News

Four major insurers quit industry net zero initiative

Three of Europe’s biggest insurers and a large Japanese insurer have quit the Net-Zero Insurance Alliance as growing US political pressure and legal fears plunge the climate initiative into crisis.

Axa, the group’s former chair, Allianz, and Scor, as well as Japan’s Sompo Holdings, said on Thursday that they were leaving the NZIA, which is one part of Mark Carney’s umbrella group Glasgow Financial Alliance for Net Zero, created by the former Bank of England governor ahead of the UN climate summit held in Glasgow in 2021.

The Australian insurer QBE said on Friday it had also left the climate club, after joining in February 2022.

The departures bring the total number of large insurers which have left the NZIA to at least nine, severely curbing its collective power and posing a question over its future. Its website listed 22 members on Thursday.

Gfanz and its members have come under attack from Republican politicians in the US, who are targeting collective climate action groups they perceive to be unfairly hitting the oil and gas industry.

On Friday, Gfanz said the “political attacks” were interfering with insurers’ “efforts to price climate risk, which will harm policyholders, main street investors and local economies”. It pledged to continue to support insurers’ efforts to develop transition plans.

Other than a high-profile departure from the US asset manager Vanguard in December, Gfanz’s asset management, banking and asset owner subgroups have mostly weathered the storm.

However, its insurance arm, the NZIA, has struggled to gain members outside of Europe and Asia. And, earlier this month, its members were sent a letter from US state attorneys-general raising “serious concerns” over whether the alliance complied with antitrust laws.

Munich Re, one of the world’s biggest reinsurers and a founding member of the NZIA, quit the group in late March. Its chief executive said he did not want to expose the group to “material antitrust risks”.

Zurich, an insurance group, and Hannover Re, another reinsurer, left in April. Reinsurer Swiss Re also left earlier this week.

“As the Net-Zero Insurance Alliance disintegrates before our eyes, we must ask why these huge companies with their hordes of lawyers did not see antitrust issues as a major obstacle when they founded the alliance. And we must wonder whether their ditching of the alliance has more to do with fears of losing business in the US than real legal jeopardy,” said Patrick McCully, senior analyst at the non-profit Reclaim Finance.

Two people briefed on the decisions by insurers to quit said they did not think that the initiative, which has considered competition issues from the start, would lose a legal fight, but feared the distraction it would cause. “This is a battle that insurers can spare themselves,” said one.

European governments have also privately expressed concerns that insurers in the NZIA could cause the cost of energy to rise if they collectively stopped underwriting fossil fuels, according to a person close to the leadership team at the Glasgow Financial Alliance for Net Zero.

“For national security [reasons] they are worried about keeping the lights on,” the person said.

France’s Axa said on Thursday that it would “continue its individual sustainability journey, as an insurer, an investor and a responsible company”.

Allianz said it remained “fully committed” to a parallel organisation for asset owners.

Reinsurer Scor’s departure was announced by its new chief executive at Thursday’s annual meeting, alongside a set of new climate pledges.

The Japanese insurer Sompo, which joined the alliance last June, said it would continue to pursue its climate goals “as vigorously” outside the group.

Insurers have come under increasing pressure from activist investors and campaigners in recent years to cut their coverage of the most polluting sectors.

The NZIA was one attempt to corral insurers around the goal of reducing the carbon footprint of their underwriting, but critics highlighted the lack of US members and the fact that a ban on insuring coal was not a condition of joining.

The challenges faced by the NZIA demonstrate the need for greater intervention by governments, argued Peter Bosshard, co-ordinator of the Insure our Future advocacy group: “If the insurers can no longer act collectively, this is a strong reason for regulation.”

Lloyd’s of London, the City’s speciality insurance market, which was subject to yet another protest by climate activists at its annual meeting on Thursday, said it remained an NZIA member. It later added that it was reviewing the letter sent by US state attorneys-general and noted that it was “for the individual businesses that operate in the Lloyd’s market to make their own business and strategy decisions”.

The United Nations Environment Programme Finance Initiative, which convenes the NZIA, did not immediately respond to a request for comment on the latest departures, but has previously noted that it is “a voluntary initiative”.

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here

News

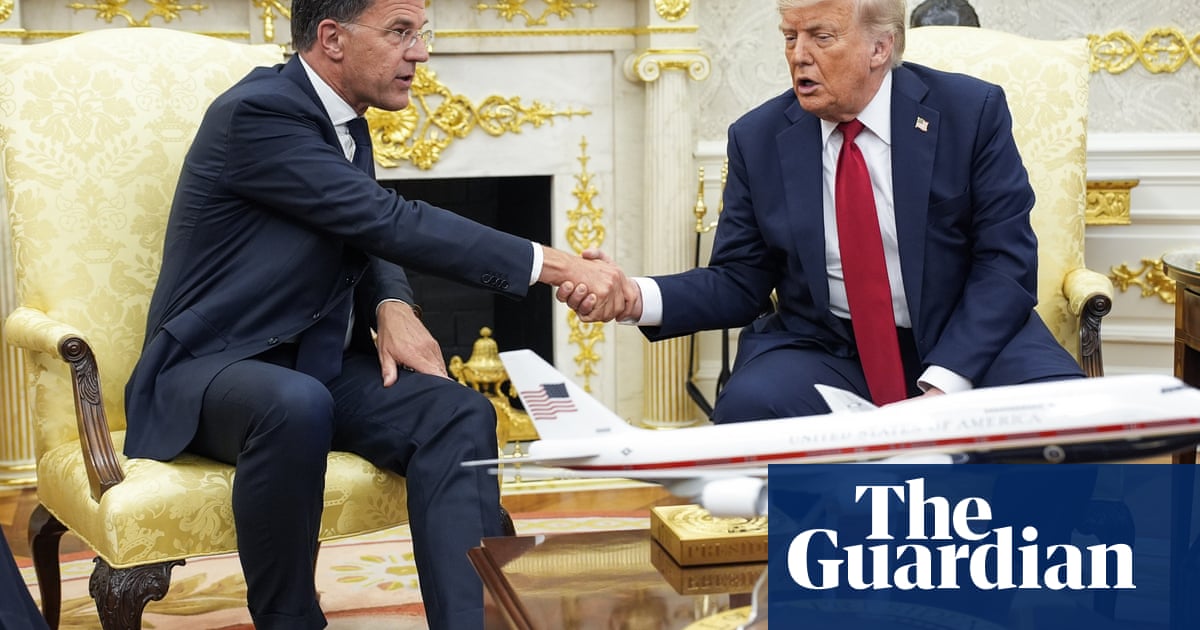

Trump does deal with Nato allies to arm Ukraine and warns Russia of severe sanctions

Donald Trump said he has sealed an agreement with Nato allies that will lead to large-scale arms deliveries to Ukraine, including Patriot missiles, and warned Russia that it will face severe sanctions if Moscow does not make peace within 50 days.

After a meeting with the Nato secretary general, Mark Rutte, Trump said they had agreed “a very big deal”, in which “billions of dollars’ worth of military equipment is going to be purchased from the United States, going to Nato … And that’s going to be quickly distributed to the battlefield.”

Speaking in the White House alongside a clearly delighted Rutte, the US president said the arms deliveries would be comprehensive and would include the Patriot missile batteries that Ukraine desperately needs for its air defences against a daily Russian aerial onslaught.

“It’s everything: it’s Patriots. It’s all of them. It’s a full complement, with the batteries,” Trump said.

He did not go into any more detail, but made clear the weapons would be entirely paid for by Washington’s European allies, and that initial missile deliveries would come “within days” from European stocks, on the understanding they would be replenished with US supplies.

At a White House lunch with religious leaders later in the day, Trump said the deal was “fully approved, fully done”.

“We’ll send them a lot of weapons of all kinds and they’re going to deliver those weapons immediately … and they’re going to pay,” he said.

At his meeting with Trump, Rutte said there was a significant number of Nato allies – including Germany, Finland, Denmark, Sweden, Norway, the Netherlands and Canada – ready to rearm Ukraine as part of the deal.

“They all want to be part of this. And this is only the first wave. There will be more,” he said.

The German chancellor, Friedrich Merz, said last week that Berlin was ready to acquire additional Patriot systems.

Trump claimed there was one country, which he did not name, but which had “17 Patriots getting ready to be shipped”. Monday’s deal would include that stockpile, or “a big portion of the 17”, he said.

Such an arms delivery would represent a significant reinforcement of Ukraine’s air defences. Kyiv is currently thought to have only six Patriot batteries, at a time when it is coming under frequent and intense Russian drone and missile bombardments.

At the same time, Trump expressed increased frustration with Vladimir Putin, whom he accused of giving the impression of pursuing peace while intensifying attacks on Ukrainian cities. He gave the Russian president a new deadline of 50 days to end the fighting or face 100% tariffs on Russian goods, and more importantly, sweeping “secondary tariffs”, suggesting trade sanctions would be imposed on countries who continue to pay for Russian oil and other commodities.

“The secondary tariffs are very, very powerful,” the president said.

The announcement marked a dramatic change for the administration, both in substance and tone.

The Trump White House had not only made clear it would continue its predecessor’s policy of continuing to supply Ukraine out of US stocks, but the president and his top officials have been derisive about Kyiv’s chances of prevailing.

On Monday, Trump delivered his most admiring language on Ukraine and its European backers to date, with Rutte on one side and the US vice-president, JD Vance, the administration’s biggest sceptic on US involvement in Europe, on the other.

“They fought with tremendous courage, and they continue to fight with tremendous courage,” Trump said of the Ukrainians.

“Europe has a lot of spirit for this war,” he said, suggesting he had been taken by surprise by the level of commitment shown by European allies at the Nato summit in The Hague last month. “The level of esprit de corps spirit that they have is amazing,” he said. “They really think it’s very, very important.

“Having a strong Europe is a very good thing. It’s a very good thing. So I’m okay with it,” he said.

Trump described his deepening disillusion with Putin, and suggested his wife, Melania, may have played a role in pointing out the Russian leader’s duplicity in talks over a peace deal.

“My conversations with him are always very pleasant. I say, isn’t that a very lovely conversation? And then the missiles go off that night,” Trump said. “I go home, I tell the first lady: I spoke with Vladimir today. We had a wonderful conversation. She said: Really? Another city was just hit.”

Ukrainian regional officials reported at least six civilians killed and 30 injured by Russian bombing in the past 24 hours. The country’s air force said Moscow had attacked with 136 drones and four S-300 or S-400 missiles.

“Look, I don’t want to say he’s an assassin, but he’s a tough guy. It’s been proven over the years. He’s fooled a lot of people,” Trump said, listing his predecessors in the White House.

“He didn’t fool me. But what I do say is that at a certain point, ultimately talk doesn’t talk. It’s got to be action,” he said.

Russian officials and pro-war bloggers on Monday largely shrugged off Trump’s announcement, declaring it to be less significant than anticipated.

Konstantin Kosachev, a senior Russian lawmaker, wrote on Telegram that it amounted to “hot air”.

It was broadly welcomed in Kyiv, where there has been longstanding and deep anxiety about Trump’s intentions. Andrii Kovalenko, a member of Ukraine’s national security and defence council, posted a one-word response: “Cool.”

There was still scepticism however, over whether even the promise of new weaponry for Ukraine combined with the threat of trade sanctions would be enough to halt Russia’s offensive.

Illia Ponomarenko, a Ukrainian journalist and blogger wrote: “How many Ukrainian lives could have been saved if, from the very beginning, Trump had listened to wise and honest people about helping Ukraine, instead of the artful lies of that cannibal Putin on the phone?”.

News

Senate committee details failures by Secret Service in preventing Trump shooting

Then-candidate Donald Trump is rushed offstage by U.S. Secret Service agents after being struck by a bullet during a rally on July 13, 2024, in Butler, Pa.

Anna Moneymaker/Getty Images

hide caption

toggle caption

Anna Moneymaker/Getty Images

A Senate committee report released Sunday blames the U.S. Secret Service for a “cascade of preventable failures” that led up to the assassination attempt against then-presidential candidate Donald Trump during a rally in Butler, Pa., last summer.

Trump was injured in the shooting when a bullet whizzed past his head, grazing his ear. Two attendees were wounded, and rally-goer and former fire chief Corey Comperatore was killed.

A Secret Service sniper shot and killed the perpetrator, 20-year-old Thomas Matthew Crooks of Bethel Park, Pa.

In its report, the Senate Homeland Security and Governmental Affairs Committee said the Secret Service’s “lack of structured communication was likely the greatest contributor to the failures” on the day of the rally. The report was released by the committee’s chairman, Sen. Rand Paul, R-Ky.

For instance, the Secret Service security room agent, who is responsible for collecting and disseminating information, learned about a suspicious person with a rangefinder from a counterpart in the Pennsylvania State Police roughly 25 minutes before the shooting. That agent relayed the report to a fellow Secret Service agent in the room, but the information did not go out over the radio or make it to Trump’s security detail in time for them to prevent him from taking the stage.

There were communication gaps both within the Secret Service hierarchy, and also among the agency and the state and federal law enforcement agencies on scene, the committee said.

There were organizational mistakes, too. The committee noted that one of the Secret Service countersniper teams protecting Trump at the Butler rally had an obstructed view of the roof of the nearby American Glass Research building where Crooks was located.

The report, released one year to the day after the shooting, also found that the Secret Service had denied some resources to Trump’s detail during the 2024 presidential election and said former Secret Service Director Kimberly Cheatle had falsely testified to Congress when she said no requests were denied for the Butler rally.

In a statement on Sunday, Secret Service Director Sean Curran said the agency “took a serious look at our operations” following last year’s shooting and “implemented substantive reforms to address the failures that occurred that day.”

The agency announced last week that it had put in place 21 of 46 recommendations made by congressional oversight bodies, including streamlining communication procedures and clarifying the responsibilities of advance teams.

The Secret Service also said it had disciplined six employees in relation to the Butler shooting, with suspensions ranging from 10 to 42 days without pay. Still, the committee said in its report that “not a single person has been fired.”

Curran, who was one of the agents who surrounded Trump as shots were fired in Butler, added in his statement that the Secret Service will “continue to work cooperatively with the committee as we move forward in our mission.”

News

Texas flood death toll rises as search continues for victims – UPI.com

A young girl carries a stuffed bear during a vigil for those lost in the Texas floods at the “Wall of Hope” fence memorial in Kerrville, Texas, on Friday. Photo by Dustin Safranek/EPA

July 12 (UPI) — More than 2,100 searchers from a dozen Texas Counties, other states and Mexico are continuing recovery efforts to find more victims of the deadly flash flooding in central Texas.

The confirmed-deaths toll rose to 129 with 170 still missing after officials in Travis and Kerr counties reported the recovery of more bodies, USA Today reported.

Most of the dead, 103, were found in Kerr County, including 36 children and 67 adults.

Among those missing is Volunteer Fire Chief Michael Phillips, whose rescue vehicle was swept away when flash flooding struck Burnet County.

Search crews later found the vehicle, but Phillips was not inside.

“Specialist teams and equipment continue to deploy into the search area and work themselves to exhaustion or until nightfall in the effort to find him,” the Burnet County Sheriff’s Office announced on Saturday, according to USA Today.

Many states and Mexico sent entire first responder teams, including Indiana, which deployed personnel from 15 fire and police departments to help the recovery effort, The New York Times reported.

Many volunteer groups also traveled to Kerr County, where most search efforts are focused.

“It’s overwhelming to see so many people come and help in the search,” Kerrville, Texas, resident Amy Vanlandingham told The New York Times.

“This is our town,” she said. “I do it so I can sleep.”

The Guadalupe River’s flash flooding during the early morning hours of July 4 decimated several local camps and other popular visitor destinations on one of their busiest days of the year.

The bodies of victims likely are situated in debris fields located along more than 100 miles of narrow and shallow valleys along the Guadalupe River in the mostly rural area of Texas Hill Country.

President Donald Trump, first lady Melania Trump and others visited Kerr County on Friday to assess the situation and better gauge the need for federal assistance.

-

Culture1 week ago

Culture1 week agoTry to Match These Snarky Quotations to Their Novels and Stories

-

News5 days ago

News5 days agoVideo: Trump Compliments President of Liberia on His ‘Beautiful English’

-

News1 week ago

News1 week agoTexas Flooding Map: See How the Floodwaters Rose Along the Guadalupe River

-

Business1 week ago

Companies keep slashing jobs. How worried should workers be about AI replacing them?

-

Finance1 week ago

Do you really save money on Prime Day?

-

News4 days ago

News4 days agoVideo: Clashes After Immigration Raid at California Cannabis Farm

-

Politics1 week ago

Politics1 week agoJournalist who refused to duck during Trump assassination attempt reflects on Butler rally in new book

-

Technology1 week ago

Technology1 week agoApple’s latest AirPods are already on sale for $99 before Prime Day