Crypto

Cryptocurrency: Many invest but few find fortune

Many people buy cryptocurrency in the hope of getting rich. But this kind of risky investment doesn’t necessarily mean big bucks for everyone.

In fact, relatively few buyers hold millions of dollars’ worth of crypto assets worldwide, according to a recent report.

While the sector has been experiencing an unprecedented crisis of confidence for several months, cryptocurrency remains a widespread investment. Some 425 million people hold crypto worldwide, of whom 210 million have Bitcoin. But far fewer have amassed a small fortune thanks to these virtual currencies.

The Crypto Wealth Report from investment firm Henley & Partners estimates that only 88,200 people worldwide own the equivalent of at least US$1mil (RM4.68mil) in crypto. This represents less than 1% of all users of these virtual currencies.

Half of them hold this amount in Bitcoin, attesting to the popularity of the most famous cryptocurrency.

There are even fewer crypto centi-millionaires and billionaires, with the former reportedly totaling just 182 individuals, 78 of whom owe their status to Bitcoin holdings. The latter category is thought to comprise 22 investors. Of these, six are reported to be Bitcoin billionaires. These figures should be treated with caution, however, given the highly volatile nature of digital currencies.

Nevertheless, they show that investors are keen to embrace these assets, as much out of a taste for easy money as out of distrust of the traditional banking system. But interest in crypto varies across age groups and from country to county.

It’s Singapore that tops Henley & Partners’ Global Crypto Adoption Index. The top three also includes Switzerland and the United Arab Emirates, followed by Hong Kong in fourth and the United States in fifth place. Australia (6th), Canada (8th), Austria (15th) and Portugal (18th) have embraced this new form of finance more than France or Belgium, for example.

The geography of cryptocurrency adoption shows that these digital assets are also flourishing in economically challenged emerging countries such as Malaysia (10th), Thailand (11th), and Antigua and Barbuda (14th).

Many of the countries most welcoming to cryptocurrency offer advantageous tax regimes to those who own them, although some, like Portugal, heavily tax capital gains on cryptocurrency investments. – AFP Relaxnews

Crypto

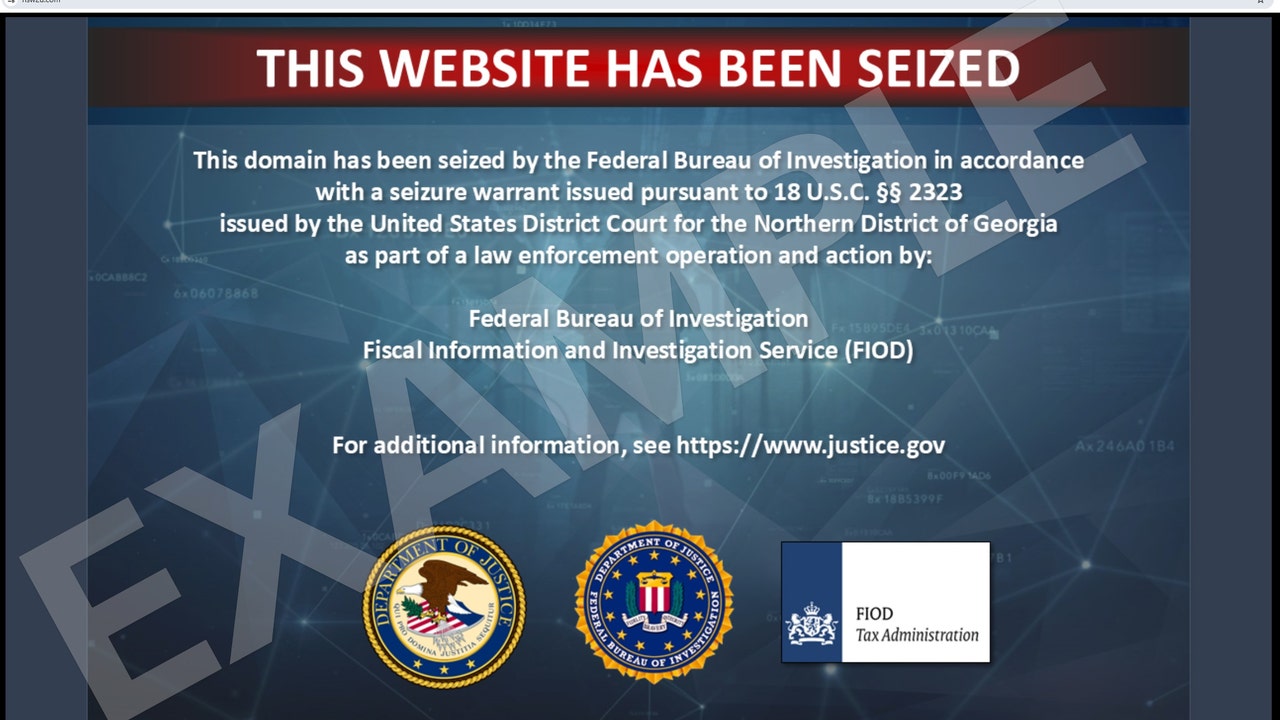

Attorney General Jackson and Secretary of State Marshall Launch Crypto Scams Prevention Effort

Crypto

Bank of America Embraces On-Chain Data Analysis for Cryptocurrency Insights

Bank of America has been discreetly preparing for potential disruptions in the cryptocurrency market by focusing on on-chain data analysis. This strategic move is aimed at better understanding the volatile nature of digital currencies and gaining deeper insights into market trends, investor behavior, and potential risks. The bank has been conducting extensive research and analysis on blockchain data, which allows for a more granular understanding of the market compared to traditional financial metrics.

By analyzing blockchain data, Bank of America can track transactions, monitor wallet activity, and assess the overall health of the cryptocurrency ecosystem. This approach enables the bank to make more informed decisions and mitigate risks associated with the cryptocurrency market. The shift towards on-chain data analysis reflects a broader trend within the financial industry, as institutions increasingly recognize the need to integrate blockchain analysis into their risk management strategies.

This proactive approach by Bank of America underscores its commitment to staying ahead in an ever-evolving financial landscape. The bank’s efforts are part of a larger initiative to enhance its capabilities in the digital asset space. By leveraging on-chain data, Bank of America aims to provide more comprehensive and accurate assessments of the cryptocurrency market, thereby better serving its clients who are increasingly interested in digital currencies and blockchain technology.

The move by Bank of America to focus on on-chain data analysis is a significant development in the financial industry. It highlights the growing importance of blockchain technology and the need for financial institutions to adapt to the changing landscape. As the cryptocurrency market continues to evolve, Bank of America’s proactive approach positions it well to navigate the challenges and opportunities that lie ahead. This strategic shift not only enhances the bank’s risk management capabilities but also demonstrates its readiness to embrace the future of finance.

Crypto

House Votes on Key Cryptocurrency Bills This Week

The U.S. House of Representatives is poised to vote on several pivotal cryptocurrency bills this week, marking a crucial juncture in the regulatory evolution of digital assets. The legislative package under consideration includes the CLARITY Act, the GENIUS Act, and the Anti-CBDC Surveillance State Act, each addressing distinct facets of the cryptocurrency ecosystem to foster a more structured and transparent market.

The CLARITY Act, formally known as the Digital Asset Market Clarity Act of 2025, is designed to establish clear, functional requirements for participants in the digital asset market. This legislation aims to enhance consumer protection while encouraging innovation, ensuring that the market operates within a well-defined regulatory framework. The GENIUS Act, meanwhile, focuses on stablecoin regulations, offering a comprehensive approach to managing these digital assets. The Anti-CBDC Surveillance State Act seeks to prohibit the Federal Reserve from issuing a central bank digital currency (CBDC), underscoring the importance of privacy and individual control over financial transactions.

The White House has highlighted the significance of this legislative push, with digital asset adviser Bo Hine referring to it as “Crypto Week.” This initiative is part of a broader effort to integrate cryptocurrencies into the mainstream financial system, balancing the need for regulation with the potential for innovation. The House Committee on Financial Services, led by Chairman French Hill, has been at the forefront of this agenda, emphasizing the importance of these bills in providing a clear regulatory framework for digital assets. This framework is essential for both consumer protection and market stability, and the committee’s efforts have garnered support from various stakeholders, including industry experts and policymakers.

The voting process is anticipated to attract close scrutiny from industry participants and regulators, as the outcomes will have wide-ranging implications for the future of digital assets in the U.S. The CLARITY Act is particularly notable, as it is seen as a foundational element of the regulatory framework, offering much-needed clarity on the legal status of digital assets and the responsibilities of market participants. The GENIUS Act and the Anti-CBDC Surveillance State Act complement this effort by addressing specific areas of concern within the cryptocurrency ecosystem.

As the House of Representatives prepares to vote on these bills, the focus remains on creating a balanced regulatory environment that supports innovation while protecting consumers. The outcomes of these votes will significantly influence the future trajectory of digital assets in the U.S., setting the stage for further developments in this dynamic and rapidly evolving field.

-

Culture1 week ago

Culture1 week agoTry to Match These Snarky Quotations to Their Novels and Stories

-

News6 days ago

News6 days agoVideo: Trump Compliments President of Liberia on His ‘Beautiful English’

-

News1 week ago

News1 week agoTexas Flooding Map: See How the Floodwaters Rose Along the Guadalupe River

-

Business1 week ago

Companies keep slashing jobs. How worried should workers be about AI replacing them?

-

Finance1 week ago

Do you really save money on Prime Day?

-

Technology1 week ago

Technology1 week agoApple’s latest AirPods are already on sale for $99 before Prime Day

-

News5 days ago

News5 days agoVideo: Clashes After Immigration Raid at California Cannabis Farm

-

Politics1 week ago

Politics1 week agoJournalist who refused to duck during Trump assassination attempt reflects on Butler rally in new book