Business

TikTok’s C.E.O. Struggles to Make His Case in Washington

TikTok’s powerful day in Congress

The C.E.O. of TikTok was grilled for practically 5 hours in Congress on Thursday about his firm’s ties to China, and his testimony did little to recommend the video platform’s issues are over. The aggressive questioning of Shou Chew has solely added gasoline to fiery U.S.-China relations and highlighted TikTok’s awkward place as a battleground between Washington and Beijing. The Biden administration needs TikTok’s Chinese language proprietor ByteDance to promote the corporate or face a ban, however hours earlier than Mr. Chew testified, China stated it opposed a sale.

How did Chew fare? It was at all times going to be powerful for Mr. Chew to placate his interrogators, given the extent of bipartisan anti-China sentiment in Washington. However many thought his look went even worse than anticipated, regardless of the corporate’s monthslong effort to win associates and affect coverage forward of the listening to.

Lawmakers often reduce him off midsentence and repeatedly requested if TikTok was spying on People on behalf of the Chinese language authorities. “ByteDance isn’t owned or managed by the Chinese language authorities,” he stated, in a response that failed to steer them.

What did we be taught? “The way forward for TikTok within the U.S. is unquestionably dimmer and extra unsure as we speak,” Lindsay Gorman, head of expertise and geopolitics on the German Marshall Fund suppose tank and a former tech adviser to the Biden administration, instructed The Occasions.

How are traders responding? Mr. Chew tried to allay considerations about Chinese language involvement in ByteDance partly by pointing to its large U.S. traders, together with BlackRock, KKR and Sequoia Capital. But when they’re attempting to assist, they aren’t speaking. BlackRock and KKR declined to remark and Sequoia didn’t reply to DealBook’s question.

Shares of TikTok’s U.S. opponents, together with Snap and Meta, rose throughout Mr. Chew’s testimony. However the U.S. corporations shouldn’t wager on a ban: It’s not clear the Biden administration has the authorized authority to impose one, or that it’s well worth the potential political price, given the thousands and thousands of younger People who use the app.

How did TikTokers reply? Principally with mockery and disbelief on the lawmakers’ tech information. “You may’t make this up 😂” one consumer wrote after Buddy Carter, Republican of Georgia, requested Mr. Chew if TikTok makes use of cellphone cameras to evaluate customers’ pupil dilation and enhance algorithmic suggestions. “DOES HE NOT UNDERSTAND HOW INTERNET ACCESS WORKS?!” one other stated after Richard Hudson, Republican of North Carolina, requested if TikTok might “entry the house Wi-Fi community.”

HERE’S WHAT’S HAPPENING

Deutsche Financial institution leads a pointy fall in European financial institution shares. The inventory fell as a lot as 13 % on Friday morning after the price of insuring the financial institution’s debt rose sharply this week. The Stoxx 600 index of European banks was additionally down sharply regardless of efforts by policymakers to reassure traders.

Ukraine will want $411 billion to rebuild, the World Financial institution estimates. That new determine is considerably increased than the $349 billion the establishment forecast in September. In the meantime, President Volodymyr Zelensky of Ukraine urged E.U. leaders to impose extra sanctions on Russia and velocity up his nation’s software to hitch the bloc.

Chinese language authorities arrest staff at an American due diligence agency’s Beijing workplace. The New York-based Mintz Group stated its workplace was raided and all of its Chinese language workers members have been detained this week. The arrests have been made simply days forward of a gathering of Chinese language officers and world executives, together with Tim Cook dinner of Apple and the Bridgewater founder Ray Dalio, that’s supposed to rebuild worldwide investor confidence within the nation.

The Financial institution of England raises charges once more to fight inflation. Britain’s central financial institution elevated charges by 1 / 4 level, to 4.25 %, following comparable strikes by the European Central Financial institution and the Fed. The Financial institution of England stated that the nation’s banks have been resilient, and indicated it was extra nervous about persistently rising shopper costs.

Yellen walks again her U-turn

Financial institution shares took a roller-coaster trip this week, as traders tried to maintain up with Treasury Secretary Janet Yellen’s steerage on what the federal government would do to shore up the sector. On Wednesday, shares tumbled after Ms. Yellen performed down the prospect of a common assure on financial institution deposits. She moved to wash up these feedback yesterday, although it’s unsure that markets really feel Washington’s method to propping up lenders is any clearer.

Buyers pointed to 11 phrases from Yellen’s ready remarks for a Home listening to. “Actually, we’d be ready to take further actions if warranted,” she stated in that testimony, on high of current authorities instruments to stabilize wobbly lenders.

These feedback stand in distinction to what she stated the day before today. She instructed senators that the Biden administration wasn’t contemplating briefly increasing authorities insurance coverage to all U.S. financial institution deposits with out Congressional approval. (Buyers had taken coronary heart from experiences that the Treasury Division was finding out simply that.)

And the feedback on Wednesday gave the impression to be a change from what Ms. Yellen stated Tuesday at a gathering held by the American Bankers Affiliation: “Related actions might be warranted if smaller establishments endure deposit runs that pose the chance of contagion,” she instructed the gathering.

The lesson stays the identical. Buyers wish to know what the federal government will do if weakened lenders are battered once more. That uncertainty was mirrored in how financial institution shares traded yesterday: First Republic, which continues to be looking for a lifeline, fell 6 %, whereas PacWest dropped 8.5 %. The broader KBW financial institution index closed down 1.7 %.

Jack Dorsey confronts a brief vendor

Shares in Block, Jack Dorsey’s monetary expertise firm, plunged practically 15 % on Thursday after it was attacked by a formidable opponent: Hindenburg Analysis, the brief vendor that has already taken on the likes of the Indian conglomerate Adani Group and Nikola, the electric-truck maker.

In a prolonged report printed yesterday, Hindenburg accused Block of facilitating fraud by means of its Money App, a cell funds service, and inflating the service’s consumer numbers — and stated it was betting that the corporate’s shares would fall.

The report strikes at Block’s most outstanding service. The corporate, initially often called Sq., rose to fame by way of its ubiquitous bank card readers and later purchased the Afterpay buy-now-pay-later service and the Tidal streaming music platform. However Block needs to show Money App right into a monetary superplatform. “Every thing that you just want in your monetary life, you could find inside Money App,” Mr. Dorsey stated in November.

As of yr finish, Block stated Money App had 51 million lively customers, and it generated $2.9 billion in gross revenue for 2022.

What Hindenburg says: Money App is rife with faux accounts that artificially inflate its consumer numbers and is getting used for a variety of crimes, from drug dealing to intercourse trafficking. (Maybe in a bid to seize consideration, Hindenburg cited a number of rap lyrics referencing Money App’s use in drug gross sales and tried murders.)

Block is preventing again. The corporate stated it plans to “work with the S.E.C.” and “discover authorized motion” in opposition to Hindenburg over what it referred to as an inaccurate and deceptive report. “We have now reviewed the complete report within the context of our personal information and consider it’s designed to deceive and confuse traders,” Block added.

What’s subsequent for Hindenburg? The agency’s founder, Nathan Anderson, instructed DealBook in October that Hindenburg was near publishing investigations into 4 publicly traded corporations. He gave few hints in regards to the targets, however stated he was targeted on companies susceptible to rising rates of interest. “When you might have a rising charge surroundings and extremely levered corporations, oftentimes you see extra intense efforts at accounting manipulation to try to paper over these issues,” he stated. “These may be actually fascinating areas for fraud analysis.”

“We should be taught the teachings from the previous few days — in any other case Credit score Suisse can have fallen in useless.”

— Tidjane Thiam, the C.E.O. of Credit score Suisse from 2015 to 2020, on how final weekend’s shotgun merger of UBS and his former employer can have a long-lasting impression on traders and the European banking sector.

Crypto’s most wished fugitive is arrested

There’s been a significant breakthrough in one of many crypto world’s longest-running prison issues: Do Kwon, the manager wished within the U.S. and South Korea (and below investigation in Singapore) for the $40 billion collapse of his stablecoin firm final yr, was arrested yesterday in Montenegro.

Kwon had been on the lam for practically a yr following the market crash of his agency’s twin digital currencies, the TerraUSD stablecoin and Luna. That implosion spooked the crypto market, setting off a brutal stoop in digital asset values that worn out traders and triggered a string of bankruptcies.

Hours after officers in Montenegro introduced Mr. Kwon’s arrest, federal prosecutors within the Southern District of New York stated they have been charging the 31-year-old founding father of Terraform Labs with eight counts of fraud and market manipulation. The S.E.C. has additionally charged him with masterminding “a multibillion-dollar crypto asset securities fraud.”

Police apprehended Mr. Kwon as he tried to move by means of airport safety with “counterfeit documentation,” Filip Adzic, Montenegro’s inside minister, said on Twitter.

The query is the place Kwon will go subsequent. In a congratulatory response to Mr. Adzic, Korea’s nationwide police company tweeted: “We sit up for your help” in extraditing Kwon to Korea.

THE SPEED READ

Offers

-

Tom Brady is taking a stake within the WNBA’s Las Vegas Aces. (Axios)

-

Adidas and Beyoncé reportedly agreed to finish the partnership behind the singer’s Ivy Park activewear line. (The Hollywood Reporter)

-

A chatbot start-up based by ex-Google staff was valued at $1 billion in a brand new funding spherical. (NYT)

-

MSCI is about to strip lots of of mutual funds of scores tied to environmental, social and company governance points, whereas 1000’s extra shall be downgraded. (FT)

Coverage

Better of the remainder

-

“Tradition conflict: the problem of uniting fierce rivals UBS and Credit score Suisse” (FT)

-

“The Youthful Brother Caught within the Center of the FTX Investigation” (NYT)

-

The brand new C.E.O. of Starbucks says he’ll work a shift a month within the firm’s shops. (CNBC)

We’d like your suggestions! Please e-mail ideas and solutions to dealbook@nytimes.com.

Business

Las Vegas' Mirage Resort to close after 34-year run. Volcano to go dormant

Once hailed as “Las Vegas’ first 21 Century resort,” The Mirage Hotel & Casino confirmed Wednesday that its iconic volcano outside of its front entrance is going dormant less than a quarter of a century into the new millennium.

Owner Hard Rock International announced the hotel will cease operations on July 17, with bookings being accepted until July 14. The iconic resort — sporting a jungle-fantasy theme —was perhaps best known for its exploding 54-foot man-made volcano, magicians Siegfried and Roy, and its white tigers and dolphins.

“We’d like to thank the Las Vegas community and team members for warmly welcoming Hard Rock after enjoying 34 years at The Mirage,” said Jim Allen, Chairman of Hard Rock International in a statement.

The resort is expected to be redeveloped into the Hard Rock Hotel & Casino and Guitar Hotel Las Vegas, with the volcano giving way to a nearly 700-foot guitar-shaped hotel. The project is expected to open in spring 2027. A similar 638-room hotel stands in Hollywood, Fla.

The Associated Press reported that more than 3,000 employees will be laid off. Hard Rock acknowledged it would pay roughly $80 million in severance packages for union and nonunion labor.

The Culinary and Bartenders Union accounts for about 1,700 Mirage workers. It announced Wednesday that its workers have two options.

The first was a severance package of $2,000 for every year of service plus six months of pension and health benefits. The second option gives employees a lesser, undisclosed amount while maintaining seniority rights for the duration of the property’s closure along with 36 months of recall rights for jobs at the new hotel.

“Culinary Union members at The Mirage have a strong union contract, ensuring that workers are protected, even as the property closes its doors entirely for three years from July 2024 – May 2027,” said Ted Pappageorge, Culinary Union secretary-treasurer, in a statement Wednesday.

The new hotel is projected to employ nearly 7,000 employees, according to Hard Rock management, while 2,500 construction jobs are expected during the rebuilding process.

Hard Rock said that all reservations beyond July 14 would be canceled and that guests should contact the guest services department or booking agency for a refund.

The Mirage’s closure is the second on the strip this year.

In April, the 66-year-old Tropicana closed its doors to make way for a 30,000-seat stadium that is expected to serve as the home of the Oakland A’s.

The Mirage’s opening by casino tycoon Stephen A. Wynn in 1989 was hailed as the ushering of a new era of resorts. It was the first strip hotel to open since the MGM Grand in 1973.

Wynn shelled out $600 million, then the most expensive casino project, for the sprawling 103-acre property.

The Mirage was the first fully integrated hotel, according to Alan Feldman, a Distinguished Fellow at UNLV’s International Gaming Institute.

Integration meant operating and treating all facets of the resort, including casino, food and beverage, retail, entertainment and convention space, with equal importance, according to Feldman, who rose to become an executive with the Mirage and stayed from 1989 to 2019.

Feldman said hotel owners previously cared first about the casino and “everything else was last.”

“They gave away entertainment, food and rooms as long as someone came and played,” said Feldman. “The Mirage was the first to believe you could actually make money in these areas if you invested enough.”

Its glistening 30-story white-and-gold towers were said to make neighboring Caesars Palace look “retiring by comparison.” Traffic occasionally backed up on the strip as engineers tested gas-flared flames 40 feet into the air every few minutes.

“People just got out of the cars and went over to see what was going on,” one limousine driver said at the time.

The hotel included a 20,000-gallon fish tank at its reception desk and 3,049 rooms.

Its animals — and its white tiger habitat — brought the resort fame and infamy, including in 2003 when a tiger critically injured magician Roy Horn.

The Mirage’s opening kicked off a resort building and remodeling spree that included the debut of the Circus Circus’ Excalibur in June 1990, the $250-million renovation of Caesars Palace and the opening of Treasure Island in 1994.

Business

Sony warns tech companies: Don't use our music to train your AI

Sony Music Group is sending letters to 700 artificial intelligence developers and music streaming services warning them to not use its artists’ music to train generative AI tools without its permission.

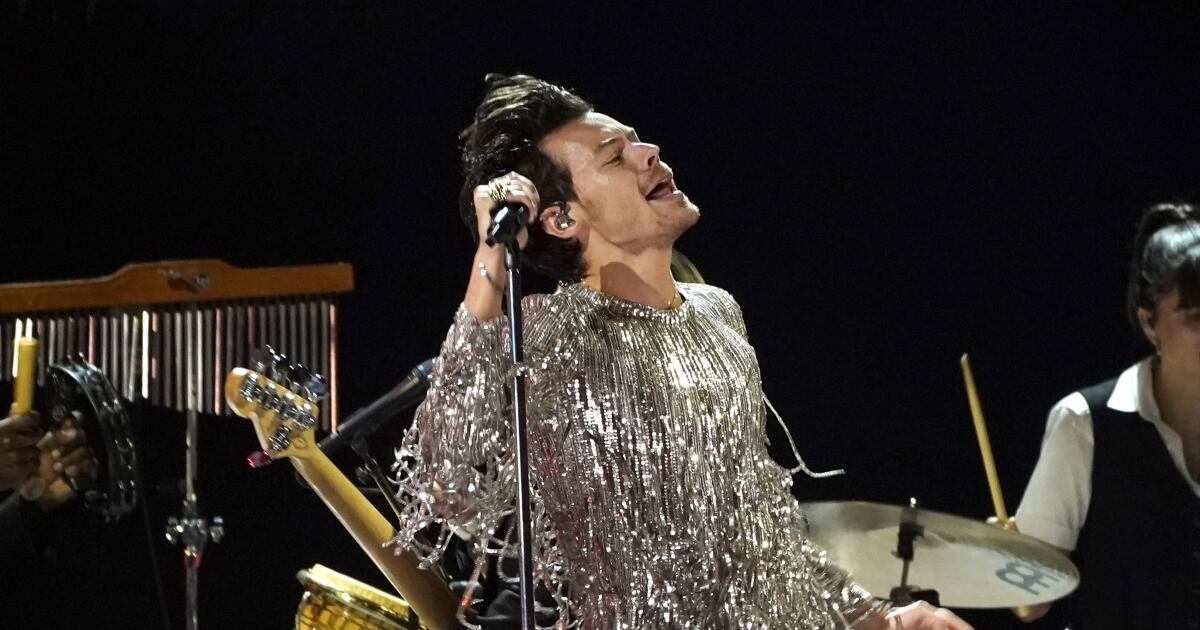

The company — one of the three largest recorded music firms — said it is explicitly opting out of the use of its music for training or developing AI models through text or data mining or web scraping as it relates to lyrics, audio recordings, artwork, musical compositions and images. Sony Music Group artists include Celine Dion, Doja Cat and Harry Styles.

“We support artists and songwriters taking the lead in embracing new technologies in support of their art,” Sony Music Group said in a statement on its website Thursday. “Evolutions in technology have frequently shifted the course of creative industries. … However, that innovation must ensure that songwriters’ and recording artists’ rights, including copyrights, are respected.”

The letters were sent to companies including San Francisco-based ChatGPT creator OpenAI and Mountain View-based search giant Google, according to a person familiar with the matter who was not authorized to speak publicly. OpenAI and Google did not immediately respond to requests for comment.

The move comes as the entertainment industry is grappling with rapid innovations in artificial intelligence technology. Writers and actors raised concerns last summer about whether leaving AI unchecked could threaten their livelihoods. Meanwhile, some creatives have marveled at the advancements that could allow them to pursue bold ideas with tight budgets.

This year, OpenAI unveiled its text-to-video tool Sora, which was used to create a four-minute music video for music artist Washed Out. The director of the video told The Times that Sora helped him depict multiple locations and visual effects that he otherwise couldn’t have.

But AI can also create chaos. Celebrities have dealt with “deep fakes” — false videos or audio depicting a celebrity endorsing certain brands or activities. To help protect their clients against unauthorized use of their voice and likeness, Century City-based Creative Artists Agency is helping talent create their own digital doubles.

On Thursday, two New York voice-over actors sued Berkeley-based AI voice generator business Lovo for unauthorized use of their voices. Lovo did not immediately return a request for comment. The lawsuit was filed in U.S. District Court for the Southern District of New York.

Some people in the entertainment industry have said they would like the AI companies to be more transparent about how they are training their tools and whether they have the appropriate copyright permissions.

OpenAI has said its large language models, including those that power ChatGPT, are developed through information available publicly on the internet, material acquired through licenses with third parties and information its users and “human trainers” provide.

The company said in a blog post that it believes training AI models on publicly available materials on the internet is “fair use.”

But some media outlets, including the New York Times, have sued OpenAI. The newspaper raised alarms about how its stories are being used by the tech company.

In Sony Music Group’s letters to AI businesses, the company said it has reason to believe its content may have been used to train, develop or commercialize artificial intelligence systems without its permission, according to a copy obtained by the Times. Sony Music Group asked the tech companies to provide information regarding that use and why it was necessary.

Sony Music Group, owned by Tokyo-based electronics giant Sony Corp., also wants music streaming providers to add language in its terms of service saying that third parties are not allowed to mine and train using Sony Music Group content, the person familiar with the matter said.

Business

A woman was dragged by a self-driving Cruise taxi in San Francisco. The company is paying her millions

General Motors’ autonomous car company, Cruise, has reportedly agreed to pay an $8-million to $12-million settlement to a woman who was hospitalized after getting dragged along the pavement by a self-driving taxi in San Francisco last year.

The woman, a pedestrian, was struck by a hit-and-run vehicle at 5th and Market streets and thrown into the path of Cruise’s self-driving car, which pinned her underneath, according to Cruise and authorities. The car dragged her about 20 feet as it tried to pull out of the roadway before coming to a stop.

She sustained “multiple traumatic injuries” and was treated at the scene before being hospitalized.

It’s unclear when the settlement was reached or the exact amount, sources familiar with the situation told Fortune and Bloomberg. The condition of the woman, whose name was not released by authorities, is unknown, but a representative of Zuckerberg San Francisco General Hospital told Fortune that she had been discharged.

Cruise initially said that its self-driving car “braked aggressively to minimize impact” but later said the vehicle’s software made a mistake in registering where it hit the woman. The car tried to pull over but continued driving 7 mph for 20 feet with the woman still under the vehicle.

“The hearts of all Cruise employees continue to be with the pedestrian, and we hope for her continued recovery,” Cruise said in a statement.

Cruise halted its driverless operations after its autonomous taxi license was suspended by California’s Department of Motor Vehicles. The company was also accused of lying to investigators and withholding footage of the car crash.

Cruise said this week that it would start testing robotaxis in Arizona with a “safety driver” behind the wheel in case a human needs to take control of the vehicle, according to a company news release.

“Safety is the defining principle for everything we do and continues to guide our progress towards resuming driverless operations,” according to the release.

-

Politics1 week ago

Politics1 week agoRFK Jr said a worm ate part of his brain and died in his head

-

World1 week ago

World1 week agoPentagon chief confirms US pause on weapons shipment to Israel

-

News1 week ago

News1 week agoStudents and civil rights groups blast police response to campus protests

-

World1 week ago

World1 week agoConvicted MEP's expense claims must be published: EU court

-

Politics1 week ago

Politics1 week agoCalifornia Gov Gavin Newsom roasted over video promoting state's ‘record’ tourism: ‘Smoke and mirrors’

-

Politics1 week ago

Politics1 week agoOhio AG defends letter warning 'woke' masked anti-Israel protesters they face prison time: 'We have a society'

-

News1 week ago

News1 week agoNine Things We Learned From TikTok’s Lawsuit Against The US Government

-

Politics1 week ago

Politics1 week agoBiden’s decision to pull Israel weapons shipment kept quiet until after Holocaust remembrance address: report