Iranians were able to access more than 1,500 Binance accounts last year, and $1.7 billion was transferred from two of them to terrorist proxies, The New York Times reported Monday.

Crypto

New cryptocurrency GBTC hits 5M: What is Green Bitcoin, and why are traders backing it for its upside potential?

With the presale rapidly progressing, the early adopter’s opportunity to get positioned at the lowest price is quickly running thin as the price consistently increases in the unique fundraising design.

Green Bitcoin officially crossed the $5 million fundraising milestone, as traders back the predict-to-earn protocol for considerable gains in the coming weeks. The project has created a unique staking mechanism that allows users to place forecasts on the future price of Bitcoin to earn massive rewards scaled to their level of investment while earning staking rewards simultaneously.Green Bitcoin is being hailed as a greener alternative to Bitcoin. It combines Bitcoin’s legacy with Ethereum’s co-friendly proof-of-stake mechanism. As a result, Green Bitcoin has birthed an ecosystem tied to Bitcoin’s price through price predictions with no environmental impact.

The project intends for its blockchain to experience a high level of activity. Its users will consistently stake $GBTC to participate in the daily price contests and earn massive rewards. The price contests are rooted in the staking system, and the team will release new daily and weekly challenges based on Bitcoin’s price action to keep the content fresh.

What is Green Bitcoin, and how does it reward users for accurate price forecasts?

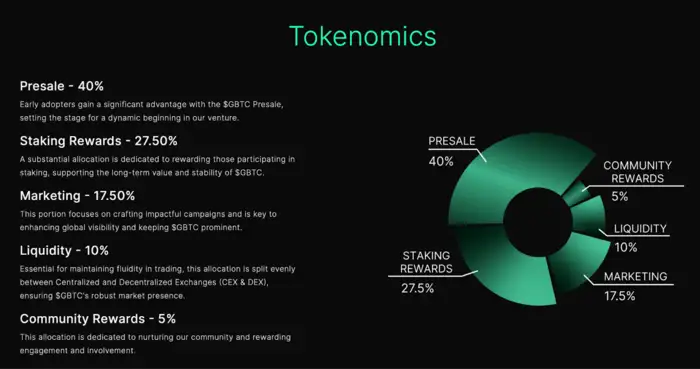

Spotlight Wire

Spotlight WireGreen Bitcoin introduces a novel staking ecosystem called Gamified Green Staking. This ecosystem allows users to stake $GBTC tokens to be eligible to place daily price predictions on Bitcoin’s value. Those who accurately place correct forecasts are proportionally rewarded from the daily mining rewards pool, scaled to their level of commitment to the ecosystem.Green Bitcoin pays homage to Bitcoin’s legacy. Its rewards are distributed to winners every ten minutes, in line with the original Bitcoin block schedule. Contestants can claim their accumulated rewards from the protocol once every 24 hours to keep transaction costs low. The team has allocated an enormous 27.5% of the entire $GBTC supply to provide the rewards for accurate predictions for the next two years.

Spotlight Wire

Spotlight WireUsers must lock their $GBTC into the Gamified Green Staking mechanism and submit their forecast before 11:30 PM EST to participate. At midnight, the smart contract will tally the day’s stakes against the actual price of Bitcoin and reward forecasts that land in the ‘Green Zone.’

As mentioned, the rewards earned depend on the level of investment made and the duration committed to the ecosystem. For example, those who have staked their $GBTC tokens in the Gamified Green Staking mechanism for more than a week are entitled to a 5% bonus on top of their regular daily rewards to recognise their extended commitment.

Those staking their tokens while participating in the daily price contests also earn an APY reward on top of their holdings through daily passive staking. The staking currently provides a 110% APY return, further incentivising users to keep their $GBTC locked into the ecosystem.

Why are traders backing it for huge upside potential?

Spotlight Wire

Spotlight WireTraders are quickly flocking to the presale, expecting upside potential for $GBTC due to its supply constraint dynamics.

Influential YouTubers ClayBro and Matthew Perryare backing the project with bullish views. They believe the unique staking system will cause $GBTC to surge following its exchange listing.

Users are required to stake their $GBTC into the ecosystem to participate in the price contests, so the tokens aren’t available for purchase on the open market. As a result, these experts predict that there might be a supply shock on centralised and decentralized exchanges as most $GBTC will be locked into the ecosystem.

Therefore, newcomers to $GBTC will likely be forced to pay higher prices to acquire the token and participate in the predict-to-earn ecosystem following the presale.

Investors are comparing the supply dynamics for Green Bitcoin as very similar to those of Bitcoin itself, which is currently experiencing a pre-halving rally ahead of its block reward cut. Both cryptocurrencies will likely experience massive supply shocks on the open market, causing prices to surge.

How to buy $GBTC today

$GBTC can be purchased at presale prices through the project’s website. Green Bitcoin is utilising the Web3Payments gateway to ensure the safety and security of everybody investing.

- Go to the official $GBTC presale page.

- Fund your wallet with $ETH or $USDT and connect to the Web3Payments widget.

- Use the presale widget to swap your currency for $GBTC, entering the desired amount you wish to purchase.

- If you prefer plastic, order $GBTC tokens to your wallet using your credit/debit card.

Once purchased, your $GBTC will be automatically staked, allowing you to start earning a return on your investment throughout the presale stage. You can claim your $GBTC through the same portal when the token officially launches.

Overall, it’s unsurprising to see investors rushing to the $GBTC project, which, with its unique staking dynamics, is about to cause a supply shock on the open market, leading to much higher prices following the presale.

Buy $GBTC today.

Disclaimer: The above content is non-editorial, and TIL hereby disclaims any and all warranties, expressed or implied, relating to the same. TIL does not guarantee, vouch for or necessarily endorse any of the above content, nor is it responsible for them in any manner whatsoever. The article does not constitute investment advice. Please take all steps necessary to ascertain that any information and content provided is correct, updated and verified.

Crypto

Cryptocurrency Investment Fraud: Bizman loses Rs 2.6 cr to crypto, investment fraud | Hyderabad News – The Times of India

Hyderabad: A 69-year-old businessman from Somajiguda lost 2.65 crore allegedly in a cryptocurrency and stock investment fraud. Based on his complaint, Hyderabad Cyber Crime police have registered a case.The complainant was first contacted by a fraudster posing as Ramya Krishnan on Aug 30, 2025 through Facebook. She persuaded the victim to invest in a cryptocurrency and stock trading platform, Polyus Finance PFP Gold, hosted at the domain pfpgoldfx.vip, promising high returns to finance his proposed resort and apparel ventures.Fraudsters provided the victim a contact number for daily communication and sent screenshots showing notional profits credited in his wallet in USDT cryptocurrency. To build trust, the fraudster even allowed the victim a token withdrawal of 4,300 on Sept 12, 2025.Encouraged, the victim transferred over 2.65 crore in 10 transactions between Sept 10 and Dec 39, 2025 to various current accounts provided by the accused.When he attempted to withdraw his ‘earnings’, the accused demanded an additional 15% conversion commission. After he refused, the website became inaccessible and calls to the fraudsters went unanswered.Realising that he was duped, the victim filed an online report on the National Cybercrime Reporting Portal (NCRP) before approaching the Cyber Crime police on Feb 25.Based on his complaint, a case was registered under Sections 66C and 66D of the Information Technology Act and Sections 111(2)(b) (Organised crime), 318(4) (Cheating), 319(2) (Cheating by personation), 336(3) (Forgery for purpose of cheating), 338 (Forgery of valuable security, will, etc.) and 340(2) (Using as genuine a forged document or electronic record) of the Bharatiya Nyaya Sanhita on Wednesday. Police were analysing financial transactions to identify and arrest the accused.

Crypto

Terror groups receive $1.7b. from Iran through Binance | The Jerusalem Post

That was a potential violation of global sanctions, the report said, citing company records and documents collected by internal investigators.

The cryptocurrency exchange site reportedly fired or suspended at least four employees cited in the internal investigation. The company blamed “violations of company protocol” relating to its clients’ data, the Times reported.

The report came days after The Jerusalem Post spoke with experts from blockchain intelligence platform NOMINIS.io about how the Iranian regime was evading Western sanctions through cryptocurrencies.

The regime maintains a steady income using cryptocurrency through oil sales to Russia and China, NOMINIS CEO Snir Levi said at the time.

Regarding the latest scandal, he told the Post this week: “The latest allegations about Binance come months after the lawsuit by the victims’ families of October 7 – the ongoing Balva [versus] Binance case.

The majority of the allegations can be easily confirmed by on-chain data. There are thousands of cases where money has been sent and received to and from wallets that have clear connections to Iran.”

Binance founder Changpeng Zhao is being sued by the families of American victims and hostages of the October 7 massacre. He has been accused of knowingly enabling Hamas, Hezbollah, Palestinian Islamic Jihad, and Iran’s Islamic Revolutionary Guard Corps to transfer more than $1b. through its platform, including more than $50 million after the October 7 massacre.

Zhao pleaded guilty to anti-money-laundering violations in connection with Binance in 2023. US President Donald Trump pardoned him last October.

“They say what he did was not even a crime,” Trump told reporters last October. “It wasn’t a crime. That he was persecuted by the Biden administration, and so I gave him a pardon at the request of a lot of very good people.”

Binance representative Rachel Conlan said the accounts linked to the $1.7b. in Iranian transactions have been removed and the relevant authorities were informed.

“Any suggestion that Binance knowingly allowed sanctionable activity to continue unchecked is incorrect and defamatory,” she said, despite Zhao’s earlier admission of anti-money-laundering violations.

More than half a dozen compliance officials have left Binance, including a sanctions manager and the leader of the enterprise compliance team, over the past few months, the Times reported.

“No investigator was dismissed for raising compliance concerns or for reporting potential sanctions issues,” Conlan said in a statement to The Guardian.

Democrat senator opens inquiry into cryptocurrency company

While Conlan insisted there was no wrongdoing, US Sen. Richard Blumenthal (D-Connecticut) opened an inquiry into Binance on Tuesday, seeking records of the company’s dealings in Hong Kong , where funds have previously been transferred in a network against sanctions.

“Binance appears to have ignored warnings and recommendations to prevent Iranian money-laundering schemes on its cryptocurrency exchange,” Blumenthal wrote in a letter to Binance co-chief executive Richard Teng.

“According to documents obtained by the Times and the Journal, Binance was even warned that Hexa Whale was financing terrorist organizations such as the Yemeni Houthis, and internal investigators found cryptocurrency transfers to wallets associated with Iran’s Islamic Revolutionary Guards Corps and payments to crew members of Russia’s sanctions-evading shadow fleet of oil tankers,” he wrote.

“Instead of actually preventing illicit use, Binance has sought to evade accountability and influence the White House through lobbying and a financial partnership with World Liberty Financial (WLFI), the cryptocurrency firm owned by the sons of President Trump and his special envoy Steve Witkoff… This influence campaign has worked: In May 2025, the Securities and Exchange Commission announced that it was dismissing a lawsuit against Binance for lying to regulators and mishandling funds, followed in October by the stunning Presidential pardon of founder Changpeng Zhao.”

“The scale of the newly revealed illicit transfers – uncaught until nearly $2 billion flowed to sanctioned entities – and the unexplained firing of internal investigators call into question Binance’s compliance with American sanctions and banking laws, and its 2023 agreement to resolve the previous federal investigation,” Blumenthal wrote.

Crypto

1 Artificial Intelligence (AI) Stock With More Potential Than Any Cryptocurrency | The Motley Fool

Crypto is stumbling while AI is advancing.

We’re in one of those times when market players are shunning crypto investments. Factors such as persistent inflation, a declining likelihood of interest rate cuts (typically a major catalyst for crypto price pops), and outflows from once-hotly popular crypto exchange-traded funds (ETFs) have put the hurt on even the most prominent digital coins and tokens.

Given that, it’s worthwhile to consider another high-potential technology — artificial intelligence (AI). Despite huge growth opportunities ahead, AI has also taken it on the chin lately as well. It still has a bright future, and I believe investors can still hop on this train with a company that’s not a pure play, but one deeply — albeit not exclusively — involved in the technology.

Read on to see what AI giant I believe can outpace even the most popular cryptocurrencies.

Image source: Alphabet.

Alphabet is advancing AI

That company is none other than Google owner Alphabet (GOOG +0.68%)(GOOGL +0.68%). Although it’s still known, with some justification, as a search engine operator, the company has been neck-deep in AI for years. It’s developed both hardware and the large language models (LLMs) powered by it, and it clearly aims to be a top name in this technology.

I have no doubt it can succeed. Google’s AI component Gemini is now fused into the company’s search and many other features (like Google Mail). This makes it a convenient option for web searchers querying for more than basic information on a subject. Its functionalities are also integrated into offerings like Google Docs, where users can harness AI to help with their writing. The Gemini platform itself is a hot item, with a monthly active user count now topping 750 million.

On the hardware front, Alphabet is not only actively developing and deploying Tensor Processing Units (TPUs) — chips designed to power AI functionality — it invented them. Originally designed to bolster the company’s AI capabilities, the processors are now being sold to external customers, opening another revenue stream.

Today’s Change

(0.68%) $2.11

Current Price $313.03

Market Cap

$3.8T

Day’s Range

$309.36 – $313.66 52wk Range

$142.66 – $350.15

Volume

20M

Avg Vol 23M

Gross Margin

59.68%

Dividend Yield

0.27%Key Data Points

AI is a growth catalyst for Alphabet

Alphabet doesn’t break out the revenue it derives from AI hardware and services, so we can’t put a precise number on how much the technology is bringing in for the company.

Still, it’s clearly foundational these days — the phrase “AI” was mentioned 94 times during management’s fourth-quarter and full-year 2025 earnings conference call. And the tech giant stated in the accompanying earnings release that “We’re seeing our AI investments and infrastructure drive revenue and growth across the board.”

Alphabet’s two main revenue buckets, Google Services and Google Cloud — both of which feature AI-enhanced products — have seen robust increases. The former’s revenue grew 14% year over year during the quarter to almost $96 billion, while the latter’s skyrocketed 48% to just under $18 billion.

The numbers don’t lie. Even if the economy slows or inflation remains stubborn, demand for Alphabet’s impressively large suite of AI products and services will remain strong. I’d feel much more confident parking my money in this AI stock than gambling it on a wobbly cryptocurrency.

-

World2 days ago

World2 days agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Massachusetts2 days ago

Massachusetts2 days agoMother and daughter injured in Taunton house explosion

-

Montana1 week ago

Montana1 week ago2026 MHSA Montana Wrestling State Championship Brackets And Results – FloWrestling

-

Oklahoma1 week ago

Oklahoma1 week agoWildfires rage in Oklahoma as thousands urged to evacuate a small city

-

Louisiana4 days ago

Louisiana4 days agoWildfire near Gum Swamp Road in Livingston Parish now under control; more than 200 acres burned

-

Technology6 days ago

Technology6 days agoYouTube TV billing scam emails are hitting inboxes

-

Denver, CO2 days ago

Denver, CO2 days ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Technology6 days ago

Technology6 days agoStellantis is in a crisis of its own making