Business

FTX founder Sam Bankman-Fried arrested in Bahamas after U.S. authorities file criminal charges

Disgraced FTX founder Sam Bankman-Fried has been arrested within the Bahamas and might be extradited to the U.S. to face felony fees stemming from the sudden implosion of his cryptocurrency trade final month.

Authorities within the Bahamas made the arrest after receiving discover from the U.S. that it had filed fees towards the 30-year-old and doubtless would request his extradition, the nation’s authorities mentioned Monday afternoon.

“The Bahamas and the US have a shared curiosity in holding accountable all people related to FTX who could have betrayed the general public belief and damaged the regulation,” Prime Minister Philip Davis mentioned in an announcement.

The arrest caps off a shocking fall from grace for Bankman-Fried, who was, till very lately, thought-about the golden boy and white knight of the crypto world. At one level, he was estimated to be price $26 billion; now he claims to have simply $100,000 left.

As chief govt of FTX, Bankman-Fried grew the cryptocurrency trade he based in 2019 into one of many largest on the earth, with greater than 1 million customers at its peak final yr. He was hailed as a constructive pressure and reliable spokesperson for the rising trade, particularly as he rescued a number of failing crypto companies this yr.

However FTX collapsed in spectacular vogue final month when customers, apprehensive in regards to the trade’s solvency, started pulling out their cash en masse. That led to a catastrophic fiasco for FTX, which filed for Chapter 11 chapter safety on Nov. 11. Not less than $1 billion in buyer funds has disappeared, based on estimates, and the collapse has triggered a surge in outflows throughout different world crypto exchanges.

In a courtroom submitting submitted just a few days later, its newly put in chief govt, John J. Ray III, a longtime insolvency knowledgeable, detailed the disastrous state of economic affairs on the once-heralded firm.

“I’ve been the Chief Restructuring Officer or Chief Govt Officer in a number of of the biggest company failures in historical past,” Ray wrote in his declaration. “By no means in my profession have I seen such an entire failure of company controls and such an entire absence of reliable monetary info as occurred right here.”

FTX and Bankman-Fried are actually going through investigations within the U.S. and the Bahamas, the place the corporate is predicated, into a spread of potential fraud.

One key inquiry considerations whether or not buyer funds have been lent to buying and selling agency Alameda Analysis, which Bankman-Fried additionally based. Prosecutors are additionally inspecting whether or not lots of of hundreds of thousands of {dollars} have been improperly transferred to the Bahamas across the time of FTX’s chapter submitting.

The arrest was made primarily based on a sealed indictment, mentioned Damian Williams, the U.S. lawyer for the Southern District of New York.

“We count on to maneuver to unseal the indictment within the morning and may have extra to say at the moment,” Williams mentioned in an announcement posted on Twitter.

Shortly afterward, the U.S. Securities and Alternate Fee mentioned it had licensed separate fees towards Bankman-Fried “referring to his violations of securities legal guidelines, to be filed publicly tomorrow.”

Bankman-Fried was scheduled to testify earlier than the Home Monetary Companies Committee on Tuesday. However he declined to seem for a listening to with the Senate Banking Committee the day after, prompting lawmakers to sentence his “unprecedented abdication of accountability.”

Congresswoman Maxine Waters (D-Los Angeles), chairwoman of the Home Monetary Companies Committee, mentioned she was “shocked” to listen to of Bankman-Fried’s arrest given his scheduled look the following day.

“Though Mr. Bankman-Fried have to be held accountable, the American public deserves to listen to straight from Mr. Bankman-Fried in regards to the actions that’ve harmed over a million folks, and worn out the hard-earned life financial savings of so many,” Waters mentioned in an announcement. “The timing of this arrest denies the general public this chance.”

Bankman-Fried had been on a media blitz in latest weeks, doling out quite a few interviews in an effort to clarify what occurred at FTX.

Earlier on Monday, throughout an interview on Twitter Areas, he mentioned he was going to testify earlier than the Home remotely, as a substitute of in individual, on Tuesday as a result of “the paparazzi impact is sort of giant.”

“Are you apprehensive you is likely to be detained for those who stepped foot into the U.S.?” one of many panelists responded.

“I don’t consider I might be,” Bankman-Fried mentioned.

Bloomberg was utilized in compiling this report.

Business

Randy Travis releases new music with the help of AI after a stroke

For the first time since suffering a stroke, Randy Travis has released new music — with the help of artificial intelligence.

The country star’s latest single, “Where That Came From,” arrived Friday after Travis and his wife, Mary Travis, permitted his record label to re-create his soulful vocals using AI, according to the Associated Press.

Until last week, Randy Travis hadn’t put out anything new in roughly a decade. After he was hospitalized and diagnosed with viral cardiomyopathy (a disease that targets the heart) in July 2013, the “Forever and Ever, Amen” and “Deeper Than the Holler” artist suffered a stroke and developed aphasia, a brain disorder that has limited his ability to speak.

When Warner Music Nashville Co-President Cris Lacy proposed the idea of harnessing AI to reproduce the singer’s voice, the Travises leaped at the opportunity.

“Well, we were all over that,” Mary Travis told AP, “we were so excited.”

“All I ever wanted since the day of the stroke was to hear that voice again.”

The AI technology pulled from Randy Travis music spanning 28 years to create his version of “Where That Came From,” a romantic ballad written by Scotty Emerick and John Scott. Travis’ longtime producer, Kyle Lehning, selected the song because he believed it would best suit the crooner’s vocals.

Mary Travis told AP that the final product moved her husband to tears.

“I remember watching him when he first heard the song after it was completed. It was beautiful because at first, he was surprised, and then he was very pensive, and he was listening and studying,” she said.

“And then he put his head down and his eyes were a little watery. I think he went through every emotion there was, in those three minutes of just hearing his voice again.”

In April, more than 200 musicians — including Stevie Wonder, Billie Eilish and Nicki Minaj — signed an open letter urging AI developers, tech companies and music platforms to stop using AI “to infringe upon and devalue the rights of human artists.” The statement acknowledged, however, that “AI has enormous potential to advance human creativity” when used responsibly.

Other creatives — such as Hollywood writers, actors and craftspeople — have also taken steps to mitigate the encroachment of AI.

Randy Travis is not the only musician to embrace the AI revolution.

Last week, indie pop artist Washed Out released an AI-generated music video for his new song “The Hardest Part.”

“This isn’t a stunt, and it’s not a parlor trick,” Lacy told AP after releasing “Where That Came From.” “It was important to have a song worthy of him.”

Business

Armed with venture capital, Skims and Kim Kardashian write their 'second chapter'

Kim Kardashian was already a successful celebrity businesswoman when she launched Skims five years ago.

But more often than not, she simply had attached her name to a string of existing companies: QuickTrim supplements, Carl’s Jr. salads, Skechers Shape-Ups, Sugar Factory confections, Midori liqueur, Silly Bandz bracelets, Beach Bunny swimwear, and so on.

“We did every product that you could imagine — from cupcake endorsements to a diet pill at the same time, to sneakers or things that I didn’t know enough about for them to be super-authentic to me,” the reality television star told The Times in 2019. “Like it all made sense a little bit, but it wasn’t my own brand.”

Skims, Kardashian’s homegrown apparel company built upon her famous curves and her love of body-cinching shapewear, was on brand — and, finally, her brand.

Kim Kardashian at a Skims pop-up at the Grove in 2021. The company pulled in nearly $1 billion in net sales last year and will open its first physical stores soon.

(Skims)

Its first years were marked by explosive growth. The start-up is now a retail juggernaut with around $1 billion in net sales and Kardashian has become a savvy entrepreneur with an eye for spotting and setting trends. Skims has made a huge dent in the shapewear market previously dominated by Spanx while adding several new categories to its merchandise mix.

This year Skims is aggressively moving into its next phase, one that will see the Hollywood company enter the competitive bricks-and-mortar space for the first time.

Underscoring Skims’ growth is the heightened interest the retailer is drawing from investors. Last year it raised $330 million in venture capital funding, ranking it second among companies in the greater L.A. area and the only retail brand in the top 10, according to a recent analysis by CB Insights.

That influx of cash was particularly notable given the tough investment climate locally: The region saw a steep decline in venture capital funding from 2021 to 2023, when the amount of investment dollars fell 74%, the analytics firm said.

Co-founded by Karadashian, who is chief creative officer, and Jens Grede, the company’s chief executive, Skims pulled in nearly $1 billion in net sales last year, according to Bloomberg, roughly double its 2022 total.

Kim Kardashian, center, in a Skims ad campaign starring Candice Swanepoel, Tyra Banks, Heidi Klum and Alessandra Ambrosio.

(Courtesy of Skims)

The company is reportedly eyeing an initial public offering this year. Kardashian and Grede declined to comment.

What began as a collection of undergarments designed to give women a more flattering, contoured silhouette has swelled into a comprehensive apparel giant: There’s underwear, bras, swimwear, dresses, tees and tanks, loungewear and pajamas. Inclusive sexy-meets-cozy clothing is the hook, with merchandise available in a wide range of sizes and skin tones.

In October, Skims launched a menswear line and became the official underwear partner of the NBA, WNBA and USA Basketball. It sells some accessories and clothing for kids, and this year will open bricks-and-mortar stores in several cities including a flagship location in Los Angeles.

“Skims has evolved into becoming a brand that can provide comfort for all audiences, not just for women,” Kardashian, 43, said when announcing the menswear line.

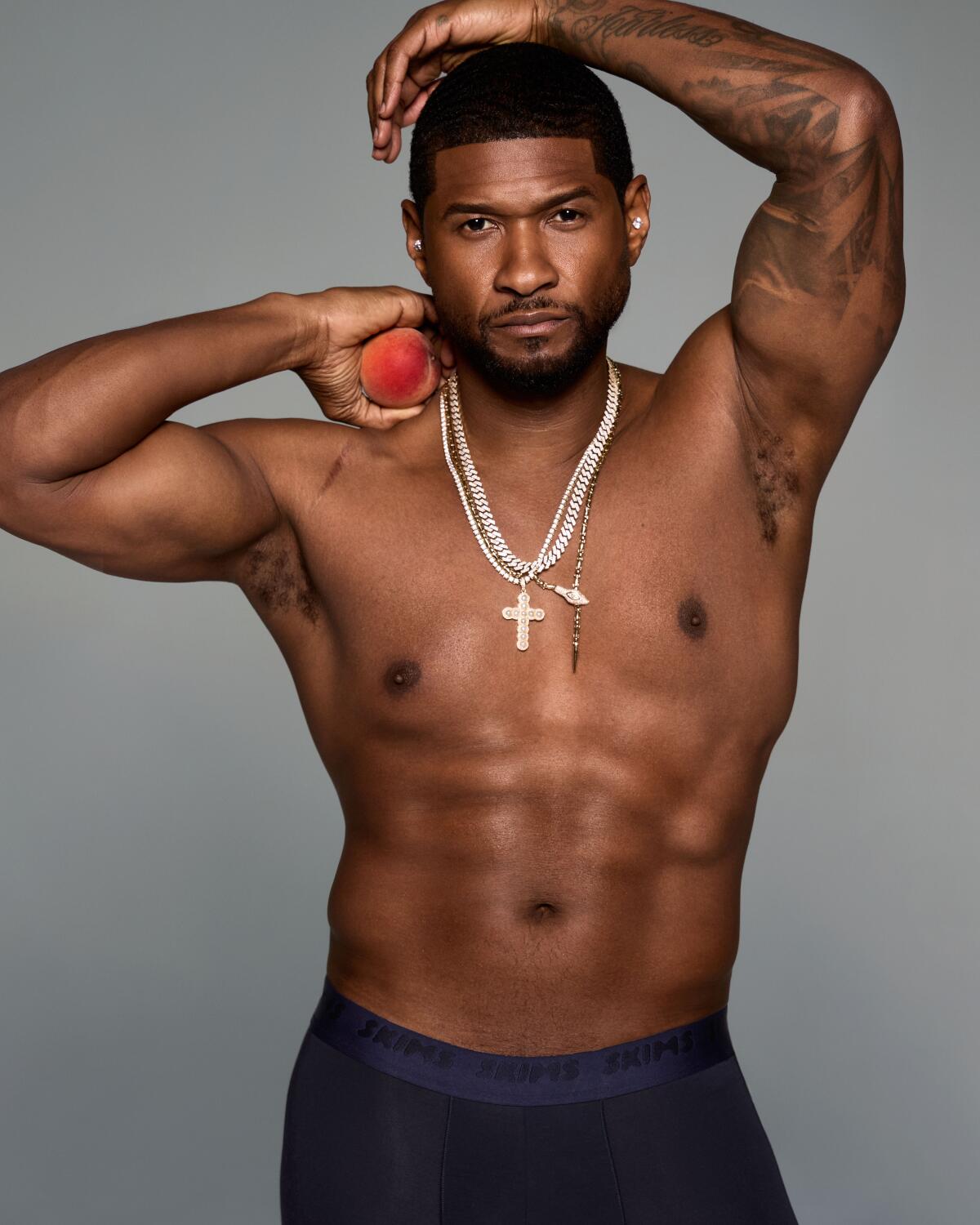

Usher in Skims. The brand launched menswear in October.

(Courtesy of Skims)

The company’s swift rise was undoubtedly fueled in part by Kardashian’s name and marketing prowess. She models the latest collections herself, posting glossy professional photos and casual at-home closet videos to her millions of social media followers, and has tapped her A-list friends to star in Skims ad campaigns including Lana Del Rey, Kate Moss, SZA, Cardi B, Sabrina Carpenter, Usher and Patrick Mahomes.

“Kim Kardashian’s visibility, I think, gives them a big leg up on marketing,” said Alex Lee, research editor at CB Insights, which compiled its data by analyzing companies in Los Angeles, Orange, Ventura, San Bernardino and Riverside counties.

But more than that, Lee said, Skims “is a really interesting example of the confluence of celebrity with technology and consumer trends.”

The rise of athleisure — stylish athletic clothing that can be worn at the gym or as everyday wear — was a game-changer in retail, said Simeon Siegel, managing director at BMO Capital Markets, who follows companies including Victoria’s Secret and Lululemon.

“That notion of comfort stretched to every possible category of apparel,” he said. “What we saw was a race among companies to figure out how to apply what Lulu revolutionized. Shapewear was a very logical category to go after with the new advancements in technology,” which includes improved fabrics and better fits.

Skims at first sold its products online only through its website before expanding to retailers including Nordstrom and Saks Fifth Avenue and hosting occasional pop-ups. Its foray into physical stores “marks the second chapter” for the company, Grede said in an interview with Bloomberg last year, and its ambitions are high.

Kim and I can envision a future where years from today there’s a Skims store anywhere in the world you’d find an Apple store or a Nike store.

— Jens Grede, Skims co-founder and CEO

In the fourth quarter, Skims is scheduled to open a 5,000-square-foot store on the Sunset Strip in West Hollywood. The company also plans to open stores in other U.S. cities and then target major international markets.

“Kim and I can envision a future where years from today there’s a Skims store anywhere in the world you’d find an Apple store or a Nike store,” Grede said.

Skims was most recently valued at $4 billion after a funding round last summer, a valuation that propelled Kardashian to sixth on Forbes’ list of the World’s Celebrity Billionaires 2024 with an estimated net worth of $1.7 billion.

“No one has cashed in on reality star fame more than Kim Kardashian, who has become a billionaire from her beauty and clothing brands,” the magazine said.

Business

Boeing Starliner launch delayed due to possibly faulty rocket valve

The launch of Boeing’s Starliner capsule to the International Space Station was scrubbed Monday evening due to a malfunctioning valve on the Atlas V rocket that would blast it into space. It was not immediately certain when it would be rescheduled.

The rocket is a reliable workhorse and is made by the United Launch Alliance, a joint venture of Boeing and Lockheed Martin. After years of delays in Boeing’s Starliner program, the launch with two astronauts aboard is considered crucial.

NASA said an oxygen relief valve on the rocket’s Centaur second stage was “buzzing,” or rapidly opening and closing, and would be closely examined to determine whether it needed to be replaced because of cycling too many times.

The space agency said the launch could be rescheduled as soon as Tuesday or possibly Friday or Saturday. NASA officials said that the crew was never in danger and that the launch might have proceeded if it were a satellite payload.

The decision to scrub the launch was made by NASA, Boeing and the United Launch Alliance.

Boeing’s new Starliner capsule was scheduled to blast off with a crew last summer, but a problem was discovered with its parachute system and the use of flammable tape in the craft, a mile of which was removed. It had been just the most recent of several delays prior to Monday.

This week’s flight plan called for NASA astronauts Barry Wilmore and Sunita Williams to spend a minimum of eight days testing the docked Starliner before returning to Earth as soon as May 15.

Boeing’s capsule is intended to provide NASA with a second U.S. vehicle to reach the space station — along with SpaceX’s Crew Dragon capsule. A prior unmanned Starliner test flight last year docked with the station, but the first flight in 2019 failed to reach it.

The stakes are high for Boeing, which received a $4.2-billion contract from NASA in 2014 to service the International Space Station, while rival SpaceX of Hawthorne received a smaller $2.6-billion contract to also provide the service — and has already sent eight crews to the station.

Boeing is counting on the Starliner to be a success, given the company’s tarnished reputation after two crashes of its 737 Max 8 jets and a door plug that blew out of a 737 Max 9 flight this year on its way to Ontario International Airport in San Bernardino County. The company also had to absorb a reported $1.5 billion in Starliner cost overruns.

NASA selected the companies to provide it with American launch services after having to rely on the Russian program since the space shuttle program ended in 2011.

-

World1 week ago

World1 week agoRussian forces gained partial control of Donetsk's Ocheretyne town

-

Movie Reviews1 week ago

Challengers Movie Review

-

Politics1 week ago

Politics1 week agoHouse Republicans brace for spring legislative sprint with one less GOP vote

-

World1 week ago

World1 week agoAt least four dead in US after dozens of tornadoes rip through Oklahoma

-

Politics1 week ago

Politics1 week agoWashington chooses its wars; Ukraine and Israel have made the cut despite opposition on right and left

-

Politics1 week ago

Politics1 week agoDems disagree on whether party has antisemitism problem

-

Politics1 week ago

Politics1 week agoAnti-Trump DA's no-show at debate leaves challenger facing off against empty podium

-

Politics1 week ago

Politics1 week agoStefanik hits special counsel Jack Smith with ethics complaint, accuses him of election meddling