Finance

Op-ed: Want a stronger economy? Start by teaching personal finance to teachers

Caiaimage/chris Ryan | Istock | Getty Pictures

Whereas U.S. voters are divided on many points immediately, there are not less than two the place they’ll agree: They need a stronger economic system and higher schooling.

The excellent news for policymakers is that there’s a easy method to make voters happier on each fronts: They will improve the variety of states requiring Ok-12 monetary schooling.

Presently, solely half of the states within the U.S. require not less than one course in both economics or private finance for high-school commencement, in keeping with information from the Council for Financial Schooling. Meaning tens of millions of U.S. shoppers are getting into maturity with out primary life abilities wanted to handle debt, make investments, save correctly and appropriately weigh financial tradeoffs over their lifetimes.

On condition that consumption represents some two-thirds of the general U.S. economic system, this frequent absence of economic functionality can have important penalties. We’ve seen shopper choices repeatedly play significant roles in financial downturns, together with the housing hypothesis that fueled the 2008 Monetary Disaster and ensuing Nice Recession.

Extra from Private Finance:

A pilot program goals to get college students into accounting

This technique may shave hundreds off the price of faculty

The right way to perceive your monetary help provide

Whereas monetary literacy alone won’t remove such dangers, there’s ample proof that it could actually enhance financial decisions that in flip affect broader financial traits. Take into account a number of examples:

- Analysis revealed within the October 2020 Economics of Schooling Overview concluded that “monetary schooling necessities are related to fewer defaults and better credit score scores amongst younger adults.”

- A latest report by the Monetary Business Regulatory Authority, an business regulatory physique, discovered that “monetary literacy has important predictive energy for future monetary outcomes,” even after controlling for baseline monetary and demographic traits.

- Analysis by Montana State College economics professors Christiana Stoddard and Carly City revealed in 2018 targeted on how mandated private finance schooling in highschool impacted choices round monetary help and spending getting into and through faculty. It confirmed that college students receiving monetary schooling have been extra possible to make use of lower-cost sources of capital to pay for school and had decrease credit-card balances and pupil mortgage quantities.

It would not take a lot to provide an enormous incremental enchancment in general shopper monetary well-being, given the influence of this schooling on key monetary choices corresponding to faculty financing decisions, which may imply much less debt afterward and a better potential to purchase a primary dwelling — all drivers of the economic system.

Doing the mathematics on monetary schooling

Take into account 5 states that presently do not need any commencement requirement tied to private finance or economics coursework: Illinois, Maryland, Massachusetts, Pennsylvania and Washington. These states characterize 15% of U.S. gross home product and 13.5% of the U.S. high-school pupil inhabitants. Educating each graduate in simply this handful of states has the potential to have an outsized influence on the inhabitants and not directly, the nation’s economic system.

Within the U.S., schooling coverage is overseen by state and native governments, so monetary schooling necessities typically want approval from state our bodies or schooling boards. Whereas solely three states — Florida, Georgia and Michigan — final yr handed new financial-literacy coursework mandates, the quantity of debate across the subject was encouraging. Thirty state legislatures proposed 117 associated payments in 2022, in keeping with the Nationwide Endowment for Monetary Schooling.

As soon as mandates are in place, it is a matter of educating the lecturers. Right here once more, there’s a giant potential achieve relative to the funding wanted. About 4 million college students will graduate highschool within the U.S. this yr. Assuming every highschool instructor conservatively reaches about 150 college students per yr, we solely want about 26,000 well-trained lecturers to teach all these high-school seniors — that’s lower than 1% of all of the lecturers within the nation.

A lot of this coaching comes from skilled non-profits, with monetary help from federal and state governments, in addition to the non-public sector.

In fact, these lecturers can typically find yourself educating for many years. So efficient preliminary and ongoing coaching for a instructor may help not only one graduating class however a complete era. Meaning tens of millions of younger adults who could also be extra prone to make higher monetary choices.

Guaranteeing monetary functionality for each little one in each state appears to have broad voter help, in keeping with a Pew Analysis ballot final yr that listed schooling and the economic system as high areas of focus for respondents from each events. Policymakers ought to take notice.

Pushing for better monetary literacy is not only a possible political win for each events; it could additionally contribute to economically stronger constituents and a extra sturdy economic system over time. And it is simple to maneuver the needle: Go extra mandates and practice the lecturers.

— By Rebecca Patterson, chair of the board of the Council for Financial Schooling and former chief funding strategist at Bridgewater Associates

Finance

Personal finance lessons from Warren Buffett’s latest letter

Last Nov. 25, Warren Buffett announced that he would donate a substantial portion of the shares he owned in Berkshire Hathaway to his four family foundations.

In his announcement, he included a letter which contained some important personal finance lessons that we can apply to our own situation.

One of my favorites is his comment that hugely wealthy parents should only leave their children enough so they can do anything but not enough that they can do nothing.

Despite being one of the richest men in the world, Buffett shared that his children only received $10 million each when his wife died. Although $10 million is a lot of money, it’s less than 1% of his wife’s estate.

I am not hugely wealthy, nor do I have $10 million. However, Buffett’s comment about just giving our children enough made me reflect on the importance of also making our children resilient.

Many of us want to make sure that our children will be financially secure by the time we pass away. While there is nothing wrong with this, sometimes we go overboard in making sure that this goal is met.

Article continues after this advertisement

For example, sometimes my husband and I are guilty of overindulging our children.

Article continues after this advertisement

Warren Buffett’s comment reminded me that we should also allow our children to go through difficulties so that they will become resilient and learn how to survive comfortably with less. Aside from letting them know that they shouldn’t expect much in terms of inheritance, this could mean limiting their allowance, allowing them to commute to school when there is no car available, and saying “no” to their request to buy nice and expensive things like the latest top of the line gadgets.

Another thing that we are guilty of (especially if you are Filipino Chinese like me) is thinking that we need to build a successful business so that our children will eventually have a steady source of income and the bragging rights of being their own boss.

Although there is nothing wrong with building a successful business, passing it on to our children should not be a priority. This is because there’s no guarantee that our children will want to run our business. In fact, they might not be equipped to run the business properly. If that is the case, they may end up running our business to the ground. This would put them in a worse position, especially if they were raised to think that they do not have to worry about money because they have a business that will take care of them.

Another personal finance lesson Warren Buffett shared is the importance of being grateful and learning to give back.

In his comments, Warren Buffett acknowledged the role of luck in making him wealthy—being born in the US as a white male in 1930 and living long enough to enjoy the power compounding.

However, he recognized that not everyone is as lucky as he is. Because of this, Buffett and his family are focused on giving back so that others who were given a very short straw at birth would have a better chance at gaining wealth.

Learning how to be grateful is very important. We cannot be truly happy unless we are grateful for what we have. In fact, many people who are rich are unhappy because they constantly compare themselves to others who have something that they don’t.

Meanwhile, giving back is a natural outcome of being grateful. It is also very fulfilling. For example, in my company COL Financial, we believe that everyone deserves to be rich. This is why we actively educate Filipinos on personal finance and the stock market.

Helping Filipinos better manage their hard-earned money is one of the greatest fulfillments of my career as an analyst. In fact, this is one of the reasons why I have stayed as an analyst despite the availability of other higher paying jobs.

Finally, Warren Buffett shared the importance of learning how to say no.

People who are wealthy will always be approached by friends, family and others seeking help. Although giving back is important, there is a limit as to how much we can give. Because of that, we need to learn how to say no, even if it is difficult or unpleasant.

To make it easier for his children to say no, Buffett’s foundations have a “unanimous decision” provision which states that unless all his three children agree, the foundations cannot distribute funds to grant seekers.

Although most of us are not as rich as Buffett, we can also benefit from having an accountability partner to help us say no to requests for help. That person can be our spouse, our sibling, or someone who shares our values and understands that while we want to be generous, our resources are limited. Our accountability partner can also help us decide who we should or should not help which is also a difficult task.

Warren Buffett ended his letter by saying that his children spend more time directly helping others than he has and are financially comfortable but not preoccupied with wealth. Because of that, his late wife would be proud of them and so is he.

As a parent, I’d be happier to have children who grow up to become productive citizens with good values rather than to have children who become very rich but are dishonest and greedy. INQ

Finance

Personal finance guru Dave Ramsey warns over 'mind-blowing' Christmas debt

Personal finance expert Dave Ramsey joined ‘Fox & Friends’ to discuss the Federal Reserve possibly cutting interest rates and how Americans can avoid overspending during the holidays.

Holiday spending is putting a big strain on American wallets and leaving some in debt well past the holiday season; however, personal finance expert Dave Ramsey said ‘mind-blowing’ debt can be avoided.

“The average over the last several years has been that people pay their credit card debt from Christmas into May,” The Ramsey Solutions personality shared during an appearance on “Fox & Friends” on Wednesday. “So it takes them about half the year to come back, and because they don’t plan for Christmas… it sneaks up on them like they move it or something.”

According to a study conducted by Achieve, the average American will spend more than $2,000 for the 2024 holiday season, breaking down the outflow of cash into travel and holiday spending on hosting parties, food, clothing, and other gifts.

STOP OVERSPENDING OVER THE HOLIDAYS AND START THE NEW YEAR OFF FINANCIALLY STRONG

Another recent survey by CouponBirds indicated that parents will spend an average of $461 per child and that 49% of parents will go into debt to pay for this Christmas.

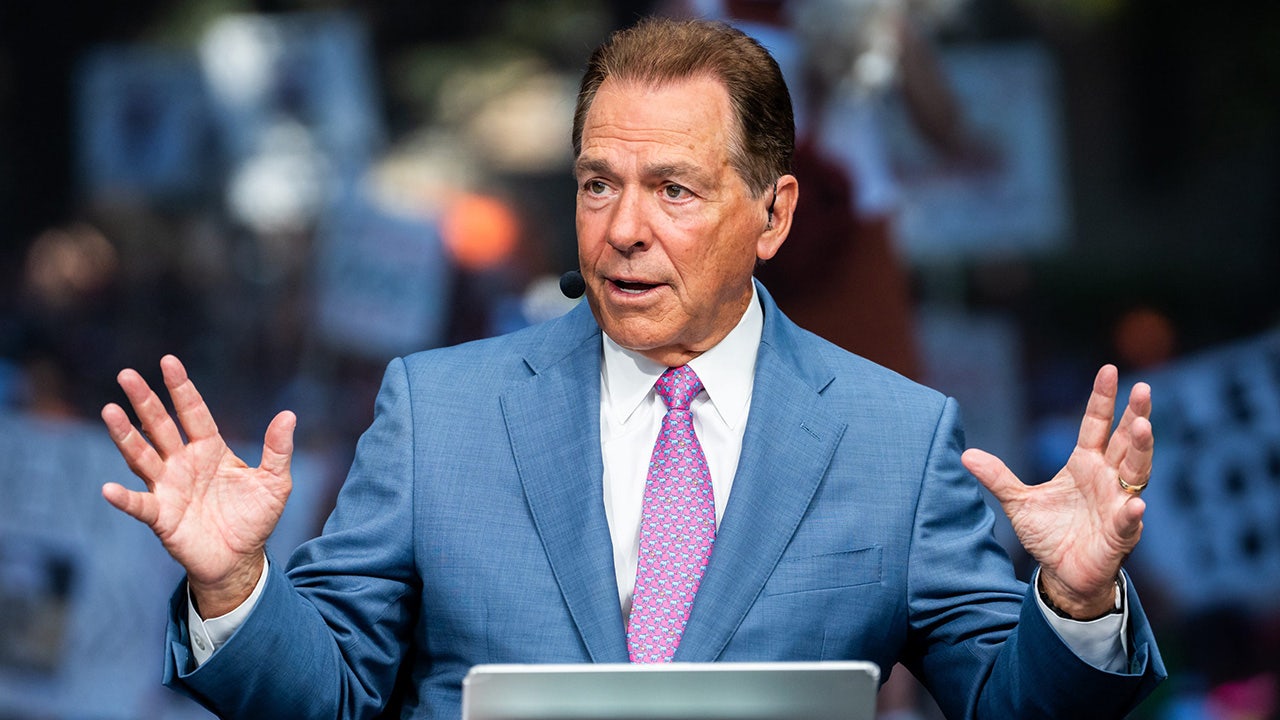

Ramsey Solutions’ Dave Ramsey says “you won’t overspend” if you stick to a Christmas budget. (Getty Images)

The Ramsey Solutions personality balked at the amount of money shelled out for the season while explaining that the holiday should not come as a shock, and that spending for it should be planned out.

“Those numbers are mind-blowing when you look at the averages there. That’s a lot of money going out,” Ramsey added, “all in the name of happiness comes from stuff, and it doesn’t.”

He also weighed in and agreed on advice from fellow expert, Ramsey Solutions personality and daughter Rachel Cruze, who suggested making a list of people to shop for and noting how much to spend on each.

FOX Business’ Lauren Simonetti details the holiday shopping season on ‘Cavuto: Coast to Coast.’

“You know, I’m old, and I met a guy from the North Pole,” the expert joked. “He said ‘make a list and check it twice,’ so Rachel’s right.”

Ramsey followed up by expanding on his daughter’s suggestion: “If you do that, and you put a name beside it, and then you total up those dollar amounts, you have what’s called a Christmas budget.”

“If you stick to that, you won’t overspend,” “The Ramsey Show” host remarked.

National Retail Federation CEO Matt Shay reacts to the latest report that holiday spending is expected to reach $989B this year.

The money guru pointed out what he sees as problematic with the holiday season – not taking a shot at Christmas itself – but referring back to the spending issues.

“The problem with Christmas is not that we enjoy buying gifts for someone else. That’s a wonderful thing,” he reassured. “The problem is we impulse our butts off, and we double up what we spend because the retailers make all their money during this season.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Ramsey concluded by advising shoppers to be wary of retailers and to not be ensnared by their marketing strategies.

“They’re great merchandisers,” he warned. “They’re great at putting stuff in front of us that we hadn’t planned to buy.”

READ MORE FROM FOX BUSINESS

Ramsey Solutions personality Jade Warshaw breaks down the latest economic data that shows consumer credit card debt is piling up amid a jump in spending.

Finance

Can AI Solve Your Personal Finance Problems? Well …

Switch the Market flag

for targeted data from your country of choice.

Open the menu and switch the

Market flag for targeted data from your country of choice.

Need More Chart Options?

Right-click on the chart to open the Interactive Chart menu.

Use your up/down arrows to move through the symbols.

-

Politics1 week ago

Politics1 week agoCanadian premier threatens to cut off energy imports to US if Trump imposes tariff on country

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg) Technology1 week ago

Technology1 week agoOpenAI cofounder Ilya Sutskever says the way AI is built is about to change

-

Politics1 week ago

Politics1 week agoU.S. Supreme Court will decide if oil industry may sue to block California's zero-emissions goal

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg) Technology1 week ago

Technology1 week agoMeta asks the US government to block OpenAI’s switch to a for-profit

-

Business1 week ago

Business1 week agoFreddie Freeman's World Series walk-off grand slam baseball sells at auction for $1.56 million

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg) Technology1 week ago

Technology1 week agoMeta’s Instagram boss: who posted something matters more in the AI age

-

News1 week ago

East’s wintry mix could make travel dicey. And yes, that was a tornado in Calif.

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png) Technology2 days ago

Technology2 days agoGoogle’s counteroffer to the government trying to break it up is unbundling Android apps

/cdn.vox-cdn.com/uploads/chorus_asset/file/25784221/247333_EOY_Package_Check_In_CVirginia_PRIME.jpg)