Crypto

G-7 to push for tighter cryptocurrency regulations

The Group of Seven main industrialized democracies will promote more durable rules of the cryptocurrency sector, aiming to extend enterprise transparency and client protections, officers with information of the plan stated Sunday.

The G-7 will speed up the tempo of associated discussions towards a gathering of finance ministers and central bankers in mid-Might, simply days earlier than Japanese Prime Minister Fumio Kishida hosts this yr’s summit in Hiroshima, in line with the officers.

Image picture reveals a coin bearing the emblem of cryptocurrency Bitcoin and a graph exhibiting value fluctuations. (Kyodo)

Amid lingering concern about potential dangers to the worldwide monetary system posed by crypto belongings, they stated Japan and the opposite members — Britain, Canada, France, Germany, Italy and the USA, in addition to the European Union — are in search of to state their collective efforts in a leaders’ declaration.

The plan follows the collapse of the key cryptocurrency trade FTX in November, which has laid naked the poor governance of the trade and despatched shockwaves by means of monetary markets.

It additionally comes as buyers have been rattled by two sudden financial institution failures this month in the USA. The 2 have been Silicon Valley Financial institution, which specialised in coping with expertise startups, and Signature Financial institution, which served crypto shoppers.

Of the G-7 members, Japan already has cryptocurrency rules. Canada and the USA presently apply current monetary rules.

Whereas the authorized standing of digital belongings and guidelines about them differ by nation, the group is hoping to take the lead in formulating international requirements.

Internationally, the Monetary Stability Board, headquartered in Switzerland, launched a set of suggestions in October final yr towards making a regulatory framework, wherein it stated crypto belongings must also be topic to rules for business financial institution actions.

Whereas the FSB plans to announce its last model of the framework in July this yr, the Worldwide Financial Fund launched a coverage paper in February outlining key parts to be thought-about by every nation within the improvement of complete and coordinated guidelines following the unfold of crypto.

Amongst different tips, IMF administrators have typically agreed that crypto belongings shouldn’t be granted official foreign money or authorized tender standing.

Points related to crypto belongings are additionally more likely to be on the agenda of the upcoming assembly of finance ministers and central financial institution governors from the Group of 20 main economies in Washington in mid-April, in line with the officers, who spoke on situation of anonymity.

Crypto

Cryptocurrency Titans Bitcoin and Ethereum Poised for Robust July Based on Historical Patterns

As tradition guides us in the financial world, history often sheds light on what might be forthcoming. In this context, July has consistently proven to be a favorable juncture for the titans of the cryptocurrency market, Bitcoin and Ethereum. As we gingerly step into July, market experts are observing with keen interest, the patterns of the past, hoping for another lucrative period in the digital currency realm.

Time-honored market pundits from QCP Capital have deduced that over the years, Bitcoin has shown a median yield of 9.6% in July, bearing a consistent pattern of recuperating substantially after a rather lethargic performance in June. This year, following a dip of roughly 10% in its June performance, Bitcoin is set to possibly see an uplift this July, guided by these historical pointers.

Adding more colors of positivity to this promising picture, David Duong and David Han, two-discerning analysts from Coinbase, have affirmed this trend. They reckon that the expected bonanza of liquidity in July could provide an additional springboard to the market.

June’s downturns have purged the financial market of excess, potentially smoothing the path ahead for more secure and optimistic price shifts. Furthermore, Bitcoin and Ethereum’s trading volumes, which include spot and futures transactions on global exchanges, dwindled from $90 billion in May to $75 billion in June. Market watchers perceive this constriction in trade volumes as laying a sturdier groundwork for the next surge of market activity.

The favorable July seasonality has not been exclusive to leading cryptocurrencies but is also buttressed by broader market dynamics. Analysts including the likes of Ali underscore that recovery patterns ensuing June’s lapses historically denote a “vigorous bounce back” in July performances.

This observation holds notably true for Bitcoin, which has consistently delivered an average return of approximately 8% during this period.

The recent technical analysis of Bitcoin’s price fluctuations also provides credence to the hypothesis for a bullish July. Bitcoin noted a significant upsurge of 2.7% in just the past 24 hours. Now trading at $63,104, Bitcoin has started the month on a strong note. This recent rise has nudged its weekly gains also to 2.7%, echoing an uptick in investor confidence.

However, predictions are not without their hurdles. Factors including macroeconomic influences and regulatory advancements could still steer cryptocurrency prices in a direction contrary to expectations. And while analysts maintain an optimistic outlook based on statistical and historical evidence, the characteristic volatility of the cryptocurrency markets implies that significant deviations from past trends can still transpire.

Crypto

Cryptocurrency: 3 Bullish July Meme Coins To Stack For Maximum Gains

Bullish July is a serendipitous term prevalent in the cryptocurrency domain. It seems that July has often been noted to usher in significant price surges for tokens such as Bitcoin and Shiba Inu, making it a “lucky” month for crypto tokens to document new highs. The phenomenon as mentioned earlier might be a random fluke, but it has now transformed into an event that investors often watch.

With the onset of July, here are the top three trending token recommendations that one should stash to earn stellar gains soon.

Also Read: Cryptocurrency: 3 Coins To Majorly Rebound This July

Bullish July Meme Coins to Stack for Robust Profits

Cryptocurrency#1- Bonk

The Solana-based crypto coin BONK is now surging at an impeccable price pace, rising and peaking by 10% in the last 24 hours. According to CoinMarketCap, BONK is currently trading at $0.00002602, with prospects hinting at the token’s future price hike.

The dog-themed token was launched in 2022 and since then has grown exponentially, gaining nearly 23,674% in valuation. CoinCodex, a notable crypto analytics platform, predicts that the token may spike even more, surging to trade at levels behind 200%.

“The price of Bonk may rise by 227.72% and reach $0.00008520 by August 1, 2024. Per our technical indicators, the current sentiment is bullish, while the Fear & Greed Index is showing 51 (neutral). Bonk recorded 15/30 (50%) green days with 16.81% price volatility over the last 30 days.”

The platform further states the bonk is emanating a bullish sentiment, making it a lucrative coin to hold and stash for future gains.

Cryptocurrency #2: Dogwifhat

Dogwifhat, or WIF, recently took the crypto domain by surprise by peaking and surging by nearly 58% in the last seven days, trading at $2.32 at press time. The Solana-based token is currently basking in the glory of the recent SOL ETF filings that have been lodged by financial giants Ark 21 Shares and VanEck.

According to CoinCodex, WIF may peak further, surging nearly 200% in the process. CC shares that the token may peak to trade at a new ATH of $7 by the end of July 2024.

“The price of Dogwifhat may rise by 228.25% and reach $7.38 by August 1, 2024. Per our technical indicators, the current sentiment is bullish, while the Fear & Greed Index is showing 51 (neutral). Dogwifhat recorded 12/30 (40%) green days with 21.62% price volatility over the last 30 days.”

The technical indicators also categorize WIF as coin trading in the bullish realm. This makes WIF a suitable crypto coin to explore in the long run.

Cryptocurrency #3: Shiba Inu

The Shiba Inu Ecosystem is currently undergoing massive changes. For instance, the latest tweet by Shytoshi Kusama, Shiba Inu tech lead, has spurred a major shift in space. Kusama has teased his personality reveal in the upcoming IVS2024 event in Kyoto, Japan, a development that has sent shivers of excitement within the Shiba inu community.

At the same time, the token is known to make the most out of the bullish July phase, basking in the after-effects of the phenomenon by trading at higher price levels each July.

According to CoinCodex, SHIB may initially display a bearish sentiment. CC predicts the token will surge by 60% by July 9, 2024.

Also Read: Shiba Inu: Bullish July To Help SHIB Heal & Hit $0.000375, Here’s How?

“The Shiba Inu price forecast for the next 30 days is a projection based on the positive and negative trends. SHIB will be changing hands at $0.00002822 on July 9, 2024, gaining 64.80% in the process.”

Crypto

Top Bitcoin Price Predictions: Can BTC Reach $150,000 This Year?

TL;DR

BTC is Yet to Make the Headlines?

Despite the downfall in the past month, 2024 has so far been quite successful for the primary cryptocurrency, whose price hit an all-time high of over $73,000 in mid-March. Some analysts and prominent figures believe the asset might reach new impressive peaks before the end of 2024, with Tom Lee being one example.

The American entrepreneur reiterated his prediction that BTC could rally to $150,000 in the following months. Lee claimed that the asset’s valuation has been negatively affected lately due to the issues related to the now-defunct crypto exchange Mt. Gox.

The once-leading platform suspended operations a decade ago and filed for bankruptcy protection. It also lost approximately 850,000 BTC due to hacking and alleged mismanagement. Most recently, the court-appointed trustee overseeing the exchange’s bankruptcy proceedings announced that the company will begin paying back thousands of users almost $9 billion worth in assets.

“Bitcoin’s probably been suffering from the Mt. Gox which was a huge overhang for many years. But if I was investing in crypto and knowing that one of the biggest overhangs is going to disappear in July, I think it’s a reason to expect a pretty sharp rebound in the second half. So, I think $150K is still within,” Lee said.

It is worth mentioning that the American has not always been spot-on with his crypto forecasts. At the end of 2020, hepredictedthat Bitcoin’s price could tap $120,000 in 2021. The asset experienced a substantial bull run that year but could not exceed the $70K level.Other Bets

Numerous cryptocurrency analysts touched upon BTC’s price lately, envisioning a rally if the asset surpasses certain resistance levels. The X user Jelle claimed that Bitcoin’s “local market structure continues to improve,“ adding that a sustained trading above $61,500 could lead to a “test of that $65,000 area.“

“Break that, and we’re off to the races,“ the analyst suggested.

Michael van de Poppe gave his two cents, too. He believes BTC could settle at the $61,000-$61,500 support zone and rise above $67K this month.

#Bitcoin is looking for a higher low and support. It seems very likely that we’ll be looking at the $61-61.5K area.

A slow grind upward is what I’m expecting for the markets in July. pic.twitter.com/LHnXTydh8P

— Michaël van de Poppe (@CryptoMichNL) July 2, 2024

-

News1 week ago

News1 week agoA Florida family is suing NASA after a piece of space debris crashed through their home

-

Movie Reviews1 week ago

Movie Reviews1 week agoFilm Review: Everyday of the Dead (2023) by Yuyuma Naoki

-

Politics1 week ago

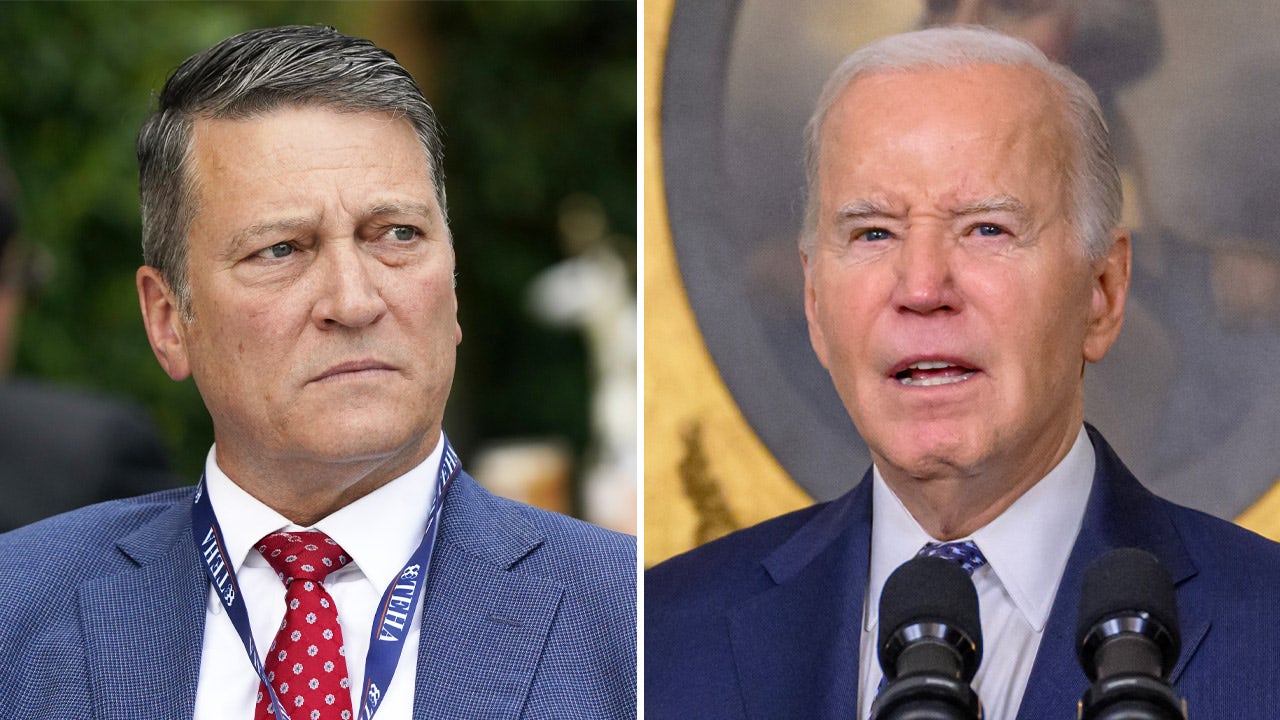

Politics1 week agoBiden official says past social media posts don’t reflect ‘current views,’ vows to support admin ‘agenda’

-

World1 week ago

World1 week agoNew Caledonia independence activists sent to France for detention

-

World1 week ago

World1 week agoIsrael accepts bilateral meeting with EU, but with conditions

-

World1 week ago

World1 week agoNetanyahu says war will continue even if ceasefire deal agreed with Hamas

-

News1 week ago

News1 week agoArkansas police confirm 4th victim died in grocery store shooting

-

Politics1 week ago

Politics1 week agoDeSantis signs bill allowing residents to kill bears, vetoes bill that fines slow left lane drivers