Reporting by Hannah Lang in Washington; additional reporting by Chris Prentice in New York; Editing by Michelle Price and Rod Nickel

Washington

Payments app Zelle begins refunds for imposter scams after Washington pressure

/cloudfront-us-east-2.images.arcpublishing.com/reuters/BXTGZLD5URKUNBYKIEJD5OC6BQ.jpg)

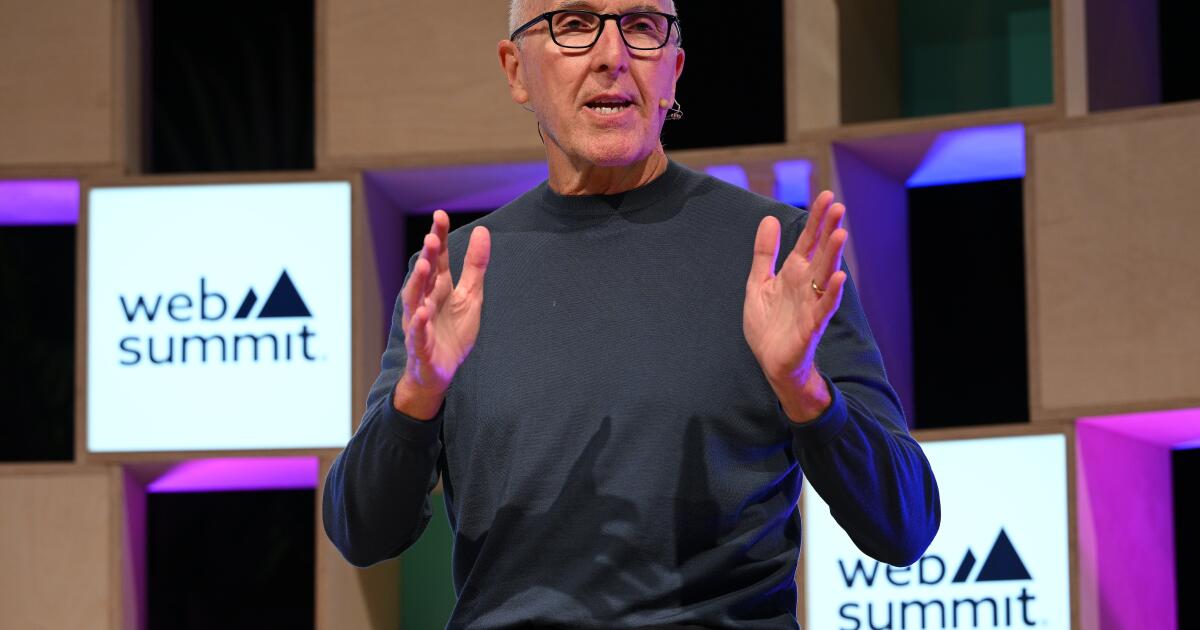

Nov 13 (Reuters) – Banks on the payment app Zelle have begun refunding victims of imposter scams to address consumer protection concerns raised by U.S. lawmakers and the federal consumer watchdog, in a major policy change.

The 2,100 financial firms on Zelle, a peer-to-peer network owned by seven banks including JPMorgan Chase (JPM.N) and Bank of America (BAC.N), began reversing transfers as of June 30 for customers duped into sending money to scammers claiming to be from a government agency, bank or existing service provider, said Early Warning Services (EWS), the banks’ company that owns Zelle.

That’s “well above existing legal and regulatory requirements,” Ben Chance, chief fraud risk officer at EWS, told Reuters.

Federal rules require banks to reimburse customers for payments made without their authorization, such as by hackers, but not when customers themselves make the transfer.

While Zelle disclosed Aug. 30 that it had introduced a new reimbursement benefit for “specific scam types,” it has not previously provided details on its new imposter scam refund policy due to worries doing so might encourage criminals to make false scam claims, a spokesperson said.

The new policy marks a major shift from last year when bankers, including JPMorgan CEO Jamie Dimon, told lawmakers worried about rising scams that it was unreasonable to require banks to refund transfers that customers were tricked into approving.

Following its launch in 2017, Zelle grew to become one of the largest U.S. peer-to-peer payments networks by total payments. A March 2022 New York Times report that scams were flourishing on Zelle caught the attention of lawmakers frequently critical of big banks, including Senator Elizabeth Warren.

She and other lawmakers started an investigation, estimating that Zelle users had lost $440 million to all types of fraud in 2021 alone. During a Senate hearing last year, Warren told Dimon and other bank CEOs that they had created a “perfect weapon” for criminals but had not stood by their customers. More than 100 million people, all with U.S. bank accounts, have access to Zelle, according to EWS.

Impersonator fraud was the most-reported scam in 2022 across all payment methods in the U.S., accounting for $2.6 billion in losses, according to the Federal Trade Commission.

Banks worry that covering the cost of authorized transactions will encourage more fraud and put them on the hook for potentially billions of dollars. Instead of requiring lenders to reimburse customers, EWS has implemented a mechanism that allows banks to claw back funds from the recipient’s account and return them to the sender, said Chance.

Lenders on Zelle are also now required to implement a tool that flags transfers with risky attributes, such as a payment to an account that has never transacted on the Zelle network, said Chance. He said Zelle has seen “a step-change reduction” in fraud and scam rates this year but declined to provide details.

“We have had a strong set of controls since the launch of the network, and as part of our journey we have continued to evolve those controls… to keep pace with what we see is going on in the marketplace,” he said.

Chance said EWS has been engaging with policymakers on the need for a “holistic approach” to combating scams, including advocating for more dedicated law enforcement resources.

Under pressure from Warren and other lawmakers, the Consumer Financial Protection Bureau (CFPB) considered compelling lenders to reimburse scams, but Zelle’s changes have so far satisfied the agency, said a person familiar with the matter.

A CFPB spokesperson declined to comment on Zelle or potential rule changes, but said the agency is working to protect customers “including by ensuring that financial institutions are living up to their investigation and error-resolution obligations.”

JPMorgan, Bank of America and Zelle’s five other owner banks declined to comment.

“Zelle’s platform changes are long overdue,” said Warren in a statement to Reuters. “The CFPB is standing with consumers, and I urge the agency to keep the pressure on Zelle to protect consumers from bad actors.”

MARKET PRESSURE

Zelle has long argued its fraud and scam rates are low.

It processed $629 billion worth of payments in 2022, according to the network, with 99.9% of transfers made without a fraud or scam report.

It competes with other peer-to-peer payment platforms like PayPal (PYPL.O) and Venmo that review situations case-by-case and have a purchase-protection program for eligible transactions that covers scams. Experts note that it is difficult to compare fraud and scam rates across platforms because classifications vary.

Zelle’s u-turn shows how banks are feeling competitive pressure to step up the “market standard of care”, said Trace Fooshee, a strategic advisor at Datos Insights.

Still, regulations mandating imposter fraud protections would be better for customers since lenders’ policies may be unclear or they may not follow them as promised, said Carla Sanchez-Adams, a senior attorney at the National Consumer Law Center.

“The one thing that I think is problematic is that the consumer really wouldn’t know that they have that option, and if they do know, and if the bank fails to reimburse them, there is no private remedy,” she said, noting Zelle’s policy change was nevertheless a “good first step.”

Payment fraud is expected to come up again when bank CEOs appear before the Senate next month, according to industry experts. This time, they believe they have a good story to tell.

“The banks through Zelle – without regulation, without legislation – have actually proactively gone and said, we’re going to make sure that we are… trying to address any kind of consumer issue or harm,” said Lindsey Johnson, CEO of the Consumer Bankers Association.

Our Standards: The Thomson Reuters Trust Principles.

Washington

Washington alum Jayden Johannsen returning to MVFC and transferring to Murray State

SIOUX FALLS, S.D. (Dakota News Now) – Five years after transferring out of North Dakota State, a former Washington High School star is coming back to the Missouri Valley Football Conference with the chance to play his former school as well as the programs from his home state.

After four stellar seasons at Division Two South Dakota Mines, quarterback Jayden Johannsen will transfer and play his final season of eligibility with the Division FCS Murray State Racers.

At Washington Jayden was a three year starter under center for the Warriors, passing for 2100 yards and 22 touchdowns while rushing for 300 yards and five more scores, helping lead the Warriors to 33 straight wins and three 11AAA state titles.

After graduating in 2019 Johannsen initially went to NDSU but transferred to Mines after one redshirt year where he would throw for nearly 8200 yards and 74 touchdowns and run for another 1600 yards and 24 from 2020 through 2023. He was nominated in 2022 for the Harlon Hill award, Division Two’s version of the Heisman Trophy.

With the addition of Johannsen the Racers now have five quarterbacks on their roster. However, with the other four quarterbacks having combined to play only one game at the college level, Jayden’s experience gives him a good chance to be Murray State’s starting quarterback in 2024.

Should that happen it coincidentally comes in a year where the Racers will play all four Dakota schools. Jayden’s first game against a school from his home state would be against the University of South Dakota in Kentucky on October 5th. A few weeks later, on October 26th, he’d face the program he began his college career with, North Dakota State, also in Murray, Kentucky. Then a week later, on November 2nd, he’d come back to native soil for the Racers game at two-time defending FCS National Champion South Dakota State in Brookings.

Copyright 2024 Dakota News Now. All rights reserved.

Washington

True Freshman Talent at Washington – Khmori House

Washington’s Spring roster featured a handful of early-enrollee freshmen. For players that would otherwise still be in high school, several of them started to show the kind of potential they might have for the future of this program. One of them was linebacker Khmori House. The class of 2024 early-enrollee was a three-star recruit out of St. John Bosco High School in Bellflower, California. The Trinity League in Southern California is known to be one of the nation’s most competitive high school leagues. In three seasons at the varsity level at St. John Bosco, House recorded 118 tackles, 12.5 tackles for loss, 4.5 sacks, and five pass breakups. He was a productive player at linebacker and strong safety for the Braves. And his transition to Big Ten Football has been fluid thus far.

Recognition from Robert Bala

After Washington’s final open practice of the Spring, we asked linebacker coach Robert Bala if there was a player in his room who had taken the biggest step this Spring. He immediately pointed to the true freshman House. “He’s done a really good job of understanding what we ask him to do either fundamentally, technically, schematically.”

That football knowledge and overall ability to digest the defensive scheme under Bala and Steve Belichick is critical. It will earn him time on the field earlier in his career. Bala continued, “He’s been a bright spot for us this spring and I think he is going to have an opportunity to get on the field a lot earlier in his career.” He’s a player who had been on campus for a little over four months at the time. This recognition speaks volumes to what the coaching staff believes House can be, and how well he’s already been performing.

What Khmori House Does Well

You notice a few things right off the bat when watching House play linebacker. One of which is his size for a true freshman. He is listed at 6’-0” and 187 pounds but his build does not look like that of a true freshman. House uses his size to deliver physical contact on ball carriers and blockers. There were multiple occasions this Spring when we heard a “pop” during the play. A closer look revealed it was the number 28 on the delivering end of the blow. His high school tape backs this up as well. House did not shy away from laying down hard contact. His size helps him be a dependable tackler, bringing players down to the turf consistently.

The other thing that stands out about the linebacker is his speed and athleticism. House’s high school film show him getting up in run fits as well as sliding back into coverage. He is able to use his quickness to get around the offensive line in rush defense and to close in on the wide receiver in pass defense. This Spring, that quickness was on display. House’s footwork during linebacker drills and agility in live play make him a versatile player for Bala.

Khmori House’s Speed in Pressure

One of the plays that stood out this Spring was not one you would see in the stat book. Rather, it was a run-down of Washington’s speedy quarterback Demond Williams Jr. During one of the team scrimmages in April, Williams lined up in shotgun where he took the snap and fled the pocket to his right. He initially looked to have an angle to the outside. But House shot out of the middle level of the defense. The linebacker’s angle and quickness forced Williams to stretch his run to the sideline rather than upfield. Instead of a five-yard gain around the edge, House forced Williams out of bounds for no gain. The awareness and athleticism of House to get an angle on Williams were impressive. Though it was just one small play, it reinforces his potential to be a multi-faceted player on this defense who will see the field early on.

Photo courtesy: Nick Lemkau, Last Word on College Football

Washington

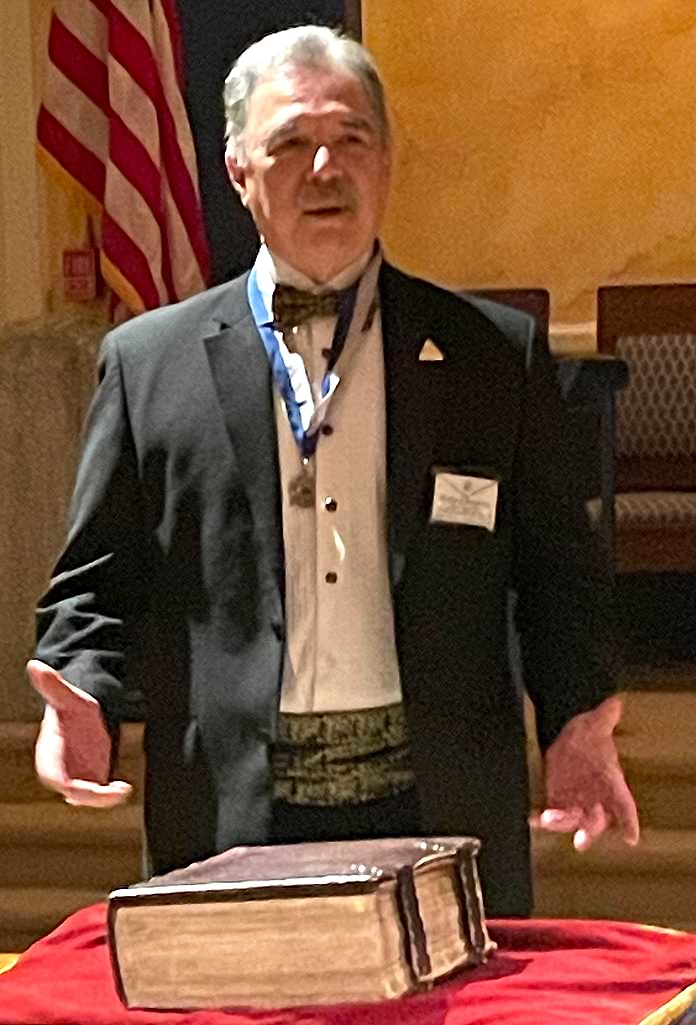

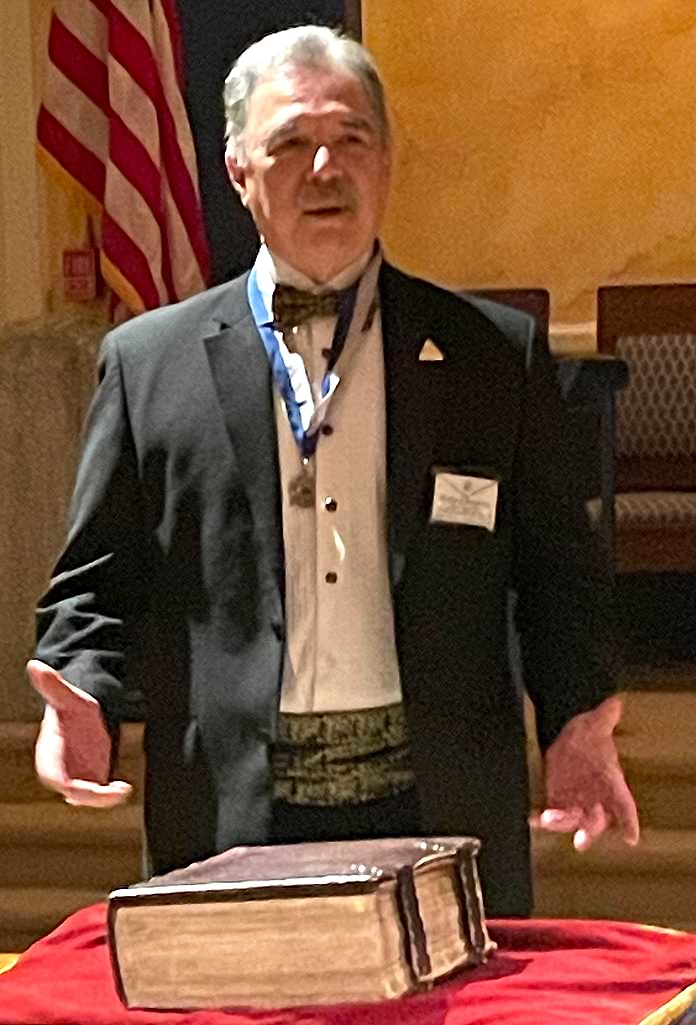

A page from history: George Washington’s inauguration Bible comes to Westport | Westport Journal

By Gretchen Webster

WESTPORT — Many towns in New England claim, “George Washington slept here.” Whether Westport can make that claim or not, Westporters can be certain the Bible used at the inauguration of the nation’s first president has visited Westport.

On Saturday, the 257-year-old George Washington Inaugural Bible was proudly displayed for the community by the men of Westport’s Masonic Lodge, Temple No. 65, to mark the lodge’s 200th anniversary.

The Westport Masonic Lodge was chartered on May 12, 1824, before the town of Westport itself was incorporated, and is one of the oldest organizations in town, according to Richard Ruggiano, worshipful master of the Westport temple.

The hands of four U.S. presidents have rested on the Bible during their inauguration, who in addition to Washington, include Warren G. Harding, Dwight Eisenhower and Jimmy Carter. George W. Bush also would have been sworn in using the Bible, but because it was raining the priceless Bible couldn’t be exposed to the weather, Ruggiano said.

The Bible was also present at the funerals for Washington and Abraham Lincoln, and at ceremonies to lay the cornerstone for both the U.S. Capitol building and the Washington Monument, he said.

“We should be sharing this with our community,” Ruggiano said of the Bible, which is owned by Masonic Lodge St. John’s No. 1 A.Y.M. (Ancient York Masons) in New York. “It has never been shone in Connecticut.”

The Bible’s public display Saturday drew Westport residents, members of nearby Masonic lodges and even “Benjamin Franklin,” a.k.a. Westport lodge member Chris Jennings, who portrayed Franklin. The real Franklin was a friend of Washington’s Jennings said in a presentation to visitors.

In his presentation, Jennings recounted the history preceding Washington’s inauguration, from the perspective of Franklin. He referred to Washington as “a young Virginia militia colonel,” 20 years before he became leader of a new nation.

Washington did not sign the Declaration of Independence because he was in New York state with his troops, according to Jennings, and was one of the nation’s founding fathers who believed it was important for the national legislature to have two houses: the House of Representatives and the Senate.

Washington’s inauguration as the first president of the United States took place in 1789 at Federal Hall in New York City, according to information from St. John’s lodge. It lay open on a crimson velvet cushion when the oath of office was administered to Washington by the first secretary of the U.S. Senate, Samuel Otis. Among those present were the nation’s first vice president, John Adams; the first chief justice of the Supreme Court, John Jay; the first secretary of war, Henry Knox, and the first governor of New York, George Clinton.

Many of the nation’s founders were Masons, Ruggiano said, including Washington himself, his generals and many of the men who signed the Declaration of Independence.

On Saturday, the Inaugural Bible made the trip from Manhattan accompanied by four members of St. John’s lodge, who donned white gloves and flanked the Bible as it was displayed in the local lodge to ensure its safety.

“We hire a conservation organization to take care of it,” said Andreas Vavaroutsos, a member of the New York lodge and part of the group that transported the Bible. The men drove the Bible to the Westport lodge at 210 Post Road East, and planned to drive it back to New York on Saturday evening.

It took Ruggiano many years to arrange for the Bible to be displayed in conjunction with the Westport lodge’s bicentennial, he said. But with arrangements complete and the Bible at the center of attention on a special day for the Westport lodge, he said, “We feel graced and blessed.”

Freelance writer Gretchen Webster, a Fairfield County journalist for many years, was editor of the Fairfield Minuteman and has taught journalism at New York and Southern Connecticut State universities.

-

News1 week ago

News1 week agoSkeletal remains found almost 40 years ago identified as woman who disappeared in 1968

-

World1 week ago

World1 week agoIndia Lok Sabha election 2024 Phase 4: Who votes and what’s at stake?

-

Politics1 week ago

Politics1 week agoTales from the trail: The blue states Trump eyes to turn red in November

-

World1 week ago

World1 week agoBorrell: Spain, Ireland and others could recognise Palestine on 21 May

-

World1 week ago

World1 week agoCatalans vote in crucial regional election for the separatist movement

-

Politics1 week ago

Politics1 week agoNorth Dakota gov, former presidential candidate Doug Burgum front and center at Trump New Jersey rally

-

Movie Reviews1 week ago

Movie Reviews1 week ago“Kingdom of the Planet of the Apes”: Disney's New Kingdom is Far From Magical (Movie Review)

-

World1 week ago

World1 week agoUkraine’s military chief admits ‘difficult situation’ in Kharkiv region