California

California Tax Budget Trailer Bill Review – California Globe

On August 26, Meeting Invoice 158 by the Meeting Committee on Funds was gutted-and-amended to cope with tax aid. The invoice would amend Sections 17053.71, 17131.8, 23628, and 24308.6 of, add Part 17053.75 to, and repeal and add Part 19551.3 of, the Income and Taxation Code, amend Part 8161 of the Welfare and Establishments Code, and repeal Part 26 of Chapter 264 of the Statutes of 2020.

Part 1 of the invoice would amend Income and Taxation Code Part 17053.71 to make a technical correction.

Part 2 of the invoice would add Income and Taxation Code Part 17053.75 to offer, for taxable years starting January 1, 2024, a tax credit score in higher quantity of (1) for dues paid that taxable yr by the certified taxpayers by the employees’ tax credit score adjustment issue, or (2) for the quantity equal to dues paid in that taxable yr by the certified taxpayer as much as $100.

It’s the intent of the Legislature that the employees’ tax credit score adjustment issue and the utmost greenback quantity allowed is to be set to restrict the annual income loss to not more than $400 million. The invoice would outline the next phrases: “bona fide labor group,” “dues,” and “certified taxpayer.”

This credit score is in lieu of some other credit score or deduction that the certified taxpayer could also be allowed for these quantities. If the credit score exceeds the tax legal responsibility, then the surplus is credited in opposition to different quantities due and the steadiness refunded to the certified taxpayer if monies are appropriated by the Legislature for that goal.

To adjust to Part 41 necessities, there are legislative findings and declarations relating to the aim of the credit score allowed, which is to assist people with the price of being a member of a union. There are efficiency indicators for the Legislature to make use of, and a requirement that the FTB present an annual report back to the Legislature containing specified info.

Part 3 of the invoice would amend Income and Taxation Code Part 17131.8 to make clear that amendments made earlier this yr are operative for taxable years starting on or after January 1, 2019.

Part 4 of the invoice would repeal Income and Taxation Code Part 19551.3 require the trade of knowledge between the Division of Well being Care Providers and the Franchise Tax Board.

Part 5 of the invoice would add Income and Taxation Part 19551.3 to require the Division of Social Providers and the Division of Well being Care Providers to trade information with the Franchise Tax Board for people who could qualify for the California Earned Revenue Tax Credit score. The info is to stay confidential and solely be used for specified functions.

The DSS and DHCS should yearly present to the FTB the outcomes and findings of outreach carried out to measure whether or not the outreach achieves its meant goal of accelerating the variety of claims for the federal earned earnings tax credit score, the California earned earnings tax credit score, and different state and federal antipoverty tax credit. Required info is specified.

Part 6 of the invoice would amend Income and Taxation Code Part 23628 to make a technical correction.

Part 7 of the invoice would amend Income and Taxation Code Part 24308.6 to make clear that amendments made earlier this yr are operative for taxable years starting on or after January 1, 2019.

Part 8 of the invoice would amend Welfare and Establishments Code Part 8161 to substitute the Franchise Tax Board for the Controller for making a one-time fee to every certified recipient.

Part 9 of the invoice would repeal Part 26 of Chapter 64 from 2020. Part 10 of the invoice would applicable $20,000 to the FTB for administering the info sharing provisions of this act.

Part 11 of the invoice incorporates legislative findings and declarations that the applying of the exclusion from gross earnings for mortgage quantities forgiven pursuant to the federal PPP Extension Act of 2021 to taxable years starting on or after January 1, 2019, as offered by this act, serves the general public goal of securing the monetary situation of companies that had been harmed by the COVID-19 pandemic, and doesn’t represent a present of public funds.

Part 12 of the invoice gives that no reimbursement to an area company or college district is required by this act. Part 13 of the invoice gives that this invoice is said to the Funds Invoice and can take impact instantly.

California

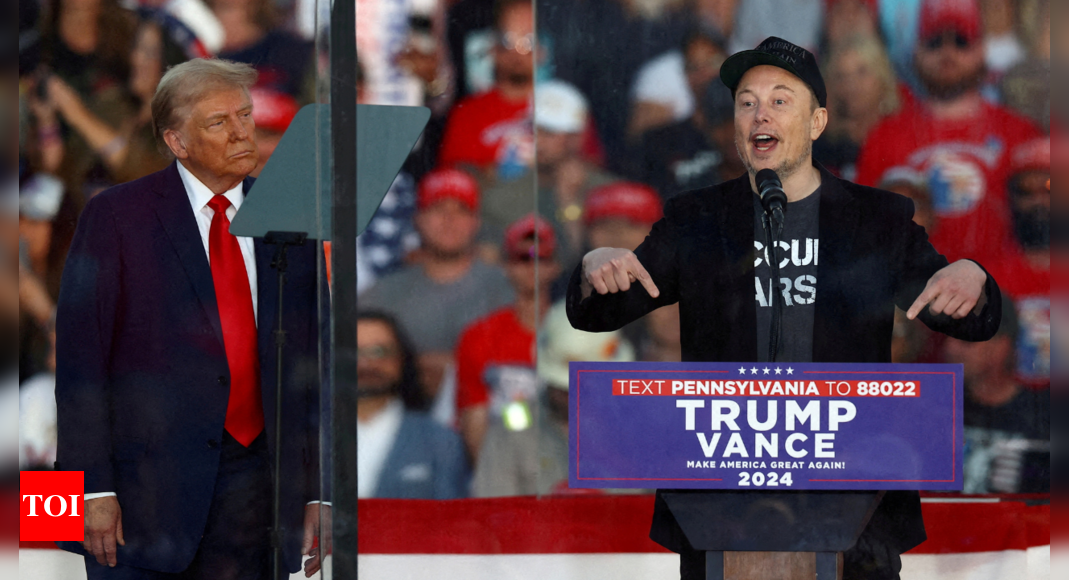

California proposes its own EV buyer credit — which could cut out Elon Musk's Tesla

- Gov. Gavin Newsom plans to revive California’s EV rebate if Trump ends the federal tax credit.

- But Tesla, the largest maker of EVs, would be excluded under the proposal.

- Elon Musk criticized Tesla’s potential exclusion from the rebate.

California Gov. Gavin Newsom is preparing to step in if President-elect Donald Trump fulfills his promise to axe the federal electric-vehicle tax credit — but one notable EV maker could be left out.

Newsom said Monday if the $7,500 federal tax credit is eliminated he would restart the state’s zero-emission vehicle rebate program, which was phased out in 2023.

“We will intervene if the Trump Administration eliminates the federal tax credit, doubling down on our commitment to clean air and green jobs in California,” Newsom said in a statement. “We’re not turning back on a clean transportation future — we’re going to make it more affordable for people to drive vehicles that don’t pollute.”

The rebates for EV buyers would come from the state’s Greenhouse Gas Reduction Fund, which is funded by polluters of greenhouse gases under a cap-and-trade program, according to the governor’s office.

But Tesla’s vehicles could be excluded under the proposal’s market-share limitations, Bloomberg News first reported.

The governor’s office confirmed to Business Insider that the rebate program could include a market-share cap which could in turn exclude Tesla or other EV makers. The office did not share details about what market-share limit could be proposed and also noted the proposal would be subject to negotiations in the state legislature.

A market-share cap would exclude companies whose sales account for a certain amount of total electric vehicle sales. For instance, Tesla accounted for nearly 55% off all new electric vehicles registered in California in the first three quarters of 2024, according to a report from the California New Car Dealers Association. By comparison, the companies with the next highest EV market share in California were Hyundai and BMW with 5.6% and 5% respectively.

Tesla sales in California, the US’s largest EV market, have recently declined even as overall EV sales in the state have grown. Though the company still accounted for a majority of EV sales in California this year as of September, its market share fell year-over-year from 64% to 55%.

The governor’s office said the market-share cap would be aimed at promoting competition and innovation in the industry.

Elon Musk, who has expressed support for ending the federal tax credit, said in an X post it was “insane” for the California proposal exclude Tesla.

The federal electric vehicle tax credit, which was passed as part of the Biden administration’s Inflation Reduction Act in 2022, provides a $7,500 tax credit to some EV buyers.

Musk, who is working closely with the incoming Trump administration, has expressed support for ending the tax credit. He’s set to co-lead an advisory commission, the Department of Government Efficiency, which is aimed at slashing federal spending.

The Tesla CEO said on an earnings call in July that ending the federal tax credit might actually benefit the company.

“I think it would be devastating for our competitors and for Tesla slightly,” Musk said. “But long-term probably actually helps Tesla, would be my guess.”

BI’s Graham Rapier previously reported that ending the tax credit could help Tesla maintain its strong standing in the EV market by slowing its competitors growth.

Prior to the EV rebate proposal, Newsom has already positioned himself as a foil to the incoming Trump administration. Following Trump’s election win the governor called on California lawmakers to convene for a special session to discuss protecting the state from Trump’s second term.

“The freedoms we hold dear in California are under attack — and we won’t sit idle,” Newsom said in a statement at the time.

California

California Gov. Gavin Newsom says state will provide rebates if Trump removes tax credit for electric vehicles

California Gov. Gavin Newsom said the state will provide rebates to residents if President-elect Donald Trump’s incoming administration does away with a federal tax credit for electric vehicles.

In a news release issued Monday, Newsom said he would restart the state’s Clean Vehicle Rebate Program, which provided financial incentives on more than 590,000 vehicles before it was phased out late 2023.

“We will intervene if the Trump Administration eliminates the federal tax credit, doubling down on our commitment to clean air and green jobs in California,” Newsom said. “We’re not turning back on a clean transportation future — we’re going to make it more affordable for people to drive vehicles that don’t pollute.”

The federal rebates on new and used electric vehicles were implemented in the Inflation Reduction Act that President Joe Biden signed into law in 2022. When Trump’s second term in office begins next year, he could work with Congress to change the rules around those rebates. Those potential changes could limit the federal rebates, including by reducing the amount of money available or limiting who is eligible.

Limiting federal subsidies on electric vehicle purchases would hurt many American automakers, including Ford, General Motors and the EV startup Rivian. Tesla, which also builds its automobiles in the United States, would take a smaller hit since that company currently sells more EVs and has a higher profit margin than any other EV manufacturer.

Newsom also announced earlier this month that he will convene a special session “to protect California values,” including fundamental civil rights and reproductive rights, that he said “are under attack by this incoming administration.”

“Whether it be our fundamental civil rights, reproductive freedom, or climate action — we refuse to turn back the clock and allow our values and laws to be attacked,” Newsom said on X on Nov. 7.

A spokesperson for Trump did not immediately respond to a request for comment.

This isn’t the first time California will be taking action against the Trump’s administration concerning clean transportation legislation.

In 2019, California and 22 other states sued his administration for revoking its ability to set standards for greenhouse gas emission and fuel economy standards for vehicles, The Associated Press reported.

California sued the Trump administration over 100 times during his first term, primarily on matters including gun control, health care, education and immigration, the Los Angeles Times reported.

California

45 Years Later, California Murder Mystery Solved Through DNA Evidence

A 45-year-old cold case of a 17-year-old girl brutally raped and murdered has been resolved, bringing closure to the family. On February 9, 1979, Esther Gonzalez walked from her parents’ home to her sister’s in Banning, California, roughly 137 km east of Los Angeles. She never arrived. The next day, her body was discovered in a snowpack near a highway in Riverside County, California. Authorities determined she had been raped and bludgeoned to death, leading to an investigation that spanned decades.

The lab was able to match the DNA to a man named Lewis Randolph “Randy” Williamson, who died in 2014. Williamson, a US Marine Corps veteran, called authorities on the fateful day to report finding Ms Gonzalez’s body. At the time, he claimed he could not identify whether the body was male or female. Described as “argumentative” by deputies, Williamson was asked to take a polygraph test, which he passed, clearing him of suspicion in the pre-DNA era. He had faced assault allegations in the past but was never convicted of any violent crimes, according to the Los Angeles Times.

Despite limited leads, the Riverside County cold case homicide team didn’t give up. A semen sample recovered from Ms Gonzalez’s body in 1979 was preserved but remained unmatched in the national Combined DNA Index System (CODIS) for decades.

In 2023, forensic technology finally caught up. The homicide team collaborated with a genetic lab in Texas that specialises in forensic genealogy. A sample of Williamson’s blood from his 2014 autopsy provided the DNA match needed to confirm him as the 17-year-old’s rapist and killer.

The Gonzalez family had mixed emotions—relief at finally having answers and sadness knowing Williamson would not face justice, as he died in Florida ten years ago. Ms Gonzalez, remembered by her family as a shy yet funny and mild-mannered young woman, was the fourth of seven children. Her oldest brother, Eddie Gonzalez, wrote on Facebook, “The Gonzalez family would like to thank the Riverside County Sheriff’s Department on a job well done. After 40 years, the Gonzalez family has closure.”

“We are very happy that we finally have closure,” Ms Gonzalez’s sister, Elizabeth, 64, shared with CNN. “We are happy about it but, since the guy has died, a little sad that he won’t spend any time for her murder.”

-

Business1 week ago

Business1 week agoColumn: Molly White's message for journalists going freelance — be ready for the pitfalls

-

Science6 days ago

Science6 days agoTrump nominates Dr. Oz to head Medicare and Medicaid and help take on 'illness industrial complex'

-

Politics1 week ago

Politics1 week agoTrump taps FCC member Brendan Carr to lead agency: 'Warrior for Free Speech'

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg) Technology1 week ago

Technology1 week agoInside Elon Musk’s messy breakup with OpenAI

-

Lifestyle1 week ago

Lifestyle1 week agoSome in the U.S. farm industry are alarmed by Trump's embrace of RFK Jr. and tariffs

-

World1 week ago

World1 week agoProtesters in Slovakia rally against Robert Fico’s populist government

-

Health3 days ago

Health3 days agoHoliday gatherings can lead to stress eating: Try these 5 tips to control it

-

News1 week ago

News1 week agoThey disagree about a lot, but these singers figure out how to stay in harmony