California

Fact checking ads for California’s sports betting propositions

In abstract

The campaigns for Propositions 26 and 27 on this November’s poll have made all kinds of claims, particularly about how the cash gleaned from sports activities betting in California will get distributed.

Odds are, one of many many adverts for legalizing sports activities betting has snagged your consideration, given their ubiquity on TV, web sites and billboards throughout California.

You’d be forgiven, although, for nonetheless not having a transparent sense of what both of the initiatives do. A number of the adverts don’t point out sports activities betting in any respect, probably leaving Californians foggy on what precisely it’s they’re being requested to resolve.

The adverts are “oversimplified to some extent of not being absolutely correct,” stated Mary Beth Moylan, an affiliate dean and professor on the McGeorge Faculty of Regulation at College of the Pacific who oversees a journal devoted to California’s initiatives.

Proposition 26 would legalize sports activities betting at tribal casinos and at California’s 4 personal horse race tracks. It’s being paid for by a couple of dozen Native American tribes. It will additionally permit tribes to start providing roulette and cube video games.

Proposition 27 would legalize on-line sports activities betting throughout the state and is being paid for by a handful of huge gaming firms. Below Proposition 27, each gaming firms and tribes may provide on-line and cell sports activities betting.

However how truthful are the adverts? Right here’s what you could learn about a number of the often-repeated claims.

Declare: “Tribal leaders help the Options Act (Prop 27)”

Leaders from three of California’s 110 federally acknowledged Native American tribes — Santa Rosa Rancheria Tachi Yokut Tribe, Middletown Rancheria of Pomo Indians and Huge Valley Band of Pomo Indians — help the web sports activities betting proposition.

Chairman Jose “Moke” Simon III of the Middletown Racheria of Pomo Indians stated in an interview with CalMatters that he helps Proposition 27 as a result of it offers the tribe a chance to usher in extra funds. The tribe is rural and has a on line casino about an hour’s drive north of Napa.

“Our brick and mortar (on line casino) is restricted by simply our space the place we’re situated and the cell sports activities betting would permit us to succeed in a much wider viewers,” stated Simon III.

However, over 50 tribes and tribal organizations oppose Proposition 27. They are saying it might disrupt the gaming that has been working on tribal lands for many years and would drive enterprise away from Indian casinos.

True?

It’s true that a number of tribal leaders help Proposition 27, however way more tribal leaders oppose the measure.

Declare: Proposition 27 “helps each California tribe, together with financially deprived tribes that don’t personal large casinos”

It’s true that each tribe would see some sort of profit from Proposition 27. Tribes which have compacts with the state of California that permit them to supply playing may create their very own cell sports activities betting app or web site. Or, they might associate with a gaming firm that desires to supply on-line sports activities betting in California.

The initiative additionally taxes on-line sports activities betting and units apart 15% of the cash for tribes that aren’t concerned in sports activities betting. However, as a result of it’s onerous to know precisely how many individuals will place bets, what number of firms and tribes will need to provide sports activities betting, or what number of tax deductions firms will take, it’s unattainable to know precisely how a lot cash that will likely be.

True?

Each tribe has the potential to learn from Proposition 27, sure. It’s unclear to what diploma every tribe would profit.

Declare: Proposition 27 gives “a whole bunch of thousands and thousands in yearly funding to lastly deal with homelessness in California”

This one is a bit difficult. It’s doable the proposition will generate a whole bunch of thousands and thousands of {dollars} yearly to handle homelessness, but it surely’s not assured.

Every election cycle, the non-partisan Legislative Analyst’s Workplace opinions every proposition and estimates the brand new prices and income every may create for the state. They discovered that Proposition 27, through taxes and charges, would improve cash flowing to the state by “probably within the a whole bunch of thousands and thousands of {dollars} however probably no more than $500 million yearly.” The workplace didn’t embrace a lower-end estimate.

First, that cash can be used to cowl new prices associated to regulating sports activities betting, which the analysts estimate may attain tens of thousands and thousands of {dollars} yearly.

Out of the cash that is still, 15% would go to tribes that don’t take part in sports activities betting and 85% would go to homelessness options. The Legislature may additionally select to direct a few of it to playing habit remedies.

True?

It’s doable that Proposition 27 would wind up producing a whole bunch of thousands and thousands of {dollars} per 12 months for the state to handle homlessness. But when taxes and charges find yourself bringing in $100 or $200 million a 12 months — versus $500 million — then it might not. Additionally, if the Legislature decides to direct a big portion to playing habit remedies, that would cut back the quantity that goes to homelessness options.

How does this cash match into what California is already spending to handle homelessness? California spent $7.2 billion on homelessness-related packages within the 2021-22 funds 12 months, in line with state analysts. If Proposition 27 added, say, $300 million, that might translate to a 4% increase.

Declare: “90% of the earnings [of Prop. 27] go to out-of-state firms”

This declare is predicated on the truth that Proposition 27 taxes on-line sports activities betting at a charge of 10%. So the query is: The place precisely will the opposite 90% go? The reality is that it’s unattainable to know exactly.

If Proposition 27 passes, gaming firms headquartered in different states will need to get in on the motion, since they’re those funding the measure. The businesses bankrolling the initiative have a number of the hottest on-line sports activities betting platforms: FanDuel instructions 31% of the U.S. market, adopted by DraftKings with 26% and BetMGM with 16%, in line with Eilers & Krejcik, a analysis agency targeted on gaming. So, it’s cheap to count on their platforms can be common in California, too.

Does that imply these firms would reap the entire revenue? The initiative additionally permits California tribes to supply cell and on-line sports activities betting on their very own. If tribes select to do this, they’d be incomes a number of the earnings.

Gaming firms headquartered in different states may also wind up needing to spend cash in California to do enterprise right here. For instance, firms might want to make a cope with a tribe with a view to legally function, and that deal may embrace some sort of cost or income sharing. Gaming firms might also have to pay staff or contractors in California to get their enterprise going right here.

True?

The businesses funding the marketing campaign are headquartered exterior California. What share of earnings would truly go to them is unattainable to know proper now.

Declare: Tribes are “pushing Prop 26 to ensure themselves a digital monopoly on all gaming in California by giving personal trial attorneys the powers of the Legal professional Common to bury their licensed cardroom rivals with frivolous lawsuits.”

This argument incorporates a number of claims. It’s primarily based on part of Proposition 26 that permits any particular person (or group) that believes another person is breaking California playing legal guidelines — by providing an unlawful recreation, for instance — to sue. Earlier than they might sue, although, they’d have to first ask the state Division of Justice to behave, and will solely transfer forward if the division doesn’t take motion, or the division does file a case and the courtroom rejects the case however permits it to be re-filed. It’s difficult authorized stuff. But it surely’s not a completely novel thought; California has used an analogous course of to implement labor legal guidelines.

True?

Buckle up.

Are tribes attempting to “assure themselves a digital monopoly?” In 2000, Californians voted to permit tribes to supply sure types of playing — together with slot machines and card video games backed by the on line casino — that no different entity in California is allowed to supply. Proposition 26 would permit tribes to start providing roulette and cube video games, which no different entity can provide, as long as they renegotiate their settlement with the state. So, the initiative would develop tribes’ unique rights to supply sure types of playing.

Would the brand new lawsuit course of give “personal trial attorneys the powers of the Legal professional Common to bury their licensed cardroom rivals with frivolous lawsuits?” It will permit personal attorneys to deliver instances which can be presently below the purview of presidency attorneys. The Proposition 26 marketing campaign hasn’t hidden the truth that tribes intend to sue cardrooms, which compete with tribal casinos.

The lawsuit course of was “crafted to settle the home financial institution video games regulation that governs cardrooms,” stated Kathy Fairbanks, a spokesperson for Sure on 26 marketing campaign, at a latest debate. The principles over precisely how cardrooms are allowed to supply sure video games has lengthy been a supply of disagreement between cardrooms and tribes. The tribes don’t have standing to problem them in courtroom, Fairbanks stated, so they need a manner to do this.

The notion that this could unlock a slew of meritless lawsuits, although, assumes that courts don’t have already got a course of in place to deal with frivolous lawsuits, stated Moylan, the regulation professor. Courts can sanction attorneys who deliver frivolous lawsuits, for instance, Moylan stated.

California

California may exclude Tesla from EV rebate program

Spear Invest founder and Chief Investment Officer Ivana Delevska discusses the value of A.I. data centers and the future of driverless cars on ‘Making Money.’

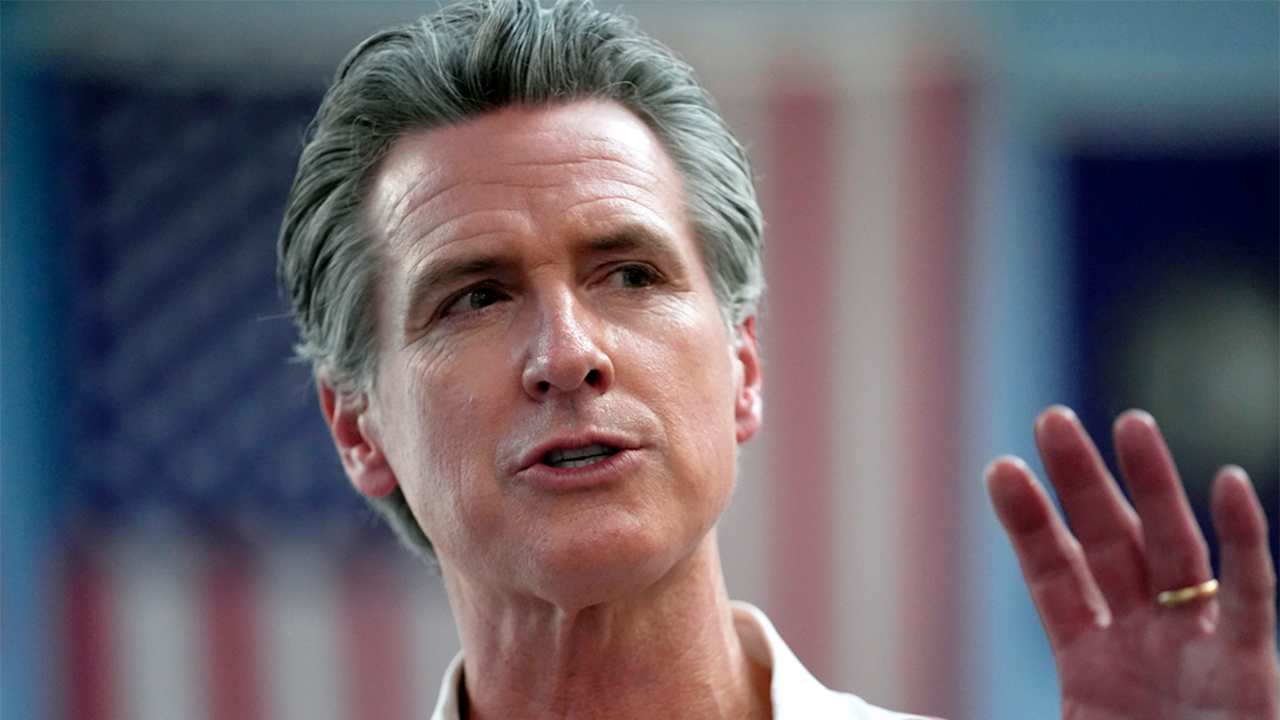

California Gov. Gavin Newsom may exclude Tesla and other automakers from an electric vehicle (EV) rebate program if the incoming Trump administration scraps a federal tax credit for electric car purchases.

Newsom proposed creating a new version of the state’s Clean Vehicle Rebate Program, which was phased out in 2023 after funding more than 594,000 vehicles and saving more than 456 million gallons of fuel, the governor’s office said in a news release on Monday.

“Consumers continue to prove the skeptics wrong – zero-emission vehicles are here to stay,” Newsom said in a statement. “We’re not turning back on a clean transportation future – we’re going to make it more affordable for people to drive vehicles that don’t pollute.”

The proposed rebates would be funded with money from the state’s Greenhouse Gas Reduction Fund, which is funded by polluters under the state’s cap-and-trade program, the governor’s office said. Officials did not say how much the program would cost or save consumers.

NEBRASKA AG LAUNCHES ASSAULT AGAINST CALIFORNIA’S ELECTRIC VEHICLE PUSH

California Gov. Gavin Newsom on Monday proposed creating a new version of the state’s Clean Vehicle Rebate Program if the incoming Trump administration scraps a federal tax credit for electric car purchases. (Photo by Justin Sullivan/Getty Images, File / Getty Images)

They would also include changes to promote innovation and competition in the zero-emission vehicles market – changes that could prevent automakers like Tesla from qualifying for the rebates.

Tesla CEO Elon Musk, who relocated Tesla’s corporate headquarters from California to Texas in 2021, responded to the possibility of having Tesla EVs left out of the program.

Tesla and other automakers may not qualify for the proposed tax credits, according to the governor’s office. (Getty Images, File / Getty Images)

“Even though Tesla is the only company who manufactures their EVs in California! This is insane,” Musk wrote on X, which he also owns.

BENTLEY PUSHES BACK ALL-EV LINEUP TIMELINE TO 2035

Those buying or leasing Tesla vehicles accounted for about 42% of the state’s rebates, The Associated Press reported, citing data from the California Air Resources Board.

Newsom’s office told Fox Business Digital that the proposal is intended to foster market competition, and any potential market cap is subject to negotiation with the state Legislature.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| TSLA | TESLA INC. | 338.59 | -13.97 | -3.96% |

“Under a potential market cap, and depending on what the cap is, there’s a possibility that Tesla and other automakers could be excluded,” the governor’s office said. “But that’s again subject to negotiations with the legislature.”

Newsom’s office noted that such market caps have been part of rebate programs since George W. Bush’s administration in 2005.

Newsom has pushed Californians to replace gas-powered vehicles with zero-emission vehicles. (Chip Somodevilla/Getty Images / Getty Images)

Federal tax credits for EVs are currently worth up to $7,500 for new zero-emission vehicles. President-elect Trump has previously vowed to end the credit.

CLICK HERE TO GET THE FOX NEWS APP

California has surpassed 2 million zero-emission vehicles sold, according to the governor’s office. The state, however, could face a $2 billion budget deficit next year, Reuters reported, citing a non-partisan legislative estimate released last week.

California

STEVE HILTON: Five things California Democrats still don't get

NEWYou can now listen to Fox News articles!

Along with most other Democratic politicians in California, Gov. Gavin Newsom still doesn’t seem to understand what happened in the 2024 election.

For years, Newsom, along with California cronies like former House Speaker Nancy Pelosi and, of course, Vice President Kamala Harris, bragged about their state being a “model for the nation.”

In one sense–not the one they intended, of course–that’s true. California became a model of what not to do.

CALIFORNIA VOTERS NARROWLY REJECT $18 MINIMUM WAGE; FIRST SUCH NO-VOTE NATIONWIDE SINCE 1996

The terrible combination of elitism and extremism that has defined Democratic policymaking in my home state for at least the last decade has delivered failure on every front.

Despite having the highest taxes in the nation, despite the state’s budget nearly doubling in the last ten years (even as our population has been falling, in the exodus from blue state misrule), California has the highest rate of poverty in America. We have the highest housing costs, the lowest homeownership, highest gas and utility bills, and the worst business climate–ten years in a row.

This record of failure is exactly why Democrats lost so badly on November 5th. Voters had a clear choice: between more of the same Democrat policies that raised the cost of living and lowered their quality of life, or a return to the peace and prosperity of the Trump years.

GAVIN NEWSOM TO MEET WITH BIDEN AFTER VOWING TO PROTECT STATE’S PROGRESSIVE POLICIES AGAINST TRUMP ADMIN

In many ways, the contest between Donald Trump and Kamala Harris represented a battle between the ‘blue state model’ championed by Gavin Newsom in California, and the ‘red state model’ that has driven people and businesses out of California and into the arms of more welcoming states like Texas, Tennessee and Florida.

Of course, the red state model won and the blue state model was roundly rejected.

You would think that would make blue state leaders like Newsom pause and reflect. But the exact opposite has happened. Gavin Newsom immediately called a “special session” of the California legislature to “Trump-proof” his state.

What California really needs is “Newsom-proofing.”

Instead, California Democrats are doubling down on the exact same agenda that was defeated across the country – including in California, which saw the biggest shift from Democrats to the GOP in decades.

Here are the five things California Democrats still don’t get:

1. People want results, not lectures

Democrats and their media sycophants can do all the self-righteous, sanctimonious bloviating they like about “our democracy” and “equity”, but in the end people want the basics of the American Dream: a good job that pays enough to raise your family in a home of your own in a safe neighborhood with a good school so your kids can have a better life than you. No amount of moral superiority from the people in charge will make up for that if they fail to provide it.

2. Enough with the ‘climate’ extremism

“Climate” has become a religion for Democrats, and you see that especially clearly in California. But when you look at the main reason life is so unaffordable for working people, whether that’s gas prices, utility bills or housing costs, extreme climate policies are to blame. Working-class Americans can’t afford these ‘luxury beliefs.’

CLICK HERE FOR MORE FOX NEWS OPINION

3. Who cares about Hollywood?

This election destroyed forever the myth that fancy celebrities can sway votes. Oprah, Beyonce, George Clooney, Taylor Swift…nobody cares! The new cultural powerhouses are the podcast hosts, comedians…the raw power of UFC is where it’s at, not the decadent Hollywood elite who won’t even turn up to support “their” candidate without a multimillion dollar paycheck.

Producer and actress Oprah Winfrey holds up Vice President and Democratic presidential candidate Kamala Harris’ hand as she arrives onstage during a campaign rally on the Benjamin Franklin Parkway in Philadelphia, Pennsylvania, on November 4, 2024. (Getty Images)

4. ‘Little tech’ beats Big Tech

Democrats may console themselves with the knowledge that California’s Big Tech monopolies are on their side. But in this election we saw the rise of what famed Silicon Valley investor Marc Andressen calls “little tech”, the upstarts and rebels who reject leftist groupthink. They got engaged in this election in a way we’ve never seen before. It’s a massive shift and will be a huge force for the future.

5. Working class beats the elite

Back in 2016, after the Brexit vote, and then Donald Trump’s victory here, shocked the world, I predicted that the Republican Party had the opportunity to become a “multiracial working class coalition.” Trump’s 2024 victory has delivered that — a revolutionary shift in our political landscape. The other part of my prediction? Democrats will be left as the party of the “rich, white and woke.”

CLICK HERE TO GET THE FOX NEWS APP

Unless Democrats come to terms with these realities and change course, they can expect to lose elections for years to come. The reaction in California – epicenter of today’s Democrat elite — shows that there is zero sign of this happening.

They just don’t get it.

CLICK HERE TO READ MORE FROM STEVE HILTON

California

California proposes its own EV buyer credit — which could cut out Elon Musk's Tesla

- Gov. Gavin Newsom plans to revive California’s EV rebate if Trump ends the federal tax credit.

- But Tesla, the largest maker of EVs, would be excluded under the proposal.

- Elon Musk criticized Tesla’s potential exclusion from the rebate.

California Gov. Gavin Newsom is preparing to step in if President-elect Donald Trump fulfills his promise to axe the federal electric-vehicle tax credit — but one notable EV maker could be left out.

Newsom said Monday if the $7,500 federal tax credit is eliminated he would restart the state’s zero-emission vehicle rebate program, which was phased out in 2023.

“We will intervene if the Trump Administration eliminates the federal tax credit, doubling down on our commitment to clean air and green jobs in California,” Newsom said in a statement. “We’re not turning back on a clean transportation future — we’re going to make it more affordable for people to drive vehicles that don’t pollute.”

The rebates for EV buyers would come from the state’s Greenhouse Gas Reduction Fund, which is funded by polluters of greenhouse gases under a cap-and-trade program, according to the governor’s office.

But Tesla’s vehicles could be excluded under the proposal’s market-share limitations, Bloomberg News first reported.

The governor’s office confirmed to Business Insider that the rebate program could include a market-share cap which could in turn exclude Tesla or other EV makers. The office did not share details about what market-share limit could be proposed and also noted the proposal would be subject to negotiations in the state legislature.

A market-share cap would exclude companies whose sales account for a certain amount of total electric vehicle sales. For instance, Tesla accounted for nearly 55% off all new electric vehicles registered in California in the first three quarters of 2024, according to a report from the California New Car Dealers Association. By comparison, the companies with the next highest EV market share in California were Hyundai and BMW with 5.6% and 5% respectively.

Tesla sales in California, the US’s largest EV market, have recently declined even as overall EV sales in the state have grown. Though the company still accounted for a majority of EV sales in California this year as of September, its market share fell year-over-year from 64% to 55%.

The governor’s office said the market-share cap would be aimed at promoting competition and innovation in the industry.

Elon Musk, who has expressed support for ending the federal tax credit, said in an X post it was “insane” for the California proposal exclude Tesla.

The federal electric vehicle tax credit, which was passed as part of the Biden administration’s Inflation Reduction Act in 2022, provides a $7,500 tax credit to some EV buyers.

Musk, who is working closely with the incoming Trump administration, has expressed support for ending the tax credit. He’s set to co-lead an advisory commission, the Department of Government Efficiency, which is aimed at slashing federal spending.

The Tesla CEO said on an earnings call in July that ending the federal tax credit might actually benefit the company.

“I think it would be devastating for our competitors and for Tesla slightly,” Musk said. “But long-term probably actually helps Tesla, would be my guess.”

BI’s Graham Rapier previously reported that ending the tax credit could help Tesla maintain its strong standing in the EV market by slowing its competitors growth.

Prior to the EV rebate proposal, Newsom has already positioned himself as a foil to the incoming Trump administration. Following Trump’s election win the governor called on California lawmakers to convene for a special session to discuss protecting the state from Trump’s second term.

“The freedoms we hold dear in California are under attack — and we won’t sit idle,” Newsom said in a statement at the time.

-

Business1 week ago

Business1 week agoColumn: Molly White's message for journalists going freelance — be ready for the pitfalls

-

Science7 days ago

Science7 days agoTrump nominates Dr. Oz to head Medicare and Medicaid and help take on 'illness industrial complex'

-

Politics1 week ago

Politics1 week agoTrump taps FCC member Brendan Carr to lead agency: 'Warrior for Free Speech'

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg) Technology1 week ago

Technology1 week agoInside Elon Musk’s messy breakup with OpenAI

-

Lifestyle1 week ago

Lifestyle1 week agoSome in the U.S. farm industry are alarmed by Trump's embrace of RFK Jr. and tariffs

-

World1 week ago

World1 week agoProtesters in Slovakia rally against Robert Fico’s populist government

-

Health4 days ago

Health4 days agoHoliday gatherings can lead to stress eating: Try these 5 tips to control it

-

News1 week ago

News1 week agoThey disagree about a lot, but these singers figure out how to stay in harmony