Business

A drug for pregnant women doesn’t work, according to the FDA. A company is selling it anyway

American infants are at far increased danger of dying earlier than their first birthdays than these in virtually another rich nation. An enormous motive for these deaths, greater than 21,000 every year, is that too many are born too quickly.

For greater than a decade, a pharmaceutical firm has mentioned it holds the important thing to serving to these infants: a drug known as Makena, which is aimed toward stopping untimely beginning.

However the drug doesn’t work, based on the Meals and Drug Administration.

A current massive examine “unequivocally didn’t exhibit” that Makena lowered the danger of preterm beginning, company scientists defined in a 2020 memo. They really helpful or not it’s taken off the market.

The corporate has refused.

As an alternative, Covis Pharma, a Luxembourg firm owned by personal fairness agency Apollo World Administration Inc., has continued to advertise Makena, emphasizing a necessity by Black ladies, who’re most vulnerable to preterm births.

Covis dismisses the outcomes of the current examine because it included extra white European ladies than Black Individuals. It factors to favorable older trials additionally disputed by the FDA, and it’s asking for extra time to show to authorities that Makena works.

The corporate’s continued push to promote the drug, in addition to choices by the nation’s prime societies of physicians caring for pregnant ladies to proceed to advocate it, has troubled and angered some medical doctors.

“We hold injecting pregnant ladies with an artificial hormone that hasn’t been proven to work,” mentioned Adam Urato, chief of maternal and fetal drugs at MetroWest Medical Heart in Framingham, Mass.

Greater than 310,000 ladies have taken Makena throughout their pregnancies since 2011 when the FDA rejected issues of outdoor specialists in addition to considered one of its personal scientists and authorized the drug.

Amongst these ladies is Brittany Horsey, who had simply obtained her weekly Makena injection in 2020 when she went into labor later that day — 4 weeks too quickly.

She had an analogous expertise with the drug three years earlier than along with her second being pregnant. That little one got here six weeks early.

“It didn’t work,” mentioned Horsey, 24. However the Baltimore mom nonetheless suffered from the unwanted side effects. She was hit with migraines and despair quickly after beginning the photographs. The drug’s written label lists each as potential issues.

Makena’s lack of effectiveness has not lowered what Covis lists because the drug’s value — at present $803 per weekly shot, based on GoodRx, which tracks nationwide costs set by drug producers, or about $13,000 for the total course of injections typically prescribed throughout a being pregnant.

And, regardless of the prescriptions, the speed of preterm births within the U.S. has continued to rise. Federal officers reported in March that 10.23% of the nation’s births had been preterm in 2019 — the fifth-straight annual rise.

Covis, which took over gross sales of Makena when it bought AMAG Prescribed drugs late final 12 months, declined to make executives obtainable for interviews. In a written assertion, it pointed to a current reanalysis of earlier Makena trials that discovered proof that the drug labored. The FDA says it already thought-about these earlier trials and had not modified its discovering that the drug was not efficient. The corporate additionally mentioned the drug is secure. It desires the FDA to permit it to maintain promoting the drug whereas it performs extra research aimed toward making an attempt once more to indicate that Makena helps sufferers or sure subgroups like Black ladies.

“The totality of knowledge on … Makena helps its continued optimistic benefit-risk profile and the necessity for continued affected person entry,” the corporate mentioned in an announcement.

Covis added that the quantity paid for Makena by “most payers” was “considerably much less” than its listed value, which it claims isn’t correct. It mentioned, for instance, it had just lately lowered “the online value” of Makena paid by purchasers together with state Medicaid packages, which cowl the poor.

In August the FDA granted Covis a listening to to once more evaluation the proof on the drug. A date for the listening to has not but been set, which implies hundreds extra ladies might be prescribed the drug earlier than the company decides whether or not to drive the corporate to cease gross sales.

The story of Makena reveals how pharmaceutical firms can use America’s drug approval system to make tons of of tens of millions of {dollars} from an inexpensive, decades-old drugs with questionable effectiveness and security.

It additionally raises questions in regards to the affect of company cash on American medical doctors, even in an space of drugs that serves some of the susceptible group of sufferers: pregnant ladies and their youngsters.

Urato factors out that scientists don’t but know the long-term results of Makena on the youngsters of moms who get the photographs.

“It’s loopy. This can be a drug that has by no means been proven to have medical profit,” he mentioned. “There isn’t any method this drug ought to nonetheless be available on the market.”

A desktop show of the homepage of makena.com with details about the drug Makena.

(Jerome Adamstein / Los Angeles Occasions)

Seeing revenue in an previous drug

Medical doctors have been treating pregnant ladies with the artificial hormone generally known as 17-alpha hydroxyprogesterone caproate, or just 17P, because the Fifties. The pure hormone progesterone is crucial for a being pregnant, however scientists have by no means been in a position to decide how including an artificial model may assist ladies take their pregnancies to full time period.

Developed in 1953, the drug was first authorized underneath the model identify Delalutin. However in 1999, Bristol-Myers Squibb, the corporate then promoting it, requested the FDA to take away its federal approval after many medical doctors misplaced curiosity in prescribing it.

The drug remained obtainable, nonetheless, at compounding pharmacies that would make it at a physician’s path for about $15 a dose.

Executives at Adeza Biomedical in Sunnyvale, Calif., noticed a monetary alternative when a government-funded examine in 2003 discovered that the drug appeared to scale back the danger of preterm beginning. The examine, nonetheless, was not designed to indicate it lowered deaths or incapacity amongst infants — the true objective of medical doctors prescribing it.

The executives’ plan, based on the corporate’s public paperwork for traders: Get the FDA to approve a budget generic drug as a treatment for preterm beginning primarily based on the taxpayer-funded examine. The corporate would then get an unique license to promote it and the power to lift its value.

It was not laborious to get the FDA to see the necessity for a drug which may scale back the danger of getting a child too quickly.

Infants born earlier than 37 weeks — the official definition of a preterm beginning — have a higher danger of issues. The sooner they’re born the upper their danger of significant lifelong disabilities and even loss of life. Lungs and digestive programs might not be totally developed. They will undergo bleeding of their brains.

Most in danger are Black infants. In 2019, greater than 14% of births to Black ladies had been preterm, in contrast with simply over 9% of births to white ladies.

The company plan took years as a result of FDA scientists and outdoors specialists questioned whether or not the drug was efficient and secure.

FDA scientists identified that research wherein excessive doses of the drug got to rats and different animals had not confirmed it was secure for human embryos, The Occasions present in a evaluation of paperwork written by company employees members. The scientists additionally warned there was not sufficient data on whether or not it’d hurt youngsters’s studying, habits and replica.

One other concern: There was just one medical trial — the 2003 examine funded by the federal government — that had proven the drug lowered the danger of preterm beginning.

That examine was flawed. The ladies taking the placebo had an abnormally excessive charge of preterm beginning, which can have exaggerated the trial’s conclusion. Organizers of the trial later decided that the group given the placebo had been extra in danger as a result of a better proportion of them had already had two preterm births.

In 2006 the FDA requested a committee of outdoor specialists what they considered the trial’s knowledge. The panel voted 19 to 2 that the trial had failed to indicate that the drug lowered deaths or severe well being issues in infants. And the committee agreed unanimously that there have to be extra examine of whether or not it’d trigger miscarriages or stillbirths. It voted 13 to eight that the security knowledge had been “ample” to assist approval.

Within the months and years after the assembly, the FDA repeatedly requested the corporate to assemble extra scientific knowledge on the drug. That data answered a number of the questions posed by the company’s workforce of scientists reviewing the drug, but it surely by no means was in a position to persuade one member of that group. Lisa Kammerman, an FDA statistician, repeatedly raised questions in regards to the firm’s plan over time, together with in regards to the flaws within the 2003 examine.

“From a statistical perspective, the knowledge and knowledge submitted … don’t present convincing proof relating to the effectiveness,” Kammerman wrote on the prime of her 58-page evaluation of the drug in 2010.

Regardless of her opposition, the FDA authorized Makena in 2011 underneath an accelerated regulatory pathway that has been questioned by specialists.

The accelerated course of is aimed toward serving to sufferers vulnerable to severe well being issues who don’t but have therapies. Below these laws, the company can approve a drug that isn’t but backed by stable scientific proof, permitting it to be prescribed whereas a examine is completed to substantiate its advantages. Final 12 months, the company stirred controversy when it used the principles to approve the drug Aduhelm for Alzheimer’s illness regardless of a scarcity of knowledge exhibiting that it slowed dementia.

In Makena’s case, the company mentioned it will enable the drug to be offered whereas the corporate carried out one other medical trial to indicate it truly saved infants from loss of life or incapacity.

By then, the drug had been bought by KV Pharmaceutical Co.

That extra trial — which in the end confirmed the drug didn’t work — would take eight years. The value hike was fast.

KV launched the drug at an inventory value of greater than $1,400 a dose, or practically $30,000 for the 20-week course of injections wanted throughout many pregnancies. Going through widespread outrage, KV quickly lowered the value to $690 — nonetheless greater than 40 instances what compounding pharmacies had been charging for what was then a virtually 60-year-old generic drugs.

A part of a slide presentation that AMAG Prescribed drugs gave to traders in 2015, detailing how it will promote Makena. The corporate mentioned it noticed a billion-dollar “alternative.”

Billion-dollar alternative

Three years after the FDA authorized Makena, yet one more firm acquired rights to the drug.

Executives at AMAG Prescribed drugs mentioned they had been excited in regards to the drug as a result of KV had put it “on a remarkably robust gross sales development trajectory,” based on a information launch.

They usually advised traders that they had a grander plan.

In a slide presentation in 2015, the executives described a “$1B Makena Market Alternative.” They calculated $1 billion in annual gross sales primarily based on getting 140,000 pregnant ladies to comply with greater than 16 injections throughout every of their pregnancies with internet income earned for every shot of $425.

The “important alternative,” based on the slides, got here from first making an attempt to steer extra of the ladies vulnerable to preterm beginning — those that had already had one little one prematurely — to take the Makena photographs.

Secondly, the corporate deliberate to search out methods to extend the variety of injections given to every pregnant lady from the typical then of 13.5 injections per being pregnant towards the utmost potential of 21 injections. Its objective, based on the slides, was a mean of 16 injections for every pregnant affected person taking the drug.

To extend the typical variety of injections, AMAG mentioned within the slides it will launch a program of “adherence/persistency” — that’s, discovering methods to maintain ladies taking the photographs even once they want to cease due to unwanted side effects or different issues akin to attending to the physician each week.

AMAG mentioned its “development technique” included having its advertising workforce deal with three key teams: physicians prescribing the drug, the skilled societies that these medical doctors belong to and the nonprofit affected person teams advocating for pregnant ladies and their youngsters.

The corporate advised traders that it had created “a publications committee” made up of “KOLs,” or key opinion leaders — a time period the drug business makes use of for physicians who could possibly sway the opinions of their friends. Firms typically rent these medical doctors to write down medical journal articles or give speeches to different medical doctors about their merchandise.

The Occasions discovered that tutorial physicians employed as consultants by AMAG later wrote articles about how Makena was efficient, how its unwanted side effects had been little to fret about, and why medical doctors shouldn’t belief a budget variations of the drug obtainable at compounding pharmacies.

Covis advised The Occasions it couldn’t touch upon actions of AMAG earlier than it bought the corporate. AMAG’s former chief government didn’t reply to messages in search of remark.

A method AMAG stored in contact with medical doctors it thought-about opinion leaders was on the Society for Maternal-Fetal Medication. The group’s membership contains greater than 5,000 physicians, scientists and ladies’s well being professionals from world wide.

AMAG quickly grew to become a prime monetary supporter of the society and its occasions. On the society’s annual assembly in 2019, the place medical doctors gathered at Caesars Palace in Las Vegas, AMAG was listed in this system as the highest company funder of the group’s basis, giving not less than $100,000. The Occasions discovered comparable contributions going again to 2015.

The corporate can be listed as a “premier” member of the society’s company council. In line with a society brochure on this system, a paid membership brings firms and the society’s doctor leaders collectively “to deal with points and initiatives of mutual curiosity in high-risk being pregnant.”

AMAG additionally gave cash to the American Faculty of Obstetricians and Gynecologists, the nation’s largest skilled affiliation for medical doctors caring for pregnant ladies and their youngsters.

The affiliation’s web site lists AMAG as an “business companion.” The corporate gave not less than $200,000 to the affiliation in 2018, sufficient to change into a sponsor of its President’s Cupboard.

Each the Society for Maternal-Fetal Medication and the American Faculty of Obstetricians and Gynecologists have continued to assist the usage of Makena regardless of the dearth of scientific knowledge that it really works.

Covis repeatedly cited the 2 teams’ suggestions for prescribing Makena in paperwork it submitted to the FDA demanding the drug keep available on the market.

And in August, the affiliation revealed new pointers on preterm beginning, persevering with to advocate Makena for sure sufferers however not mentioning that the FDA had really helpful or not it’s pulled from the market. These pointers didn’t disclose that AMAG has been among the many affiliation’s prime monetary supporters.

Each the society and the affiliation advised The Occasions that the corporate’s funds had no affect on their suggestions for treating pregnant ladies.

Christopher Zahn, the affiliation’s vp of apply actions, mentioned the group had advised its members in regards to the FDA’s motion on Makena in different communications and didn’t see a necessity to incorporate the knowledge within the new pointers.

“There isn’t any function for business within the improvement of ACOG’s Apply Bulletins,” Zahn mentioned in an announcement utilizing an abbreviation for the affiliation, “and ACOG neither solicited nor accepted any industrial involvement in the event of the content material of the Apply Bulletin.”

Kerri Wade, a society spokeswoman, mentioned that the group has a strict conflict-of-interest coverage and “business has no enter into the society’s medical steerage, well being coverage initiatives, analysis, or the particular academic content material.”

The corporate’s cash didn’t simply go to the medical societies. It went into the pockets of hundreds of American obstetricians.

In 2018, AMAG gave money or presents to five,800 physicians as its gross sales reps promoted Makena, based on a ProPublica evaluation of a federal database.

AMAG’s advertising plan succeeded in considerably boosting prescriptions, however the firm didn’t attain its objective of $1 billion in annual gross sales. An FDA evaluation discovered that the variety of sufferers who prescribed the drug elevated from 8,000 in 2014 to 38,000 in 2017. Gross sales reached $387.2 million in 2017 earlier than beginning to decline.

Even after the FDA mentioned Makena must be faraway from pharmacies, prescriptions for poor ladies lined by Medicaid are nonetheless being written at 55% of the speed of their excessive level in 2017, based on a December examine.

The persevering with assist of Makena from the 2 skilled teams of obstetricians has helped again these current prescriptions — inflicting some medical doctors to query the teams’ acceptance of the company money.

“Is tutorial drugs on the market?” requested David Nelson, affiliate professor of obstetrics and gynecology on the College of Texas Southwestern Medical Heart in Dallas, and two different scientists in an article detailing AMAG’s funds to the 2 teams.

“We had been greatly surprised by the quantity of monetary scope and affect in our specialty,” they wrote, including that the “information are resoundingly persuasive” that medical doctors shouldn’t prescribe Makena.

Adversarial results

Covis and medical doctors who’re advocates of the drug say Makena has few unwanted side effects and it will not hurt sufferers to proceed gross sales whereas extra analysis is completed to attempt to present it’s efficient. “Its security profile for the mom and child are effectively established,” Covis mentioned in an announcement to The Occasions.

An FDA database comprises greater than 18,000 reviews of sufferers experiencing antagonistic results, from rashes to severe issues like stillbirths.

A spokeswoman for the FDA mentioned that “the presence of a report” within the database “doesn’t imply the drug induced the antagonistic occasion.”

The company continues to watch the database, she mentioned, in addition to issues reported in medical trials. And it has already required Covis to warning sufferers about issues akin to blood clots, diabetes, hypertension and despair within the written label that comes with a prescription.

Stillbirths have been a priority since not less than 2003, when the federal government trial confirmed a small however elevated danger in ladies taking Makena. Two % of volunteers taking the drug had a stillbirth in contrast with 1% of these taking the placebo.

Questions in regards to the increased charge of stillbirths had been raised by specialists on an FDA committee that met on Oct. 29, 2019, to debate the drug.

Julie Krop, an AMAG government, advised the panel that the corporate had an skilled evaluation every of the stillbirths suffered by ladies in medical trials to find out whether or not it was attributable to the drug.

The skilled launched by Krop was Baha Sibai, a professor of obstetrics, gynecology and reproductive sciences on the College of Texas Well being Science Heart in Houston. In line with a transcript of the assembly, Krop emphasised to the committee that Sibai was “impartial” from the corporate.

“I regarded by means of each considered one of these,” Sibai advised the committee. “There was just one unexplained.”

As an alternative, Sibai mentioned he had recognized different elements akin to a mom’s smoking or diabetes that might clarify the stillbirths.

“And it’s reassuring to see that, actually, in both of these research, there was no sign that 17P will increase stillbirth.”

Sibai had been one of many researchers within the 2003 examine of the drug and throughout the assembly he was known as on repeatedly to reply questions. His message: Makena works and is secure, and to take it off the market would have “catastrophic” penalties.

The Occasions discovered that AMAG had paid Sibai greater than $14,000 in consulting charges and reimbursements for meals and journey within the months main as much as the assembly.

After the assembly, the corporate’s funds to Sibai elevated sharply. By early the following 12 months, he had personally obtained a further $50,000 from AMAG, based on a federal database of funds that pharmaceutical firms give to medical doctors.

The corporate was additionally giving Sibai’s employer massive monetary grants. AMAG paid the College of Texas Well being Science Heart a complete of $215,000 in 2019 and 2020 for a analysis examine of considered one of its experimental medication that concerned Sibai.

Deborah Mann Lake, a college spokeswoman, mentioned Sibai wasn’t obtainable to remark.

“It’s our understanding that Dr. Sibai was compensated for the hours he spent making ready his testimony” on the 2003 examine, Lake mentioned. She identified that early within the eight-hour assembly Krop had advised the committee that the obstetricians and different specialists the corporate had invited to talk had been paid by AMAG for his or her time and journey bills. Lake additionally mentioned that the college was simply considered one of 18 establishments that AMAG had paid for medical trials of its experimental drug.

Krop didn’t reply to messages asking for her remark.

Scientists even have questions on Makena’s longer-term results. They don’t but know what hurt the drug might trigger over time for moms and their youngsters.

Some researchers are involved that Makena might enhance the danger of cancers within the youngsters of ladies who take it.

Barbara Cohn, an epidemiologist on the Public Well being Institute in Oakland, and three different scientists revealed a examine in November that discovered a better danger of most cancers among the many offspring of 200 California ladies who had taken 17P throughout their pregnancies within the Fifties and ’60s when it was offered underneath the Delalutin identify.

The moms had agreed to take part within the Little one Well being and Improvement Research, a gaggle who obtained prenatal care between 1959 and 1966 at Kaiser Permanente in Northern California.

Utilizing the California Most cancers Registry, the scientists found the youngsters of ladies injected with the drug had been practically twice as prone to be identified with most cancers than these not uncovered to the drug within the womb. The kids’s charge of most cancers of the mind, colon and prostate was particularly excessive.

The findings “elevate substantial concern” for prescribing the drug throughout being pregnant, the scientists concluded.

The Covis spokesperson mentioned the examine “gives no comparability to Makena” because it had been utilized in these earlier many years to “deal with a special affected person inhabitants for a special function.” The spokesperson famous that the American Faculty of Obstetricians and Gynecologists had advised its members the examine had limitations and “shouldn’t affect apply.”

The spokesperson additionally identified that the FDA’s choice to advocate the drug’s elimination was not due to security issues however due to “conflicting efficacy knowledge.” The corporate believes that each the 2003 examine and the brand new trial confirmed the drug was secure, the spokesperson mentioned.

Cohn mentioned in an interview that her group determined to analyze the long-term results of Makena due to its similarity to a different artificial hormone known as diethylstilbestrol, or DES. Medical doctors started prescribing DES to pregnant ladies within the Nineteen Forties. Many years later, scientists discovered it might trigger uncommon cancers within the moms’ youngsters. Some research have discovered that DES might hurt even the third technology.

“Hormones have very broad potential impacts on the physique,” Cohn mentioned. “Something the pregnant mom is uncovered to, her youngsters are uncovered to and her grandchildren are uncovered to concurrently.”

A letter despatched to the Meals and Drug Administration in Could 2021 by the Preterm Delivery Prevention Alliance — a company created with cash from Covis.

Lobbying to cease the FDA

A letter arrived on the FDA in Could 2021.

Below a crimson letterhead brand depicting a mom and little one, the Preterm Delivery Prevention Alliance requested to satisfy with Janet Woodcock, the performing FDA commissioner, to share their members’ issues in regards to the plan to halt gross sales of Makena.

What the alliance didn’t point out within the letter was that Covis had paid to create the group.

Two months later, alliance members met with the White Home Home Coverage Council, the place they left “inspired” by the council’s “receptivity,” based on a be aware in regards to the assembly on the alliance’s web site.

They then quickly met with employees from the workplace of Rep. Madeleine Dean, a Pennsylvania Democrat.

“We’re so inspired to search out an ally and champion of maternal well being in Consultant Dean,” the alliance wrote on its web site, “and look ahead to continued engagement on this situation along with her workplace.”

Tim Mack, a spokesman for Dean, mentioned the alliance had not disclosed that it was funded by Covis throughout the July assembly. “We by no means knew the alliance was paid by the producer,” Mack mentioned. “That’s a troubling factor to search out out.”

A White Home official confirmed that the Home Coverage Council and the Gender Coverage Council had met with alliance members. Council members mentioned they weren’t conscious that cash from Covis had created the group, based on the official.

Covis gave the cash to create the Preterm Delivery Prevention Alliance to a well known shopper group in Washington, D.C., known as the Nationwide Shoppers League. The nonprofit group was created in 1899 by social reformers making an attempt to enhance working circumstances. Amongst its founding ideas is that “shoppers ought to demand security and reliability from the products and companies they purchase.”

Lately, the league has change into extra pleasant with firms. It invitations company executives to pay to sit down on its well being advisory council. Earlier than it was acquired by Covis, AMAG had paid to be a member of the council since not less than 2017, based on the league’s web site. AMAG is at present listed as a “platinum” funder — the designation for firms giving essentially the most.

A spokeswoman for the buyer league didn’t reply a query from The Occasions on why it had not disclosed Covis’ funding within the letter despatched to the FDA or in shows it gave on the White Home or to Dean’s employees. She pointed to a disclosure in a single sentence on the backside of the alliance’s web site and on the finish of two brochures that mentioned Covis had supplied the funds to create the brand new group.

“We offer supplies that disclose funding and embody hyperlinks to our web site … at each assembly we attend,” she mentioned in an announcement. She added that Covis “isn’t concerned within the strategic path of the Alliance or its actions.”

Covis advised The Occasions it had been “clear in its actions with clinicians and advocates, which the corporate believes is in the most effective curiosity of sufferers.”

The correspondence that Covis and the alliance individually despatched to the FDA mirror one another in key methods.

Like Covis, the alliance dismisses the outcomes of the massive new examine, saying it didn’t embody sufficient American Black ladies. And each the corporate and the alliance requested for one more listening to the place moms, particularly those that had been Black, might testify on the necessity for Makena — a request the FDA granted in August.

The FDA has already repeatedly addressed the priority that stopping the drug’s sale might damage Black infants. It defined final 12 months that its scientists had analyzed the medical trials, hoping to search out that in the event that they separated the information by the race of the mom they might discover it helped some teams.

“After a number of analyses,” the company mentioned, it was “unable to establish a gaggle of ladies for whom Makena had an impact.”

Drug firms have typically used the voices of sufferers to attempt to affect regulatory choices. AMAG despatched sufferers to talk on the FDA committee assembly in 2019. The sufferers testified that they believed Makena had helped lengthen their pregnancies. Some disclosed that the corporate had paid for his or her journey and resort bills.

Daniel Gillen, professor and chair of statistics at UC Irvine, sat on the 2019 committee. He mentioned he appreciated listening to from sufferers as a result of it helped him perceive how devastating it may be to have a baby born prematurely.

However he identified that by far the vast majority of the affected person volunteers within the massive trial that prompted the FDA’s push to take away the drug went on to have a supply at full time period — whether or not they took the drug or the placebo.

Relying solely on “the case examine will be very harmful,” Gillen mentioned, referring to the tales of particular person sufferers.

“The gold customary of proof right here is the randomized trial outcomes,” he mentioned. “We’re nonetheless ready on that clinically related knowledge to say this drug is really efficient and outweighed by the potential dangers.”

Stephen Chasen, professor of medical obstetrics and gynecology at Weill Cornell Medication in New York, mentioned he cares for a lot of minority ladies vulnerable to preterm beginning. He mentioned it’s laborious to inform his sufferers that there isn’t a drug he can advocate.

“However what could be worse than being trustworthy with sufferers,” he mentioned, “could be for us to mislead them by recommending an intervention that has no proof that it really works — which is actually, what’s being executed in prescribing Makena.”

Assist past Makena

There are different methods to scale back the danger of getting a child too quickly.

When Cochrane, a world healthcare analysis group that doesn’t settle for cash from firms, got down to decide how pregnant ladies might keep away from preterm beginning, Makena didn’t make its checklist. The group had gathered and analyzed dozens of research from world wide on interventions aimed toward extending pregnancies.

On the prime of the checklist was care delivered by midwives, which Cochrane mentioned research had proven supplied a “clear profit” in lowering the danger of an early beginning.

Poor maternal care, particularly of Black, Native American and Latina moms, has lengthy been related to preterm births.

Nearly 10% of Black moms obtained dangerously late or no prenatal care in any respect in 2019, based on a current report by the Facilities for Illness Management and Prevention. That was greater than double the speed for white moms.

In South Los Angeles, Kimberly Durdin, a Black midwife at Kindred House LA, mentioned a go to for being pregnant care within the mainstream medical system might final simply 5 minutes. Compared, at a birthing middle, she mentioned, midwives change into companions with their sufferers all through their being pregnant and beginning. Girls are inspired to ask questions, she mentioned, and the visits are lengthy sufficient to get recommendation on vitamin and even how a lot water to drink.

The medical system, Durdin mentioned, “doesn’t enable sufficient time to ship the care folks must keep away from slipping by means of the cracks.”

Horsey, the mom in Baltimore, mentioned that when she just lately obtained pregnant once more the physician and employees on the clinic she visits advised her she ought to begin the Makena photographs.

She reminded them of the unwanted side effects she had suffered from the photographs in two earlier pregnancies and the way, regardless of taking the drug, she had nonetheless delivered her infants too quickly.

Horsey mentioned she advised them she had determined to not get the injections with this being pregnant — and so they initially pushed again.

“I felt my opinion didn’t matter,” she mentioned.

Horsey in the end satisfied them she didn’t want Makena. On Jan. 7, she gave beginning to a lady at 38 weeks, which is taken into account full time period.

Durdin mentioned she had heard comparable tales from Black ladies who felt their medical doctors didn’t hear once they raised issues.

She identified that obstetricians prescribing Makena are protected against unhealthy outcomes as a result of they will present they’re following pointers issued by their skilled societies.

These skilled teams must be working to vary the system, Durdin mentioned, “so folks can have higher care and extra time with their practitioners.”

“There’s completely no accountability,” Durdin mentioned. “The large downside is the entire doggone system. That’s the elephant within the room that nobody is keen to handle.”

Business

L.A. consumer group calls FAIR Plan insurance reforms an industry 'bailout'

A new law that could force homeowners across California to cover billions of dollars of insurer losses caused by a catastrophic wildfire is generating pushback from a leading consumer group, which has called it an industry “bailout.”

State Insurance Commissioner Ricardo Lara announced Friday he had reached an agreement with the California FAIR Plan that would allow losses suffered by the state’s insurer of last resort to be recouped by surcharges on residential and commercial insurance policies statewide in an “extreme worst case scenario.”

The FAIR Plan, which insures property owners who cannot get or afford traditional policies, is backed by licensed insurers such as State Farm and Allstate. As the program is structured, they are on the hook to pay claims if the FAIR Plan runs through its reserves, reinsurance and catastrophe bonds.

Under Lara’s agreement, if that happens and those insurers suffer large losses, they could seek to be reimbursed by their own policyholders. The deal allow insurers that are assessed by the FAIR Plan to cover up to $1 billion in residential losses and up to $1 billion in commercial losses to ask the insurance commissioner to allow them to surcharge their policyholders for half of the assessed amounts. They also could seek surcharges on policyholders for 100% of losses that exceed those limits. Homeowners would not be surcharged for commercial losses.

“It’s outrageous and outside the law for the insurance commissioner to force consumers to bail out home insurance companies and then call that consumer protection,” said Carmen Balber, executive director of Los Angeles-based Consumer Watchdog.

Gabriel Sanchez, Lara’s press secretary, defended the agreement, saying, “It would be easy to listen to the elites and the entrenched interests defending a system that clearly isn’t working. Commissioner Lara is focused on hearing from the public, following the data and creating realistic, long-lasting solutions for everyone in this state.”

The FAIR Plan assessment is the latest element of Lara’s Sustainable Insurance Strategy, a package of executive actions intended to stabilize the California market, which has seen insurers stop writing new policies and decline to renew existing policies amid a sharp increase in claims for wildfires damage.

Just this week, firefighters are battling the massive Park fire in Butte, Tehama and Shasta counties, where 100 structures have been destroyed, 4,200 were threatened and 26,000 people were forced to evacuate as of Monday. It is the sixth-largest fire in state history.

As insurers have pulled back from high-fire risk neighborhoods, the number of residential FAIR Plan policies has more than doubled since 2019 to about 408,000 as of June. Commercial policies similarly increased to 11,026.

The FAIR Plan has a market share under 4%. Policyholders are concentrated in canyons, hillsides and other high-risk neighborhoods, vulnerable to fire and catastrophic insurance losses. The plan’s loss exposure was $393 billion as of June, even though the plan’s policies are more limited than those available through the regular commercial market.

Lara said Friday in a release announcing the agreement that “modernizing the FAIR Plan is a crucial step in our strategy to stabilize California’s insurance market.”

The FAIR Plan’s financial risk is overwhelmingly due to its residential policies, which account for about 95% of its $393 billion in total loss exposure, according to the insurer.

The Insurance Department downplayed a worst-case scenario, noting that even the 2018 Camp fire in Butte County that ravaged the town of Paradise, destroying or damaging more than 19,000 structures and causing some $16.5 billion in damage, did not deplete the FAIR Plan‘s reserves.

The Insurance Department contended that the agreement was actually favorable to consumers because under current law there is nothing prohibiting the insurers from seeking policyholder assessments on all FAIR Plan losses they must cover.

“The agreement … requires insurance companies to share the burden, something not clearly outlined before. That protects consumers by providing predictability which leads to stability,” Sanchez said.

Balber disputed that reading of the law and said Lara has not been able to get legislative authority for the insurer policyholder assessments, so he proceeded under questionable executive authority. “We have several questions about the legality of this proposal and are looking into it,” she said.

Consumer Watchdog has called for requiring insurers to offer policies in wildfire-prone neighborhoods to homeowners who have taken steps to reduce fire risks on their property as the best method to reduce enrollment in the FAIR Plan and stabilize the state’s insurance market.

Another key element of Lara’s FAIR Plan reforms call for the insurer to offer greater commercial coverage — up to $20 million per structure and $100 million for any one location.

Dan Dunmoyer, chief executive of the California Building Industry Assn., said the trade group has been seeking higher commercial coverage limits due to the rise of insurance premiums, which have slowed the construction of condominium complexes that builders insure.

He estimated that astronomical insurance rate increases have slowed condo construction by about 70% in the last 12 months, with fewer than 6,000 units built.

“Our view on this is: Get some competition in the marketplace, expand commercial coverage, let us build the most affordable for sale homes in California, which are condos,” he said.

The American Property Casualty Insurance Assn., an industry trade group, called Lara’s plan “an important step toward restoring the FAIR Plan’s financial stability and ensuring consumers have access to the coverage they need.”

The deal reached by Lara with the FAIR Plan is a binding legal stipulation and it requires the insurer to develop a “Plan of Operation” within 30 days detailing how it will carry out the agreement. It has 120 days to submit a rate plan for offering the higher commercial coverage.

The FAIR Plan was sued last week by four California residents who claim its policies offer subpar coverage for fire and smoke damage. The proposed class-action lawsuit seeks to represent more than 300,000 of the plan’s residential policyholders. The plan also is facing a lawsuit from more than 1,000 homeowners in Los Angeles who say the plan wrongly denied their claims.

Business

Column: What FDR could advise Biden about reforming the Supreme Court — tread lightly

If it’s true that as Mark Twain supposedly said, history doesn’t repeat itself but it often rhymes, then we are about to embark on a poetry slam for the ages, with the Supreme Court as its theme.

President Biden on Monday unveiled a package of proposals to rein in a court that has seen public confidence reach a low ebb not recorded by the Gallup Organization in readings dating back to 1973.

Most significantly, he is calling for 18-year term limits for Supreme Court justices and the imposition by Congress of binding conduct and ethics rules requiring the justices to “disclose gifts, refrain from public political activity, and recuse themselves from cases in which they or their spouses have financial or other conflicts of interest.”

Term limits would… make timing for Court nominations more predictable and less arbitrary; and reduce the chance that any single Presidency imposes undue influence for generations to come.

— President Biden on his Supreme Court reform plan

He is also proposing a constitutional amendment to neutralize a court decision appearing to give former presidents immunity for crimes committed while in office.

The template for these proposals is Franklin Roosevelt’s 1937 plan to “pack” the court by allowing presidents to appoint a new justice when any sitting justice failed to resign or retire within six months of turning 70, up to a maximum of six new justices.

The manifest goal was to dilute the influence of a cadre or conservative justices who had overruled almost every New Deal law or regulation that had come before them, as well as several other measures.

If FDR could counsel Biden today, he might warn him to move carefully; FDR’s court-packing scheme went down in flames amid congressional opposition, cut deeply into the popularity that had brought him a landslide reelection victory in the 1936 election, and brought the New Deal to a screeching halt. It also represented a moment in which FDR lost his unique ability to gauge the popular mood and act upon it.

The politics of Supreme Court reform today resemble those of 1937 in many ways, though as Twain’s supposed quip suggests, there are significant differences. Let’s look at the differences first.

Roosevelt was then at the outset of his second term, riding high on an electoral victory that may have given him a greater sense of his political omnipotence than he actually possessed. Biden, of course, is less than six months away from the end of his presidency. Roosevelt could look ahead at four more years of policymaking; Biden may be more focused on cementing his legacy of progressive achievements by bequeathing the nation a reformed Supreme Court.

Both presidents may have felt they had nothing to lose by taking on what seemed to be the most revered of the three branches of government, albeit for different reasons — Roosevelt because nothing could chip away at his popularity, Biden because his own term in office can’t be affected by the fate of his reform proposals.

Roosevelt was faulted for springing his scheme on an unsuspecting public and Congress. Notwithstanding public discontent with the court, its reform hadn’t been an issue in the presidential campaign recently ended. FDR had not spoken publicly about the court after a series of anti-New Deal rulings in 1935 and 1936 except after one ruling in which he accused the court of relegating the country to “the horse-and-buggy definition of interstate commerce.”

Instead, he blindsided the nation by announcing his plan in a speech on Feb. 5. To his surprise, voters and legislators — including reliable New Deal supporters on Capitol Hill — reacted with fury.

It was not merely the secrecy in which the scheme had been plotted that its critics found dismaying. FDR’s stated rationale, which was that the aging justices were overworked and needed help to manage their docket, was transparently deceptive.

That rationale might have looked superficially reasonable at first, since the oldest member of the court’s so-called Four Conservative Horsemen, Willis Van Devanter, had been born during the administration of James Buchanan, which supposedly rendered him utterly out of step with the politics of the 1930s.

However, the oldest justice on the court, Louis Brandeis, was even older — at 80, he had been born during the administration of Franklin Pierce, Buchanan’s predecessor, but nevertheless was the court’s liberal lion and not an impediment to the New Deal.

Biden seems to have absorbed the lessons of FDR’s failed effort. He has been telegraphing for weeks that he is contemplating Supreme Court reforms. His proposals are not as radical as expanding the court outright, but they address some of the most evident issues driving the court’s public standing into the sub-basement: a conservative majority that has shown no respect for values and rights long cherished by most Americans, and a record of financial grifting and overt partisanship, chiefly by conservative Justices Clarence Thomas and Samuel A. Alito Jr.

As in 1937, there is a sense that the court has taken aim at progressive principles and laws, running roughshod over individual rights.

The court’s direction has been led by a conservative majority including three judges appointed by Donald Trump — among them Neil M. Gorsuch, who slid into a seat kept open by Senate Republicans’ refusal to even consider Barack Obama’s nomination of Merrick Garland to the late Antonin Scalia’s seat; and Amy Coney Barrett, rushed to confirmation by Senate Republicans in October 2020 only 38 days before the election that would unseat Trump and bring Biden to the White House.

Barrett took the seat vacated by the death of Ruth Bader Ginsburg, one of the most liberal justices ever to sit on the court.

The three Trump judges were in the majority that in 2022 overturned Roe vs. Wade, the decision that had protected women’s reproductive health rights since 1973.

It may be useful to compare the court’s behavior in recent years with what provoked FDR into launching his court-packing scheme.

The court’s distaste for elements of the New Deal was assumed as the Roosevelt administration proceeded to remake the U.S. economy. But it didn’t become palpable until it issued three decisions on May 27, 1935, a date that would become known to progressives as “Black Monday.”

In the first decision, the court overturned Roosevelt’s ouster of a reactionary member of the Federal Trade Commission, placing a limit on a president’s authority over executive officers. The court then invalidated a farm mortgage law because it applied to existing mortgages, not just new ones. Then came the court’s invalidation of the National Recovery Administration, through which the government had tried to regiment competition throughout the economy to help dig the country out of the Depression.

All three decisions were unanimous, but they still signaled that a conservative cadre was poised to undermine New Deal initiatives due to come before the justices. In 1936, the court narrowed the authority of the Securities and Exchange Commission and invalidated a relief program for coal companies. Most significantly, it overturned a New York minimum wage law in a decision known as Tipaldo, after its detestable protagonist, the owner of a laundry who had been cheating his laundresses of their legal wages.

Condemnation of the Tipaldo decision came from across the entire political spectrum. “If this decision does not outrage the moral sense of the country, then nothing will,” FDR’s Interior secretary, Harold Ickes, wrote in his diary. Conservatives were dismayed that the decision undercut their argument that labor rights should remain in the hands of the states — how could that be, if the Supreme Court had overturned a state minimum wage law?

Roosevelt and his fellow progressives foresaw that the court would invalidate the entire New Deal. For a time, FDR seemed content to let that happen, reasoning that it would help him get a constitutional amendment enacted that would allow Congress to save any law the court deemed unconstitutional by reenacting it. If the court kept overturning the New Deal, he reasoned, there would be “marching farmers and marching miners and marching workingmen throughout the land.”

In the end, he chose to go with the court-packing scheme, recognizing that it fit within the constitutional provision giving Congress the unquestioned right to dictate the size of the court.

For many Americans today, the court’s Dobbs decision overturning Roe vs. Wade has supplanted its 1857 Dred Scott decision as the worst in its history. By relegating abortion to a state-level decision, Dobbs has spawned a patchwork of punitive state laws that have life-threatening ramifications for pregnant women (among many other shortcomings).

Public distaste for Dobbs, as was the case with Tipaldo, has been manifest. Since it was handed down in June 2022, every single state initiative to protect women’s reproductive rights has prevailed at the ballot box. The chief weapons in the antiabortion camp’s quiver have been efforts to stymie referendum and initiative votes by changing the ballot box rules, as has been tried in Florida and Ohio.

Biden’s proposal to establish staggered 18-year terms for justices has several virtues. One is that it would rebalance a court on which GOP appointees are arguably overrepresented. From 1960 through this year, Republicans held the White House for 32 years and Democrats for 31, almost an even split. But in that period, Republicans have appointed 15 justices and Democrats only ten. Under Biden’s proposal, every president would have the opportunity to appoint two justices during each four-year term.

“Term limits would … make timing for Court nominations more predictable and less arbitrary; and reduce the chance that any single Presidency imposes undue influence for generations to come,” the Biden White House says.

The one flaw in the proposal is that it could require a constitutional amendment. The Constitution states that federal justices may serve “during good behavior,” but expert opinion is divided over whether that bars Congress from imposing any other conditions on their service.

It’s worth noting that the Supreme Court was so unnerved by the groundswell of criticism it faced after Tipaldo that Chief Justice Charles Evans Hughes engineered an about-face, orchestrating a 5-4 opinion upholding a Washington state minimum wage law that was almost identical to the New York law it had overturned, also by 5 to 4. That helped to take the wind out of FDR’s scheme. The change would forever be known as “the switch in time that saved nine.” The court never overturned another New Deal initiative.

But few such opportunities for an about-face are on the horizon. The damage this court has done to individual rights and the rule of law is manifest. Biden’s sense is that the time is ripe for reform, and that this time the public may go along.

Business

As competitors falter, SoCal's Skechers is surging with strategy of 'try and try again'

In a crowded sneaker market roiled by the stumbles of its longtime king, Manhattan Beach-based Skechers has been climbing its way up the ranks.

While Nike, which has dominated the athletic footwear landscape for years, made headlines last month for its plummeting stock price and gloomy outlook, Skechers announced record sales in the first quarter of 2024 of $2.25 billion, a 12.5% increase over last year. Since 2019, it has increased its annual revenue by more than 50%.

In June, Bank of America upgraded its rating on Skechers’ stock to a strong buy, and this week Morgan Stanley followed suit — notable votes of confidence in the fundamentals of a company that has seen its stock price rise more than 20% over the last year. Shares closed at $65.10 on Tuesday.

Analysts and company leadership attribute the brand’s success to a strategy built around constant innovation and a diverse array of footwear products. Sam Poser, a footwear and apparel analyst at Williams Trading, said Skechers is navigating choppy waters better than its rivals.

“It’s not like the macro environment is different for Skechers than it is for Nike or New Balance or Adidas,” Poser said. “One of the reasons they’re outperforming is because they’re executing in this difficult environment.”

While Skechers offers a wide variety of footwear — from soccer cleats to work boots to summer sandals — it has still managed to find a strong company identity, Poser said.

1

2

3

1. Skechers and Snoop Dogg collaborated on shoes. 2. Skechers offers a wide variety of footwear — soccer cleats, work boots, summer sandals and more. 3. Children’s shoes on display at the Skechers store in Manhattan Beach. (Christina House / Los Angeles Times)

“Skechers owns the comfort business,” Poser said. “What they’re doing is bigger than I think a lot of people appreciate.”

Skechers brought in $8 billion in sales in 2023 compared with $7.4 billion in 2022. The company has a near-term goal of reaching $10 billion in sales by 2026, said Chief Financial Officer John Vandemore.

The self-proclaimed “comfort technology company” has seen success with recent releases such as Hands Free Slip-ins and podiatrist-certified Arch Fit shoes. Its website lists 14 different footwear technologies, with names like Glide-Step and Hyper Burst.

“You have to be innovative and you have to deliver newness,” Vandemore said in an interview. “There was no analogy in the marketplace when we started Slip-ins, and it’s done exceedingly well.”

The company is scheduled to announce its second-quarter results on Thursday, with analysts estimating revenue of $2.21 billion, up 10% from the same period a year ago, and earnings of 92 cents a share, down 6.1% from a year earlier, according to Zacks Equity Research.

Not all of Skechers’ gambles have paid off, Vandemore acknowledged. Introduced in 2009, Shape-up sneakers were immensely popular until the company was sued by the Federal Trade Commission over its claims that the shoes would help customers lose weight and tone their muscles. Skechers paid $40 million to settle the class-action lawsuit in 2013.

Other Skechers models have seen longer-term success, such as the children’s line of light-up Twinkle Toes sneakers, introduced in 2008 and still widely available.

Caleigh Hopson, 7, browses shoes with her mother, Laura, at the Skechers store in Manhattan Beach.

(Christina House / Los Angeles Times)

“I think that willingness to try and try again until you succeed is noteworthy and it’s led to a significant amount of success,” Vandemore said. He praised the company’s chief executive, Robert Greenberg, for his willingness to take risks.

“One of Robert’s key talents is being able to tolerate risks and, quite frankly, not dwell upon them,” Vandemore said. “In our culture we try a lot of different things. Some of them work and some of them don’t.”

In contrast, Poser said, Nike has not been able to come up with fresh offerings for consumers in recent years.

“Nike was not innovating enough and putting a lot of non-compelling product into the marketplace,” he said.

When Nike released its tepid first-quarter earnings report in March, its chief financial officer, Matthew Friend, said the company was “taking action to build a faster, more efficient Nike and maximize the impact of our new innovation cycle.”

Along with a pipeline of new products, Vandemore said, value and affordability are among the brand’s top priorities. Several models featuring the popular Slip-in technology are available for less than $100.

“They’re delivering a quality product that has comfort and style at a reasonable price,” said Jim Duffy, a sports and lifestyle analyst at Stifel. “In an environment where the consumer is facing pressures to their discretionary spending capacity, Skechers is doing a very good job of offering value.”

In a trend brought on by COVID-19, Duffy said, more consumers of all income levels are buying and wearing athletic footwear. A nice dinner out may have required dress shoes before the global pandemic, he said, but standards have changed.

“COVID was an accelerator for casualization and that’s really expanded the wearable occasions for sneakers and comfort footwear,” Duffy said. “Skechers has done well to capitalize on that.”

Skechers’ customer base is mostly children and older adults, Duffy said, not teens and young adults. But Poser said the customer demographic varies largely across markets, both in the U.S. and internationally.

“It’s much broader than you think,” Poser said. “They have K-pop bands wearing their shoes.”

Last year, international sales accounted for 62% of the company’s global revenue. Vandemore said Skechers’ investment in growing its international footprint has provided the company an important boost in growth.

Store manager Diane Morales unboxes a pair of shoes for a customer at the Skechers store in Manhattan Beach.

(Christina House / Los Angeles Times)

At the end of March, the company had slightly more than 1,100 international stores, 565 domestic locations and more than 3,500 “distributor, licensee and franchise stores,” according to company figures. The corporate offices in Manhattan Beach house 1,280 employees.

Vandemore also said the company’s balance of wholesale and direct-to-consumer sales set it apart from other brands in the industry.

“Some of our competitors have chosen to primarily focus on their own stores or their own online sales at the expense of wholesale partners, which is not our strategy,” Vandemore said. “We embrace all avenues.”

In 2023, 44% of Skechers’ annual profits came from direct-to-consumer sales and 56% came from wholesale business.

Looking to the future, Vandemore said Skechers will stick to its core strategy while adapting to new trends and demands.

“We’ve been very successful focusing on developing and delivering great products, growing our direct-to-consumer channel and growing internationally,” he said. “That formula, we do believe, will continue to yield results.”

-

Politics1 week ago

Politics1 week agoManchin considers re-registering as Democrat to run for president

-

News1 week ago

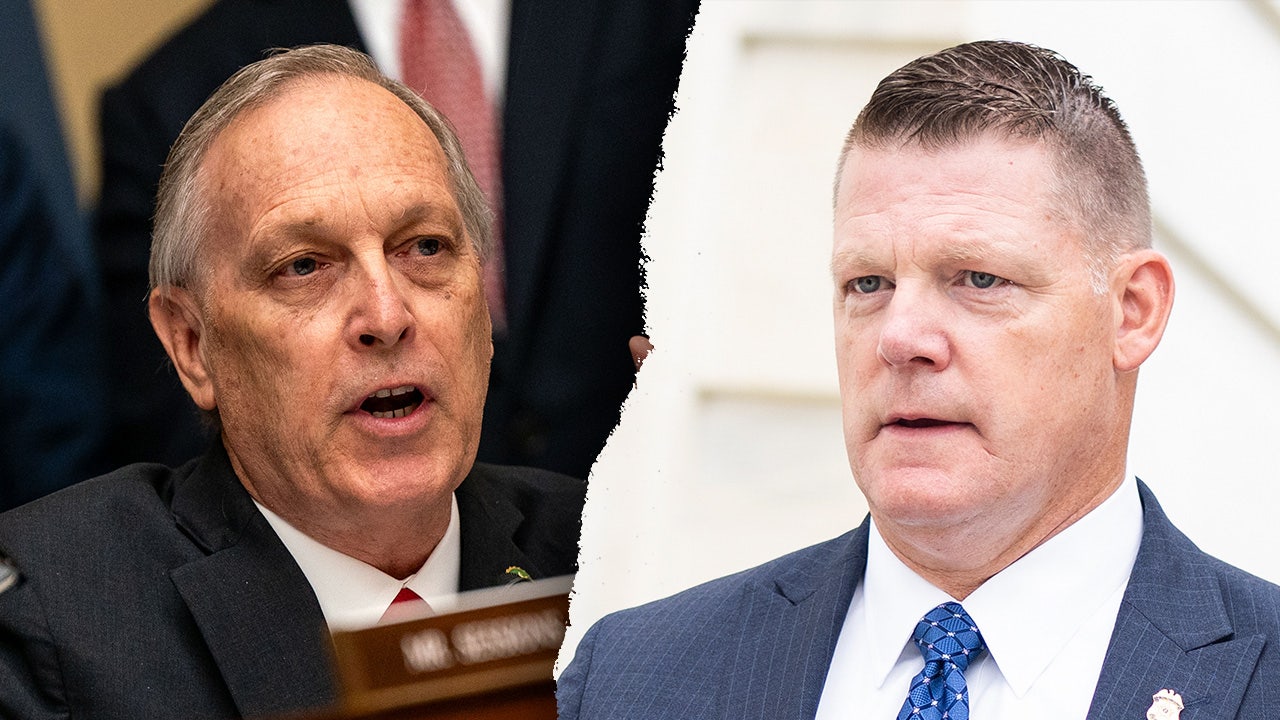

News1 week agoHow the Trump Rally Gunman Had an Edge Over the Countersnipers

-

World1 week ago

World1 week ago‘Torn up bodies’: Israel intensifies bombing campaign in Gaza

-

Politics1 week ago

Politics1 week agoTop five moments from Secret Service director's hours-long grilling after Trump assassination attempt

-

Politics1 week ago

Politics1 week agoTrump tells Jesse Watters that he was not warned about gunman, despite reports

-

Politics1 week ago

Politics1 week agoDem strategists say Harris 'only practical choice' as party leaders begin endorsing her

-

Politics1 week ago

Politics1 week agoTrump blows past Biden in June fundraising race, with July numbers expected to be worse for Democrats

-

World1 week ago

World1 week agoUkraine and Russia fire dozens of drones at each other