Business

Sister of 73-year-old lookout killed in McKinney fire, dozens of others sue utility company

Every week after PacifiCorp was sued by Northern California residents who misplaced houses and property within the McKinney hearth, the utility firm faces one other lawsuit on behalf of dozens of individuals, together with the sister of a longtime Siskiyou County hearth lookout killed within the blaze, alleging wrongful loss of life, negligence and different claims.

The lawsuit, filed in Sacramento County Superior Courtroom on Friday, states that the blaze ignited when PacifiCorp’s electrical gear contacted or induced sparks to fly into surrounding vegetation.

Shirley Shoopman, the sister of 73-year-old hearth lookout Kathy Shoopman, the primary of the blaze’s 4 victims recognized, is called as a plaintiff together with greater than 50 different residents, enterprise house owners and others affected by the McKinney hearth.

The lawsuit accuses PacifiCorp of “negligently, recklessly and willfully” failing to examine, restore, preserve and function the gear, and failing to handle the vegetation round its infrastructure.

“Total, these fires don’t should be our new regular,” stated Dave Fox, the lead legal professional representing the plaintiffs. “Our utilities can do higher. They completely can handle their energy strains and surrounding vegetation higher to maintain issues safer.”

The hearth ignited July 29 in Klamath Nationwide Forest exterior Yreka. Excessive warmth, low humidity, excessive winds and bone-dry vegetation fueled explosive development that noticed the blaze tear by way of the neighborhood of Klamath River, the place Kathy Shoopman lived.

Within the days after the fireplace began, evacuees instructed The Occasions of their harrowing escapes, surrounded by flames and smoke and practically overtaken by the flaming entrance.

4 separate occasions, columns of smoke rose past the altitude at which a typical jet flies, penetrating the stratosphere, injecting a plume of soot and ash miles above Earth’s floor and making a pyrocumulonimbus cloud — a phenomenon that NASA as soon as memorably described as “the fire-breathing dragon of clouds.”

Klamath Nationwide Forest officers introduced Kathy Shoopman’s loss of life on Aug. 8.

She was a resident of Klamath River for practically 50 years, the officers stated, and was remembered as a gifted artist, gardener and animal lover.

Fox, the lead legal professional, instructed The Occasions that Kathy and her sister, Shirley, had been very shut.

The sisters didn’t have youngsters, he stated. Their dad and mom had died, and the siblings had been main elements of one another’s lives.

As of Friday, the McKinney hearth had burned 60,138 acres and was 99% contained. It has destroyed 185 buildings, broken 11 extra and left 12 individuals injured, along with the 4 deaths.

“This wildfire was not the results of an ‘act of God,’ ” in keeping with the lawsuit. “Reasonably this wildfire was began by sparks from high-voltage transmission strains, distribution strains, appurtenances, and different electrical gear inside PacifiCorp’s utility infrastructure that ignited surrounding vegetation. Regardless of their data of this excessive hearth threat, defendants intentionally prioritized earnings over security.”

The submitting comes on the heels of different latest authorized motion associated to the blaze.

Final week, residents within the burn space sued PacifiCorp, alleging that sparks from the utility’s transmission strains and different gear ignited the fireplace.

PacifiCorp, which is owned by Warren Buffet’s Berkshire Hathaway Power holding firm, operates {an electrical} grid throughout Oregon, Washington and Northern California. The utility firm reported to California regulators that it operates an influence line that runs close to Freeway 96 in Siskiyou County the place the McKinney hearth is believed to have began, the California Division of Forestry and Fireplace Safety reported.

“Per firm coverage, we don’t focus on ongoing litigation,” Brandon Zero, an organization spokesperson, instructed The Occasions on Friday.

Fox, the plaintiffs’ lead legal professional in Friday’s lawsuit, stated that though he’s representing dozens of individuals, the case shouldn’t be a class-action submitting.

Every plaintiff has distinctive claims in opposition to PacifiCorp, however they’re being introduced beneath one case for the sake of effectivity and within the hopes of holding the utility accountable, he stated.

Business

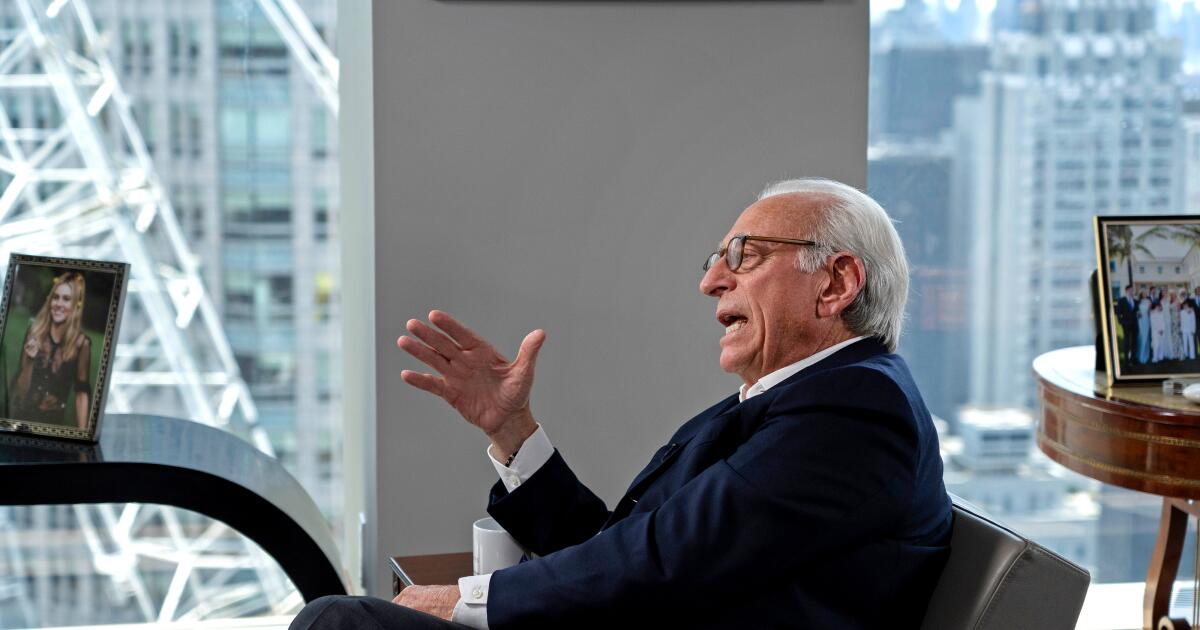

Nelson Peltz cashed out his Disney stake after losing his proxy fight

In the end, veteran investor Nelson Peltz came away with a big win in his battle with the Walt Disney Co.

Peltz’s Trian Fund Management sold its Disney shares after Peltz lost his hard-fought campaign to join the Burbank entertainment giant’s board of directors and exert influence over the Magic Kingdom.

Last month, Disney shareholders rejected the billionaire’s proxy bid, but Trian still profited by selling its Disney stake to reap about $1 billion on its investment, according to business news network CNBC, which quoted an unnamed person familiar with the matter.

Trian reportedly capitalized on Disney’s recent run-up in stock price, when shares traded at about $120 in early April.

Since then, Disney’s stock has fallen. Shares were hovering around $101 on Thursday.

Still, Disney is up 12% since the beginning of the year as Chief Executive Bob Iger seeks to demonstrate that he’s properly managing the company to achieve success in the streaming era.

While Disney strenuously campaigned against Peltz and his ally, former Disney executive Jay Rasulo, the company has heeded some of Peltz’s calls, including implementing rounds of rigorous cost-cutting, resulting in about 8,000 positions being eliminated.

Representatives of Trian and Disney declined to comment.

In what became Disney’s most consequential board election in 20 years, Peltz repeatedly hammered the company for its missteps and bungled succession efforts.

Peltz’s proxy campaign zoomed in on Disney’s subpar stock performance over the last five years, uneven box-office results and $71-billion purchase of much of Rupert Murdoch’s 21st Century Fox, which provided Disney with more library content and intellectual property, including “Avatar,” “The Simpsons,” and “Deadpool.” Peltz and some analysts viewed the Murdoch deal as a costly mistake.

Another sore point was Disney board members’ decision to hire Bob Chapek as CEO four years ago and extending Chapek’s contract less than six months before directors forced him out. Chapek, who was Iger’s handpicked replacement, made several costly blunders, including allowing Disney to become fodder for the culture war campaign of Florida Gov. Ron DeSantis.

Disney also racked up billions of dollars in losses on streaming.

Peltz unveiled Trian’s proxy fight last fall. It was his second stab at winning a board seat, but the activist investor withdrew his initial effort in early 2023 after Iger first announced his cost-cutting plans. Last fall, Peltz reportedly added to his Disney stake. In October, the stock was trading below $90 a share.

Peltz mustered the votes of about 30% of shareholders who voted in April’s election, according to a Securities and Exchange filing.

Iger received 94% of shareholders’ support — a clear victory that reinforced his popularity among large institutional investors as well as small shareholders who are nostalgic for the company, its characters and theme parks. Three-quarters of “retail” shareholders (as opposed to larger institutional investors, such as mutual funds) voted in support of Disney’s slate of 12 board nominees, which included Iger.

Despite their proxy battle victory, Iger and his management team remain under pressure to accelerate the company’s turnaround plans, including efforts to make its streaming business profitable. Disney must preserve the power of its ESPN sports empire, and other TV channels, while also reinvigorating its movie pipeline and expanding its theme parks and resorts business.

Disney has announced a $60-billion investment in theme parks, resorts and cruise lines over the next decade. In April, the Anaheim City Council approved a $1.9-billion expansion plan for the sprawling Disneyland Resort.

Disney board members must also find a capable successor for Iger — a duty that has eluded the company for years. Iger’s current contract runs through 2026.

Staff writer Samantha Masunaga contributed to this report.

Business

State audit finds major backlog of wage theft claims in California

Claims of wage theft filed by California workers are routinely left in limbo for years by state investigators who are facing a massive backlog of cases, according to a recent audit of the California Labor Commissioner’s office.

As a result of the sluggish pace, workers are left waiting years to receive money they may be owed, the audit found.

When claims are eventually investigated, the Labor Commissioner’s Office often does not recover wages. The audit found that in cases where workers requested help recovering their wages, they received the full amount owed to them only 12% of the time.

The backlog of unresolved cases has more than doubled in the last five years, from 22,000 claims in fiscal year 2017-18 to 47,000 in fiscal year 2022-23, the audit found.

The Labor Commissioner would need “hundreds of additional positions under its existing process to resolve the backlog,” California State Auditor Grant Parks wrote in a letter accompanying the audit to Gov. Gavin Newsom and state lawmakers Wednesday.

Wage theft occurs when employers fail to pay minimum wage or overtime rates or force workers to forgo legally required break times.

State law requires that a decision be made on a wage claim within 135 days from when it was first filed. But the Labor Commissioner’s office often takes two years or longer to process wage claims — more than six times longer than the law allows, the audit found.

Some 2,800 claims involving upwards of $63.9 million in unpaid wages have been open for five years or longer, according to the audit.

“Workers have virtually no recourse because it takes so long. We need emergency hiring of these positions. We need the state to deal with it,” Lorena Gonzalez, head of the California Labor Federation, said of the audit’s findings.

Gonzalez said the audit underscored a problem that labor advocates and others have pointed out for years. She criticized the state for failing to act with urgency to better protect workers vulnerable to exploitation, especially low-wage laborers.

“Where is the outrage? How many hearings have [lawmakers] had on retail theft, on crime? Well this is a crime, and it happens every day to working people.”

The Los Angeles, Oakland, and Long Beach field offices of the labor commissioner have among the biggest backlogs of claims and on average take the longest to close wage theft investigations, according to the audit.

A slow hiring process and low salaries that make it difficult for the agency to retain staff and fill positions have contributed to the high vacancy rates. Vacancy rates in field offices ran as high as 45% in Santa Ana, 44% in Sacramento, 38% in Oakland and 35% in Los Angeles and Long Beach as of June 2023.

But even if all vacant positions were filled, the labor commissioner would be short of the manpower needed to address the backlogs and process claims in the time frame required by law, the audit found. The labor commissioner has about 315 positions, about a third of which are vacant. But it needs 892 full-time positions, nearly three times as many, the audit said.

The audit found that poor technological infrastructure that has led to inaccuracies, and spotty data in the agency’s case management system has also made it difficult for the office to track claims.

California’s Department of Industrial Relations, which includes the Labor Commissioner’s Office, said it “is committed to finding ways to continually improve its programs and ensure that it meets its mission to protect and improve the health, safety and economic well-being of over 18 million wage earners.”

The department’s director, Katrina S. Hagen. said the division is working on improvements to the case management system and conducting a study of staff salaries to improve retention.

And last week, the Department of Industrial Relations announced $8.5 million in grants to 17 local prosecutors to run wage theft enforcement programs locally and bring criminal charges against problem employers.

Other California agencies responsible for enforcing labor laws have also been beset by staffing problems and claims of ineffectiveness. The Division of Occupational Safety and Health, known as Cal/OSHA, is grappling with a 38% job vacancy rate and faced sharp criticism at a February hearing of the Assembly Committee on Labor and Employment, where farmworkers testified that they’d been exposed to extreme heat and pesticides on the job.

The release of the audit comes as lawmakers and lobbyists are in negotiations over the future of California law that labor leaders say is a crucial alternative for dealing with wage theft and other workplace abuses.

The law, known as the Private Attorneys General Act, or PAGA, gives workers the right to file lawsuits against their employers over back wages and to seek civil penalties on behalf of themselves and other employees.

A business-backed initiative seeking to repeal the law will appear on the ballot in November, unless a deal is reached in the next few weeks.

The California Labor Federation and other labor groups are backing Assembly Bill 2288, introduced by Ash Kalra (D-San José), that aims to give PAGA more teeth by allowing courts to order employers to correct violations. Advocates say it will help ensure bad behavior by employers is halted, rather than simply awarding a settlement and allowing a company to go back to problematic practices.

Business

How Beyond Meat is trying to get its sizzle back

When Beyond Meat went public in 2019 in an initial stock offering that saw its shares nearly triple in price, it seemed to confirm that plant-based meats had arrived.

The food technology, capable of converting beans into something approaching meat in taste and appearance, caught the imagination of the public, restaurant chefs and media alike. Deals with fast-food chains and soaring sales during the pandemic seemed to only underscore how a once-fringe idea had gone mainstream.

But those heady days are over as industry sales have fallen amid concerns about the healthfulness of plant-based meat, a sticker price that remains higher than a basic burger — and the fact that the product still only approximates the real thing.

“We thought we were just gonna go from our meteoric rise into the mainstream and not have to deal with this cycle that we’re in,” said Beyond Meat founder and Chief Executive Ethan Brown, in an interview at the company’s new El Segundo offices. “The trough has been a difficult place to be the last couple of years.”

Now the company is betting it can turn around its fortunes with a newly formulated burger that it says not only is a big leap in taste, but has won the seals of approval of leading health and nutrition organizations.

“I give credit where it’s due. I think they’ve made some clear improvements in the ingredients and nutritional profile, so there’s clear progress there,” said John Baumgartner, an analyst at Mizuho Securities, who has had an “underweight” rating on Beyond’s stock.

As the first plant-based meat company to go public, Beyond has been an industry bellwether, with its travails documented in the media and regulatory filings.

Though the company’s growing lineup, including breakfast patties, beef tips and chicken tenders, are sold at 130,000 retail and food service outlets worldwide, some of its heralded fast-food deals with companies such as Carl’s Jr., Dunkin Donuts and KFC have either petered out or not moved beyond test phases.

It’s also faced stiff competition from chief rival, Impossible Foods in Redwood City, Calif., which has made fast sales gains at supermarkets and is available as a Whopper at Burger King.

Beyond’s net revenue fell by more than 25% to $343 million in 2023 compared with 2021. Sales decreased another 18% in the first quarter of this year, with the company racking up $54 million in losses.

With numbers like that, investors have taken a beating. The stock is down more than 90% since its all-time highs topping $200 in 2019. Shares closed Thursday at $7.35.

The sales decline has taken a sharp financial toll, with the company’s cash position falling from $733 million in 2021 to $190 million last year.

That prompted TD Cowen in a May earnings note to say the company may run out of money if it can’t stem the bleeding or raise funds — an outcome Brown dismisses. In Beyond’s quarterly conference call, the chief financial officer talked about raising funds through either debt or equity.

“It’s challenging,” Baumgartner said. “The category is still trying to find its way.”

Sales of plant-based meats and seafood were down 12% in 2023 to $1.2 billion, with unit sales falling even more by 19%, according to the Good Food Institute.

While the novelty of plant-based meat has worn off, what has stuck are persistent cries of “fake” or “faux” meat by critics — a diverse group that includes nutritionists, the entrenched meat industry and whole food absolutists who proselytize eating foods closer to nature.

The meat industry has for years helped bankroll a campaign highlighting the highly processed nature of Beyond’s and other makers’ plant-based beef products. “Fake meat, real chemicals,” is one such campaign sponsored by the Center for Consumer Freedom, a business backed nonprofit.

“Our campaign simply informed the public about what’s in fake meat. Consumers have seen past the marketing spin and realized that these products are just ultraprocessed goop that costs more and isn’t healthier than real meat,” said James Bowers, executive director of the center, in an emailed statement to The Times.

Beyond has tried to stress that all its ingredients come from plant-based sources, but there are many nutritionists on the web who also have voiced concerns about the fat and sodium content of the older burgers — and an industrial process that creates a product Grandma would not have stocked in her kitchen.

Baumgartner thinks those voices have resonated more than any industry-backed campaign.

Brown maintains entrenched food lobbies are the real culprit, while also acknowledging their effectiveness.

“So if you look at 2020, 50% or more of consumers thought that plant-based meat was healthy. That dropped to 38% in 2022. And it’s probably lower today,” he told The Times.

Beyond is banking its turnaround on the fourth iteration of its burger meat, which began wide distribution in May. Beyond has switched from canola and coconut oils to avocado oil, reducing saturated fat by 60% to 2 grams per serving, while cutting sodium by 20%.

Brown said the new recipe, which includes peas, red lentils, faba beans and brown rice, was developed through consultation with the company’s scientific and nutritional advisors, as well as leading health groups.

The new burger has earned key endorsements by the American Diabetes Assn. and Good Housekeeping that Beyond plans to slap on its labeling. The American Heart Assn. is including the product in its heart-healthy recipe collection.

Beyond also says its major recipe change has resulted in its “meatiest, juiciest” burger ever, citing early taste tests to back up its claim. That’s an important consideration, given the competition.

Impossible Foods, founded by a Stanford University biochemist, makes soy-based burgers, using a bean that has been manipulated by the food industry for decades to make an assortment of products. The company’s burgers also contain a genetically modified plant-based version of heme, an iron-containing molecule that is a component of beef.

In online taste tests, Impossible often beat Beyond’s burgers, which are based on peas. Brown chose peas due to alleged health concerns over soy-based products, the vast majority of which are genetically modified.

Impossible’s burgers became the darlings of foodies and chefs at high-end restaurants prior to pandemic, and since then, like Beyond, the company has continued to improve them, with multiple versions now available.

While both companies laid off workers amid the industry’s downturn, Impossible has seen strong retail sales and claims it is “the fastest growing meat from plants brand” in the country. It’s also managed to make its Impossible Whopper stick on Burger King’s menus. As a privately held company, it does not release detailed financial information.

Overseas, Beyond, which can market its product as non-GMO, sells in far more markets, and, though McDonald’s decided against selling a Beyond-based burger in the United States, it does so in Europe.

Despite how much is riding on its newest burger, Beyond has raised the retail prices, partially to offset the higher costs of the ingredients, but also to improve its margins.

Baumgartner questioned the move, especially after Beyond had cut the price of its prior burger.

“I think what complicates the matter now is in 2023, when you had inflation and you were seeing food prices going up, Beyond cut their prices. Now, as prices have generally stabilized, Beyond Meat is raising prices.”

Brown dismissed the concerns, saying the company needs to raise its margins after the prior price cut destroyed them, while doing nothing to improve sales.

While Brown’s goal has been to achieve pricing parity with animal meat, he said Beyond’s customers — health conscious and concerned about the environmental issues surrounding the beef industry — have been found to be “price insensitive.”

The fundamental challenge for Beyond, he said, is turning around the wider perception that its products are not good for you.

“Once that narrative became complicated for people because of misinformation or whatever, it became harder to grow the business. We have addressed that thoroughly in this product,” he said.

-

News1 week ago

News1 week agoRead the I.C.J. Ruling on Israel’s Rafah Offensive

-

News1 week ago

News1 week agoVideo: Protesters Take Over U.C.L.A. Building

-

World1 week ago

World1 week ago€440k frozen in Italy over suspect scam by fake farmers

-

World1 week ago

World1 week agoHoping to pave pathway to peace, Norway to recognise Palestinian statehood

-

Science1 week ago

Science1 week agoSecond human case of bird flu detected in Michigan dairy worker

-

Politics1 week ago

Politics1 week agoAOC demands Senate Democrats investigate reports of Jan. 6 flags flown at Supreme Court Justice Alito's home

-

News1 week ago

News1 week agoLegendary U.S. World War II submarine located 3,000 feet underwater off the Philippines

-

Politics1 week ago

Politics1 week agoNYC Mayor Eric Adams announces Urban Rat Summit to combat rodent crisis: 'I hate rats'