- Major risk for banks involves U.S. sanctions on China-source

- Banks not given any specific directions for actions-sources

- Top 3 banks’ total China credit exposure about 1% of assets

- Dealing with China sanctions would be complex for banks-source

Finance

Exclusive: Japan regulator sounded out top domestic banks about China risks, sources say

/cloudfront-us-east-2.images.arcpublishing.com/reuters/22PHZZRGUBNDZEXBHHUVGFYRNY.jpg)

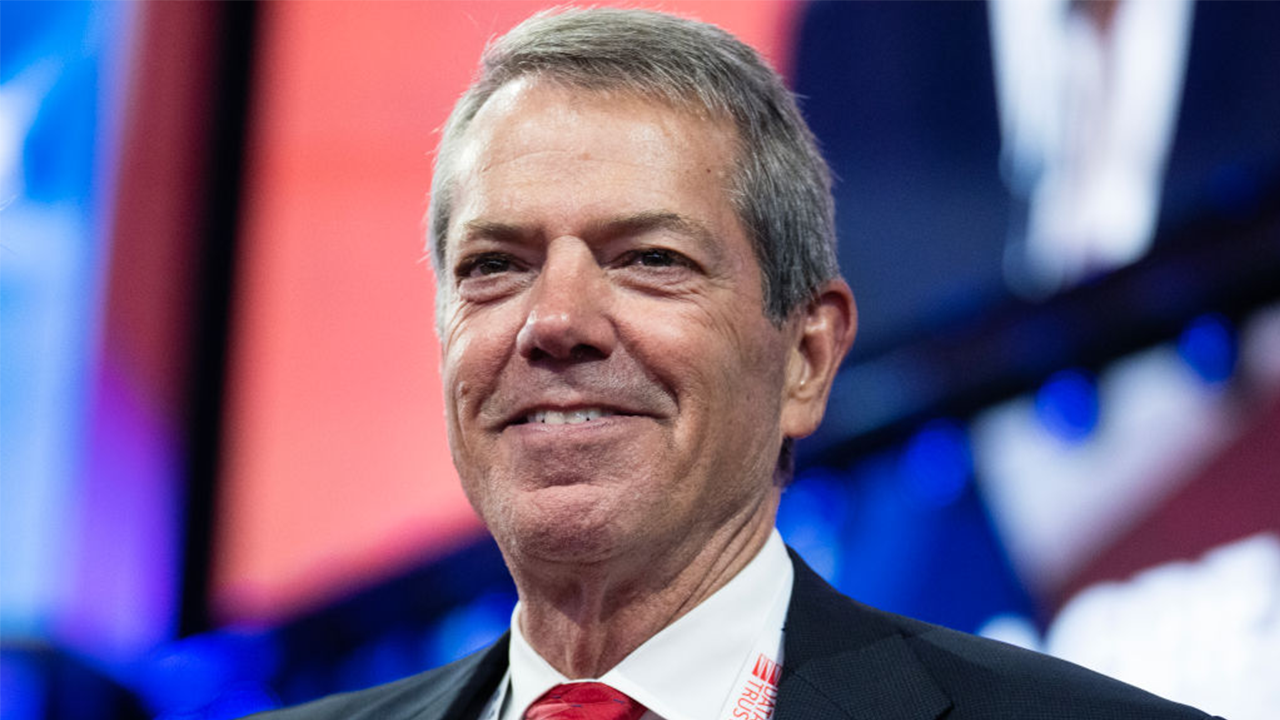

TOKYO, June 19 (Reuters) – Japan’s financial regulator has sounded out top domestic banks about China risks and whether they have plans in place if Sino-Western tensions escalate, according to multiple sources with direct knowledge of the matter.

The Financial Services Agency’s (FSA) request, which has not been previously reported, is to ensure Japan’s megabanks are thinking about the risks and are prepared to respond if the geopolitical situation worsens, including over the issue of Taiwan’s political status, said three of the sources.

Japanese megabanks Mitsubishi UFJ Financial Group (MUFG) (8306.T), Sumitomo Mitsui Financial Group (SMFG) (8316.T) and Mizuho Financial Group (8411.T) have a combined $6.5 trillion in assets, according to Refinitiv.

As of end-March, the three banks had total credit exposure of about $64 billion to China, or roughly 1% of their total assets, according to their financial statements. The number does not include all business unit of the banks.

A major risk for Japanese banks would involve U.S. sanctions on China, hobbling their ability to do business there similar to the bans on Russia dealings after the invasion of Ukraine, said one of the sources, who is a financial industry executive.

All the sources requested anonymity because of the sensitivity of the matter.

The FSA, MUFG and Mizuho declined to comment. SMFG said it declined to comment on anything related to dealings with regulators.

The FSA has not given the banks any specific directions for actions they need to take, one of the other sources said, adding the lenders were thinking about various eventualities and the regulator was hoping for their insights and information.

The FSA’s request to look into China-related geopolitical risk was made in May, said two other sources. At a meeting last month, one of the banks was asked by the FSA how it is assessing risk related to China operations, one of them said.

The watchdog’s move comes as tensions between China and Western allies have increased over the last 18 months amid a series of disputes involving the Russia-Ukraine war, Taiwan’s sovereignty, and technology access.

In particular, tensions have risen between the United States and China.

U.S. Secretary of State Antony Blinken met with China’s top diplomat Wang Yi on Monday at the start of the second and final day of a rare visit to Beijing aimed at ensuring that the many disagreements do not spiral into conflict.

CONTINGENCY PLANS

Japanese banks, like many multinational companies, find themselves faced with the prospect of being caught in the middle.

Top Japanese financial firms, led by banks, are heavily exposed to China either via their onshore operations in the world’s second-largest economy or through their offshore business networks. They also do business in the West.

The regulator’s move underscores how far-reaching the impact of a geopolitical crisis, such as one involving Taiwan, would be for the global economy and businesses.

China claims democratically governed Taiwan as its territory and has never renounced the use of force to bring it under its control. Taiwan strongly objects to China’s sovereignty claims and says only the island’s people can decide their future.

China has over the past three years stepped up its pressure to try and force Taiwan to accept Beijing’s sovereignty, including staging war games around the island.

Many global businesses worry an escalation of tensions could result in the U.S. imposing sanctions on China, as it did with Russia in the aftermath of the Ukraine war. They are taking steps such as drafting contingency plans and inquiring about manufacturing capacity outside Taiwan.

Almost half of the companies surveyed by the American Chamber of Commerce in Taiwan are revising or plan to revise their business continuity plans amid tensions with China, Reuters reported in February.

For Japanese banks with large exposure to the United States, the impact of any Western sanctions against China is likely a greater concern than the fallout of their direct exposure to Taiwan, the financial industry executive said.

Dealing with China sanctions would be extremely complex, the executive added.

Reporting by Takaya Yamaguchi and Makiko Yamazaki in Tokyo and Paritosh Bansal in New York; Editing by Sumeet Chatterjee and Jamie Freed

Our Standards: The Thomson Reuters Trust Principles.

Continue Reading

Finance

Wall Street preps for shortened trading week, Honda & Nissan merger talks: Yahoo Finance

It is a short trading week for Wall Street. The equity markets will close early on Tuesday, December 24, and be closed all day on Wednesday, December 25, for the Christmas holiday. Two stocks in focus today are Honda (HMC) and Nissan (7201.T, NSANY), which officially announced they are in talks to merge. The companies expect the transaction to be completed in 2026. Other trending tickers on Yahoo Finance include Palantir Technologies (PLTR), Tilray Brands (TLRY), and Novo Nordisk (NVO).

Key guests include:

9:10 a.m. ET – Ben Emons, Fed Watch Advisors, Chief Investment Officer/Founder

10:25 a.m. ET – Eric Sheridan, Goldman Sachs Senior U.S. Internet Sector Equity Research Analyst

10:45 a.m. ET – Tony Bancroft, Gabelli Funds Portfolio Manager

11:20 a.m. ET – Steven Wieting, Citi Wealth Chief Investment Strategist and Chief Economist

11:30 a.m. ET – Michael Liersch, Wells Fargo Head of Advice and Planning

Finance

The Container Store files for Chapter 11 bankruptcy

Investors in The Container Store (TCSG) have been sent packing as the struggling home goods chain files for bankruptcy.

The retailer filed for Chapter 11 bankruptcy protection late Sunday, Yahoo Finance learned exclusively. The company said in a press release it is doing this in order to refinance its debt to “bolster its financial position, fuel growth initiatives, and drive enhanced long-term profitability.”

For the quarter-ended Sept. 28, 2024, The Container Store listed total liabilities of $836.4 million against $969 million in total assets.

CEO Satish Malhotra — a former Sephora executive who took over atop The Container Store in 2021 — is confident the maneuver will allow the 46-year old company to stick around.

“The Container Store is here to stay,” Malhotra said in a statement, adding that it is taking these necessary steps in order to advance the business, strengthen customer relationships, expand its reach and bolster its capabilities.

It plans to lean into custom space offerings, “which continue to demonstrate strength,” he said.

The bankruptcy process is expected to last several weeks with the reorganization anticipated to happen within 35 days. The bankruptcy does not include the company’s Elfa home goods business in Sweden.

The business will operate as usual across all stores, online and in-home services. The company operates 102 stores across 34 states.

The company says all customer deposits are safe and protected, and vendors will get paid in full. There are no planned layoffs.

There are also no planned store closures, but that may be a possibility in the future as the company goes through the reorganization process.

Chapter 11 allows companies to “renegotiate the terms of their leases to align their store footprint with market realities and business needs,” sources told Yahoo Finance, adding “if they do not achieve meaningful rent reductions, they may be forced to close a select few locations.”

The filing has been expected by industry experts.

Read more: Why Walmart won the 2024 Yahoo Finance Company of the Year award

The Container Store — a chain founded in 1978 that rose to fame for its nifty home organizational goods in the 1990s — was delisted from the New York Stock Exchange on Dec. 9 after it fell below the exchange’s standard to maintain a market cap of $15 million over 30 consecutive trading days.

The company has seen its profits plunge post the home remodeling frenzy fueled by the COVID-19 pandemic and competition picked up from Walmart (WMT), Amazon (AMZN) and Target (TGT). It has been unprofitable for the past two fiscal years, with losses tallying about $10 million for the fiscal year-ended Sept. 28, 2024.

Finance

Personal finance lessons from Warren Buffett’s latest letter

Last Nov. 25, Warren Buffett announced that he would donate a substantial portion of the shares he owned in Berkshire Hathaway to his four family foundations.

In his announcement, he included a letter which contained some important personal finance lessons that we can apply to our own situation.

One of my favorites is his comment that hugely wealthy parents should only leave their children enough so they can do anything but not enough that they can do nothing.

Article continues after this advertisement

Despite being one of the richest men in the world, Buffett shared that his children only received $10 million each when his wife died. Although $10 million is a lot of money, it’s less than 1% of his wife’s estate.

I am not hugely wealthy, nor do I have $10 million. However, Buffett’s comment about just giving our children enough made me reflect on the importance of also making our children resilient.

Many of us want to make sure that our children will be financially secure by the time we pass away. While there is nothing wrong with this, sometimes we go overboard in making sure that this goal is met.

Article continues after this advertisement

For example, sometimes my husband and I are guilty of overindulging our children.

Article continues after this advertisement

Warren Buffett’s comment reminded me that we should also allow our children to go through difficulties so that they will become resilient and learn how to survive comfortably with less. Aside from letting them know that they shouldn’t expect much in terms of inheritance, this could mean limiting their allowance, allowing them to commute to school when there is no car available, and saying “no” to their request to buy nice and expensive things like the latest top of the line gadgets.

Article continues after this advertisement

Another thing that we are guilty of (especially if you are Filipino Chinese like me) is thinking that we need to build a successful business so that our children will eventually have a steady source of income and the bragging rights of being their own boss.

Although there is nothing wrong with building a successful business, passing it on to our children should not be a priority. This is because there’s no guarantee that our children will want to run our business. In fact, they might not be equipped to run the business properly. If that is the case, they may end up running our business to the ground. This would put them in a worse position, especially if they were raised to think that they do not have to worry about money because they have a business that will take care of them.

Article continues after this advertisement

Another personal finance lesson Warren Buffett shared is the importance of being grateful and learning to give back.

In his comments, Warren Buffett acknowledged the role of luck in making him wealthy—being born in the US as a white male in 1930 and living long enough to enjoy the power compounding.

However, he recognized that not everyone is as lucky as he is. Because of this, Buffett and his family are focused on giving back so that others who were given a very short straw at birth would have a better chance at gaining wealth.

Learning how to be grateful is very important. We cannot be truly happy unless we are grateful for what we have. In fact, many people who are rich are unhappy because they constantly compare themselves to others who have something that they don’t.

Meanwhile, giving back is a natural outcome of being grateful. It is also very fulfilling. For example, in my company COL Financial, we believe that everyone deserves to be rich. This is why we actively educate Filipinos on personal finance and the stock market.

Helping Filipinos better manage their hard-earned money is one of the greatest fulfillments of my career as an analyst. In fact, this is one of the reasons why I have stayed as an analyst despite the availability of other higher paying jobs.

Finally, Warren Buffett shared the importance of learning how to say no.

People who are wealthy will always be approached by friends, family and others seeking help. Although giving back is important, there is a limit as to how much we can give. Because of that, we need to learn how to say no, even if it is difficult or unpleasant.

To make it easier for his children to say no, Buffett’s foundations have a “unanimous decision” provision which states that unless all his three children agree, the foundations cannot distribute funds to grant seekers.

Although most of us are not as rich as Buffett, we can also benefit from having an accountability partner to help us say no to requests for help. That person can be our spouse, our sibling, or someone who shares our values and understands that while we want to be generous, our resources are limited. Our accountability partner can also help us decide who we should or should not help which is also a difficult task.

Warren Buffett ended his letter by saying that his children spend more time directly helping others than he has and are financially comfortable but not preoccupied with wealth. Because of that, his late wife would be proud of them and so is he.

As a parent, I’d be happier to have children who grow up to become productive citizens with good values rather than to have children who become very rich but are dishonest and greedy. INQ

-

Politics1 week ago

Politics1 week agoCanadian premier threatens to cut off energy imports to US if Trump imposes tariff on country

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg) Technology1 week ago

Technology1 week agoOpenAI cofounder Ilya Sutskever says the way AI is built is about to change

-

Politics1 week ago

Politics1 week agoU.S. Supreme Court will decide if oil industry may sue to block California's zero-emissions goal

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg) Technology1 week ago

Technology1 week agoMeta asks the US government to block OpenAI’s switch to a for-profit

-

Business1 week ago

Business1 week agoFreddie Freeman's World Series walk-off grand slam baseball sells at auction for $1.56 million

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg) Technology1 week ago

Technology1 week agoMeta’s Instagram boss: who posted something matters more in the AI age

-

News1 week ago

East’s wintry mix could make travel dicey. And yes, that was a tornado in Calif.

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png) Technology2 days ago

Technology2 days agoGoogle’s counteroffer to the government trying to break it up is unbundling Android apps