Colorado

Colorado man struggles finding health care while waiting for kidney donation

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

Colorado

Colorado lawmakers duel over data centers: Grant millions in tax breaks or regulate them without incentives?

Colorado lawmakers are deciding this year between two disparate approaches on data centers — one that aims to lure them to the Centennial State with millions of dollars in tax incentives and another that would implement some of the strictest statewide regulations in the country on the booming tech industry.

Either of the two competing bills would create the state’s first regulations specific to data centers. Sponsors of both bills say they hope to minimize environmental impacts from the power and water demands of the centers, while also ensuring that the cost of new infrastructure they need doesn’t wind up on residents’ electric bills.

Both bills are sponsored by Democrats but differ widely in what they’d do.

The bill supported by the data center industry — House Bill 1030 — would incentivize companies to comply with regulations in exchange for large tax breaks. The legislation would not regulate data centers whose owners forgo a tax break.

The other bill — Senate Bill 102 — would offer no incentives, instead imposing regulations on all large data center development across the state. It is supported by environmental and community groups.

“We want to make sure that as data centers come here, they come on our terms,” said Megan Kemp, the Colorado policy representative for Earthjustice’s Rocky Mountain office.

The bills have landed as debate over the future of data center regulation intensifies across the state. Data centers house the computer servers that function as the main infrastructure for the digital world. They crunch financial data, store patients’ health information, process online shopping, register sports betting and — increasingly — make possible the heavy data demands of artificial intelligence.

Several companies have begun construction on large data centers across the Front Range in recent years. A 160-megawatt hyperscale facility is under development in Aurora and could consume as much power as 176,000 homes once completed.

The construction of a 60-megawatt data center campus in north Denver has angered those who live by the site and prompted Denver city leaders last week to call for a moratorium on new data center development while they craft regulations for the industry. Larimer County and Logan County have enacted similar moratoriums.

Hundreds gathered Tuesday night at a community meeting about the northern Denver campus owned by CoreSite. Frustration in the crowd — which filled overflow rooms and the front lawn of the building that hosted the meeting — erupted as residents of the neighborhoods surrounding the center expressed concerns about how it would impact their air quality, power and water supplies.

Attendees said they did not know the data center was being built until they saw construction underway.

CoreSite leaders had planned to attend the meeting. But they pulled out of participating the day before because of safety concerns, company spokeswoman Megan Ruszkowski wrote in an email. She did not elaborate on the concerns. A Denver police spokesman said the department did not have any record of a police report filed by CoreSite in the days prior to the meeting.

CoreSite’s absence left officials from the city and utilities to answer the crowd’s questions and field their frustrations. City leaders told attendees that they had no say in whether the data center could be built because there are no city regulations specific to the industry.

“Data centers are proliferating quickly and we don’t know all the impacts,” said Danica Lee, the city’s director of public health investigations. “That’s why we need this moratorium.”

Promises of future regulation meant little to the residents of Elyria-Swansea, where the data center is scheduled to go online this summer. More than an hour into the meeting, a man took the microphone. He noted that so much of the conversation had focused on technicalities — but the information provided had not answered a question on many residents’ minds.

“How do we stop it now?” he asked, to a loud round of applause from the room.

Transformative opportunity?

Some in the state Capitol think more data centers would be beneficial for Colorado.

Supporters of the tax incentive bill in the legislature said luring the industry to Colorado would create high-paying jobs, help pay for electrical grid modernizations and strengthen local tax bases.

“This could be transformative for the state,” said Rep. Alex Valdez, a Denver Democrat who is one of HB-1030’s sponsors.

In exchange for complying with rules, data center companies would be exempted from sales and use taxes for 20 years for purchases related to the data center, like the expensive servers they must replace every few years. After two decades, the companies could apply for an extension to the exemption.

To earn the tax break, data center companies would have to meet requirements that include:

- Breaking ground on the data center within two years.

- Investing at least $250 million into the data center within five years.

- Creating full-time jobs with above-average wages, though the legislation doesn’t specify how many jobs would be required.

- Using a closed-loop water cooling system that minimizes water loss, or a cooling system that does not use water.

- Working to make sure the data center “will not cause unreasonable cost impacts to other utility ratepayers.”

- Consulting with the Colorado Department of Natural Resources about wildlife and water impacts.

While the bill would exempt data centers from sales tax on some purchases, they would still be on the hook for all other taxes, Valdez said, and would bring both temporary and permanent jobs. The bill does not specify how many permanent jobs must be created to qualify for the tax break.

Dozens of other states have enacted tax incentive programs for data centers. Such incentives are a key factor that companies weigh when deciding where to build, said Dan Diorio, the vice president of state policy for the Data Center Coalition, an industry group.

“Colorado is not competitive right now,” he said.

Figuring out the projected impact of the bill on the state’s finances gets complicated.

The legislature’s nonpartisan analysts estimated that the state would miss out on $92.5 million in sales tax revenue in the first three years, assuming a total of 17 data centers would qualify for the tax breaks in that time period.

But Valdez said that is revenue that the state otherwise wouldn’t see if the data centers weren’t built here. And the companies would still pay all other state and local taxes, he said.

“We see it as unrealized revenue, rather than a tax cut,” he said.

Some of that lost tax revenue would be offset by an increase in income taxes paid by low-income families, according to the bill’s fiscal note.

That’s because the projected decrease in sales tax revenue in the first year of the program would decrease the amount of money available for the state to provide its recently enacted Family Affordability Tax Credit. State law ties the amount available for the family tax credit to state revenue growth and whether the state collects money above a revenue cap set by the Taxpayer’s Bill of Rights. TABOR requires money above that level to be returned to taxpayers.

If the state doesn’t have excess revenue, it can’t fund that tax credit.

In the next fiscal year, which begins in July, data center companies would avoid paying $29 million in sales taxes, which would trigger a change in the family tax credit. Low-income families would be made to pay a total of $106 million more, the fiscal note estimates.

Bill sponsors are planning to address the fallout for the tax credit in forthcoming amendments, Valdez said.

“We’re not out to trigger any negative impacts to low-income families,” he said.

Baseline guardrails

Forgoing tax dollars during a state budget crisis is a hard sell to Rep. Kyle Brown, a Louisville Democrat sponsoring the regulatory bill. He and other supporters of SB-102 aren’t convinced tax incentives are necessary to bring data centers to the state.

Major construction projects are already underway, he said. In Denver, CoreSite chose not to pursue $9 million in tax breaks from the city but continued construction on its facility regardless.

“The point of our policy is (putting) reasonable, baseline guardrails on this development so it can be smart,” Brown said.

Brown last session co-sponsored a failed bill with Valdez that offered tax incentives to data centers. Since then, however, he’s seen other states that offer tax incentives express buyers’ remorse, he said.

Brown pointed to concerns in Virginia about rising electricity costs due to data center demand and a proposal by the governor of Illinois to suspend the state’s tax credit so that the impacts of the data center boom it sparked could be studied.

His bill this session — co-sponsored by Sen. Cathy Kipp, a Fort Collins Democrat — requires that data centers over 30 megawatts:

- Draw as much power as possible from newly sourced renewable energy by 2031.

- Pay for any additions or changes to the grid needed to serve the data center.

- Adhere to local rules about water efficiency.

- Limit the use of backup generators that consume fossil fuels; if such generators are necessary, they must be a certain type that limits emissions.

- Conduct an analysis of the data center’s impacts on local neighborhoods, engage in community outreach and sign a legally binding good-neighbor agreement if the community is disproportionately affected by pollution.

Owners of data centers would also need to report metrics annually to the Colorado Department of Public Health and Environment. They would cover the center’s annual electricity consumption, how much of that power came from renewable sources, the total number of hours backup generators were used and annual water use.

Utilities, too, would face additional requirements.

The legislation would ban utilities from offering discounted rates to large data centers. It also would prohibit them from supplying electricity to a data center if doing so would affect the utility’s ability to provide power to its other customers — or its ability to meet state emissions reduction goals.

Environmental groups supporting the bill say the state needs regulations to make sure the increased electrical demand generated by data centers doesn’t expand the state’s use of fossil fuels or slow the retirement of fossil fuel-powered plants.

If not done thoughtfully, the groups said, the increased electrical load could imperil the state’s climate goals.

“What we need to avoid is a race to attract data centers that turns into a race to the bottom,” said Alana Miller, the Colorado policy director for the Natural Resources Defense Council’s climate and energy program.

If the legislature enacts SB-102, it would implement the strictest data center regulations in the country and would ward off future data center development, Diorio said. He sees many of the rules as unattainable.

“It would make it nearly impossible to develop a data center in the state of Colorado,” he said.

Conversations between the sponsors of the two bills are underway, Valdez and Brown said. Both expressed hope that a consensus could be found between the two pieces of legislation.

Neither bill had been scheduled for a committee hearing.

Stay up-to-date with Colorado Politics by signing up for our weekly newsletter, The Spot.

Colorado

Colorado family pushes for change after rare disease clinical trial abruptly ends

Colorado

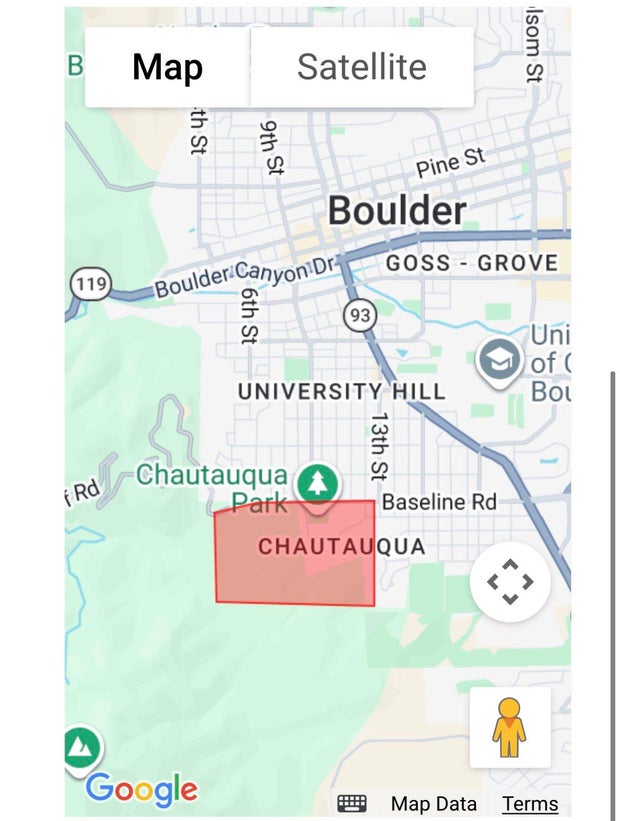

Evacuation warning issued for area near wildfire in southwest Boulder

Authorities have issued an evacuation warning for homes near a wildfire that broke out in southwest Boulder on Saturday afternoon.

Just before 1 p.m., Boulder Fire Rescue said a wildfire sparked in the southwest part of Boulder’s Chautauqua neighborhood. The Bluebell Fire is currently estimated to be approximately five acres in size, and more than 50 firefighters are working to bring it under control. Mountain View Fire Rescue is assisting Boulder firefighters with the operation.

Around 1:30, emergency officials issued an evacuation warning to the residents in the area of Chatauqua Cottages. Residents in the area should be prepared in case they need to evacuate suddenly.

Officials have ordered the DFPC Multi-Mission Aircraft (MMA) and Type 1 helicopter to assist in firefighting efforts. Boulder Fire Rescue said the fire has a moderate rate of spread and no containment update is available at this time.

Red Flag warnings remain in place for much of the Front Range as windy and dry conditions persist.

-

World4 days ago

World4 days agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Massachusetts4 days ago

Massachusetts4 days agoMother and daughter injured in Taunton house explosion

-

Montana1 week ago

Montana1 week ago2026 MHSA Montana Wrestling State Championship Brackets And Results – FloWrestling

-

Denver, CO4 days ago

Denver, CO4 days ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Louisiana7 days ago

Louisiana7 days agoWildfire near Gum Swamp Road in Livingston Parish now under control; more than 200 acres burned

-

Technology1 week ago

Technology1 week agoYouTube TV billing scam emails are hitting inboxes

-

Technology1 week ago

Technology1 week agoStellantis is in a crisis of its own making

-

Politics1 week ago

Politics1 week agoOpenAI didn’t contact police despite employees flagging mass shooter’s concerning chatbot interactions: REPORT