Business

Verizon’s new plan: Consumers win, investors lose

Verizon has introduced again its limitless knowledge plan. That is nice when you’re a Verizon buyer. However it’s horrible information for its buyers.

Verizon (VZ) inventory fell practically 1.5% in early buying and selling Monday. It is now down about 10% to this point this yr, making it the Dow’s worst performer of 2017.

Verizon’s transfer is a transparent signal the corporate has to tug out all of the stops to stay aggressive with wi-fi rivals AT&T (T), Dash (S) and T-Cellular (TMUS).

“In latest months, each T-Cellular and Dash had some success taking further share from Verizon by advantage of their limitless choices,” wrote Morgan Stanley analysts in a report Monday morning.

Which will clarify why shares of T-Cellular and Dash, which is now managed by Japanese tech conglomerate SoftBank, are each up this yr whereas Verizon is down. T-Cellular and Dash have additionally been perennially linked as doable merger companions.

However the brand new telecom value struggle is not the one drawback for Verizon.

AT&T lately acquired satellite tv for pc broadcast supplier DirecTV, a transfer that makes Ma Bell extra aggressive in opposition to Verizon within the battle to manage individuals’s residing rooms. Verizon gives its personal FiOS broadband TV service.

Associated: Verizon brings again limitless knowledge plans

And AT&T can also be making a a lot greater wager on content material, with plans to buy CNN’s guardian firm Time Warner (TWX). Verizon already owns AOL and is seeking to purchase the core property of Yahoo to bolster its personal digital content material choices.

However the Yahoo (YHOO) deal may collapse within the wake of revelations of large knowledge breaches at Yahoo over the previous few years.

Yahoo lately mentioned it hopes that the take care of Verizon will shut within the second quarter of this yr. It was initially imagined to be finalized by the primary quarter.

Nevertheless, in its newest earnings launch, Verizon merely mentioned that it “continues to work with Yahoo to evaluate the affect of information breaches” — not that it anticipated the deal to shut anytime quickly.

Verizon has lots on its plate, which might be making buyers nervous. Along with the Yahoo deal, the corporate can also be within the course of of shopping for the fiber optic community of XO Communications. And it is promoting its knowledge heart enterprise to Equinix (EQIX).

There even have been rumors previously few weeks that Verizon may even think about shopping for cable supplier Constitution Communications (CHTR).

Which may be greater than Verizon can realistically deal with proper now. However nothing could also be off the desk for Verizon given how aggressive the wi-fi world is as of late.

Something that might give Verizon a leg up on AT&T, Dash and T-Cellular may be doable.

Associated: Constitution shares popped on report of doable Verizon takeover

Nonetheless, it is value noting that shares of AT&T are decrease this yr too, down about 5%. And Verizon and A&T have one thing in widespread that Dash and T-Cellular lack — Verizon and AT&T pay gigantic dividends.

Firms which have large dividend yields have not fared as properly since Donald Trump was elected. Traders are betting on a large stimulus bundle from him and the Republican Congress, which can be fueled partially by debt.

That is precipitated bond yields to rise — and that makes shares of massive dividend payers like Verizon lots much less enticing.

The Federal Reserve is anticipated to boost rates of interest a couple of instances this yr too. That would push bond yields even increased.

So Verizon faces many large challenges that might damage its inventory this yr.

That is why Verizon, nicknamed Massive Crimson due to its emblem’s crimson hue, might even see its inventory within the pink for the foreseeable future.

CNNMoney (New York) First revealed February 13, 2017: 11:27 AM ET

Business

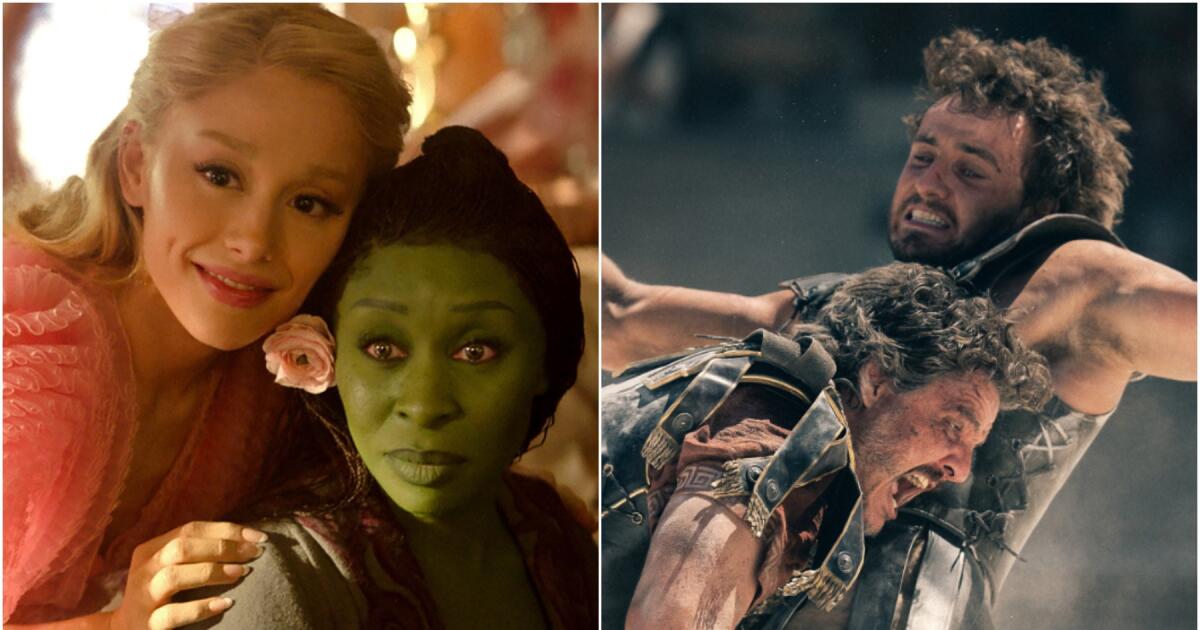

'Wicked' and 'Gladiator' set the stage for gravity-defying box office weekend

Universal Pictures’ “Wicked” and Paramount Pictures’ “Gladiator II” are expected to post gravity-defying numbers at the domestic box office this weekend.

On the heels of a solid summer (“Inside Out 2,” “Deadpool & Wolverine”) and a mildly disappointing fall (“Megalopolis,” “Joker: Folie à Deux”), the witches of Oz and the warriors of ancient Rome are joining forces to kick off the holiday movie season.

Each buoyed by star power, aggressive marketing and beloved intellectual property, “Gladiator II” is projected to launch somewhere between $65 million and $75 million, while “Wicked” is expected to conjure $120 million to $140 million in the United States and Canada, according to estimates from Boxoffice Pro.

Studio projections are lower, putting “Gladiator II” around $60 million and “Wicked” around $100 million.

“‘Wicked’ is the one that’s really moving up. ‘Gladiator II’ has been consistent,” said Daniel Loria, editorial director and senior vice president of content strategy at Boxoffice Pro.

“A lot of that is driven by a very healthy fan culture. This is a musical that has been around for a long time. People are familiar with it. I know musicals haven’t had the best track record at the box office, but ‘Wicked’ is the blockbuster musical of this generation.”

Theaters have been longing for a four-quadrant, double-feature moviegoing event since last year’s same-day release of Warner Bros.’ “Barbie” and Universal’s “Oppenheimer” created the global “Barbenheimer” sensation. Movie houses and entertainment companies have increasingly come to rely on movies that become viral, must-see cultural phenomena, a trend that accelerated after the COVID-19 pandemic scrambled audience behaviors and studio strategies.

“Wicked” and “Gladiator II” will be playing in thousands of theaters nationwide, with Disney’s highly anticipated “Moana 2” on the not-so-distant horizon, portending a much-needed period of healthy cinema attendance. Following multiple critical and commercial flops, morale is up among exhibitors betting on a strong end to 2024 and start to 2025.

A hat trick for “Gladiator II,” “Wicked” and “Moana 2” would be huge for the industry “coming off of the worst October of the post-pandemic era,” Loria said. Domestic box office so far this year is down 11% from the same span in 2023, and remains significantly lower than pre-pandemic levels, according to Comscore.

“I’m not sure this Venn diagram is going to be as big as the one we had for ‘Barbenheimer,’” Loria added. “But it’s another example of this industry responding to consumer demands and responding to the need for diversity … at the multiplex.”

Directed by Jon M. Chu, “Wicked” tells the origin story of Glinda, the Good Witch of the North, and Elphaba, the Wicked Witch of the West, before Dorothy arrived in Munchkinland and followed the yellow brick road. The long-awaited reframing of “The Wizard of Oz” — based on the hit Broadway musical of the same name — stars pop phenom Ariana Grande as Glinda and Tony Award winner Cynthia Erivo as Elphaba.

Universal has gone all out to promote the production, which cost an estimated $150 million to produce, not including marketing. The 2-hour, 40-minute film only covers the first act of the stage musical. Part two arrives in theaters next year.

Unlike the marketing around other films in the genre — such as Paramount Pictures’ “Mean Girls” and Warner Bros.’ “Wonka” — the “Wicked” campaign has not downplayed its musical elements. On the contrary, Grande and Erivo’s renditions of fan-favorite songs, from “Popular” to “Defying Gravity,” have featured prominently in trailers and TV spots promoting the movie.

“You couldn’t hide it if you wanted to,” said a studio source who was not authorized to comment.

But the “Wicked” marketing machine goes way beyond the music.

Universal partnered with 400 brands worldwide — including Starbucks, Ulta Beauty, Bloomingdale’s and Lexus — to douse retail shelves in pink and green, the signature colors of the movie’s leading sorceresses. There are “Wicked”-themed shoes, clothes, phone cases, laptop sleeves, luggage, candles, makeup palettes, jewelry, cups, office supplies, backpacks and hairdryers.

At least one of the brand collaborations drew unwanted attention. Mattel’s line of Glinda and Elphaba dolls made headlines recently when customers noticed that the packaging included the web address for a porn site instead of the movie’s official landing page. The toy company quickly apologized for the gaffe, calling the misprint an “unfortunate error.”

Unfortunate errors and all, Universal certainly has made a massive effort to live up to its source material’s fame with its ubiquitous rollout.

“Whenever you have a marketing campaign that can go to your exercise bike, that can go to your supermarket, that can really exit the theater and permeate the culture — that’s when you know the studio has really pulled out all the stops,” Loria said. “I’m not sure I can name a movie since ‘Barbie’ that has done that.”

The marketing team behind “Gladiator II” — director Ridley Scott’s lega-sequel to his early-aughts best picture winner, starring Paul Mescal, Pedro Pascal and Denzel Washington — has pulled out a few tricks as well.

For example: a Colosseum-shaped popcorn bucket with a virtual-reality twist and a controversial deal with Airbnb to bring Medieval Times-esque entertainment to the actual Colosseum in Rome.

“Gladiator II” cost an estimated $250 million to make, not including marketing costs.

Exhibitors are joining in on the fun too.

Look Cinemas — a dine-in theater chain with locations in Downey, Glendale, Monrovia and Redlands — has curated a special “Wickedator” menu with themed food and beverage items ranging from Arena Nachos (“Gladiator”) to Emerald City Sours (“Wicked”).

James Meredith, head of marketing and revenue at Look Cinemas, said the company has been preparing for this weekend for months, reserving premium screening rooms for both films, hosting advance screenings as early as Wednesday and expanding its showtimes and hours of operation to meet consumer demand reminiscent of the “Barbenheimer” craze.

“Our guests want to come in and escape for a while and have a big event or celebration around some of these popular movies,” Meredith said. “These types of movies … remind customers of how special the moviegoing experience is.”

Business

Column: It's the season for scams, so here's a piece of advice: Never do business with strangers

The text arrived midday, saying a delivery to me was on hold. To fix the problem, all I had to do was click on a web link and enter my ZIP Code.

“Have a great day from the USPS team!” the text said.

The awkwardly worded message (with bad punctuation and an international phone number) was clearly not from the Postal Service. And if I can hazard a wild guess, I don’t think the senders really wanted me to have a great day.

They wanted to rip me off and, so, a word to the wise this holiday season:

Watch your wallet.

California is about to be hit by an aging population wave, and Steve Lopez is riding it. His column focuses on the blessings and burdens of advancing age — and how some folks are challenging the stigma associated with older adults.

Fraud is a year-round, multibillion-dollar international enterprise. But for thieves, the season of joy is a wide-open window of opportunity, as AARP warned Nov. 18:

“With scammers looking to take advantage of consumers from all angles, new AARP survey research reveals that people need to be vigilant this holiday season as they buy gifts, book their travel arrangements, and donate to charities.”

Many of the scams are run by sophisticated international syndicates, said Kathy Stokes, director of fraud prevention at AARP’s Fraud Watch Network. Those crooks are working every channel, fishing for victims by email, phone calls, texts, fliers and regular mail.

Unwitting people are forking over money via gift cards, cryptocurrency, credit cards, cash and wire transfers. Losses often are virtually impossible to recover because the money is on foreign soil before the victims know they’ve been robbed.

Stokes said that in one common ripoff, thieves are going after people who own timeshares they’re trying to dump.

“There’s all this paperwork that makes it look legitimate, like you’re paying to get out of the timeshare,” Stokes said. But the crooks are pocketing thousands of dollars while the target is still stuck with the timeshare.

Last week, in a national conference on scams targeting older adults, Deborah Royster of the federal Consumer Financial Protection Bureau warned that consumers are being wiped out in a flash.

“Retirement savings and other resources that people have earned over a lifetime, and depend on,” Royster said, “can be gone in an instant.”

In that same conference, Virginia lawyer Julie M. Strandlie said her 85-year-old mother lost $80,000 between Thanksgiving and Christmas five years ago in a common scam that began with “flashing graphics and pounding voices” on her computer screen, warning of a virus.

“There’s a number to call for help, but it’s not the real Microsoft,” Strandlie said.

Her mother fell for the ruse, giving the criminals remote access to unlock her frozen computer. She was then duped into believing they had deposited money into her account, and she needed to pay it back in cash and gift cards from Best Buy and Target.

As LAPD Lead Officer Carlos Diaz, left, looks on, LAPD Det. Albert Smith leaves his card with Marta Barillas after a presentation about financial scams and physical abuse against seniors at St. Barnabas Senior Services in Los Angeles in June 2023.

(Genaro Molina / Los Angeles Times)

Steve McFarland, president and CEO of the Better Business Bureau region that runs from Palo Alto to Long Beach, said his office is getting 1,100 consumer complaints of all types each and every day.

He wasn’t kidding and repeated the number.

McFarland and other sources say a greater percentage of millennials report fraud than do older adults, but the latter group suffers greater losses. And across the age spectrum, McFarland said, gift card scams are hot right now.

Bar codes on those cards can be tampered with or photographed by someone before they’re sold, McFarland said. The buyer of the card goes to a checkout stand and puts, let’s say, $100 on the card to be redeemed at Target, Burger King or any number of establishments.

But when the recipient goes to redeem it, the funds are gone. It happened last year to L.A. County Supervisor Janice Hahn, who bought a $100 VISA gift card for a nephew who found that it wasn’t worth a nickel. Hahn later warned of the scam, along with McFarland, on L.A.’s Eyewitness News.

“It’s called gift card draining and these scammers have found several slick ways to victimize unsuspecting shoppers,” Hahn said.

In addition to outright scams, this is a time of year when solicitations for charitable donations can fill your mailbox.

“A lot of charities are trying to close out strong, and criminals know that and are vying for the same dollars,” Stokes said.

If it’s not an established organization that’s known for its good work, Stokes advised going to the Better Business Bureau’s give.org website, where you can type in the name of the charity to find out whether it’s legit. You can also find out what percentage of donations go to the cause versus overhead costs.

Your best policy, unfortunately, is to be suspicious of everything. I recently got a letter with my mortgage lender’s name in the window and opened it to find a warning that this was my “FINAL NOTICE” to avoid a monthly payment increase.

It looked hinky, and on the back page, in fine print, I learned that the mail was from a lender unaffiliated with my mortgage company.

If you see “final notice,” “urgent” or “benefit disbursement enclosed,” don’t even bother opening the envelope.

A friend shared a tall stack of mail that keeps coming for his mother, who died months ago, and as I sifted through it I found one attempt after another to separate her from her money. “Copy of Final Check Enclosed,” said one, and in the cellophane window was what looked like a check for $437.18 that said “Pay to the order of …”

But it wasn’t a check, of course. It was a solicitation from a lobbying firm claiming it will fight to preserve Social Security funding (and by the way, she had a lot of mail from organizations claiming they were out to do the same).

The fake check was described as an example of what she stood to lose if she didn’t immediately support the cause by pulling out her credit card and making an “urgent donation” to keep Social Security solvent.

And then there were solicitations from organizations representing a Noah’s Ark of endangered animals. Look, I’m an animal lover, but how does one begin to sort through all the pleas?

Save the pigs. The horses. The bees. The lions. The donkeys.

“Sunday, a baby donkey was ripped from his mother and brutalized,” said one envelope.

Lots of appeals for dogs, too. One included the photo of a dog with amazing verbal skills, judging by the quote attributed to the canine: “I wish for no one else to be hurt the way humans have hurt me.”

I feel for the dog, but if he can actually speak, let’s get him an agent and send him out on tour so the pup can raise a fortune for his cause.

Of course, there are plenty of good charities out there that are worthy of your generosity, but be careful.

With solicitations. With email. With texts. With phone calls.

All of it.

Banks should be doing more to prevent repeated, questionable, out-of-the-ordinary withdrawals and wire transfers. The gift card industry ought to be able to rein in rampant fraud with smarter security measures.

And people of all ages need to be more discerning, refuse to provide personal information such as Social Security numbers, and get some advice from a trusted friend or loved one before signing any checks or doing business with strangers.

Last year I wrote about two retired L.A. residents, a former teacher and a former banker, who were swindled out of roughly $80,000 apiece in internet scams. Earlier this year I wrote about a Redwood City woman who was taken for $1.8 million, and an Alhambra woman, Alice Lin, who lost $720,000 in an “investment” scheme introduced to her by a man she met on a chat app.

I reached out to Lin, who had some good advice on all forms of communication from sources you don’t know or trust.

“Do not respond,” Lin said. “Don’t touch it.”

steve.lopez@latimes.com

Business

Advance Auto Parts to close hundreds of stores, shut down West Coast operations

A plan by Advance Auto Parts to stem deepening losses by closing hundreds of stores will result “in a complete exit of certain markets on the West Coast” as the company shutters California locations, its chief executive said.

The national auto supply chain plans to close more than 725 locations around the country as well as four distribution centers on the West Coast, Chief Executive Shane O’Kelly said in an earnings call last week.

Although he didn’t specify which stores would close, O’Kelly signaled that the downsizing would focus heavily on California and the Pacific Northwest, saying that stores supplied by the four distribution centers marked for closure will also be shut down.

“Our four distribution centers on the West Coast serve a lower concentration of stores,” O’Kelly said in the earnings call. “We believe that investing in other core areas of the business will help deliver stronger profitability.”

Advance Auto Parts currently has 139 locations in California, according to its website. The North Carolina-based company operates about 4,700 stores along with 1,100 independently operated locations, which are primarily in the U.S. but also in Canada, Mexico and the Caribbean islands. Operations in Canada will not be affected, O’Kelly said.

The automotive aftermarket is a roughly $300-billion industry, said Bret Jordan, a research analyst at Jeffries. Supply chain efficiency is key for auto part retailers, he said, something Advance Auto Parts has struggled with. Whereas Advance Auto generally receives shipments from distribution centers about once a week, competitor O’Reilly Auto Parts gets shipments once a day, Jordan said.

For the record:

6:07 p.m. Nov. 21, 2024An earlier version of this story incorrectly said the auto parts industry is a roughly $300 million industry. It should have said a roughly $300 billion industry.

“What they’re doing on the West Coast is getting out of regional markets where they don’t have an effective supply chain or the density to build an effective supply chain,” he said. “They’re trying to improve company wide profitability by cutting out the least profitable regions.”

The reduction in its footprint is part of the company’s “strategic plan to improve business performance,” according to a statement released as part of its recent quarterly earnings report. The company also plans to increase the pace of new store openings in higher-performing regions, the release said.

The car parts seller, which stocks batteries, motor oil and more, posted underwhelming third-quarter results this month, reporting a net loss of $6 million on revenue of $2.1 billion. The figures marked an improvement compared with the $62-million loss it posted for the same period last year on $2.2 billion in revenue. The company’s stock closed Thursday at $38.69, down more than 37% this year.

Advance Auto Parts closed a $1.5-billion sale of Worldpac, its car parts wholesale distribution business, to investment firm Carlyle this month.

O’Kelly did not comment on the number of employees expected to be affected.

-

Business7 days ago

Business7 days agoColumn: Molly White's message for journalists going freelance — be ready for the pitfalls

-

Science4 days ago

Science4 days agoTrump nominates Dr. Oz to head Medicare and Medicaid and help take on 'illness industrial complex'

-

Politics6 days ago

Politics6 days agoTrump taps FCC member Brendan Carr to lead agency: 'Warrior for Free Speech'

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg) Technology5 days ago

Technology5 days agoInside Elon Musk’s messy breakup with OpenAI

-

Lifestyle6 days ago

Lifestyle6 days agoSome in the U.S. farm industry are alarmed by Trump's embrace of RFK Jr. and tariffs

-

World6 days ago

World6 days agoProtesters in Slovakia rally against Robert Fico’s populist government

-

News6 days ago

News6 days agoThey disagree about a lot, but these singers figure out how to stay in harmony

-

News6 days ago

News6 days agoGaetz-gate: Navigating the President-elect's most baffling Cabinet pick