Business

Column: No, folks, Harris isn't planning to tax your unrealized capital gains — but a wealth tax is still a good idea

That fetid gust of hot air you may have detected wafting from Republican and conservative social media postings over the last day or two was a fabricated claim that Kamala Harris is plotting to tax everyone’s unrealized capital gains if she becomes president.

That would be a departure from current law, which taxes capital gains only when the underlying assets are sold, or “realized.”

That it’s a mythical allegation hasn’t stopped right-wingers and GOP functionaries from hand-wringing over the economic implications of any such change, and over the purportedly horrible impact on average Americans.

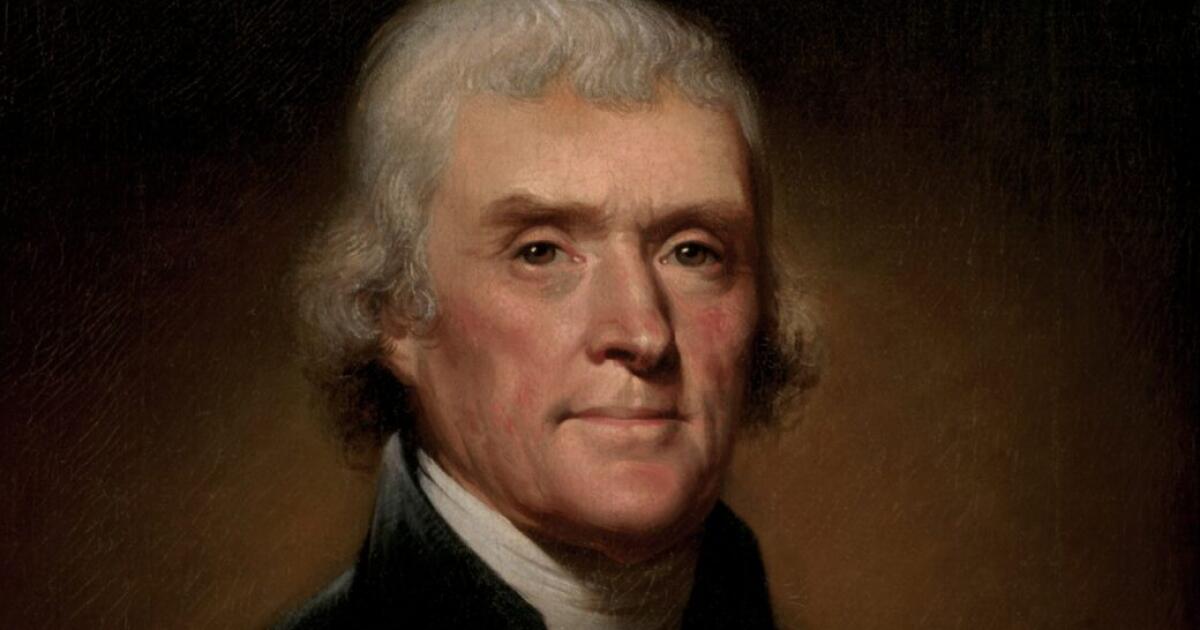

Whenever there is in any country, uncultivated lands and unemployed poor, it is clear that the laws of property have been so far extended as to violate natural right.

— Thomas Jefferson

Here, for instance, is the far-right blowhard Mike Cernovich, in tweeting Tuesday on X: “If you own a house, subtract what you paid for it from the Zillow estimate. Be prepared to pay 25% of that in a check to the IRS. That’s your unrealized capital gains taxed owed under the Kamala Harris proposal.”

And Chicago venture investor Robert Nelson: “Taxing unrealized gains is truly the most insane, economy destroying, innovation killing, market crashing, retirement fund decimating, unconstitutional idea, which was probably planted by Russia or China to destroy the economy. Dems need to run away from this wildly stupid idea.”

All right, guys, take a deep breath. Harris hasn’t proposed taxing your unrealized capital gains, or mine. What she has said, as the Harris campaign told me, is that she “supports the revenue raisers in the FY25 Biden-Harris [administration] budget. Nothing beyond that.”

So what’s in that Biden-Harris administration budget for fiscal year 2025?

The budget plan does indeed call for taxation of unrealized capital gains held by the country’s uber-rich. That’s part of its proposal for a 25% minimum tax on the annual income of taxpayers with wealth of more than $100 million — a wealth tax. If you’re a member of that cohort, lucky you. But at that level of affluence you don’t have grounds to complain about paying a minimum 25% of your annual income.

Anyway, there aren’t very many of you “centi-millionaires,” as the category is known—10,660 in the U.S., according to a 2023 estimate. That includes a handful of centi-billionaires such as Elon Musk ($249 billion, according to Forbes), Jeff Bezos ($198.5 billion) and Mark Zuckerberg ($185.3 billion). It’s doubtful that anyone in this category is poring over Zillow estimates to calculate the sale value of his or her house (or houses).

Several other proposals in the budget plan are relevant to taxes on the wealthy. One would restore the top income tax rate of 39.6%, which was cut to 37% in the Republicans’ 2017 Tax Cut and Jobs Act; Biden proposed to allow that cut to expire as scheduled next year. The restored top rate would apply to income over $731,200 for couples, $609,350 for singles, starting with this year’s income.

Another provision would raise the tax rate on capital gains and dividends to the same rate charged on ordinary income — but only on annual income exceeding $1 million for couples ($500,000 for single filers). Under current law, capital gains and dividends get a huge break: The top rate is 20%, though it’s zero for couples with income of $89,250 or less ($44,625 for singles), and 15% for those with income more than that but less than $553,850 ($492,300 for singles).

The preferential rates on cap gains “disproportionately benefit high-income taxpayers and provide many high-income taxpayers with a lower tax rate than many low- and middle-income taxpayers,” the White House explains. They also “disproportionately benefit White taxpayers, who receive the overwhelming majority of the benefits of the reduced rates.”

The proposal would also eliminate the notorious step-up in basis enjoyed by heirs. Currently, if those inheriting stocks, bonds, real estate or other capital assets sell those assets, they’re taxed only on the difference between what they were worth at the time of the original owner’s death and their value upon the subsequent sale — not the difference between what they cost when purchased (the “basis”) and what they were worth when ultimately sold.

This process turns the capital gains tax into what the late Ed Kleinbard, the tax expert at USC, called America’s only voluntary tax. Since owners of capital assets don’t pay tax on their appreciation in value until they’re sold, they can defer the tax indefinitely by simply not selling. When they die, the step-up in basis extinguishes the prior capital gains liability forever, leaving only a tax on any gains for the heirs reaped starting from the date of their inheritance.

And rich families can enjoy the benefits of their capital portfolio by borrowing against it, never having to sell. That’s an option seldom available to the ordinary taxpayer, who may have to sell to make ends meet. This is how those families perpetuate their fortunes without paying their fair share of income tax.

The Biden plan would repeal the step-up for heirs by levying the capital gains tax on the bequeathed asset, calculated from the original purchase and charged to the decedent’s estate. Inheritances by spouses would be exempt, and the existing exemption of $250,000 in gains per person on the transfer of a principal residence would remain in effect.

Biden’s plan also would increase the net investment income tax and Medicare tax rates to 5% each from the current 3.8% on income over $400,000. That would bring the top capital gains rate to 44.6%.

Is that a lot? Too much? Not enough? It’s true that the capital gains tax has typically been lower than the tax on ordinary income, reaching as high as 40% only briefly in the 1970s. Overall, however, it’s a relative pittance in postwar terms: The top tax rate on ordinary income was 90% or higher from 1944 through 1963, 70% from 1965 through 1981, and 50% from 1981 through 1986. Americans enjoyed unexampled prosperity throughout most of that time span.

That brings us back to the wealth tax idea, which terrifies the rich and their water-carriers in the press and punditocracy. Noah Rothman of the right-wing National Review, for example, got especially exercised over Michelle Obama’s critique of “the affirmative action of generational wealth” in her speech at the Democratic convention Tuesday night.

“The idea that accumulating material wealth and bequeathing it to your offspring with the hope that they build on it and do the same for their children is one of the fundaments of the American social compact,” Rothman grumbled. “Trying to make that sense of industry into a source of shame is absurd.”

The idea that the offspring of millionaires and billionaires are building on their inherited wealth is pretty, but in practice rare. As the wealth management firm UBS reported, last year for the first time in the nine years that it had been tracking extreme wealth, billionaires “accumulated more wealth through inheritance than entrepreneurship.” This “great wealth transfer,” it added, “is gaining momentum.”

As I’ve written before, the concentration of wealth in America has reached levels that make the gilt of the 19th century Gilded Age look like dross. In the U.S. there were 66 billionaires in 1990, and about 750 in 2023.

Critics of a wealth tax often assert that it’s unworkable because it’s hard to value non-tradable assets — think artworks, or almost anything other than stocks, bonds and real estate, which can be valued at a market price. The Biden plan has an answer to that. Non-tradable assets would be valued at their purchase price or their value the last time they were borrowed against or invested in, with an annual increase based on Treasury interest rates.

As for those who think there’s something un-American in a wealth tax, they can take up the issue with the Founding Fathers, who considered generationally accumulated wealth to be inimical to a free republic.

“Whenever there is in any country, uncultivated lands and unemployed poor,” Thomas Jefferson wrote to James Madison in October 1785, “it is clear that the laws of property have been so far extended as to violate natural right.”

Madison in 1792 viewed the duty of political parties as acting to combat “the inequality of property, by an immoderate, and especially an unmerited, accumulation of riches.” Benjamin Franklin urged the Constitutional Convention in Philadelphia, albeit unsuccessfully, to declare that “the state has the right to discourage large concentrations of property as a danger to the happiness of mankind.”

They didn’t seem concerned that fighting the immoderate accumulation of riches would be complicated or unnecessary. Quite the opposite: They would appear to agree, were they with us today, with the line beloved of equality advocates that “every billionaire is a policy failure.”

Put it all together, and it sounds almost as if Michelle Obama was channeling the Founders. And if Kamala Harris supports the provisions in the Biden budget plan aimed at requiring the super-rich to pay their fair share of taxes — as her campaign confirms — she’s channeling them too.

Business

How our AI bots are ignoring their programming and giving hackers superpowers

Welcome to the age of AI hacking, in which the right prompts make amateurs into master hackers.

A group of cybercriminals recently used off-the-shelf artificial intelligence chatbots to steal data on nearly 200 million taxpayers. The bots provided the code and ready-to-execute plans to bypass firewalls.

Although they were explicitly programmed to refuse to help hackers, the bots were duped into abetting the cybercrime.

According to a recent report from Israeli cybersecurity firm Gambit Security, hackers last month used Claude, the chatbot from Anthropic, to steal 150 gigabytes of data from Mexican government agencies.

Claude initially refused to cooperate with the hacking attempts and even denied requests to cover the hackers’ digital tracks, the experts who discovered the breach said. The group pummelled the bot with more than 1,000 prompts to bypass the safeguards and convince Claude they were allowed to test the system for vulnerabilities.

AI companies have been trying to create unbreakable chains on their AI models to restrain them from helping do things such as generating child sexual content or aiding in sourcing and creating weapons. They hire entire teams to try to break their own chatbots before someone else does.

But in this case, hackers continuously prompted Claude in creative ways and were able to “jailbreak” the chatbot to assist them. When they encountered problems with Claude, the hackers used OpenAI’s ChatGPT for data analysis and to learn which credentials were required to move through the system undetected.

The group used AI to find and exploit vulnerabilities, bypass defences, create backdoors and analyze data along the way to gain control of the systems before they stole 195 million identities from nine Mexican government systems, including tax records, vehicle registration as well as birth and property details.

AI “doesn’t sleep,” Curtis Simpson, chief executive of Gambit Security, said in a blog post. “It collapses the cost of sophistication to near zero.”

“No amount of prevention investment would have made this attack impossible,” he said.

Anthropic did not respond to a request for comment. It told Bloomberg that it had banned the accounts involved and disrupted their activity after an investigation.

OpenAI said it is aware of the attack campaign carried out using Anthropic’s models against the Mexican government agencies.

“We also identified other attempts by the adversary to use our models for activities that violate our usage policies; our models refused to comply with these attempts,” an OpenAI spokesperson said in a statement. “We have banned the accounts used by this adversary and value the outreach from Gambit Security.”

Instances of generative AI-assisted hacking are on the rise, and the threat of cyberattacks from bots acting on their own is no longer science fiction. With AI doing their bidding, novices can cause damage in moments, while experienced hackers can launch many more sophisticated attacks with much less effort.

Earlier this year, Amazon discovered that a low-skilled hacker used commercially available AI to breach 600 firewalls. Another took control of thousands of DJI robot vacuums with help from Claude, and was able to access live video feed, audio and floor plans of strangers.

“The kinds of things we’re seeing today are only the early signs of the kinds of things that AIs will be able to do in a few years,” said Nikola Jurkovic, an expert working on reducing risks from advanced AI. “So we need to urgently prepare.”

Late last year, Anthropic warned that society has reached an “inflection point” in AI use in cybersecurity after disrupting what the company said was a Chinese state-sponsored espionage campaign that used Claude to infiltrate 30 global targets, including financial institutions and government agencies.

Generative AI also has been used to extort companies, create realistic online profiles by North Korean operatives to secure jobs in U.S. Fortune 500 companies, run romance scams and operate a network of Russian propaganda accounts.

Over the last few years, AI models have gone from being able to manage tasks lasting only a few seconds to today’s AI agents working autonomously for many hours. AI’s capability to complete long tasks is doubling every seven months.

“We just don’t actually know what is the upper limit of AI’s capability, because no one’s made benchmarks that are difficult enough so the AI can’t do them,” said Jurkovic, who works at METR, a nonprofit that measures AI system capabilities to cause catastrophic harm to society.

So far, the most common use of AI for hacking has been social engineering. Large language models are used to write convincing emails to dupe people out of their money, causing an eight-fold increase in complaints from older Americans as they lost $4.9 billion in online fraud in 2025.

“The messages used to elicit a click from the target can now be generated on a per-user basis more efficiently and with fewer tell-tale signs of phishing,” such as grammatical and spelling errors, said Cliff Neuman, an associate professor of computer science at USC.

AI companies have been responding using AI to detect attacks, audit code and patch vulnerabilities.

“Ultimately, the big imbalance stems from the need of the good-actors to be secure all the time, and of the bad-actors to be right only once,” Neuman said.

The stakes around AI are rising as it infiltrates every aspect of the economy. Many are concerned that there is insufficient understanding of how to ensure it cannot be misused by bad actors or nudged to go rogue.

Even those at the top of the industry have warned users about the potential misuse of AI.

Dario Amodei, the CEO of Anthropic, has long advocated that the AI systems being built are unpredictable and difficult to control. These AIs have shown behaviors as varied as deception and blackmail, to scheming and cheating by hacking software.

Still, major AI companies — OpenAI, Anthropic, xAI, and Google — signed contracts with the U.S. government to use their AIs in military operations.

This last week, the Pentagon directed federal agencies to phase out Claude after the company refused to back down on its demand that it wouldn’t allow its AI to be used for mass domestic surveillance and fully autonomous weapons.

“The AI systems of today are nowhere near reliable enough to make fully autonomous weapons,” Amodei told CBS News.

Business

iPic movie theater chain files for bankruptcy

The iPic dine-in movie theater chain has filed for Chapter 11 bankruptcy protection and intends to pursue a sale of its assets, citing the difficult post-pandemic theatrical market.

The Boca Raton, Fla.-based company has 13 locations across the U.S., including in Pasadena and Westwood, according to a Feb. 25 filing in U.S. Bankruptcy Court in the Southern District of Florida, West Palm Beach division.

As part of the bankruptcy process, the Pasadena and Westwood theaters will be permanently closed, according to WARN Act notices filed with the state of California’s Employment Development Department.

The company came to its conclusion after “exploring a range of possible alternatives,” iPic Chief Executive Patrick Quinn said in a statement.

“We are committed to continuing our business operations with minimal impact throughout the process and will endeavor to serve our customers with the high standard of care they have come to expect from us,” he said.

The company will keep its current management to maintain day-to-day operations while it goes through the bankruptcy process, iPic said in the statement. The last day of employment for workers in its Pasadena and Westwood locations is April 28, according to a state WARN Act notice. The chain has 1,300 full- and part-time employees, with 193 workers in California.

The theatrical business, including the exhibition industry, still has not recovered from the pandemic’s effect on consumer behavior. Last year, overall box office revenue in the U.S. and Canada totaled about $8.8 billion, up just 1.6% compared with 2024. Even more troubling is that industry revenue in 2025 was down 22.1% compared with pre-pandemic 2019’s totals.

IPic noted those trends in its bankruptcy filing, describing the changes in consumer behavior as “lasting” and blaming the rise of streaming for “fundamentally” altering the movie theater business.

“These industry shifts have directly reduced box office revenues and related ancillary revenues, including food and beverage sales,” the company stated in its bankruptcy filing.

IPic also attributed its decision to rising rents and labor costs.

The company estimated it owed about $141,000 in taxes and about $2.7 million in total unsecured claims. The company’s assets were valued at about $155.3 million, the majority of which coming from theater equipment and furniture. Its liabilities totaled $113.9 million.

The chain had previously filed for bankruptcy protection in 2019.

Business

Startup Varda Space Industries snags former Mattel plant in El Segundo

In an expansion of its business of processing pharmaceuticals in Earth’s orbit, Varda Space Industries is renting a large El Segundo plant where toy manufacturer Mattel used to design Hot Wheels and Barbie dolls.

The plant in El Segundo’s aerospace corridor will be an extension of Varda Space Industries’ headquarters in a much smaller building on nearby Aviation Boulevard.

Varda will occupy a 205,443-square-foot industrial and office campus at 2031 E. Mariposa Ave., which will give it additional capacity to manufacture spacecraft at scale, the company said.

Originally built in the 1940s as an aircraft facility, the complex has a history as part of aerospace and defense industries that have long shaped the South Bay and is near a host of major defense and space contractors. It is also close to Los Angeles Air Force Base, headquarters to the Space Systems Command.

Workers test AstroForge’s Odin asteroid probe, which was lost in space after launch this year.

(Varda Space Industries)

Varda is one of a new generation of aerospace startups that have flourished in Southern California and the South Bay over the last several years, particularly in El Segundo, often with ties to SpaceX.

Elon Musk’s company, founded in 2002 in El Segundo, has revolutionized the industry with reusable rockets that have radically lowered the cost of lifting payloads into space. Though it has moved its headquarters to Texas, SpaceX retains large-scale operations in Hawthorne.

Varda co-founder and Chief Executive Will Bruey is a former SpaceX avionics engineer, and the company’s spacecraft are launched on SpaceX’s workhorse Falcon 9 rockets from Vandenberg Space Force Base in Santa Barbara County.

Varda makes automated labs that look like cylindrical desktop speakers, which it sends into orbit in capsules and satellite platforms it also builds. There, in microgravity, the miniature labs grow molecular crystals that are purer than those produced in Earth’s gravity for use in pharmaceuticals.

It has contracts with drug companies and also the military, which tests technology at hypersonic speeds as the capsules return to Earth.

Its fifth capsule was launched in November and returned to Earth in late January; its next mission is set in the coming weeks. Varda has more than 10 missions scheduled on Falcon 9s through 2028.

For the last several decades, the Mariposa Avenue property served as the research and development center for Mattel Toys. El Segundo has also long been a center for the toy industry as companies like to set up shop in the shadow of Mattel.

The Mattel facility “has always been an exceptional property with a legacy tied to aerospace innovation, and leasing to Varda Space Industries feels like a natural continuation of that story,” said Michael Woods, a partner at GPI Cos., which owns the property.

“We are proud to support a company that is genuinely pushing the boundaries of what’s possible, and are excited to watch Varda grow and thrive here in El Segundo,” Woods said.

As one of the country’s most active hubs of aerospace and defense innovation, El Segundo has seen its industrial property vacancy fall to 3.4% on demand from space companies, government contractors and technology startups, real estate brokerage CBRE said.

Successful startups often have to leave the neighborhood when they want to expand, real estate broker Bob Haley of CBRE said. The 9-acre Mattel facility was big enough to keep Varda in the city.

Last year, Varda subleased about 55,000 square feet of lab space from alternative protein company Beyond Meat at 888 Douglas St. in El Segundo, which it started moving into in June.

Varda will get the keys to its new building in December and spend four to eight months building production and assembly facilities as it ramps up operations. By the end of next year, it expects to have constructed 10 more spacecraft.

In the future, Varda could consolidate offices there, given its size. Currently, though, the plan is to retain all properties, creating a campus of three buildings within a mile of one another that are served by the company’s transportation services, Chief Operating Officer Jonathan Barr said.

“We already have Varda-branded shuttles running up and down Aviation Boulevard,” he said.

-

World1 week ago

World1 week agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Wisconsin4 days ago

Wisconsin4 days agoSetting sail on iceboats across a frozen lake in Wisconsin

-

Massachusetts1 week ago

Massachusetts1 week agoMother and daughter injured in Taunton house explosion

-

Maryland5 days ago

Maryland5 days agoAM showers Sunday in Maryland

-

Massachusetts3 days ago

Massachusetts3 days agoMassachusetts man awaits word from family in Iran after attacks

-

Florida5 days ago

Florida5 days agoFlorida man rescued after being stuck in shoulder-deep mud for days

-

Denver, CO1 week ago

Denver, CO1 week ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Oregon6 days ago

Oregon6 days ago2026 OSAA Oregon Wrestling State Championship Results And Brackets – FloWrestling