Rhode Island

Fed interest rate cuts could draw out-of-state homebuyers to Rhode Island, increasing home prices – The Boston Globe

Some experts expect the reduction could come as soon as next month, though Powell did not provide a specific timeline. “The time has come for policy to adjust,” the Fed chair said in a speech. “The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

Chris Whitten, president-elect of the Rhode Island Association of Realtors, told the Globe Friday that buyers who had been waiting for mortgage rates to fall may now move to acquire homes. The 30-year fixed-rate mortgage currently averages close to 6.5 percent, according to Freddie Mac.

Whitten suggested that lower borrowing costs could encourage potential homeowners from across the border in Massachusetts, for example, to look for more affordable options in Rhode Island.

In July, the median price for a single-family home in Rhode Island had risen to $495,000, a 12.5 percent increase over a year ago. While home prices may be going up in the Ocean State, in neighboring Massachusetts homes are even more expensive. The median price of a single-family home in the Bay State is $678,500, according to the Massachusetts Association of Realtors.

During the pandemic when rates were lower, willing buyers who were priced out of Massachusetts towns close to the Rhode Island border — like Rehoboth, North Attleboro and Plainville — were looking to purchase in the Rhode Island communities of Lincoln, Cumberland, Burrillville and East Providence, where homes were less expensive, Whitten said.

“What I anticipate with the rates coming down is that you’re going to have a lot of people coming from Massachusetts looking over the border, because things are a little bit more affordable,” he told the Globe. “We did see that happen, and I really anticipate that will be the case again, once the rates start to go low, because we’re going to have more buyers in the market and the prices going up due to the supply and demand.”

Whitten said that Rhode Island has struggled to build enough homes to match increasing demand. “Here’s another thing that’s sadly unique to Rhode Island. We are dead last in new construction build and we are also dead last in the country in permits, the start of new construction,” Whitten said. “We are a small state, and we love it for so many reasons, but we are a small state that doesn’t have a lot of land to develop.”

Rhode Island Realtors has been working to encourage policymakers to reduce red tape to allow for more homes to be developed, Whitten said, to increase the supply of homes and ease the pressure on prices in the state’s housing market.

“You’re looking at a lot of existing, preexisting, homes that everybody is going to be buying and selling and very, very, very few new construction homes,” he said.

Omar Mohammed can be reached at omar.mohammed@globe.com. Follow him on Twitter (X) @shurufu.

Rhode Island

Attorney General Neronha endorses Democrat Helena Foulkes for Rhode Island Governor

(WJAR) — Rhode Island Attorney General Peter Neronha endorsed Democrat Helena Foulkes in her bid for Rhode Island Governor on Thursday.

Neronha spoke at a campaign event with Foulkes.

The term-limited Attorney General says he hadn’t been comfortable endorsing people because of his position.

Neronha said he had gotten to know Foulkes after she reached out to him about health care, an issue Neronha has been vocal about.

“I found Helena to be a great listener, a great thought partner, a person of integrity and character, and that is foremost why I’m endorsing her today,” he said.

“What Rhode Island needs today and into the future is strong capable leadership,” he said. “This is not a state that can afford to keep muddling around in the four, eight, ten, fifteen years.”

He said Foulkes could offer bold leadership.

Neronha has publicly admitted to having a strained relationship with Gov. Dan McKee.

JOIN THE CONVERSATION (1)

This story will be updated.

Rhode Island

RI Lottery Powerball, Numbers Midday winning numbers for March 4, 2026

The Rhode Island Lottery offers multiple draw games for those aiming to win big.

Here’s a look at March 4, 2026, results for each game:

Winning Powerball numbers from March 4 drawing

07-14-42-47-56, Powerball: 06, Power Play: 4

Check Powerball payouts and previous drawings here.

Winning Numbers numbers from March 4 drawing

Midday: 2-7-4-4

Evening: 7-6-0-2

Check Numbers payouts and previous drawings here.

Winning Wild Money numbers from March 4 drawing

08-11-12-18-24, Extra: 15

Check Wild Money payouts and previous drawings here.

Winning Millionaire for Life numbers from March 4 drawing

12-13-36-39-58, Bonus: 03

Check Millionaire for Life payouts and previous drawings here.

Feeling lucky? Explore the latest lottery news & results

Are you a winner? Here’s how to claim your prize

- Prizes less than $600 can be claimed at any Rhode Island Lottery Retailer. Prizes of $600 and above must be claimed at Lottery Headquarters, 1425 Pontiac Ave., Cranston, Rhode Island 02920.

- Mega Millions and Powerball jackpot winners can decide on cash or annuity payment within 60 days after becoming entitled to the prize. The annuitized prize shall be paid in 30 graduated annual installments.

- Winners of the Millionaire for Life top prize of $1,000,000 a year for life and second prize of $100,000 a year for life can decide to collect the prize for a minimum of 20 years or take a lump sum cash payment.

When are the Rhode Island Lottery drawings held?

- Powerball: 10:59 p.m. ET on Monday, Wednesday, and Saturday.

- Mega Millions: 11:00 p.m. ET on Tuesday and Friday.

- Lucky for Life: 10:30 p.m. ET daily.

- Millionaire for Life: 11:15 p.m. ET daily.

- Numbers (Midday): 1:30 p.m. ET daily.

- Numbers (Evening): 7:29 p.m. ET daily.

- Wild Money: 7:29 p.m. ET on Tuesday, Thursday and Saturday.

This results page was generated automatically using information from TinBu and a template written and reviewed by a Rhode Island editor. You can send feedback using this form.

Rhode Island

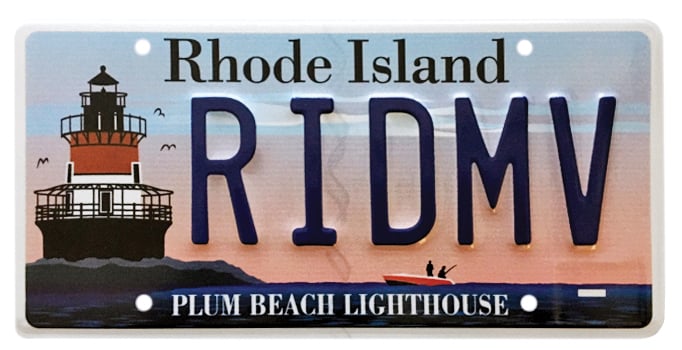

Ranking Rhode Island’s Most Popular Charity License Plates – Rhode Island Monthly

When it comes to expressing ourselves, Rhode Islanders have elevated license plates to an art form. You might not be able to get a new vanity plate — the state suspended applications in 2021 after a judge ruled a Tesla owner could keep his FKGAS plates — but you can still express your Rhody pride with one of seventeen state-approved charity plates. The program has funded ocean research, thrown parades, saved crumbling lighthouses and even provided meals for residents. About half of the $43.50 surcharge goes to the associated charity, while the other half covers the production cost.

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Atlantic Shark Institute

Year first approved: 2022

Plates currently on road: 7,007

Total raised: $269,530

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Friends of Plum Beach Lighthouse

Year first approved: 2009

Plates currently on road: 5,024

Total raised: $336,890

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Wildlife Rehabilitators Association of Rhode Island

Year first approved: 2013

Plates currently on road: 2,102

Funds raised: $32,080

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Rocky Point Foundation

Year first approved: 2016

Plates currently on road: 1,616

Funds raised: $50,450

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Rhode Island Community Food Bank

Year first approved: 2002

Plates currently on road: 765

Funds raised since 2021: $11,060*

*Prior to 2021, customers ordered plates directly through the food bank, and total revenue numbers are not available.

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

New England Patriots Charitable Foundation

Year first approved: 2009

Plates currently on road: 1,472

Funds raised: $136,740

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Audubon Society of Rhode Island and Save the Bay

Year first approved: 2006

Plates currently on road: 1,132

Funds raised: $61,380 for each organization (proceeds split evenly)

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Boston Bruins Foundation

Year first approved: 2014

Plates currently on road: 1,125

Funds raised: $36,880

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Beavertail Lighthouse Museum Association

Year first approved: 2023

Plates currently on road: 1,105

Funds raised: $37,610

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Bristol Fourth of July Committee

Year first approved: 2011

Plates currently on road: 1,104

Funds raised: $17,640

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Red Sox Foundation

Year first approved: 2011

Plates currently on road: 860

Funds raised: $88,620

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Gloria Gemma Breast Cancer Resource Foundation

Year first approved: 2012

Plates currently on road: 1,510

Funds raised: $33,360

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Providence College Angel Fund

Year first approved: 2016

Plates currently on road: 693

Funds raised: $23,220

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Rose Island Lighthouse and Fort Hamilton Trust

Year first approved: 2022

Plates currently on road: 383

Funds raised: $10,640

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Friends of Pomham Rocks Lighthouse

Year first approved: 2022

Plates currently on road: 257

Funds raised: $7,580

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Day of Portugal and Portuguese Heritage in RI Inc.

Year first APPROVED: 2018

Plates currently on road: 132

Funds raised: $3,190

-

World1 week ago

World1 week agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Wisconsin4 days ago

Wisconsin4 days agoSetting sail on iceboats across a frozen lake in Wisconsin

-

Massachusetts1 week ago

Massachusetts1 week agoMother and daughter injured in Taunton house explosion

-

Maryland5 days ago

Maryland5 days agoAM showers Sunday in Maryland

-

Massachusetts3 days ago

Massachusetts3 days agoMassachusetts man awaits word from family in Iran after attacks

-

Florida5 days ago

Florida5 days agoFlorida man rescued after being stuck in shoulder-deep mud for days

-

Denver, CO1 week ago

Denver, CO1 week ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Oregon6 days ago

Oregon6 days ago2026 OSAA Oregon Wrestling State Championship Results And Brackets – FloWrestling