Crypto

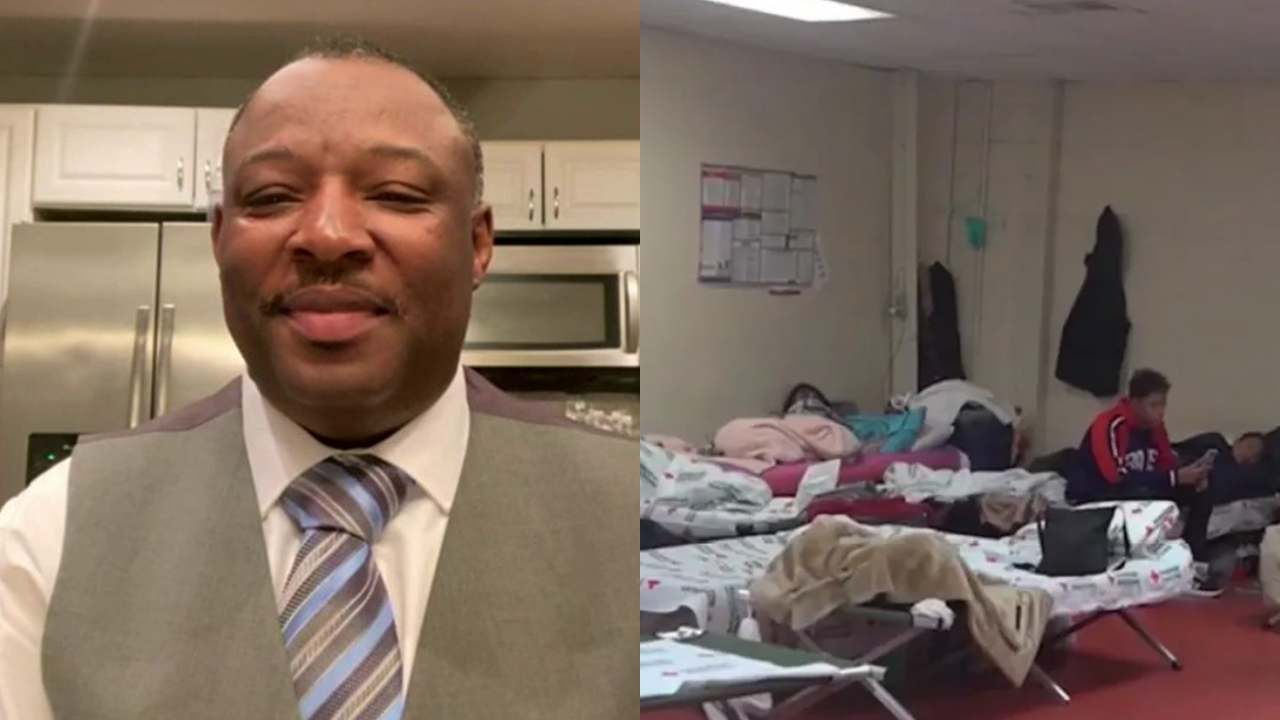

Bitcoin’s plunge spells trouble for the dot-com era entrepreneur who went all in

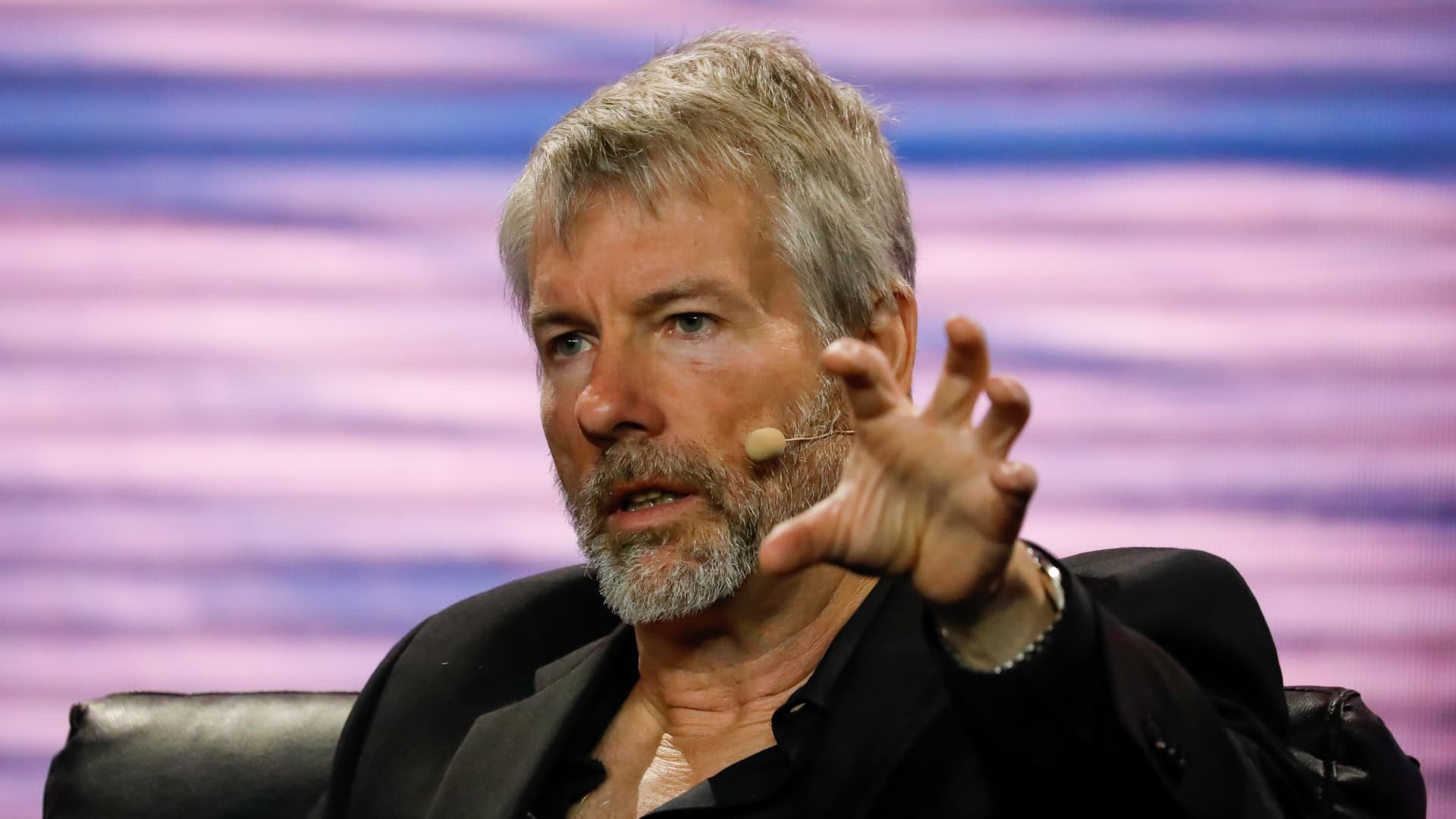

Michael Saylor, chairman and chief govt officer of MicroStrategy, first received into bitcoin in 2020, when he determined to start out including the cryptocurrency to MicroStrategy’s steadiness sheet as a part of an unorthodox treasury administration technique.

Eva Marie Uzcategui | Bloomberg | Getty Photographs

Having as soon as misplaced $6 billion on the peak of the dotcom bubble, software program entrepreneur Michael Saylor isn’t any stranger to volatility within the monetary markets.

In 1999, MicroStrategy, Saylor’s software program agency, admitted to overstating its revenues and erroneously reporting a revenue when it really made a loss. The fiasco shaved over $11 billion off MicroStrategy’s inventory market worth in a single day.

Now, greater than 20 years later, MicroStrategy is once more going through questions over a few of its accounting practices — this time in relation to a $4 billion guess on bitcoin.

The world’s largest cryptocurrency briefly tumbled under $21,000 Tuesday, a key degree at which MicroStrategy can be confronted with a margin name that traders worry may power the corporate to liquidate its bitcoin holdings.

MicroStrategy was not instantly accessible for remark when contacted by CNBC.

$1 billion loss

Saylor first received into bitcoin in 2020, when he determined to start out including the cryptocurrency to MicroStrategy’s steadiness sheet as a part of an unorthodox treasury administration technique.

His perception was a standard one among the many crypto devoted — that bitcoin offers a retailer of worth uncorrelated with conventional monetary markets.

That is turned out to be a dangerous gamble, with digital currencies now transferring in lockstep with shares and different property plunging amid fears of an aggressive rate of interest mountaineering cycle from the Federal Reserve.

Bitcoin’s value plunged 10% to $20,843 on Tuesday, extending a brutal sell-off and dragging it deeper into ranges not seen since December 2020. That comes after crypto lending agency Celsius halted withdrawals on Monday, citing “excessive market situations.”

MicroStrategy has guess billions on the cryptocurrency — $3.97 billion, to be precise. As at March 31, MicroStrategy held 129,218 bitcoins, every bought at a median value of $30,700, in response to an organization submitting.

With bitcoin at present buying and selling at $22,818, MicroStrategy’s crypto stash would now be value simply over $2.9 billion. That interprets to an unrealized lack of greater than $1 billion.

Margin name

So as to add to MicroStrategy’s woes, the corporate now faces what’s often called a “margin name,” a state of affairs the place an investor has to commit extra funds to keep away from losses on a commerce augmented with borrowed money.

The corporate took out a $205 million mortgage from Silvergate, a crypto-focused financial institution, to proceed its bitcoin shopping for spree. To safe the mortgage, MicroStrategy posted a number of the bitcoin it held on its books as collateral.

Silvergate didn’t instantly return a request for remark.

On an earnings name in Might, MicroStrategy Chief Monetary Officer Phong Le defined that if bitcoin had been to fall under $21,000, it might be confronted with a margin name the place it is compelled to cough up extra bitcoin — or promote a few of its holdings — to satisfy its collateral necessities. Bitcoin briefly slipped under that degree Tuesday.

“Bitcoin wants to chop in half or round $21,000 earlier than we might have a margin name,” Le mentioned on the time. “That mentioned, earlier than it will get to 50%, we may contribute extra Bitcoin to the collateral bundle, so it by no means will get there.”

It isn’t but clear if MicroStrategy has pledged extra funds to safe the mortgage.

In June, Saylor insisted the corporate has greater than sufficient bitcoin to cowl its collateral necessities. The cryptocurrency would wish to stoop to $3,500 earlier than it needed to provide you with extra collateral, he added.

Shares of MicroStrategy, thought of by some as a proxy for investing in bitcoin, tumbled greater than 25% on Tuesday, taking its year-to-date losses to over 70%. That is even worse than bitcoin’s efficiency — the No. 1 digital coin has roughly halved in value because the begin of 2022.

Saylor hasn’t but commented on bitcoin’s drop under $21,000. He posted a brand new profile image on Twitter Monday exhibiting his face with lasers popping out of his eyes — a nod to a meme signaling bullishness on bitcoin.

A number of hours after, Saylor tweeted: “In #Bitcoin We Belief.”

WATCH: Crypto fanatics need to reshape the web with ‘Web3.’ This is what meaning

Crypto

DeFi Future of Token Burn Mechanisms in Cryptocurrency Supply Control | Bitcoinist.com

Token burn mechanisms are becoming a crucial strategy in the cryptocurrency space for controlling supply, enhancing scarcity, and driving value over time. Projects like the Lightchain AI Presale are leading the way, introducing innovative tokenomics to foster sustainable growth and value creation.

By permanently removing tokens from circulation, burn mechanisms help regulate supply to match demand, benefiting token holders and supporting ecosystem sustainability. This approach has been embraced by major cryptocurrencies like Binance Coin (BNB) and newer initiatives aiming to refine the model with features such as automated burns and community-driven frameworks.

As more projects adopt these mechanisms, token burns are set to play a significant role in building transparent, efficient, and value-driven cryptocurrency ecosystems. The future of token burns holds exciting potential for ensuring long-term growth and sustainability in the crypto world.

Overview of Token Burn Mechanisms

Token burn mechanisms are designed to reduce the circulating supply of a cryptocurrency by permanently removing tokens from circulation. This is typically achieved by sending tokens to an unspendable address, also known as a burn address.

There are various ways in which token burns can be implemented, and each project may have its own unique approach. Some common methods include manual burns, where the project team decides on a set amount of tokens to be burnt periodically, and automated burns, where a portion of transaction fees or network rewards are automatically burned.

Additionally, community-driven token burns have gained popularity as they involve active participation from token holders through voting or staking mechanisms. By involving the community, these projects can enhance decentralization and transparency while aligning the long-term interests of stakeholders.

Types of Token Burn Mechanisms

This method involves periodic token burns initiated by the project team and can be used to reward early investors, reduce inflation, or align with the project’s roadmap and growth strategy. However, this approach requires a high level of trust in the team’s decision-making process and may not always be perceived positively by the community.

With automated burns, a portion of transaction fees or network rewards are automatically sent to a burn address, reducing the circulating supply over time. This is often seen as a fairer approach as it eliminates human bias in determining when and how much to burn.

By involving token holders in the decision-making process through voting or staking mechanisms, community-driven burns can enhance decentralization and transparency. This approach also aligns with the interests of stakeholders and can foster a more engaged and active community.

Benefits of Token Burn Mechanisms

Token burn mechanisms offer significant benefits in cryptocurrency supply control by enhancing scarcity, stabilizing tokenomics, and boosting long-term value. By permanently removing tokens from circulation, burns reduce overall supply, creating deflationary pressure that can increase token value, benefiting investors and holders. This controlled scarcity aligns with economic principles similar to stock buybacks, fostering confidence and attracting demand.

Token burns also stabilize ecosystems by addressing inflation and oversupply concerns, particularly in projects with high token issuance rates. Additionally, burn mechanisms tied to transaction fees or usage, like Ethereum’s EIP-1559, incentivize network activity and promote sustainability.

Community-driven burns foster decentralization and governance participation, strengthening trust. Projects like Lightchain AI (LCAI) leverage innovative burn strategies to optimize tokenomics while integrating with presale dynamics, highlighting their utility as a transparent, strategic tool for long-term ecosystem health and growth.

Obstacles to the Adoption of Burn Mechanisms

While token burn mechanisms have clear benefits, their adoption is not without challenges. One of the main obstacles is developing a fair and transparent process for implementing burns that align with stakeholders’ interests. Additionally, determining the right amount to burn can be a delicate balance as too much can harm ecosystem growth, and too little may not have a significant impact on supply control.

Another challenge relates to regulatory concerns surrounding token burns, particularly in jurisdictions where cryptocurrencies are still in a grey area or strictly regulated. Projects must navigate these complexities while ensuring compliance and transparency to avoid potential legal issues.

Emerging Alternatives to Traditional Burn Models

As the cryptocurrency space continues to evolve, innovative alternatives to traditional burn models are emerging. For example, proof-of-burn protocols like Counterparty use token burning as a way to validate transactions and secure networks, creating more utility for burned tokens.

Projects are also experimenting with creative ways to integrate burns with other features such as staking, liquidity mining, and gamification. These initiatives aim to incentivize participation while promoting sustainability and value creation in the long run.

Future Implications and Innovations

Token burn mechanisms are an essential tool for managing cryptocurrency supply and promoting sustainability. As the industry continues to mature, we can expect to see more projects adopting these mechanisms in innovative ways to optimize their ecosystems’ health and growth.

Innovations such as decentralized autonomous organizations (DAOs) and smart contracts will offer new opportunities for community-driven burns, enhancing decentralization and transparency even further. With the potential for cross-chain compatibility and interoperability, token burn mechanisms may also have a more significant impact on the broader crypto ecosystem beyond individual projects.

The Role of Lightchain AI (LCAI) in Burn Innovations

Lightchain AI (LCAI) is pioneering token burn innovations to enhance cryptocurrency supply control. Its deflationary model burns a portion of transaction fees and AI task payments, reducing token supply over time and increasing scarcity.

This strategy aims to boost token value and incentivize network participation. Additionally, LCAI’s Proof of Intelligence (PoI) consensus mechanism rewards nodes for performing AI computations, promoting meaningful contributions to AI development while maintaining network security.

These combined approaches position LCAI as a leader in integrating AI with blockchain technology, offering a sustainable and efficient ecosystem for decentralized applications. As of December 2024, LCAI has raised over $2.2 million in its ongoing presale, reflecting growing investor confidence in its innovative model.

How Lightchain AI (LCAI) is Addressing Challenges and Innovating in Token Burning

Lightchain AI (LCAI) has addressed challenges in implementing fair and transparent token burns by involving community members through staking mechanisms. Token holders can stake their LCAI tokens, locking them up for a set period, and participating in voting on burn proposals.

Additionally, LCAI’s deflationary model includes a built-in mechanism to adjust the burn rate based on market conditions, creating a more dynamic approach to supply control. This flexible approach aims to ensure that the project’s growth and ecosystem health are always top priorities.

Through its innovative Proof of Intelligence consensus mechanism and integration with AI development, LCAI is pushing the boundaries of traditional token burn models. By promoting network activity while maintaining scarcity, LCAI is creating a sustainable ecosystem for the future.

To Recap

Token burn mechanisms offer significant benefits for cryptocurrency ecosystems, including enhancing scarcity, stabilizing tokenomics, and boosting long-term value. Despite challenges in adoption and potential regulatory concerns, projects like Lightchain AI (LCAI) are pioneering innovative burn strategies to optimize ecosystem health and growth.

With continued advancements and integration with emerging technologies, token burns will continue to play a vital role in the evolution of the crypto space. So let’s keep an eye on how this technology develops and the impact it will have on the future of cryptocurrencies.

https://lightchain.ai

https://lightchain.ai/lightchain-whitepaper.pdf

https://x.com/LightchainAI

https://t.me/LightchainProtocol

Disclaimer: This is a paid release. The statements, views and opinions expressed in this column are solely those of the content provider and do not necessarily represent those of Bitcoinist. Bitcoinist does not guarantee the accuracy or timeliness of information available in such content. Do your research and invest at your own risk.

Crypto

Bitcoin soars to $107,000: Will the upward trend sustain? Experts weigh in | Stock Market News

Bitcoin surged to a record-breaking high of $107,000, reflecting a nearly 6 per cent increase over the past week. This unprecedented rally was fueled by President-elect Donald Trump’s proposal to establish a Strategic Bitcoin Reserve, modeled after the U.S. Strategic Petroleum Reserve. The announcement has sparked optimism within the cryptocurrency market, signalling a potential shift toward a more favourable regulatory environment under Trump’s administration.

Trump’s pro-crypto stance has been widely welcomed, with his vision of integrating Bitcoin into the national strategic reserves marking a historic milestone in the recognition of digital assets at a government level. Analysts suggest this policy could enhance Bitcoin’s legitimacy.

Adding to the momentum are expectations of another U.S. Federal Reserve interest rate cut, as lower rates typically favour risk assets like Bitcoin. The rally also received a boost from the inclusion of MicroStrategy in the Nasdaq 100 index—a landmark event highlighting the growing institutional acceptance of Bitcoin.

As per CoinSwitch Markets Desk, this move integrates Bitcoin into one of the world’s largest ETFs, boasting over $300 billion in assets under management (AUM).

“BTC touched an all-time high again after 10 days of consolidation. It seems to have marked its support over 2 trillion dollar market cap – making it the 7th largest asset in the world by market cap with Amazon and Google being less than 15% away,” it said.

Bitcoin among 10 most-valued assets

Bitcoin’s leap beyond the $107,000 mark follows a steady seven-week winning streak, underscoring the cryptocurrency’s robust fundamentals.

Rahul Pagidipati, CEO of ZebPay, noted that Bitcoin’s milestone reflects its evolution into a legitimate asset class. “Bitcoin is now effectively one of the top 10 most valued assets globally, ranking above most commodities and corporations,” Pagidipati said. He also highlighted that the total crypto market capitalisation has crossed $3.5 trillion, underscoring the scale of adoption.

Similarly, Tanvi Kanchan, Head of Strategy at Anand Rathi Shares and Stock Brokers, highlighting the broader implications of these developments said, “The proposed Strategic Bitcoin Reserve and increasing corporate treasury integration signify a shift toward mainstream adoption.”

Global Crypto Outlook

As the crypto market matures, innovations in decentralised finance (DeFi), blockchain interoperability, and tokenised assets are expected to redefine financial systems.

Sathvik Vishwanath, Co-Founder & CEO of Unocoin, described Bitcoin’s surge as transformative, saying, the market focus now shifts to the $110,000 level as momentum remains strong despite earlier bearish predictions.

“The proposed reserve cemented Bitcoin’s status as a critical financial asset and fueled renewed confidence in its potential. Bitcoin is now up more than 50 per cent since the US election, reflecting its growing influence and appeal as a hedge against traditional market uncertainty,” Vishwanath said.

Thangapandi Durai, CEO of Koinpark, said Bitcoin’s sustained momentum alongside broader adoption and innovative use cases, signals a promising future for the crypto token. While analysts predict potential short-term pullbacks, Bitcoin’s seven-week winning streak exemplifies its strong market fundamentals, he added.

Pankaj Balani, CEO & Co-Founder of Delta Exchange, said Bitcoin ETFs now hold 1% of all U.S. ETF assets, signalling further potential for growth.

“This followed by pro-crypto statements from President-elect Donald Trump, the selection of an SEC chair who is believed to be pro-crypto and increased institutional participation in the last few months have boosted the sentiment and excitement amongst traders. Market participants remain long with current OI hovering around record OI levels and expect further move up here,” he added.

Vishal Sacheendran, Head of Regional Markets at Binance also believes the outlook for crypto appears increasingly promising. However, he cautioned that as crypto momentum builds, investors must remain vigilant—prioritising research, diversifying portfolios and staying informed about industry trends to navigate this transformative era successfully.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before taking any investment decisions.

Catch all the Business News , Market News , Breaking News Events and Latest News Updates on Live Mint. Download The Mint News App to get Daily Market Updates.

MoreLess

Crypto

Virginia man convicted for sending cryptocurrency to ISIS members

A Virginian man was convicted for attempting to financially support ISIS, the US Department of Justice reported on Monday.

Mohammed Azharuddin Chhipa, from Springfield, Virginia, was convicted last week for collecting and sending money to female ISIS members in Syria in an attempt to finance their escape prison camps as well as supporting ISIS fighters.

Chhipa used social media accounts to raise funds, converting them to cryptocurrency before transferring the money to Turkey, where it was smuggled to ISIS members in Syria.

He was assisted by a British-born ISIS member living in Syria who was involved in raising funds for prison escapes, terrorist attacks, and ISIS fighters, the US Department of State reported.

Hundreds of thousands in crypto

The US Department of Justice stated that, in total, Chhipa had sent out over $185,000 in cryptocurrency.

The jury found Chhipa guilty of one count of conspiracy to provide material support or resources to a designated foreign terrorist organization and four counts of providing and attempting to provide material support or resources to a designated foreign terrorist organization.

Chhipa faces a maximum sentence of 20 years in prison per count. A sentencing hearing has been scheduled for May 5, 2025.

The FBI is currently investigating the case.

-

Technology1 week ago

Technology1 week agoStruggling to hear TV dialogue? Try these simple fixes

-

Business1 week ago

Business1 week agoOpenAI's controversial Sora is finally launching today. Will it truly disrupt Hollywood?

-

Politics4 days ago

Politics4 days agoCanadian premier threatens to cut off energy imports to US if Trump imposes tariff on country

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25782636/247422_ChatGPT_anniversary_CVirginia.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25782636/247422_ChatGPT_anniversary_CVirginia.jpg) Technology5 days ago

Technology5 days agoInside the launch — and future — of ChatGPT

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg) Technology3 days ago

Technology3 days agoOpenAI cofounder Ilya Sutskever says the way AI is built is about to change

-

Politics3 days ago

Politics3 days agoU.S. Supreme Court will decide if oil industry may sue to block California's zero-emissions goal

-

Politics5 days ago

Politics5 days agoConservative group debuts major ad buy in key senators' states as 'soft appeal' for Hegseth, Gabbard, Patel

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg) Technology4 days ago

Technology4 days agoMeta asks the US government to block OpenAI’s switch to a for-profit