In 23 days the Ethereum community will transition to a proof-of-stake (PoS) consensus algorithm after working as a proof-of-work (PoW) blockchain since July 30, 2015. Whereas the change could not imply a lot to ethereum customers and merchants, what’s altering below the hood is a really large deal.

You’ve Heard About The Merge, Why Is It a Massive Deal?

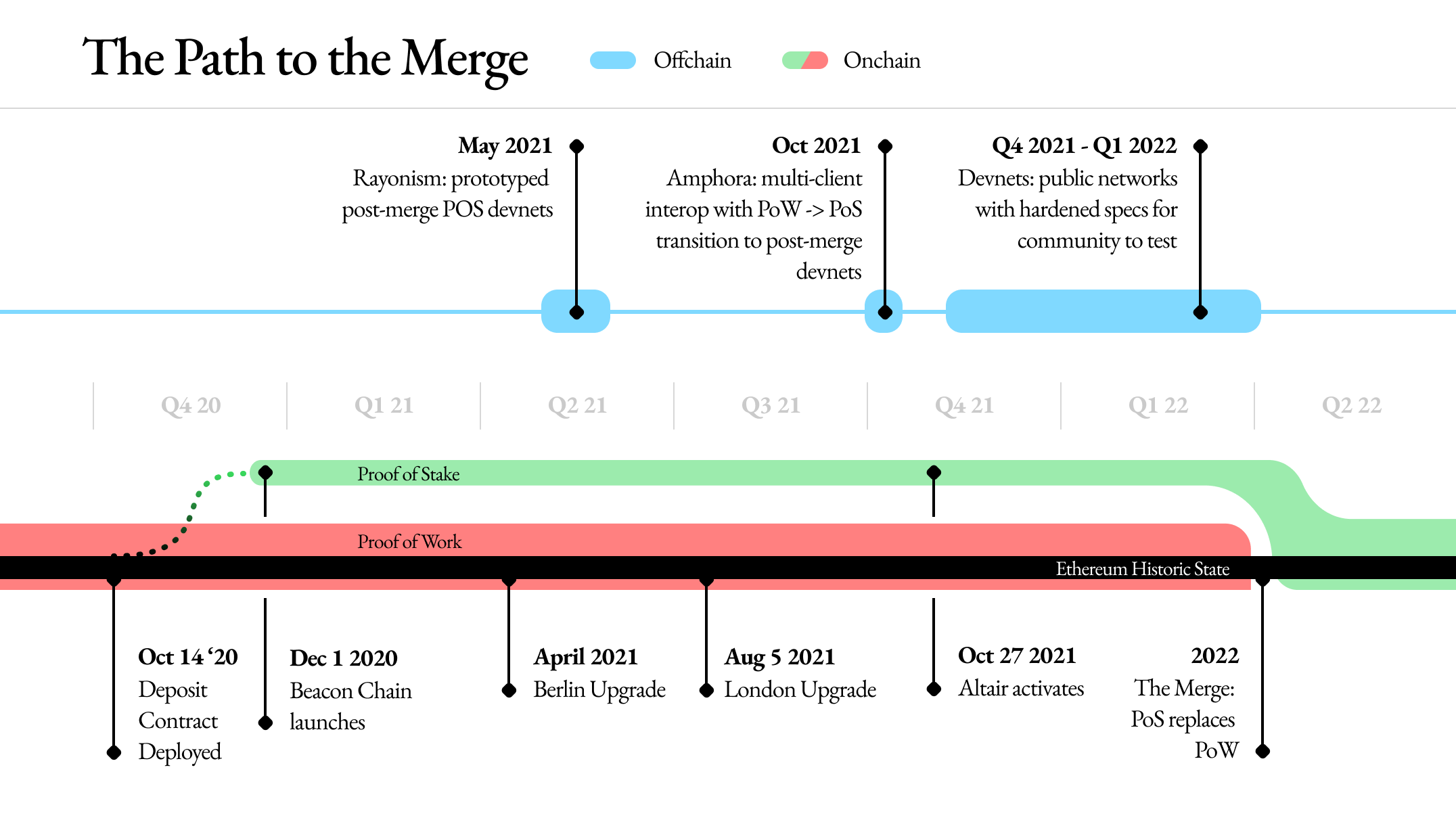

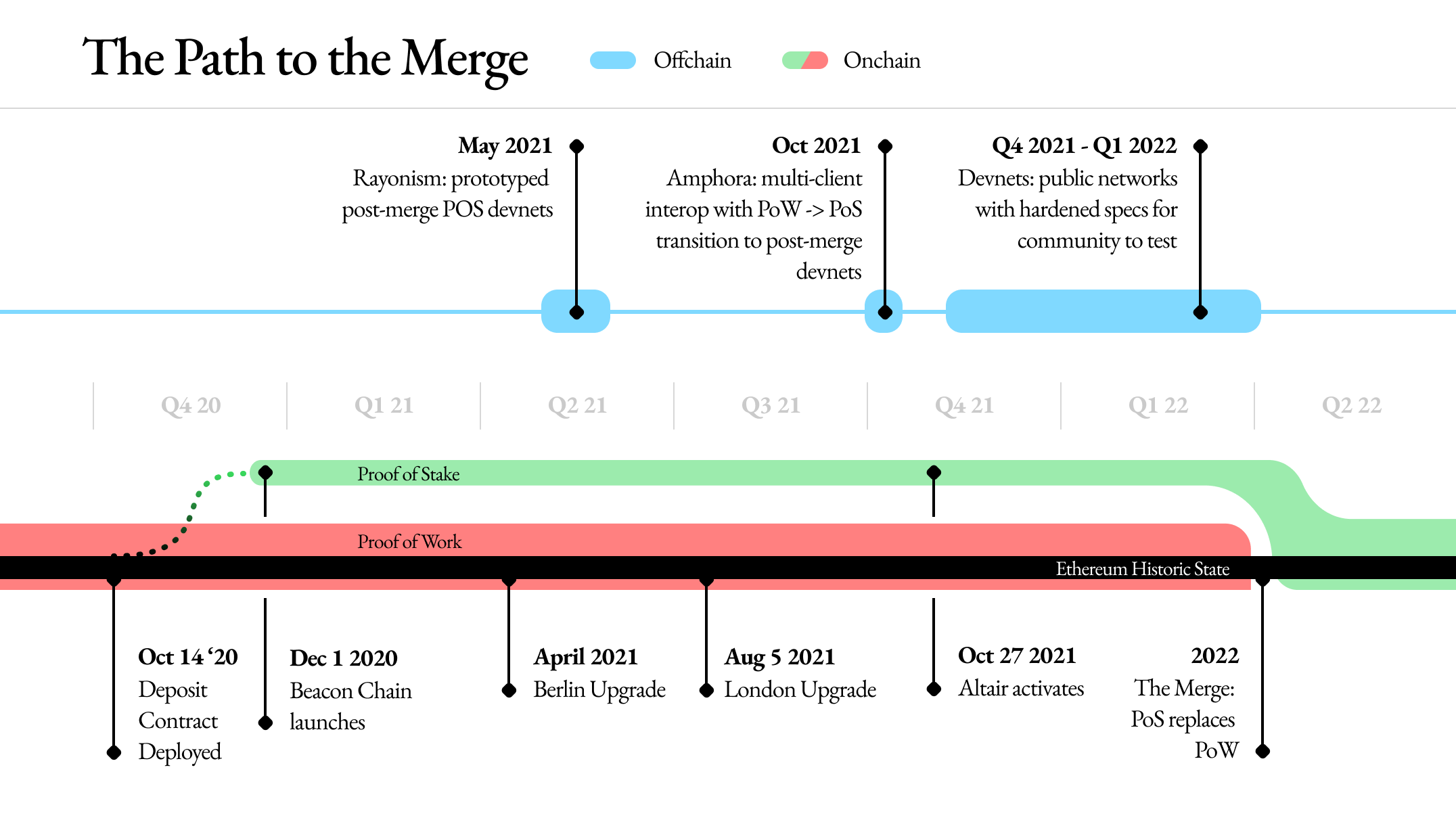

Subsequent month will probably be a monumental time for the Ethereum community and its contributors. The Merge will doubtless be some of the anticipated and recognizable upgrades the blockchain has seen since The DAO arduous fork. On or round September 15, 2022, Ethereum will implement The Merge and which means the chain will utterly change the consensus mechanism it as soon as used. For the reason that blockchain was created, Ethereum’s consensus mechanism has been a proof-of-work (PoW) scheme, much like Bitcoin’s consensus mechanism.

Nonetheless, as a substitute of the PoW consensus mechanism SHA256, Ethereum depends on a scheme referred to as Ethash, a PoW consensus settlement preceded by a mechanism often called Dagger-Hashimoto. The principle objective of Ethash was to supply ASIC resistance however after a number of years, Ethash ASIC miners appeared in the marketplace alongside using graphics processing items (GPUs). Just like Bitcoin’s PoW consensus algorithm, Ethash miners should put forth the computational value of buying and working ASIC or GPU miners, and utilizing electrical energy.

When The Merge takes place, Ethereum won’t depend upon miners to validate transactions. As a substitute, the community’s transactions will probably be validated by entities referred to as validators. By utilizing a PoS consensus mechanism, Ethereum validators are chosen by proudly owning 32 ether and they’re required to run three completely different items of software program which embody a validator, an execution consumer, and a consensus consumer. On the time of writing, 13,406,821 ETH has been added to the Ethereum 2.0 contract and there are greater than 416,000 validators.

The Ethereum blockchain’s roadmap has had plans to develop into a PoS chain for plenty of years. The Ethereum Basis offers six completely different the explanation why PoS is an enchancment and some of the talked about is “higher vitality effectivity.” The Ethereum Basis’s abstract of ETH’s transition to PoS additionally says that the consensus mechanism offers “decrease boundaries to entry” due to “decreased {hardware} necessities” and “there is no such thing as a want for elite {hardware} to face an opportunity of making new blocks.”

Ethereum’s proof-of-work miners, those with ASICs and GPUs, might want to mine one other crypto asset that leverages the Ethash algorithm and there are a number of that exist at this time. Miners can select from mining ethereum basic, ravencoin, ergo, beam, and presumably a brand new PoW Ethereum fork that’s created amid The Merge transition. Just a few days in the past, on August 20, 2022, Ethereum Basic’s hashrate reached an all-time excessive. Ethereum (ETH) will observe a brand new set of consensus guidelines and mining ethereum with a machine will probably be out of date. Whereas the PoS subject has been mentioned an incredible deal, improvement towards reaching the objective has been profitable as properly.

Presently, Ethereum runs a PoS chain referred to as the Beacon chain that runs parallel with the PoW blockchain community. Builders have safely docked The Merge with all three main testnets — Ropsten, Sepolia, and Goerli — and roughly 9 shadow forks have been executed. The Merge will probably be executed on Ethereum’s essential community on or round September 15, 2022, or when the whole problem reaches 58750000000000000000000. At the moment the community will merge with the PoS consensus mechanism that has been utilized to the Beacon chain, and the testnets Ropsten, Sepolia, and Goerli.

Tags on this story

Beacon Chain, beam, Ergo, ETH, ETH 2.0 Contract, Ethash, Ethash mining, ether, Ether PoS, Ether PoW, Ethereum, Ethereum (ETH), Ethereum Basic, Goerli, Hashrate, PoS, PoS consensus, PoS consensus mechanism, PoS Validators, PoW, ravencoin, Ropsten, Sepolia, Terminal Whole Issue, The Merge, complete problem

What do you consider Ethereum altering its consensus mechanism to PoS from PoW? Tell us what you consider this topic within the feedback part under.

Jamie Redman

Jamie Redman is the Information Lead at Bitcoin.com Information and a monetary tech journalist residing in Florida. Redman has been an energetic member of the cryptocurrency neighborhood since 2011. He has a ardour for Bitcoin, open-source code, and decentralized functions. Since September 2015, Redman has written greater than 5,700 articles for Bitcoin.com Information concerning the disruptive protocols rising at this time.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any harm or loss triggered or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.