Sign up for the latest from The Hill here

News

House GOP off to wobbly start in bringing up first funding bills

House Republicans are showing small signs of progress as leaders try to wrangle the conference’s various factions together to pass their first batch of federal funding bills this week.

The House cleared a key procedural hurdle Wednesday by voting to begin debate on legislation to fund military construction, the Department of Veterans Affairs (VA) and related agencies for fiscal 2024 — but not without hours of drama as conservatives press for deeper spending cuts.

Hard-line conservative Republicans huddled in Speaker Kevin McCarthy’s (R-Calif.) office for discussions that continued right up until the procedural rule vote. It ultimately passed 217-206, with two Republicans bucking the party and voting “no.”

Rep. Ralph Norman (R-S.C.), a member of the House Freedom Caucus, told reporters while walking into the vote that he would support the rule — despite his previous opposition — citing a supposed agreement to lower overall funding to levels he and other conservatives have been pushing for.

Norman and other conservative have pushed to review all 12 appropriations bills in their final form before voting on individual bills, so they can ensure overall spending levels are low enough.

“I’m voting for the rule, I previously was opposed to it,” Norman said. “They worked the things out with the topline numbers so we’ll vote for the rule.”

Top stories from The Hill

Rep. Bob Good (R-Va.), another member of the conservative group, also said he would vote in favor of the rule “with the commitment” that the party’s funding bills would be set to fiscal 2022 levels.

McCarthy, however, denied that any deal had been reached, telling reporters there was “no new agreement.”

“I’m willing to work on any way we can save money, where we get to 218 … I haven’t talked to Ralph, I mean, there’s no new agreement to anything, we’ve all been working together the whole time through,” he added.

While McCarthy scored a victory on the rule vote, he faces an uphill battle to win passage of the Milcon-VA appropriations bill and another spending measure pertaining to agriculture, rural development, Food and Drug Administration and related agencies programs — both of which are on the schedule for this week.

Speaker Kevin McCarthy (R-Calif.) greets tourists in Statuary Hall of the Capitol after opening up the House for the week on July 25, 2023.

On the latter bill, GOP leadership is staring down a potential problem with moderates over provisions in the bill pertaining to the abortion drug mifepristone. The legislation would nullify a Biden administration rule that allows mifepristone to be sold in retail pharmacies and by mail with prescriptions from a certified health care provider.

“I have said from the very beginning that I would not support legislation that would ban abortion nationwide,” Rep. Mike Lawler (R-N.Y.), a top Democratic target in 2024, said Wednesday morning. “And to me, some of these issues that are being dealt with should be dealt with at the state level, and that’s it. Some states allow it to be mailed, some states don’t. But that should be a decision with the states and the FDA.”

Overall, conservatives have accused leadership of using rescissions, or clawed back funding that was previously allocated, to get to their preferred overall fiscal 2022 levels.

Conservatives support the proposals to yank back funds from some Democratic priorities that were greenlit in the previous Congress without GOP support. But they have been adamant that the funding should not be repurposed in appropriations bills to allow for spending at higher levels than those set for fiscal 2022.

“You’re going to hear that we have made rescissions to get down to the number that you heard, the $1.471 [trillion],” Rep. Keith Self (R-Texas) said Tuesday at a press conference held by the House Freedom Caucus, referring to the top line sought by conservatives.

“But then those rescissions are going to be added back later. Watch for it. That should not happen,” he said. “If we go down to the $1.471 [trillion], we stay there.”

Rep. Keith Self (R-Texas) addresses reporters during a press conference with members of the House Freedom Caucus July 25, 2023, to discuss the fiscal 2024 appropriations process. (Greg Nash)

GOP appropriators announced earlier this year that they would mark up their funding bills in line with the fiscal 2022 levels, a key ask from some conservatives. But negotiators also proposed more than $100 billion in rescissions, while redirecting the funding toward areas like border security and addressing “threats posed by the People’s Republic of China” and abroad.

Rep. Mike Simpson (R-Idaho), who serves on the appropriations panel, suggested that making such cuts would be tough.

“Then you just drop it on the floor and stomp on it. What else do you do with it?” he told reporters. “You can’t make logical cuts in there.”

Simpson told reporters that he planned to meet with some members of the House Freedom Caucus later Wednesday to discuss some of the funding proposals. “So, that they know what we’ve done, and why we’ve cut certain things — and why we haven’t,” he explained.

Simpson also acknowledged that there’s an understanding that the partisan House-passed bills will likely look much different after negotiations eventually with the Democratic-led Senate.

“It’s not gonna become a law,” he said, adding: “That’s gonna take compromise. That’s the nature of politics.”

The push and pull underscores the difficult balancing act leaders face in getting all 12 funding bills through the House floor with a narrow majority.

Rep. Rosa DeLauro (Conn.), top Democrat on the House Appropriations Committee, said on Tuesday that she isn’t anticipating any support from her side of the aisle.

“Why would we?” DeLauro told The Hill, before taking aim at what she called “programmatic cuts” in the GOP-backed bills. “Then they compound that with rescissions. So, they take money from other great programs, and they move it just to cover their tracks.”

Rep. Rosa DeLauro (D-Conn.) speaks to reporters after a closed-door House Democratic Caucus meeting on June 6, 2023.

Some Republicans say they’re watching the process as closely as possible as more chatter emerges around potential amendments, with some making clear they won’t be a rubber stamp for any changes.

“I’m of the view that when you make an agreement, like we did with the President and the Speaker, that we should live within that spirit,” Rep. Don Bacon (R-Neb.) said Tuesday.

“I’m not an absolute yes or I’m not a ‘stamp yes.’ I’m gonna watch what’s going on, and go from there,” Bacon said.

Emily Brooks contributed.

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

News

Confused by the legal battles over troop deployments? Here’s what to know

A member of the Texas National Guard stands at an army reserve training facility on October 07, 2025 in Elwood, Illinois.

Scott Olson/Getty Images North America

hide caption

toggle caption

Scott Olson/Getty Images North America

President Trump’s federalization and deployment of National Guard troops to both Oregon and Illinois are facing a pair of legal litmus tests — including one at the Supreme Court — that could be decided in the coming days.

At the heart of both challenges is whether or not to defer to the president’s assessment that major cities in both places — Portland and Chicago — are lawless and in need of immediate military intervention to protect federal property and immigration officers, despite local leaders and law enforcement saying otherwise. Both deployments were done against the wishes of Democratic state governors, and were quickly temporarily blocked by district courts.

On Monday, a divided panel on the 9th Circuit court of appeals overturned a temporary restraining order put in place by a federal judge in Portland, siding with the Trump administration, however another temporary restraining order remains in place.

That ruling came days after the 7th Circuit court of appeals upheld a similar block from a federal judge in Illinois on the deployment of National Guard troops to Chicago. The Trump administration has asked the Supreme Court to intervene.

Movement in both cases is expected in the coming days, in what has been a dizzying pingpong of legal disputes around Trump’s use of the military domestically in several Democratic-led cities around the country. And while any decision will only impact troop deployment in an individual state, they could impact how courts weigh in on such cases going forward — and embolden the administration, legal experts say.

“This could be a pretty seminal week in terms of the bigger legal fight over domestic deployments,” says Scott R. Anderson, a fellow at the non-partisan Brookings Institution and senior editor of Lawfare.

The 9th Circuit and Portland, Ore.

The 9th Circuit’s decision earlier this week only applies to one of the two temporary restraining orders that U.S. District Judge Karin Immergut issued this month to block the National Guard deployments — meaning that troops can still not be on the streets in Portland. But the federal government has asked Immergut to remove her second temporary order. A court hearing has been scheduled for Friday to discuss the dissolution of that order.

Karin J. Immergut, nominated to be U.S. district judge for the District of Oregon, attends a judicial nomination hearing held by the Senate Judiciary Committee October 24, 2018 in Washington, D.C.

Win McNamee/Getty Images North America

hide caption

toggle caption

Win McNamee/Getty Images North America

The 9th Circuit is also deciding whether or not to revisit the ruling made earlier this week with a larger group of judges — and that decision could come before Immergut’s deadline.

Trump has said that the 9th Circuit decision has made him feel empowered to send the National Guard to any city where he deems it necessary.

“That was the decision. I can send the National Guard if I see problems,” Trump told reporters Tuesday. In recent days, Trump has renewed an interest in sending troops to San Francisco.

Justin Levitt, a law professor at Loyola Marymount University Loyola Law School and an expert in constitutional law, worries the ruling by the 9th Circuit “authorized blindness to facts.”

“It said [Trump] can decide that there’s a war when there’s nothing but bluebirds,” he says, noting that’s likely why an immediate call for a full review was made. “I fully expect a larger group of 9th Circuit judges to say we don’t have to be blind to what’s actually going on in order to give ample deference to the Trump administration.”

The Supreme Court and Chicago

At the same time, the Trump administration has issued an emergency appeal to the Supreme Court on whether National Guard troops can be deployed in Illinois, after the 7th Circuit court of appeals upheld a district court’s block.

It’s unknown when, or if, the Supreme Court will issue a decision, although experts expect it in the coming days as well.

The decision, although not precedent-setting, will likely clarify the president’s power to deploy federal military resources — and how deferential the courts should be to his administration’s presentation of facts — but only to a point. Emergency decisions are usually short, without much reasoning provided by the justices, experts say.

“It ends up kind of putting the onus on district and appellate courts to read the tea leaves of those interim orders to inform these much larger questions in very different factual environments, you know, possibly months in the future,” says Chris Mirasola, a national security law professor at the University of Houston Law Center.

National Guard troops arrive at an immigration processing and detention facility on October 09, 2025 in Broadview, Illinois.

Scott Olson/Getty Images North America

hide caption

toggle caption

Scott Olson/Getty Images North America

He says that while the emergency decisions from the Supreme Court don’t apply broadly, in recent months, some judges have started to treat them as if they do.

“I think what we’re going to get in at least the medium term is even more confusion than we’ve had so far,” he says.

But just how the Supreme Court might weigh in isn’t clear.

“I think it’s a harder case for the Supreme Court than some people might think, who go in with the assumption the Supreme Court is just naturally inclined toward the administration’s positions on things — and it is in many contexts,” says Anderson of the Brookings Institution.

He says that while it’s standard for courts to be deferential to the president, it’s also standard to believe the facts presented by the local courts.

“That is a tricky, tricky sort of situation here,” Anderson says.

What could this mean for possible deployments going forward?

These two expected decisions will only directly affect Portland or Chicago. But the implications of both – especially something from the Supreme Court – could have ripple effects in future litigation.

Elizabeth Goitein, senior director of the Liberty and National Security Program at the Brennan Center for Justice, says that what’s particularly worrying is that the Department of Justice has been expressly celebrating high arrest counts by law enforcement in places like Chicago, while still saying the military is necessary to help.

“If the bar is so low that the President can use the military at a time when his administration is touting how effective civilian law enforcement is, it becomes hard to imagine a scenario where he couldn’t deploy the military,” she says.

Experts say that these legal challenges are just the beginning of what will surely be a long and winding road through the U.S. court system.

“This is really just the first battle. There are a lot of legal questions that come after this,” Anderson says.

News

Video: Driver Crashes Car Into Security Gate Near White House

new video loaded: Driver Crashes Car Into Security Gate Near White House

By Axel Boada

October 22, 2025

News

New York City ICE raid nets 9 arrests of illegal aliens from West Africa, 4 protesters also arrested

NEWYou can now listen to Fox News articles!

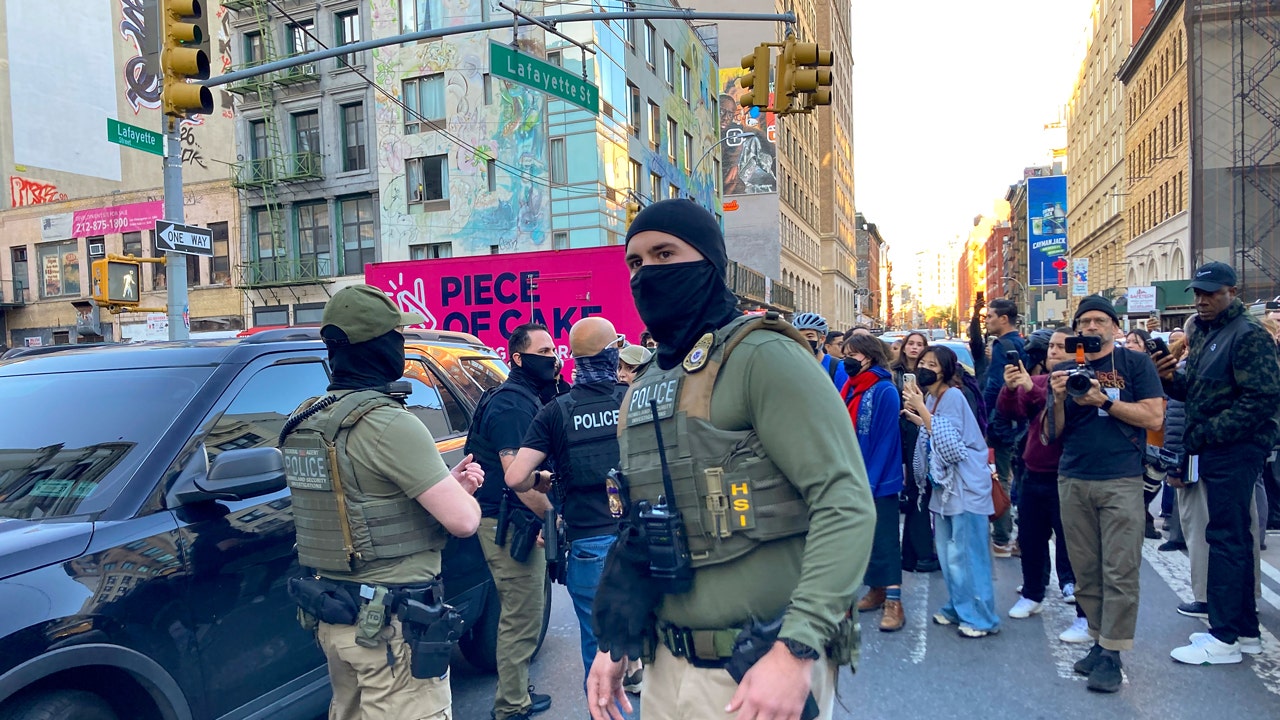

A federal raid in New York City’s Chinatown neighborhood on Tuesday resulted in the arrests of nine migrants from West Africa who were in the United States illegally, the Department of Homeland Security (DHS) and U.S. Immigration and Customs Enforcement (ICE) told Fox News.

Four protesters were also taken into custody for allegedly blocking ICE officers and throwing objects at them.

Officials said the migrants are from Senegal, Mali and Guinea and were busted for allegedly selling counterfeit items in the area.

ICE said the protesters who were detained have criminal backgrounds.

PROTESTS ERUPT AS ICE AGENTS RAID NYC CHINATOWN STREET VENDORS ALLEGEDLY SELLING COUNTERFEIT GOODS

Federal agents conduct an immigration sweep on Canal Street in Chinatown as protesters gather on Tuesday, Oct. 21, 2025, in New York. (AP Photo/Jake Offenhartz)

Department of Homeland Security Assistant Secretary Tricia McLaughlin told Fox News that ICE and federal partners conducted a “targeted, intelligence-driven enforcement operation” on Canal Street focused on criminal activity related to the sale of alleged counterfeit goods.

“During this law enforcement operation, rioters who were shouting obscenities, became violent and obstructed law enforcement duties, including blocking vehicles and assaulting law enforcement,” McLaughlin wrote in a statement. “Already, one rioter has been arrested for assault on a federal officer.”

During a news conference Tuesday night, Murad Awawdeh, vice president of advocacy at the New York Immigration Coalition, said between 15 and 40 vendors were arrested, and at least two locals were taken into custody for protesting and blocking their arrest efforts.

City officials quickly moved to distance themselves from the raid.

US MARSHAL, ILLEGAL MIGRANT SHOT DURING LOS ANGELES IMMIGRATION OPERATION

Federal agents conduct an immigration sweep on Canal Street in Chinatown, Tuesday, Oct. 21, 2025, in New York. (AP Photo/Jake Offenhartz)

Mayor Eric Adams’ press secretary, Kayla Mamelak Altus, told Fox News that New York City “never cooperates with federal law enforcement on civil deportation matters, in accordance with local laws,” and had “no involvement in this matter.”

“Mayor Adams has been clear that undocumented New Yorkers trying to pursue the American Dream should not be the target of law enforcement, and resources should instead be focused on violent criminals,” she said.

Protestors confront federal agents as they walk down Lafayette Street after an immigration sweep on Canal Street through Chinatown, Tuesday, Oct. 21, 2025, in New York City. (Jake Offenhartz/AP)

Socialist mayoral candidate Zohran Mamdani weighed in on X, calling the Manhattan raid “aggressive and reckless.”

CLICK HERE TO GET THE FOX NEWS APP

“Federal agents from ICE and HSI—some in military fatigues and masks—descended on Chinatown today in an aggressive and reckless raid on immigrant street vendors,” Mamdani wrote in a post. “Once again, the Trump administration chooses authoritarian theatrics that create fear, not safety. It must stop.”

Fox News’ Greg Wehner and CB Cotton contributed to this report.

-

World2 days ago

World2 days agoIsrael continues deadly Gaza truce breaches as US seeks to strengthen deal

-

Technology2 days ago

Technology2 days agoAI girlfriend apps leak millions of private chats

-

News2 days ago

News2 days agoTrump news at a glance: president can send national guard to Portland, for now

-

Business2 days ago

Business2 days agoUnionized baristas want Olympics to drop Starbucks as its ‘official coffee partner’

-

Politics2 days ago

Politics2 days agoTrump admin on pace to shatter deportation record by end of first year: ‘Just the beginning’

-

Science2 days ago

Peanut allergies in children drop following advice to feed the allergen to babies, study finds

-

News1 day ago

News1 day agoVideo: Federal Agents Detain Man During New York City Raid

-

News2 days ago

News2 days agoBooks about race and gender to be returned to school libraries on some military bases