Finance

India RBI chief says urgent need to boost green finance flows to emerging markets

/cloudfront-us-east-2.images.arcpublishing.com/reuters/OL56GGUB5JNJZMX563TMZYLAB4.jpg)

Reserve Bank of India (RBI) Governor Shaktikanta Das speaks during a press conference after a G20 Finance Ministers’ and Central Bank governors’ meeting at Gandhinagar, India, July 18, 2023. REUTERS/Amit Dave/File Photo

MUMBAI, Aug 11 (Reuters) – There is an urgent need to increase green finance flows to emerging market economies, India’s central bank chief said on Friday.

In closing remarks at a G20 finance event in Mumbai, Reserve Bank of India (RBI) Governor Shaktikanta Das said investment needs for a smooth green transition are large, but actual financial flows to green projects are “by and large, concentrated in advanced economies.”

Since such flows are dependent on ESG ratings, it is important that green ratings reflected the actual environmental impact of a project to avoid ‘greenwashing’, Das said.

India currently holds the presidency of the G20 and will host leaders of these countries between September 9-10.

Das said a multilateral debt relief program providing assistance to low-income countries with high debt levels needs to be considered on a priority basis.

“This initiative can be designed with a clear focus on utilisation of debt relief for sustainable development projects and poverty reduction efforts,” he said. “Instruments such as debt-for-development swaps and green debt relief programs could be employed.”

Reporting by Swati Bhat and Siddhi Nayak, writing by Shilpa Jamkhandikar and Ira Dugal, editing by Christina Fincher

Our Standards: The Thomson Reuters Trust Principles.

Finance

Do you have the top predictor for financial well-being? Here’s what Vanguard’s research says.

It doesn’t take $1 million to achieve the top predictor of financial well-being, according to new research from investment firm Vanguard. Instead, it’s something far more attainable: Socking away at least $2,000 in an emergency savings account.

People with at least $2,000 saved for an unexpected expense report a greater improvement in financial well-being than those who have incomes of more than $500,000 or assets of more than $1 million, the survey of more than 12,000 Vanguard investors found.

The findings come as many Americans are feeling more financially stressed, with a separate study from Primerica finding that about half of middle-class households expect to be worse off financially in 2026, almost double the share in December, due to worries about the cost of living and the economy. Taking small steps to build an emergency savings account could prove to help alleviate financial anxiety, noted Paulo Costa, a behavioral economist and certified financial planner at Vanguard who co-authored the research.

“What’s so powerful about this research is that it’s not about gathering a lot of money to have that peace of mind,” Costa told CBS MoneyWatch. “That initial $2,000 makes a big difference.”

While it may seem that having $1 million in assets should boost financial well-being more than $2,000 in a savings account, the results show the importance of being prepared for an unplanned expense, Costa added. The median cost of an emergency is about $2,000, which means having that cash on hand gives people the confidence that they can handle a sudden money stressor, he said.

“When is $2,000 more than a million dollars? It’s when it comes to emergency savings,” Costa said. “The point of emergency savings is to have that money readily available if you need it. A lot of people have money, for example, in retirement accounts that may have some requirements about when you can withdraw that money and may have some tax consequences and some penalties.”

Retirement assets are generally not readily available to cover unexpected expenses, with people younger than 59 1/2 incurring a 10% penalty for taking out money. But having $2,000 set aside in a bank account means that you’ve got the peace of mind that you’ll be able to handle a surprise car repair or medical bill.

And people with $2,000 in emergency savings typically spend about 2 hours less each week thinking about their finances versus those without any savings, the study found.

How many people can handle emergency expenses?

To be sure, obtaining $2,000 in savings could prove out of reach for many Americans, especially those who are low income, struggling with debt or who reside in an area with a high cost of living. Vanguard’s survey includes only people who have investment accounts at the company, which signals they access to 401(k)s and other types of investment accounts that many Americans lack.

Almost 4 in 10 Americans say they don’t have the cash on hand to pay for an $400 emergency expense, according to research from the Federal Reserve.

Still, more Americans appear to be socking away money for a rainy day, with the Primerica study finding that 64% of those surveyed in March said they had an emergency fund of at least $1,000, up from 58% two years earlier.

Even if saving $2,000 seems out of reach, you can start small by saving as little as $10 week, Costa said. The best idea is to find a strategy that works for you, whether that’s budgeting or automating savings by directing a certain amount into a dedicated account with each paycheck, he said.

“I love the idea of, ‘out of sight, out of mind,’ so when you get paid, you immediately send money to your savings account,” he said. “By saving $50 per week, you will build up to $2,000 in less than a year.”

He added, “Saving something is better than saving nothing. So just getting started, that really makes a big difference.”

Finance

Trump’s tariff revenue has already topped $22 billion in May

President Trump’s tariffs continued to be felt by importers in May with a measure of government receipts for “Customs and Certain Excise Taxes” already topping $22.3 billion this month, according to Treasury Department data.

The monthly total is likely to rise only slightly in the coming days, with importers often depositing their tariff duties largely in a single day. A massive deposit of more than $16.5 billion appeared in government coffers on May 22.

May’s total so far has already topped April’s full-month haul of $17.4 billion — not to mention March’s haul of $9.6 billion.

It was a continuation of revenue spikes seen during Trump’s second term in office, which dwarfed recent history and Trump’s first term.

All told, more than $92 billion has flowed into government coffers since Jan. 1.

May’s surge in revenue came as many of Trump’s duties were only felt for an entire month after his biggest tariffs — 10% duties on nearly every country in the world — took effect on April 5.

The haul also came after other new concessions from Trump this month that saw a slashing of tariffs on China and a limited lowering of duties on the UK.

Trump added Tuesday in a social media post that more duties could be coming, saying of his decision to delay 50% tariffs on Europe for now, “Remember, I am empowered to ‘SET A DEAL’ for Trade into the United States if we are unable to make a deal.”

Read more: What Trump’s tariffs mean for the economy and your wallet

The president is also threatening new tariffs in the weeks and months ahead, including new sector-specific tariffs to be announced on items such as semiconductors and pharmaceuticals and possible tariffs aimed at companies like Apple (AAPL) and Samsung (005930.KS).

The data is significant but could be slightly overstated, with the Treasury Department reporting both customs duties and certain excise taxes as a single category from the Department of Homeland Security.

Excise taxes are different from customs duties. More precise data for only customs duties is expected to be available in a few weeks. But customs duties have historically made up the lion’s share of the combined figure.

Trump himself has regularly touted the surge of government tariff receipts, suggesting the US government is on its way to a repeat of an era in US history that ended more than a century ago when tariffs made up a significant portion of government revenues.

“We’re going to make a lot of money [from tariffs] and that money’s going to be used to reduce taxes,” Trump said on April 23. “We’re going to get big, big tax breaks.”

Finance

ARCPOINT REPORTS Q1 2025 FINANCIAL RESULTS

Greenville, South Carolina, May 26, 2025 (GLOBE NEWSWIRE) — ARCpoint Inc. (TSXV: ARC) (the “Company” or “ARCpoint”) is pleased to report that it has filed its unaudited Q1, 2025 Financial Statements and related Management Discussion and Analysis as summarized below.

Interim CFO and Director, Adam Ho commented, “In addition to a year over year reduction in overall costs as a result of the CRESSO transaction, we have also recently enacted additional temporary reductions in overall compensation and professional services costs of approximately USD$57k per month. These temporary reductions are a testament to the commitment of our team members in our pursuit of increasing value for our shareholders and other stakeholders.”

Beginning in mid-April of this year, the Company enacted temporary reductions in overall compensation and professional services costs totalling approximately USD$57k on a monthly basis. These temporary reductions represent approximately 40% of total monthly compensation and key, monthly recurring professional services costs. The reductions are temporary and are intended to help the Company manage its finances while it works to increase revenues through the addition of new users of the Company’s MyARCpointLabs (“MAPL”) technology platform.

Mr. Ho added, “Although a reduction in costs is important and we are grateful for the sacrifices our team members are making, we remain focused on adding new users of our MAPL platform and look forward to reporting on our progress in this regard soon”.

On Aug. 20, 2024, the company announced that it had entered into a transaction with Any Lab Test Now (ALTN) to bring together the franchise operations of both Any Lab Test Now and ARCpoint into a new joint venture company, CRESSO Brands LLC. ALTN, based in Atlanta, Ga., was founded in 1992 and at the time of the Aug. 20, 2024, transaction, had more than 235 United States franchise locations, providing direct access to clinical, DNA, and drug and alcohol lab testing services, as well as phlebotomy and other specimen collection services, through its retail storefront business model. When combined with the more than 135 ARCpoint franchise group locations, also at the time of the transaction, CRESSO is now the largest franchise network of its kind in the United States. At the time of the CRESSO transaction, ALTN and ARCpoint also agreed to make ARCpoint’s MyARCpointLabs technology platform (MAPL) the systems choice for CRESSO brand franchisees. Given that the Company now holds a 29.5% interest in the CRESSO, ARCpoint’s interest is accounted for using the equity method. As a result, revenues and costs previously attributable to the Company’s franchise operations, are no longer consolidated into the ARCpoint’s financial statements.

-

News1 week ago

News1 week agoMaps: 3.8-Magnitude Earthquake Strikes Southern California

-

Politics1 week ago

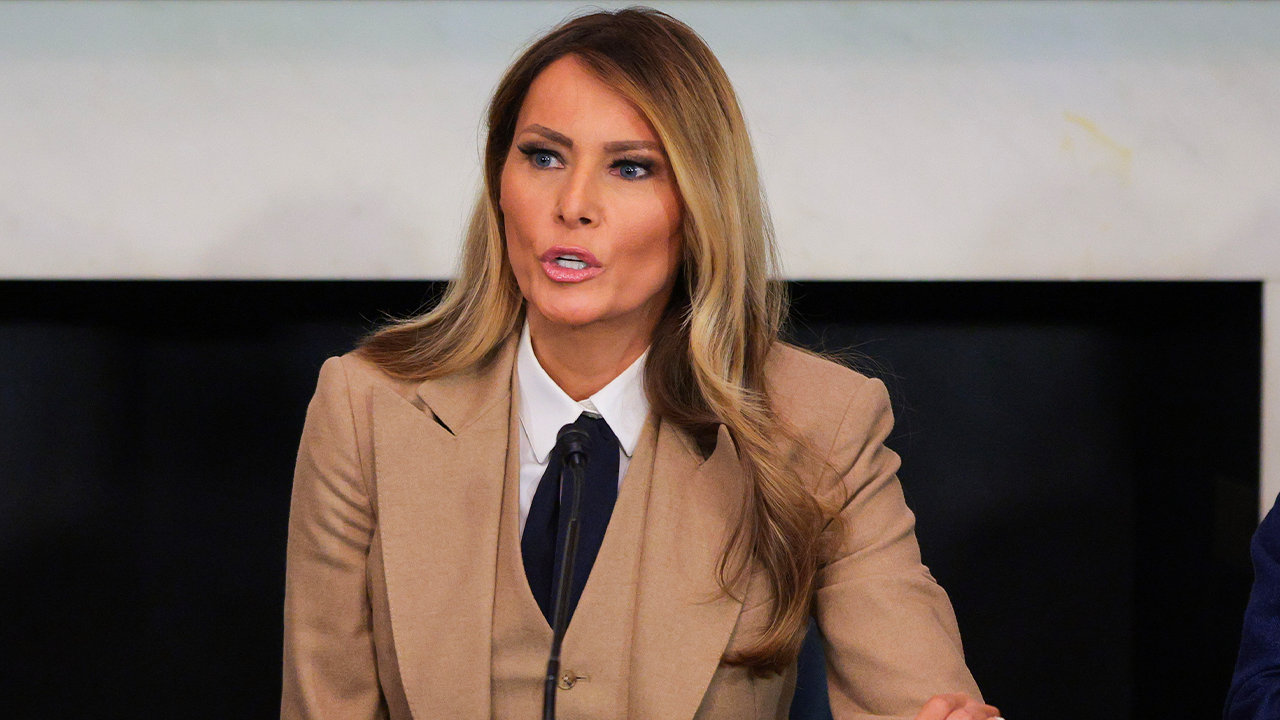

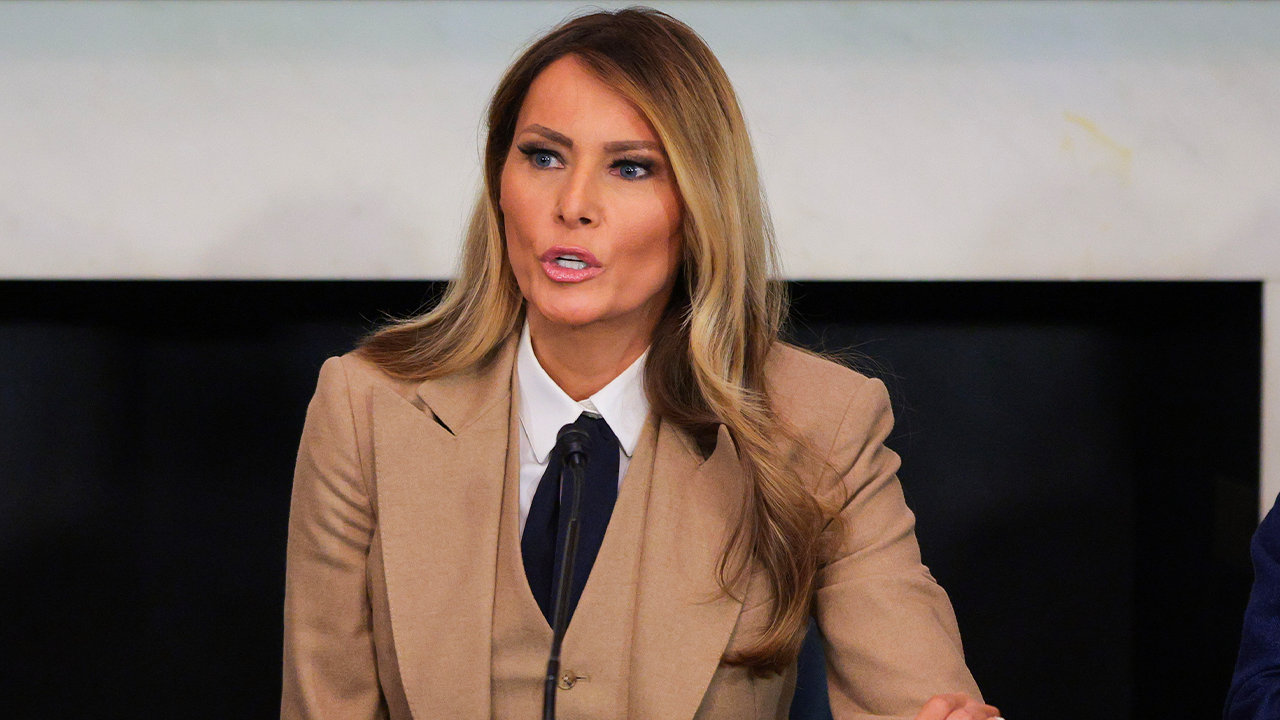

Politics1 week agoTrump, alongside first lady, to sign bill criminalizing revenge porn and AI deepfakes

-

Movie Reviews1 week ago

Movie Reviews1 week agoReview | Magellan, conqueror of Philippines, as we’ve never seen him before

-

Education1 week ago

Education1 week agoHow Usher Writes a Commencement Speech

-

Politics1 week ago

Politics1 week agoExpert reveals how companies are rebranding 'toxic' DEI policies to skirt Trump-era bans: 'New wrapper'

-

World1 week ago

World1 week agoDigitisation fronts new Commission strategy to boost EU single market

-

Culture1 week ago

Culture1 week agoDo You Know the English Novels That Inspired These Movies and TV Shows?

-

World1 week ago

World1 week agoEU reaches initial deal to lift economic sanctions on Syria: Reports