Business

Bounced paychecks, frozen 401(k)s — How Fresno’s ‘shining star’ let down the people it aimed to serve

In retrospect, the signs that trouble was brewing for Bitwise Industries had been piling up for months.

Lawsuits. Bounced paychecks. Missed property tax payments.

But for the last decade, the Fresno company had been selling a powerful dream to cities across the Central Valley and the country — places that had been left behind in the digital transformation of the economy. Bitwise offered workforce training to the underserved, software services, and co-working spaces to revitalize downtowns. City officials and community members rallied behind the business. Gov. Gavin Newsom even thanked the company for its services during the pandemic.

That dream was abruptly shattered when Bitwise furloughed all 900 of its employees on Memorial Day evening, as first reported by the Fresno Bee and Bakersfield Californian, with no answers from any of its leaders ever since.

“We are facilitating here a fairly significant transition of our regional economy [and] we felt like they were going to serve a critical role,” said Kern County chief administrative officer Ryan Alsop. “They were a bright and shining star.”

Bitwise’s board of directors has since fired co-CEOs and co-founders Irma Olguin Jr. and Jake Soberal and hired Ollen Douglass, CEO of consulting firm Hanover Street Advisors, as interim president, the board said in a news release June 3. Meanwhile, former employees are pursuing legal action over missed paychecks and alleged labor violations.

“The Board of Directors was recently made aware of the company’s cash deficit by management and took immediate action as a result,” Douglass said in the release. “We are committed to determining the root cause and will continue to take swift action.”

Much remains to be untangled in the story of how the company imploded, but this much is clear: Bitwise was not a mere casualty of a slowing economy, as has been the case with so much of the tech industry that has suffered waves of layoffs. City officials and employees instead paint a picture of a decade-old beloved community institution of underdogs — one that seemingly disappeared overnight.

‘Insufficient funds’

In April, Olguin and Soberal sent an email out to employees announcing that payroll would be transitioning from direct deposit to paper checks.

“Your anxiety may be trying to tell you, ‘OMG the business is failing, we’re out of money.’ No. That’s not what this is about. We’re literally trying to make your lives simpler and remove uncertainty,” the email shared with The Times said.

And the preceding months of payroll issues? The co-CEOs wrote that those were due to everything from “bank failures to delivery problems to software glitches to literal natural disasters.”

The move to paper checks, they explained, was so the company could transition from small community banks to “larger, brand name banks where the size and complexity of our company can be better served.”

Multiple employees reported that their paychecks, which came from First Republic Bank, started bouncing in April, with one employee’s bank rejecting the check due to “insufficient funds” a week after the deposit was made.

After the switch to paper checks, 401(k) contributions also started to go missing.

Bitwise co-CEOs Jake Soberal and Irma Olguin Jr., right.

(Fresno Bee)

Again, Olguin and Soberal addressed employees in an email late May, saying the company had been “carefully tracking all 401K contributions manually since our switch from direct deposit,” and they were working on transferring contributions and company matches from their bank to John Hancock — their retirement account provider — in “partial deposits.”

Employees recalled Olguin and Soberal continually reassuring them that the company was doing fine and that many startups weren’t profitable. In one all-staff meeting, however, that left some of them unsettled, Soberal joked that he’d have to “fire like 15 of you guys to make payroll.”

“There were so many assurances of everything was fine,” said a former Bitwise director, who withheld her name because the company still owed her money. “If you questioned anything, you didn’t believe in the company and you kinda got iced out.”

That unease gave way to real panic around 8 p.m. Memorial Day, when Soberal sent an email informing workers of an “URGENT” all-staff call. By the end of that call, all 900 of Bitwise’s employees had lost their jobs in what the CEOs called a furlough.

Soberal told the Fresno Bee late May 29 that the furloughs were expected to be “a very temporary action” and that it was the result of “several critical [financial] transactions [that] either did not materialize or materialized unfavorably.”

“The events that we’re dealing with that led to furloughs of the team were very new and very unexpected,” Soberal told the Bee.

Some were initially hopeful they would eventually return to work, sending messages of encouragement to Soberal and Olguin on a companywide email thread. But since then, several employees have reported that their last two paychecks — covering three weeks of work — haven’t cleared. Those desperate to make ends meet have been unable to withdraw or borrow from their 401(k) accounts. Healthcare benefits have been terminated, with little information so far on how to apply for COBRA insurance.

On June 2, the landlord for Bitwise’s three Fresno buildings was preparing to evict its errant tenant.

“The rent on this property has been due and unpaid for over sixty two consecutive days and the landlord believes you have abandoned the property,” read notices posted on the buildings, the Fresno Bee reported.

Olguin and Soberal did not respond to requests for comment.

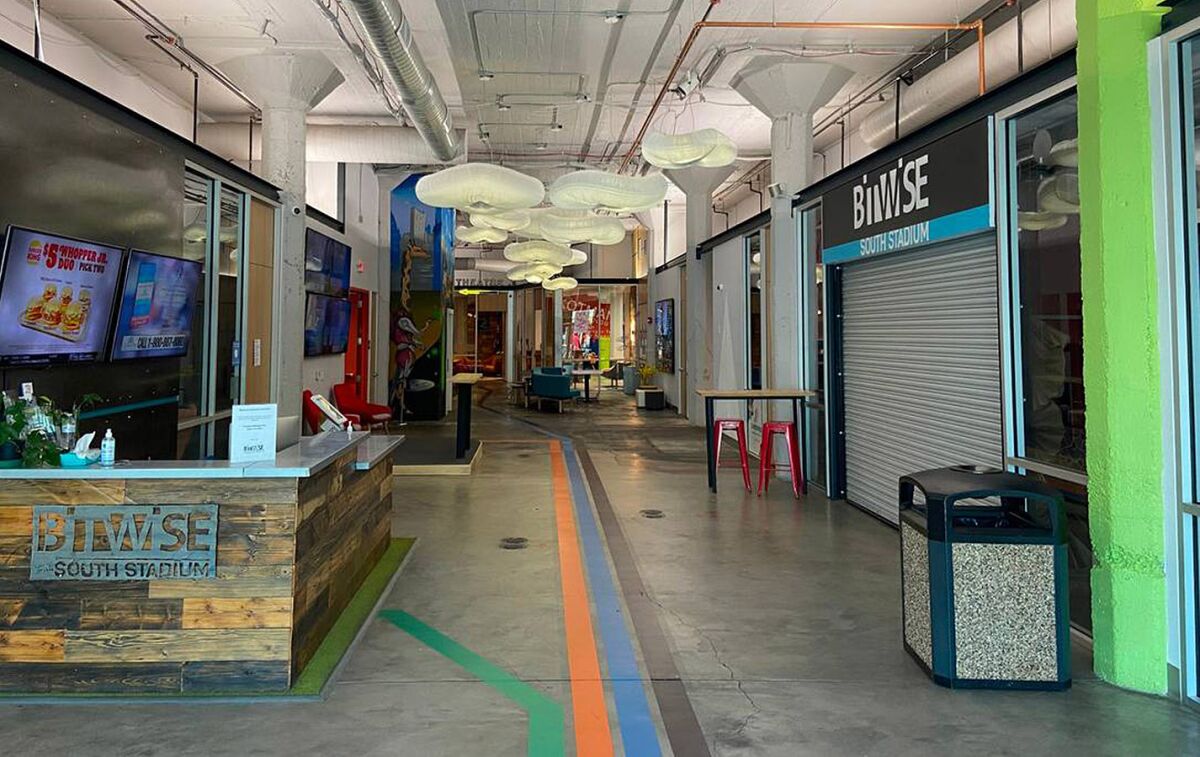

The empty main lobby of Bitwise South Stadium in downtown Fresno on May 31, two days after the tech services and real estate company announced it was furloughing its entire workforce.

(Marek Warszawski / Fresno Bee)

Christopher Ramos and his husband both worked for Bitwise, as well as his mother who was just hired in January after leaving her job of 10 years. On June 1, Ramos, who runs the Instagram account Vintage Fresno, explained the situation and asked for help.

“We wanted to work at Bitwise as a family until we all retired and believed in the work Bitwise was doing in the world,” Ramos wrote. “We can’t pay any of our bills and are left without answers.”

Since the company’s implosion, Fresno and Kern County officials have hosted resource and job fairs for former Bitwise employees with employers in need of tech-savvy hires.

Former employees also are pursuing a class-action lawsuit against Bitwise for violating the California Worker Adjustment and Retraining Notification Act, which requires adequate notice for mass layoffs or furloughs, as well as wage theft and numerous other labor code violations.

Olguin and Soberal have stated under oath that they had $80 million in their Central Valley Bank account as of March 9 of this year, the lawsuit said. The company had announced the previous month an $80-million funding round from investors including Kapor Center, Motley Fool Ventures, and Goldman Sachs, that was supposed to fuel their expansion to Chicago’s South Side.

“It begs the question, what do you do with $80 million in three months?” said Roger Bonakdar, an attorney with Bonakdar Law Firm in Fresno who’s representing the plaintiffs. “If they in fact had $80 million in March, they should have taken that money and earmarked it for the staff first to make sure they could have carried that payroll and benefit expense.”

Right after the furloughs, Soberal told investors “Bitwise is done” and admitted he was concerned about employee labor claims and liability, the lawsuit said.

The legal action names Olguin and Soberal as well as the members of the Bitwise board, which includes interim president Douglass.

“It is flatly impossible that the board did not know and did not contemplate the imminent and catastrophic consequences for all of these employees,” Bonakdar said.

Legal “notices of belief of abandonment” signs were posted on the exterior of the Bitwise 41, Bitwise South Stadium, and Bitwise Hive buildings on June 2.

(Melissa Montalvo / Fresno Bee)

Another class-action lawsuit was filed with lead plaintiffs including employees in New York and Maine in the Eastern District of California.

Douglass and the board did not respond to requests for comment. The only communication employees have received from him is a notice Tuesday to preserve company documents and records — indicating the company may be gearing up for a legal fight.

‘People really believed in Bitwise’

Despite receiving millions of dollars from investors and garnering enviable coverage in major news outlets, Bitwise’s operations — and how exactly it made revenue — may be puzzling to outside observers. That might be due to the sheer number of lines of business the company was juggling.

Bitwise began in 2013 as Geekwise Academy, a coding bootcamp based in Fresno, that initially targeted underserved populations such as veterans and the formerly incarcerated. Over the years, it acquired several buildings in Fresno, hosting local businesses and opening co-working spaces in California, Texas, and Ohio. There was also a software development arm, which employed many of its own former trainees. Bitwise raised a $27-million Series A round of funding in 2019 and Series B funding of $50 million in 2021.

The company also began to land hundreds of thousands of dollars in public funding through contracts with locales such as the city of Bakersfield and Kern County to operate a job training center as well as an accelerator for aspiring entrepreneurs.

During the pandemic, Bitwise launched the OnwardCA website to help match out-of-work Californians with jobs, an effort that received a shout-out from Newsom.

More recently in February, Fresno committed $1 million in American Rescue Plan Act funding to Bitwise to launch a Digital Empowerment Center for helping small businesses acquire digital tools and skills such as social media strategies, Salesforce software and search engine optimization.

Fresno Mayor Jerry Dyer said the city paid $500,000 and held back the other half until proof of performance. The city verified $120,000 worth of services provided two months ago but has no proof for the rest.

“I’m certain there are people today that will say, ‘I knew that they were snake oil salesmen,’” Dyer said. “But the truth is, I had not really heard that. I heard from a lot of folks, elected officials, business community, investors, people really believed in Bitwise.”

‘This truly was the best place I have ever worked’

Former employees paint a picture of a Utopian work environment where co-workers believed wholeheartedly in Bitwise’s mission — making the company’s abrupt downfall feel all the more like a betrayal.

One employee who joined in March 2021 said it was hard for her and her colleagues looking for jobs because they know they’ll never find another place like Bitwise.

“The most heartbreaking piece of it is this truly was the best place I have ever worked,” she said, asking that her name be withheld because the company still owed her money. “Every single person that worked at this community was a generally amazingly kind human being.”

Fresno lawyer Roger Bonakdar is working with more than a hundred California-based Bitwise Industries employees on a class-action lawsuit following the company’s decision to furlough its entire workforce last week.

(Craig Kohlruss / Fresno Bee)

Like many others, she was shocked by the news — especially since Bitwise had just announced its $80-million funding round in February.

Another employee, who also requested anonymity as she had not received her last few paychecks, cited Bitwise‘s success in creating a place of “diversity and inclusion” that made everyone feel welcome. The company is composed of 50% Black, brown or Native employees, 50% LGBTQ women, nonbinary, gender nonconforming, trans individuals, and 20% first-generation immigrant employees, according to its website.

“I can’t put into words… how betrayed I feel as a former employee,” she said. “It’s almost like the company disappeared overnight and they wiped everything.”

Untangling a complicated web

Bitwise faced plenty of other legal issues before recent events that indicated the company may have been in bad financial straits.

A Texas company sued Bitwise a day after the furloughs alleging the company had illegally borrowed almost $30 million using Bitwise buildings as collateral, and illegally listed several of those properties for sale, the Fresno Bee reported. Before that, Bitwise settled a suit alleging the company had not paid rent, utilities, taxes, and other expenses on several properties. In yet another suit, the company was accused of mishandling refund checks from the U.S. Internal Revenue Service that were owed to another entity — it cost Bitwise almost $6.4 million to settle.

Shortly after the furloughs, Dyer revealed the company had not been paying city business taxes since September 2021.

“We’re going to pursue that through legal means,” Dyer said of any money Bitwise owed to the city. “But I imagine we’ll be in a long line of people pursuing their losses as well, including investors that have lost tens of millions of dollars, not to mention the employees.”

Business

Venture capital investment is rising in Los Angeles — and not just for AI startups

Early this year, private equity firm Blackstone bet big on the future of artificial intelligence by investing $300 million in a Chatsworth company that’s been around for more than two decades.

The company, DDN, helps businesses store and manage the massive trove of data that powers AI systems — the lifeblood needed for chatbots, self-driving cars and more. DDN’s high-profile customers include chipmaker Nvidia, Elon Musk’s AI startup xAI, Google Cloud and Ford. DDN, short for DataDirect Networks, has roughly 1,000 employees.

“They have a trillion dollars of assets under management, and it’s a company that we thought would really move the needle for us in terms of extending our reach,” said Jyothi Swaroop, DDN’s chief marketing officer.

The investment was among the largest this year in the Greater Los Angeles region, which remains a hot spot for investments in both old and new tech companies poised for growth.

All told, venture capital investors and private equity firms poured $3.1 billion to fund 144 deals in the L.A. area in the first quarter of this year, up 15% from a year ago, according to research firm CB Insights. The area encompasses Los Angeles, Ventura, Orange, Riverside and San Bernardino counties.

While investment levels can fluctuate, funding in the greater L.A. region has steadily increased since 2023, when investment cooled following the collapse of the cryptocurrency exchange FTX.

Along with AI, investors also financed startups and established businesses in healthcare, e-commerce and defense technology, underscoring how investment in the L.A. market has diversified in recent years beyond ad tech businesses and video apps.

“Today it’s going into much more ambitious projects,” Mark Suster, a general partner at Santa Monica-based Upfront Ventures. “It’s going into satellites, alternate energy, national defense, drones, shipbuilding and pharmaceutical drug discovery. So it’s a lot more exciting than it ever has been.”

Los Angeles-area companies that received the most money in the first quarter include Torrance-based defense company Epirus with $250 million; and Thousand Oaks-based Latigo Biotherapeutics, which received $150 million, according to CB Insights. Latigo Biotherapeutics develops non-opioid pain treatments, while Epirus makes technology that helps defend against attacks from drone swarms.

Economic consulting firm Econic Partners raised the most funding with $438 million, according to CB Insights, which relied on a report filed with the U.S. Securities and Exchange Commission. Econic disputed the total, saying it raised nine figures in the first quarter, but the company declined to say how much.

Masha Bucher, founder and general partner at Day One Ventures, said she views El Segundo as the most promising hub for “deep tech” startups tackling complex issues, such as, water scarcity.

Businesses in the L.A. area have access to a highly qualified workforce from aerospace and defense tech companies. The tech hub known as Silicon Beach also is close to the airport, making it easy for entrepreneurs to hop on a plane to raise funding in San Francisco.

“There is a power of community, and it’s definitely like a power spot on the map,” Bucher said. The firm’s investments include various AI startups and an eye-scanning crypto project backed by OpenAI’s Sam Altman in which people verify they’re human.

Investors aren’t interested in only AI, however. Culver City-based Whatnot raised $265 million, one of the biggest deals in the L.A. area this year. The live shopping app allows people to buy and sell items such as clothing and collectibles. Potential customers can ask questions about products in real-time, find deals and bid for products shown in live videos.

Whatnot says it surpassed more than $3 billion in sales in 2024, and the company expects that figure to double this year. The startup, founded in 2019, says it isn’t profitable yet, but the TikTok rival has shown investors it’s growing fast.

“Live and social shopping has the potential to be an absolutely monstrous market,” Whatnot Chief Executive Grant LaFontaine said.

The company has roughly 750 employees across the United States and Europe. The funding will help market Whatnot to attract more users and hire people to improve the shopping experience, he said.

Like other businesses, Whatnot uses AI for customer service and to moderate content on the platform.

“I tend to be sort of a purist, which is that consumers don’t care about AI. They care about problems being solved,” LaFontaine said.

Businesses have been using AI long before the rising popularity of chatbots such as ChatGPT that can generate text, images and code.

But the frenzy surrounding what’s known as generative AI has meant that various industries are confronting how technology will disrupt the way they live and work.

Not surprisingly, investor interest in AI drove much of the nation’s venture capital commitments in the first quarter. San Francisco-based OpenAI secured the largest funding round of $40 billion, placing its valuation at $300 billion, according to CB Insights.

“There’s a ton of opportunity to rewrite the playing field on which people do business in everything from across verticals, across industries,” said Jason Saltzman, head of insights for CB Insights. “Everyone recognizes the promise, and … no one wants to miss out on the promise.”

Globally, $121 billion of venture capital was raised in the first quarter, with 20% of the deals received by AI companies — the highest amount ever, according to CB Insights. Nationally, $90.5 billion in venture capital was raised last quarter, with the bulk of the money going toward startups in Silicon Valley, which brought in $58.9 billion, the research firm said.

San Francisco has experienced a surge in AI startups expanding or opening up offices, drawn to the city’s swath of talent and the Bay Area’s universities. AI leaders including OpenAI and Anthropic also are based there.

OpenAI said it would use the money raised in the first quarter toward building its tools and investing in talent.

“People understand that this is a transformative technology,” said Chris Lehane, OpenAI’s vice president of global affairs in an interview. “It’s going to permeate virtually every aspect of life.”

Silicon Valley remains the far leader in venture capital AI investments, but other cities such as New York have attracted AI funding. There’s also global competition from countries such as China. As legislators weigh whether to introduce laws that could regulate AI, some tech lobbying groups have raised concerns on how those bills could affect innovation in the state.

Suster said he doesn’t think venture capital dollars will leave California.

“The opportunity set is so great here,” Suster said. “Do we occasionally get backwards-looking bills that try to overregulate how industry works in California? Of course, we do. We find ways to work around them.”

Business

Paramount chair Shari Redstone has been diagnosed with thyroid cancer

Paramount Global chairwoman and controlling shareholder Shari Redstone is battling cancer as she tries to steer the media company through a turbulent sales process.

“Shari Redstone was diagnosed with thyroid cancer earlier this spring,” her spokeswoman Molly Morse said late Thursday. “While it has been a challenging period, she is maintaining all professional and philanthropic activities throughout her treatment, which is ongoing.

“She and her family are grateful that her prognosis is excellent,” Morse said.

The news comes nearly 11 months after Redstone agreed to sell Paramount to David Ellison’s Skydance Media in a deal that would end the family’s tenure as major Hollywood moguls.

However, the government’s review of the Skydance sale hit a snag amid President Trump’s $20-billion lawsuit against Paramount subsidiary CBS over edits to an October “60 Minutes” broadcast.

Redstone, 71, told the New York Times that she underwent surgery last month after receiving the diagnosis about two months ago. Surgeons removed her thyroid gland but did not fully eradicate the cancer, which had spread to her vocal cords, the paper said.

She continues to be treated with radiation, the paper reported.

The Redstone family controls 77% of the voting shares of Paramount. Her father, the late Sumner Redstone, built the company into a juggernaut but it has seen its standing slip in recent years. There have been management missteps and pressures brought on by consumers’ shift to streaming. The trend has crimped revenue to companies that own cable channels, including Paramount.

Redstone has wanted to settle the lawsuit Trump filed in October, weeks after “60 Minutes” interviewed then-Vice President Kamala Harris. Trump accused CBS of deceptively editing the interview to make Harris look smarter and improve her election chances, a charge that CBS has denied.

The dispute over the edits has sparked unrest within the company, prompted high-level departures and triggered a Federal Communications Commission examination of alleged news distortion.

The FCC’s review of the Skydance deal has become bogged down. If the agency does not approve the transfer of CBS television station licenses to the Ellison family, the deal could collapse.

The two companies must complete the merger by early October. If not, Paramount will owe a $400-million breakup fee to Skydance. Redstone, through the family’s National Amusements Inc., also owes nearly $400 million to a Chicago banker and tech titan Larry Ellison, who is helping bankroll the buyout of Paramount and National Amusements.

Business

How Hard It Is to Make Trade Deals

President Trump has announced wave after wave of tariffs since taking office in January, part of a sweeping effort that he has argued would secure better trade terms with other countries. “It’s called negotiation,” he recently said.

In April, administration officials vowed to sign trade deals with as many as 90 countries in 90 days. The ambitious target came after Mr. Trump announced, and then rolled back a portion of, steep tariffs that in some cases meant import taxes cost more than the wholesale price of a good itself.

The 90-day goal, however, is a tenth of the time it usually takes to reach a trade deal, according to a New York Times analysis of major agreements with the United States currently in effect, raising questions about how realistic the administration’s target may be. It typically takes 917 days, or roughly two and a half years, for a trade deal to go from initial talks to the president’s desk for signature, the analysis shows.

Roughly 60 days into the current process, Mr. Trump has so far announced only one deal: a pact with Britain, which is not one of America’s biggest trading partners.

He has also suggested that negotiations with China have been rocky. “I like President XI of China, always have, and always will, but he is VERY TOUGH, AND EXTREMELY HARD TO MAKE A DEAL WITH!!!” Mr. Trump wrote on Truth Social on Wednesday. China and the United States agreed last month to temporarily slash tariffs on each other’s imports in a gesture of good will to continue talks.

Part of what the president can accomplish boils down to what you can call a deal.

The pact with Britain is less of a deal than it is a framework for talking about a deal, said Wendy Cutler, the vice president of the Asia Society Policy Institute and a former U.S. trade negotiator. What was officially released by the two nations more closely resembled talking points for “what you were going to negotiate versus the actual commitment,” she said.

During his first term, Mr. Trump secured two major trade agreements, both signed in January 2020. One was the United States-Mexico-Canada Agreement, which was a reworking of the North American free trade treaty from the 1990s that had helped transform the economies of the three nations.

U.S.M.C.A. is an all-encompassing, legally binding agreement that resulted from a lengthy and formal process, according to trade analysts.

Such deals are supposed to cover all aspects of trade between the respective nations and are negotiated under specific guidelines for congressional consultation. Closing the deal involves both negotiation and ratification — modifying or making laws in each partner country. The deals are signed by trade negotiators before the president signs the legislation that puts it into effect for the United States.

Mr. Trump’s other major agreement in his first term was with China, in an echo of the current trade war. The pact, unlike previous deals, came about after Mr. Trump threatened tariffs on certain Chinese imports. This “tariff first, talk later” approach, said Inu Manak, a trade policy fellow at the Council on Foreign Relations, is part of the same playbook the administration is currently using.

The result was a nonbinding agreement between the two countries, known as “Phase One,” that did not require approval from Congress and that could be ended by either party at any time. Still, it took almost one year and nine months to complete. China ultimately fell far short of the commitments it made to purchase American goods under the agreement.

A comparison of the two first-term Trump deals shows the drawn-out and sometimes winding paths each took to completion. Fragile truces (including ones made for 90 days) were formed, only for talks to break down later, all while rounds of tariffs injected uncertainty into the diplomatic relations between countries.

The Times analysis used the date from the start of negotiations to the date when the president signed to determine the length of deal making for each major agreement dating back to 1985 that’s currently in effect. The median time it took to get to the president’s signature was just over 900 days. (A separate analysis published in 2016 by the Peterson Institute for International Economics used the date of signature by country representatives as the completion moment and found that the median deal took more than 570 days.)

With roughly one month before the administration’s self-imposed deadline, Mr. Trump’s ability to forge deals has been thrust into sudden doubt. Last week, a U.S. trade court ruled he had overstepped his authority in imposing the April tariffs.

For now, the tariffs remain in place, following a temporary stay from a federal appeals court. But in arguing its case, the federal government initially said that the ruling could upset negotiations with other nations and undercut the president’s leverage.

In a statement on Wednesday, Kush Desai, a White House spokesman, said that trade negotiators were working to secure “custom-made trade deals at lightning speed that level the playing field for American industries and workers.”

But in other recent public statements, White House officials have significantly pared back their ambitions for the deals.

In April, Scott Bessent, the Treasury secretary, hedged the number of agreements they might reach, suggesting that the United States would talk to somewhere between 50 and 70 countries. Last month he said the United States was negotiating with 17 “very important trading relationships,” not including China.

“I think when the administration first started, they thought they could actually do these binding and enforceable deals within 90 days and then quickly realized that they bit off more than they could chew,” Ms. Cutler said.

The administration told its negotiating partners to submit offers of trade concessions they were willing to make by Wednesday, in an effort to strike trade deals in the coming weeks. The deadline was earlier reported by Reuters.

The current approach to deal making may be strategic, Ms. Manak said. One of the benefits of not doing a comprehensive deal like U.S.M.C.A. is that the administration can declare small “victories” on a much faster timeline, she said.

“It means that trade agreements simply are just not what they used to be,” she added. “And you can’t really guarantee that whatever the U.S. promises is actually going to be upheld in the long run.”

Data and graphics are based on a New York Times analysis of information from the Congressional Research Service, the U.S. Trade Representative, the Organization of American States’ Foreign Trade Information System and public White House communications.

-

News1 week ago

News1 week agoVideo: Faizan Zaki Wins Spelling Bee

-

Politics6 days ago

Politics6 days agoMichelle Obama facing backlash over claim about women's reproductive health

-

News1 week ago

News1 week agoVideo: Harvard Commencement Speaker Congratulates and Thanks Graduates

-

Politics1 week ago

Politics1 week agoMusk officially steps down from DOGE after wrapping work streamlining government

-

News1 week ago

News1 week agoPresident Trump pardons rapper NBA YoungBoy in flurry of clemency actions

-

Technology1 week ago

Technology1 week agoAI could consume more power than Bitcoin by the end of 2025

-

Technology1 week ago

Technology1 week agoSEC drops Binance lawsuit in yet another gift to crypto

-

Business1 week ago

Business1 week agoSix Flags to cut 135 jobs at Knott’s, Magic Mountain and other California parks