Business

Column: Wage growth doesn’t drive inflation. So why is the Fed out to crush workers?

Federal Reserve Chairman Jerome Powell and his colleagues have made major mistakes in their battle with inflation.

They instituted the fastest increase ever in interest rates despite evidence that many of inflation’s drivers, such as shipping logjams at the ports and the Russian invasion of Ukraine, were immune to interest rate changes.

They ignored the contribution of corporate profiteering, despite data clearly showing that business profits were expanding sharply — in other words, businesses were raising prices far more than they needed to cover rising costs.

Labor-cost growth has no meaningful effect on goods or housing services inflation.

— Fed economist Adam Hale Shapiro

But the most egregious error may have been their fixation on labor costs as a driver of inflation. The truth is that workers were the victims, not the culprits, in the inflation spike.

That conclusion is underscored by the latest government figures on inflation and wages. On Tuesday, the Bureau of Labor Statistics reported that consumer inflation fell to 0.1% in May, month over month, and 4% over the past year.

Earlier, the government had reported that hiring remained robust, though wages were falling on an inflation-adjusted basis.

Despite abundant evidence that the Fed’s inflation-fighting campaign has left many workers behind, Powell has consistently harped on the need to increase unemployment to bring inflation down.

“Reducing inflation is likely to require… some softening of labor market conditions,” Powell said in his most recent news conference, following the Fed’s latest interest rate hike on May 3.

Powell treated every statistic showing labor market strength — low unemployment, “excess demand” for workers, persistent wage increases — as an obstacle to reducing inflation.

“Labor market conditions,” he said, “may have to soften a bit more to begin to see progress” against inflation. Barring that, he added, the Fed wouldn’t be willing to start cutting interest rates.

It’s hard to overstate how dangerous the Fed’s preoccupation with labor costs has been for the average American family. Powell tends to speak in the bloodless terms of academic economics, referring to “market conditions” and supply-and-demand curves. But those generalized formulas mask the potential for real pain and penury in American households in which efforts to “soften” labor conditions translate into layoffs and pay cuts.

Make no mistake: The people on the front line in this battle are not technocrats in air-conditioned rooms. They’re rank and file workers whose opportunities get liquidated in economic downturns.

Whether this approach will still hold won’t be known until Wednesday afternoon, when the Fed’s open markets committee announces its decision on interest rates. Most experts believe the Fed will pause in its more than yearlong cycle of raising interest rates. After the announcement, Powell will hold another news conference to discuss the committee’s thinking and outlook for the near future.

As I’ve been writing for nearly a year, the idea that wage increases drive inflation has been an enduring shibboleth among economists. Its most concise expression is the “Phillips curve” formulated in the 1950s by a New Zealand economist, which posits an inverse relationship between inflation and unemployment — that is, higher inflation is linked to lower unemployment and vice versa.

The most direct expression of this argument came last June from former Treasury Secretary Lawrence Summers, who said in a June 20 speech in London, as reported by Bloomberg: “We need five years of unemployment above 5% to contain inflation — in other words, we need two years of 7.5% unemployment or five years of 6% unemployment or one year of 10% unemployment.”

At the time, the unemployment rate was a historically low 3.6%. It was 3.7% in May, according to the Bureau of Labor Statistics.

Even though many respected economists recognize that if this relationship exists, it holds only in the very short term, the Phillips curve “has been the foundation of monetary policy for decades,” as Christopher J. Waller, a member of the Fed Board of Governors, observed in a March 31 speech.

The truth, Waller said, is that “if you simply plot inflation against the unemployment rate over the past 50 years,… there does not appear to be any statistically significant correlation between the two series.”

In other words, there’s no reason to assume that wage increases are a contributor to inflation. In an interview April 19 on NPR’s “Marketplace” program, Chicago Fed President Austan Goolsbee described the wage-price issue as a classic riddle along the lines of which came first — the chicken or the egg? “For sure, wage growth and price growth are tied together,” he said. The question is “are wages a leading or a lagging indicator of price inflation?” His answer was the latter.

That has been the case during the recent era of high inflation. Although wages have been rising over the last year in nominal terms, workers’ gains have been eroded by inflation, month after month.

According to the most recent wage report by the BLS, earnings increased by an average 3.4% in May, compared with a year earlier. Real wages, however — accounting for inflation — fell by 0.7%. Adjusted for inflation, average weekly earnings in May fell over the previous month by 0.085%, to $378.18 from $378.50.

None of this could be a surprise to policymakers at the Fed. “Labor-cost growth has no meaningful effect on goods or housing services inflation,” economist Adam Hale Shapiro of the Federal Reserve Bank of San Francisco reported in a May 30 paper. At most, Shapiro calculated, wages accounted for 0.1 percentage point of the recent inflation surge.

Shapiro wrote that his findings “cast some doubt on the narrative that labor-cost growth is by itself an important driver of NHS [non-housing] price inflation.” He noted, as did Goolsbee, that “wage growth tends to follow inflation.”

That leaves the question of why Fed policymakers still act as though reducing employment and slowing, even reversing, wage growth will be good for the economy overall. One answer is that preserving employment is not part of the Fed’s legal mandate.

“Policies to support labor supply are not the domain of the Fed,” Powell acknowledged in a speech last November. Its monetary policy tools, he said, are aimed at controlling demand — raising interest rates quells the demand for housing by making mortgages more expensive and reduces consumers’ purchasing power by forcing credit card rates higher and empowering retailers to raise prices.

Powell has answered questions about the impact of the Fed’s interest rate hikes on the labor market by taking the long view. He describes the effort to reduce inflation as the quest for “price stability,” which he represents as the Fed’s ultimate goal.

“Without price stability, the economy does not work for anyone,” he said at his May news conference. “In particular, without price stability, we will not achieve a sustained period of strong labor market conditions that benefit all.”

In other words, if the Fed’s medicine is sufficiently harsh, the patients will eventually recover. But what if the pain is too great for some patients to live through?

Business

Six Flags to cut 135 jobs at Knott’s, Magic Mountain and other California parks

Six Flags Entertainment Corp. has laid off the presidents of Knott’s Berry Farm and Six Flags Magic Mountain and will cut scores of other jobs in California as part of a major shake-up at the theme park giant.

The company, which operates 42 amusement parks across North America, plans to reduce its staff by 10% in the coming weeks. The cuts will include the president positions at many of its parks, Six Flags spokesperson Sara Gorgon said Tuesday.

In all, the company will eliminate about 135 jobs across its California parks by the end of June. The California parks include Knott’s in Buena Park, Magic Mountain in Valencia, Six Flags Discovery Kingdom in Vallejo and California’s Great America in Santa Clara.

The cost-cutting follows last year’s $8-billion merger of Six Flags with Cedar Fair, making it the largest amusement park operator in North America.

The cuts come during a challenging period for Six Flags and others in the tourism business. The company posted a net loss of $220 million in the first quarter of this year, citing weather variability and economic uncertainty.

State and local tourism officials are projecting a slowdown in travel to California due to Trump’s trade war and deportation policies.

Additionally, smaller theme park operators such as Six Flags struggle to compete with bigger industry players Disney and Universal, which also boast more diverse portfolios with streaming and other media.

The Orange County Register first reported that Knott’s President Jon Storbeck and Magic Mountain President Jeff Harris were among those affected by the layoffs.

Storbeck served as vice president of Disneyland before he joined Knott’s in 2016. Harris had held multiple positions at Six Flags before taking over the president role at Magic Mountain in 2023.

The Charlotte, N.C.-based company said the changes reflect its move toward a regional operating structure, rather than individual parks having their own presidents. Some park presidents will be absorbed into other roles at the company, Gorgon said.

In an earnings call earlier this month, Six Flags Chief Executive Richard Zimmerman had warned the company would significantly restructure and pare down its workforce this year. He said the company remained “firmly on track” to achieve its goal of $120 million in reduced expenses by the end of the year.

Former Cedar Fair CEO Matt Ouimet, who previously led Disneyland, lamented what he called a “parade of departures” from Six Flags in a post on LinkedIn last week. Ouimet said he had chosen to retire before having to vote on the merger because he feared the fallout.

“I recognized that I wasn’t up to watching talented colleagues being asked to exit in order to achieve the cost synergies that were promised to investors,” Ouimet wrote. “This die was cast when the merger agreement was signed.”

Also this month, Six Flags announced it would close its theme park and Hurricane Harbor water park in Bowie, Md., after the 2025 operating season.

Six Flag shares closed at $35.06, up nearly 3% on Tuesday.

Business

Louis Vuitton bets big on Rodeo Drive with new Frank Gehry-designed store

Louis Vuitton is gearing up to go over the top again in Beverly Hills.

With plans for an ultra-opulent hotel on Rodeo Drive stymied by voters two years ago, the Paris fashion house’s owners are back with a proposal for a theatrical flagship store designed by architect Frank Gehry that would anchor the north end of the famous retail corridor.

Luxury goods stores on Rodeo Drive are growing larger as top-shelf retailers increasingly up the ante to dazzle shoppers, and the vision from Louis Vuitton owner LVMH is one of the biggest stores yet with restaurants, rooftop gardens and exhibition space.

Set to open in 2029 pending city approval, the store will stretch through the block from Rodeo Drive to Beverly Drive along South Santa Monica Boulevard. It will be one continuous structure connected across an alley by two pedestrian bridges and a tunnel.

Louis Vuitton said its new store will contain 45,000 square feet on the retail side fronting on Rodeo Drive and an additional 55,000 square feet on the hospitality-focused side of the building off Beverly Drive.

“The new location will take visitors into a full Louis Vuitton lifestyle experience showcasing its diverse universes of products and one-of-a-kind client experiences,” the company said in a statement.

The retail entrance will be on Rodeo Drive, with three floors dedicated to product categories such as women’s and men’s collections, travel, watches and Jewelry, beauty and fragrance. A rooftop level will have private spaces for clients and a garden.

Pedestrians walk past a building at the intersection of Rodeo Drive and Santa Monica Boulevard in Beverly Hills.

(Mel Melcon/Los Angeles Times)

Visitors entering from Beverly Drive will find a cafe and exhibition lobby on the ground floor, two more floors of exhibition space and a rooftop with a restaurant and open-air terrace.

Louis Vuitton representatives declined to offer more details about the exhibitions or the building, but the brand perhaps best known for its signature monogrammed handbags and luggage also has made a reputation promoting art and culture.

In 2014 it opened the Fondation Louis Vuitton in Paris in a building designed by Gehry. The Fondation has art exhibits, concerts, dance performances and organized family activities such as art classes for children.

Gehry has also also collaborated with Louis Vuitton on a collection of handbags reflecting his architectural style, which is known for flowing, curvilinear sculptural forms.

In downtown Los Angeles, Gehry designed the Walt Disney Concert Hall, the Grand L.A. mixed-use complex across the street and the nearby Colburn School performing arts center under construction.

The interior of Luis Vuitton’s Beverly Hills flagship is being designed by another well-known architect, Peter Marino, who designed the existing Louis Vuitton store on Rodeo Drive and the ill-fated Cheval Blanc Beverly Hills hotel intended for the Rodeo Drive site now selected for Louis Vuitton’s new flagship.

New York-based Marino was described by Architectural Digest as “a leading architect for the carriage trade, and the architect for fashion brands.”

Marino once said the Chevel Blanc hotel, which was approved by the city before being vetoed by voters, would improve the pedestrian experience on the northern edge of Rodeo Drive’s famed shopping district, where “people get to the end, shrug their shoulders and walk back.”

The parcels intended for the hotel and now Louis Vuitton are owned by LVMH and were formerly occupied by Brooks Bros. and the Paley Center for Media. The existing unoccupied structures will be razed to make way for the new store.

Merchants on the famous three-block stretch of Rodeo Drive constantly strive to find new ways to call attention to themselves and polish their brand’s image, said real estate broker Jay Luchs of Newmark Pacific, who works on sales and leases of high-end retail properties.

“It’s competitive among brands to always be the best they can be, and they’re not sitting on spaces keeping them stale,” he said. “They’re all always reinventing themselves.”

The expensive changes to their stores are “very obvious,” Luchs said. “It’s almost like an art. The street has different top designers who have made these stores spectacular one after the other.”

Even though retail rents on Rodeo Drive are some of the highest in the country, stores are also getting bigger, the property broker said.

Fifteen years ago, stores on the street were typically 25 feet wide, he said, then gradually many became 50 feet wide, he said. “Now you’re seeing stores 100 feet wide” that may have two different landlords.

A 50-foot lot is “very big,” Luchs said, and can hold a store with 5,000 square feet on each level and may go three stories tall for a total of 15,000 square feet in the store.

The fashion house is also growing in New York, where its flagship store is being replaced with a building that will nearly double its footprint on 57th Street at 5th Avenue, the Architects Newspaper said. Construction has been concealed with a facade that looks like a giant stack of distinctive Louis Vuitton trunks.

Business

Disney vs. YouTube. The fight for talent heads back to court

In the last several years, YouTube has become an increasingly formidable competitor to streaming services and entertainment studios, providing videos from amateur and professional creators, as well as livestreaming major events and NFL games.

Now its growing threat to studios is playing out in the courts.

The Google-owned platform recently poached Justin Connolly, president of platform distribution from Walt Disney Co.

On Wednesday, Disney sued YouTube and Connolly for breach of contract, alleging that Connolly violated an employment agreement that did not expire until March 2027 at the earliest.

Connolly oversaw Disney’s distribution strategy and third-party media sales for its streaming services like Disney+ and its television networks. He also was responsible for film and TV programming distribution through broadcasting and digital platforms, subscription video services and pay networks.

As part of his role, Connolly led Disney’s negotiations for a licensing deal renewal with YouTube, Disney said in its lawsuit.

“It would be extremely prejudicial to Disney for Connolly to breach the contract which he negotiated just a few months ago and switch teams when Disney is working on a new licensing deal with the company that is trying to poach him,” Disney said in its lawsuit.

Disney is seeking a preliminary injunction against Connolly and YouTube to enforce its employment contract.

YouTube did not immediately respond to a request for comment.

At YouTube, Connolly will be become the company’s head of media and sports, where he will be in charge of YouTube’s relationships with media companies and its live sports portfolio, according to Bloomberg.

YouTube accounted for 12% of U.S. TV viewing in in March, more than other streaming services like Netflix, according to Nielsen. YouTube’s revenue last year was estimated to be $54.2 billion, making it the second-largest media company behind Walt Disney Co., according to research firm MoffettNathanson.

Unlike many other major streaming platforms, YouTube has a mix of content made by users as well as professional studios, giving it a diverse and large video library. More than 20 billion videos have been uploaded to its platform, the company recently said. There are over 20 million videos uploaded daily on average.

Streaming services such as Netflix have brought some YouTube content to their platforms, including episodes of preschool program “Ms. Rachel.”On a recent earnings call, Netflix co-Chief Executive Greg Peters named YouTube as one of its “strong competitors.”

Connolly entered into an employment agreement with Disney on Nov. 6, Disney said in its lawsuit. That contract ran from Jan. 1, 2025 to Dec. 31, 2027, with Connolly having the option of terminating the agreement earlier on March 1, 2027, the lawsuit said.

As part of the agreement, Connolly agreed not to engage in business or become associated with any entity that is in business with Disney or its affiliates, the lawsuit said. Disney said YouTube was aware of Connolly’s employment deal with Disney but still made an offer to him.

Entertainment companies have brought lawsuits in the past to stop executive talent poaching by rivals.

In 2020, Activision Blizzard sued Netflix for poaching its chief financial officer, Spencer Neumann. That case was later closed, after Activision asked to dismiss the lawsuit in 2022.

Netflix years ago also faced litigation from Fox and Viacom alleging executives broke their contract agreements to work for the Los Gatos-based streaming service. In 2019, a judge issued an injunction barring Netflix from poaching rival Fox executives under contract or inducing them to breach their fixed-term agreements.

Editorial library director Cary Schneider contributed to this report.

-

News1 week ago

News1 week agoMaps: 3.8-Magnitude Earthquake Strikes Southern California

-

Politics1 week ago

Politics1 week agoTexas AG Ken Paxton sued over new rule to rein in 'rogue' DAs by allowing him access to their case records

-

World1 week ago

World1 week agoPortuguese PM’s party set to win general election, fall short of majority

-

Politics1 week ago

Politics1 week agoAfghan Christian pastor pleads with Trump, warns of Taliban revenge after admin revokes refugee protections

-

Politics1 week ago

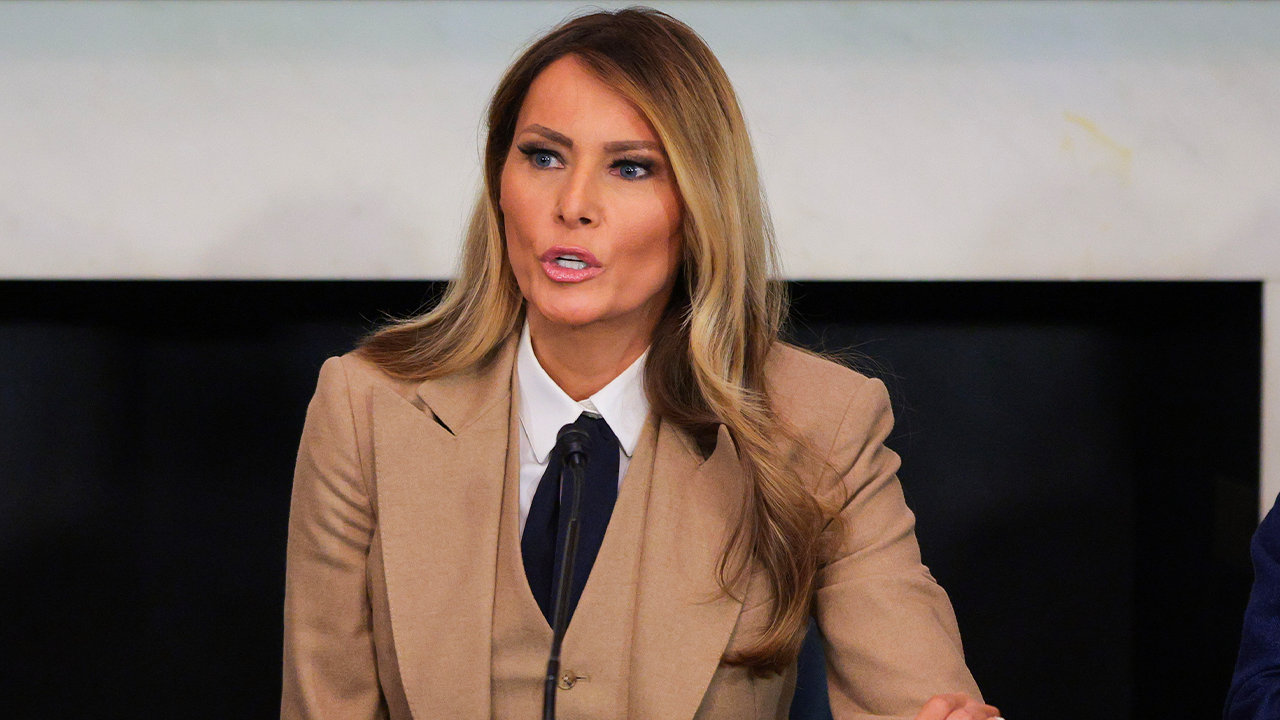

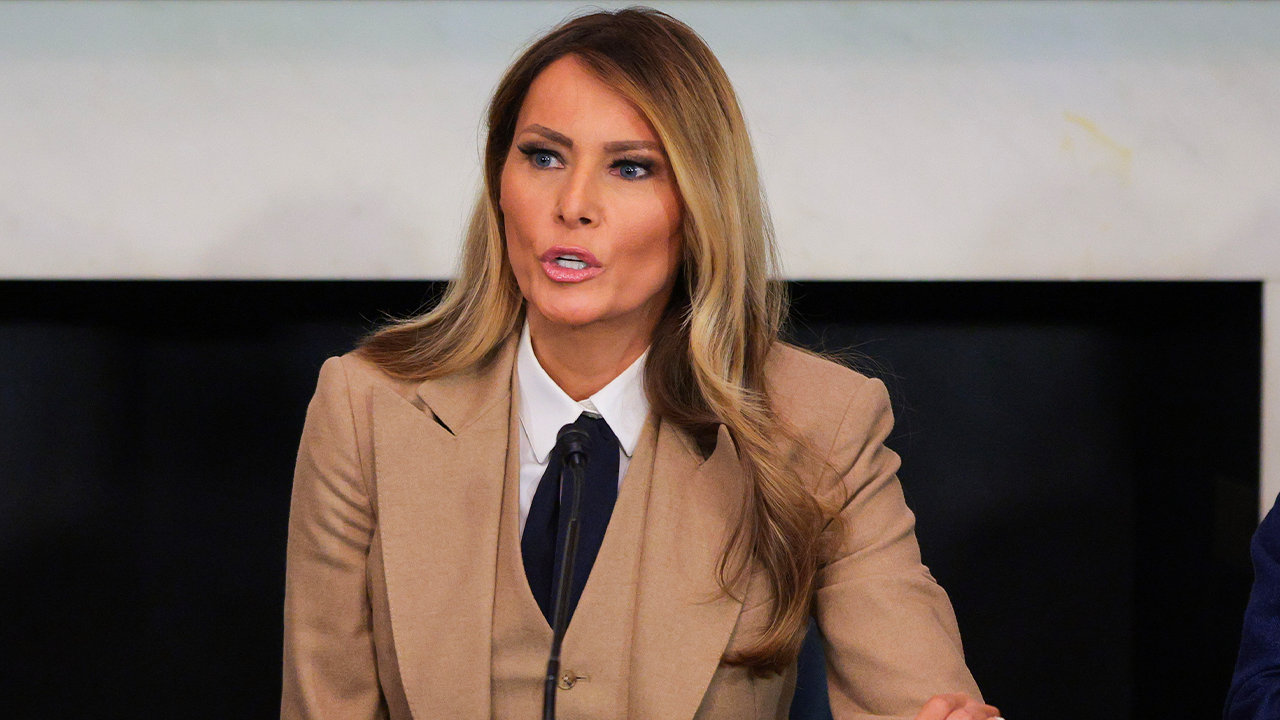

Politics1 week agoTrump, alongside first lady, to sign bill criminalizing revenge porn and AI deepfakes

-

News1 week ago

News1 week agoVideo: One Person Dead in Explosion Outside Palm Springs Fertility Clinic

-

Movie Reviews1 week ago

Movie Reviews1 week agoReview | Magellan, conqueror of Philippines, as we’ve never seen him before

-

Politics1 week ago

Politics1 week agoExpert reveals how companies are rebranding 'toxic' DEI policies to skirt Trump-era bans: 'New wrapper'