Business

Netflix turns to Microsoft to help build its new ad-supported service.

Netflix has chosen Microsoft to assist construct its forthcoming ad-supported tier, the streaming big stated on Wednesday.

In April, after asserting in its first-quarter earnings report that it had misplaced subscribers for the primary time in a decade, Netflix unexpectedly stated it might introduce a cheaper providing with commercials to attempt to increase subscription numbers. On the time, Reed Hastings, a co-chief govt at Netflix, stated the corporate would search a 3rd celebration to assist construct the brand new tier. Netflix has by no means had a devoted gross sales and promoting group, and for years had vowed that commercials would by no means seem on its service.

For the reason that announcement, Netflix had talked to plenty of firms a few potential partnership, together with NBCUniversal, Google and the Commerce Desk.

Netflix has additionally informed employees that it hopes to introduce the promoting tier by the top of the yr. The corporate will nonetheless have its commercial-free tier, which is dearer for subscribers.

“Microsoft has the confirmed capacity to help all our promoting wants as we work collectively to construct a brand new ad-supported providing,” Greg Peters, Netflix’s chief working officer, stated in an announcement. “Extra importantly, Microsoft supplied the flexibleness to innovate over time on each the know-how and gross sales facet, in addition to robust privateness protections for our members.”

It has been an unpleasant few months for Netflix. The corporate has laid off tons of of employees members, and its inventory value has gone right into a tailspin. On Tuesday, the corporate garnered fewer Emmy nominations than its rival HBO, regardless of having considerably extra programming than the cable community and its streaming service, HBO Max. Netflix will announce its second-quarter earnings subsequent week, and beforehand stated it may lose one other two million subscribers throughout the quarter.

Netflix executives hope that introducing a lower-priced promoting tier will appeal to cost-conscious subscribers. Some analysts have cautioned that by introducing a less expensive service, the streaming service may cannibalize from its base of subscribers who pay extra for a commercial-free expertise.

“At launch, customers could have extra choices to entry Netflix’s award-winning content material,” stated Mikhail Parakhin, the president of internet experiences at Microsoft. “Entrepreneurs seeking to Microsoft for his or her promoting wants could have entry to the Netflix viewers and premium linked TV stock.”

Business

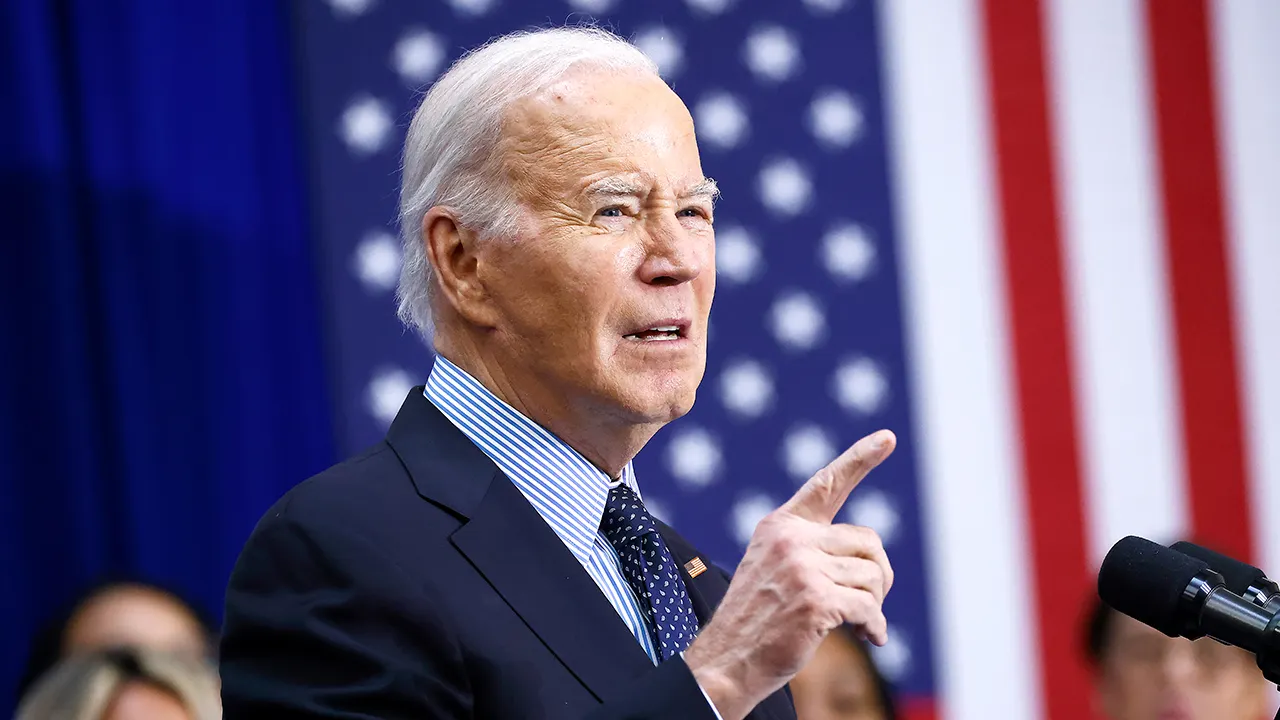

How Hard It Is to Make Trade Deals

President Trump has announced wave after wave of tariffs since taking office in January, part of a sweeping effort that he has argued would secure better trade terms with other countries. “It’s called negotiation,” he recently said.

In April, administration officials vowed to sign trade deals with as many as 90 countries in 90 days. The ambitious target came after Mr. Trump announced, and then rolled back a portion of, steep tariffs that in some cases meant import taxes cost more than the wholesale price of a good itself.

The 90-day goal, however, is a tenth of the time it usually takes to reach a trade deal, according to a New York Times analysis of major agreements with the United States currently in effect, raising questions about how realistic the administration’s target may be. It typically takes 917 days, or roughly two and a half years, for a trade deal to go from initial talks to the president’s desk for signature, the analysis shows.

Roughly 60 days into the current process, Mr. Trump has so far announced only one deal: a pact with Britain, which is not one of America’s biggest trading partners.

He has also suggested that negotiations with China have been rocky. “I like President XI of China, always have, and always will, but he is VERY TOUGH, AND EXTREMELY HARD TO MAKE A DEAL WITH!!!” Mr. Trump wrote on Truth Social on Wednesday. China and the United States agreed last month to temporarily slash tariffs on each other’s imports in a gesture of good will to continue talks.

Part of what the president can accomplish boils down to what you can call a deal.

The pact with Britain is less of a deal than it is a framework for talking about a deal, said Wendy Cutler, the vice president of the Asia Society Policy Institute and a former U.S. trade negotiator. What was officially released by the two nations more closely resembled talking points for “what you were going to negotiate versus the actual commitment,” she said.

During his first term, Mr. Trump secured two major trade agreements, both signed in January 2020. One was the United States-Mexico-Canada Agreement, which was a reworking of the North American free trade treaty from the 1990s that had helped transform the economies of the three nations.

U.S.M.C.A. is an all-encompassing, legally binding agreement that resulted from a lengthy and formal process, according to trade analysts.

Such deals are supposed to cover all aspects of trade between the respective nations and are negotiated under specific guidelines for congressional consultation. Closing the deal involves both negotiation and ratification — modifying or making laws in each partner country. The deals are signed by trade negotiators before the president signs the legislation that puts it into effect for the United States.

Mr. Trump’s other major agreement in his first term was with China, in an echo of the current trade war. The pact, unlike previous deals, came about after Mr. Trump threatened tariffs on certain Chinese imports. This “tariff first, talk later” approach, said Inu Manak, a trade policy fellow at the Council on Foreign Relations, is part of the same playbook the administration is currently using.

The result was a nonbinding agreement between the two countries, known as “Phase One,” that did not require approval from Congress and that could be ended by either party at any time. Still, it took almost one year and nine months to complete. China ultimately fell far short of the commitments it made to purchase American goods under the agreement.

A comparison of the two first-term Trump deals shows the drawn-out and sometimes winding paths each took to completion. Fragile truces (including ones made for 90 days) were formed, only for talks to break down later, all while rounds of tariffs injected uncertainty into the diplomatic relations between countries.

The Times analysis used the date from the start of negotiations to the date when the president signed to determine the length of deal making for each major agreement dating back to 1985 that’s currently in effect. The median time it took to get to the president’s signature was just over 900 days. (A separate analysis published in 2016 by the Peterson Institute for International Economics used the date of signature by country representatives as the completion moment and found that the median deal took more than 570 days.)

With roughly one month before the administration’s self-imposed deadline, Mr. Trump’s ability to forge deals has been thrust into sudden doubt. Last week, a U.S. trade court ruled he had overstepped his authority in imposing the April tariffs.

For now, the tariffs remain in place, following a temporary stay from a federal appeals court. But in arguing its case, the federal government initially said that the ruling could upset negotiations with other nations and undercut the president’s leverage.

In a statement on Wednesday, Kush Desai, a White House spokesman, said that trade negotiators were working to secure “custom-made trade deals at lightning speed that level the playing field for American industries and workers.”

But in other recent public statements, White House officials have significantly pared back their ambitions for the deals.

In April, Scott Bessent, the Treasury secretary, hedged the number of agreements they might reach, suggesting that the United States would talk to somewhere between 50 and 70 countries. Last month he said the United States was negotiating with 17 “very important trading relationships,” not including China.

“I think when the administration first started, they thought they could actually do these binding and enforceable deals within 90 days and then quickly realized that they bit off more than they could chew,” Ms. Cutler said.

The administration told its negotiating partners to submit offers of trade concessions they were willing to make by Wednesday, in an effort to strike trade deals in the coming weeks. The deadline was earlier reported by Reuters.

The current approach to deal making may be strategic, Ms. Manak said. One of the benefits of not doing a comprehensive deal like U.S.M.C.A. is that the administration can declare small “victories” on a much faster timeline, she said.

“It means that trade agreements simply are just not what they used to be,” she added. “And you can’t really guarantee that whatever the U.S. promises is actually going to be upheld in the long run.”

Data and graphics are based on a New York Times analysis of information from the Congressional Research Service, the U.S. Trade Representative, the Organization of American States’ Foreign Trade Information System and public White House communications.

Business

Terranea Resort accused of pregnancy discrimination, retaliation in lawsuit

A former marketing executive at the Terranea Resort sued the luxury establishment on Wednesday, alleging its president had made discriminatory comments towards pregnant women working at the company.

The former marketing exercutive, Chad Bustos, alleges in the lawsuit filed on Wednesday that he was fired in retaliation after he defended several female employees.

Terranea Resort and the company’s president did not respond to a request for comment about allegations in the lawsuit, which was filed in Los Angeles County Superior Court.

Bustos said he had worked at the 560-room oceanfront resort that perches on the Palos Verdes Peninsula since 2023. He had supervised an all-female marketing team, of which three employees were young moms with children under 3, according to the complaint.

The lawsuit describes a meeting in February 2024, where the resort’s president, Ralph Grippo, became “visibly angry” after hearing a woman on the team planned to take maternity leave. Her announcement had come months after another employee had returned from maternity leave.

Grippo, who also is a defendant in the lawsuit, allegedly stood up, pushed his chair back and began questioning the other women in the room. The lawsuit said Grippo pointed at each woman in turn, asking, “Are you pregnant?” After each woman answered, he sat back down and the meeting continued.

After the meeting, Grippo allegedly began “scrutinizing the marketing team and nitpicking their performance,” using the resort’s security cameras to see what time they arrived to work and when they left. He told Bustos to write up the women for what he deemed to be minor infractions, but Bustos refused, according to the complaint.

At another meeting in May 2024, Grippo scolded female employees for not working hard enough, although the team was high-performing and employees worked long hours, the lawsuit said.

Grippo was reported to the human resources department by one of the women, and Bustos confirmed her claims to the department, the lawsuit said. Bustos also confronted Grippo around that time, telling him his comments were inappropriate, according to the complaint.

After that, Grippo refused to speak with Bustos or return his calls, the lawsuit alleged, and in August 2024, Grippo fired Bustos.

Under California law, it is illegal for employers to ask employees about medical conditions, including pregnancy.

And anti-pregnancy comments can be used as evidence of sex discrimination, said Lauren Teukolsky, the attorney representing Bustos.

Bustos, who had worked with Grippo for 11 years at another company prior to joining him at the Terranea Resort, said in an interview that he initially thought Grippo would understand his perspective because of their long-standing relationship.

Bustos said his team was “very talented and hardworking,” and the sacrifices they and others have made to raise children “should be important for everybody.”

Grippo had had a history of making other anti-pregnancy comments, the lawsuit alleged.

When a woman asked Grippo for a promotion, he allegedly questioned her about how she planned to balance the promotion while raising a child. He asked another woman with two children who applied for a marketing job if her work schedule was going to be a problem since she was a mom, the lawsuit said.

Grippo wrote up another pregnant employee because she came in 15 minutes late as a result of morning sickness, and questioned another pregnant employee why she had so many doctor’s appointments, the lawsuit said.

In 2017, former dishwasher and chef assistant Sandra Pezqueda sued the resort and a staffing agency after she allegedly experienced repeated sexual harassment and assault by her supervisor, who then retaliated against her by changing her work schedule after she rejected his advances.

Pezqueda received a $250,000 settlement with the company denying any wrongdoing, news reports said.

Then-president Terri A. Haack said in a statement to Time that the company has “a zero-tolerance policy toward harassment.”

The Terranea resort is jointly owned by JC Resorts, a company with a portfolio of resorts and golf courses based in La Jolla, and Lowe Enterprises, real estate investment firm based in Los Angeles. The companies did not immediately respond to a request for comment.

Business

An Illustrated Guide to Who Really Benefits From ‘No Tax on Tips’

There’s no question that President Trump’s proposal to stop taxing tips has broad appeal. It’s popular in polling, lawmakers in both parties support it, and now a version of the idea is on its way to becoming law.

But the effect of the policy would actually be quite narrow. About 3 percent of American workers receive tips, but about a third of those employees would not see a gain from the change.

That’s because of the way Republicans structured the policy in the tax legislation they passed through the House recently. Here’s who would benefit under their plan — and who wouldn’t.

The proposal would leave out workers who are not tipped.

The tax break is good news for people in industries like dining, where tips are a big part of worker pay. But it also means that two employees making the same amount, one a bartender and one a retail salesperson, could soon face very different tax bills.

These two workers each make $40,000, but the tipped worker would owe a lot less in taxes.

The tax exemption would create a huge incentive for more people to try to earn tips. The Republican legislation lays out some ground rules, tasking the Treasury Department to limit the tax break to jobs in which workers have traditionally received tips. This could become the subject of intense lobbying, as companies try to convince the government that their employees deserve the tax break. Uber and DoorDash have already pushed to make sure their drivers can qualify for tax-free tips.

Many of the lowest-earning tipped workers wouldn’t benefit much, or at all.

Another obstacle to benefiting from the tax break is the way income is taxed in America. In general, before they pay taxes, Americans subtract deductions from their income, and then the government assesses tax on that smaller amount of money.

Everyone can take the standard deduction, which would be worth $16,000 for individuals and $32,000 for married couples this year under the Republican tax bill. “No tax on tips” would take the form of a deduction people can claim on top of the standard deduction, shrinking their taxable income even more.

But for a tipped worker who doesn’t make much more than the standard deduction — say a college student who waits tables over the summer — the ability to claim an additional deduction would not generate much in tax savings. Someone making less than the standard deduction would have no taxable income to begin with.

The policy would save this low-wage waiter a small amount.

It’s important to note that the tips exemption applies only to the federal income tax. Workers would still owe payroll taxes, like the 6.2 percent Social Security tax, on their tipped income. They may also owe state income taxes on their tips.

For many low-income Americans, payroll taxes, rather than the income tax, are the biggest taxes they pay. Roughly 37 percent of tipped workers already don’t owe any federal income tax, according to an estimate from the Budget Lab at Yale.

Others wouldn’t gain because other benefits already eliminate their tax burden.

There are other tax breaks that could eliminate a worker’s tax liability before “no tax on tips” comes into the picture. For example, a full-time Uber or Lyft driver who can take advantage of the mileage deduction, which increases with every mile driven, may not have much use for another tax break.

The policy wouldn’t make a difference for this ride-share driver.

An exception to this would be tax benefits that are “refundable.” These are tax credits, like the earned- income tax credit, that give money to Americans even if they don’t owe anything in income tax. So these tax credits can become cash payments to low-income Americans. Because of that, workers could conceivably use the tips deduction to reduce their tax bills to zero and still receive the same benefit from a refundable tax credit.

The more money someone makes, the bigger the benefit.

The deduction would be most meaningful for those who make enough to owe a fair amount in income taxes. A typical tax cut for someone earning enough to benefit from the plan could be worth roughly $1,800.

This hairdresser would save the typical amount among those who would benefit.

This dynamic is a microcosm of how cuts to income taxes often work: The more money you make, the more you pay in tax and therefore the more you save from a tax cut. In this case, though, your benefit would depend both on how much you make and what share of your income comes in the form of tips.

This Las Vegas blackjack dealer would save a lot based on his significant tips.

This would be true up to a point. The Republican legislation would bar tipped workers making more than $160,000 from claiming the break. (That level would apply for this year and increase over time.)

The cut-off is a stark one. A tipped worker making $160,001 would, under the bill, receive nothing, potentially encouraging people to try to lower their earnings to claim the tax break. Making that extra dollar could mean thousands in additional taxes.

“No tax on tips” could end up as a short-lived experiment. In the House-passed bill, the policy would last only through 2028, though the legislation could change in the Senate.

Many tax-policy experts are rooting for the demise of the deduction, which they see as another potential hole in a tax system so strewn with carve-outs that it is often compared to Swiss cheese. In general, they would prefer a system that charges roughly the same tax on workers with roughly the same earnings, rather than creating a tax advantage for certain types of work.

“It’s the exact opposite of the general principles that tax policy purists advocate for,” said Joseph Rosenberg, a senior fellow at the Urban Institute.

About the data

Illustrated examples were constructed using data from a summary of the House Republican bill (proposed tips policy, standard deductions and tax rates); the Bureau of Labor Statistics (typical wages by occupation); companies and industry groups (estimated typical tip shares); and analyses from the Budget Lab at Yale and the Tax Policy Center (distributional effects of the policy). Workers in all examples have a single tax-filing status.

-

Culture1 week ago

Culture1 week agoCan You Match These Canadian Novels to Their Locations?

-

Politics1 week ago

Politics1 week agoTrump admin asking federal agencies to cancel remaining Harvard contracts

-

Technology1 week ago

Technology1 week agoThe Browser Company explains why it stopped developing Arc

-

News1 week ago

News1 week agoHarvard's president speaks out against Trump. And, an analysis of DEI job losses

-

News1 week ago

News1 week agoRead the Trump Administration Letter About Harvard Contracts

-

News6 days ago

News6 days agoVideo: Faizan Zaki Wins Spelling Bee

-

World1 week ago

World1 week agoDrone war, ground offensive continue despite new Russia-Ukraine peace push

-

Politics5 days ago

Politics5 days agoMichelle Obama facing backlash over claim about women's reproductive health