Finance

G-7 finance chiefs reaffirm unwavering support for Ukraine

Finance chiefs from the Group of Seven industrialized nations on Sunday reaffirmed their “unwavering” support for Ukraine, Japan’s Finance Minister Shunichi Suzuki said, as Russia’s aggression against its neighbor continues.

The G-7 finance ministers and central bank governors did not discuss recent developments in the foreign exchange market, Suzuki told reporters after their meeting in India, at a time of financial market jitters over future monetary tightening in major economies.

Last week, the G-7 leaders pledged to provide military equipment, training and intelligence, among other forms of support, as Ukraine has begun its counteroffensive against Russia.

Japanese Finance Minister Shunichi Suzuki speaks to reporters in Gandhinagar, India, on July 16, 2023, after finance chiefs from the Group of Seven industrialized nations met. (Kyodo)

The rich club is also committed to giving financial support to Ukraine to help it cope with the impact of the Russian invasion since February 2022.

“We reaffirmed that we will not waver in support of Ukraine,” Suzuki said after chairing the G-7 meeting on the fringes of a financial gathering of the Group of 20 major economies in the western Indian city of Gandhinagar.

Besides Japan, which holds this year’s presidency, the G-7 also involves Britain, Canada, Germany, France, Italy and the United States plus the European Union.

The G-7 finance ministers discussed their coordinated response to Russia and global taxation reforms but not currency moves.

The yen has seen a quick reversal of its recent slide against the U.S. dollar, partly because of slowing inflation in the United States that has prompted market participants to pare back expectations of further aggressive rate hikes by the Federal Reserve.

The Fed and the Bank of Japan are scheduled to hold a policy-setting meeting in late July, respectively, amid speculation that the dovish Japanese central bank may modify its program to keep borrowing costs at rock-bottom levels.

Bank of Japan Governor Kazuo Ueda speaks at a press conference following a meeting of the Group of Seven finance ministers and central bank governors in Gandhinagar, western India, on July 16, 2023. (Kyodo) ==Kyodo

“Yield curve distortions have been rectified,” BOJ Governor Kazuo Ueda told reporters after the G-7 meeting. Uncertainty over the global economy is “high,” he added.

The yield curve control program has been blamed for distorting bond markets as the BOJ has been seeking to keep 10-year Japanese government bond yields within a narrow range.

Related coverage:

G-7 justice chiefs reaffirm support for Russian war crimes probe

G-7 says will closely coordinate over Russia amid alleged uprising

Japan boosts cooperation with NATO, aid for Ukraine

Finance

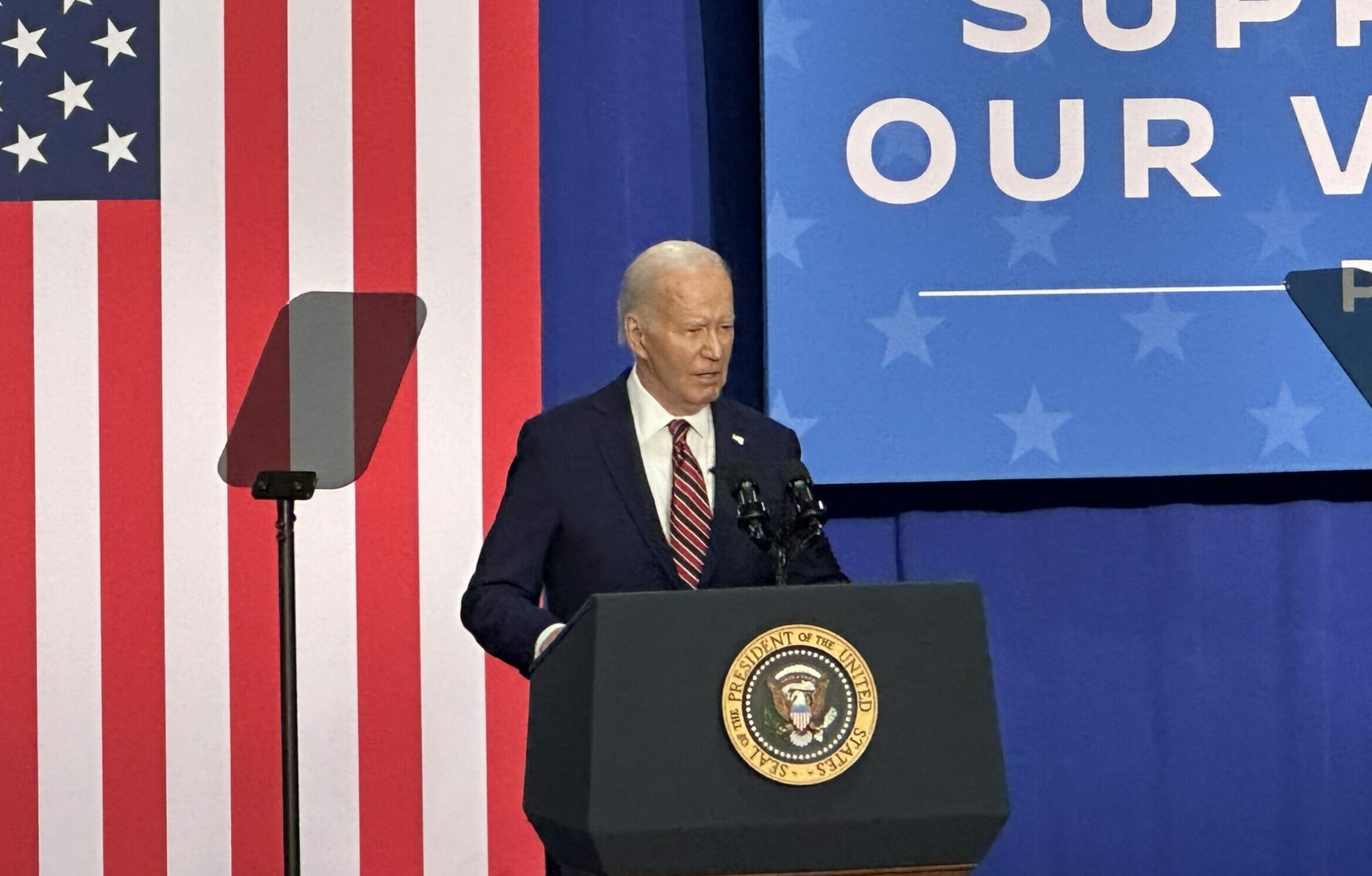

Donald Trump looks to entice the alt-finance crowd. His campaign will now accept crypto assets

Donald Trump ‘s presidential campaign said Tuesday it would begin accepting donations in cryptocurrency as part of an effort to build what it calls a “crypto army” leading up to Election Day.

The Trump campaign launched a fundraising page that allows “any federally permissible donor the ability to give” to its political committees using any crypto asset accepted through the Coinbase cryptocurrency exchange.

The announcement promotes Trump’s message that he is a crypto-friendly candidate, and also appeals to a core group of young male voters who are increasingly likely to dabble in digital assets. It came as Trump’s defense rested in his hush money case in New York.

Cryptocurrencies are a digital asset that can be traded over the internet without relying on the global banking system.

Trump’s campaign is accepting a range of popular cryptocurrencies that include Bitcoin, Ether and US Dollar Coin, and also include the low-value coins that tend to be popular with Internet personalities like Shiba Inu Coin, and Dogecoin.

Billionaire Elon Musk, most notably, is considered a fan of the latter two, traded on markets as DOGE and SHIB.

It’s not clear whether the Trump campaign will hold onto the crypto or will immediately sell it, and what sort of fees it may pay to liquidate. While the campaign says it plans to follow U.S. election laws, the anonymous nature of cryptocurrencies can make it tricky to confirm the funds are coming from who they say they are.

Trump has already received millions in cryptocurrency personally through his Trump Digital Trading Cards non-fungible token projects and his MAGA coin, which was released last August.

Julia Krieger, a spokeswoman for Coinbase, told The Associated Press that “crypto is nonpartisan and moves money forward because it’s cheaper and faster,” adding that the Coinbase platform is open to all candidates this election season.

A representative from President Joe Biden’s campaign did not respond to an Associated Press request for comment on whether it will begin accepting cryptocurrency donations.

While some states don’t allow cryptocurrency donations in state races under existing campaign finance laws, the Federal Election Commission does allow committees to receive bitcoin as contributions.

A 2014 advisory opinion issued by the commission concluded that bitcoin is “money or anything of value” within the meaning of the law and political committees should value the contribution based on the market value of bitcoin at the time the contribution is received.

The presidential campaign for independent candidate Robert F. Kennedy Jr. currently accepts bitcoin donations.

In conventional money, Biden and the Democratic National Committee said Monday that they raised more than $51 million in April, falling well short of the $76 million that Trump and the Republican Party reported taking in for the month.

Finance

Taxes and Finance: Understanding the home gain exclusion

When is a tax planning session essential?

One of the biggest tax benefits available today is the exclusion of gains when you sell your qualified home. Here is what you need to know.

The tax benefit explained

For those who qualify, a married couple can exclude up to $500,000 ($250,000 for unmarried taxpayers) in capital gains from the sale of your principal residence. This exclusion can be taken once every two years as long as you pass two tests; a two-years out of five residency test and an ownership test before you sell the property.

Special situations can cause complications

Often tax planning is required to ensure you maximize this tax benefit. Here are some situations that require a review prior to selling your home.

Ownership and principal residency tests met using different years. As long as the two-year requirement is met for both tests you can take the deduction. It does not matter that you use different years for each test. The most common example of this occurs when you rent a home or condo and then buy it later.

Life events complicate things

Marriage, divorce, and death are common life-events that require planning to maximize the gain exclusion tax benefit. For example, you can take advantage of the full $500,000 gain exclusion after the death of a spouse, but usually only during the time you are able to file a joint tax return.

Selling a second home requires planning

While you can use the gain exclusion every two years, you need to be careful with a second home. You may be able to plan your living arrangements to make each home a primary residence during different tax years to meet the two-year requirement for both properties. This means you need to determine your primary residence each year with good record keeping in case you are audited.

Business use of your home

You will need to adjust your home basis (cost) for any business activity and depreciation of your home. This can create a depreciation recapture tax event when you sell your home.

A partial gain exemption is possible

There are exceptions to the two-year tests when certain events occur. The normal exceptions include a required move for work, health reasons, or unforeseen circumstances. Since the IRS definition of each is vague, you should review your options if you are required to move.

Record keeping matters

Be prepared to document the gain on your property and how you meet the residency and ownership tests. Please keep all documents relating to the purchase and sale of your property. Save any receipts that document improvements to your home. Also keep an accurate record to support your claim of principal residence if you own a second home.

Given the potential for tax savings, please ask for help before selling your home or vacation property.

James Angell is a Willits based Certified Public Accountant. His office is located at 461 S. Main St. and he can be reached at 707-459-4205.

Finance

What are the best ways to finance excellent hotel studies? – Part 2

While the hospitality industry is renowned for being a veritable social ladder, where someone without a degree can start out as a dishwasher before working their way up to become a hotel manager, education remains the quickest route to positions of great responsibility. Future talents are turning to the best hotel schools to train and join this rich industry. However, the cost of excellent studies can be daunting for many students. This is a financial barrier that schools, authorities and even the students themselves are trying to overcome through various financing solutions.

To (re)discover part 1 of this analysis, which looks at the cost of student life in 2024, click here. A wide range of funding options Grants, funding and support While such studies may seem out of reach for many students because of their cost, there are many ways of financing them. Whether it’s the…

-

News1 week ago

News1 week agoSkeletal remains found almost 40 years ago identified as woman who disappeared in 1968

-

World1 week ago

World1 week agoIndia Lok Sabha election 2024 Phase 4: Who votes and what’s at stake?

-

World1 week ago

World1 week agoUkraine’s military chief admits ‘difficult situation’ in Kharkiv region

-

Movie Reviews1 week ago

Movie Reviews1 week agoAavesham Movie Review

-

News1 week ago

News1 week agoTrump, Reciting Songs And Praising Cannibals, Draws Yawns And Raises Eyebrows

-

Movie Reviews1 week ago

Movie Reviews1 week agoUnfrosted Movie Review: A sweet origins film which borders on the saccharine

-

World1 week ago

World1 week agoCatalans vote in crucial regional election for the separatist movement

-

Politics1 week ago

Politics1 week agoNorth Dakota gov, former presidential candidate Doug Burgum front and center at Trump New Jersey rally