Business

Regional Bank Stocks Rebound as Panic Appears to Pause

Regional financial institution shares, a few of which misplaced practically half their worth on Monday, rebounded in early buying and selling on Tuesday, serving to Wall Road to recuperate and providing a pause out there panic over the well being of the monetary system.

The S&P 500 rose 1.5 p.c in morning buying and selling, recouping a few of its losses from the fast collapse of Silicon Valley Financial institution and Signature Financial institution, and pointing to a semblance of stability returning to monetary markets. Traders appeared to take to coronary heart assurances that depositors can be protected by federal authorities, serving to to calm nerves within the banking sector.

First Republic Financial institution, one of many banks most within the crosshairs of traders in latest days, was up practically 50 p.c, having fallen by an analogous quantity on Monday. Western Alliance Bancorp rose roughly 40 p.c, following a fall of practically 50 p.c. The KBW Financial institution index, which tracks the efficiency of 24 banks, rose over 4 p.c, its greatest day in roughly 4 months.

Our Protection of the Funding World

The decline of the inventory and bond markets this yr has been painful, and it stays troublesome to foretell what’s in retailer for the longer term.

The rally disregarded inflation knowledge that confirmed costs proceed to rise at a stubbornly excessive tempo. Client Value Index knowledge launched earlier than buying and selling started confirmed inflation cooling barely for the yr by February, however accelerating from the earlier month.

Sometimes that might garner a powerful response from the Federal Reserve, leading to even greater rates of interest that sometimes weigh on the inventory market. However expectations for additional fee will increase have been moderated by the banking disaster, leaving the Fed in a troublesome spot. The central financial institution has mentioned that it’ll maintain elevating rates of interest till it has inflation underneath management however it’s those self same rate of interest will increase that had been on the root of the ache amongst banks over the previous week.

“Persons are making an attempt to gauge what the Fed is definitely going to do given all the brand new info for the reason that finish of final week,” mentioned Charlie Ripley, a senior funding strategist at Allianz Funding Administration. “I feel there’s a large quantity of uncertainty. The Fed actually has a dilemma on its fingers right here.”

Some traders posited that the disaster within the banking sector appeared contained, boosting sentiment, but it’d nonetheless be sufficient to offer the Fed motive to forgo additional rate of interest will increase, bolstering that constructive sentiment.

Traders’ bets on whether or not or not the Fed will increase rates of interest subsequent week tilted again to anticipating 1 / 4 level improve following the recent inflation knowledge, however that’s nonetheless markedly decrease than the place expectations stood per week in the past.

“That is giving the Fed a motive to again off and modify what they’ve finished,” mentioned Liz Ann Sonders, chief funding strategist at Charles Schwab, after the info was launched. “Absent additional deterioration in regional banks I feel the market is greedy on the Fed being given an excuse to pause and reassess.”

Within the bond market, sentiment appeared much less hopeful. The 2-year Treasury yield, which is delicate to adjustments in rate of interest expectations, rose by greater than 0.3 share factors — a big transfer for an asset that sometimes rises and falls in tiny fractions of a share level. The ten-year Treasury yield remained extra anchored, suggesting fading hopes for financial progress over the long run.

“I feel what’s mirrored within the bond market is an elevated danger of recession and a credit score crunch however for no matter motive it hasn’t reached inventory traders but,” mentioned Ms. Sonders.

Business

Column: Examining Trump's lies about what he did with Obamacare and COVID

My favorite Lily Tomlin line is this one: “No matter how cynical you become, it’s never enough to keep up.”

I love it more today than ever, because it applies so perfectly to how we must respond to the campaign claims of Donald Trump and JD Vance. Especially Trump’s assertions about his role — heroic, in his vision — in “saving” the Affordable Care Act and fighting the COVID pandemic.

I’ve written before about the firehouse of fabrication and grift emanating from the Trump campaign like a political miasma. On these topics, he has moved beyond his habit of merely concocting a false reality about, say, immigration and crime to deliberately concocting a false reality about himself.

Donald Trump could have destroyed [Obamacare]. Instead, he worked in a bipartisan way to ensure that Americans had access to affordable care.

— JD Vance, flagrantly lying about Trump’s management of the Affordable Care Act

To start by summarizing: Trump did everything in his power to destroy the Affordable Care Act, starting on the very first day of his term in 2017. On COVID, he did everything in his power to make America defenseless against the spreading pandemic.

Let’s take them in order.

Here’s what Trump said about the Affordable Care Act during his Sept. 10 debate with Kamala Harris: “I had a choice to make when I was president, do I save it and make it as good as it can be? Never going to be great. Or do I let it rot? … And I saved it. I did the right thing.”

This was the prelude to his head-scratching assertion that he has “concepts of a plan” to reform healthcare in the U.S. I examined what that might mean in a recent column, in which I explained that it would turn the U.S. healthcare system to the deadly dark ages when people with preexisting medical conditions would be either denied coverage or charged monstrous markups.

During his own debate Tuesday with Tim Walz, Vance made himself an accomplice to Trump’s crime against truth .

Here’s Vance’s version of the Trumpian fantasy:

“Donald Trump has said that if we allow states to experiment a little bit on how to cover both the chronically ill, but the non-chronically ill … He actually implemented some of these regulations when he was president of the United States. And I think you can make a really good argument that it salvaged Obamacare. … Donald Trump could have destroyed the program. Instead, he worked in a bipartisan way to ensure that Americans had access to affordable care.”

Here’s what Trump actually did to the Affordable Care Act during his presidency. He had made repealing the ACA a core promise of his 2016 presidential campaign, stating on his website, “On day one of the Trump Administration, we will ask Congress to immediately deliver a full repeal of Obamacare.” (Thanks are due to the indispensable Jonathan Cohn of Huffpost for excavating the quote.)

Trump drove down Obamacare enrollment every year he was in office; when Biden removed Trump’s obstacles, enrollment soared.

(KFF / Kevin Drum)

On Inauguration Day, Trump issued an executive order instructing the entire executive branch to find ways to “waive, defer, grant exemptions from, or delay the implementation of any provision or requirement” of the ACA.

During his presidency, he never abandoned the Republican dream of repealing Obamacare, even after July 28, 2017, when the late Sen. John McCain (R-Ariz.) strode to the Senate well and delivered a thumbs-down coup de grace to a GOP repeal bill.

Trump never ceased slandering the ACA as a “disaster.” He returned to the theme during last month’s debate: “Obamacare was lousy healthcare,” he said. “Always was. It’s not very good today.” As president, he threatened to make it “implode,” and used every tool he could get his fingers on to do so.

Just after taking office, he abruptly canceled the customary last-minute advertising blitz to encourage enrollments in Obamacare plans before open enrollment ended on Jan. 31. The last minute surge in enrollments, which had occurred every previous year, vanished. The drop-off was particularly devastating because it was concentrated among the healthiest potential enrollees — those who often wait until the last minute to sign up and whose premiums generally subsidize older, less healthy patients.

In September 2017 he slashed the advertising budget for the upcoming open enrollment period for individual insurance policies by a stunning 90%, to $10 million from the previous year’s $100 million. He also cut funds for nonprofit groups that employ “navigators,” those who help people in the individual market understand their options and sign up, by roughly 40%, to $36.8 million from $62.5 million.

The impact these policies had on enrollment was dire. In the three years before Trump took office, ACA marketplace plans experienced annual enrollment increases, to 12.7 million enrollees in 2016 from 8 million in 2014. During every year of the Trump administration, enrollment declined, falling to 11.4 million in 2020.

Every year since Joseph Biden took office, enrollment has increased, reaching a record 21.3 million this year — an 86% increase over Trump’s last year.

As for Vance’s fatuous claim that Trump “worked in a bipartisan way to ensure that Americans had access to affordable care,” you have the right to ask what Vance has been smoking.

The only bipartisanship on the ACA during the Trump years, Cohn observes, were the actions of GOP senators such as McCain and Lisa Murkowski of Alaska to cooperate with Democrats to stave off their fellow Republicans’ anti-ACA vandalism.

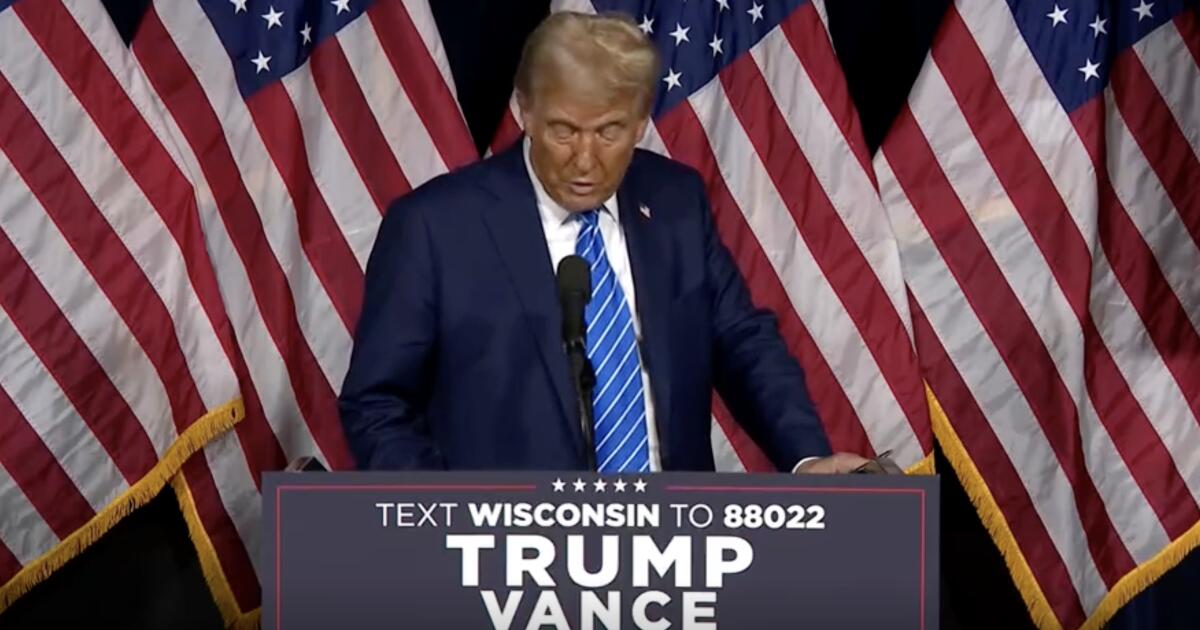

Now onto Trump’s fantasy vision of his role in fighting the COVID pandemic. Speaking in a low-energy, exhausted monotone at a speech Tuesday in Milwaukee and reading at times from a binder, he praised himself for instituting Operation Warp Speed, which funded COVID vaccine development in record time and got them rolled out in January 2021.

“We did a great job with the pandemic. Never got the credit we deserved,” he said. He then veered into blaming China for the pandemic, a familiar topic. He said bluntly that the pandemic was “caused by the Wuhan lab. I said that from the beginning, came from Wuhan. And the Wuhan lab, it wasn’t from bats in a cave that was 2,000 miles away. … It’s really the China virus.”

As for the rest of his COVID performance, he said this: “We did a great job with the ventilators, the masks and the gowns and everything. … When we got here the cupboards, our cupboards, I used to say our cupboards were bare. … No president put anything in for a pandemic.” Then he segued into praising himself for a big tax cut, and COVID was forgotten.

A few points about this spiel:

Trump is correct that Operation Warp Speed was a significant achievement. But he didn’t continue to support it by advocating for its product, the COVID vaccine. Instead, he has thrown in his lot with fanatical anti-vaccine agitators such as Robert F. Kennedy. He has repeated an anti-vax mantra, promising, “I will not give one penny to any school that has a vaccine mandate or a mask mandate.” This is a formula for exposing children to vaccine-preventable diseases such as measles and even polio.

Trump’s reference to the Wuhan Institute of Virology as the source of SARS-CoV-2, the virus that causes COVID, underscores how closely the so-called lab-leak theory of COVID’s origins is tied to right-wing partisan politics. The theory originated with Trump acolytes at the State Department, who saw the accusation as a convenient weapon in Trump’s economic war with China.

To this day, not a speck of evidence has been produced to validate this claim; scientists versed in the relevant disciplines of virology and epidemiology say the evidence overwhelmingly supports the hypothesis that the virus reached humans via the wildlife trade, and that its journey may well have started with bats thousands of miles from Wuhan, China.

Trump is lying when he says his predecessors in the White House left him without resources. The truth is that Trump himself hobbled pandemic response from the start.

In 2016, in the wake of the Ebola epidemic in Africa, President Obama had established the the Directorate for Global Health Security and Biodefense at the National Security Council “to prepare for and, if possible, prevent the next outbreak from becoming an epidemic or pandemic,” in the words of its senior director, Beth Campbell. Trump dissolved it in 2018.

During the pandemic, Trump cut off funding for the World Health Organization. He eliminated a $200-million pandemic early-warning program training scientists in China and elsewhere to detect and respond to such threats. He sidelined the White House Office of Science and Technology Policy, which had been established under Franklin D. Roosevelt.

Due to these steps, the U.S. was fated to sleepwalk into the pandemic. The COVID death toll in the U.S. stands at more than 1.2 million, and its reported death rate from COVID of 341.1 per 100,000 population is the highest in the developed world.

Ventilators, masks and gowns? Trump placed the procurement of this essential personal protective equipment in the hands of his son-in-law, Jared Kushner, who handled the task incompetently. Kushner turned away urgent appeals from state and local officials for those supplies.

“The notion of the federal stockpile was it’s supposed to be our stockpile, it’s not supposed to be states’ stockpiles that they then use,” Kushner said at a briefing.

Following his remarks, the website of the government’s national strategic stockpile of medicines and supplies was changed from asserting that its purpose was to “support” the emergency efforts of state, local and tribal authorities by ensuring that “the right medicines and supplies get to those who need them most.” The new language redefined the stockpile’s role as “to supplement state and local supplies … as a short-term stopgap.”

Supplies of ventilators, masks and gowns remained scarce through the first months of the pandemic. A procurement official at a Massachusetts hospital system told me of having had to cut a deal with a shadowy broker offering 250,000 Chinese-made masks at an inflated price, completing the transaction for $1 million at a darkened warehouse five hours from home.

Trump made anti-science incompetence and disregard for the welfare of Americans part of our history. The same thing, or worse, looms on the horizon in a second Trump term.

Business

Albertsons to pay $3.9 million over allegations it overcharged, lied about weight of groceries

Grocery titan Albertsons will pay $3.9 million to resolve a civil law enforcement complaint alleging that it ripped off customers at hundreds of its Vons, Safeway and Albertsons stores in California, authorities said Thursday.

According to the complaint, groceries sold by Albertsons Cos. — including produce, meats, baked goods and other items — had less product in the package than indicated on the label. The company also is accused of charging customers prices higher than its lowest advertised price.

“False advertising preys on consumers, who are already facing rising costs, and unfairly disadvantages companies that play by the rules,” L.A. County Dist. Atty. George Gascón said. “This kind of corporate conduct is especially egregious when it comes to essential groceries, as Californians rely on accurate advertised prices to budget food for their families.”

The case was filed in Marin County Superior Court in partnership with the consumer protection units of the district attorney’s offices of Los Angeles, Marin, Alameda, Sonoma, Riverside, San Diego and Ventura counties.

The settlement will be divided among the seven counties and used to support future enforcement of consumer protection laws, according to the Marin County district attorney’s office. None of the money will be paid back to consumers.

The fine comes just over a year after the same company was ordered to pay $3.5 million for selling expired over-the-counter drug products. The company is also currently fighting a federal antitrust lawsuit that seeks to block its planned merger with grocery giant Kroger Inc.

Albertsons Cos. operates 589 Albertsons, Safeway and Vons stores in California. The company did not admit wrongdoing. It cooperated with the investigation and has taken steps to correct the violations, according to the L.A. County district atttorney’s office.

In a statement on the settlement, the company said it takes the matter seriously and is committed to ensuring its customers can shop with confidence.

“We have taken steps to ensure our price accuracy guarantee is more visible to customers by posting signage at multiple locations at the front of our stores,” the company stated. “We have conducted additional comprehensive training for associates to reinforce the importance of price accuracy and customer transparency. Additionally, we have enhanced price tracking systems to better ensure real-time accuracy at stores.”

Prosecutors in the lawsuit alleged that the company failed to implement a price accuracy policy ordered by a court in 2014.

The policy requires that customers who are overcharged for an item either receive the item for free or receive a $5 gift card, depending on which option is worth more. It is designed to encourage customers to immediately report false advertising.

Under the judgment reached Thursday, the grocery giant must implement this policy and ensure staff are properly trained to place accurate weight labels on products.

The serial overcharging was discovered through inspections by Marin County’s Department of Agriculture, Division of Weights and Measures and its counterparts across the state.

“We could not have achieved this result without the outstanding work of our Weights and Measures inspectors as well as vigilant consumers,” said Deputy Dist. Atty. Andres Perez, who prosecuted the case for Marin County.

For the next three years, Albertsons Cos. is required to hire an independent auditor to ensure it is complying with the terms of the judgment.

Business

Disney faces class action lawsuit over employee data breach

Walt Disney Co. has been hit with a class action lawsuit accusing the Burbank-based entertainment giant of negligence, breach of implied contract and other misconduct in connection with a massive data breach that occurred earlier this year.

Plaintiff Scott Margel submitted the complaint on Thursday in Los Angeles County Superior Court against Disney and Disney California Adventure. The 32-page document also accuses the company of violating privacy laws by not doing enough to prevent or notify victims of the extent of the leak.

The class members, estimated to number in the thousands, are described in the complaint as individuals who gave “highly sensitive personal information” to Disney in connection with their employment at the company — information that was allegedly compromised in the breach.

Representatives of Disney did not immediately respond Friday to The Times’ request for comment.

The lawsuit cites an article published in September by the Wall Street Journal, which reported that a hacking group known as NullBulge publicly released data spanning more than 18,800 spreadsheets, 13,000 PDFs and 44 million internal messages sent via the workplace communication platform Slack.

According to the Journal, the compromised Slack messages contained sensitive information belonging to Disney cruise employees, including passport numbers, visa details, birthplaces and physical addresses; at least one spreadsheet listed the names, addresses and phone numbers of some Disney Cruise Line passengers. The publication later reported that Disney planned to stop using Slack after the breach.

The plaintiff and class members “remain, even today, in the dark regarding which particular data was stolen, the particular malware used, and what steps are being taken, if any, to secure their [personal information] going forward,” the complaint reads.

The plaintiff and class members “are, thus, left to speculate as to where their [data] ended up, who has used it and for what potentially nefarious purposes.”

In July, NullBulge said that it had leaked roughly 1.2 terabytes of Disney data in rebuke of the company’s treatment of artists, “approach to AI” and “pretty blatant disregard for the consumer.” The self-proclaimed hacktivists told CNN that they were able to penetrate Disney’s system thanks to “a man with Slack access who had cookies.”

A Disney spokesperson said in a statement at the time that the company was “investigating this matter.”

Margel is demanding that Disney take steps to reinforce its security system and educate class members about the risks associated with the breach. The plaintiff is also seeking unspecified damages and a jury trial.

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25439572/VRG_TEC_Textless.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25439572/VRG_TEC_Textless.jpg) Technology4 days ago

Technology4 days agoCharter will offer Peacock for free with some cable subscriptions next year

-

World3 days ago

World3 days agoUkrainian stronghold Vuhledar falls to Russian offensive after two years of bombardment

-

World3 days ago

World3 days agoWikiLeaks’ Julian Assange says he pleaded ‘guilty to journalism’ in order to be freed

-

Technology2 days ago

Technology2 days agoBeware of fraudsters posing as government officials trying to steal your cash

-

Virginia4 days ago

Virginia4 days agoStatus for Daniels and Green still uncertain for this week against Virginia Tech; Reuben done for season

-

Sports1 day ago

Sports1 day agoFreddie Freeman says his ankle sprain is worst injury he's ever tried to play through

-

Health18 hours ago

Health18 hours agoHealth, happiness and helping others are vital parts of free and responsible society, Founding Fathers taught

-

News19 hours ago

News19 hours agoLebanon says 50 medics killed in past three days as Israel extends its bombardment