Business

The U.S. scales back metal tariffs as Britain lifts duties on American whiskey and jeans.

As a part of the settlement, america and Britain may even proceed to confer on “market-distorting affect or possession” within the metal and aluminum industries.

The US stated it will ship a commerce delegation to Britain for additional talks quickly.

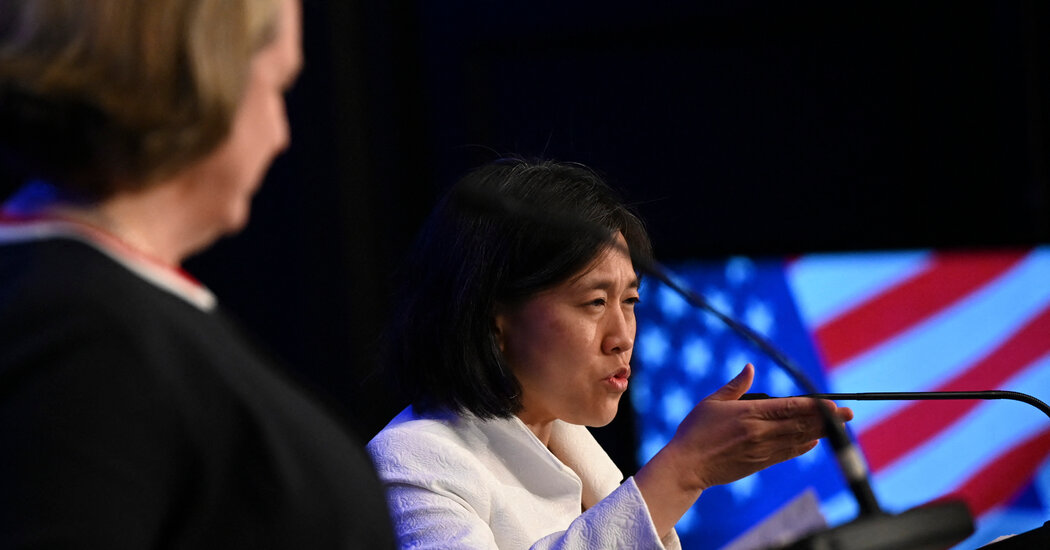

The deal “delivers on President Biden’s imaginative and prescient to restore relationships with our allies whereas additionally serving to to make sure the long-term viability of our metal and aluminum industries, the communities they assist, and most significantly, the employees in these industries on each side of the Atlantic,” Ms. Tai stated in a press release.

The Russia-Ukraine Conflict and the World Economic system

Thomas M. Conway, the worldwide president of United Steelworkers, stated the union supported the settlement and that it was “an vital step in addressing systemic issues like unlawful dumping and world overcapacity that threaten the vitality and way forward for our metal and aluminum industries.”

Chris Swonger, the chief government of the Distilled Spirits Council, stated that American distillers have been “cheering the top of this lengthy tariff nightmare.” In accordance with the group, American whiskey exports to Britain had declined by 42 p.c since 2018, when the tariffs have been imposed.

“With the elimination of the U.Okay.’s debilitating retaliatory tariffs on American Whiskey exports, U.S. distillers are prepared to fireside up the stills,” he added.

The 2 nations didn’t profess their intention to finish negotiations that started throughout the Trump administration for a free-trade settlement. British leaders had lauded the potential deal as an unbiased step for his or her financial system after departing the European Union and have pushed the Biden administration to take up negotiations.

However the Biden administration has proven little urge for food for adopting the Trump administration’s objectives, saying as an alternative that the commerce dialogue with the UK ought to discover “mutual worldwide commerce priorities rooted in our shared values, whereas selling innovation and inclusive financial progress.”

The approaching dialogue will tackle points like commerce and funding involving small companies, the digital financial system, sturdy provide chains, and defending labor rights and the atmosphere, the Biden administration stated.

Business

LinkedIn cuts 281 workers in California as tech layoffs continue

LinkedIn, the professional social network where people search for work, is shedding jobs.

The Microsoft-owned tech company has cut 281 workers in California, a notice filed this week to the California Employment Development Department shows.

Earlier this month, Microsoft said that it was terminating 3% of staff, or about 6,000 workers. The layoffs affected its California employees and LinkedIn workers.

LinkedIn is among major tech companies that have slashed their workforces this year. Meta, Google, Autodesk and other tech companies have also been cutting workers, citing various reasons, including restructuring, investments in artificial intelligence and low worker performance.

LinkedIn, headquartered in Sunnyvale and Mountain View, notified its employees about the layoffs on May 13. Workers posted about their pink slips on the social network, letting hiring managers and recruiters know that they were open to work.

The company didn’t respond to a request for comment. Its website says it has roughly 18,400 employees and offices in more than 30 cities globally.

LinkedIn’s California layoffs affected workers at its offices in San Francisco, Mountain View, Carpinteria and Sunnyvale. More than half of those cuts hit its workforce in Mountain View.

Software engineers were heavily impacted by LinkedIn’s California layoffs, according to data provided to the state. Talent account directors, senior product managers and other workers also lost their jobs.

The cuts come as tech companies are releasing more artificial intelligence-powered tools that can generate code. Executives have also said that would impact engineering jobs.

Microsoft Chief Executive Satya Nadella said in April that as much as 30% of the company’s code is written by AI. Nadella spoke during a conversation with Meta Chief Executive Mark Zuckerberg at the social network’s AI developer conference.

As Microsoft competes to release more AI tools, the company has said that it’s trying to increase how fast it moves by reducing the number of managers and cutting down on redundancies.

It’s the latest cost-cutting round at LinkedIn. In 2023, the company laid off nearly 700 employees and said that it was trying to improve agility and accountability as part of a reorganization effort.

Microsoft purchased LinkedIn for $26 billion in 2016. In April, the company reported that its revenue in the third fiscal year quarter reached $4.3 billion in the third fiscal year quarter, up 7% over last year.

Business

FCC commissioner sounds alarms about free speech 'chilling effect' under Trump

Federal Communications Commissioner Anna M. Gomez traveled to Los Angeles this week to sound an alarm that attacks on the media by President Trump and his lieutenants could fray the fabric of the 1st Amendment.

Gomez’s appearance Wednesday at Cal State L.A. was designed to take feedback from community members about the changed media atmosphere since Trump returned to office. The president initially expelled Associated Press journalists from the White House, for example. He signed an executive order demanding government funding be cut to PBS and NPR stations.

Should that order take effect, Pasadena-based radio station LAist would lose nearly $1.7 million — or about 4% of its annual budget, according to Alejandra Santamaria, chief executive of parent organization Southern California Public Radio.

“The point of all these actions is to chill speech,” Gomez told the small crowd. “We all need to understand what is happening and we need people to speak up and push back.”

Congress in the 1930s designed the FCC as an independent body, she said, rather than one beholden to the president.

But those lines have blurred. In the closing days of last fall’s presidential campaign, Trump sued CBS and “60 Minutes” over edits to an interview with then-Vice President Kamala Harris, alleging producers doctored the broadcast to enhance her election chances. CBS has denied the allegations and the raw footage showed Harris was accurately quoted.

Trump-appointed FCC Chairman Brendan Carr, upon taking office in January, revived three complaints of bias against ABC, NBC and CBS, including one alleging the “60 Minutes” edits had violated rules against news distortion. He demanded that CBS release the unedited footage.

The FCC’s review of Skydance Media’s pending takeover of CBS-parent Paramount Global has been clouded by the president’s $20-billion lawsuit against CBS. The president rejected Paramount’s offer to settle for $15 million, according to the Wall Street Journal, which said Trump has demanded more.

Two high-level CBS News executives involved in “60 Minutes” were forced out this spring.

Gomez, in an interview, declined to discuss the FCC’s review of the Skydance-Paramount deal beyond saying: “It would be entirely inappropriate to consider the complaint against the ’60 Minutes’ segment as part of a transaction review.” Scrutinizing edits to a national newscast “are not part of the public interest analysis that the commission does when it considers mergers and acquisitions,” she said.

For months, Gomez has been the lone voice of dissent at the FCC. Next month, she will become the sole Democrat on the panel.

The longtime communications attorney, who was appointed to the commission in 2023 by former President Biden, has openly challenged her colleague Carr and his policies that align with Trump’s directives. She maintains that some of Carr’s proposals, including opening investigations into diversity and inclusion policies at Walt Disney Co. and Comcast, go beyond the scope of the FCC, which is designed to regulate radio and TV stations and others that use the public airwaves.

The pressure campaign is working, Gomez said.

“When you see corporate parents of news providers … telling their broadcasters to tone down their criticisms of this administration, or to push out the executive producer of ’60 Minutes’ or the head of [CBS] News because of concerns about retribution from this administration because of corporate transactions — that is a chilling effect,” Gomez said.

Wednesday’s forum, organized by the nonprofit advocacy group Free Press, was punctuated with pleas from professors, journalists and community advocates for help in fending off Trump’s attacks. One journalist said she lost her job this spring at Voice of America after Trump took aim at the organization, which was founded more than 80 years ago to counter Nazi propaganda during World War II.

The Voice of America’s remaining staffers could receive reduction-in-force notices later this week, according to Politico.

Latino journalists spoke about the difficulty of covering some stories because people have been frightened into silence due to the administration’s immigration crackdown.

For now, journalists are able to carry out their missions “for the most part,” said Gabriel Lerner, editor emeritus of the Spanish-language La Opinión.

But he added a warning.

“Many think that America is so exceptional that you don’t have to do anything because fascism will never happen here,” Lerner said. “I compare that with those who dance on the Titanic thinking it will never sink.”

The White House pushed back on such narratives:

“President Trump is leading the most transparent administration in history. He regularly takes questions from the media, communicates directly to the public, and signed an Executive Order to protect free speech on his first day back in office,” spokesperson Anna Kelly said. “He will continue to fight against censorship while evaluating all federal spending to identify waste, fraud, and abuse.”

FCC Commission Chairman Brendan Carr on Capitol Hill.

(Alex Wroblewski / Bloomberg via Getty Images)

Traditionally, the five-member FCC has maintained an ideological balance with three commissioners from the party in power and two from the minority. But the senior Democrat — Geoffrey Starks — plans to step down next month, which will leave just three commissioners: Gomez, Carr and another Republican, Nathan Simington.

Trump has nominated a third Republican, Olivia Trusty, but the Senate has not confirmed her appointment.

Trump has not named a Democrat to replace Starks.

Some on Wednesday expressed concern that Gomez’s five-year tenure on the commission could be cut short. Trump has fired Democrats from other independent bodies, including the Federal Trade Commission and the Consumer Product Safety Commission.

Gomez said if she is pushed out, it would only be because she was doing her job, which she said was defending the Constitution.

Rep. Raul Ruiz (D-Indio) applauded Gomez’s efforts and noted that he’s long appreciated coordinating with her on more routine FCC matters, such as ensuring wider broadband internet access.

“But now the fight is the survival of the free press,” Ruiz said.

He noted that millions of people now get news from non-journalist sources, leading to a rise of misinformation and confusion.

“What is the truth?” Ruiz said. “How can we begin to have a debate? How can we begin to create policy on problems when we can’t even agree on what reality is?”

Business

Contributor: A Trump deregulator may set us up for a sequel to the 2008 crisis

The movie “The Big Short” — dramatizing the reckless behavior in the banking and mortgage industries that contributed to the 2008 financial crisis — captures much of Wall Street’s misconduct but overlooks a central player in the collapse: the federal government, specifically through Fannie Mae and Freddie Mac.

These two government-created and government-sponsored enterprises encouraged lenders to issue risky home loans by effectively making taxpayers co-sign the mortgages. This setup incentivized dangerous lending practices that inflated the housing bubble, eventually leading to catastrophic economic consequences.

Another critical but overlooked factor in the collapse was the Community Reinvestment Act. This federal law was intended to combat discriminatory lending practices but instead created substantial market distortions by pressuring banks to extend loans to borrowers who might otherwise have been deemed too risky. Under threat of regulatory penalties, banks significantly loosened lending standards — again, inflating the housing bubble.

After the bubble inevitably burst, Fannie and Freddie were placed under conservatorship by the Federal Housing Finance Agency. The conservatorship imposed rules aimed at preventing future taxpayer-funded bailouts and protecting the economy from government-fueled market distortions.

Now, President Trump’s appointee to lead that agency, Bill Pulte, is considering ending this conservatorship without addressing the core structural flaw that fueled the problem in the first place: implicit government guarantees backing all Fannie and Freddie mortgages. If Pulte proceeds without implementing real reform, taxpayers on Main Street are once again likely to be exposed to significant financial risks as they are conscripted into subsidizing lucrative deals for Wall Street.

Without genuine reform, the incentives and practices that led to the crisis remain unchanged, setting the stage for a repeat disaster.

Pulte’s proposal isn’t likely to unleash free-market policies. Instead, it could further rig the market in favor of hedge funds holding substantial stakes in Fannie and Freddie, allowing them to profit enormously from the potential upside, while leaving taxpayers to bear all the downside risks.

A meaningful solution requires Fannie and Freddie to significantly strengthen their capital reserves. The two government-sponsored enterprises still remain dangerously undercapitalized. A report from JP Morgan Chase describes it this way: “Despite steady growth in [their net worth], the GSEs remain well below the minimum regulatory capital framework requirements set by the Federal Housing Finance Agency in 2020.” Imposing robust capital requirements similar to those that govern private banks would oblige the two enterprises to internalize their risks, promoting genuine market discipline and accountability.

Further reforms should address transparency and oversight. Enhanced disclosure standards would allow investors, regulators and the public to better assess risks. Additionally, limiting the types of mortgages these entities can guarantee could reduce exposure to the riskiest loans, further protecting taxpayers. Implementing clear rules that prevent Fannie and Freddie from venturing into speculative financial products would also mitigate potential market distortions.

Critically, the federal government must clearly communicate that future bailouts are not an option. Explicitly removing government guarantees would compel Fannie and Freddie to operate responsibly, knowing that reckless behavior will lead to their insolvency, not to another taxpayer rescue. Clear legal separation from government backing is essential to prevent moral hazard.

The combination of government guarantees, regulatory pressure from policies such as the Community Reinvestment Act and inadequate capital standards created the perfect storm for the 2008 financial crisis. Ignoring these lessons and repeating past mistakes would inevitably lead to a similar disaster.

Proponents of prematurely releasing Fannie and Freddie argue that market conditions have changed and risk management has improved. Yet, history repeatedly demonstrates that without structural changes, financial entities — particularly those shielded by government guarantees — inevitably revert to risky behavior when market pressures and profit incentives align. Markets function best when participants bear the full consequences of their decisions, something impossible under the current structure of these government-sponsored enterprises.

Ultimately, the only responsible approach is removing taxpayers from the equation entirely. Fannie Mae and Freddie Mac should participate in the mortgage market only as fully private entities, without any implicit government guarantees.

The American public doesn’t need a sequel to “The Big Short.” The painful lessons of the 2008 crisis are too recent and too severe to be ignored or forgotten. Market discipline, fiscal responsibility and genuine reform — not government-backed risk-taking — must guide our approach going forward. We can only hope that the Trump administration chooses fiscal responsibility over risky experiments that history has already shown end in disaster.

Veronique de Rugy is a senior research fellow at the Mercatus Center at George Mason University. This article was produced in collaboration with Creators Syndicate.

-

Education1 week ago

Education1 week agoVideo: Columbia University President Is Booed at Commencement Ceremony

-

Technology1 week ago

Technology1 week agoAre Character AI’s chatbots protected speech? One court isn’t sure

-

News1 week ago

News1 week agoRead the Full ‘Make America Healthy Again’ Report

-

Culture1 week ago

Culture1 week agoHow Manga Megastar Junji Ito Makes Terrifying Series Like ‘Uzumaki’

-

News1 week ago

News1 week agoVideo: Trump Repeats False Claims to South African President

-

Technology1 week ago

Technology1 week agoNow you can watch the Internet Archive preserve documents in real time

-

Technology1 week ago

Technology1 week agoDiscord might use AI to help you catch up on conversations

-

Science1 week ago

Science1 week agoTrump Has Cut Science Funding to Its Lowest Level in Decades