Business

Column: As Silicon Valley Bank’s red flags were flying, the Fed was AWOL

On Jan. 18, William C. Martin, a short-seller and former hedge fund government, warned his Twitter followers that they had been lacking one thing vital about Silicon Valley Financial institution.

SVB’s shares had misplaced about 65% of their worth over the earlier 12 months. Traders had been “rightly fixated” on the financial institution’s publicity to the enterprise world, which was getting hammered by the fast run-up in rates of interest, he wrote.

“Nonetheless, dig just a bit deeper, and you will see a a lot greater set of issues,” he wrote.

Apparently, the Fed was AWOL.

— Dennis Kelleher, Higher Markets

What Martin had noticed was a plunge within the worth of securities within the financial institution’s portfolio of “held to maturity” securities — Treasury bonds and government-backed mortgage securities that it owned as a backstop to its deposits.

As a result of the financial institution had no intention of promoting the so-called HTM securities earlier than they matured, it was permitted to worth them on its books on the worth at which they’d been bought, relatively than at their values in actual time.

However the worth of the HTM holdings had declined as rates of interest rose. That’s a pure phenomenon: Mounted-income securities at all times decline in worth as charges rise, and rise in worth when charges fall.

If the financial institution had been compelled to dump these holdings earlier than maturity, Martin noticed, it might be “functionally underwater.”

SVB hadn’t stored this problem a secret. In its monetary disclosure for the third quarter that ended Sept. 30, 2022, which was Martin’s supply, it reported that its $93.3-billion held-to-maturity portfolio was value solely $77.4 billion in actual time, for implicit losses of $15.9 billion. That was nicely greater than the financial institution’s $11.5 billion in whole fairness.

The financial institution’s place didn’t a lot enhance within the fourth quarter. It reported then that its HTM portfolio had shrunk barely, however was nonetheless displaying unrealized losses of $15.16 billion. In keeping with accounting guidelines, different securities designated as “accessible on the market” need to be carried at their real-time worth, a course of often called “marking to market.”

The truth that SVB’s issues had been hiding in plain sight, proper as much as the purpose Friday when the financial institution was taken over and shut down by California and federal authorities, is definite to be close to the highest of the agenda as lawmakers, shareholders, prospects and regulators study the catastrophe.

Because the financial institution’s major regulator, it was the Federal Reserve’s accountability to acknowledge its rising issues and guarantee it continued to satisfy requirements of security and soundness and monetary stability, says Dennis Kelleher, chief government of Higher Markets, a Washington-based watchdog over monetary establishments and authorities regulators.

The financial institution’s operations bristled with “screaming pink flags,” Kelleher informed me. These included a “hyperconcentration” of uninsured depositors from a slender enterprise sector — mainly high-tech and biotech startups — in addition to a dramatic mismatch between property (that’s, loans and investments) and liabilities (deposits) and the mounting tide of unrealized losses on its books.

“These had been seen to anybody who needed to look,” Kelleher informed me. “However apparently, the Fed was AWOL.”

Kelleher observes that the Fed’s coverage of pegging rates of interest close to zero throughout the pandemic “was inflicting bubbles everywhere and reckless lending.”

The Fed staged an unprecedented about-face on rates of interest beginning in March 2022 — elevating charges by 4.5 share factors within the area of 9 months. “Banks weren’t going to have the ability to reposition their portfolios wherever close to as rapidly because the Fed is altering coverage.”

That behooved the Fed to take a detailed take a look at all of the banks. Kelleher says that Fed examiners ought to have demanded a plan final 12 months from SVB’s administration or board for unwinding its massive and rising impairment. It didn’t accomplish that.

One other pink flag for regulators ought to have been the financial institution’s fast progress, which just about definitely positioned strain on administration abilities within the company suite.

Deposits soared from $49.3 billion on the finish of 2018 to $189.2 billion on the finish of 2021, earlier than falling again barely to $173.1 billion on the finish of final 12 months.

The drawdown was a clue that the venture-funded sector had slowed down — enterprise companies had been being much less freewheeling with their cash amid the run-up in rates of interest, which additionally created enterprise head winds for his or her portfolio firms, which in flip wanted to attract down their deposit balances.

Throughout the identical interval, the financial institution’s asset holdings rose from $71 billion in 2018 to $211.8 billion on the finish of final 12 months. The overwhelming majority of its fixed-rate property, plainly, had been bought when charges had been near zero and subsequently had been susceptible to plunges in worth as charges rose.

As a lot as two-thirds of these holdings had been within the held-to-maturity portfolio, nevertheless, in order that they had been carried on the financial institution’s stability sheet at their buy worth, not the true worth.

It’s true that financial institution laws making use of to establishments the dimensions of SVB had been liberalized in 2018 by President Trump — partly because of lobbying by SVB itself, amongst others. However that didn’t absolve the Fed of the duty to scrutinize the financial institution’s operations, Kelleher says.

The Fed wasn’t the one entity that allowed the dimensions of SVB’s issues to go unremarked. Questions are positive to be raised in regards to the efficiency of the financial institution’s auditing agency, KPMG. The agency issued a clear invoice of well being for the financial institution, often called an “unqualified” opinion, with the financial institution’s annual report, launched on Feb. 24.

KPMG hinted that it was involved in regards to the financial institution’s methodology for projecting credit score losses on a few of its loans, however didn’t rule them as improper. As an alternative, it designated the tactic a “important audit matter,” which generally refers to points which might be “particularly difficult, subjective, or complicated” however don’t warrant a warning about an organization’s prospects for failure.

It’s true that the crash within the financial institution’s fortunes developed after Dec. 31, the endpoint of KPMG’s audit. However the agency may have been extra express in regards to the perils lurking within the financial institution’s monetary construction.

Additionally deserving scrutiny is the function of enterprise funding companies and their portfolio firms. Many enterprise companies inspired the startup firms they nurtured to do their banking enterprise with SVB.

Certainly, having a monetary relationship with SVB was handled as nearly a badge of honor for a startup, a sign that it genuinely had enterprise potential. The phrases of loans that SVB made to startups usually required that the debtors do all their banking with SVB, a mandate that concentrated the financial institution’s depositor base whereas exposing the startups to dangers associated to the FDIC’s $250,000 cap on its deposit insurance coverage safety. Some depositors stored uninsured money balances within the lots of of tens of millions of {dollars} at SBV, an clearly reckless apply.

The complacency about SVB’s situation as its issues accelerated is illustrated by its reputation amongst Wall Road inventory pickers—its shares were rated “buy “ by funding analysts at JP Morgan, Financial institution of America Securities, Jefferies and Goldman Sachs, amongst others, as lately as days earlier than its collapse.

On Feb. 8, inventory market guru Jim Cramer, whose every day CNBC program is extensively adopted by beginner inventory merchants, named shares of SVB Monetary, the financial institution’s guardian firm, as one among his “10 high performers” for 2023.

Cramer known as SVB a “service provider financial institution with a deposit base that Wall Road is mistakenly involved about.” He argued that “long-term personal fairness and enterprise capital … will not be going away, and being a banker to those immense swimming pools of capital has at all times been an excellent enterprise.”

Because it occurs, Cramer’s inventory picks have had such an uneven report that one funding agency lately introduced out an exchange-traded fund that enables traders to take the alternative aspect of Cramer’s picks.

Anybody who disdained the suggestions of Cramer and the opposite enthusiastic analysts on SVB and shorted the inventory relatively than shopping for would have made a wholesome revenue. The shares closed at $106.04 on Thursday, and the subsequent day had been successfully value zero.

Business

Florida tourism board approves Walt Disney World expansion plans, ending Disney-DeSantis feud

A special Florida district that governs Walt Disney World Resort has voted unanimously to approve the company’s plans for expansion, officially ending the years-long feud between the House of Mouse and Florida Gov. Ron DeSantis.

The Central Florida Tourism Oversight District voted Wednesday in favor of Walt Disney Co.’s proposal to expand its theme park complex in Orlando, including an $8-billion investment during the first 10 years and up to $17 billion over the next 10 to 20 years.

The expansion is part of a major investment spree by the Burbank media and entertainment giant into its so-called “experiences” division, which is largely comprised of its theme park empire around the world. Disneyland Resort in Anaheim is expected to expand as well, with an investment of at least $1.9 billion.

At Wednesday’s meeting, local tourism executives and board members alike praised the benefits of the proposal and its potential economic effect on the state.

“Walt Disney World is inextricably intertwined in the fabric of the state of Florida, and the success of Walt Disney World is the success of Central Florida,” board member Brian Aungst Jr. said during the meeting. “I was always extremely optimistic and knew that we would get here because it’s the right outcome.”

The path to Wednesday’s approval was long and winding. The controversy began in 2022, when Disney — Florida’s largest private employer — voiced opposition to DeSantis’ so-called “Don’t Say Gay” legislation, which banned instruction on sexual orientation and gender identity in local schools.

DeSantis then took control of what was known as the Reedy Creek Improvement District, a quasi-municipal government that controlled the land Walt Disney World sat on but was run for years by officials essentially selected by Disney. DeSantis renamed the governing body the Central Florida Tourism Oversight District and appointed his allies as members.

Dueling lawsuits ensued, including a First Amendment case Disney filed against the state and the governor, which was eventually tossed. Tensions started to ease in March, after Disney and the state of Florida reached a settlement of a separate state lawsuit, a move that came a few months after DeSantis ended his presidential bid. DeSantis had made Disney a high-profile culture war punching bag even before his doomed campaign began.

After Wednesday’s vote, Walt Disney World Resort President Jeff Vahle cheered the outcome, saying in a statement that the new development agreement “paves the way for us to invest billions of dollars in Walt Disney World Resort, supporting the growth of this global destination, fueling the Florida economy, and allowing us to deliver even more memorable and extraordinary experiences for our guests.”

Business

Eggs of grapevine-gobbling insect snagged en route to California. Are vineyards at risk?

Eggs of the spotted lanternfly, an invasive species that’s wreaked havoc on crops across more than a dozen states, were recently discovered on a metal art installation that was headed to Sonoma County, one of California’s most esteemed wine regions.

The discovery of the infamous bug’s eggs represents the first time the insect has been seen in California. The California Assn. of Winegrape Gowers, a statewide nonprofit, warns the invasive plant-hopper native to Asia has the potential to affect the entire winegrape industry in California, potentially pushing up prices if an infestation results in a smaller grape crop.

“Spotted lanternflies have been found in 18 states and have proven to pose a serious threat to vineyards,” Natalie Collins, president of the growers group, said. “These invasive insects feed on the sap of grapevines, while also leaving behind a sticky honeydew residue on the clusters and leaves.”

Impacts of the stress on the plant could range from reduced yields — and fewer bottles of wine for consumers — and, if severe and persistent enough, complete vine death and higher wine prices. No adult spotted lanterflies have been reported in the state, Collins said.

California is responsible for an average of 81% of the total U.S. wine production each year, according to the Wine Institute.

The association warned that if there are additional egg masses in California from other shipments that haven’t been detected “they may produce adult [spotted lanternflies] in the coming weeks with peak populations expected in late summer or early fall.”

The California Department of Food and Agriculture last year developed an action plan to try to eradicate the pests if they were to enter the state. State officials have asked the public to look for egg masses outdoors. If a bug is found, they recommend grabbing it and placing it in a container where it can’t escape, snapping a photo and reporting it to the CDFA Pest Hotline at (800) 491-1899

The metal art installation on which the eggs were found was shipped to California in late March from New York, where the insects have been a persistent problem. After 11 viable egg masses were spotted at the Truckee Border Protection Station, the 30-foot-tall artwork was sent back to Nevada, where officials discovered an additional 30 egg masses. The art was power washed with detergent and then sent on its way again to Truckee, according to the association.

By the time the installation reached Sonoma County on April 4, the owner agreed to allow officials to open up the hollow beams in the artwork to inspect it further. Inside, they found an additional three egg masses and searched until they were confident no other eggs were present.

Spotted lanternflies were first discovered in Pennsylvania in 2014 and quickly spread to nearby states, where they became a nuisance. In New York they proved to be such a problem that officials encouraged residents to kill them on sight. The pest has become so notorious that it made an appearance on “Saturday Night Live” in a 2022 skit where one viewer applauded them for capturing “the unbelievable hubris of the lanternfly.”

While they feed on more than 100 different plant species, they have a particular affinity for grapevines and a tree known as the “tree of heaven.” The adults, which have the ability to fly short distances, are typically 1 inch long. At rest, with its wings folded, the bug is a dull tan-gray color with black spots. During flight, its open wings feature a bright red, black and white pattern.

The species is often described as a “hitchhiker,” since its egg masses appear similar to cakes of mud and can easily be transported on tractor trailers and semi-trucks. During the first three immature stages of the bug’s life cycle they appear to be black with white spots and later turn red and black with white spots.

Business

After a pandemic strike, nurses union must pay Riverside hospital millions in damages

The union representing nurses at Riverside Community Hospital has been ordered to pay more than $6 million to the hospital for the fallout from a 2020 strike.

The unusual financial penalty was imposed by an arbitrator who found the 10-day work stoppage during the pandemic violated the terms of the labor agreement signed by HCA Healthcare, which operates the hospital, and Service Employees International Union Local 121RN. The $6.26-million fine, the arbitrator determined, was necessary to compensate the hospital for the cost of replacing workers who walked off the job during the strike, according to a statement released Wednesday.

Nurses walked off the job in June 2020 in an effort to force the hospital to increase staffing and improve safety as COVID-19 infections surged, the union said at the time. But hospital officials argued that because nurses also voiced complaints about shortages of personal protective equipment, the reasons for the strike were too expansive to be allowed under the collective bargaining agreement the two sides had signed.

“Our contract was clear, and the union showed reckless disregard for its members and the Riverside community by calling the strike,” said Jackie Van Blaricum, president of HCA Healthcare’s Far West Division, who was the hospital’s chief executive during the strike. “We applaud the arbitrator’s decision.”

SEIU 121RN Executive Director Rosanna Mendez objected to the arbitrator’s findings, saying nurses were permitted under their contract to go on strike. She called the arbitrator’s decision “absurd and outrageous.”

“It is absolutely shocking that an arbitrator would expect nurses to not talk about safety issues,” Mendez said, adding that the union was exploring its options to contest the arbitrator’s decision.

-

Movie Reviews1 week ago

Movie Reviews1 week agoFilm Review: I Used To Be Funny offsets its humorously-adjacent title with a dark, heartbreaking temperament. – The AU Review

-

World1 week ago

World1 week agoEconomy, migration: Voters' main concerns ahead of elections

-

News1 week ago

News1 week agoWoman handcuffed in police car hit by freight train reaches $8.5M settlement

-

Politics1 week ago

Politics1 week agoTrump campaign accelerates vetting of potential running mates

-

Politics1 week ago

Politics1 week agoHunter Biden trial enters 3rd day with cross-examination of FBI agent

-

Politics1 week ago

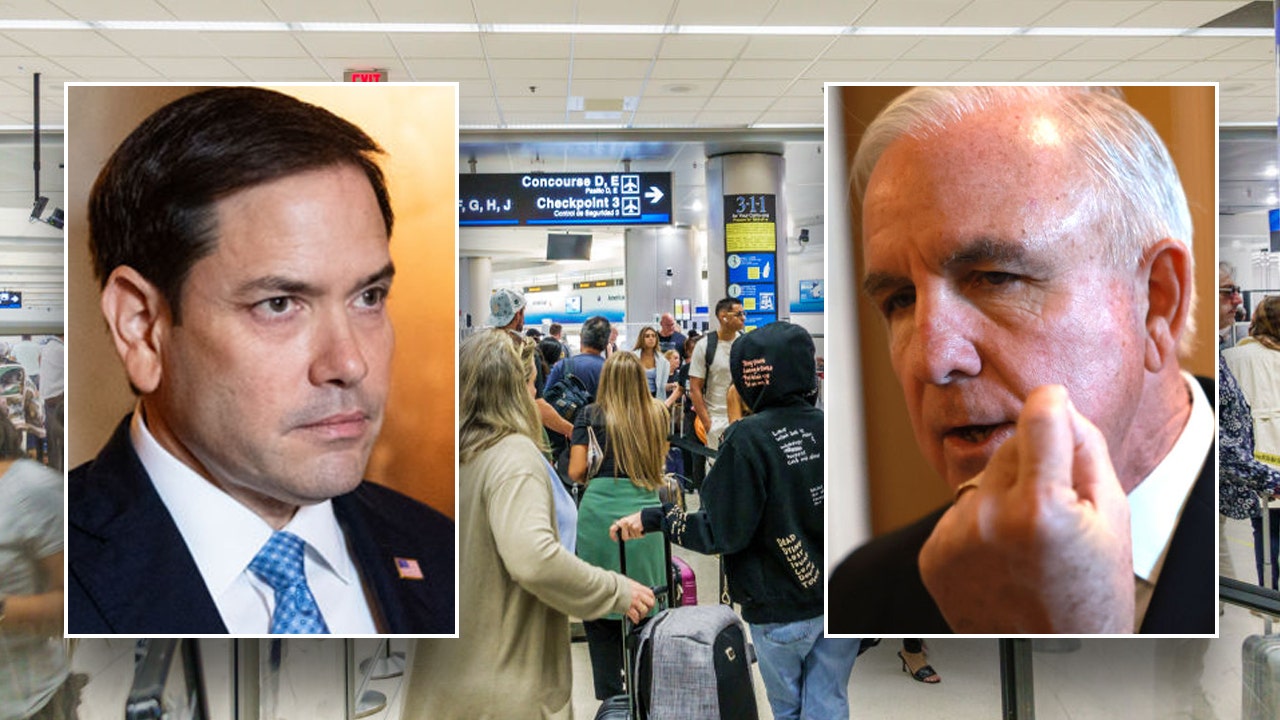

Politics1 week ago'It's absurd': Congress takes bipartisan action after Cuban officials' tour secure parts of major airport

-

Politics1 week ago

Politics1 week agoNew York appeals court judges in Trump case routinely donated to Democrats, records show

-

World1 week ago

World1 week agoFamine ‘likely’ already stalking northern Gaza: Report