has had a horrible begin to the yr and is sending a possible sign {that a} vital financial slowdown is forward.

What Else?

President Biden’s price range proposal included a tax on billionaires. The S&P 500 rose 3.6 % in March, regaining greater than half its losses from its lowest level this yr. And Jen Psaki, the White Home press secretary, is reportedly in talks to go away for MSNBC.

Business

Netflix adds stages to New Mexico production hub as part of major expansion project

Netflix has expanded its New Mexico production facility to include four new soundstages, in a move that increases the streaming giant’s robust presence in the state with its film and television productions.

In addition to the stages, the expansion encompasses three mills, a production office, two stage support buildings and two backlot spaces spanning 108 acres on the property near Albuquerque, the streaming giant announced Thursday.

The Los Gatos, Calif.-based entertainment company acquired what was then known as ABQ Studios in 2018 and has shot several films and TV series in the region, such as supernatural thriller “Stranger Things” and gritty western “The Harder They Fall.” A representative for Netflix declined to comment on the cost of the new additions.

Thursday’s grand opening is part of a larger expansion project by Netflix. In 2020, the streamer unveiled plans to grow its New Mexico campus to include 10 new stages, postproduction facilities, offices, mills, backlots and other infrastructure.

“New Mexico has proven to be an exceptional production hub for us,” Ted Sarandos, co-chief executive of Netflix, said in a statement. “It offers a rich tapestry of landscapes, a talented workforce, and a supportive community. … Our continued investment in this region underscores our commitment to the local community and New Mexico’s vibrant cultural and economic landscape.”

The streamer isn’t the only entertainment company that has used the facilities at what is now Netflix Albuquerque Studios. Before the company took over, non-Netflix productions filmed at least partially on the Mesa del Sol lot include Disney’s “The Avengers”; Lionsgate’s “Sicario”; and AMC Networks’ “Breaking Bad,” produced by Sony Television.

Productions have been flocking to New Mexico in recent years to take advantage of its tax incentive program. Film and TV tax credits in the state range from 25% to 40% of direct production and postproduction costs. In part because of generous tax incentives offered in New Mexico, Georgia and other filming hot spots, Los Angeles continues to contend with the threat of runaway production.

Netflix alone has invested nearly $575 million in New Mexico productions and hired more than 4,000 local cast and crew members since purchasing ABQ Studios, the company said. New Mexico-based shoots for the company have included “Stranger Things,” “The Harder They Fall,” “Army of the Dead” and “El Camino: A Breaking Bad Movie.”

While introducing the latest Albuquerque Studios expansion on Thursday, Netflix teased three upcoming projects shooting at the facility: western romance “Ransom Canyon,” medical procedural “Pulse” and supernatural series “The Boroughs.”

The streamer also pledged its “commitment to sustainability,” noting that the revamp incorporates solar and battery-storage systems, geothermal heating and cooling, electric appliances and 50 electric vehicle chargers.

Business

In big win for business, Supreme Court dramatically limits rulemaking power of federal agencies

In a major victory for business, the Supreme Court on Friday gave judges more power to block new regulations if they are not explicitly authorized by federal law.

The court’s conservative majority overturned a 40-year-old rule that said judges should defer to agencies and their regulations if the law is not clear.

The vote was 6 to 3, with the liberal justices dissenting.

The decision signals a power shift in Washington away from agencies and in favor of the businesses and industries they regulate. It will give business lawyers a stronger hand in challenging new regulations.

At the same time, it deals a sharp setback to environmentalists, consumer advocates, unions and healthcare regulators. Along with the Biden administration, they argued that judges should defer to agency officials who are experts in their fields and have a duty to enforce the law.

This deference rule, known as the Chevron doctrine, had taken on extraordinary importance in recent decades because Congress has been divided and unable to pass new laws on pressing matters such as climate change, online commerce, hospitals and nursing care and workplace conditions.

Instead, new administrations, and in particular Democratic ones, sought to make change by adopting new regulations based on old laws. For example, the climate change regulations proposed by the Obama and Biden administrations were based on provisions of the Clean Air Act of 1970.

But that strategy depended on judges being willing to defer to the agencies and to reject challenges from businesses and others who maintained the regulations went beyond the law.

The court’s Republican appointees came to the case skeptical of the Chevron doctrine. They fretted about the “administrative state” and argued that unelected federal officials should not be afforded powers typically reserved for lawmakers.

“Chevron is overruled,” Chief Justice John G. Roberts Jr. wrote Friday for the majority. “Courts must exercise their independent judgment in deciding whether an agency has acted within its statutory authority.” Judges “may not defer to an agency interpretation of the law simply because a statute is ambiguous,” he added.

In dissent, Justice Elena Kagan said the Chevron rule was crucial “in supporting regulatory efforts of all kinds — to name a few, keeping air and water clean, food and drugs safe, and financial markets honest. And the rule is right,” she said. It now “falls victim to a bald assertion of judicial authority. The majority disdains restraint, and grasps for power.” Justices Sonia Sotomayor and Ketanji Brown Jackson agreed.

Senate Majority Leader Charles E. Schumer (D-N.Y.) voiced outrage. “In overruling Chevron, the Trump MAGA Supreme Court has once again sided with powerful special interests and giant corporations against the middle class and American families. Their headlong rush to overturn 40 years of precedent and impose their own radical views is appalling.”

Experts said the impact of the ruling may not be clear for some time.

Washington attorney Varu Chilakamarri said the ruling means “industry’s interpretation of the law will be viewed as just as valid as the agency’s. It will be some time before we see the effects of this decision on the lawmaking process, but going forward, agency action will be under even greater scrutiny and there will likely be more opportunities for the regulated community to challenge agency rules and adjudications.”

In decades past, the Chevron doctrine was supported by prominent conservatives, including the late Justice Antonin Scalia. In the 1980s, he believed it was better to entrust decisions about regulations to agency officials who worked for the president rather than to unelected judges. He was also reflecting an era when Republicans, from Richard Nixon and Gerald Ford to Ronald Reagan and George H.W. Bush, controlled the White House.

But since the 1990s, when Democrat Bill Clinton was president, conservatives have increasingly complained that judges were rubber-stamping new federal regulations.

Business lawyers went in search of an attractive case to challenge the Chevron doctrine, and they found it in the plight of four family-owned fishing boats in New Jersey.

Their case began with a 1976 law that seeks to conserve the stocks of fish. A regulation adopted by the National Marine Fishery Service in 2020 would have required some herring boats to not only carry a federal monitor on board, but also pay the salary of the monitor. Doing so was predicted to cost more than $700 a day, or about 20% of what the fishing boats earned on average.

The regulation had not taken effect, but it was upheld by a federal judge and the D.C. Circuit Court’s appellate judges who deferred to the agency’s interpretation of the law.

Business

State Farm seeks major rate hikes for California homeowners and renters

State Farm General is seeking to dramatically increase residential insurance rates for millions of Californians, a move that would deepen the state’s ongoing crisis over housing coverage.

In two filings with the state’s Department of Insurance on Thursday signaling financial trouble for the insurance giant, State Farm disclosed it is seeking a 30% rate increase for homeowners; a 36% increase for condo owners; and a 52% increase for renters.

“State Farm General’s latest rate filings raise serious questions about its financial condition,” Ricardo Lara, California’s insurance commissioner, said in a statement. “This has the potential to affect millions of California consumers and the integrity of our residential property insurance market.”

State Farm did not return requests for comment.

Lara noted that nothing immediately changes for policyholders as a result of the filings. His said his department would use all of its “investigatory tools to get to the bottom of State Farm’s financial situation,” including a rate hearing if necessary, before making a decision on whether to approve the requests.

That process could take months: The department is averaging 180 days for its reviews, and complex cases can take even longer, according to a department spokesperson.

The department has already approved recent State Farm requests for significant home insurance rate increases, including a 6.9% bump in January 2023 and a 20% hike that went into effect in March.

State Farm’s bid to sharply increase home insurance rates seeks to utilize a little-known and rarely used exception to the state’s usual insurance rate-making formula. Typically, such a move signals that an insurance provider is facing serious financial issues.

In one of the filings, State Farm General said the purpose of its request was to restore its financial condition. “If the variance is denied,” the insurer wrote, “further deterioration of surplus is anticipated.”

California is facing an insurance crisis as climate change and extreme weather contribute to catastrophic fires that have destroyed thousands of homes in recent years.

In March, State Farm announced that it wouldn’t renew 72,000 property owner policies statewide, joining Farmers, Allstate and other companies in either not writing or limiting new policies, or tightening underwriting standards.

The companies blamed wildfires, inflation that raised reconstruction costs, higher prices for reinsurance they buy to boost their balance sheets and protect themselves from catastrophes, as well as outdated state regulations — claims disputed by some consumer advocates.

As insurers have pulled back from the homeowners market, lawmakers in Sacramento are scrambling to make coverage available and affordable for residents living in high-risk areas.

Times staff writer Laurence Darmiento contributed to this report.

-

News1 week ago

News1 week agoTracking a Single Day at the National Domestic Violence Hotline

-

Fitness1 week ago

Fitness1 week agoWhat's the Least Amount of Exercise I Can Get Away With?

-

News1 week ago

News1 week agoSupreme Court upholds law barring domestic abusers from owning guns in major Second Amendment ruling | CNN Politics

-

Politics1 week ago

Politics1 week agoTrump classified docs judge to weigh alleged 'unlawful' appointment of Special Counsel Jack Smith

-

Politics1 week ago

Politics1 week agoSupreme Court upholds federal gun ban for those under domestic violence restraining orders

-

World5 days ago

World5 days agoIsrael accepts bilateral meeting with EU, but with conditions

-

Politics1 week ago

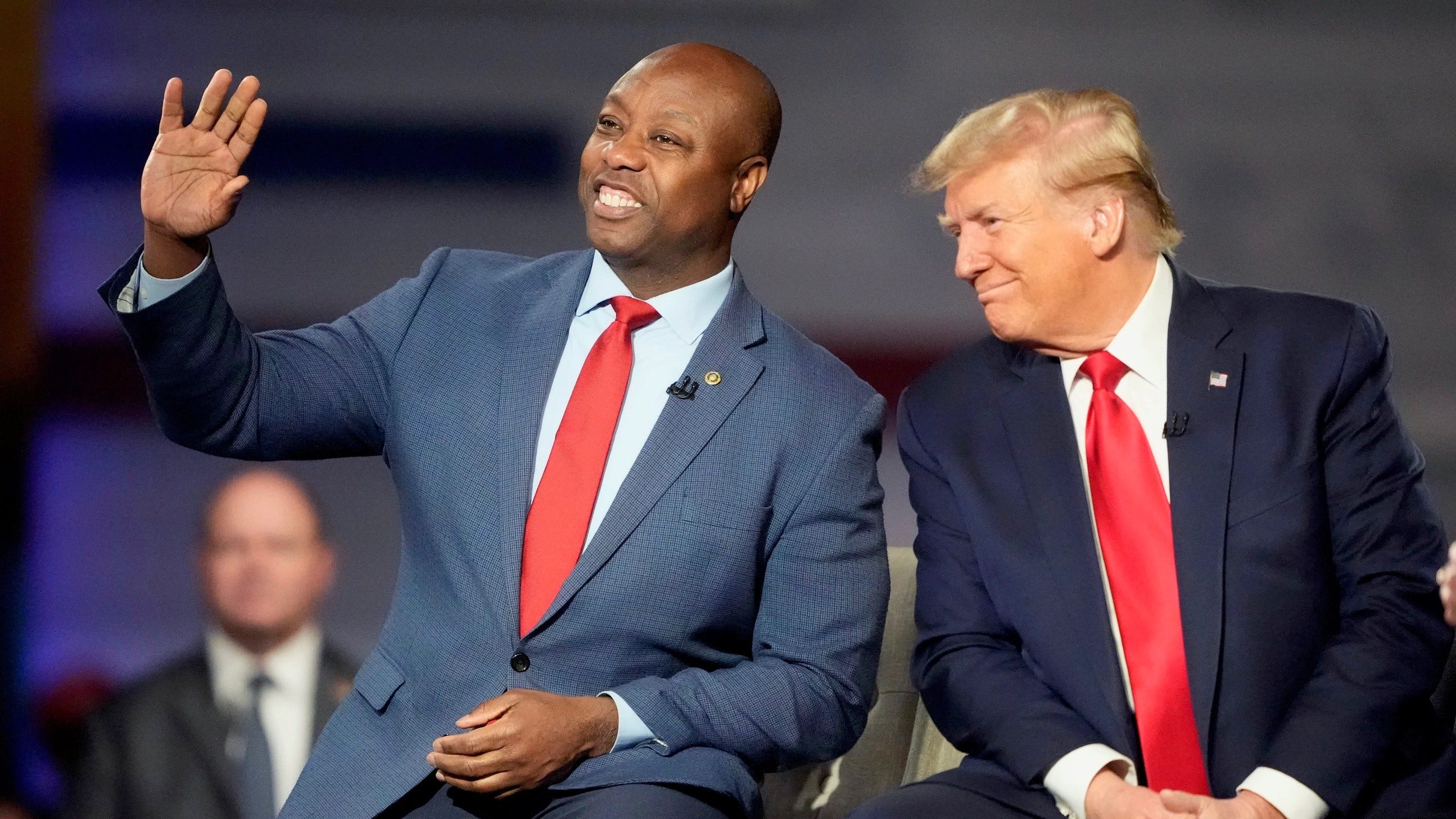

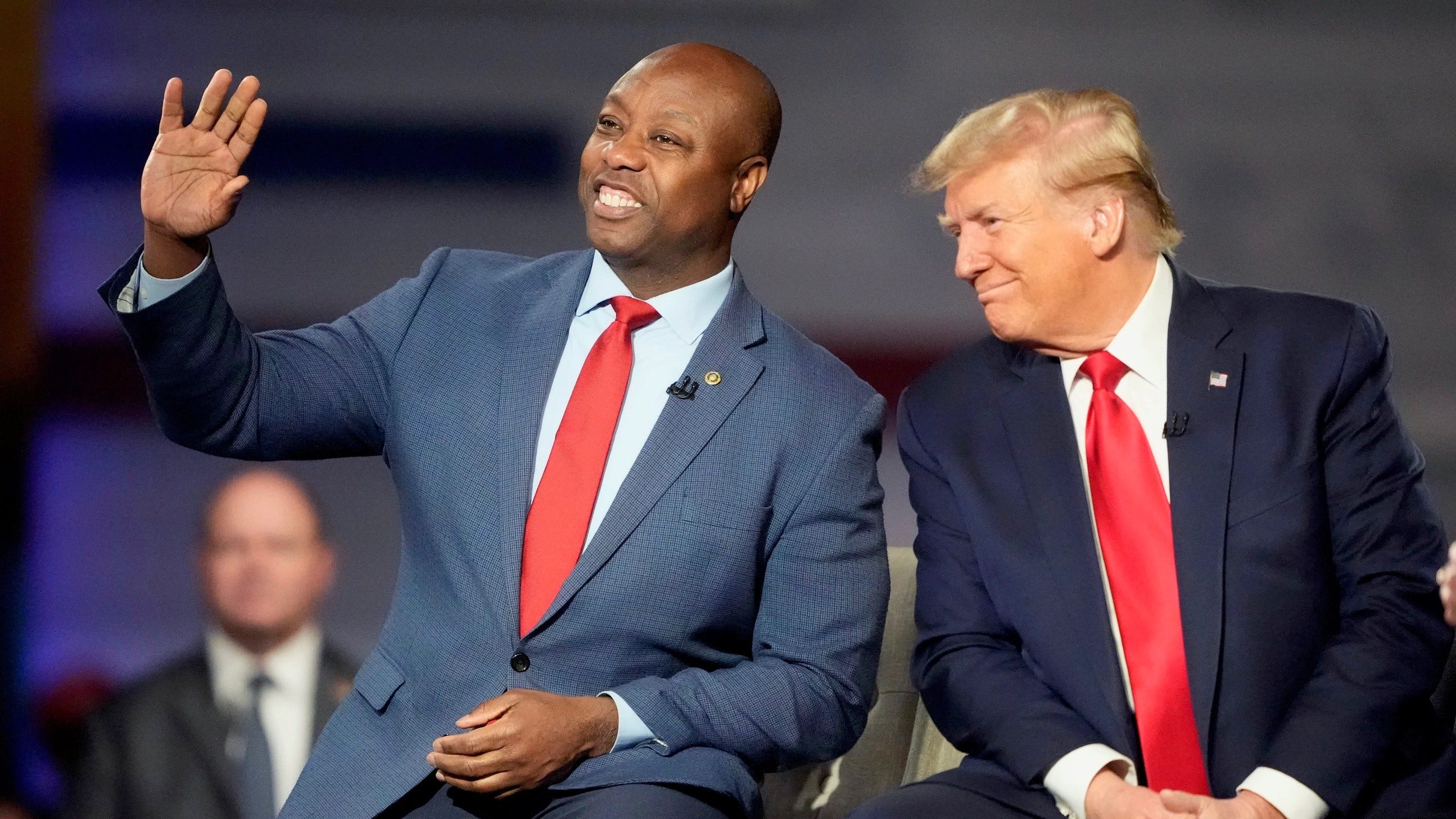

Politics1 week agoTrump VP hopeful proves he can tap into billionaire GOP donors

-

World1 week ago

World1 week agoInfluencers and politicians – meet the most connected lawmakers