Business

Paramount's board approves bid by David Ellison's Skydance Media in sweeping Hollywood deal

Tech scion David Ellison’s months-long quest to win control of Paramount Global moved closer to the finish line Sunday, in a deal that marks a new chapter for the long-struggling media company and parent of one of Hollywood’s oldest movie studios.

Paramount Global board members on Sunday approved the bid by Ellison’s Skydance Media and its backers to buy the Redstone family’s Massachusetts holding firm, National Amusements Inc., said two sources close to the deal who were not authorized to comment.

A spokesperson for Paramount declined to comment.

The Redstones’ voting stock in Paramount would be transferred to Skydance, giving Ellison, son of billionaire Oracle Corp. co-founder Larry Ellison — a key backer of the deal — control of a media operation that includes Paramount Pictures, broadcast network CBS and cable channels MTV, Comedy Central and Nickelodeon.

The proposed $8.4 billion multipronged transaction also includes merging Ellison’s production company into the storied media company, giving it more heft to compete in today’s media environment.

The agreement, which mints Ellison as a Hollywood mogul, came together during the last two weeks as Ellison and his financing partners renewed their efforts to win over the Redstone family and Paramount’s independent board members.

Shari Redstone has long preferred Ellison’s bid over other those of potential suitors, believing the 41-year-old entrepreneur possesses the ambition, experience and financial heft to lift Paramount from its doldrums.

But, in early June, Redstone got cold feet and abruptly walked away from the Ellison deal — a move that stunned industry observers and Paramount insiders because it was Redstone who had orchestrated the auction.

Within about a week, Ellison renewed his outreach to Redstone. Ellison ultimately persuaded her to let go of the entertainment company her family has controlled for nearly four decades. The sweetened deal also paid the Redstone family about $50 million more than what had been proposed in early June. On Sunday Paramount’s full board, including special committee of independent directors, had signed off on the deal, the sources said.

Under terms of the deal, Skydance and its financial partners RedBird Capital Partners and private equity firm KKR have agreed to provide a $1.5-billion cash infusion to help Paramount pay down debt. The deal sets aside $4.5 billion to buy shares of Paramount’s Class B shareholders who are eager to exit.

The Redstone family would receive $1.75-billion for National Amusements, a company that holds the family’s Paramount shares and a regional movie theater chain founded during the Great Depression, after the firm’s considerable debts are paid off.

The proposed handoff signals the end of the Redstone family’s nearly 40-year reign as one of America’s most famous and fractious media dynasties. The late Sumner Redstone’s National Amusements was once valued at nearly $10 billion, but pandemic-related theater closures, last year’s Hollywood labor strikes and a heavy debt burden sent its fortunes spiraling.

In the last five years, the New York-based company has lost two-thirds of its value. Its shares are now worth $8.2 billion based on Friday’s closing price of $11.81 a share.

The struggles in many ways prompted Shari Redstone to part with her beloved family heirloom. Additionally, National Amusements was struggling to cover its debts, and the high interest rates worsened the outlook for the Redstone family.

Paramount boasts some of the most historic brands in entertainment, including the 112-year-old Paramount Pictures movie studio, known for landmark films such as “The Godfather” and “Chinatown.” The company owns television stations including KCAL-TV (Channel 9) and KCBS-TV (Channel 2). Its once-vibrant cable channels such as Nickelodeon, TV Land, BET, MTV and Comedy Central have been losing viewers.

The handover requires the approval of federal regulators, a process that could take months.

In May, Paramount’s independent board committee said it would entertain a competing $26-billion offer from Sony Pictures Entertainment and Apollo Global Management. The bid would have retired all shareholders and paid off Paramount’s debt, but Sony executives grew increasingly wary of taking over a company that relies on traditional TV channels.

Earlier this year, Warner Bros. Discovery expressed interest in a merger or buying CBS. However, that company has struggled with nearly $40 billion in debt from previous deals and is in similar straits as Paramount. Media mogul Byron Allen has also shown interest.

Skydance Media founder and Chief Executive David Ellison prevailed in his bid for Paramount.

(Evan Agostini/Invision/Associated Press)

Many in Hollywood — film producers, writers and agents — have been rooting for the Skydance takeover, believing it represents the best chance to preserve Paramount as an independent company. Apollo and Sony were expected to break up the enterprise, with Sony absorbing the movie studio into its Culver City operation.

The second phase of the transaction will be for Paramount to absorb Ellison’s Santa Monica-based Skydance Media, which has sports, animation and gaming as well as television and film production.

Ellison is expected to run Paramount as its chief executive. Former NBCUniversal CEO Jeff Shell, who’s now a RedBird executive, could help manage the operation. It’s unclear whether the Skydance team will keep on the three division heads who are now running Paramount: Paramount Pictures CEO Brian Robbins, CBS head George Cheeks and Showtime/MTV Entertainment Studios chief Chris McCarthy.

Skydance has an existing relationship with Paramount. It co-produced each film in the “Mission: Impossible” franchise since 2011’s “Mission: Impossible — Ghost Protocol,” starring Tom Cruise. It also backed the 2022 Cruise mega-hit “Top Gun: Maverick.”

Ellison first approached Redstone about making a deal last summer, and talks became known in December.

Redstone long viewed Ellison as a preferred buyer because the deal paid a premium to her family for their exit. She also was impressed by the media mogul , believing he could become a next-generation leader who could take the company her father built to a higher level, according to people knowledgeable of her thinking.

Larry Ellison is said to be contributing funding to the deal.

David Ellison was attracted to the deal because of his past collaborations with Paramount Pictures and the allure of combining their intellectual properties as well as the cachet of owning a historic studio, analysts said. Paramount’s rich history contains popular franchises including “Transformers,” “Star Trek,” “South Park” and “Paw Patrol.”

“Paramount is one of the major historic Hollywood studios with a massive base of [intellectual property], and so it seems to us that it’s more about using the capital that Ellison has and what he’s built at Skydance and leveraging that into owning a major Hollywood studio,” Brent Penter, senior research associate at Raymond James, said prior to the deal. “Not to mention the networks and everything else that Paramount has.”

The agreement prepares to close the books on the Redstone family’s 37-year tenure at the company formerly known as Viacom, beginning with Sumner Redstone’s hostile takeover in 1987.

Seven years later, Redstone clinched control of Paramount, after merging Viacom with eventually doomed video rental chain Blockbuster to secure enough cash for the $10-billion deal. Redstone long viewed Paramount as the crown jewel, a belief that took root a half-century ago when he wheeled-and-dealed over theatrical exhibition terms for Paramount’s prestigious films to screen at his regional theater chain.

Under Redstone’s control, Paramount won Academy Awards in the ’90s for “Forrest Gump” and “Saving Private Ryan.”

He pioneered the idea of treating films as an investment portfolio and hedging bets on some productions by taking on financial partners — a strategy now widely used throughout the industry.

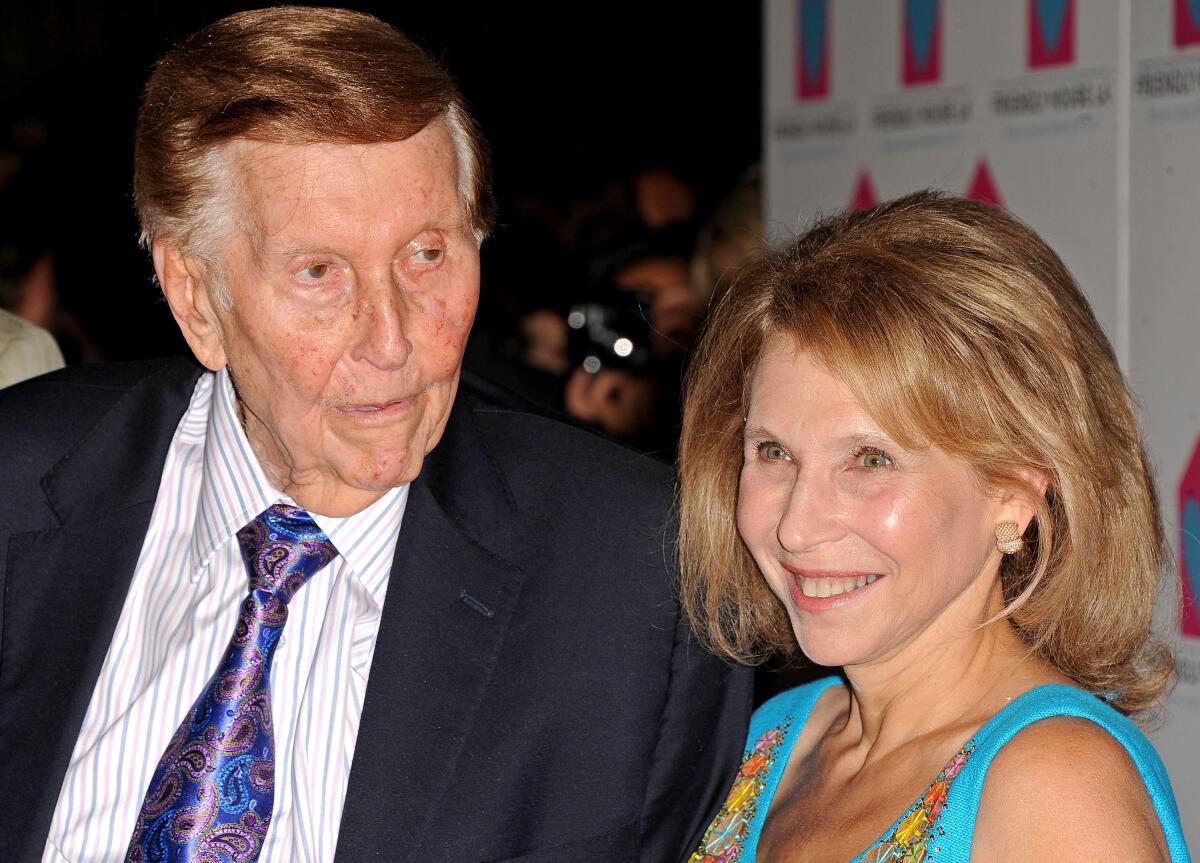

The late Sumner Redstone and his daughter Shari Redstone have owned a controlling interest in Viacom, which was rebranded as Paramount, through their family holding company, National Amusements Inc., since 1987.

(Katy Winn/Invision/Associated Press)

In 2000, Redstone expanded his media empire again by acquiring CBS, a move that made Viacom one of the most muscular media companies of the time, rivaling Walt Disney Co. and Time Warner Inc. Just six years later, Redstone broke it up into separate, sibling companies, convinced that Viacom was more precious to advertisers because of its younger audience. Redstone also wanted to reap dividends from two companies.

After years of mismanagement at Viacom, which coincided with the elder Redstone’s declining health, and boardroom turmoil, his daughter stepped in to oust Viacom top management and members of the board. Three years later, following an executive misconduct scandal at CBS, Shari Redstone achieved her goal by reuniting CBS and Viacom in a nearly $12-billion deal.

The combined company, then called ViacomCBS and valued at more than $25 billion, was supposed to be a TV juggernaut, commanding a major percentage of TV advertising revenue through the dominance of CBS and more than two dozen cable channels.

But changes in the TV landscape took a toll.

As consumer cord-cutting became more widespread and TV advertising revenue declined, ViacomCBS’ biggest asset became a serious liability.

The company was late to enter the streaming wars and then spent heavily on its Paramount+ streaming service to try to catch up with Netflix and even Disney. (In early 2022, the company was renamed Paramount Global in a nod to its moviemaking past and to tie in with its streaming platform of the same name.)

The company’s eroding linear TV business and the decline of TV ad revenue, as well as its struggles trying to make streaming profitable, will be major challenges for Ellison as he takes over Paramount. Though traditional TV is declining, it still brings in cash for Paramount.

And streaming is a whole different economic proposition from television, one that offers slimmer profits. Meanwhile, the company also faces larger industry questions about when — if ever — box office revenue will return to pre-pandemic levels.

“This is a company that is floating on hope,” said Stephen Galloway, dean of Chapman University’s Dodge College of Film and Media Arts. “And hope isn’t a great business strategy.”

Business

iPic movie theater chain files for bankruptcy

The iPic dine-in movie theater chain has filed for Chapter 11 bankruptcy protection and intends to pursue a sale of its assets, citing the difficult post-pandemic theatrical market.

The Boca Raton, Fla.-based company has 13 locations across the U.S., including in Pasadena and Westwood, according to a Feb. 25 filing in U.S. Bankruptcy Court in the Southern District of Florida, West Palm Beach division.

As part of the bankruptcy process, the Pasadena and Westwood theaters will be permanently closed, according to WARN Act notices filed with the state of California’s Employment Development Department.

The company came to its conclusion after “exploring a range of possible alternatives,” iPic Chief Executive Patrick Quinn said in a statement.

“We are committed to continuing our business operations with minimal impact throughout the process and will endeavor to serve our customers with the high standard of care they have come to expect from us,” he said.

The company will keep its current management to maintain day-to-day operations while it goes through the bankruptcy process, iPic said in the statement. The last day of employment for workers in its Pasadena and Westwood locations is April 28, according to a state WARN Act notice. The chain has 1,300 full- and part-time employees, with 193 workers in California.

The theatrical business, including the exhibition industry, still has not recovered from the pandemic’s effect on consumer behavior. Last year, overall box office revenue in the U.S. and Canada totaled about $8.8 billion, up just 1.6% compared with 2024. Even more troubling is that industry revenue in 2025 was down 22.1% compared with pre-pandemic 2019’s totals.

IPic noted those trends in its bankruptcy filing, describing the changes in consumer behavior as “lasting” and blaming the rise of streaming for “fundamentally” altering the movie theater business.

“These industry shifts have directly reduced box office revenues and related ancillary revenues, including food and beverage sales,” the company stated in its bankruptcy filing.

IPic also attributed its decision to rising rents and labor costs.

The company estimated it owed about $141,000 in taxes and about $2.7 million in total unsecured claims. The company’s assets were valued at about $155.3 million, the majority of which coming from theater equipment and furniture. Its liabilities totaled $113.9 million.

The chain had previously filed for bankruptcy protection in 2019.

Business

Startup Varda Space Industries snags former Mattel plant in El Segundo

In an expansion of its business of processing pharmaceuticals in Earth’s orbit, Varda Space Industries is renting a large El Segundo plant where toy manufacturer Mattel used to design Hot Wheels and Barbie dolls.

The plant in El Segundo’s aerospace corridor will be an extension of Varda Space Industries’ headquarters in a much smaller building on nearby Aviation Boulevard.

Varda will occupy a 205,443-square-foot industrial and office campus at 2031 E. Mariposa Ave., which will give it additional capacity to manufacture spacecraft at scale, the company said.

Originally built in the 1940s as an aircraft facility, the complex has a history as part of aerospace and defense industries that have long shaped the South Bay and is near a host of major defense and space contractors. It is also close to Los Angeles Air Force Base, headquarters to the Space Systems Command.

Workers test AstroForge’s Odin asteroid probe, which was lost in space after launch this year.

(Varda Space Industries)

Varda is one of a new generation of aerospace startups that have flourished in Southern California and the South Bay over the last several years, particularly in El Segundo, often with ties to SpaceX.

Elon Musk’s company, founded in 2002 in El Segundo, has revolutionized the industry with reusable rockets that have radically lowered the cost of lifting payloads into space. Though it has moved its headquarters to Texas, SpaceX retains large-scale operations in Hawthorne.

Varda co-founder and Chief Executive Will Bruey is a former SpaceX avionics engineer, and the company’s spacecraft are launched on SpaceX’s workhorse Falcon 9 rockets from Vandenberg Space Force Base in Santa Barbara County.

Varda makes automated labs that look like cylindrical desktop speakers, which it sends into orbit in capsules and satellite platforms it also builds. There, in microgravity, the miniature labs grow molecular crystals that are purer than those produced in Earth’s gravity for use in pharmaceuticals.

It has contracts with drug companies and also the military, which tests technology at hypersonic speeds as the capsules return to Earth.

Its fifth capsule was launched in November and returned to Earth in late January; its next mission is set in the coming weeks. Varda has more than 10 missions scheduled on Falcon 9s through 2028.

For the last several decades, the Mariposa Avenue property served as the research and development center for Mattel Toys. El Segundo has also long been a center for the toy industry as companies like to set up shop in the shadow of Mattel.

The Mattel facility “has always been an exceptional property with a legacy tied to aerospace innovation, and leasing to Varda Space Industries feels like a natural continuation of that story,” said Michael Woods, a partner at GPI Cos., which owns the property.

“We are proud to support a company that is genuinely pushing the boundaries of what’s possible, and are excited to watch Varda grow and thrive here in El Segundo,” Woods said.

As one of the country’s most active hubs of aerospace and defense innovation, El Segundo has seen its industrial property vacancy fall to 3.4% on demand from space companies, government contractors and technology startups, real estate brokerage CBRE said.

Successful startups often have to leave the neighborhood when they want to expand, real estate broker Bob Haley of CBRE said. The 9-acre Mattel facility was big enough to keep Varda in the city.

Last year, Varda subleased about 55,000 square feet of lab space from alternative protein company Beyond Meat at 888 Douglas St. in El Segundo, which it started moving into in June.

Varda will get the keys to its new building in December and spend four to eight months building production and assembly facilities as it ramps up operations. By the end of next year, it expects to have constructed 10 more spacecraft.

In the future, Varda could consolidate offices there, given its size. Currently, though, the plan is to retain all properties, creating a campus of three buildings within a mile of one another that are served by the company’s transportation services, Chief Operating Officer Jonathan Barr said.

“We already have Varda-branded shuttles running up and down Aviation Boulevard,” he said.

Business

How Iran War Is Threatening Global Oil and Gas Supplies

Ships near the Strait of Hormuz before and after attacks began

Every day, around 80 oil and gas tankers typically pass through the Strait of Hormuz, the narrow waterway off Iran’s southern coast that carries a fifth of the world’s oil and a significant amount of natural gas.

On Monday, just two oil and gas tankers appear to have crossed the strait, according to a New York Times analysis of shipping activity from Kpler, an industry data firm. Since then, one tanker passed through.

“It’s a de facto closure,” said Dan Pickering, chief investment officer of Pickering Energy Partners, a Houston financial services firm. “You’ve got a significant number of vessels on either side of the strait but no one is willing to go through.”

Tankers have been staying away from Hormuz since the U.S.-Israeli attacks on Iran that began on Saturday. A prolonged conflict could ripple broadly across the global economy, threatening the energy supplies of countries halfway around the world and stoking inflation.

International oil prices have climbed 12 percent since the fighting began, trading Tuesday around $81 a barrel, and natural gas prices have surged in Europe and in Asia.

A senior Iranian military official threatened on Monday to “set on fire” any ships traveling through the Strait of Hormuz. Vessels in the region have already come under attack. Several oil and gas facilities have also been struck or affected by nearby shelling, though the damage did not initially appear to be catastrophic.

Where ships and energy facilities have been damaged

A fire broke out Tuesday at a major energy hub in Fujairah, United Arab Emirates, from the falling debris of a downed drone, the authorities said. On Monday, Qatar halted production of liquefied natural gas, or fuel that has been cooled so that it can be transported on ships, after attacks on its facilities.

The sharp reduction in tanker traffic is reducing the supply of oil and gas to world markets, pushing up prices for both commodities. And the longer that ships stay away from the Strait of Hormuz, the less oil and gas get out to the world, which could raise prices even more.

Shipping companies have paused their tankers to protect their crew and cargo, and because insurance companies are charging significantly more to cover vessels in the conflict area.

On Tuesday, President Trump said that “if necessary,” the U.S. Navy would begin escorting tankers through the strait. He also said a U.S. government agency would begin offering “political risk insurance” to shipping lines in the area.

In addition to tankers, other large vessels regularly go through the strait, including car carriers and container ships. In normal conditions, nearly 160 make the trip each day.

Some ships in the region turn off the devices that broadcast their positions, while others transmit false locations — making it hard to give a full picture of the traffic in the strait.

The Shiva is a small oil tanker that has repeatedly faked its location, according to TankerTrackers.com, which tracks global oil shipments. It is suspected of carrying sanctioned Iranian oil, according to Kpler. The Shiva was one of the two tankers that crossed the strait on Monday.

The oil and gas that typically move through the strait come from big producing countries like Saudi Arabia, Iraq, Iran and United Arab Emirates, and are exported around the world.

Where tankers moving through the Strait have traveled

In 2024, more than 80 percent of the oil and gas transported through the Strait of Hormuz went to Asia. China, India, Japan and South Korea were the top importers, according to the U.S. Energy Information Administration.

Countries have energy stockpiles that could last them into the coming months, but a continued shutdown of the strait could damage their economies.

Several big disruptions have roiled supply chains in recent years, but the tanker standstill in the Strait of Hormuz could have an outsize impact.

-

World1 week ago

World1 week agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Massachusetts1 week ago

Massachusetts1 week agoMother and daughter injured in Taunton house explosion

-

Wisconsin3 days ago

Wisconsin3 days agoSetting sail on iceboats across a frozen lake in Wisconsin

-

Maryland4 days ago

Maryland4 days agoAM showers Sunday in Maryland

-

Denver, CO1 week ago

Denver, CO1 week ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Florida4 days ago

Florida4 days agoFlorida man rescued after being stuck in shoulder-deep mud for days

-

Oregon6 days ago

Oregon6 days ago2026 OSAA Oregon Wrestling State Championship Results And Brackets – FloWrestling

-

Massachusetts2 days ago

Massachusetts2 days agoMassachusetts man awaits word from family in Iran after attacks