Finance

Apollo Commercial Real Estate Finance: Challenges And Prospects (NYSE:ARI)

Kunakorn Rassadornyindee/iStock through Getty Pictures

I imagine one of the best strategy to take with Apollo Industrial Actual Property Finance, Inc. (NYSE:ARI) is a cautious one, and therefore advocate a maintain place on the inventory. I element under the assorted challenges that Apollo Actual Property faces, and the way this has been adversely impacting its efficiency. Nonetheless, regardless of the unsustainability that’s related to its security internet, I discover little to recommend ARI is a weak inventory in relation to the broader mortgage REIT business.

Firm Overview

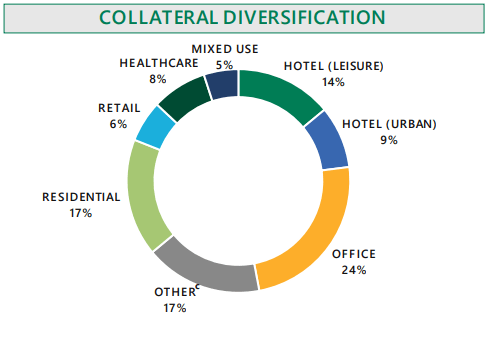

Apollo Industrial Actual Property Finance is a New York-based mortgage mREIT (mortgage actual property funding belief) that primarily offers with business mortgage loans and related mortgage financing and actual property debt-based investments. The 2 main dealings of the corporate will be divided into both senior mortgages or subordinate loans, that are collateralized by properties that adjust by their kind, and areas that span the U.S., UK, and Western Europe.

With a market capitalization of $1.6 billion (as of Might 2022), the Apollo REIT is a small firm and holds inside its steadiness sheet a mortgage portfolio that has a carrying worth of roughly $8.4 billion. The REIT’s portfolio diversification is offered under as follows:

Apollo Actual Property Presentation – Might 2022

Rising Curiosity Price Concerns

As is the case of typical mortgage REITs, Apollo Actual Property’s destiny is closely influenced by altering circumstances within the macroeconomic atmosphere, and particularly short-term rates of interest. Nonetheless, what’s extra, important in figuring out Apollo’s future potential is the diploma to which it is able to strategically adapt in response to such shifts.

Taking a look at historic traits, it’s clear that REIT efficiency has been outstanding in durations that had been outlined by step by step rising long-term rates of interest, as had been seen from 1994 to late 2021. It’s important for this rise in charges to be gradual, because it permits the mREIT business to regulate its portfolios accordingly. Sometimes, rising rates of interest adversely impression REIT steadiness sheets by diminishing the worth of fixed-term mortgages, as they ship returns by older and decrease rates of interest. When this rise is gradual, it permits mREIT managers to step by step improve portfolios to carry higher publicity to the upper charges of return. Nonetheless, when this rise is just too fast, mortgage buyers (reminiscent of Apollo) are unable to maintain up with the shifts and fail to regulate their portfolios with the prevalent charges of return.

One space of power that Apollo REIT possesses in opposition to looming uncertainties about rates of interest is its portfolio, which consists primarily of floating-rate mortgages, on account of which the entity is well-hedged in opposition to rising charges of curiosity. The current local weather of an rate of interest climb is, in actual fact, sure to boost internet revenue per share for the REIT.

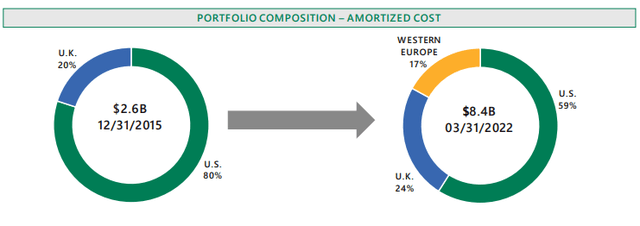

Apollo Actual Property Presentation – Might 2022

Nonetheless, the sustainability of this upward development have to be thought of, as rising rates of interest severely cut back demand for mortgages, which might be problematic for ARI. Mortgage housing purposes fell by 9% in April 2022, in solely 12 months, given rate of interest hikes carried out by the U.S. Federal Reserve. For that reason, I don’t suppose a constantly rising curiosity curve is a trigger for Apollo REIT buyers to glee, because it might jeopardize the expansion prospects of the corporate, particularly if this development continues into the long-term.

ARI achieves considerably of a security internet by means of its predominantly floating-rate mortgage-based portfolio (regardless of the sustainability issues I highlighted above), in addition to the geographic range. Nonetheless, it’s unlikely that even geographic range could also be a adequate hedge in opposition to the slowly declining financial atmosphere, given the globalized nature of those circumstances.

Apollo Actual Property Presentation – Might 2022

Earnings and Efficiency

Having a look on the firm’s historic efficiency, issues haven’t been wanting nice for the corporate, with investor returns falling for the third consecutive 12 months. In its most up-to-date quarterly announcement for the three months ended March 2022, Apollo introduced in a complete internet curiosity revenue of $55.1 million, versus $71.2 million within the comparable quarter of 2021, which mirrored a drop of 29.2%. These income figures are inclusive of each the corporate’s operational income by means of its owned actual property property, in addition to its curiosity revenue.

Internet revenue throughout this era fell by an alarming 73.9%, from $58.3 million final 12 months, to a mere $15.2 million this 12 months. This important drop in quarterly figures was primarily a results of a internet reversal of mortgage losses amounting to $18.6 million, and a overseas foreign money translation loss exceeding $32.5 million. This means that the geographic diversification that the corporate claims comes at a major price, slicing closely at its internet revenue determine.

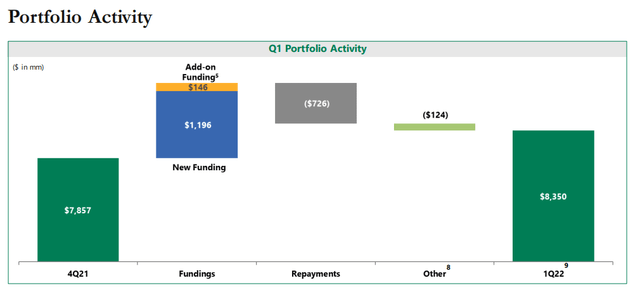

Nonetheless, regardless of this important shortfall in income, Apollo did handle to broaden its portfolio worth by means of extra funding from $7.86 billion to $8.35 billion in a single quarter. Furthermore, throughout the quarter, the corporate had made commitments to new mortgage loans amounting to $1.8 billion, 100% of which had been at a floating charge. As I’ve identified above, I do imagine this strategy could present considerably of a security internet when the curiosity improve takes place at average ranges however might show to be unsustainable throughout financial slowdowns.

ARI Q1 Earnings 2022 – Presentation

Regardless of this obvious enchancment within the portfolio, the REIT noticed a fall in its e-book worth per share put up basic present anticipated credit score losses allowance and depreciation. This determine had dropped from $15.06 per share in Q1 2021 to $14.81 per share in Q1 2022. Because of this, the possession, by way of e-book worth, after netting of debt obligations, truly declined by virtually 2%, which isn’t very promising, particularly when buyers anticipate REITs to be robust hedges in opposition to inflation, which was recorded at 9.2% in March 2022. By this metric, not solely did BVPS fail to maintain up with charges of inflation, however misplaced worth over the 12 months, which is very alarming for the inventory.

Valuation

Regardless of the challenges I’ve outlined for Apollo REIT, I discover that its valuation metrics in relation to its friends show that it’s the greatest within the mortgage REIT business. That is helpful to contemplate for an investor that’s adamant about together with inventory from this sector of their portfolio. That is demonstrated within the desk under:

Ticker

Firm

Market Cap

Ahead P/E

P/B Dividend Yield

Float Brief

Return on Funding

Whole Debt/Fairness

Gross Margin Value

ARI

Apollo Industrial Actual Property Finance, Inc.

1.69B

8.63 0.77

11.27%

3.42%

2.30%

2.86 61.70%

12.42

(FBRT)

Franklin BSP Realty Belief, Inc.

1.15B 19.71

0.92

10.01%

2.38%

0.10% 7.79

21.50%

14.19

(KREF)

KKR Actual Property Finance Belief Inc. 1.29B

10.68

0.75

8.81%

2.17% 2.10%

3.30

60.90%

19.52

(LADR) Ladder Capital Corp.

1.41B

9.82

0.94

7.04% 1.90%

1.00%

2.89

54.80%

11.37 (RWT)

Redwood Belief, Inc.

1.12B

6.62

0.81 9.40%

2.77%

2.20%

8.64

27.60% 9.79

As will be noticed, by way of ahead P/E, ARI is available in with the second-lowest determine of 8.63, which signifies progress that’s but to be realized. One issue which will doubtlessly clarify that is ARI’s predominantly floating charge mortgages which hedge in opposition to devaluation by means of rate of interest hikes. This facet is probably going to provide the corporate an edge above its rivals and additional reinforces the potential of a possible undervaluation.

Furthermore, with a powerful dividend yield at 11.27%, not solely can market members look ahead to a attainable rise within the inventory’s value sooner or later (given the undervaluation this determine suggests) but in addition excessive money returns for the funding quantities they put in. With an ROI of two.3% and a gross margin of 61.7%, ARI definitely seems as among the finest choices to contemplate right here. It additionally has the bottom debt to fairness ratio, additional including to its potential likeability amongst market members.

As within the case of REITs, an particularly helpful metric to contemplate is the inventory’s value to e-book ratio, which primarily denotes the diploma to which the market has priced a inventory by way of the e-book worth of its internet property. ARI has the second-lowest PB ratio with 0.77, trailing behind solely KREF, which has 0.75. This means that given its value, shareholders are attributable to the next internet asset (e-book) worth of its actual property property compared to that of different corporations. One deduction of this evaluation is that ARI is priced considerably decrease in comparison with most of its friends, and therefore its market value is presently undervalued.

Nonetheless, regardless of this ARI continues to carry one of many highest quick charges, at 3.42%, which is a metric that can’t be ignored on this evaluation. I imagine that is largely a results of the persistently declining monetary outcomes which the REIT has been delivering, as is denoted within the gross revenue traits through the years of the comparative shares:

Macrotrends

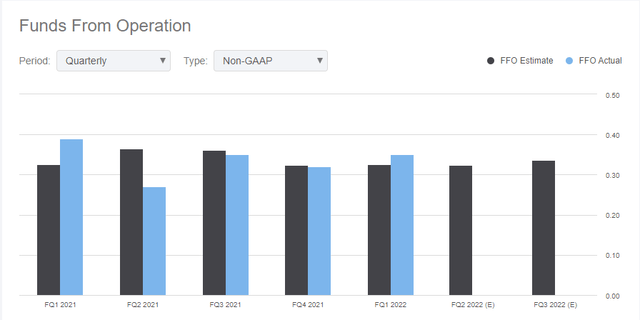

This highlights how dwindling gross efficiency of ARI lately, has been on a gradual decline. As compared, each different comparative inventory has not too long ago been on an upward bettering development, which locations ARI’s progress prospects beneath query. Regardless that ARI brings within the highest gross revenue compared to its friends, it’s the route of this development, since 2021, that’s worrisome. Furthermore, within the final 4 quarters since FQ2 2021, ARI has managed to beat FFO estimates solely as soon as, which was in its most up-to-date quarter of FQ2 2022:

Searching for Alpha

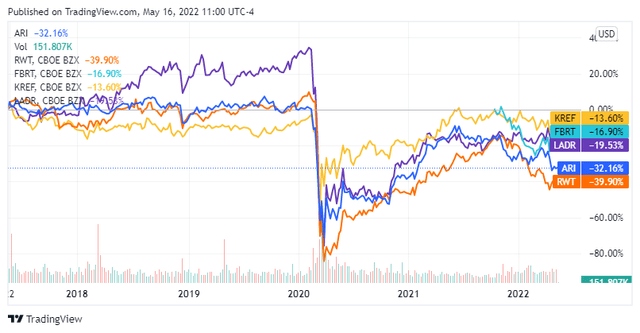

Nonetheless, wanting on the value traits of ARI together with every of its friends signifies a excessive correlation in motion, successfully dispelling the notion that ARI has underperformed and even overachieved in relation to the broader mortgage REIT market. This performs a major position in contributing to my maintain place towards ARI.

Searching for Alpha

Macroeconomic Dangers

REITs have historically been seen as protected investments throughout occasions of financial uncertainty, because of the notion that bricks and mortar can survive any financial disaster. Nonetheless, that is removed from the fact, and macroeconomic disruptions, and specifically, the potential of a recession might severely impression the monetary sustainability of ARI. It’s particularly weak to such a danger, given the predominantly business nature of its portfolio.

The current inflationary local weather in the US, impacted primarily by world provide chain disruptions because of the ongoing disaster in Ukraine, and financial sanctions in opposition to Russia, appears sure to be pushed in direction of an financial slowdown. These pressures, coupled with the fallout of the Covid-19 pandemic, add to the probability of antagonistic circumstances for the actual property sector to thrive.

A discount in financial exercise and heightened rates of interest could result in a drop in new mortgages that will impression each the expansion of ARI, in addition to the return it may well ship for buyers. Though increased rates of interest would immediately set off the next charge of return, the broader circumstances that this may result in make such an increase in revenue largely unsustainable for the corporate.

Conclusion

In some ways, ARI isn’t too totally different from every other inventory within the area of U.S. Mortgage REITs. It faces the identical publicity to rate of interest dangers and publicity to broader macroeconomic actions in both route. Nonetheless, the corporate is geographically well-diversified and has a portfolio that consists primarily of free float mortgages which ship considerably of a security internet to the REIT, compared to its friends. Maybe that is why the inventory is deemed engaging and doubtlessly undervalued by a number of valuation value metrics.

Nonetheless, I’d insist on a cautious place on the inventory, as looming financial uncertainty is probably not as robust safety to its monetary place in opposition to its security nets. If inflation continues to set off rate of interest hikes, and a possible financial slowdown, ARI might go down with the remainder of the mortgage REIT sector. Nonetheless, these fears are but to be rationalized, and within the meantime, I like to recommend a maintain place on ARI.

Finance

Tata Motors’ subsidiaries – TPEM and TMPV join hands with Bajaj Finance, offers financing program for authorized passenger and electric vehicle dealers – Tata Motors

Press release -

May 20, 2024

Tata Motors’ subsidiaries – TPEM and TMPV join hands with Bajaj Finance, offers financing program for authorized passenger and electric vehicle dealers

Tata Motors Passenger Vehicles (TMPV) and Tata Passenger Electric Mobility (TPEM) join hands with Bajaj Finance to offer financing program for authorized passenger and electric vehicle dealers. In the image, Mr. Dhiman Gupta, Chief Financial Officer, Tata Passenger Electric Mobility Ltd. and Director, Tata Motors Passenger Vehicles Ltd. and Mr. Siddhartha Bhatt, Chief Business Officer, Bajaj Finance Ltd. at the MoU signing in Mumbai.

In a bid to improve options and ease of financing for the dealers, Tata Motors Passenger Vehicles (TMPV) and Tata Passenger Electric Mobility (TPEM) – subsidiaries of Tata Motors, India’s leading automotive manufacturer, have joined hands with Bajaj Finance, part of Bajaj Finserv Ltd., one of India’s leading and most diversified financial services groups, to extend supply chain finance solutions to its passenger and electric vehicle dealers. Through this memorandum of understanding (MoU), the participating companies will come together to leverage Bajaj Finance’s wide reach to help dealers of TMPV and TPEM access funding with minimal collateral.

The MoU for this partnership was signed by Mr. Dhiman Gupta, Chief Financial Officer, Tata Passenger Electric Mobility Ltd. and Director, Tata Motors Passenger Vehicles Ltd. and Mr. Siddhartha Bhatt, Chief Business Officer, Bajaj Finance Ltd.

Commenting on the partnership, Mr. Dhiman Gupta, Chief Financial Officer, Tata Passenger Electric Mobility Ltd. and Director, Tata Motors Passenger Vehicles Ltd., said, “Our dealer partners are integral to our business, and we are happy to actively work towards solutions to help them in ease of doing business. Together, we aim to further grow the market and offer our New Forever portfolio to an increasing set of customers. To that effect, we are excited to partner with Bajaj Finance for this financing program, which will further strengthen the access of our dealer partners to increased working capital.”

Speaking on this partnership, Mr. Anup Saha, Deputy Managing Director, Bajaj Finance Ltd, said, “At Bajaj Finance, we have always strived to provide best-in-class processes by using the India stack for financing solutions that empower both individuals and businesses. Through this financing program, we will arm TMPV and TPEM’s authorized passenger and electric vehicle dealers with financial capital, which will enable them to seize the opportunities offered by a growing passenger vehicles market. We are confident that this collaboration will not only benefit dealers but also contribute to, and enhance the growth of, the automotive industry in India.”

TMPV and TPEM have been pioneering the Indian automotive market with its groundbreaking efforts it both ICE and EV segments. The company’s overarching New Forever philosophy has led to the introduction of segment leading products which are being appreciated by consumers at large.

Bajaj Finance is one of the most diversified NBFCs in India with presence across lending, deposits and payments, serving over 83.64 million customers. As of March 31, 2024, the company’s assets under management stood at ₹3,30,615 crore.

Media Contact Information: Tata Motors Corporate Communications: [email protected] / 91 22-66657613 / www.tatamotors.com

Finance

Drive Finance announces EGP 1.4bn securitisation bond issuance – Dailynewsegypt

Drive Finance, a GB Capital subsidiary and part of GB Corp’s financial division, has closed its fifth securitisation bond issuance, valued at EGP 1.4bn. This marks the second issuance under Capital Securitization’s fifth program, which aims for a total of EGP 5bn.

Following the previous issuance in December, this latest development highlights the company’s portfolio growth and investor confidence.

Ahmed Osama, Managing Director of Drive Finance, welcomed the robust investor response, noting that interest surpassed the issuance amount twofold. “This enthusiasm underscores our strong market position and our sustained creditworthiness amidst economic challenges,” he remarked.

Remon Gaber, Drive Finance’s Treasury Head, took pride in the issuance’s success, attributing it to the strategic diversification of funding sources. This approach has bolstered the company’s objectives, broadened its financing services, and extended its market presence, thereby boosting its share in consumer finance and factoring sectors.

The issuance comprised three tranches:

- First Tranche: EGP 546.8m, 13-month term, AA+(sf) rating.

- Second Tranche: EGP 644.9m, 36-month term, AA(sf) rating.

- Third Tranche: EGP 210.3m, 58-month term, A(sf) rating.

Commercial International Bank (CIB) played a pivotal role as the financial advisor, manager, arranger, and promoter. Arab African International Bank was the custodian, underwriter, and subscription handler. Legal advice was provided by the El-Derini Law Office, while Sherif Mansour Dabus–Russell Bedford conducted the audit. Middle East Rating & Investors Service (MERIS) assigned the ratings.

Finance

Finance union chief calls for ‘pause’ on bank branch closures for five years

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/5H7R6GNCPVDEFKUTAUCOCYKKT4.jpg)

A call for a five-year moratorium on bank branch closures North and South of the Border was backed by delegates at the Financial Services Union (FSU) conference in Belfast on Saturday.

The motion was one of a number adopted that expressed support for the safeguarding of access to cash and provision of financial services and advice, all of which were seen as important to communities and, in particular, older customers.

FSU general secretary John O’Connell said the scale of bank bailouts received after the 2008 crash continued to give the debate on branch closures a moral aspect.

“We need the banks to remember that it was the people in these communities who bailed out their business,” Mr O’Connell said. “We are not saying they can never close branches but we are saying it would be reasonable to pause the closures now for five years, so everyone can consider what is on the horizon.”

Roger James, representing the AIB sector, told the conference the issue of closures has had an “unbelievable” impact on staff over the years. He said opposition to additional closures was not just about protecting jobs but also about protecting communities.

“People need and want access to cash, access to services,” Mr James said.

AIB’s branch network in the North had shrunk from 32 to seven, he said, with the company suggesting the reduction had been driven by changing customer behaviour. But Mr James said “if you find a branch that’s open now and then find a staff member, all they can do is point you to a machine, so it is the banks that are driving people away”.

Wilma Stewart, a staff member at Danske Bank, said its network will have declined in size from 104 when she joined the company to 24 by June 6th when another four branches are due to shut. The reduction, she said, was “staggering”.

“What we need to see is the development of a blend of services,” Ms Stewart said, referring to a proposed balance of service provision between online, and branched through third parties, such as post offices.

“Many people are happy to do their banking online but no community or sector of business should be left without blended services,” she said.

In the Republic, the various banks closed 176 branches in the five years to September 2023. As of now, Bank of Ireland and AIB still have about 170 each with PTSB operating just shy of 100 in the wake of its takeover of parts of the former Ulster Bank network.

Tom Ruttledge, from the Bank of Ireland sector, said banks were “withdrawing services from locations because it suits their cost model, not because it suits their customers”.

Older clients, he said, often missed out on advice from staff that might have helped them make better decisions with regard to financial services and products.

Ali Agur, chief economist and head of prudential regulation at the Banking and Payments Federation Ireland, said he did not believe the decision to close a branch was “purely about a profit and loss decision”.

“Banking is a relationship business and AI is not going to build that relationship for you,” Mr Agur said.

Nevertheless, he said, the trend is areas like ATM cash withdrawals was clear with substantial declines both in terms of value and volume, while more recent entrants to the retail financial services market were piggybacking on the ATM network without contributing to the costs involved. “We need to recognise the reality of the situation.”

-

News1 week ago

News1 week agoSkeletal remains found almost 40 years ago identified as woman who disappeared in 1968

-

World1 week ago

World1 week agoIndia Lok Sabha election 2024 Phase 4: Who votes and what’s at stake?

-

Politics1 week ago

Politics1 week agoTales from the trail: The blue states Trump eyes to turn red in November

-

World1 week ago

World1 week agoBorrell: Spain, Ireland and others could recognise Palestine on 21 May

-

Movie Reviews1 week ago

Movie Reviews1 week ago“Kingdom of the Planet of the Apes”: Disney's New Kingdom is Far From Magical (Movie Review)

-

World1 week ago

World1 week agoUkraine’s military chief admits ‘difficult situation’ in Kharkiv region

-

World1 week ago

World1 week agoCatalans vote in crucial regional election for the separatist movement

-

Politics1 week ago

Politics1 week agoNorth Dakota gov, former presidential candidate Doug Burgum front and center at Trump New Jersey rally