Business

Ye Poses a Test for a Post-Musk Twitter

To Ye, or to not Ye

Ye, the designer and musician previously referred to as Kanye West, confirmed this weekend why Elon Musk’s acquisition of Twitter and his imaginative and prescient of free speech may develop into problematic for the platform.

The scandal started offline final week, when Ye wore a T-shirt bearing the phrases “White Lives Matter” — a phrase that the Anti-Defamation League has labeled “white supremacist” — at his Paris vogue present. He despatched fashions down the runway in the identical shirts.

The response was swift. Adidas stated on Thursday that it was reviewing its relationship with Ye, and the musician Sean Combs, the rapper referred to as Diddy, criticized him publicly for the shirts. Ye responded by declaring “warfare,” and stated Combs had acted underneath the management of Jewish individuals. For that remark, Instagram, owned by Meta, restricted Ye’s entry to his account.

Mayhem then ensued on Twitter. Ye returned to the social community on Saturday after a two-year absence. Yesterday he posted an antisemitic rant, together with a menacing-sounding menace that he would quickly be going “demise con 3 On JEWISH PEOPLE.” He additionally accused Mark Zuckerberg, the C.E.O of Meta, which owns Instagram, of getting him faraway from the platform. All that earned him one other journey to the penalty field. Twitter finally hit Ye with a brief suspension from the platform.

What would Musk do on this scenario? Musk has promised to take a special strategy to content material moderation if he finally ends up proudly owning Twitter. It’s unclear what he has in thoughts, however his feedback about wanting to construct the “de facto public town square” to uphold democracy and free speech recommend he’ll help a extra free-flowing change of concepts, even when that turns off some advertisers. Others aren’t so positive Musk would ever permit Twitter to show right into a poisonous sewer.

The place does Musk stand on the Ye controversy? Laborious to know. Musk prolonged the mercurial artist a hearty “Welcome back to Twitter, my friend!” greeting on Saturday, however has stated nothing about him since.

HERE’S WHAT’S HAPPENING

Ben Bernanke is awarded the Nobel economics prize. The previous Fed chair and two different lecturers had been acknowledged for his or her analysis into banks and monetary crises. Their insights “have improved our capacity to keep away from each critical crises and costly bailouts,” the chair of the prize committee stated.

Russia launches missile strikes throughout Ukraine. The assaults on a number of cities, together with the capital, killed at the least 5 individuals and knocked out energy. They had been an obvious retaliation for a blast that broken a key bridge connecting Russia and the Crimean peninsula.

South Carolina pulls cash from BlackRock over E.S.G. The state’s treasurer plans to withdraw $200 million from the agency by yr finish, becoming a member of states like Louisiana and Utah. Pink states have dedicated to pulling investments to punish the agency over its dedication to environmental investing insurance policies.

What Occurred to Elon Musk’s Twitter Deal

A blockbuster deal. In April, Elon Musk made an unsolicited bid price greater than $40 billion for the social community, saying he wished to make Twitter a non-public firm and permit individuals to talk extra freely on the service.

Harvey Weinstein’s second intercourse crimes trial begins immediately. The disgraced film mogul faces 11 prices in a trial in Los Angeles. He faces life imprisonment if convicted, no matter whether or not his conviction in New York is overturned on enchantment.

Why Elon Musk might have little wiggle room

All method of questions nonetheless swirl round Elon Musk’s off-again-on-again $44 billion takeover bid for Twitter. One large puzzler: What was Musk pondering in returning to the $54.20-per-share supply after negotiations for a cut-price deal fell aside? That he actually didn’t need to do his deposition is one concept. DealBook has one other one.

What we find out about renegotiation talks: Probably on the suggestion of the super-agent Ari Emanuel (who was pleasant with each Musk and the Twitter board member Egon Durban), the 2 sides had talks final month about renegotiating the deal. Conversations finally settled round a deal that reportedly would have shaved about $4 billion from the asking worth. We all know a bit of bit about why these talks fell aside: Twitter was centered on certainty round closing the deal, and wouldn’t let up on litigation. May that be a motive Musk walked away?

What if a $4 billion lower was truly extra costly for Musk? The banks which are on the hook to lend Musk $12.5 billion to finance the deal might have seen any reopening of negotiations as a potential out — to both stroll away or revise the phrases of their loans to Musk. That’s what occurred in 2007 in the course of the leveraged buyout of HD Provide after the mortgage market imploded. Equally, the financing surroundings has worsened since Musk first struck the deal, and the banks at the moment are staring down a possible $500 million in losses.

Had Musk pushed Twitter to redo the deal, the banks may have tried to reprice their loans at increased rates of interest, pushing financing prices up for the billionaire. Or they may have pushed to cut back the whole quantity of debt they funded, making Musk — who’s on the hook for the entire remaining fairness — personally accountable for a bigger portion of the deal. (Most probably it might have been some mixture of the 2.) Was there a scenario the place shaving $4 billion off the whole deal worth was not truly price it to Musk?

The banks’ debt commitments seem to forestall him from altering the deal in “materials” methods. That might give banks a “first rate argument” to push for revised debt preparations, since judges typically view worth as materials, stated Eric Talley, a professor at Columbia Legislation Faculty. No matter what occurred in current weeks, a worth lower might now be even much less possible. Twitter is asking Musk for curiosity on each additional day the deal drags on previous final month’s shareholder vote endorsing the transaction. Which means it’s costing Musk greater than $54.20 with every passing day.

A tough quarter awaits traders

It’s earnings season, with the S&P 500 heavyweights PepsiCo and Delta Air Traces and the large banks set to report third-quarter outcomes this week. Buyers’ large concern: Firms will reveal that the mix of inflation and slowing financial progress has eaten into earnings.

It’s a blended image. Simply 65 firms within the S&P 500 have warned that third-quarter outcomes are more likely to disappoint, based on the market information agency FactSet, whereas 41 firms have delivered earnings upgrades. And S&P 500 firms are anticipated to report that on common, income jumped by practically 9 % final quarter. However earnings are solely anticipated to develop by 2.4 %, probably the most lackluster enhance because the worst days of the Covid pandemic in 2020.

Virtually the entire earnings progress is coming from the vitality sector. Of the 11 sectors within the S&P 500, solely 4 — vitality, airways, actual property and client discretionary industries like eating places and motels — are anticipated to point out general progress. The underside strains of vitality firms are anticipated to leap a median of 117 % versus a yr in the past, which is the largest enhance of any sector. With out the 21 vitality firms within the S&P 500, the underside strains of the remaining firms would truly drop, by 4.2 % on common, based on Financial institution of America.

The sturdy greenback is dangerous information for multinational firms. Though the current rise within the greenback is a boon to U.S. vacationers, it’s dangerous information for exports, which make up about 40 % of gross sales for S&P 500 firms. A robust greenback means American items are dearer to abroad consumers, and fewer worthwhile again house when international revenues are transformed into {dollars}. John Butters, a senior earnings analyst at FactSet, says that of firms fessing as much as earnings issues, about half have pointed to the greenback as a contributing issue.

“There’s a danger that just about every part Mark has outlined concerning the metaverse is true, besides the timing is farther out than he imagined.”

— Matthew Ball, a Silicon Valley investor who has suggested Mark Zuckerberg, warning that Meta faces an enormous timing danger because it bets billions on developing a digital world the place customers can play, work and socialize.

PayPal will get burned within the tradition wars

PayPal stumbled into the tradition wars late final week when an apparently errant coverage replace set off an uproar over whether or not the corporate was in search of to police customers over misinformation.

The difficulty started on Friday, when The Each day Wire, a conservative information web site, reported {that a} pending replace to PayPal’s acceptable use coverage would come with a positive of as much as $2,500 for customers who “promote misinformation.” The report gained traction in right-wing circles, the place some critics accused PayPal of censoring conservatives.

PayPal has been outspoken on political and social points, together with discrimination and hate speech, drawing the ire of conservatives. Proper-wing critics say the corporate has gone too far in banning some accounts, together with the Free Speech Union, a bunch that claims it stands in opposition to “cancel tradition.” (That call was reversed.)

There was blowback from some stunning quarters. Conservative activists stated they’d cease utilizing PayPal amid the uproar. However the critics had been joined by David Marcus, a former president of the corporate, who tweeted on Saturday: “@PayPal’s new AUP goes in opposition to every part I consider in. A personal firm now will get to determine to take your cash should you say one thing they disagree with. Madness.” To which Elon Musk, a PayPal co-founder, replied, “Agreed.” That stated, PayPal’s current acceptable use coverage already bars customers from utilizing the service for actions that contain selling hate, violence or “racial or different types of intolerance that’s discriminatory.”

PayPal stated the doc was printed in error. “PayPal isn’t fining individuals for misinformation and this language was by no means supposed to be a part of our coverage,” a spokeswoman for PayPal stated in a press release. “We’re sorry for the confusion this has induced.” The spokeswoman declined to touch upon the origins of the wording or why it was withdrawn.

THE SPEED READ

Offers

Coverage

Better of the remainder

-

Why Elon Musk’s dream of a WeChat-like super-app within the U.S. might not fly. (TechCrunch)

-

Whistle-blowers accused EY of whitewashing suspicious trades on behalf of a consumer. (FT)

-

The electrical carmaker Rivian recalled 13,000 autos — practically all of these it has delivered to this point — over a problem that might have an effect on steering. (NYT)

-

Nikki Finke, the Hollywood journalist who based Deadline and infrequently acerbically referred to as out film executives, died yesterday. She was 68. (Deadline)

-

Your new iPhone may assume you’ve been in a automotive crash — while you’ve actually simply ridden a curler coaster. (WSJ)

We’d like your suggestions! Please e-mail ideas and recommendations to dealbook@nytimes.com.

Business

Paramount's board approves bid by David Ellison's Skydance Media in sweeping Hollywood deal

Tech scion David Ellison’s months-long quest to win control of Paramount Global moved closer to the finish line Sunday, in a deal that marks a new chapter for the long-struggling media company and parent of one of Hollywood’s oldest movie studios.

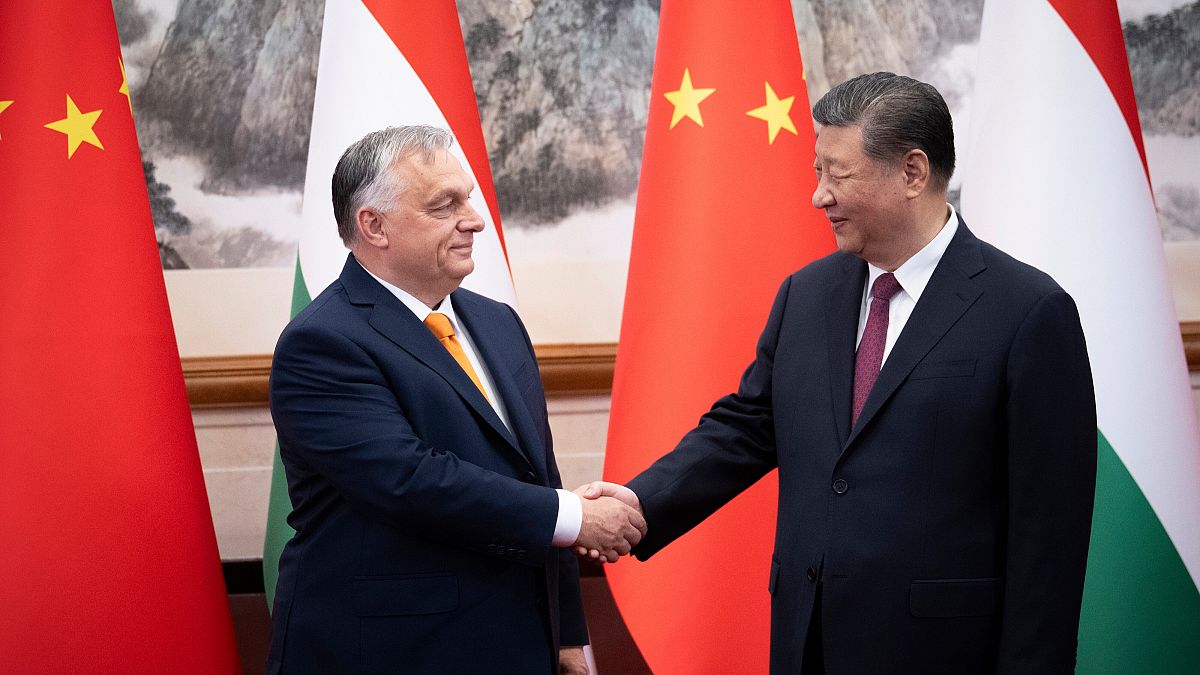

Paramount Global board members on Sunday approved the bid by Ellison’s Skydance Media and its backers to buy the Redstone family’s Massachusetts holding firm, National Amusements Inc., said two sources close to the deal who were not authorized to comment.

A spokesperson for Paramount declined to comment.

The Redstones’ voting stock in Paramount would be transferred to Skydance, giving Ellison, son of billionaire Oracle Corp. co-founder Larry Ellison — a key backer of the deal — control of a media operation that includes Paramount Pictures, broadcast network CBS and cable channels MTV, Comedy Central and Nickelodeon.

The proposed $8.4 billion multipronged transaction also includes merging Ellison’s production company into the storied media company, giving it more heft to compete in today’s media environment.

The agreement, which mints Ellison as a Hollywood mogul, came together during the last two weeks as Ellison and his financing partners renewed their efforts to win over the Redstone family and Paramount’s independent board members.

Shari Redstone has long preferred Ellison’s bid over other those of potential suitors, believing the 41-year-old entrepreneur possesses the ambition, experience and financial heft to lift Paramount from its doldrums.

But, in early June, Redstone got cold feet and abruptly walked away from the Ellison deal — a move that stunned industry observers and Paramount insiders because it was Redstone who had orchestrated the auction.

Within about a week, Ellison renewed his outreach to Redstone. Ellison ultimately persuaded her to let go of the entertainment company her family has controlled for nearly four decades. The sweetened deal also paid the Redstone family about $50 million more than what had been proposed in early June. On Sunday Paramount’s full board, including special committee of independent directors, had signed off on the deal, the sources said.

Under terms of the deal, Skydance and its financial partners RedBird Capital Partners and private equity firm KKR have agreed to provide a $1.5-billion cash infusion to help Paramount pay down debt. The deal sets aside $4.5 billion to buy shares of Paramount’s Class B shareholders who are eager to exit.

The Redstone family would receive $1.75-billion for National Amusements, a company that holds the family’s Paramount shares and a regional movie theater chain founded during the Great Depression, after the firm’s considerable debts are paid off.

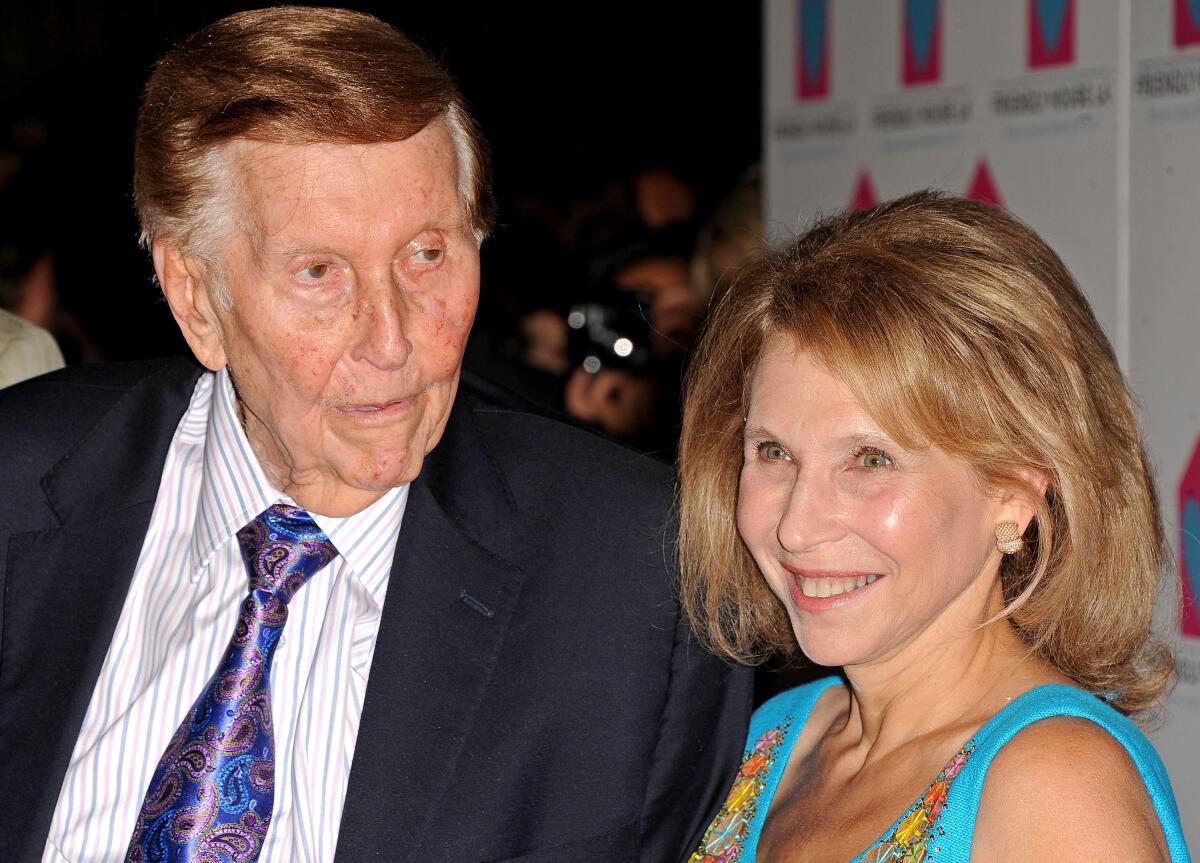

The proposed handoff signals the end of the Redstone family’s nearly 40-year reign as one of America’s most famous and fractious media dynasties. The late Sumner Redstone’s National Amusements was once valued at nearly $10 billion, but pandemic-related theater closures, last year’s Hollywood labor strikes and a heavy debt burden sent its fortunes spiraling.

In the last five years, the New York-based company has lost two-thirds of its value. Its shares are now worth $8.2 billion based on Friday’s closing price of $11.81 a share.

The struggles in many ways prompted Shari Redstone to part with her beloved family heirloom. Additionally, National Amusements was struggling to cover its debts, and the high interest rates worsened the outlook for the Redstone family.

Paramount boasts some of the most historic brands in entertainment, including the 112-year-old Paramount Pictures movie studio, known for landmark films such as “The Godfather” and “Chinatown.” The company owns television stations including KCAL-TV (Channel 9) and KCBS-TV (Channel 2). Its once-vibrant cable channels such as Nickelodeon, TV Land, BET, MTV and Comedy Central have been losing viewers.

The handover requires the approval of federal regulators, a process that could take months.

In May, Paramount’s independent board committee said it would entertain a competing $26-billion offer from Sony Pictures Entertainment and Apollo Global Management. The bid would have retired all shareholders and paid off Paramount’s debt, but Sony executives grew increasingly wary of taking over a company that relies on traditional TV channels.

Earlier this year, Warner Bros. Discovery expressed interest in a merger or buying CBS. However, that company has struggled with nearly $40 billion in debt from previous deals and is in similar straits as Paramount. Media mogul Byron Allen has also shown interest.

Skydance Media founder and Chief Executive David Ellison prevailed in his bid for Paramount.

(Evan Agostini/Invision/Associated Press)

Many in Hollywood — film producers, writers and agents — have been rooting for the Skydance takeover, believing it represents the best chance to preserve Paramount as an independent company. Apollo and Sony were expected to break up the enterprise, with Sony absorbing the movie studio into its Culver City operation.

The second phase of the transaction will be for Paramount to absorb Ellison’s Santa Monica-based Skydance Media, which has sports, animation and gaming as well as television and film production.

Ellison is expected to run Paramount as its chief executive. Former NBCUniversal CEO Jeff Shell, who’s now a RedBird executive, could help manage the operation. It’s unclear whether the Skydance team will keep on the three division heads who are now running Paramount: Paramount Pictures CEO Brian Robbins, CBS head George Cheeks and Showtime/MTV Entertainment Studios chief Chris McCarthy.

Skydance has an existing relationship with Paramount. It co-produced each film in the “Mission: Impossible” franchise since 2011’s “Mission: Impossible — Ghost Protocol,” starring Tom Cruise. It also backed the 2022 Cruise mega-hit “Top Gun: Maverick.”

Ellison first approached Redstone about making a deal last summer, and talks became known in December.

Redstone long viewed Ellison as a preferred buyer because the deal paid a premium to her family for their exit. She also was impressed by the media mogul , believing he could become a next-generation leader who could take the company her father built to a higher level, according to people knowledgeable of her thinking.

Larry Ellison is said to be contributing funding to the deal.

David Ellison was attracted to the deal because of his past collaborations with Paramount Pictures and the allure of combining their intellectual properties as well as the cachet of owning a historic studio, analysts said. Paramount’s rich history contains popular franchises including “Transformers,” “Star Trek,” “South Park” and “Paw Patrol.”

“Paramount is one of the major historic Hollywood studios with a massive base of [intellectual property], and so it seems to us that it’s more about using the capital that Ellison has and what he’s built at Skydance and leveraging that into owning a major Hollywood studio,” Brent Penter, senior research associate at Raymond James, said prior to the deal. “Not to mention the networks and everything else that Paramount has.”

The agreement prepares to close the books on the Redstone family’s 37-year tenure at the company formerly known as Viacom, beginning with Sumner Redstone’s hostile takeover in 1987.

Seven years later, Redstone clinched control of Paramount, after merging Viacom with eventually doomed video rental chain Blockbuster to secure enough cash for the $10-billion deal. Redstone long viewed Paramount as the crown jewel, a belief that took root a half-century ago when he wheeled-and-dealed over theatrical exhibition terms for Paramount’s prestigious films to screen at his regional theater chain.

Under Redstone’s control, Paramount won Academy Awards in the ’90s for “Forrest Gump” and “Saving Private Ryan.”

He pioneered the idea of treating films as an investment portfolio and hedging bets on some productions by taking on financial partners — a strategy now widely used throughout the industry.

The late Sumner Redstone and his daughter Shari Redstone have owned a controlling interest in Viacom, which was rebranded as Paramount, through their family holding company, National Amusements Inc., since 1987.

(Katy Winn/Invision/Associated Press)

In 2000, Redstone expanded his media empire again by acquiring CBS, a move that made Viacom one of the most muscular media companies of the time, rivaling Walt Disney Co. and Time Warner Inc. Just six years later, Redstone broke it up into separate, sibling companies, convinced that Viacom was more precious to advertisers because of its younger audience. Redstone also wanted to reap dividends from two companies.

After years of mismanagement at Viacom, which coincided with the elder Redstone’s declining health, and boardroom turmoil, his daughter stepped in to oust Viacom top management and members of the board. Three years later, following an executive misconduct scandal at CBS, Shari Redstone achieved her goal by reuniting CBS and Viacom in a nearly $12-billion deal.

The combined company, then called ViacomCBS and valued at more than $25 billion, was supposed to be a TV juggernaut, commanding a major percentage of TV advertising revenue through the dominance of CBS and more than two dozen cable channels.

But changes in the TV landscape took a toll.

As consumer cord-cutting became more widespread and TV advertising revenue declined, ViacomCBS’ biggest asset became a serious liability.

The company was late to enter the streaming wars and then spent heavily on its Paramount+ streaming service to try to catch up with Netflix and even Disney. (In early 2022, the company was renamed Paramount Global in a nod to its moviemaking past and to tie in with its streaming platform of the same name.)

The company’s eroding linear TV business and the decline of TV ad revenue, as well as its struggles trying to make streaming profitable, will be major challenges for Ellison as he takes over Paramount. Though traditional TV is declining, it still brings in cash for Paramount.

And streaming is a whole different economic proposition from television, one that offers slimmer profits. Meanwhile, the company also faces larger industry questions about when — if ever — box office revenue will return to pre-pandemic levels.

“This is a company that is floating on hope,” said Stephen Galloway, dean of Chapman University’s Dodge College of Film and Media Arts. “And hope isn’t a great business strategy.”

Business

Missing the paperwork on your IRAs? All is not lost

Dear Liz: I have four daughters, now in their late 30s and early 40s. When they were very young, I started investing for them. As they began to earn their own money, I started Roth IRAs for them as well.

A decade ago, due to an unexpected divorce, a 30-day escrow and a move, I lost the paperwork for their accounts. After the investment company was acquired by another in 2015, I forwarded the new company’s contact information to my daughters. One transferred her account to another investment company, while her sisters left theirs in place.

Recently I found the old investment paperwork. The company has changed hands again, but the new company says it has no information about my three other daughters’ accounts. Can anything be done?

Answer: Since the latest company can’t find the accounts, your daughters should contact the escheat office of the state where you lived before your move.

Perhaps you didn’t update your address with the original company when you moved and the account statements or other mail were returned as undeliverable. If the company and its successor couldn’t find you — and some companies don’t look very hard — the accounts would be considered unclaimed and would have to be turned over to the state.

Links to state escheat offices can be found online at unclaimed.org, the website for the National Assn.

of Unclaimed Property Administrators.

The good news is that there’s no time limit for claiming previously unclaimed property.

The bad news is that some states will liquidate stocks and other investments after escheatment. If that’s the case, then the three daughters who didn’t move their accounts will have missed out on nearly a decade of investment returns.

Dear Liz: Is it common for a brokerage agreement to say the firm can close my account for any reason and without any notice? The agreement goes on to say that the brokerage can liquidate the investments in my account if it’s closed and that the brokerage is not responsible for any investment losses that result.

Answer: The short answer is yes — brokerage accounts can be closed at any time by the firm or by the client.

Such agreements often specify certain actions that can trigger a closure, such as failing to maintain a minimum required balance. But the agreements also typically have language that allows the brokerage to close your account at any time and for any reason.

Brokerages don’t commonly close customer accounts. If yours does, however, move quickly to transfer your investments to another firm.

Failure to act could result in your investments being liquidated, and you would owe capital gains taxes on any appreciation in their value.

Dear Liz: You have written that non-spouse beneficiaries are now required to drain their inherited IRAs within 10 years. Is this requirement retroactive?

I inherited an IRA from my mother in 2015. I have been taking out the minimum required each year. If I must drain the account within 10 years, will the increase in yearly income affect my Social Security benefits?

Answer: The 10-year requirement applies only to accounts inherited from people who died after Dec. 31, 2019.

IRA distributions don’t affect Social Security benefits, but could affect Medicare premiums if the withdrawal is large enough. Taxable income above certain limits triggers a Medicare surcharge known as an income-related monthly adjustment amount, or IRMAA.

Dear Liz: My husband passed away 10 months ago. I applied for widow benefits.

The Social Security Administration sent me a letter that said they cannot pay because my Social Security benefit would equal two-thirds of the amount of my pension. Please help me with this.

Answer: This is known as the government pension offset, and it applies to people who receive a pension from a job that didn’t pay into Social Security. Any survivor or spousal benefits you might receive are reduced by two-thirds of the pension amount. In your case, your entire benefit was offset.

People are understandably upset to learn they don’t qualify for survivor or spousal benefits through Social Security. But since your pension is large enough to offset any benefit, you’re financially better off with the pension than without it.

For more information, see the government pension offset pamphlet, available online at SSA.gov/pubs or by calling the Social Security Administration toll-free at (800) 772-1213.

Business

California’s workplace violence prevention law is now in effect. Here's how it changes things

Beginning this month, California businesses will be required to have plans in place to prevent violence in the workplace.

Senate Bill 553, signed by Gov. Gavin Newsom last fall, requires that employers develop plans to protect workplaces from foreseeable threats of violence, which can range from bullying and harassment to active shooter and hostage situations. Under the law, employers were to have these comprehensive plans in place by July 1.

Here’s what you should know about the new law:

Who pushed for the workplace violence prevention law, and why?

State Sen. Dave Cortese (D-San Jose), who wrote the legislation, said he began looking into regulating workplace violence after a major shooting in 2021 at a light-rail yard roiled his district. In the incident, an employee killed nine colleagues at the Santa Clara Valley Transportation Authority before taking his own life.

Surveying the scene soon after the shooting, Cortese said he felt there could have been a clear plan for how workers might respond in such a situation. “It would have saved lives,” he said.

Cortese said the requirements outlined by the law took cues from a regulation the California Division of Occupational Safety and Health had been in the process of developing. Their safety standard, however, given their lengthy rule-making process and bureaucratic delays, probably would have taken several more years to get final approval.

More than half of such shootings in 2021 occurred in places of commerce, including grocery stores and manufacturing sites, according to the FBI.

SB 553 was backed by several unions, among them the United Food and Commercial Workers Western States Council. The union sought a law that would help address what it described as a rash of violent attacks at grocery stores and pharmacies, as workers were being pressured by their employers to crack down on shoplifting.

Grocery and other retail workers who interact with the public have long worried about violence in the workplace. Notably, they faced harassment and at times assault from customers who refused to comply with mask mandates in the early years of the COVID-19 pandemic. Fast-food workers also have complained of violent and dangerous customers.

Did anyone oppose the legislation? If so, why?

Industry groups such as the National Retail Assn. had vehemently opposed SB 553, arguing the paperwork would be overly burdensome for businesses.

They also took issue with a provision the bill had in its early stages that prohibited businesses from requiring nonsecurity employees to confront shoplifters and active shooters. That language was later removed. Eventually, the trade groups dropped their opposition.

What exactly is required under the law?

Legal experts said many companies had already started loosely addressing workplace violence concerns as mass shootings and other violent incidents dominated headlines over the years. The law helps to clarify employers’ obligations in this arena, experts said.

The law defines four types of workplace violence employers should try to prevent: violent action by a third-party person with no real reason to be at the worksite — essentially, a stranger showing up and harming an employee; violence by parties that are entitled to be there, such as customers, clients, patients or other authorized visitors; violence committed against employees by another employee; and violence by a third party who has a romantic or other personal relationship with an employee.

Under the law, most California businesses with at least 10 employees are required to have a policy document identifying potential violence and plans to deal with it — either as a standalone document, or as part of an existing injury and illness prevention policy.

They must also make workers aware of the violence prevention plan through annual training, and maintain a log of incidents of violence over a minimum of five years.

What else should I know about the law?

The law makes it easier for employees — or the unions that represent them — to get temporary restraining orders if they are threatened by a coworker or someone else in the workplace.

“That’s a big thing — most employees don’t get to choose who they work with or what happens at work,” said Ian A. Wright, a labor and employment attorney at Alston & Bird. “It gives employees an additional form of protection that they can go and seek themselves.”

Noncompliance could be met with civil penalties, and businesses that haven’t yet implemented the law are already several days past the deadline.

“My advice would be to get it done as soon as possible,” Wright said.

-

World1 week ago

World1 week agoTension and stand-offs as South Africa struggles to launch coalition gov’t

-

Politics1 week ago

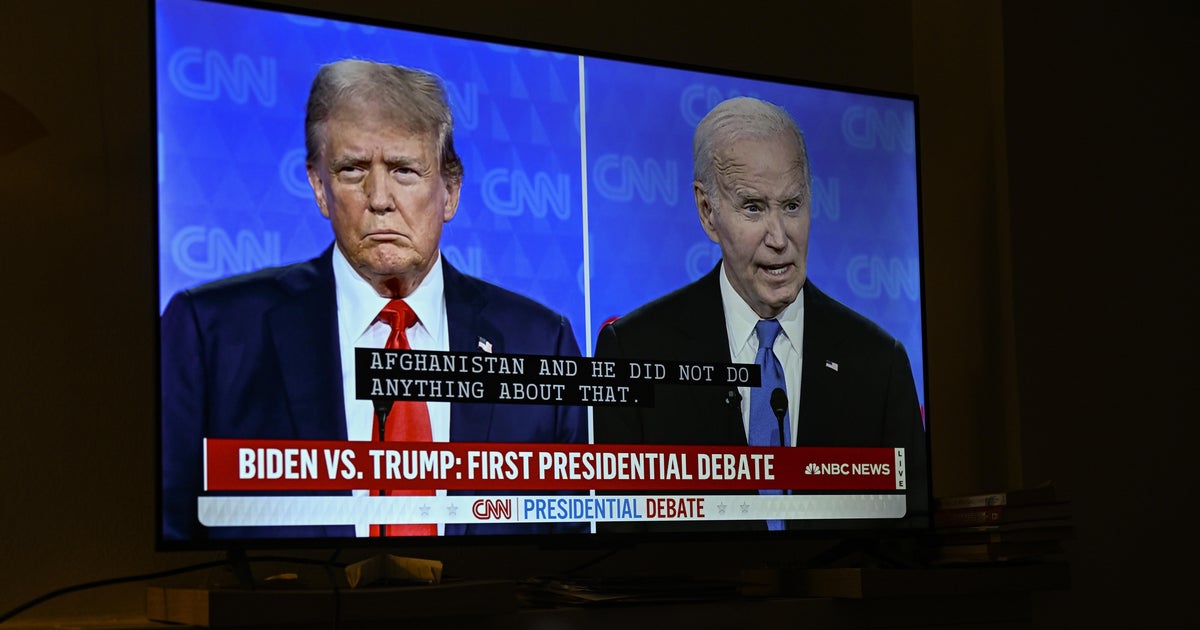

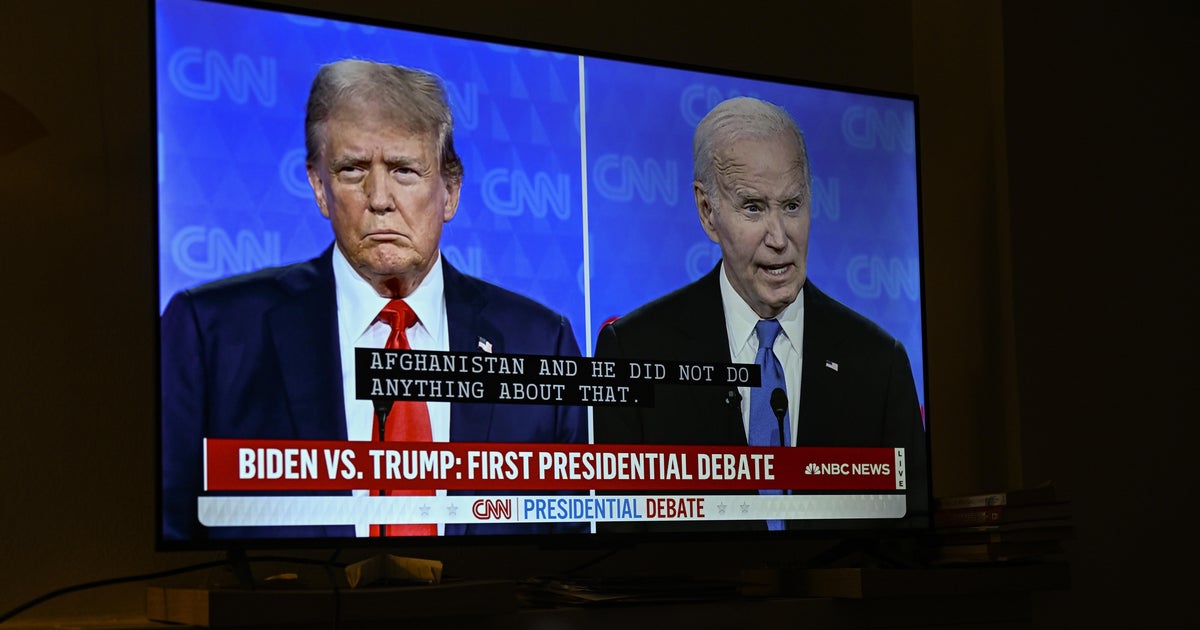

Politics1 week agoFirst 2024 Trump-Biden presidential debate: Top clashes over issues from the border to Ukraine

-

News1 week ago

News1 week ago4 killed, 9 injured after vehicle crashes into Long Island nail salon

-

News1 week ago

News1 week agoSupreme Court denies Steve Bannon's plea to stay free while he appeals

-

News1 week ago

News1 week agoVideo: How Blast Waves Can Injure the Brain

-

Politics1 week ago

Politics1 week agoTrump says 'biggest problem' not Biden's age, 'decline,' but his policies in first appearance since debate

-

Movie Reviews1 week ago

Movie Reviews1 week agoMovie review: A Quiet Place, quivering since Day One

-

News1 week ago

News1 week agoIncreasing numbers of voters don’t think Biden should be running after debate with Trump — CBS News poll