Florida

3 Florida property insurance companies announce reduction in rates, desire to give homeowners some relief

JACKSONVILLE, Fla. – Three Florida property insurance companies have either announced a reduction in their rates or the desire to pass some relief on to homeowners.

Insurance experts call this move a glimmer of hope in an otherwise troubled insurance market in Florida.

The reductions in property insurance premiums don’t equate to a whole lot of money, but they could mean a step in the right direction.

Bridget Shearn talked about how much she pays right now for property insurance; in a house she’s owned for the past 26 years.

″It’s huge, 4,000 is a lot of money, it’s not like I have a huge house,” Shearn said. “It went up $1,000 from last year, and from that year, it went up like $2,000.”

RELATED | 8 new property insurance companies coming to Florida to promote market stability | Property insurance expert says 8 new companies will increase competition, opportunities

News4JAX spoke with Cooper Nightingale, who said his premium skyrocketed steadily from 2019 to the present.

“When I first moved in my house I was paying, $1,600 a year, and now it’s like $5,000,” Nightingale said.

TELL US | Has your bill gone up in the last year?

Nightingale said his premium consistently jumped 15 to 20% each year. But now, there’s some potentially good news on the horizon for Florida homeowners.

The following three companies have either reduced their rates or are seeking a rate reduction from the Office of Insurance Regulation:

-

Florida Peninsula Insurance announced a 2% average reduction in property insurance for the more than 122,000 residential policies it insures, for new policies and renewals, starting in July.

-

Slide Insurance Company is seeking a 0.5% decrease in the average rate it charges to insure single-family homes.

-

Florida Family Insurance Company is also seeking a 0.5% decrease in premiums for owners of houses, condominium units and rentals.

There’s also encouraging news from the state-backed insurance company Citizens, which posted a net income of $746 million last year, compared to a $2.2 billion loss in 2022.

Citizens has also successfully used depopulation to decrease its policy count – that’s where customers are shifted to private insurance. They’ve gone from 1.4 million customers in Sept. 2023, to 1.17 million by the end of February.

MORE | Approval of thousands of property insurance policies taken from Citizens means ‘good news’ for Florida, experts say

The homeowners News4JAX spoke with on Monday just learned about what could be positive news. However, they remained skeptical because they hadn’t seen any relief on their premium yet.

“I don’t think so, that would be great, that would be wonderful,” Nightingale said.

Nightingale said he’d have to see it to believe it.

Fraudulent lawsuits were also a big reason for the property insurance crisis, but the reforms in the legislation last year seem to be working.

According to S&P’s global report, the spending on legal defense costs by Florida Insurance fell by approximately 4%.

Florida still leads the nation in the number of litigated property insurance claims. But there appears some headway in this direction as well.

Copyright 2024 by WJXT News4JAX – All rights reserved.

Florida

Hot air: Heat index to hit 105 degrees in Central Florida this weekend

ORLANDO, Fla. – A large cluster of storms continues to travel across the Florida Panhandle, sparking several severe thunderstorm warnings Friday morning.

Some of that energy could hold together through mid-morning and potentially clip northwestern counties of Central Florida, including Marion, Lake and Sumter. For this reason, rain chances remain slightly higher at 40-50% into the afternoon for those counties.

[EXCLUSIVE: Become a News 6 Insider (it’s FREE) | PINIT! Share your weather photos]

Later in the day, added moisture and instability from this area will help fuel a few scattered showers along the sea breeze. Rain chances elsewhere in Central Florida remain low at 20-30%.

For those not seeing much rain, expect another very hot day, with highs returning to the mid-90s and feeling closer to 100 degrees.

Forecast models are in a bit of disagreement as we head into the weekend ahead of an approaching cold front. Some models show another ball of energy emerging from the Gulf of Mexico on Saturday, increasing rain chances by late morning, while other models continue the typical sea breeze driven storms later in the day.

With this uncertainty, we will keep a 40-50% shot for rain and storms on Saturday. Along with more storms, highs will heat up even further — into the upper 90s, with heat indices at 100-105 degrees.

By Sunday, a surface cold front will approach the area and looks to bring our best opportunity at widespread rainfall, with coverage at 70-80%. Don’t be surprised to see a few storms becoming strong to marginally severe. With additional rain and clouds, temperatures should remain cooler in the upper 80s.

Copyright 2024 by WKMG ClickOrlando – All rights reserved.

Florida

‘Now is the time to act’: Florida battling lithium-ion battery fires as more electric vehicles hit the roads

TALLAHASSEE, Fla. (WCTV/Gray Florida Capital Bureau) – The state of Florida is developing new standards for managing lithium-ion battery fires.

State Fire Marshal Jimmy Patronis said new rules are needed because electric vehicles and other devices like e-scooters and e-bikes are becoming more common.

“The danger is known. It is real. Now is the time to act,” Patronis said during a news conference in Orlando.

The Department of Financial Services began making rules Thursday to develop standards for managing lithium-ion battery fires. Patronis said having standards for handling these fires is critical for Florida because electric vehicles can catch fire shortly after a hurricane.

“These heavily metalized saltwater create bridges on these batteries and they short out. And when they short out they will create a cascade effect,” Patronis said.

Patronis said 20 EVs caught fire after Hurricane Ian in 2022. Florida Professional Firefighters President Bernie Bernoska said firefighter safety needs to be looked at more than just trying try put out these fires.

“Beyond the challenge of simply extinguishing these fires, there’s also another danger that is sometimes overlooked and deals with the harmful cancer-causing gases produced during a lithium battery fire incident,” Bernoska said.

In addition to creating state rules, Patronis is encouraging Congress to pass federal standards for lithium batteries.

“We’ve got to be sensitive to where the problems lie that have not yet been fully discovered or factored in how to deal with these technologies,” Patronis said.

It could take nine months to a year to develop the state standards.

Copyright 2024 WCTV. All rights reserved.

Florida

Man who allegedly defrauded CT victim of $100K+ extradited from Florida

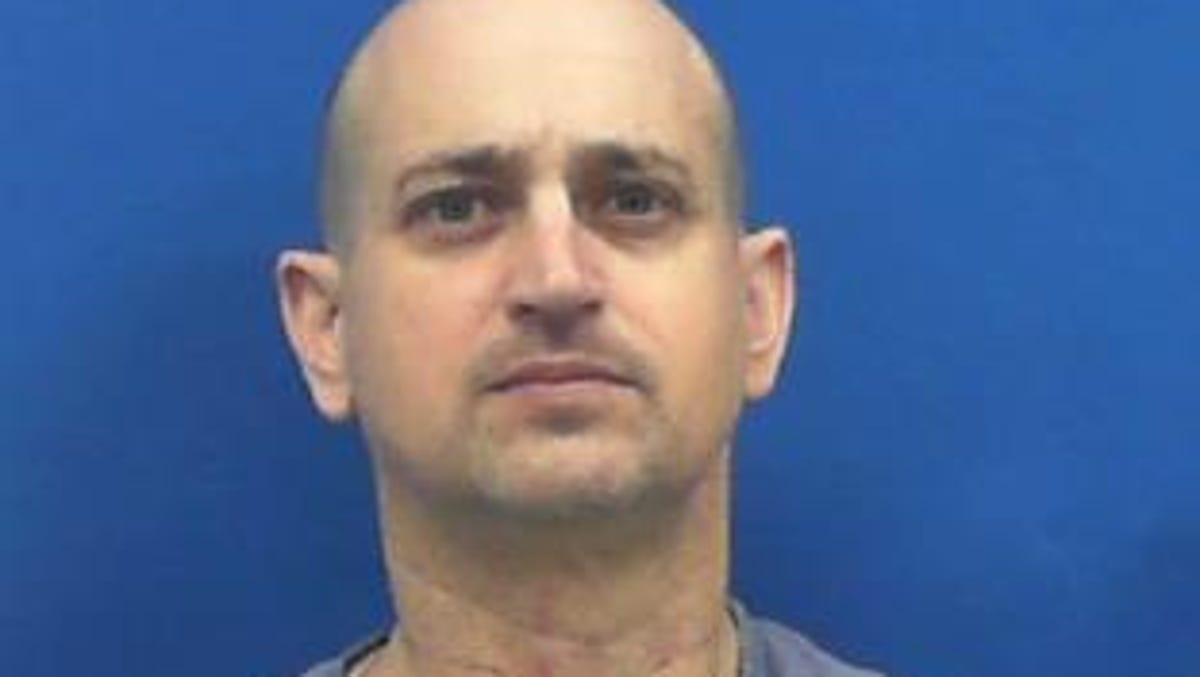

A Florida man was arrested for allegedly defrauding a victim in Connecticut of over $100,000, police said.

On Thursday, Coventry police arrested 29-year-old Osmaldy De La Rosa Nunez of Orlando, Florida, on one count of first-degree larceny after an investigation into a wire fraud in August 2022, according to the department.

Police alleged that De La Rosa Nunez communicated with the victim as a person with whom the victim was familiar and had money transferred to him that was due to a third party which amounted to a loss of around $135,000.

According to police, De La Rosa Nunez was using a fictitious name, and his true identity was discovered with the assistance of the Florida Department of Law Enforcement.

De La Rosa Nunez was held in Florida as a fugitive from justice, police said. He waived extradition and was transported back to Connecticut to face charges.

De La Rosa Nunez was being held on a $500,000 court-set bond and was scheduled to be arraigned at Rockville Superior Court on Friday.

-

Politics1 week ago

Politics1 week ago'You need to stop': Gov. Noem lashes out during heated interview over book anecdote about killing dog

-

News1 week ago

News1 week agoMan, 75, confesses to killing wife in hospital because he couldn’t afford her care, court documents say

-

Politics1 week ago

Politics1 week agoRFK Jr said a worm ate part of his brain and died in his head

-

World1 week ago

World1 week agoPentagon chief confirms US pause on weapons shipment to Israel

-

Politics1 week ago

Politics1 week agoHere's what GOP rebels want from Johnson amid threats to oust him from speakership

-

World1 week ago

World1 week agoPro-Palestine protests: How some universities reached deals with students

-

World1 week ago

World1 week agoConvicted MEP's expense claims must be published: EU court

-

Politics1 week ago

Politics1 week agoCalifornia Gov Gavin Newsom roasted over video promoting state's ‘record’ tourism: ‘Smoke and mirrors’