Tags on this story

2 million BNB, BEP20, Binance, Binance Good Chain, bnb, BNB hack, BNB Good Chain, BNB Good Chain Twitter account, chain pause, Changpeng Zhao, Cross-chain Bridges, CZ, Exploit, Hack, hack BNB, paused chain, suspended BSC

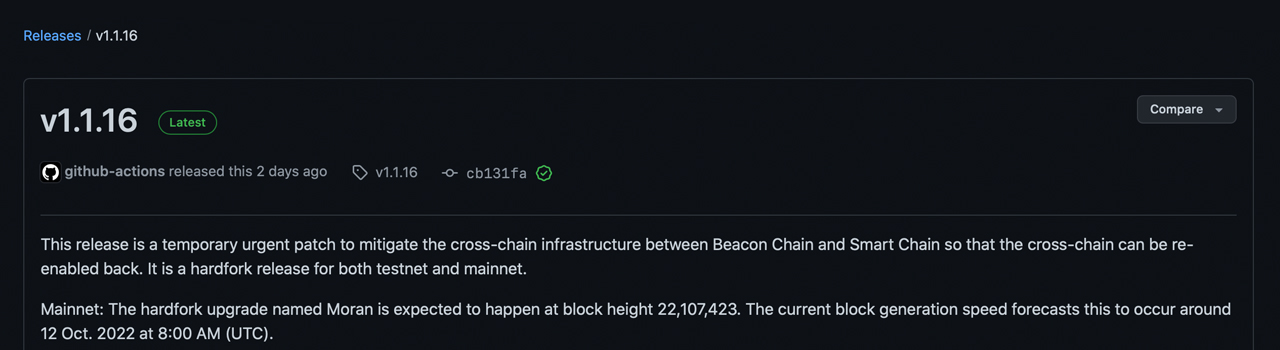

The Bnb Good Chain commenced the blockchain’s laborious fork on October 12, at block peak 22,107,423, with a view to add a safety patch to “mitigate the cross-chain infrastructure between [the] Beacon Chain and Good Chain.” Binance and the Bnb Good Chain suspended withdrawals and deposits on Wednesday with a view to execute the improve. Not too lengthy after, Binance famous that the improve was full a contact after 5 a.m. (ET) on Wednesday morning.

5 days in the past, the Bnb Good Chain was exploited for roughly $100 million and the chain was paused with a view to tackle the problem. On the time, the hacker managed to leverage phony safety proofs to take advantage of the blockchain community’s cross-chain bridge. Following the hack, Binance introduced that it deliberate to assist an improve on October 12 that can add a safety patch to the protocol that addresses the problem.

“Fellow Binancians, Binance will assist the BNB Good Chain (BEP20) community improve and laborious fork,” the trade wrote on October 11. “The BNB Good Chain (BEP20) community improve and laborious fork will happen on the BNB Good Chain block peak of twenty-two,107,423, or roughly at 2022-10-12 08:00 (UTC). Deposits and withdrawals on BNB Good Chain (BEP20) might be suspended ranging from roughly 2022-10-12 07:00 (UTC),” Binance added.

Binance additional introduced the halting of deposits and withdrawals through Twitter when it said: “Binance has briefly suspended deposits and withdrawals for BNB Good Chain (BEP20) community to assist the community improve [and] laborious fork.” At roughly 5:16 a.m. (ET) Binance defined that the Bnb Good Chain has resumed operations following the improve. “Thanks on your persistence and apologies for any inconvenience precipitated,” the world’s largest trade by commerce quantity tweeted.

Whereas 4 tokens out of the highest 5 by market cap have seen small share positive aspects on Wednesday, the worth of BNB has declined 0.4% in opposition to the U.S. greenback through the previous 24 hours. BNB has had a 24-hour value vary between $269.98 and $273.67 per unit on October 12.

BNB is the fifth largest crypto asset by market capitalization and it’s down 60% for the reason that asset’s all-time excessive (ATH). Though, 60% down from BNB’s ATH is lots higher than the 70% to 90%+ losses a substantial amount of different digital belongings have recorded since their ATHs.

What do you concentrate on the Bnb Good Chain laborious fork on Wednesday? Tell us what you concentrate on this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any injury or loss precipitated or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.

As the market trades sideways, now’s your chance to get in on this high-flying cryptocurrency.

The entire cryptocurrency market climbed 66% from just before Donald Trump’s election win in November to mid-December. Since then, however, many of the most popular cryptocurrencies have failed to continue moving higher.

Bitcoin (BTC 1.21%) has been one of the stronger performers. It set an all-time high in January, and it recently climbed slightly above that level in May. As of June 18, Bitcoin trades for about $105,000.

But multiple analysts see the value of Bitcoin nearly doubling by the end of the year, reaching $200,000. Here’s why analysts are bullish on the leading cryptocurrency.

Image source: Getty Images.

Over the last couple of months, several analysts have reaffirmed expectations for Bitcoin to climb to $200,000 by the end of the year.

There are several factors supporting the continued increase in Bitcoin’s value, according to the analysts.

Bitwise points to the rising U.S. fiscal debt, exacerbated by the new tax bill that passed through the House recently. Analysts argue that Bitcoin presents a type of insurance against sovereign debt defaults since it’s a scarce and decentralized asset.

Standard Chartered is seeing data that shows the market agrees with that sentiment. It said exchange-traded fund (ETF) flows are shifting from gold into Bitcoin, suggesting it’s more of a safe asset. It also says Bitcoin wallets with more than 1,000 Bitcoins resumed accumulating the asset during recent dips.

21Shares saw the recent Consumer Price Index numbers as a bullish sign for Bitcoin because cooler inflation could give the Federal Reserve the green light to reduce interest rates. That could push wider adoption of riskier assets.

But there’s one trend that could drive Bitcoin’s price higher well beyond 2025, and it appears to be accelerating.

Bitcoin’s price is based almost entirely on supply and demand. There’s a fixed supply of Bitcoin — only 21 million will ever exist, of which about 19.9 million are already in circulation. So, strong growth in demand will send its value up over time.

To that end, we’re seeing signs of more growth in demand. ETF inflows have reaccelerated after a pullback in March and April. On top of that, there’s growing interest in Bitcoin treasury companies that aim to follow in the footsteps of Strategy, formerly known as MicroStrategy, whose main business is buying and holding Bitcoin.

We saw a new pure play on the Strategy Bitcoin treasury idea, Twenty One, agreeing to go public in late April. Trump Media raised $2.5 billion to establish a Bitcoin treasury at the end of May. Several other businesses have taken to the idea of selling shares in their company to buy Bitcoin, injecting billions of dollars of demand and a continuous flow of more demand in the future.

So, not only is there more institutional interest in buying Bitcoin, but there’s growing corporate interest as well. The current political environment is making it easier for both to confidently hold Bitcoin on their books, so the trend should continue for a long time.

Most investors can easily invest in Bitcoin through their regular brokerage account by purchasing a Bitcoin ETF. The expense ratios on the best Bitcoin ETFs are relatively low and worth paying for the simplicity and security they provide.

If you’d rather buy Bitcoin directly, opening an account on a crypto exchange isn’t difficult, but beware of the hidden costs of crypto transactions, including slippage and take rates from exchanges. You’ll also need to remain mindful of security concerns regarding custody of your Bitcoin.

Adam Levy has positions in Bitcoin. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.

A Murdered Journalist’s Unfinished Book About the Amazon Gets Completed and Published

What Happens to Harvard if Trump Successfully Bars Its International Students?

Suspect in Arizona Rangers' death killed by Missouri troopers

Trumps to Attend ‘Les Misérables’ at Kennedy Center

Sudan’s paramilitary RSF say they seized key zone bordering Egypt, Libya

Google is shutting down Android Instant Apps over ‘low’ usage

Elon Musk says some of his social media posts about Trump 'went too far'

Slow and Steady, Kay Ryan’s “Turtle” Poem Will Win Your Heart