Crypto

Lightning Network data company Amboss announces $4 million seed round to power Bitcoin as a payments rail

Though crypto transactions have a status for being costly and unwieldy, totally different options have emerged in recent times to facilitate the know-how as an precise cost service. A number one instance is the Lightning Community, a decentralized layer-2 protocol constructed on high of Bitcoin that guarantees quick and low cost transactions.

Nonetheless, as builders search to persuade enterprise purchasers that Lightning can function an alternative choice to conventional cost rails similar to Visa and MasterCard, they have to first assure that cost processing is dependable, that means that each transaction is settled.

Amboss Applied sciences, an Oregon-based crypto agency targeted on Lightning, introduced at present that it has raised $4 million in seed funding to supply knowledge analytics to the service suppliers who preserve the community. The spherical was led by the Bitcoin-native enterprise agency Stillmark and consists of participation from Valor Fairness Companions, Draper Associates, Fulgur Ventures, and Journey Wave Ventures.

“It’s an extremely necessary firm for the maturation of the Lightning Community,” Alyse Killeen, the managing associate of Stillmark, instructed Fortune in an interview. “It completely accelerates the adoption of Lightning Community by permitting enterprise to take part.”

The Bitcoin white paper, authored by the pseudonymous Satoshi Nakamoto, created the sphere of cryptocurrency in 2008. Regardless of its first-mover benefit within the area, Bitcoin has lengthy suffered as an precise cost technique due to expensive charges and transaction limits.

When builders first envisioned the Lightning Community in 2015 and commenced to implement it the next 12 months, it rapidly gained champions as a approach for Bitcoin to hurry up transaction occasions and function as a cost infrastructure.

Outstanding entrepreneurs have embraced Lightning as a technique for cross-border funds—remittances specifically—together with Block’s Jack Dorsey. Strike has emerged as one of many main corporations within the Lightning area, with the digital pockets agency elevating $80 million in September 2022 and increasing its cross-border cost function to nations together with Nigeria, Kenya, Ghana, and the Philippines.

Regardless of the rising prevalence of the know-how, Amboss’s seed spherical indicators that infrastructure improvement continues to be mandatory for the nascent discipline. Constructing off a well-liked open-source device known as ThunderHub, Amboss serves as a professionalized model of the platform, permitting the underlying service suppliers on the Lightning Community to infer essentially the most environment friendly paths for routing funds.

Killeen described Amboss because the “Waze” of the Lightning House, with node operators in a position to deduce the perfect methods to course of transactions and earn yields in return. Over 30% of nodes on Lightning Community use Amboss, together with nodes operated by Kraken and TBD, a Lightning-focused subsidiary of Block.

With the rising effectivity supported by Amboss, Killeen mentioned that extra enterprise options—similar to remittance corporations—will flip to the Lightning Community, because of its decrease charges in contrast with different platforms similar to Western Union.

“Individuals all around the world usually gained’t have any incentive to proceed utilizing closed networks,” mentioned Vikash Singh, a principal investor at Stillmark. He added the funding will go towards bolstering product improvement at Amboss, together with within the A.I. and machine studying area.

Crypto

Top Trader Ditches Bitcoin For Altcoins, 'Dogecoin Killer' Shiba Inu's Potential Breakout And More: This Week In Cryptocurrency

The week was a rollercoaster ride in the world of cryptocurrency. From a top trader’s surprising move to a CEO’s political warning, the crypto market was buzzing with activity. Here’s a quick recap of the top stories that made headlines.

Top Trader Ditches Bitcoin for Altcoins

Renowned cryptocurrency trader Michael van de Poppe shocked the market by announcing that he had sold all his Bitcoin holdings to invest in altcoins. Despite Bitcoin’s recent weak price action, Van De Poppe clarified that his decision was not due to a loss of faith in Bitcoin. Read the full article here.

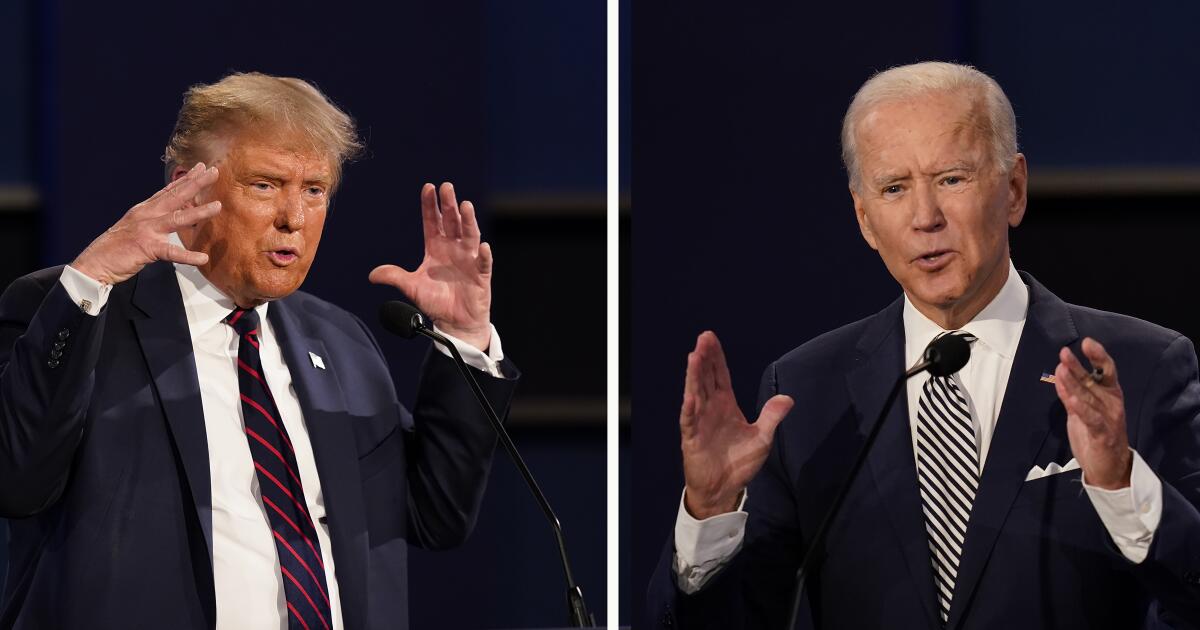

Uniswap CEO’s Political Warning

Hayden Adams, CEO of Uniswap UNI/USD, criticized the Biden administration for underestimating the political significance of cryptocurrency. Adams likened the administration’s oversight to a severe strategic miscalculation, expressing concern that this could alienate a significant voter base and impact campaign funding. Read the full article here.

See Also: ‘Dogecoin Killer’ Shiba Inu Pumps 6%: ‘I Felt Underexposed,’ Says Trader Who Sees More Short-Term Upside

Millionaire Trader’s Meme Coin Success

Trader ‘Bonk Guy’ revealed a seven-figure profit in 48 hours trading AMC AMC/USD and GameStop GME/USD derivatives on Solana. Bonk Guy invested around $155,000 in trade, which is currently worth $1.3 million, marking 641% gains. He believes the real “meme coin season” hasn’t even begun yet. Read the full article here.

‘Dogecoin Killer’ Shiba Inu’s Potential Breakout

Crypto trader Javon Marks predicts that ‘Dogecoin Killer’ Shiba Inu SHIB/USD could surpass its all-time high of $0.000088598, implying a price appreciation of over 282% from current levels. Marks suggests that the meme coin is currently in an “intermission” phase before continuing its upward trajectory. Read the full article here.

Dogecoin’s Potential Resurgence

Crypto Kaleo expressed his belief in Dogecoin’s DOGE/USD resurgence, attributing it to the retail sector’s renewed risk appetite. He emphasized Dogecoin’s enduring relevance, stating, “Dogecoin isn’t dead. As soon as it starts to catch a bit of a bid, it will move vertical once again.” Read the full article here.

Read Next: Donald Trump’s Election Odds Just Spiked To 51% According To This Crypto Prediction Market

Read Next: Why This Crypto Market Is ‘A Bear Trap’ And Which Coins This Trader Is Backing

Image via Shutterstock

Engineered by

Benzinga Neuro, Edited by

Anan Ashraf

The GPT-4-based Benzinga Neuro content generation system exploits the

extensive Benzinga Ecosystem, including native data, APIs, and more to

create comprehensive and timely stories for you.

Learn more.

Crypto

Crypto lender Genesis to return $3 billion to customers in bankruptcy wind-down

Crypto lender Genesis Global received a significant victory in bankruptcy court on Friday, securing approval for its liquidation plan that will return approximately $3 billion in cash and cryptocurrency to its customers. The ruling, however, delivers a blow to Genesis’s owner, Digital Currency Group (DCG), which will receive no recovery from the bankruptcy.

U.S. Bankruptcy Judge Sean Lane overruled DCG’s objection to the plan, which centred on the valuation of crypto assets. DCG argued that customer claims should be capped at the value of cryptocurrencies in January 2023, when Genesis filed for bankruptcy. Crypto prices have surged since then, with Bitcoin, for example, rising from $21,084 in January 2023 to its current price of around $67,000.

Judge Lane rejected DCG’s argument, stating that even with the lower valuation, Genesis would have to prioritise paying other creditors, including federal and state financial regulators with claims totalling $32 billion, before distributing funds to its equity owner.

“There are nowhere near enough assets to provide any recovery to DCG in these cases,” Judge Lane wrote in his ruling.

Genesis aims to return funds to customers in cryptocurrency wherever possible, although it lacks sufficient crypto assets to fully repay all outstanding claims.

Sean O’Neal, an attorney representing Genesis, refuted DCG’s assertion that customers could be paid in full based on the lower January 2023 valuations. “We don’t buy into the idea that claims are capped at the petition date value,” O’Neal stated.

Genesis initially estimated in February that it could repay up to 77% of the value of customer claims, subject to future fluctuations in cryptocurrency prices.

This court approval marks a significant step forward in the resolution of Genesis’s bankruptcy, providing much-needed relief to its customers while leaving its owner, DCG, without any financial recovery.

Crypto

Venezuela to shut down cryptocurrency mining farms

Venezuela’s Ministry of Electric Power announced it would disconnect all cryptocurrency mining farms from the national power grid (SEN, Sistema Electrico Nacional). The measure aims to control the high energy demand from these mining farms and ensure reliable service for citizens.

AlbertoNews, a local media outlet, reported the announcement on May 18.

“The purpose is to disconnect all cryptocurrency mining farms in the country from the SEN [National Electrical System], avoiding the high impact on demand, which allows us to continue offering an efficient and reliable service to all the Venezuelan people,”

the Ministry reported in its account in Instagram.

Notably, the announcement followed the seizure of 2,000 cryptocurrency mining machines in the country. This action is part of the government’s ongoing anti-corruption campaign. Leading to the arrests of several officials from state institutions.

Corruption with the National Superintendency of Cryptoassets

The National Superintendency of Cryptoassets (Sunacrip) has been under a restructuring board since the arrest of Superintendent Joselit Ramírez. Ramírez has connections to Tareck El Aissami, former Petroleum Minister and former president of Petróleos de Venezuela (PDVSA).

On that note, El Aissami was charged with treason, embezzlement, misuse of influence, money laundering, and criminal association.

Venezuela power grid issues and cryptocurrency mining

Venezuela has faced an ongoing electricity crisis since 2009, worsened by massive blackouts in 2019 that left cities without power for up to seven days. Frequent power outages have negatively affected the country’s quality of life and economic activities.

Therefore, Governor of Carabobo state, Rafael Lacava confirmed restrictions on cryptocurrency mining farms due to their significant electricity consumption. He urged residents to report illegal cryptocurrency mining operations to prevent power shortages.

“If you, neighbor, see a house that you know, tell that person to turn off the farm, or else report it, because when they turn off the light, because you have to give light to a man so that he can earn some reales (money), you are left without electrical service.”

– Rafael Lacava

As reported by AlbertoNews, experts attribute the crisis to poor maintenance and inadequate investment in the power grid. Meanwhile, the government blames sabotage and has promised to modernize the state-controlled power network.

Overall, Bitcoin (BTC) and cryptocurrency mining are known worldwide for their high energy consumption. Countries like China and Cazaquistan have banned the activity to preserve their power grids, centralizing mining in fewer locations.

Therefore, the fewer countries allowing this activity, the higher the security concerns will be, as a few miners dominate block discovery.

-

Finance1 week ago

Finance1 week agoSpring Finance Forum 2024: CRE Financiers Eye Signs of Recovery

-

World1 week ago

World1 week agoIndia Lok Sabha election 2024 Phase 4: Who votes and what’s at stake?

-

Politics1 week ago

Politics1 week agoTales from the trail: The blue states Trump eyes to turn red in November

-

World1 week ago

World1 week agoBorrell: Spain, Ireland and others could recognise Palestine on 21 May

-

Politics1 week ago

Politics1 week agoFox News Politics: No calm after the Stormy

-

World1 week ago

World1 week agoUkraine’s Zelenskyy fires head of state guard over assassination plot

-

Politics1 week ago

Politics1 week agoUS Border Patrol agents come under fire in 'use of force' while working southern border

-

World1 week ago

World1 week agoCatalans vote in crucial regional election for the separatist movement