North Carolina

5 things to know: New school year begins, COVID numbers climb again in N.C.

Faculty college students are beginning to transfer again into their dorms. Youthful college students in North Carolina’s traditional-calendar faculties are on the point of begin a brand new 12 months in a pair brief weeks.

North Carolina’s coronavirus case numbers have seen a bump in current weeks, fueled by yet one more new variant. However greater than two years into the pandemic, the talk has modified.

Faculty boards in North Carolina, for essentially the most half, have dropped the heated, divisive discussions on masking. Vaccines are extensively out there, even for the youngest college students. And most of those that will not be vaccinated have some immunity as a result of they’ve already had the virus, public well being consultants say.

With a brand new time period on the horizon, right here’s what we find out about COVID to start out the third college 12 months of the pandemic:

What’s the COVID state of affairs in North Carolina?

COVID numbers in North Carolina have gone up over the summer time, this time pushed by the BA.5 variant.

There are greater than 1,350 folks within the hospital with the virus, based on the Division of Well being and Human Companies. North Carolina hasn’t had that many COVID sufferers within the hospital since late February.

Wastewater monitoring, a measure of how a lot virus is in wastewater across the state, continues to extend. With folks doing extra at-home assessments, public well being officers use wastewater monitoring as a extra reliable measure of how many individuals are contaminated.

Well being officers say that fewer individuals are ending up within the hospital or in intensive care due to vaccinations and new remedies for folks vulnerable to COVID’s worse signs. DHHS knowledge reveals that on common there have been 152 sufferers with the virus in intensive care models across the state.

Out of 100 counties in North Carolina, 67 are thought-about “excessive danger” by the Facilities for Illness Management and Prevention. The CDC advises folks to put on masks in public indoor areas in high-risk counties.

How many individuals are vaccinated or immune?

“Over 95% of the inhabitants in most of our districts will both be vaccinated, contaminated or each previously 12 to 18 months, which places each kids and adults within the college setting at a great state of affairs for COVID,” mentioned Dr. Danny Benjamin, a Duke pediatrician who studied masking in faculties in the course of the pandemic. He additionally suggested Wake County faculties on COVID insurance policies.

Statewide, about 63% of individuals are absolutely vaccinated, based on DHHS knowledge. About 59% of individuals in North Carolina have obtained not less than one booster shot.

Vaccines at the moment are out there for all age teams, together with the youngest college students.

The very best vaccination charges within the state are within the Triangle. Dare and Hyde counties on the coast, Inexperienced County within the east, and Buncombe County within the mountains all have vaccination charges about 65%, based on DHHS knowledge.

“There are some counties in North Carolina the place the vaccination charges are fairly low,” Benjamin mentioned. However, he added, “The mixed complete of vaccination plus an infection can be a excessive quantity in every of the counties in North Carolina.”

Are any faculties requiring masks?

No public college methods in North Carolina plans to require face masks originally of the college 12 months.

“We’re not listening to an entire lot of speak about COVID points from our members,” mentioned Leanne Winner, head of the North Carolina Faculty Boards Affiliation. Her group represents college boards from throughout the state.

“Our members are extra centered on staffing points and faculty security,” she mentioned.

“We’re at a degree within the pandemic the place many of the faculties act more often than not as if we’ve moved from an acute pandemic stage again to a give attention to training and scholar emotional wellbeing and the full well being of the scholar,” Benjamin mentioned.

“That’s excellent news not just for dad and mom and kids but additionally for directors and faculty boards,” he mentioned.

When ought to faculties require masks?

Benjamin, who spent a lot of the final two years determining how you can hold COVID out of colleges, mentioned requiring masks in faculties must be a final resort.

He mentioned it’s time for varsity well being insurance policies to get again to extra routine approaches to preserving college employees and college students wholesome. Consider how faculties dealt with the flu in 2019, he mentioned.

However his analysis does present that if faculties get a critical outbreak, whether or not that’s COVID or the flu, masks can sluggish the unfold.

“Implement masking provided that it’s to maintain the college open or if it’s in a particular circumstance, like we get a brand new variant sooner or later,” Benjamin mentioned.

If a virus received so dangerous that it threatened to close down a college with instructor absences, that’s when a college ought to think about a brand new masks mandate, he mentioned.

“In the event that they get a brand new variant or have a lot of infections, whether or not it’s influenza, RSV or another virus, then they’ve instruments at their disposal,” Benjamin mentioned.

What about youngsters and employees who’re in danger?

Benjamin mentioned anybody who’s medically susceptible must be vaccinated and, in the event that they’re eligible, boosted.

“Any little one who’s significantly susceptible or at larger danger medically, clearly you ought to be in contact along with your little one’s pediatrician,” he mentioned. “Sporting a masks for that individual little one will not be as properly researched as common masking however most likely helps some.”

“It’s one thing that oldsters might do in the event that they so select,” he mentioned.

For employees and college students with at-risk relations at house, he mentioned they need to use at-home assessments to ensure they aren’t bringing the virus house.

Analysis revealed not too long ago by Benjamin and Duke Medical’s ABC Collaborative discovered that when kids get COVID at college they typically solely transmit that to somebody at house 25 to 30% of the time.

The principle message from Benjamin is that this 12 months faculties must be able to get again to educating college students, with out face masks, however be prepared to reply in case there’s a giant virus outbreak, whether or not that’s the annual flu or a brand new spike in COVID circumstances.

North Carolina

Freeze watch issued for counties in Western North Carolina

CHARLOTTE, N.C. (WBTV) – A freeze watch was issued on Wednesday for counties in Western North Carolina.

Officials said that the freeze watch was issued for Ashe, Avery, and Watauga counties along with southwest and west central Virginia, southeast West Virginia, and the northern mountains of North Carolina.

The freeze watch was expected to last through Friday morning, according to officials.

Temperatures were expected to reach as low as 28 degrees for Ashe, Avery, and Watauga counties.

Forecast –> Charlotte Metro to remain cool and dry through the weekend

Thursday and Friday morning will start in the 30s and low 40s for most across the area. Temperatures in the upper 20s are even possible in our mountain communities on Friday morning, prompting a freeze watch for those locations.

Copyright 2025 WBTV. All rights reserved.

North Carolina

North Carolina loses three more players, including early season offensive line starter

Three more players have left the North Carolina football team amid a tumultuous start to head coach Bill Belichick’s first season with the Tar Heels.

Offensive lineman William Boone, pass rusher Pryce Yates and tight end Yasir Smith are no longer with the team, a team spokesman confirmed to WRAL on Tuesday. Inside Carolina first reported the departures.

None of the players are listed on the team’s online roster. UNC (2-4 overall, 0-2 in the ACC) hosts No. 16 Virginia on Saturday.

Boone, a transfer from Prairie View A&M, started the first three games of the season. His agent posted on social media that Boone “will be pursuing a medical redshirt in hopes of having 2 years of eligibility remaining. He should be 100% for spring practice.”

Yates, a transfer from UConn, played in just one game for the Tar Heels after dealing with an injury in the early part of the season. Smith, a freshman tight end, didn’t appear in a game for the Tar Heels.

Previously, senior running back Caleb Hood announced his retirement after UNC’s fifth game of the season. Hood scored the first touchdown of the Belichick era in the season opener against TCU.

Wide receivers Paul Billups and Aziah Johnson and offensive tackle Treyvon Green also left the program earlier this season.

The most recent departures come two weeks after a WRAL report that players brought in by Belichick were receiving preferential treatment over those who were with the program before Belichick’s arrival. One assistant coach was suspended for NCAA violations tied to the report, though cornerbacks coach Armond Hawkins is back with the team.

Several sources who spoke to WRAL News, including high school football coaches, former UNC players and an NIL agent, said Belichick’s demeanor when it comes to recruiting and dealing with former players is starting to sour people from the program.

While the program has faced scrutiny and a call for an independent review for student leadership, Belichick refuted a report that he was looking for an early exit from the program and said he felt the reports of a divide in the locker room were unfounded.

“I don’t know what kind of perspective some of those people have that are saying that, but I think anybody that’s around it on a daily basis would see that,” Belichick said in an Oct. 13 press conference.

“I’m sure the players all see the improvement they’re making.”

North Carolina

North Carolina Supreme Court Lets Stand Greg Lindberg’s Civil Fraud Liability

The North Carolina Supreme Court has decided that it will not, after all, review another legal filing by convicted insurance entrepreneur Greg Lindberg.

The Oct. 17 ruling lets stand a 2023 decision by the state Court of Appeals, which found that Lindberg and some of his affiliated companies were liable for fraud by misleading life insurance companies and a reinsurance firm that he once owned.

“We hold the trial court’s conclusions of law were supported by findings of fact based on competent evidence,” the appeals court judges wrote in the 2023 opinon.

The high court in December 2023 had agreed to review the appeal court’s order, at Lindberg’s behest. But after hearing oral arguments, the Supreme Court justices changed their minds, noting that “discretionary review was improvidently allowed by order on 13 December 2023.”

No further explanation was offered. But with multiple criminal and civil proceedings stemming from the bribery conviction of and the regulatory crackdown on Lindberg, the appeal court’s 24-page opinion offers a valuable recount of some of the main aspects of the voluminous litigation involving Lindberg since 2016.

“Simply put, Lindberg created a scheme in which he caused $1.2 billon held for Plaintiffs’ policyholders to be invested into other non-insurance companies that he also owned or controlled,” the appellate judges wrote in the opinion in Southland National Insurance Corp., et al, vs. Greg Lindberg, et al.

It all began in 2014 under previous North Carolina Insurance Commissioner Wayne Goodwin, the court explained. Lindberg sought to re-domesticate Southland, Bankers Life Insurance Co., Colorado Bankers Life Insurance Co., and Southland National Reinsurance Corp. to North Carolina. Lindberg struck a special agreement with Goodwin, allowing Lindberg to break what has often been considered a cardinal rule for insurance companies – keeping adequate reserves on hand and under the control of the insurance carrier.

Instead, Lindberg was allowed to invest up to 40% of the insurance companies’ assets into affiliated business entities, and Lindberg soon invested hundreds of millions into non-insurance firms he owned or controlled.

In 2016, Mike Causey defeated Goodwin in the election and took over as insurance commissioner. Causey moved swiftly to reduce the cap on affiliated investments – back to 10%, the court explained.

Lindberg in early 2018 attempted to bribe Causey with heavy campaign contributions, hoping for a relaxation of the rules as he struggled to “untangle his affiliated investments,” the appellate judges noted. Causey cooperated with federal authorities and wore a recording device during the meeting with Lindberg. Lindberg was convicted of bribery in 2020, had his conviction overturned due to improper jury instructions, then was convicted again in 2024. He’s still awaiting sentencing.

Meanwhile, in late 2018, while Lindberg’s prosecution was pending, it became obvious that Lindberg’s affiliated companies would not meet their obligations to restore funds to cover the life insurers’ policyholder liabilities. NCDOI placed Southland and the other insurance companies under administrative supervision. An out-of-state consultant was put in charge, and deadlines were set for repayment of the assets.

With it becoming clear that Lindberg’s affiliated firms would not meet the deadlines, Southland and the other insurance companies signed a memorandum of understanding and other agreements, restucturing the financial obligations, providing a $40 million line of credit to a company owned by Lindberg, and making the affiliated firms subsidiaries of a newly created holding company, the court explained.

In 2019, Lindberg’s affiliated firms failed to meet the restructuring agreements’ goals and failed to make the affiliated businesses part of the holding company. Southland filed suit, charging fraud.

The trial court in Wake County largely agreed, and the appeals court upheld the lower court’s ruling.

“Defendants attempt to convince this Court that the MOU’s main purpose was not only to rehabilitate Plaintiffs’ companies, but to ensure Lindberg would continue to benefit from the overall transaction,” the appellate judges wrote. “This argument ignores another of Defendants’ motivations: to make money using capital provided by hardworking, North Carolina policyholders.”

Lindberg’s team claimed that the memorandum of understanding was unenforceable. The appeals court didn’t buy that argument.

“Defendants and Lindberg have enjoyed the benefit of millions of dollars of debt relief provided by Plaintiffs, yet continue to claim the MOU is unenforceable,” the court wrote.

On other arguments the court was equally critical of Lindberg’s assertions.

“Put plainly, Defendants made representations about their ability to perform under the MOU, then just two weeks before performance was due, cited those exact representations as the reason why they could not perform,” Judge April Wood wrote in the opinion.

And because Lindberg understood the intricacies of the affiliated businesses’ structures, he knew that performance under the MOU was impossible, “yet made representations that induced Plaintiffs to enter into the contract. For those reasons, we hold the trial court did not err in finding Defendants’ actions satisfied the elements of fraud.”

The appeals court remanded part of the case to the lower court to determine remedies available to Southland and the other plaintiff insurance companies.

In November 2024, Lindberg pleaded guilty to $2 billion in fraud in a related prosecution. In July of this year, a federal judge approved a plan to distribute $318 million from the sale of a Lindberg-owned software firm to the life insurance policyholders. In early October, the judge allowed the release of policyholder information so that a special master in the case could finally begin distributing funds to the victims of the fraud.

Read more about Lindberg’s bribery conviction here, and other court rulings here.

Topics

Fraud

North Carolina

Liability

-

World2 days ago

World2 days agoIsrael continues deadly Gaza truce breaches as US seeks to strengthen deal

-

Technology2 days ago

Technology2 days agoAI girlfriend apps leak millions of private chats

-

News2 days ago

News2 days agoTrump news at a glance: president can send national guard to Portland, for now

-

Business2 days ago

Business2 days agoUnionized baristas want Olympics to drop Starbucks as its ‘official coffee partner’

-

Politics2 days ago

Politics2 days agoTrump admin on pace to shatter deportation record by end of first year: ‘Just the beginning’

-

Science2 days ago

Peanut allergies in children drop following advice to feed the allergen to babies, study finds

-

News1 day ago

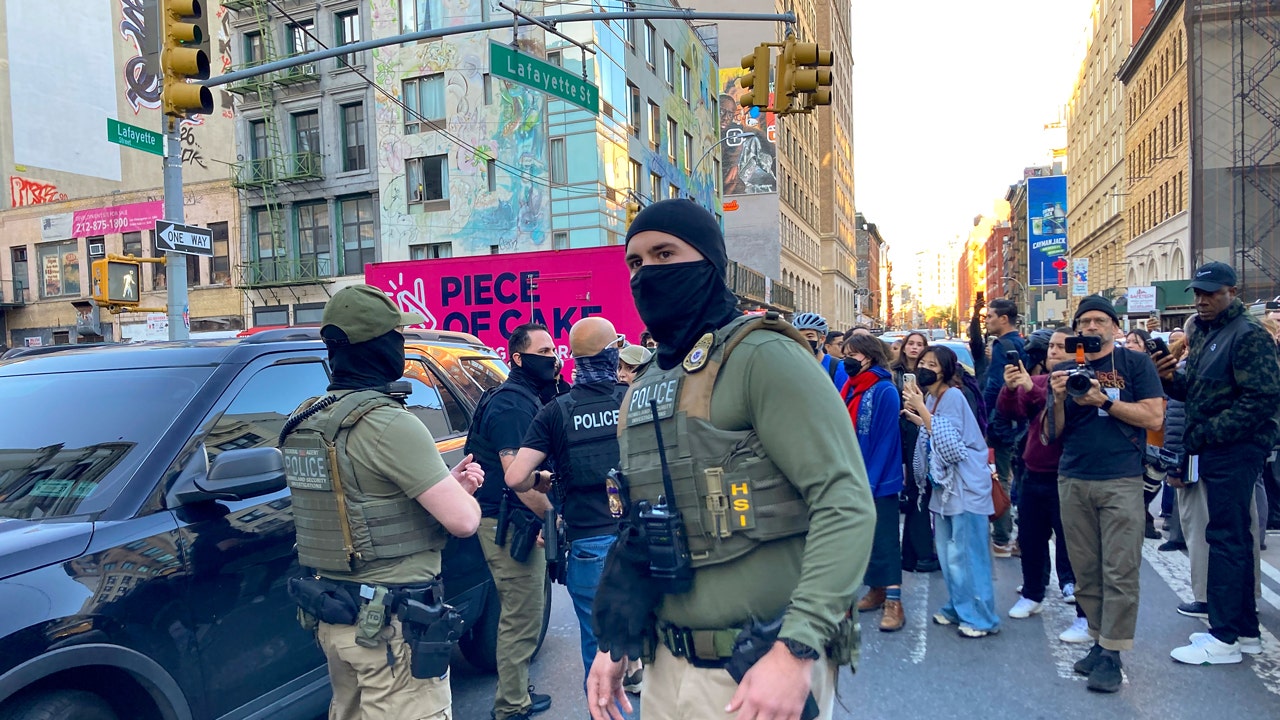

News1 day agoVideo: Federal Agents Detain Man During New York City Raid

-

News1 day ago

News1 day agoBooks about race and gender to be returned to school libraries on some military bases