Crypto

Republicans claim betrayal as cryptocurrency PAC backs Democrats

JACKSON HOLE, Wyo. — A leading pro-cryptocurrency political group has dumped millions of dollars into high-profile Michigan and Arizona Senate races to back Democrats against Donald Trump-endorsed candidates, angering top Republicans who viewed the industry as an ally, not an opponent.

Fairshake PAC and its affiliated super PACs are reserving millions in advertising spending to influence three U.S. Senate races this cycle, and have announced commitments of about $3 million each to Democrats Rep. Ruben Gallego, who is running in Arizona, and Rep. Elissa Slotkin, a candidate in Michigan, it said on Wednesday.

The spending risks upending GOP efforts to secure seats in two key battleground states in the fight for control of the Senate and comes as top Republicans — amid a hostile regulatory environment — have leveraged their political capital to broker closer ties to the cryptocurrency industry.

When asked for comment, Fairshake referred NBC News to Slotkin and Gallego’s current A-ratings from Stand With Crypto, a nonprofit group advocating for the crypto industry. Both Democrats this year crossed party lines to support a historic crypto bill.

For years, Slotkin had expressed skepticism of cryptocurrency until an apparent change of heart in recent months. The Michigan lawmaker earned an F-rating from Stand With Crypto as recently as March.

Gallego, who is facing off against Republican Kari Lake, had failed in the past to back legislation that was supported by the crypto industry and, in 2022, praised on social media a candidate who “slayed the Crypto beast.” Last year, Gallego signed onto a letter, spearheaded by Sen. Elizabeth Warren, D-Mass., to address crypto-financed reforms, crediting her as an “outspoken advocate for regulation and oversight of crypto.” He has also criticized business owners like Elon Musk for “pushing Bitcoin” and profiting off cryptocurrency, and signed onto legislation perceived as hostile by the industry in years past.

Lake earned an A rating from the group Stand With Crypto for her strong statements about supporting the industry, and is assessed as “very pro-crypto.”

A spokesperson for Fairshake, Josh Vlasto, said in a statement that the super PAC and its affiliates are working to “support candidates who embrace innovation, want to protect American jobs and are committed to working across the aisle to get things done and oppose those who do not.”

The crypto industry and its aligned super PACs have amassed more than $100 million to spend in House and Senate races, part of an effort to shape a favorable regulatory landscape by bolstering crypto-friendly candidates. In Ohio alone, the group is targeting $12 million in support of a Republican Senate candidate running to unseat Democratic Sen. Sherrod Brown, chair of the powerful Committee on Banking, Housing and Urban Affairs, who is viewed by industry advocates as a crypto skeptic.

Fairshake is the leading PAC funded by digital asset firms, with its most significant contributions coming from a handful of donors: blockchain firm Ripple; individual donors affiliated with the venture firm Andreessen Horowitz; and Coinbase, the largest U.S. cryptocurrency exchange.

Republican operatives making the case for crypto say that it is a growth industry that the party has embraced for good reasons, and that these efforts will continue to pay off over time.

“The world has changed since Trump’s first term in office,” said Matt Mackowiak, a GOP strategist based in Austin, Texas. “The smart Republicans have seen that opportunity and have moved towards it. And it has multiple advantages: One, it is a source of fundraising. Two, it is a way to attract votes from a younger demographic. And three, it is an issue that can set up a contrast with the Democrats, and makes Republicans look like the party of the future.”

Now, simmering tensions are moving into the open as alarmed Republicans eye Fairshake, its affiliated super PACs and top backers with mounting skepticism. They warn that the groups risk losing sway with Republicans after working to cultivate hard-won relationships and are questioning the durability of Gallego and Slotkin’s support.

“It is reminiscent of when the Chamber of Commerce bankrolled a bunch of anti-business House Democrats who turned around and passed massive tax hikes on businesses with the so-called Inflation Reduction Act,” a senior GOP Senate aide said. “Now, the Chamber of Commerce can’t even get a meeting with House Republican Leadership to discuss their priorities.”

Congressional Republicans and the Chamber of Commerce have been on rocky terms in recent years after the business lobbying group became irate with Republicans for not supporting immigration reforms and not stopping Trump’s tariffs, both positions the group felt harmed American business. The chamber announced a willingness to back Democrats, a move that was unimaginable in the Obama era and that enraged many Republicans on the hill.

The aide continued: “It is surprising that whoever is advising Fairshake has come up with the same flawed strategy.”

One GOP strategist involved in Senate races warned that the spending risks hurting Trump as well since his allies are being attacked.

“Coinbase and Fairshake are attempting to become toxic to Republicans. Spending against two key GOP candidates could jeopardize the Senate and harm Trump,” said the source, who was not authorized to speak publicly so as not to get ahead of the former president. “Gallego and Slotkin have voted against bitcoin interests and would vote to confirm a far-Left SEC Chairman. It makes no sense.”

The spending was a hot topic of conversation as Republicans descended on Jackson Hole this week, alongside Marc Andreessen and representatives from Coinbase and other crypto groups, to attend consecutive retreats hosted by the Congressional Leadership Fund super PAC and House Speaker Mike Johnson, R-La. Andreessen and his business partner, Ben Horowitz, have endorsed Trump in the presidential race and criticized the Biden-Harris administration’s regulatory agenda and its promise to tax unrealized capital gains. Together, Andreessen and Horowitz are among Fairshake’s most significant donors.

“Republicans are WTF about what’s going on with Fairshake, and I think that’s a pretty bad omen for the industry, that people are wondering why our main trade association is pointing its arsenal at our friends,” said one industry leader who was granted anonymity to speak freely. “A lot of people are walking around the CLF conference astonished that this is the strategic chess move that the industry has made.”

A prominent member of Trumpworld likened the support “to a pro-Israel group giving money to the Squad.” A source familiar with the comments who was not authorized to speak publicly said the comparison suggests that Fairshake is supporting a cohort hostile to its interest.

Trump has promised to implement crypto-friendly policies if elected, culminating in a reversal of his stance from his time in the White House, when he criticized Bitcoin as “highly volatile and based on thin air.” Trump’s campaign now accepts Bitcoin donations, and his selection of running mate JD Vance was viewed as a win for the industry. Vance has called for looser regulation of crypto and disclosed that he has $250,000 to $500,000 worth of bitcoin among his assets.

Mackowiak said the shift is in part generational, with Vance credited with convincing a group of Silicon Valley investors to host Trump on their popular podcast and hold a San Francisco fundraiser that raked in millions.

A former Trump regulator said that a future Trump administration would invite “a more nuanced approach to regulation” around crypto but that a regulatory shift should be expected regardless of who wins the presidential race. “It’ll just be faster if you have a Trump presidency.”

Since taking over the Democratic Party’s nomination, Vice President Kamala Harris has begun seeking a “reset” with the crypto industry, with executives from Coinbase, Ripple and Kraken voicing their concerns to the White House during a Zoom call, according to Bloomberg. Democrats have launched a Crypto4Harris group that is seeking to formalize the industry’s ties to the presidential candidate. Top Harris surrogates are also signaling a more open environment should she win in November, with Maryland Gov. Wes Moore promising during a recent interview on CNBC that Harris would offer a regulatory framework that would be more business-friendly than under Biden.

The former regulator said many are still skeptical, however.

“The big political question here is, can Harris convince proponents of industry that she has done a 180, or is it just talk?” he said. “Because they will not believe that she will cross Elizabeth Warren.”

This article was originally published on NBCNews.com

Crypto

Cryptocurrency Stocks To Research

Crypto

Crypto and Human Trafficking: 2026 Crypto Crime Report

TL;DR

- Cryptocurrency flows to suspected human trafficking services, largely based in Southeast Asia, grew 85% in 2025, reaching a scale of hundreds of millions across identified services.

- Telegram-based “international escort” services show sophisticated integration with Chinese-language money laundering networks (CMLNs) and guarantee platforms, with nearly half of transactions exceeding $10,000.

- Analysis reveals global reach of Southeast Asian trafficking operations, with significant cryptocurrency flows from destinations across the Americas, Europe, and Australia.

- CSAM networks have evolved to subscription-based models and show increasing overlap with sadistic online extremism (SOE) communities, while strategic use of U.S.-based infrastructure suggests sophisticated operational planning.

- Unlike cash transactions, cryptocurrency’s inherent transparency creates unprecedented opportunities for law enforcement and compliance teams to detect, track, and disrupt trafficking operations.

The intersection of cryptocurrency and suspected human trafficking intensified in 2025, with total transaction volume reaching hundreds of millions of dollars across identified services, an 85% year-over-year (YoY) increase. The dollar amounts significantly understate the human toll of these crimes, where the true cost is measured in lives impacted rather than money transferred.

This surge in cryptocurrency flows to suspected human trafficking services is not happening in isolation, but is closely aligned with the growth of Southeast Asia–based scam compounds, online casinos and gambling sites, and Chinese-language money laundering (CMLN) and guarantee networks operating largely via Telegram, all of which form a rapidly expanding local illicit ecosystem with global reach and impact. Unlike cash transactions that leave no trace, the transparency of blockchain technology provides unprecedented visibility into these operations, creating unique opportunities for detection and disruption that would be impossible with traditional payment methods.

Our analysis tracks four primary categories of suspected cryptocurrency-facilitated human trafficking:

- “International escort” services: Telegram-based services that are suspected to traffic in people

- “Labor placement” agents: Telegram-based services that facilitate kidnapping and forced labor for scam compounds

- Prostitution networks: suspected exploitative sexual service networks

- Child sexual abuse material (CSAM) vendors: networks of individuals engaged in the production and dissemination of CSAM

Payment methods vary significantly across these categories. While “international escort” services and prostitution networks operate almost exclusively using stablecoins, CSAM vendors have traditionally relied more heavily on bitcoin. However, even within CSAM operations, bitcoin’s dominance has decreased with the emergence of alternative Layer 1 networks. Broadly, the predominant use of stablecoins by “international escort” services and prostitution networks suggests that these entities prioritize payment stability and ease of conversion over the risks that these assets might be frozen by centralized issuers.

As we detail below, the “international escort” services are tightly integrated with Chinese-language money laundering networks. These networks rapidly facilitate the conversion of USD stablecoins into local currencies, potentially blunting concerns that assets held in stablecoins might be frozen.

Nearly half of Telegram-based “international escort” service transactions exceed $10,000, demonstrating professionalized operations

The distribution of transaction sizes reveals distinct operational models across different types of suspected trafficking services. “International escort” services show the highest concentration of large transactions, with 48.8% of transfers exceeding $10,000, suggesting organized criminal enterprises operating at scale. In contrast, prostitution networks cluster in the mid-range, with approximately 62% of transactions between $1,000-$10,000, indicating potential agency-level operations.

These “international escort” services operate with sophisticated business models, complete with customer service protocols and structured pricing. For example, one prominent operation advertises across major East Asian cities with a tiered pricing system ranging from 3,000 RMB ($420) for hourly services to 8,000 RMB ($1,120) for extended arrangements, including international transport. These standardized pricing models create identifiable transaction patterns that investigators and compliance teams can use to detect suspicious activity at scale.

CSAM vendors and marketplaces

CSAM operations demonstrate different but equally concerning patterns. While approximately half of CSAM-related transactions are under $100 – unfortunately, there’s more CSAM on the internet than ever before, and it’s never been cheaper to produce – these operations have evolved sophisticated financial and distribution strategies. In 2025, we observed that, while these networks still collect payments in mainstream cryptocurrencies, they increasingly use Monero for laundering proceeds. Instant exchangers, which provide rapid and anonymous cryptocurrency swapping without KYC requirements, play a crucial role in this process.

The business model for CSAM operations has largely consolidated around subscription-based services rather than pay-per-content transactions, generating more predictable revenue streams while simplifying administration. These subscriptions typically cost less than $100 per month, creating a lower barrier to entry while establishing regular revenue for operators.

A disturbing trend emerged in 2025 with increasing overlap between CSAM networks and sadistic online extremism (SOE) communities. Following law enforcement actions against groups like “764” and “cvlt,” we observed SOE content appearing within CSAM subscription services, commonly advertised as “hurtcore.” These SOE groups specifically target and manipulate minors through sophisticated sextortion schemes, with the resulting content being monetized through cryptocurrency payments, perpetuating cycles of abuse.

The scale of these operations became particularly evident in July 2025, when Chainalysis identified one of the largest CSAM websites operating on the darkweb following a UK law enforcement lead. This single operation utilized over 5,800 cryptocurrency addresses and generated more than $530,000 in revenue since July 2022, surpassing the notorious “Welcome to Video” case from 2019.

Geographic analysis of clearnet CSAM operations reveals strategic use of U.S. infrastructure [1]. While U.S.-based IP addresses account for a large portion of CSAM activity associated with surface websites, IPs from other countries like South Korea, Spain, and Russia show smaller flows. This suggests that these operations leverage U.S.-based infrastructure for scale, reliability, and an initial appearance of legitimacy that helps the activity blend into normal traffic and delays detection. Further, if the operators are outside the U.S., it reduces their personal exposure.

Chris Hughes, Internet Watch Foundation Hotline Director, told us, “In 2025, the Internet Watch Foundation identified 312,030 reports containing child sexual abuse images and videos. This is more than ever before, with an increase of 7% from the previous year. Early analysis of IWF data indicates that most clearweb sites offering virtual currency as a payment for child sexual abuse are hosted in the US, while darkweb sites were the second highest. Any payment information that we identify on commercial websites is captured and shared with global law enforcement and organisations like Chainalysis to disrupt further distribution of criminal imagery and to help in the investigation of those who create, share and profit from the sale of child sexual abuse material.”

Despite these concerning trends, 2025 saw significant law enforcement successes, including the takedown of “KidFlix” by German authorities and increased arrests of CSAM consumers across the United States. These cases demonstrate how blockchain analysis can provide critical evidence for identifying, investigating, and prosecuting both operators and consumers of CSAM networks.

Telegram-based services show deep integration with Chinese-language money laundering networks (CMLNs) and guarantee platforms

“International escort” services

The cryptocurrency footprint of escort services reveals sophisticated integration with established financial infrastructure, particularly CMLNs and guarantee platforms. While some escort services operate legally, cryptocurrency transaction patterns help identify potential trafficking operations through their distinct financial behaviors.

The majority of cryptocurrency movements flow through a combination of mainstream exchanges, institutional platforms, and guarantee services like Tudou and Xinbi. This creates both vulnerabilities and opportunities: while these platforms provide easier access to the financial system, they also serve as critical chokepoints where compliance teams can detect and investigate suspicious patterns.

“Labor placement” agents

It’s been widely reported that scam operations — pig butchering schemes in particular — are deeply intertwined with human trafficking. Victims are often lured by fake job offers before being forced to work in Southeast Asian scam compounds, where they face brutal conditions and are coerced into operating romance/investment scams under threat of violence.

These operations utilize guarantee services’ “human resource” vendors to facilitate recruitment. Channel participants inquire about methods to transport workers who have been detained at immigration checkpoints, while compound administrators provide updates concerning regional developments that might affect their operations, such as the ongoing border tensions between Thailand and Cambodia.

Blockchain analysis shows that recruitment payments typically range from $1,000 to $10,000, aligning with advertised pricing tiers. This provides another opportunity to leverage identifiable transaction patterns to detect suspicious activity at scale. These agents maintain presence across multiple guarantee platforms to maximize their reach, with some operating through mainstream cryptocurrency exchanges.

The involvement of established criminal organizations became evident through our analysis of trafficking-related channels. For example, we identified an administrator account linked to the “Fully Light Group,” a Kokang-based organization previously flagged by the United Nations Office on Drugs and Crime (UNODC) for illegal gambling and money laundering. Their presence in channels facilitating transactions between scam compounds and “labor placement” agents suggests how established criminal networks provide critical financial infrastructure for trafficking operations.

Southeast Asian organizations facilitating potential trafficking show global reach through cryptocurrency

Geographic analysis of “international escort” services in 2025 reveals how Southeast Asian services, particularly Chinese-language operations, have expanded their reach globally through cryptocurrency adoption [2]. The transparency of the blockchain provides valuable insight into broader trafficking patterns and financial flows of these types of operations.

Based on our data, Chinese-language services operating through networks spanning mainland China, Hong Kong, Taiwan, and various Southeast Asian countries demonstrate sophisticated payment processing capabilities and extensive international reach. Their large-scale cryptocurrency transactions show significant flows from countries including Brazil, the United States, the United Kingdom, Spain, and Australia, indicating the truly global scope of these operations.

While traditional trafficking routes and patterns persist, these Southeast Asian services exemplify how cryptocurrency technology enables trafficking operations to facilitate payments and obscure money flows across borders more efficiently than ever before. The diversity of destination countries suggests these networks have developed sophisticated infrastructure for global operations.

Key risk indicators and monitoring strategies

While the sophistication of cryptocurrency-facilitated trafficking operations continues to grow, the transparent nature of blockchain technology provides powerful tools for detection and prevention. Our analysis has identified several key indicators that compliance teams and law enforcement can monitor:

- Large, regular payments to labor placement services paired with cross-border transactions

- High-volume transactions through guarantee platforms

- Wallet clusters showing activity across multiple categories of illicit services

- Regular stablecoin conversion patterns

- Concentrated fund flows to regions known for trafficking operations

- Connections to Telegram-based recruitment channels

The increasing sophistication of these operations, particularly their growing intersection with legitimate businesses and professional money laundering networks, requires a comprehensive monitoring approach that leverages blockchain analysis alongside traditional anti-trafficking efforts and public education. As these networks continue to evolve, the transparency of blockchain technology provides unprecedented opportunities for detection, disruption, and enforcement that would be impossible with traditional payment methods.

[1] This analysis is limited to the clearweb portion of the CSAM industry. A significant portion of CSAM transactions are conducted peer-to-peer through encrypted messaging apps or the darkweb, where reliable IP addresses can not be obtained for this analysis.

[2] This analysis involved a combination of signals to estimate the country of origin, including web traffic data and the use of regional crypto exchanges.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.

Crypto

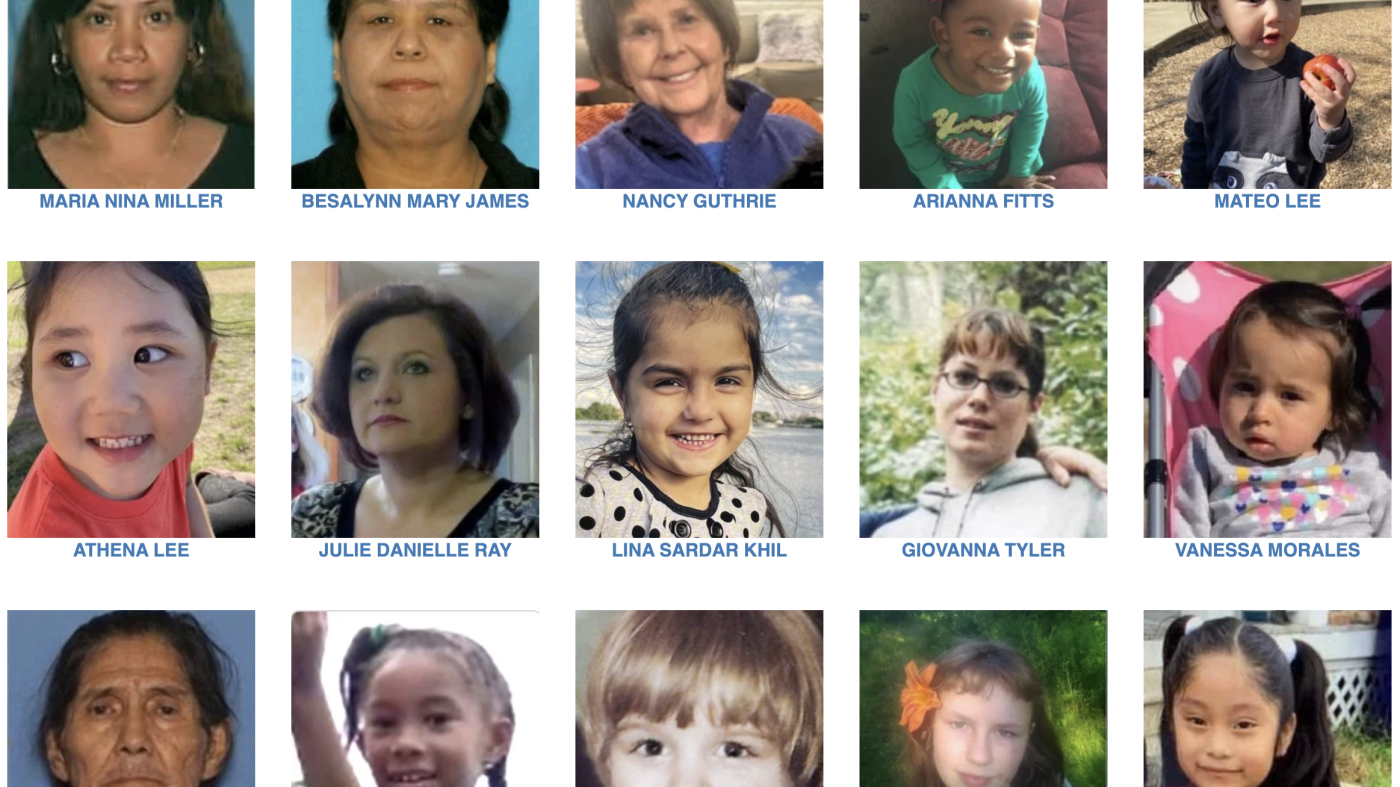

Nancy Guthrie disappearance highlights cryptocurrency’s role in criminal activity

PHOENIX (AZFamily) — The high-profile disappearance of Nancy Guthrie has brought new attention to the world of cryptocurrency, with multiple ransom notes sent to media outlets demanding payment in Bitcoin in exchange for Nancy Guthrie or her whereabouts.

What is cryptocurrency?

Cryptocurrency is digital money that only exists online. It operates on a network or blockchain rather than being controlled by a bank. It allows person-to-person transactions and uses a public ledger to record transactions. Crypto is most frequently used for online payments or investments.

Crypto expert Robert Hockensmith said every transaction is tracked and verified.

“Any time you buy it, any time you sell it, any time you use it to buy a product or service, any time you connect it or take it to another place, it is identified as you touching it. That’s how it works,” said Hockensmith, who works with AZ Money Guy.

Why criminals use cryptocurrency

Despite the tracking capabilities, criminals use crypto because it’s not that simple to trace. A cybersecurity expert said a lot of criminals have found creative ways to avoid being traced.

They’ll use multiple crypto wallets and addresses to obscure their identity. Funds can be transferred globally almost instantly, and if some IP addresses are hidden, they can be harder to locate. Once a transaction is confirmed, it’s extremely difficult to reverse.

“If you think about, for example, ID theft, cybercriminals might literally steal someone’s identity and that might include their access to something like Coinbase and then use that victim’s Coinbase to receive stolen funds and move it somewhere else, same way they used to do it with wire transfers,” said Eric Foster, cybersecurity and crypto expert and CEO of Tenex.AI.

Another crypto expert said criminals will keep moving their crypto over and over again, making it harder and harder to trace. He calls crypto the modern way of transporting large sums of money and said it has become the currency of choice for criminals.

See a spelling or grammatical error in our story? Please click here to report it.

Do you have a photo or video of a breaking news story? Send it to us here with a brief description.

Copyright 2026 KTVK/KPHO. All rights reserved.

-

Politics1 week ago

Politics1 week agoWhite House says murder rate plummeted to lowest level since 1900 under Trump administration

-

Alabama6 days ago

Alabama6 days agoGeneva’s Kiera Howell, 16, auditions for ‘American Idol’ season 24

-

Politics1 week ago

Politics1 week agoTrump unveils new rendering of sprawling White House ballroom project

-

San Francisco, CA1 week ago

San Francisco, CA1 week agoExclusive | Super Bowl 2026: Guide to the hottest events, concerts and parties happening in San Francisco

-

Ohio1 week ago

Ohio1 week agoOhio town launching treasure hunt for $10K worth of gold, jewelry

-

Culture1 week ago

Culture1 week agoAnnotating the Judge’s Decision in the Case of Liam Conejo Ramos, a 5-Year-Old Detained by ICE

-

Culture1 week ago

Culture1 week agoIs Emily Brontë’s ‘Wuthering Heights’ Actually the Greatest Love Story of All Time?

-

News1 week ago

News1 week agoThe Long Goodbye: A California Couple Self-Deports to Mexico