Finance

Financial Literacy Impacting Professional Outcomes As Students Transition To Careers

With out monetary literacy expertise are faculties lacking a possibility? (Picture by David McNew/Getty … [+]

Getty Photographs

When discussing scholar studying fashions, possession and company are lead points in schooling circles. But, with regards to monetary literacy and the important components of taking possession of funds, many college students are requested to search out out independently.

A latest Newsweek article highlights analysis performed by the Centre for Social Justice within the U.Okay. on the important cash habits and expertise fashioned between the ages of three and seven. Solely 38% of youngsters and youth within the U.Okay. obtain any sort of monetary schooling at school. The analysis backs Milken Institute findings that reveal a scarcity of primary monetary data and expertise in highschool college students within the U.S.

With out monetary literacy on the fingertips of scholars and younger adults, real-life success tales carry much more which means by shedding mild on historical past, patterns, and decisions that result in profitable outcomes. College students and youth can glean data by listening to the tales of people, regardless of their age, who concentrate on their interior resolve, persevere and problem themselves to push by obstacles to acquire monetary freedom and make a distinction for others.

This reporter wished to be taught extra about people overcoming private challenges to search out success within the monetary sector. Using setbacks as studying instruments, classes have been revealed inside and outdoors the ‘faculty’ of laborious knocks illustrating the ability of buying monetary literacy for early-career professionals.

Jeremiah, “The Bull” Evans, is a novel particular person who took possession of hardships and translated them into success on the age of 26. He’s the CEO and Founding father of Alpha Monetary Company, together with seven different corporations and extra pursuits. In his spare time, he produces the Bullpen Podcast and works on his ebook, Alpha Hero. Whereas the ‘alpha’ branding is distinguished in all his efforts, it discovered its form by years of persistence and going through fears relationship again to childhood.

No One Is Coming to Save You

Incessant bullying was part of Evans’s each day battle at college. Youngsters taunted him with the title “The Bull,” ridiculing his weight and stature. “I didn’t need to get up, go to highschool and endure these issues,” recollects Evans. “Each single day felt like one thing was going to occur. They might beat me up or pin me all the way down to the bottom.”

When his father found the bullying, not like some dad and mom who step in on their little one’s behalf, he believed Jeremiah wanted to take full possession himself. “Nobody is coming to avoid wasting you,” mentioned his father, demanding that he tackle a selected bully who had struck him. “Don’t return residence till you confront him,” mentioned his dad. In order that’s precisely what he did.

“My father pressured me to push by that concern. To push by my limitations and notice my capabilities. For the remainder of his life shifting ahead, I knew it doesn’t matter what occurs, I might do it and maintain my shoulders larger,” says Evans.

He leaned on sports activities, however when soccer didn’t pan out, he used the identical angle of no excuses to enter into the enterprise chapter of his life.

Turning a mocking phrase of “fats bull” into his personal moniker, “The Bull” he took possession and delight in his rediscovery of self. It gave him a way of empowerment that carried over into his entrepreneurial pursuits.

Making Cash to Make a Distinction

“I did not select the sector. I simply did it as a result of finance and monetary providers make extra millionaires than some other trade on the planet,” says Evans. It isn’t the cash that motivates him however quite the liberty it permits to pursue different areas of curiosity to have an effect on change. “To make a distinction, sadly, it needs to be by cash. As a lot as folks would possibly argue that it should not be the best way—it’s. Simply do what it’s important to do to turn out to be the one that makes the distinction.”

Evans turns the thought of ardour on its head. He admits that he was not initially captivated with finance-driven ventures however quite about potentialities derived from monetary freedom and the acquisition of monetary literacy expertise.

Alpha Monetary Company, Evans’s mothership, trains and instructs brokers on how you can turn out to be established within the monetary providers enterprise correctly. With a focus on leads within the insurance coverage trade, and actual property investing, Evans supplies alternatives for others to develop their very own type of possession in monetary freedom. Success is measured by others succeeding. “What number of brokers have I been in a position to assist reside a lifetime of freedom and might discover time and goal to donate to bigger causes?” asks Evans.

“I am 26. I’ve loads of companies which have generated over $50 million in gross sales within the final two to 3 years. The world can pay you what it thinks you are value. Cash is simply worth,” he provides.

His philosophy of “Be Nice or Be Nothing” carries over into his ardour for extra philanthropic pursuits working with Tim Ballard and Operation Underground Railroad, by donating to their efforts to rescue youngsters from trafficking and exploitation.

Which means By Concern

Typically monetary literacy comes from adopting a piece ethic and interior make-up to push by adversity. For Evans, it’s all in regards to the embrace of concern. “As soon as you are feeling concern, it means you are doing one thing to develop and stretch. It means you are doing one thing significant. Nothing significant in life was ever accomplished by somebody who did not present braveness and push by concern,” he says.

“Success will stand on high of a mountain of failures,“ says Evans. In terms of entrepreneurial efforts within the gig financial system, he relates concern on to advertising methods. In line with Evans, advertising is nothing however testing what works and changing into obsessive about the ‘no.’

Entrepreneurs want to search out what doesn’t work, change it, and, if crucial, change it once more. Failure is commonly baked-in to the success for enterprise and life.”That is the crucible that separates the 1% from the 99%. The one distinction between me at 26 and another person at 26 is I’ve pushed myself by much more concern than they’ve. The 1% is prepared to do what the 99% are unwilling to do. That is the one distinction.”

Useful resource allocation continues to have a seat on the proverbial schooling desk of taglines. The dispersal of data that helps long run investments in college students as they turn out to be early-career professionals has the potential to impression multiple’s backside line or LinkedIn profile.

The schooling sector would possibly profit from making certain that monetary literacy is given a everlasting seat on the ever-evolving desk of an trade in dire want of certain footing that can fulfill the final word buyer, the scholar.

The ‘Bull’ continues to guess on it. Perhaps schooling ought to too.

Interviews have been edited and condensed for readability.

Finance

The brave new world of Open Finance

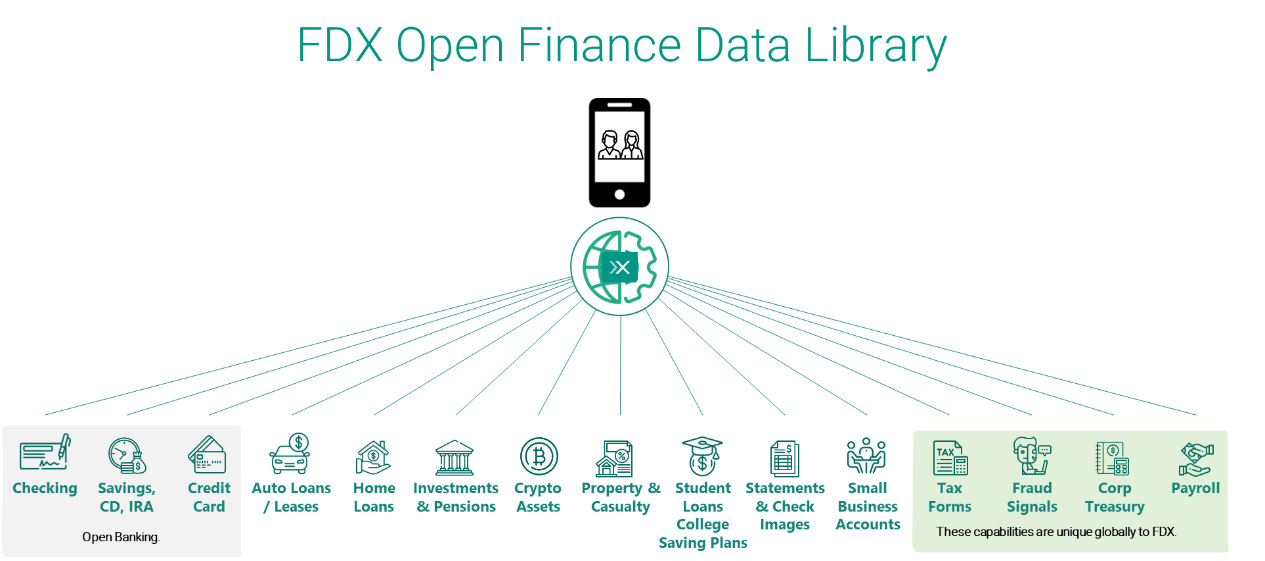

Don Cardinal of Financial Data Exchange (FDX) explores how Open Finance extends beyond Open Banking, revolutionising financial data sharing.

Much ink has been spilt on the topic of Open Banking, but I wanted to take a step today into a larger world of Open Finance. Whereas Open Banking is most commonly associated with current accounts (checking, savings, credit cards), Open Finance is concerned with the totality of your financial world.

While current accounts are important in the personal financial management use case, when you look at more sophisticated needs, liability accounts like auto loans, home loans, and student loans are required to help give context to a personal balance sheet. Finally, the addition of investment and retirement accounts gives the wealth management user a full 360-degree view of the consumer’s financial health.

Additional use cases – such as account and balance verification, bill payment, and payroll needs like verification of income/employment and pay stub retrieval – along with the ability to retrieve tax forms like W2, 1098, 1099, and capital gain statements for tax preparation, round out the most common consumer demands for linking accounts.

These are all important use cases for consumers and small businesses, but it is also important to address why data providers like banks, brokers, and others would benefit from data sharing.

We know that one in three digitally-enabled consumers has shared access to their financial data in the last year and similar polls of financial institutions tell us that at least one-third (if not more) of their online banking traffic was credential-based access (screen scraping) to power these use cases.

Imagine if a data provider could reduce one-third of its entire load on its online infrastructure in favour of a portal 100 times more efficient than screen scraping. The introduction of secure APIs does just that. Lowering costs of hardware overall.

One of the other uses by data providers is data-in, to pre-fill new account applications as well as provide strong signals for Know Your Customer (KYC), including account tenure at a predecessor institution. Better data means faster, more accurate decisions leading to fewer abandons or declines, meaning more revenue for the institution.

As a banker for a number of years, one of the biggest questions we had was ‘What was our share of a given customer’s wallet?’ We often had to try to infer based on monies in and out, but with Open Finance, you can link to other institutions and know in real time what your share of wallet is. This allows you to be almost surgical in your marketing and product offering.

All this is made possible by secure, permissioned data sharing via a common API standard.

Looking forward

Avoid FUD (fear, uncertainty, and doubt). Many jurisdictions have implemented Open Banking (the UK, EU, Australia, Brazil, among others) and there has yet to be a mass exodus of consumers in any of these nations. Why? If you are confident in your product, your pricing, and your service, making data available via an API does nothing to incent consumers to leave, rather the opposite. The largest credit union in Brazil said at the FDX Spring 2024 Summit that they saw a net increase in digital engagement and accounts per customer after Open Banking was introduced.

A last bit of advice: APIs are a net new channel and will be the third leg in the digital stool. Online, Mobile, and API will be the troika. APIs are much more efficient and can deliver data that cannot be displayed visually. As you make your plans for 2025 and 2026 for your digital roadmap, you would be remiss in not including Open Finance APIs in your product mix. Your competitors are.

This editorial piece was first published in The Paypers’ Open Finance Report 2024, the latest comprehensive market overview and analysis focusing on the key players and products within the Open Banking and Open Finance ecosystem. Download the full report to discover more insightful content.

About Don Cardinal

Don Cardinal is Managing Director of Financial Data Exchange (FDX) and has led it since its inception. Previously, he spent over 20 years with Bank of America, serving as head of digital for its Military Bank, VP of Digital Banking & Senior VP of Information Security. Don holds 18 US patents and CPA, CISA, CISM certificates.

Don Cardinal is Managing Director of Financial Data Exchange (FDX) and has led it since its inception. Previously, he spent over 20 years with Bank of America, serving as head of digital for its Military Bank, VP of Digital Banking & Senior VP of Information Security. Don holds 18 US patents and CPA, CISA, CISM certificates.

About FDX

The Financial Data Exchange (FDX) is dedicated to unifying the financial industry around a common, interoperable, royalty-free standard for the secure and convenient access of permissioned consumer and business financial data: the FDX Application Programming Interface (FDX API). FDX is a global 501(c)(6) nonprofit organisation with no commercial interests operating in the US and Canada.

The Financial Data Exchange (FDX) is dedicated to unifying the financial industry around a common, interoperable, royalty-free standard for the secure and convenient access of permissioned consumer and business financial data: the FDX Application Programming Interface (FDX API). FDX is a global 501(c)(6) nonprofit organisation with no commercial interests operating in the US and Canada.

Finance

Boost your finances in 2025: Experts share top New Year's money resolutions

Boost your finances: Experts share top 2025 money resolutions

With holiday credit card bills starting to roll in, you might want to shift your New Years resolution from your waistline to your wallet.

CHICAGO – With holiday credit card bills starting to roll in, you might want to shift your New Year’s resolution from your waistline to your wallet.

In a Fox 32 money saver special report, we asked the experts for a little help on how to boost your finances in 2025.

SMART MONEY MOVES

Why you should care:

“Some of the resolutions, some of the tips we would recommend for your New Year resolutions, financially, is to plan for retirement,” said Chip Lupo, a writer and analyst at WalletHub.

Lupo said it’s critically important that you begin to build an emergency fund to avoid relying on high-interest credit cards during life’s unexpected moments.

“We’re in a situation now where, because of the inflationary economy, people are now relying on credit cards for everyday expenses when the primary objective of a credit card for most people is to have basically an emergency fund,” Lupo said.

Lupo said that wages aren’t keeping up with the rate of inflation, and people are turning to credit cards for the essentials such as food and gas, which leads to significant debt by the end of the year.

“I think a big area that lot of consumers can agree on was the rising living costs,” said consumer finance expert Andrea Woroch. “Inflation impacting how much they’re spending on housing, transportation, groceries as well as even health care.”

MAKE A GAME PLAN

What you can do:

Woroch said you need to get back to the basics – set a budget this year and follow it.

“A lot of people think of a budget as being really restrictive and while it does cap you on spending in certain areas, a budget allows you to see where you are potentially wasting money on things you don’t need,” Woroch said.

If you think setting up a budget can be overwhelming, Woroch said going into debt and having no money in savings can be even worse.

Not to mention, there are digital tools and apps to help you set a budget, like the “You Need a Budget” app, or YNAB.

“Saying you are going to pay off debt is not enough. You have to be specific with how much debt you are going to pay off and set a realistic goal,” Woroch said.

When you take on this financial resolution, Woroch said it’s important to have a plan in place. Use a balance transfer credit card or pay off the smallest balance first.

If you don’t have a plan, Woroch said you will likely just continue your cycle of debt.

Another tip from our experts, they both recommended taking advantage of the high interest rates being offered with online bank accounts or CD’s.

The Source: For this story, the Fox 32 Chicago Special Projects team spoke with leading personal finance experts Chip Lupo from WalletHub and Andrea Woroch.

Finance

Stacey Abrams-founded groups slapped with historic fine for campaign finance violations

A pair of voting advocacy groups founded by failed Democrat Georgia gubernatorial candidate Stacey Abrams were hit with a historic fine by the Georgia Ethics Commission for violating campaign finance laws to bolster Abram’s 2018 election.

“Today the State Ethics Commission entered into a consent agreement with the New Georgia Project and the New Georgia Project Action Fund for a total of $300,000,” the Georgia State Ethics Commission posted in a statement on Wednesday. “This certainly represents the largest fine imposed in the history of Georgia’s Ethics Commission, but it also appears to be the largest ethics fine ever imposed by any state ethics commission in the country related to an election and campaign finance case.”

Abrams founded the New Georgia Project in 2013 as part of an effort to register more minority voters and young voters. The organization was founded as a charity that can accept tax-deductible donations, while the New Georgia Project Action Fund worked as the organization’s fundraising arm.

The groups admitted to failing to disclose about $4.2 million in contributions and $3.2 million in expenditures that were used during Abram’s election efforts in 2018, according to the commission’s consent order. The groups were hit with a total of 16 violations, including failing to register as a political committee and failure to disclose millions of dollars in political contributions.

STACEY ABRAMS SAYS TRUMP RE-ELECTION WAS NOT A ‘SEISMIC SHIFT’ OR ‘LANDSLIDE’

Stacey Abrams (Elijah Nouvelage/Getty Images/File)

The groups were accused of carrying out similar activity in 2019, when they reportedly failed to disclose $646,000 in contributions and $174,000 while advocating for a ballot initiative.

STACEY ABRAMS ACCUSES CNN HOST OF ‘REPEATING DISINFORMATION’ ABOUT HER CASTING DOUBT ON 2018 ELECTION RESULTS

“This represents the largest and most significant instance of an organization illegally influencing our statewide elections in Georgia that we have ever discovered, and I believe this sends a clear message to both the public and potential bad actors moving forward that we will hold you accountable,” the ethics commission continued in its statement Wednesday.

STACEY ABRAMS PRAISED ON ‘THE VIEW’ FOR NOT CONCEDING ELECTION, DEFENDS SAYING SHE ‘WON’ GEORGIA RACE IN 2018

Abrams stepped down from the group in 2017, with Sen. Raphael Warnock taking the reins as the New Georgia Project’s CEO from 2017 to 2019, the Associated Press reported. Warnock was elected as a U.S. senator from Georgia in 2020.

Democrat Georgia Sen. Raphael Warnock, who also serves as the head pastor at Ebenezer Baptist Church in Atlanta, speaks from the pulpit. (Paras Griffin/Getty Images/File)

A spokesperson for Warnock’s Senate office told the AP that he was working “as a longtime champion for voting rights” and that he was not aware of campaign violations. The spokesperson added that “compliance decisions were not a part of that work.” Fox Digital also reached out to Warnock’s office for additional comment but did not immediately receive a reply.

Abrams ran for governor of Georgia in 2018 and 2022, but lost to Republican Gov. Brian Kemp in both races. Abrams drew national attention after the 2018 race when she refused to concede to the Republican despite losing by 60,000 votes.

STACEY ABRAMS ON NOT CONCEDING GEORGIA LOSS: WE SHOULD BE ALLOWED TO ‘LEGITIMATELY QUESTION’ SYSTEMS

Amid the 2018 race, she touted the New Georgia Project on her X account, which was called Twitter at the time.

“When Abrams sees a problem, she doesn’t wait for someone else to step up – she does it herself. So when she saw that 800,000 people of color in Georgia weren’t registered to vote, Abrams immediately set out to fix the problem & founded The New GA Project,” she tweeted.

The New Georgia Project said in a comment provided to Fox News Digital that they are “glad to finally put this matter behind us” so the group can “fully devote its time and attention to its efforts to civically engage and register black, brown, and young voters in Georgia.”

CLICK HERE TO GET THE FOX NEWS APP

“While we remain disappointed that the federal court ruling on the constitutionality of the Georgia Government Transparency and Campaign Finance Act was overturned on entirely procedural grounds, we accept this outcome and are eager to turn the page on activities that took place more than five years ago,” the group continued.

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg) Technology1 week ago

Technology1 week agoMeta is highlighting a splintering global approach to online speech

-

Science5 days ago

Science5 days agoMetro will offer free rides in L.A. through Sunday due to fires

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25821992/videoframe_720397.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25821992/videoframe_720397.png) Technology1 week ago

Technology1 week agoLas Vegas police release ChatGPT logs from the suspect in the Cybertruck explosion

-

Movie Reviews1 week ago

Movie Reviews1 week ago‘How to Make Millions Before Grandma Dies’ Review: Thai Oscar Entry Is a Disarmingly Sentimental Tear-Jerker

-

Health1 week ago

Health1 week agoMichael J. Fox honored with Presidential Medal of Freedom for Parkinson’s research efforts

-

Movie Reviews1 week ago

Movie Reviews1 week agoMovie Review: Millennials try to buy-in or opt-out of the “American Meltdown”

-

News1 week ago

News1 week agoPhotos: Pacific Palisades Wildfire Engulfs Homes in an L.A. Neighborhood

-

Business1 week ago

Business1 week agoMeta Drops Rules Protecting LGBTQ Community as Part of Content Moderation Overhaul