Sign up for the Today newsletter

Get everything you need to know to start your day, delivered right to your inbox every morning.

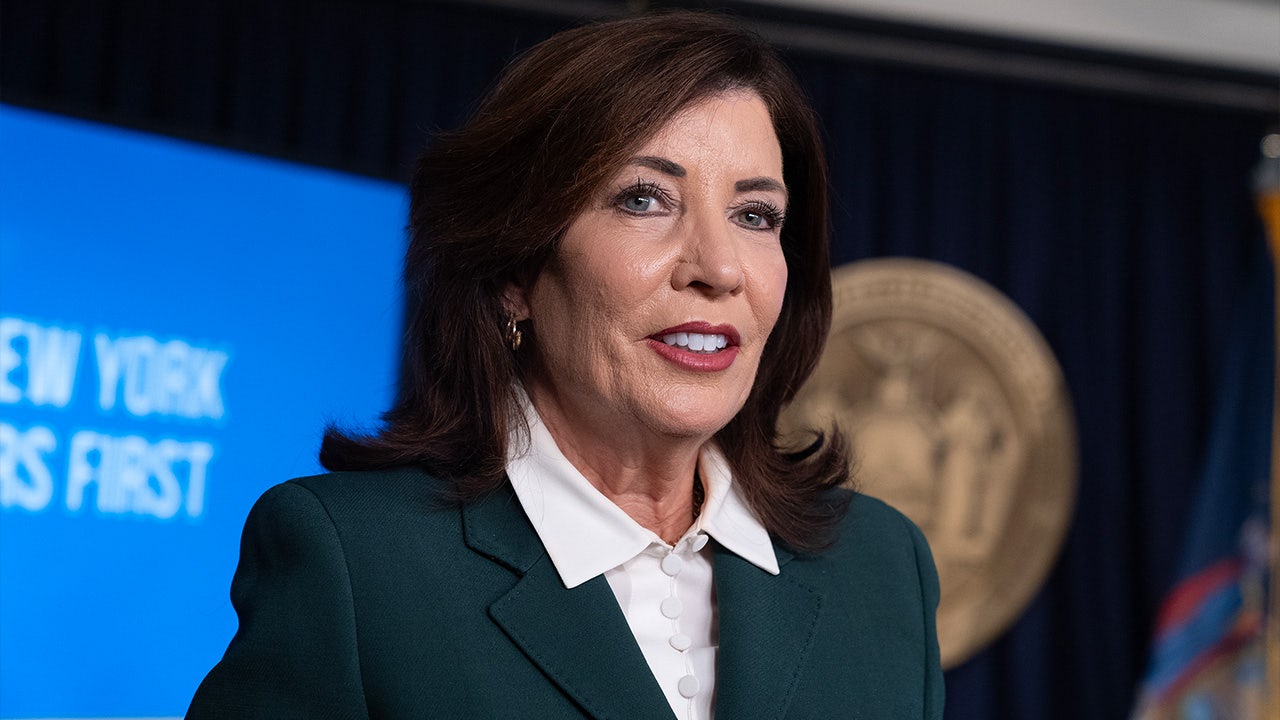

New York Democratic Gov. Kathy Hochul announced the first initiative of her 2025 State of the State plan: up to $500 in “inflation refunds” for New Yorkers dealing with spiking costs-of-living in the Empire State.

The proposal would take $3 billion in “excess” sales tax revenue that had been “driven by inflation” and return the money to nearly half of the state’s population.

Families making less than $300,000 would be eligible for $500, and individual taxpayers making less than $150,000 would receive $300 under the plan. The governor’s office said the announcement is one of several proposals aimed at lessening the burden on New Yorkers’ cost-of-living.

“Because of inflation, New York has generated unprecedented revenues through the sales tax — now, we’re returning that cash back to middle class families,” Hochul said in a statement Monday.

HOCHUL SPARKS BIPARTISAN OUTRAGE OVER CONGESTION PRICING REBOOT AS DEMS WORRIED TRUMP WOULD BLOCK IT

“My agenda for the coming year will be laser-focused on putting money back in your pockets, and that starts with proposing Inflation Refund checks of up to $500 to help millions of hard-working New Yorkers.

“It’s simple: the cost of living is still too damn high, and New Yorkers deserve a break,” said Hochul, offering a sentiment similar to that repeated by perennial candidate and Rent is Too Damn High Party founder Jimmy McMillan.

However, New York Republicans were not as receptive to Hochul’s plan, as NYSGOP Communications Director David Laska told Fox News Digital the governor appeared simply out to make friends rather than bring about long-term relief.

“With her approval rating deep underwater, Kathy Hochul is resorting to bribing New Yorkers to like her,” Laska said.

HOMAN SCOFFS AT HOCHUL’S SUDDEN OUTRAGE OVER VIOLENT MIGRANTS

“Handing out one-time checks won’t stop the crushing inflation Democrats’ policies have fueled – it will only add to it. New York needs real, permanent solutions: relief from our highest-in-the-nation tax burden and a rollback of job-killing regulations.”

New York City Council Minority Leader Joe Borelli claimed that the $300 offered to middle- and low-income residents would still be less than what is spent on each migrant daily.

“[That] is not that backslapping win the governor thinks it is,” said Borelli, R-Staten Island.

Borelli added that the plan “looks increasingly silly” in the face of Hochul’s successful push for congestion pricing and her borrowing “costly energy cues from the Greta Thunberg School of Energy Policy.”

“Newsflash for Kathy Hochul,” added Rep. Michael Lawler, R-N.Y., “Taking thousands of dollars out of New Yorkers’ left pocket and then putting $500 in their right pocket isn’t a tax cut, it’s an insult.”

State Sen. Rob Ortt, R-Niagara Falls, said that Democrats like Hochul continue to make New York State more expensive despite pleas for relief.

“The governor’s mindset is promising, however words are words,” said Ortt, the top Republican in the chamber.

New York state Senate Republican Leader Rob Ortt, R-Niagara Falls. (REUTERS/Jeenah Moon)

Ortt claimed that it is his caucus that is the true voice for hardworking New Yorkers seeking “real affordability… not just one-shot gimmicks.”

Meanwhile, Rep. Nicole Malliotakis, R-N.Y., said Albany needs to “stop treating New Yorkers like bottomless ATM machines” with their new tolls and tax hikes.

Malliotakis’ constituents now face an extra $9 “congestion” toll to enter Lower Manhattan, on top of an approximate $20 round-trip cost to commute on the state-owned Verrazzano Bridge.

“If she’d allow her constituents to keep more of their hard-earned money from the start, there would be no need for these ‘inflation refund’ checks to begin with.”

Hochul’s office estimated 8.6 million out of 19.5 million New Yorkers would benefit from the planned “refunds.”

Fox News Digital reached out to Hochul for further comment on the criticisms.

Read the full article from Here

Health

Massachusetts health officials have confirmed the state’s first two measles cases of the year, a school-aged child and a Greater Boston adult.

The Department of Public Health announced the cases Friday, marking the first report of measles in Massachusetts since 2024.

According to health officials, the adult who was diagnosed returned home recently from abroad and had an “uncertain vaccination history.” While infectious, the person visited several locations where others were likely exposed to the virus, and health officials said they are working to identify and notify anyone affected

The child, meanwhile, is a Massachusetts resident who was exposed to the virus and diagnosed with measles out-of-state, where they remain during the infectious period. Health officials said the child does not appear to have exposed anyone in Massachusetts to measles.

The two Massachusetts cases come as the U.S. battles a large national measles outbreak, which has seen 1,136 confirmed cases nationwide so far in 2026, according to the Centers for Disease Control and Prevention.

“Our first two measles cases in 2026 demonstrate the impact that the measles outbreaks, nationally and internationally, can have here at home,” Massachusetts Public Health Commissioner Robbie Goldstein said Friday. “Fortunately, thanks to high vaccination rates, the risk to most Massachusetts residents remains low.”

Measles is a highly contagious disease that spreads through the air when an infected person sneezes, coughs, or talks. The virus can linger in the air for up to two hours and may even spread through tissues or cups used by someone who has it, according to the DPH.

Early symptoms occur 10 days to two weeks after exposure and may resemble a cold or cough, usually with a fever, health officials warned. A rash develops two to four days after the initial symptoms, appearing first on the head and shifting downward.

According to the DPH, complications occur in about 30% of infected measles patients, ranging from immune suppression to pneumonia, diarrhea, and encephalitis — a potentially life-threatening inflammation of the brain.

“Measles is the most contagious respiratory virus and can cause life-threatening illness,” Goldstein said. “These cases are a reminder of the need for health care providers and local health departments to remain vigilant for cases so that appropriate public health measures can be rapidly employed to prevent spread in the state. This is also a reminder that getting vaccinated is the best way for people to protect themselves from this disease.”

According to the DPH, people who have had measles, or who have been vaccinated against measles, are considered immune. State health officials offer the following guidance for the Measles-Mumps-Rubella (MMR) vaccine:

Get everything you need to know to start your day, delivered right to your inbox every morning.

It’s a scheme made famous by a nearly 30-year-old episode of the sitcom Seinfeld.

Hoping to earn a quick buck, two characters load a mail truck full of soda bottles and beer cans purchased with a redeemable 5-cent deposit in New York, before traveling to Michigan, where they can be recycled for 10 cents apiece. With few thousand cans, they calculate, the trip will earn a decent profit. In the end, the plan fell apart.

But after Connecticut raised the value of its own bottle deposits to 10 cents in 2024, officials say, they were caught off guard by a flood of such fraudulent returns coming in from out of state. Redemption rates have reached 97%, and some beverage distributors have reported millions of dollars in losses as a result of having to pay out for excess returns of their products.

On Thursday, state lawmakers passed an emergency bill to crack down on illegal returns by increasing fines, requiring redemption centers to keep track of bulk drop-offs and allowing local police to go after out-of-state violators.

“I’m heartbroken,” said House Speaker Matt Ritter, D-Hartford, who supported the effort to increase deposits to 10 cents and expand the number of items eligible for redemption. “I spent a lot of political capital to get the bottle bill passed in 2021, and never in a million years did I think that New York, New Jersey and Rhode Island residents would return so many bottles.”

The legislation, Senate Bill 299, would increase fines for violating the bottle bill law from $50 to $500 on a first offense. For third and subsequent offenses, the penalty would increase from $250 to $2,000 and misdemeanor punishable by up to one year in prison.

In addition, it requires redemption centers to be licensed by the state’s Department of Energy and Environmental Protection (previously, those businesses were only required to register with DEEP). As a condition of their license, redemption centers must keep records of anyone seeking to redeem more than 1,000 bottles and cans in a single day.

Anyone not affiliated with a qualified nonprofit would be prohibited from redeeming more than 4,000 bottles a day, down from the previous limit of 5,000.

The bill also seeks to pressure some larger redemption centers into adopting automated scanning technologies, such as reverse vending machines, by temporarily lowering the handling fee that is paid on each beverage container processed by those centers.

The bill easily passed the Senate on Wednesday and the House on Thursday on its way to Gov. Ned Lamont.

While the bill drew bipartisan support, Republicans described it as a temporary fix to a growing problem.

House Minority Leader Vincent Candelora, R-North Branford, called the switch to 10-cent deposits an “unmitigated disaster” and said he believed out-of-state redemption centers were offloading much of their inventory within Connecticut.

“The sheer quantity that is being redeemed in the state of Connecticut, this isn’t two people putting cans into a post office truck,” Candelora said. “This is far more organized than that.”

The impact of those excess returns is felt mostly by the state’s wholesale beverage distributors, who initiate the redemption process by collecting an additional 10 cents on every eligible bottle and can they sell to supermarkets, liquor stores and other retailers within Connecticut. The distributors are required to pay that money back — plus a handling fee — once the containers are returned to the store or a redemption center.

According to the state’s Department of Revenue Services, nearly 12% of wholesalers reported having to pay out more redemptions than they collected in deposits in 2025. Those losses totaled $11.3 million.

Peter Gallo, the vice president of Star Distributors in West Haven, said his company’s losses alone have totaled more than $2 million since the increase on deposits went into effect two years ago. As time goes on, he said, the deficit has only grown.

“We’re hoping we can get something fixed here, because it’s a tough pill to be holding on to debt that we should get paid for,” Gallo said.

Still, officials say they have no way of tracking precisely how many of the roughly 2 billion containers that were redeemed in the state last year were illegally brought in from other states. That’s because most products lack any kind of identifiable marking indicating where they were sold.

“There’s no way to tell right now. That’s one of the core issues here,” said state Rep. John-Michael Parker, D-Madison, who co-chairs the legislature’s Environment Committee.

Parker said the issue could be solved if product labels were printed with a specific barcode or other feature that would be unique to Connecticut. Such a solution, for now, has faced technological challenges and pushback from the beverage industry, he said.

Not everyone involved in the handling, sorting and redemption of bottles is happy about the upcoming changes — or the process by which they were approved.

Francis Bartolomeo, the owner of a Fran’s Cans and Bart’s Bottles in Watertown, said he was only made aware of the legislation on Monday from a fellow redemption center owner. Since then, he said, he’s been contacting his legislators to oppose the bill and was frustrated by the lack of a public hearing.

“I know other people are as flabbergasted as I am because they don’t know where it comes out of,” Bartolomeo said “It’s a one sided affair, really.”

Bartolomeo said one of his biggest concerns with the bill is the $2,500 annual licensing fee that it would place on redemption centers. While he agreed that out-of-state redemptions are a problem, he said it should be up to the state to improve enforcement.

“We’re cleaning up the mess, and we’re going to end up being penalized,” Bartolomeo said. “Get rid of it and go back to 5 cents if it’s that big of a hindrance, but don’t penalize the redemption centers for what you imposed.”

Lynn Little of New Milford Redemption Center supports the increased penalties but believes the solution ultimately lies with better labeling by the distributors. She is also frustrated by the volume caps after the state initially gave grants to residents looking to open their own bottle redemption businesses.

“They’re taking a volume business, because any business where you make 3 cents per unit (the average handling fee) is a volume business, and limiting the volume we can take in, you’re crushing small businesses,” Little said.

Ritter said that he opposed a move back to the 5-cent deposit, which he noted was increased to encourage recycling. However, he said the current situation has become politically untenable and puts the state at risk of a lawsuit from distributors.

“We’re getting to a point where we’re going to lose the bottle bill,” Ritter said. “If we got sued in court, I think we’d lose.”

Exclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

Mother and daughter injured in Taunton house explosion

2026 MHSA Montana Wrestling State Championship Brackets And Results – FloWrestling

Wildfires rage in Oklahoma as thousands urged to evacuate a small city

Wildfire near Gum Swamp Road in Livingston Parish now under control; more than 200 acres burned

10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

YouTube TV billing scam emails are hitting inboxes

Stellantis is in a crisis of its own making