Finance

Pakistan finance minister says the country has avoided a Sri Lanka-like default crisis

Pakistan’s finance minister mentioned the federal government has taken steps that may put the nation heading in the right direction and assist the South Asian nation keep away from an financial collapse. However that may trigger ache for its folks, he added.

The nation is desperately preventing for its survival because the latest rise in commodity and vitality costs have exacerbated its debt issues. It has been struggling to pay for its imports as its official liquid international alternate reserves have shrunk by $754 million to $8.57 million within the week ended July 22 from the week earlier than, in accordance with the nation’s central financial institution.

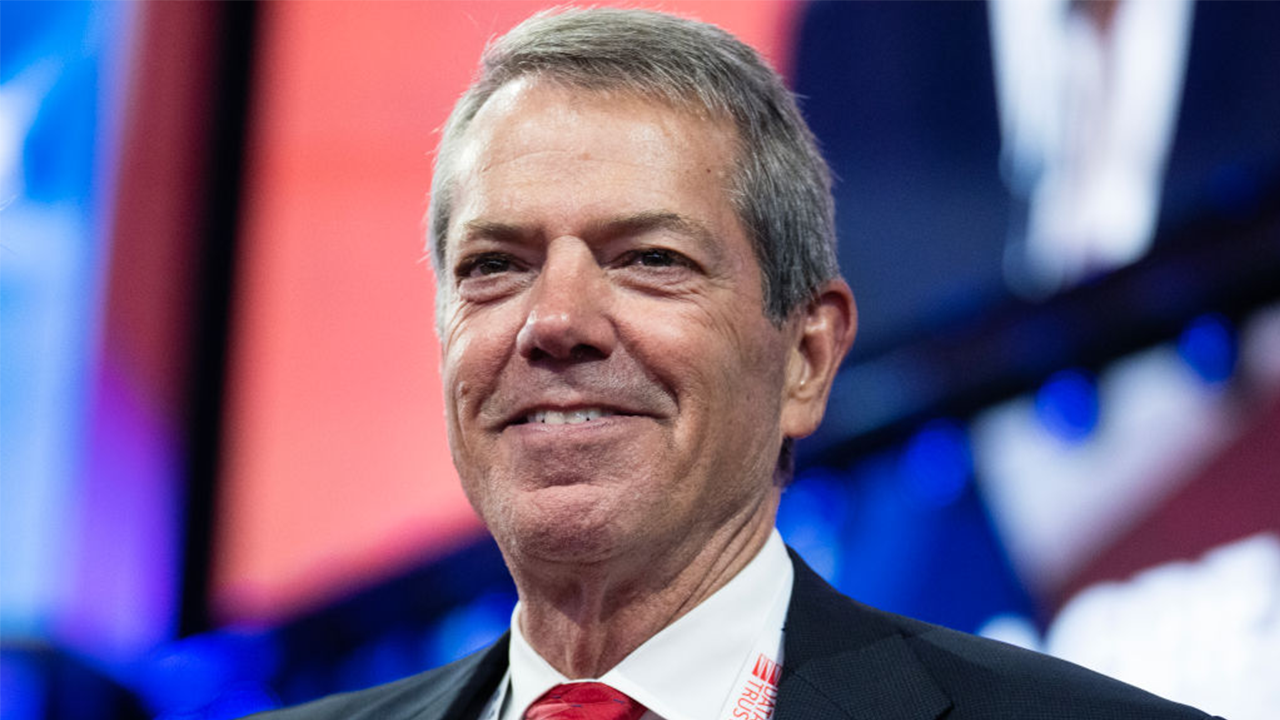

“There have been critical worries about Pakistan heading Sri Lanka’s manner, Pakistan getting right into a default-like state of affairs, however fortunately, we have made some vital adjustments. We have introduced in vital austerity, black belt tightening. And I believe we have averted that state of affairs,” Miftah Ismail informed CNBC’s “Road Indicators Asia” on Tuesday.

“We at the moment are in an IMF program. We have now reached the staff-level settlement. We count on to get a board approval later this month. We have taken off subsidies from gas, from energy … We have raised taxes. So, I believe we’re headed in the precise path.”

Nonetheless, Ismail acknowledged that latest measures taken by the federal government shall be tough for Pakistan and would imply a variety of ache for the folks.

“However take a look at the choice. If we had gone the Sri Lankan manner this is able to have been a lot worse,” the minister mentioned.

Debt disaster

Pakistan is going through a critical debt disaster just like international alternate scarcity issues that has plagued its South Asian neighbor Sri Lanka this yr.

Sri Lanka has been battling shortages of meals and gas amid the worst financial disaster because the island nation’s independence in 1948. The nation has defaulted on its debt and has requested for aid from the Worldwide Financial Fund.

However in contrast to Sri Lanka, Pakistan was capable of avert chapter by putting a take care of the IMF in July. The nation reached a staff-level settlement with the IMF to restart their stalled prolonged fund facility.

Islamabad will get a primary tranche of $1.17 billion from the IMF within the coming weeks, with additional loans attainable within the months forward.

“Pakistan is at a difficult financial juncture. A tough exterior atmosphere mixed with procyclical home insurance policies fueled home demand to unsustainable ranges,” the IMF mentioned in a press release.

“IMF has recognized a $4 billion funding hole, which is to say that IMF desires our reserves to extend by $6 billion throughout this very difficult fiscal yr,” Ismail mentioned. “And of that $6 billion, it says that we now have $2 billion and we must always try to get $4 billion from our mates. We’re largely there and I believe that inside a day or two we’ll even have that quantity.”

Tackling inflation

In July, Pakistan’s headline inflation soared to 24.93% yr on yr, in accordance with official information — the best stage since October 2008.

In his funds speech in June, the finance minister highlighted that the federal government aimed to decrease costs through the use of financial and financial coverage in a greater manner.

“I believe that wheat costs are coming down, commodity costs are coming down. Core inflation in Pakistan continues to be about 12 or 13%, it doesn’t matter what the headline quantity is,” Ismail informed CNBC.

“We have stopped financial growth. Our rates of interest are fairly excessive now, I believe. We should always have the ability to carry again inflation to about the place the core inflation is,” he added.

The federal government wanted to curtail its imports to carry down oil demand for energy-related objects reminiscent of gas and petrol, the finance minister mentioned.

“Now that the imports have come down, the stress has eased in opposition to the Pakistani rupee. In actual fact, its appreciated about 7% in opposition to the U.S. greenback final week. We are going to see now inflation actually taper off,” he mentioned.

Wanting forward, Ismail mentioned, it’s “very tough” to provide a timeframe for when issues will enhance for Pakistan, although he added that prospects are vibrant for the economic system within the coming months.

“I ought to assume that within the second quarter of this fiscal yr, which begins in October, we must always have the ability to get deal with of the economic system. Our three months variety of present account deficits could have come down. Markets could have extra perception in our austerity measures. And issues will begin trying higher.”

Finance

Wall Street preps for shortened trading week, Honda & Nissan merger talks: Yahoo Finance

It is a short trading week for Wall Street. The equity markets will close early on Tuesday, December 24, and be closed all day on Wednesday, December 25, for the Christmas holiday. Two stocks in focus today are Honda (HMC) and Nissan (7201.T, NSANY), which officially announced they are in talks to merge. The companies expect the transaction to be completed in 2026. Other trending tickers on Yahoo Finance include Palantir Technologies (PLTR), Tilray Brands (TLRY), and Novo Nordisk (NVO).

Key guests include:

9:10 a.m. ET – Ben Emons, Fed Watch Advisors, Chief Investment Officer/Founder

10:25 a.m. ET – Eric Sheridan, Goldman Sachs Senior U.S. Internet Sector Equity Research Analyst

10:45 a.m. ET – Tony Bancroft, Gabelli Funds Portfolio Manager

11:20 a.m. ET – Steven Wieting, Citi Wealth Chief Investment Strategist and Chief Economist

11:30 a.m. ET – Michael Liersch, Wells Fargo Head of Advice and Planning

Finance

The Container Store files for Chapter 11 bankruptcy

Investors in The Container Store (TCSG) have been sent packing as the struggling home goods chain files for bankruptcy.

The retailer filed for Chapter 11 bankruptcy protection late Sunday, Yahoo Finance learned exclusively. The company said in a press release it is doing this in order to refinance its debt to “bolster its financial position, fuel growth initiatives, and drive enhanced long-term profitability.”

For the quarter-ended Sept. 28, 2024, The Container Store listed total liabilities of $836.4 million against $969 million in total assets.

CEO Satish Malhotra — a former Sephora executive who took over atop The Container Store in 2021 — is confident the maneuver will allow the 46-year old company to stick around.

“The Container Store is here to stay,” Malhotra said in a statement, adding that it is taking these necessary steps in order to advance the business, strengthen customer relationships, expand its reach and bolster its capabilities.

It plans to lean into custom space offerings, “which continue to demonstrate strength,” he said.

The bankruptcy process is expected to last several weeks with the reorganization anticipated to happen within 35 days. The bankruptcy does not include the company’s Elfa home goods business in Sweden.

The business will operate as usual across all stores, online and in-home services. The company operates 102 stores across 34 states.

The company says all customer deposits are safe and protected, and vendors will get paid in full. There are no planned layoffs.

There are also no planned store closures, but that may be a possibility in the future as the company goes through the reorganization process.

Chapter 11 allows companies to “renegotiate the terms of their leases to align their store footprint with market realities and business needs,” sources told Yahoo Finance, adding “if they do not achieve meaningful rent reductions, they may be forced to close a select few locations.”

The filing has been expected by industry experts.

Read more: Why Walmart won the 2024 Yahoo Finance Company of the Year award

The Container Store — a chain founded in 1978 that rose to fame for its nifty home organizational goods in the 1990s — was delisted from the New York Stock Exchange on Dec. 9 after it fell below the exchange’s standard to maintain a market cap of $15 million over 30 consecutive trading days.

The company has seen its profits plunge post the home remodeling frenzy fueled by the COVID-19 pandemic and competition picked up from Walmart (WMT), Amazon (AMZN) and Target (TGT). It has been unprofitable for the past two fiscal years, with losses tallying about $10 million for the fiscal year-ended Sept. 28, 2024.

Finance

Personal finance lessons from Warren Buffett’s latest letter

Last Nov. 25, Warren Buffett announced that he would donate a substantial portion of the shares he owned in Berkshire Hathaway to his four family foundations.

In his announcement, he included a letter which contained some important personal finance lessons that we can apply to our own situation.

One of my favorites is his comment that hugely wealthy parents should only leave their children enough so they can do anything but not enough that they can do nothing.

Despite being one of the richest men in the world, Buffett shared that his children only received $10 million each when his wife died. Although $10 million is a lot of money, it’s less than 1% of his wife’s estate.

I am not hugely wealthy, nor do I have $10 million. However, Buffett’s comment about just giving our children enough made me reflect on the importance of also making our children resilient.

Many of us want to make sure that our children will be financially secure by the time we pass away. While there is nothing wrong with this, sometimes we go overboard in making sure that this goal is met.

Article continues after this advertisement

For example, sometimes my husband and I are guilty of overindulging our children.

Article continues after this advertisement

Warren Buffett’s comment reminded me that we should also allow our children to go through difficulties so that they will become resilient and learn how to survive comfortably with less. Aside from letting them know that they shouldn’t expect much in terms of inheritance, this could mean limiting their allowance, allowing them to commute to school when there is no car available, and saying “no” to their request to buy nice and expensive things like the latest top of the line gadgets.

Another thing that we are guilty of (especially if you are Filipino Chinese like me) is thinking that we need to build a successful business so that our children will eventually have a steady source of income and the bragging rights of being their own boss.

Although there is nothing wrong with building a successful business, passing it on to our children should not be a priority. This is because there’s no guarantee that our children will want to run our business. In fact, they might not be equipped to run the business properly. If that is the case, they may end up running our business to the ground. This would put them in a worse position, especially if they were raised to think that they do not have to worry about money because they have a business that will take care of them.

Another personal finance lesson Warren Buffett shared is the importance of being grateful and learning to give back.

In his comments, Warren Buffett acknowledged the role of luck in making him wealthy—being born in the US as a white male in 1930 and living long enough to enjoy the power compounding.

However, he recognized that not everyone is as lucky as he is. Because of this, Buffett and his family are focused on giving back so that others who were given a very short straw at birth would have a better chance at gaining wealth.

Learning how to be grateful is very important. We cannot be truly happy unless we are grateful for what we have. In fact, many people who are rich are unhappy because they constantly compare themselves to others who have something that they don’t.

Meanwhile, giving back is a natural outcome of being grateful. It is also very fulfilling. For example, in my company COL Financial, we believe that everyone deserves to be rich. This is why we actively educate Filipinos on personal finance and the stock market.

Helping Filipinos better manage their hard-earned money is one of the greatest fulfillments of my career as an analyst. In fact, this is one of the reasons why I have stayed as an analyst despite the availability of other higher paying jobs.

Finally, Warren Buffett shared the importance of learning how to say no.

People who are wealthy will always be approached by friends, family and others seeking help. Although giving back is important, there is a limit as to how much we can give. Because of that, we need to learn how to say no, even if it is difficult or unpleasant.

To make it easier for his children to say no, Buffett’s foundations have a “unanimous decision” provision which states that unless all his three children agree, the foundations cannot distribute funds to grant seekers.

Although most of us are not as rich as Buffett, we can also benefit from having an accountability partner to help us say no to requests for help. That person can be our spouse, our sibling, or someone who shares our values and understands that while we want to be generous, our resources are limited. Our accountability partner can also help us decide who we should or should not help which is also a difficult task.

Warren Buffett ended his letter by saying that his children spend more time directly helping others than he has and are financially comfortable but not preoccupied with wealth. Because of that, his late wife would be proud of them and so is he.

As a parent, I’d be happier to have children who grow up to become productive citizens with good values rather than to have children who become very rich but are dishonest and greedy. INQ

-

Politics1 week ago

Politics1 week agoCanadian premier threatens to cut off energy imports to US if Trump imposes tariff on country

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg) Technology1 week ago

Technology1 week agoOpenAI cofounder Ilya Sutskever says the way AI is built is about to change

-

Politics1 week ago

Politics1 week agoU.S. Supreme Court will decide if oil industry may sue to block California's zero-emissions goal

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg) Technology1 week ago

Technology1 week agoMeta asks the US government to block OpenAI’s switch to a for-profit

-

Business1 week ago

Business1 week agoFreddie Freeman's World Series walk-off grand slam baseball sells at auction for $1.56 million

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg) Technology1 week ago

Technology1 week agoMeta’s Instagram boss: who posted something matters more in the AI age

-

News1 week ago

East’s wintry mix could make travel dicey. And yes, that was a tornado in Calif.

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png) Technology2 days ago

Technology2 days agoGoogle’s counteroffer to the government trying to break it up is unbundling Android apps