If you want a bellwether to measure the broad impact of Donald Trump’s tariffs on the economy, look south, to Georgia. The political swing state has a $900bn economy – somewhere between the GDPs of Taiwan and Switzerland.

The hospitality industry is facing an existential crisis. Wine merchants wonder aloud if they will survive the year. But others, like those in industrial manufacturing, will carefully argue that well-positioned businesses will profit. Some say they’re insulated from international competition by the nature of their industry. Others, like the movie industry, are simply confused by the proposals that have been raised, and are looking for entirely different answers. So far, it’s a mixed bag.

In a state Donald Trump won by two points and with yet another pivotal US Senate race in a year, Republican margins are thinner than those of the retailers with their business on the line here.

Carson Demmond, a wine distributor in Georgia, finds herself looking at seaborne cargo notices for her wine shipments from France with the nervousness of a sports gambler watching football games. She’s betting on her orders of French champagne and bordeaux getting to a port in Savannah before tariffs restart.

It’s a risk. Demmond put a hold on orders after Donald Trump enacted sky-high tariffs on European goods last month. When he paused the tariffs days later, Demmond began to assess what she might chance on restarting some purchases.

But her wine isn’t showing up on a ship in France yet, she said.

“I don’t see them booked on ships yet, and normally they would already be booked, and I would already have sail dates,” she said. “I see a lot of my orders now collecting in consolidation warehouses in Europe, which says to me that there’s something wrong.”

Demmond suspects that shipping is suffering from a bullwhip-like effect from uncertainty around tariffs and the economy: so many buyers are trying to get ahead of tariffs that there aren’t enough shipping containers to go around to meet the short-term demand.

“It means that as strategic as I’m trying to be with regards to timing my orders so I don’t get hit with lots of tariff bills at the same time, I feel like now all of that is out of my control,” Demmond said. “I never want to face a situation where I have too many orders that all sail and land at the same time, and then getting hit with really large tariff bills in one fell swoop.”

US courts, meanwhile, are vacillating on the legality of Trump’s tariffs. The stock market rallied this week after the US court of international trade (CIT) ruled that Trump’s use of extraordinary powers under the International Emergency Economic Powers Act (IEEPA) exceeded his authority. Less than a day later, an appellate court lifted the lower court’s block on the tariffs while the case plays out.

Unpredictability is driving volatility, and volatility is poisonous to businesses built for stable markets and stable prices.

Georgia’s ports have not yet witnessed the massive slowdown occurring on the west coast. Shipping at the port of Los Angeles is down by a third as buyers cancel orders from China. But Savannah – the third-busiest port in the United States behind the Los Angeles area and New York/New Jersey ports – just came off its busiest month.

“We’re still watching how this goes,” said Tom Boyd, chief communications officer for Georgia’s ports authority. “We still are having 30 to 32 vessels a week. Most everybody has been front loading to avoid any supply chain disruptions. Volumes are strong, but we expect volumes to decrease.”

Savannah’s port sees more ships from the Indian subcontinent, Vietnam and Europe than from China, because it’s a few days shorter from India through the Suez Canal than across the Pacific, he said.

Demmond, who runs the wine distributor Rive Gauche, watches the reports up and down the eastern seaboard carefully because many of the ships from Europe dock in New Jersey before coming south, she said. About 60% of her business is in French wine. Shipping volumes are making logistical planning difficult, she said. Amazon has hired away warehouse workers, which slows down unloading and can leave her wine on a ship for longer periods.

She likened the logistical disruption today to the effects of Covid-19 shutdowns.

“There’s going to be a crazy ripple effect through multiple industries,” Demmond said. “In normal times, I could count on approximately eight weeks from the time I send my purchase order to the winery for them to prepare it, to the time that it arrives at port. Now, you know, I have no idea, because everything is different and unpredictable. I have a hard time quoting arrival times to people.”

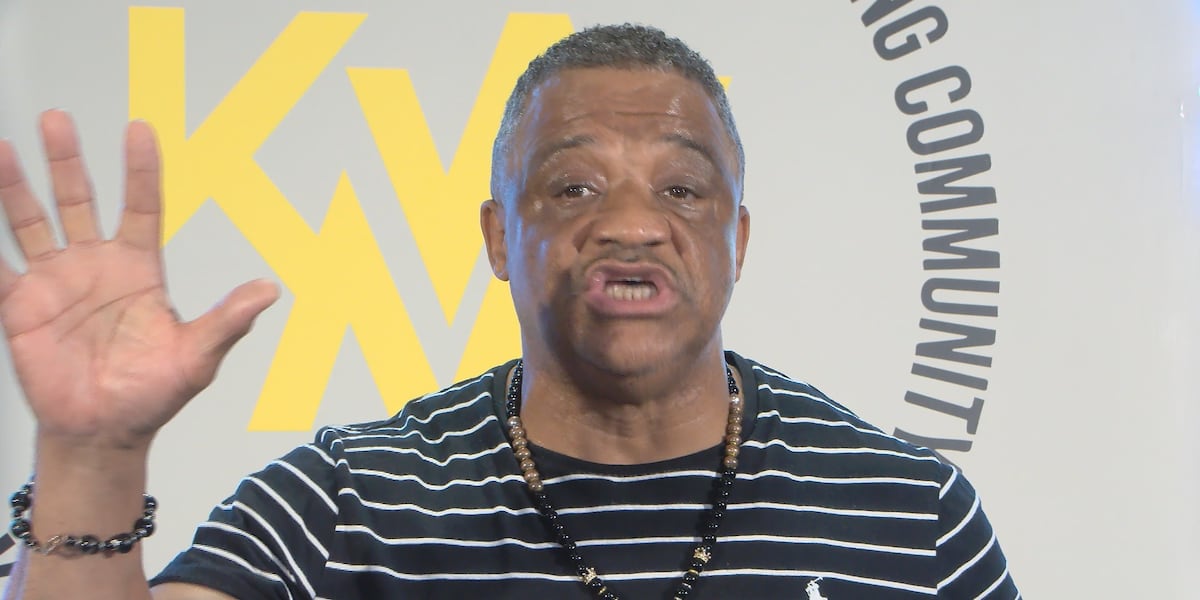

Demmond is a wine merchant, not a political economist. Predicting the course of trade negotiations has become a business hazard. She and other Georgia wine distributors met with the representative Hank Johnson last month to describe the effect of a 200% tariff on European wine imports on their business.

Many restaurants derive half of their revenue or more from alcohol sales. If the cost of spirits triples, many people will change their dining habits. Domestic supply can’t make up the difference, she said. A decision to expand a domestic winery made today wouldn’t produce a bottle of wine for three to five years. By then, Congress or a new president may have rescinded the tariffs, blowing up the investment.

If it were just European liquor, a conservative might dismiss the disruption as something affecting well-heeled wine snobs. But the problem has wide applicability, Demmond said.

“There are no American coffee growers. There are no coffee farms here,” she said. “That’s an impossibility. All you’re doing is increasing prices. You’re not helping create jobs by taxing that stuff. Some of it is impossible to re-shore.”

Georgia calls itself the Peach state, but California has long eclipsed Georgia’s peach production. Instead, the most widely exported Georgia peach has been the one moviegoers see at the end of the credits: Georgia had $2.6bn in film and television production in 2023.

Georgia’s tax incentive program is among the most aggressive in the US and the reason Georgia has become a rival to Hollywood. It’s an economic development strategy that has unusually bipartisan support in a state famously split down the middle politically. Studios have invested billions in Georgia over the last 10 years.

Between Disney’s Marvel movies like The Avengers, Tyler Perry’s studios in Atlanta and Netflix productions like Stranger Things, Georgia has overtaken Hollywood as a center for cinematic production. In any given year, studios spend $2-$4bn making movies in Georgia, according to figures from the Georgia Film Office.

But the tax-incentive-chasing film industry is fickle. Acres of shiny new studio space springing up across the state have not prevented the movie business from slowing down a bit over the last couple of years. With the release of Thunderbolts*, for the first time in more than a decade no Marvel movies are slated for production in Georgia. Disney has shifted to studios in England and Australia.

So when Donald Trump said he wanted a 100% tariff on foreign-produced films, Georgia Entertainment CEO Randy Davidson did a double take.

“It kind of took people by surprise,” Davidson said. “You know, on the one hand, you have people that have been struggling with their jobs here already, thinking initially that was going to be like a quick-fix answer to get production back here. … And then there was the other side: how is politicizing movies into the tariff discussion beneficial? Because it doesn’t make sense.”

Trump’s tariff talk emerged after a meeting at the White House with actor Jon Voight and independent film producer Steven Paul. Voight proposed to support the domestic film industry with federal tax credits and international cooperative production agreements, not with a tariff, said Duncan Crabtree-Ireland, Sag-Aftra’s chief negotiator and national executive director.

“You know, we haven’t had a federal tax incentive in the United States,” Crabtree-Ireland said. “It’s quite common in a lot of major production centers around the world now, and I think it’s definitely time for us to have that conversation.”

Films are largely a digital service today. Setting aside the logistical difficulty of assessing a tariff on intellectual property, doing so would violate American law.

Crabtree-Ireland suggested that Trump’s rhetoric might be an aggressive negotiating ploy, starting out with an extreme stand that moves a compromise point to a more favorable position. But a workable plan would have more nuance, Crabtree-Ireland said: “Which is what I think ultimately would be under consideration.”

Crabtree-Ireland said he wouldn’t expect a federal tax incentive to supplant state tax credits. But any international agreement to level the incentive playing field would have to address it.

“What Georgia can hope for is that this topic does not get entangled in a charged-up political atmosphere where it will have a shot to be an actual bipartisan effort and initiative that would actually be good for the country,” Davidson said.

As Georgia companies try to manage inventory before a tariff deadline, warehouse space is only one issue. Capital is another.

“Most companies can’t afford to get two years’ worth of inventory to manage their business while we figure out what’s going to happen, right? So, they’re going to buy a little time, but not a lot,” said Carl Campbell, an executive director for business recruitment at the Dalton chamber of commerce.

Not that there’s a warehouse to be rented in Dalton right now. The north Georgia mill town of about 34,000 in far-right representative Marjorie Taylor Greene’s district is a longstanding center of the carpet-and-flooring industry in the US. But it has had competition for warehouse and industrial space in recent years from solar panel manufacturers, spurred by state tax incentives, the Infrastructure Investment and Jobs Act and federal incentives for the semiconductor industry.

“Everything’s full, you know.” Campbell said. “We’ve got companies that are going to grow manufacturing capacity. They’re currently deciding where to do it, and so the tariffs may swing it to the US. Sometimes that’s swinging that our way. Sometimes it’s making that decision happen sooner rather than later, and sometimes it makes it not happen at all.”

Campbell notes that both Democrats and Republicans can lay claim to Dalton’s industrial successes. Qcells, a solar panel manufacturer owned by the Korean conglomerate Hanwha, is an example, he said.

“When Trump was in office the first time, he implemented tariffs on goods from China,” Campbell said. “They suddenly got very, very serious about doing panel production and assembly in the US. And they had to do that quickly and as fast as possible.” The same tariff regime began imposing costs on imported flooring from Asia, which boosted Dalton’s flooring manufacturers.

Three years later, the Inflation Reduction Act – enacted under Joe Biden – added incentives for clean energy manufacturing, and Georgia’s two Democratic senators, Jon Ossoff and Raphael Warnock, worked to make sure some of the benefit landed in Georgia. About $23bn has been invested in clean energy production in the state since the act passed. Qcells used those incentives to expand in 2023, and employs more than 2,000 people today.

“Tariffs are sometimes a tale of winners and losers. And so, yeah, we won a little bit on that,” Campbell said. “And of course, some of our companies got hurt, and they lost a little bit on that.”

The problem, again, is uncertainty, he said.

“It can create an opportunity for folks like me and companies like ours, yeah, but it can also crush business plans – if you’re reliant on foreign goods and suddenly you just took a 25% hit on your cost. It’s made some people sit on their hands and not move forward on some efforts that we were thinking would happen soon. It’s made some other folks, you know, escalate plans and have to do them faster.”