Business

Japan Has Long Sought More Inflation and a Weak Yen. But Not Like This.

TOKYO — For years, as Japan tried to spice up its chronically weak financial progress, it pursued what its central financial institution noticed as a magic system: stronger inflation and a weaker yen.

It didn’t fairly work as supposed. Inflation by no means met the federal government’s modest goal, regardless of rock-bottom rates of interest and heaps of fiscal stimulus. Staff’ wages stagnated, and progress remained anemic.

Now, Japan is instantly getting what it wished for — simply not in the way in which it had hoped.

Whereas total inflation stays average, meals and vitality prices are rising quickly, an outgrowth not of elevated demand, however of market turmoil associated to the pandemic and Russia’s invasion of Ukraine. And the yen has hit a two-decade low in opposition to the greenback, a dizzying drop of greater than 18 p.c since September that has unnerved Japanese companies.

The dual forces are posing yet one more problem for the world’s third-largest financial system as Japan trails different main nations in rising from the financial blow of the pandemic. The rise in costs has spooked Japanese customers used to many years of stability, and the weak yen is beginning to look as if it’s going to depress demand at house greater than stimulate it overseas.

“The yen depreciation is attacking the weakest level of the financial system,” mentioned Takahide Kiuchi, an economist on the Nomura Analysis Institute who served on the Financial institution of Japan’s coverage board. Households, he mentioned, “are going through a rise in costs of each imported good,” and “the state of affairs is undermining shopper sentiment even upfront of precise inflation.”

The troubles concerning the depreciating yen replicate a gradual shift within the Japanese financial system over the previous decade.

In a earlier period, when Japan was a producing superpower, a weak yen would have been trigger for celebration, making Japanese exports cheaper overseas, growing the worth of income earned abroad and attracting overseas funding.

However exporting is now much less vital to the general Japanese financial system, and firms — searching for to keep away from commerce restrictions and benefit from cheaper labor prices — have begun to provide extra of their merchandise abroad, decreasing the influence of trade charges on their backside line.

A Financial institution of Japan report launched in January discovered that though a weak yen continued to assist the financial system, its constructive influence on exports had shrunk over the last decade main as much as the pandemic. Its contribution to inflation, nonetheless, had elevated throughout the identical interval.

The pandemic and the struggle in Ukraine have most probably amplified the negatives and diminished the positives, mentioned Naohiko Baba, chief Japan economist at Goldman Sachs. Costs have been rising due to manufacturing shutdowns in China and broader logistics chain snarls, in addition to the struggle’s influence on exports of Ukrainian wheat and Russian gasoline and oil.

For resource-poor Japan, which is extremely reliant on imported gas and meals, the drop within the yen has pushed already excessive costs even increased, with the prices of some requirements rising by double digit percentages. For the primary time in over a decade, customers are paying extra for Asahi beer. And one model of comfort retailer rooster had its first worth improve in additional than 35 years.

“From the angle of exporters, the weaker yen must be useful, however for others, it must be impartial or damaging,” Mr. Baba mentioned. He added that the potential upside of the foreign money devaluation had been additional decreased by Japan’s determination to proceed barring worldwide vacationers, who is perhaps wanting to benefit from favorable trade charges.

There are a selection of causes for the yen’s weak spot. Japan’s financial system has faltered throughout the pandemic, and skyrocketing commodity costs have compelled importers to promote extra yen for {dollars} to pay their payments.

However the primary trigger, specialists say, is Japan’s insistence on sustaining rates of interest at close to zero at the same time as different central banks, led by the Federal Reserve, increase their very own drastically.

The widening unfold has triggered a rush to purchase {dollars} as buyers search for higher returns. And the exodus appears prone to proceed.

Final week, the Fed raised rates of interest by half a degree, the most important bounce in over 20 years, and it has mentioned that it intends to proceed elevating borrowing prices because it seeks to chill speedy inflation stoked by a booming American job market and rising wages.

Wages in Japan, against this, have barely budged, and the nation’s excessive employment ranges have remained comparatively regular. That implies that Japan’s inflation, which over all stays beneath the federal government’s goal of two p.c, is most probably pushed by supply-side points attributable to the struggle and the pandemic, not the elevated demand that low rates of interest are supposed to provide.

In concept, the Financial institution of Japan may stanch the yen’s devaluation by elevating rates of interest. However its governor, Haruhiko Kuroda, whose time period ends subsequent April, appears set to stay together with his insurance policies till he achieves inflation of each the standard and amount he envisioned practically a decade in the past when he was nominated by then-Prime Minister Shinzo Abe.

Modest inflation pushed by shopper demand, the pondering goes, would create a virtuous cycle of financial enlargement: Corporations’ income would develop, spurring funding, wage progress and home consumption.

In late April, Mr. Kuroda doubled down on his dedication to low charges, growing the Financial institution of Japan’s purchases of presidency bonds. The announcement was adopted by a yen sell-off.

Even when Mr. Kuroda needed to boost charges, doing so could set off a cascade of financial penalties, mentioned Gene Park, a professor of political science and worldwide relations at Loyola Marymount College who research Japanese financial coverage.

Japan has come to depend on massive spending to stimulate its financial system, Mr. Park mentioned, and elevating charges may each make that method tougher to proceed and make Japan’s nationwide debt, which stands at over 250 p.c of its annual financial output, tougher to service.

The Russia-Ukraine Battle and the International Economic system

A far-reaching battle. Russia’s invasion on Ukraine has had a ripple impact throughout the globe, including to the inventory market’s woes. The battle has brought about dizzying spikes in gasoline costs and product shortages, and is pushing Europe to rethink its reliance on Russian vitality sources.

Whereas economists disagree about whether or not that degree of debt is sustainable, policymakers should not wanting to probability it.

“Excessive inflation is politically poisonous, and making an attempt to appropriate for it, the drugs, can also be a particularly bitter tablet,” Mr. Park mentioned. “In the event that they increase rates of interest, that’s additionally going to be unpopular.”

Like Mr. Kuroda, Prime Minister Fumio Kishida has dismissed recommendations that the Financial institution of Japan ought to search to strengthen the yen by elevating rates of interest.

As a substitute, he has sought to fight rising costs with extra stimulus. This 12 months, Parliament has signed off on a number of rounds of subsidies to Japanese oil firms which are supposed to decrease gasoline costs. In April, lawmakers introduced an extra spherical of subsidies and direct money funds of about $380 to households with youngsters.

Some politicians have instructed that the Financial institution of Japan may shore up the yen’s worth via foreign money market interventions, promoting its personal greenback holdings to raise the Japanese foreign money. However that’s an costly proposition that’s unlikely to have a lot impact, mentioned Saori Katada, a professor of worldwide relations on the College of Southern California who research Japan’s commerce and financial coverage.

“Nowadays, the central financial institution has already given up on intervening available in the market,” Ms. Katada mentioned. “The entire market has gotten so massive that the precise intervention doesn’t change it. It would change it for a number of days, nevertheless it gained’t change the development.”

With few sensible choices, the one factor Japan can attempt to do is “discuss the yen up,” she mentioned, with officers making a full-court press to persuade markets that they are going to defend the foreign money’s worth. Nevertheless, “that requires different companions within the U.S. and Europe to assist,” she mentioned, and they’re too busy dealing with their very own economies’ issues to commit a lot thought to Japan.

“They don’t care an excessive amount of concerning the depreciating yen for the time being,” she mentioned.

Which means Japan might have to simply cling robust till issues flip round, mentioned Sayuri Shirai, an economics professor at Keio College in Tokyo and a former member of the Financial institution of Japan’s board.

U.S. rates of interest will “not develop perpetually,” she mentioned. “I feel we shouldn’t be panicked.”

Hisako Ueno contributed reporting.

Business

Plastic Spoons, Umbrellas, Violins: A Guide to What Americans Buy From China

Tariffs are up. Tariffs are down. Shipping is frozen. Shipping is back on.

In the past several weeks, Chinese imports to the U.S. have been on a seesaw, leaving Americans uncertain how tariffs will affect their lives.

It’s impossible to say what tariffs will do to the price or availability of any particular item, although even the Trump administration’s current level of 30 percent tariffs — on top of previous levies — will certainly make many things more expensive.

But thanks to detailed trade data, we know what Americans buy from China, and how much of it, and thus what might be most sensitive to future swings in trade status.

Here are several ways of understanding what’s on those container ships, based on 2024 data from the U.S. International Trade Commission.

First, the products where the greatest share of our imports are Chinese imports:

Goods Americans import almost exclusively from China

| ITEM | Pct. from China |

Imports from China in millions |

|

|---|---|---|---|

| 1 | Baby carriages | 97% | $380 |

| 2 | Artificial plants | 96% | $991 |

| 3 | Umbrellas | 96% | $491 |

| 4 | Filing cabinets | 96% | $88 |

| 5 | Vacuum flasks | 96% | $1,634 |

| 6 | Fireworks | 95% | $465 |

| 7 | Children’s picture books | 93% | $505 |

| 8 | Portable lighting | 91% | $901 |

| 9 | Combs | 91% | $367 |

| 10 | Travel kits | 90% | $42 |

This list is the simplest way to think about which Chinese goods the U.S. relies on most. But percentages aren’t everything. Americans buy so much from China that even goods with smaller imported shares from there could still be significantly affected by tariffs.

Chinese goods that Americans spend the most on

| ITEM | Pct. from China |

Imports from China in millions |

|

|---|---|---|---|

| 1 | Telephones | 42% | $50,085 |

| 2 | Computers | 26% | $35,473 |

| 3 | Electric batteries | 58% | $17,022 |

| 4 | Other toys | 76% | $13,463 |

| 5 | Motor vehicles; parts and accessories | 11% | $9,059 |

| 6 | Video and card games | 78% | $7,083 |

| 7 | Video displays | 33% | $6,770 |

| 8 | Electric heaters | 55% | $6,607 |

| 9 | Seats | 26% | $6,582 |

| 10 | Packaged medications | 6% | $6,146 |

This list skews slightly toward more expensive goods that the average American purchases infrequently, particularly electronics. But the International Trade Commission also tracks how many of each good the U.S. imports.

Chinese goods with huge U.S. import quantities

| ITEM | Pct. from China |

Items imported from China in millions |

|

|---|---|---|---|

| 1 | Plastic housewares | 79% | 67,895 |

| 2 | Other plastic products | 45% | 19,158 |

| 3 | Plastic lids | 22% | 13,688 |

| 4 | Electrical capacitors | 11% | 12,125 |

| 5 | Semiconductor devices | 3% | 11,368 |

| 6 | Electrical resistors | 11% | 9,276 |

| 7 | Other toys | 76% | 6,390 |

| 8 | Other cloth articles | 64% | 5,466 |

| 9 | Shaped paper | 38% | 3,895 |

| 10 | Low-voltage protection equipment | 15% | 3,626 |

In that list, you can see Americans’ well-documented reliance on China for plastic products.

Many of America’s major imports from China are consumer goods: things you buy for yourself, like clothes, housewares or entertainment. Drill down into those categories and specific products stand out.

For example, American wardrobes are somewhat dependent on China: about a fifth of U.S. clothing imports. But a majority of neckties and gloves and pantyhose are imported from China.

Clothing

| ITEM | Pct. from China |

Imports from China in millions |

|

|---|---|---|---|

| 1 | Hosiery | 58% | $149 |

| 2 | Neckties | 57% | $52 |

| 3 | Gloves | 53% | $724 |

| 4 | Handkerchiefs | 53% | $13 |

| 5 | Women’s and girls’ bathrobes | 50% | $217 |

The U.S. is more reliant on China for things made with polyester and nylon (like pantyhose) than for those made with cotton.

Athletes, especially racket-sport players, are also dependent on China:

Sporting goods

| ITEM | Pct. from China |

Imports from China in millions |

|

|---|---|---|---|

| 1 | Badminton or similar rackets | 94% | $64 |

| 2 | Equipment for table tennis | 81% | $34 |

| 3 | Lawn-tennis rackets | 70% | $41 |

| 4 | Gym and athletic equipment | 69% | $1,652 |

| 5 | Other sports and pool equipment | 64% | $1,345 |

There are also consumer-goods categories whose “Made in China” status may not be as well known. For example, the U.S. gets a lot of its imported string instruments — such as violins and cellos — from China.

Musical instruments

| ITEM | Pct. from China |

Imports from China in millions |

|

|---|---|---|---|

| 1 | String musical instruments played with a bow | 83% | $31 |

| 2 | Brass-wind instruments | 44% | $49 |

| 3 | Percussion musical instruments | 36% | $42 |

| 4 | Wind musical instruments except brass | 27% | $48 |

| 5 | Grand and upright pianos | 4% | $4.8 |

The Japanese company Yamaha manufactures some of its instruments in China, including trumpets and drums.

The U.S. also relies on China for many of its vitamins …

Vitamin derivatives

| ITEM | Pct. from China |

Imports from China in millions |

|

|---|---|---|---|

| 1 | Vitamin B6 | 90% | $32 |

| 2 | Vitamin B1 | 88% | $43 |

| 3 | Vitamin B12 | 85% | $59 |

| 4 | Vitamin C | 73% | $139 |

| 5 | Vitamin B3 and B5 | 72% | $35 |

… and eels. (China has a robust eel farming industry.)

Fish

| ITEM | Pct. from China |

Imports from China in millions |

|

|---|---|---|---|

| 1 | Preserved eel | 95% | $38 |

| 2 | Frozen cod-like fish | 91% | $8.5 |

| 3 | Frozen tilapia fillets | 75% | $308 |

| 4 | Dried, salted and brined cod-like fish fillets | 69% | $37 |

| 5 | Frozen flatfish fillets | 65% | $58 |

Then there are the goods that the U.S. imports primarily to put inside other things, like car parts.

Car parts

| ITEM | Pct. from China |

Imports from China in millions |

|

|---|---|---|---|

| 1 | Vehicle windshields and window parts | 32% | $358 |

| 2 | Motor vehicle wheels and accessories | 31% | $1,338 |

| 3 | Vehicle parts: brakes, servo-brake and parts | 25% | $1,697 |

| 4 | Bumpers and parts for motor vehicles | 5% | $79 |

| 5 | Seat belts for motor vehicles | 4% | $11 |

The U.S. relies heavily on Chinese imports to build electric vehicles in particular: Some 70 percent of its imported lithium-ion batteries are from China.

Even batteries made in the U.S. often rely on raw materials from China, particularly graphite. (China tightened its export controls on graphite at the end of last year, so this year’s numbers could end up looking very different.)

Critical minerals used in E.V. batteries

| ITEM | Pct. from China |

Imports from China in millions |

|

|---|---|---|---|

| 1 | Graphite and artificial graphite | 62% | $376 |

| 2 | Manganese ores, oxides and articles | 37% | $86 |

| 3 | Cobalt ores, oxides, hydroxides and articles | 2% | $9.8 |

| 4 | Nickel ores, oxides, hydroxides, sulphates and raw nickel | 2% | $30 |

| 5 | Lithium oxide, hydroxide and carbonate | 1% | $2.6 |

Mr. Trump’s newest tariffs are not the only levies imposed on Chinese goods, and there’s a complicated interplay of which tariffs apply to which products. Some goods that a lot of Americans buy received exemptions from the latest tariffs (though perhaps not future ones), including one item the U.S. imports almost exclusively from China: children’s books.

Select exempted goods

| ITEM | Pct. from China |

Imports from China in millions |

|

|---|---|---|---|

| 1 | Children’s picture, drawing or coloring books | 93% | $505 |

| 2 | Smartphones | 73% | $40,675 |

| 3 | Portable computers | 66% | $32,169 |

That’s a window into what Americans buy from China. But for some imports, the U.S. doesn’t rely on China. It’s a list that includes large vehicles, precious metals and tomatoes, all of which America imports largely from other countries.

Goods that the U.S. imports the least from China

| ITEM | Total imports in millions |

|

|---|---|---|

| 1 | Delivery trucks | $47,524 |

| 2 | Other precious metal products | $21,231 |

| 3 | Planes, helicopters, and/or spacecraft | $18,309 |

| 4 | Diamonds | $15,938 |

| 5 | Raw aluminum | $10,113 |

| 6 | Refined copper | $8,627 |

| 7 | Platinum | $6,973 |

| 8 | Wine | $6,697 |

| 9 | Other fruits | $5,923 |

| 10 | Silver | $5,088 |

It’s also worth noting what America exports to China. Though the U.S. sends fewer goods to China than it receives, these could still be affected in a trade war. (China has been instituting its own exemptions, which are broader than those of the U.S.)

Goods that the U.S. exports the most to China

| ITEM | Exports to China in millions |

|

|---|---|---|

| 1 | Soybeans | $12,761 |

| 2 | Civilian aircraft | $11,522 |

| 3 | Integrated circuits | $8,716 |

| 4 | Vaccines, blood, antisera, toxins and cultures | $6,680 |

| 5 | Petroleum gas | $6,187 |

| 6 | Crude petroleum | $6,160 |

| 7 | Cars | $4,931 |

| 8 | Machines used to manufacture semiconductor devices, electronic integrated circuits or flat panel displays | $4,170 |

| 9 | Medical instruments | $3,460 |

| 10 | Scrap copper | $2,795 |

To let you take a closer look at what America does and doesn’t import from China, we’ve included a searchable list below of all goods for which the U.S. imported at least $20 million (from any country) in 2024, excluding America’s major exports.

| ITEM | Pct. from China |

Imports from China in millions |

|

|---|---|---|---|

| 1 | Baby carriages | 97% | $380 |

| 2 | Artificial plants | 96% | $991 |

| 3 | Umbrellas | 96% | $491 |

| 4 | Filing cabinets | 96% | $88 |

| 5 | Vacuum flasks | 96% | $1,634 |

| 6 | Fireworks | 95% | $465 |

| 7 | Children’s picture books | 93% | $505 |

| 8 | Portable lighting | 91% | $901 |

| 9 | Combs | 91% | $367 |

| 10 | Travel kits | 90% | $42 |

| 11 | Chalkboards | 90% | $124 |

| 12 | Party decorations | 89% | $4,699 |

| 13 | Umbrella and walking stick accessories | 85% | $71 |

| 14 | Other footwear | 84% | $972 |

| 15 | Blankets | 82% | $1,398 |

| 16 | Other cutlery | 82% | $140 |

| 17 | Iron housewares | 81% | $3,155 |

| 18 | Bells and other metal ornaments | 81% | $911 |

| 19 | Ceramic tableware | 80% | $835 |

| 20 | Other domestic electric housewares | 80% | $2,696 |

| 21 | Other musical instruments | 80% | $22 |

| 22 | Other clocks | 80% | $110 |

| 23 | Scissors | 79% | $123 |

| 24 | Plastic housewares | 79% | $6,079 |

| 25 | Video and card games | 78% | $7,083 |

| 26 | Other toys | 76% | $13,463 |

| 27 | Cooking hand tools | 74% | $106 |

| 28 | Wood frames | 74% | $149 |

| 29 | Sound recording equipment | 72% | $812 |

| 30 | Aluminum housewares | 72% | $1,143 |

| 31 | Postcards | 72% | $273 |

| 32 | Glycosides | 71% | $215 |

| 33 | Manganese | 71% | $85 |

| 34 | Electric filament | 70% | $1,882 |

| 35 | Scent sprays | 70% | $173 |

| 36 | Cutlery sets | 69% | $309 |

| 37 | Image projectors | 68% | $38 |

| 38 | Graphite | 68% | $96 |

| 39 | Wood ornaments | 68% | $394 |

| 40 | Phosphoric esters and salts | 67% | $82 |

| 41 | Glass bricks | 66% | $99 |

| 42 | Wheelchairs | 66% | $273 |

| 43 | Pearl products | 65% | $605 |

| 44 | Walking sticks | 65% | $28 |

| 45 | Imitation jewelry | 65% | $602 |

| 46 | Brooms | 64% | $1,241 |

| 47 | Other cloth articles | 64% | $3,589 |

| 48 | Fake hair | 64% | $879 |

| 49 | Ornamental ceramics | 63% | $328 |

| 50 | Wood kitchenware | 63% | $267 |

| 51 | Other knit clothing accessories | 63% | $186 |

| 52 | Awnings, tents, and sails | 62% | $546 |

| 53 | Iron sewing needles | 62% | $23 |

| 54 | Iron stovetops | 62% | $2,278 |

| 55 | Pastes and waxes | 62% | $200 |

| 56 | Safes | 62% | $212 |

| 57 | Calendars | 61% | $73 |

| 58 | Interior decorative glassware | 60% | $806 |

| 59 | Artificial graphite | 60% | $280 |

| 60 | Knives | 59% | $463 |

| 61 | Fishing and hunting equipment | 59% | $512 |

| 62 | Watch straps | 58% | $121 |

| 63 | Electric batteries | 58% | $17,022 |

| 64 | Molybdenum | 58% | $109 |

| 65 | Other headwear | 57% | $328 |

| 66 | Neck ties | 57% | $52 |

| 67 | Sports equipment | 56% | $4,283 |

| 68 | Knit gloves | 56% | $602 |

| 69 | Knit socks and hosiery | 55% | $1,320 |

| 70 | Electric heaters | 55% | $6,607 |

| 71 | Hats | 55% | $62 |

| 72 | Mattresses | 54% | $2,200 |

| 73 | Processed mica | 54% | $26 |

| 74 | Other non-knit clothing accessories | 54% | $111 |

| 75 | Porcelain tableware | 54% | $179 |

| 76 | Rubber footwear | 54% | $3,440 |

| 77 | Bedspreads | 54% | $422 |

| 78 | Handkerchiefs | 53% | $13 |

| 79 | Woven fabrics | 52% | $120 |

| 80 | Bladed weapons and accessories | 52% | $12 |

| 81 | Other articles of twine and rope | 51% | $76 |

| 82 | Hair trimmers | 51% | $343 |

| 83 | Gimp yarn | 51% | $41 |

| 84 | Inedible fats and oils | 50% | $1,177 |

| 85 | Cameras | 49% | $229 |

| 86 | Artistry paints | 48% | $63 |

| 87 | Eyewear frames | 47% | $595 |

| 88 | Bathroom ceramics | 46% | $725 |

| 89 | Mannequins | 46% | $32 |

| 90 | Window dressings | 46% | $564 |

| 91 | Magnesium carbonate | 46% | $97 |

| 92 | Other carpets | 45% | $132 |

| 93 | Plastic wash basins | 45% | $273 |

| 94 | Smoking pipes | 45% | $12 |

| 95 | Electromagnets | 45% | $487 |

| 96 | Other zinc products | 44% | $125 |

| 97 | Pulley systems | 44% | $653 |

| 98 | Waterproof footwear | 44% | $65 |

| 99 | Non-knit gloves | 43% | $122 |

| 100 | Carbides | 42% | $147 |

| 101 | Telephones | 42% | $50,085 |

| 102 | Tool sets | 42% | $38 |

| 103 | Bicycles, delivery tricycles, other cycles | 42% | $417 |

| 104 | Medical furniture | 42% | $537 |

| 105 | Locust beans, seaweed, sugar beet, cane | 41% | $100 |

| 106 | Microphones and headphones | 41% | $5,365 |

| 107 | Iron anchors | 41% | $18 |

| 108 | Monopods, bipods, tripods and similar articles | 41% | $24 |

| 109 | Eyewear | 40% | $1,023 |

| 110 | Scarves | 40% | $124 |

| 111 | Other hand tools | 39% | $570 |

| 112 | Electric musical instruments | 39% | $232 |

| 113 | Rubber stamps | 39% | $14 |

| 114 | Iron toiletry | 38% | $238 |

| 115 | Scales | 38% | $329 |

| 116 | Iron oxides and hydroxides | 38% | $82 |

| 117 | Felt or coated fabric garments | 38% | $825 |

| 118 | Metal office supplies | 38% | $57 |

| 119 | Other knit garments | 37% | $550 |

| 120 | Motor-working tools | 37% | $2,742 |

| 121 | Light fixtures | 36% | $3,344 |

| 122 | Garments of impregnated fabric | 36% | $67 |

| 123 | Hand tools | 36% | $169 |

| 124 | Percussion | 36% | $42 |

| 125 | Pens | 35% | $393 |

| 126 | Textile footwear | 35% | $2,760 |

| 127 | Saddlery | 35% | $198 |

| 128 | Spring, air, and gas guns | 35% | $73 |

| 129 | Carboxyimide compounds | 35% | $102 |

| 130 | Other wood articles | 35% | $597 |

| 131 | Electrical insulators | 34% | $135 |

| 132 | Knit women’s undergarments | 34% | $1,100 |

| 133 | House linens | 34% | $1,989 |

| 134 | Toilet paper | 34% | $678 |

| 135 | Wind instruments | 34% | $97 |

| 136 | Metal mountings | 34% | $2,945 |

| 137 | Plastic floor coverings | 34% | $1,419 |

| 138 | Knit active wear | 33% | $226 |

| 139 | Garden tools | 33% | $136 |

| 140 | Titanium oxides | 33% | $20 |

| 141 | Video displays | 33% | $6,770 |

| 142 | Bi-wheel vehicle parts | 33% | $519 |

| 143 | Video recording equipment | 33% | $179 |

| 144 | Glass beads | 32% | $45 |

| 145 | Therapeutic appliances | 32% | $2,033 |

| 146 | Safety glass | 31% | $416 |

| 147 | Pencils and crayons | 31% | $99 |

| 148 | Iron chains | 31% | $216 |

| 149 | Knitted hats | 31% | $654 |

| 150 | Non-knit women’s coats | 29% | $562 |

| 151 | Printed circuit boards | 29% | $747 |

| 152 | Iron cloth | 29% | $168 |

| 153 | Vacuum cleaners | 29% | $896 |

| 154 | Other cast iron products | 29% | $160 |

| 155 | Sound recordings | 29% | $448 |

| 156 | Ketones and quinones | 28% | $278 |

| 157 | Paper notebooks | 28% | $269 |

| 158 | Ornamental trimmings | 28% | $11 |

| 159 | Rubber inner tubes | 28% | $21 |

| 160 | Non-knit men’s coats | 28% | $547 |

| 161 | Wrenches | 27% | $227 |

| 162 | Other women’s undergarments | 27% | $640 |

| 163 | Vending machines | 27% | $70 |

| 164 | Embroidery | 27% | $29 |

| 165 | Labels | 26% | $11 |

| 166 | Other metals | 26% | $182 |

| 167 | Seats | 26% | $6,582 |

| 168 | Oxygen heterocyclic compounds | 26% | $432 |

| 169 | Knit men’s undergarments | 26% | $427 |

| 170 | Chromium oxides and hydroxides | 26% | $6.8 |

| 171 | Computers | 26% | $35,473 |

| 172 | Copper housewares | 26% | $25 |

| 173 | Nucleic acids | 25% | $880 |

| 174 | Basketwork | 24% | $140 |

| 175 | Boat propellers | 24% | $149 |

| 176 | Vegetable and mineral carvings | 24% | $96 |

| 177 | Knit women’s coats | 24% | $199 |

| 178 | Twine, cordage or rope; knotted netting, fishing nets and other nets, of textile materials | 24% | $13 |

| 179 | Time switches | 24% | $15 |

| 180 | Nitrogen heterocyclic compounds | 24% | $1,167 |

| 181 | Oxygen amino compounds | 24% | $425 |

| 182 | Motorcycles and cycles | 23% | $907 |

| 183 | Calculators | 23% | $260 |

| 184 | Non-knit active wear | 23% | $536 |

| 185 | Padlocks | 23% | $662 |

| 186 | Wool grease | 23% | $5.8 |

| 187 | Wallpaper | 23% | $27 |

| 188 | Trunks and cases | 23% | $2,613 |

| 189 | Iron nails | 23% | $220 |

| 190 | Aluminum ore | 22% | $35 |

| 191 | Air pumps | 22% | $3,494 |

| 192 | Coated textile fabric | 22% | $23 |

| 193 | Knit babies’ garments | 22% | $374 |

| 194 | Carboxyamide compounds | 22% | $249 |

| 195 | Household washing machines | 22% | $502 |

| 196 | Non-knit women’s undergarments | 22% | $106 |

| 197 | Other furniture | 22% | $5,718 |

| 198 | Woodworking machines | 21% | $297 |

| 199 | Worked slate | 21% | $9.8 |

| 200 | Vegetable saps | 21% | $348 |

| 201 | Non-knit women’s suits | 21% | $2,160 |

| 202 | Woven fabric of synthetic staple fibers | 21% | $8.1 |

| 203 | Commodities not elsewhere specified | 21% | $5,136 |

| 204 | Rubber apparel | 21% | $558 |

| 205 | Balances | 21% | $25 |

| 206 | Leather footwear | 21% | $2,404 |

| 207 | Glass bottles | 21% | $343 |

| 208 | Knit women’s suits | 21% | $1,106 |

| 209 | Plastic building materials | 21% | $578 |

| 210 | Barium sulphate | 20% | $40 |

| 211 | Knit sweaters | 20% | $2,570 |

| 212 | Refrigerators | 19% | $2,585 |

| 213 | Air conditioners | 19% | $2,876 |

| 214 | Wooden tool handles | 19% | $9.2 |

| 215 | Sanitary towels (pads) | 19% | $341 |

| 216 | Vegetable alkaloids | 19% | $86 |

| 217 | Navigation equipment | 18% | $799 |

| 218 | Carboxylic acids | 18% | $267 |

| 219 | Decals | 18% | $20 |

| 220 | Stone working machines | 18% | $67 |

| 221 | Non-knit women’s shirts | 18% | $326 |

| 222 | Non-knit babies’ garments | 18% | $58 |

| 223 | Aluminum foil | 18% | $243 |

| 224 | Watch cases and parts | 18% | $4.6 |

| 225 | Knit men’s coats | 17% | $142 |

| 226 | Copper pipe fittings | 17% | $178 |

| 227 | Gum coated textile fabric | 17% | $14 |

| 228 | Broadcasting equipment | 17% | $1,924 |

| 229 | Refractory bricks | 17% | $47 |

| 230 | Warp knit fabrics | 16% | $55 |

| 231 | Inhalable tobacco/nicotine products | 16% | $93 |

| 232 | Stranded iron wire | 16% | $155 |

| 233 | Metal molds | 16% | $359 |

| 234 | Hydrazine or hydroxylamine derivatives | 16% | $23 |

| 235 | Pearls | 15% | $12 |

| 236 | Spices | 15% | $62 |

| 237 | Onions | 15% | $126 |

| 238 | Building stone | 14% | $395 |

| 239 | Vegetable waxes and beeswax | 14% | $9.4 |

| 240 | Hand saws | 14% | $126 |

| 241 | Packing bags | 14% | $98 |

| 242 | Agglomerated cork | 14% | $17 |

| 243 | Audio alarms | 14% | $519 |

| 244 | Hot-rolled stainless steel bars | 14% | $20 |

| 245 | Book-binding machines | 14% | $29 |

| 246 | Silk fabrics | 14% | $5.3 |

| 247 | Metal stoppers | 13% | $138 |

| 248 | Letter stock | 13% | $28 |

| 249 | Conveyor belt textiles | 13% | $15 |

| 250 | Rolling machines | 13% | $46 |

| 251 | Electrical ignitions | 13% | $590 |

| 252 | Retail artificial filament yarn | 13% | $5.3 |

| 253 | Rubber belting | 13% | $105 |

| 254 | Other leather articles | 13% | $19 |

| 255 | Sewing machines | 13% | $53 |

| 256 | Other vegetable oils | 13% | $31 |

| 257 | Textile wall coverings | 13% | $4.7 |

| 258 | Tufted carpets | 13% | $138 |

| 259 | Casting machines | 13% | $60 |

| 260 | Fish fillets | 13% | $951 |

| 261 | Mirrors and lenses | 13% | $195 |

| 262 | Diazo, azo or azoxy compounds | 13% | $6.2 |

| 263 | Electric motors | 12% | $1,603 |

| 264 | Furskin apparel | 12% | $12 |

| 265 | Industrial printers | 12% | $1,787 |

| 266 | Iron wire | 12% | $75 |

| 267 | Electrical transformers | 12% | $3,539 |

| 268 | Milling stones | 12% | $68 |

| 269 | Other office machines | 12% | $116 |

| 270 | Granulated slag | 12% | $26 |

| 271 | Other heating machinery | 12% | $1,066 |

| 272 | Other clocks and watches | 12% | $6.5 |

| 273 | Sulfonamides | 12% | $134 |

| 274 | Dried/salted/smoked/brined fish | 12% | $49 |

| 275 | Leather apparel | 12% | $164 |

| 276 | Non-knit men’s undergarments | 12% | $26 |

| 277 | Polycarboxylic acids | 12% | $181 |

| 278 | Electrical parts | 11% | $35 |

| 279 | Antimony | 11% | $11 |

| 280 | Engine parts | 11% | $1,228 |

| 281 | Insulated wire | 11% | $3,448 |

| 282 | Rubber pipes | 11% | $253 |

| 283 | Aluminum structures | 11% | $307 |

| 284 | Electrical resistors | 11% | $109 |

| 285 | Non-knit men’s suits | 11% | $884 |

| 286 | Other electrical machinery | 11% | $1,798 |

| 287 | Electrical capacitors | 11% | $200 |

| 288 | Motor vehicles; parts and accessories | 11% | $9,059 |

| 289 | Worked ivory and bone | 11% | $4.3 |

| 290 | Hard rubber | 11% | $3.3 |

| 291 | Other processed fruits and nuts | 11% | $449 |

| 292 | Microscopes | 11% | $60 |

| 293 | Radio receivers | 11% | $404 |

| 294 | Unprocessed artificial staple fibers | 11% | $26 |

| 295 | Electric motor parts | 11% | $368 |

| 296 | Knit men’s suits | 10% | $234 |

| 297 | Other processed vegetables | 10% | $202 |

| 298 | Insulating glass | 10% | $37 |

| 299 | Other meat | 10% | $6.6 |

| 300 | Retail artificial staple fibers yarn | 10% | $15 |

| 301 | Tea | 10% | $55 |

| 302 | Razor blades | 10% | $67 |

| 303 | Iron structures | 10% | $854 |

| 304 | Non-knit men’s shirts | 10% | $261 |

| 305 | Non-mechanical removal machinery | 10% | $90 |

| 306 | Other slag and ash | 10% | $3.6 |

| 307 | Pepper | 9% | $104 |

| 308 | Wood fiberboard | 9% | $120 |

| 309 | Machinery having individual functions | 9% | $1,265 |

| 310 | Papermaking machines | 9% | $67 |

| 311 | Metalworking machines | 9% | $30 |

| 312 | Retail cotton yarn | 9% | $4.5 |

| 313 | Dried fruits | 9% | $32 |

| 314 | Office machine parts | 9% | $4,499 |

| 315 | Knit t-shirts | 9% | $572 |

| 316 | Knitting machines | 9% | $11 |

| 317 | Light pure woven cotton | 9% | $32 |

| 318 | Steel wire | 9% | $20 |

| 319 | Fork-lifts | 8% | $691 |

| 320 | Knit women’s shirts | 8% | $167 |

| 321 | Hand-woven rugs | 8% | $130 |

| 322 | Stone processing machines | 8% | $178 |

| 323 | Gelatin | 8% | $24 |

| 324 | Pumice | 8% | $4.6 |

| 325 | Drilling machines | 8% | $30 |

| 326 | Light mixed woven cotton | 8% | $4.1 |

| 327 | Electrical lighting and signaling equipment | 8% | $532 |

| 328 | Pharmaceutical rubber products | 8% | $6.3 |

| 329 | Cement articles | 8% | $198 |

| 330 | Jute woven fabric | 8% | $3.0 |

| 331 | Other live plants, cuttings and slips; mushroom spawn |

8% | $70 |

| 332 | Iron pipes | 7% | $224 |

| 333 | Other agricultural machinery | 7% | $95 |

| 334 | Washing and bottling machines | 7% | $431 |

| 335 | Sugar preserved foods | 7% | $2.5 |

| 336 | Knit men’s shirts | 7% | $153 |

| 337 | Leather machinery | 7% | $2.3 |

| 338 | Feldspar | 7% | $18 |

| 339 | Rubberworking machinery | 7% | $228 |

| 340 | Metal-rolling mills | 7% | $95 |

| 341 | Lifting machinery | 7% | $545 |

| 342 | Electrical control boards | 7% | $1,252 |

| 343 | Blown glass | 6% | $4.8 |

| 344 | Mollusks | 6% | $78 |

| 345 | Flax woven fabric | 6% | $7.9 |

| 346 | Magnesium | 6% | $22 |

| 347 | Used rubber tires | 6% | $29 |

| 348 | Central heating boilers | 6% | $29 |

| 349 | Pasta | 6% | $109 |

| 350 | Textile processing machines | 6% | $117 |

| 351 | Traffic signals | 6% | $28 |

| 352 | Glass with edge workings | 6% | $14 |

| 353 | Other vegetable products | 6% | $10 |

| 354 | Packaged medications | 6% | $6,146 |

| 355 | Plant foliage | 6% | $15 |

| 356 | Quilted textiles | 6% | $1.5 |

| 357 | Tobacco processing machines | 6% | $5.4 |

| 358 | Wood carpentry | 6% | $188 |

| 359 | Frozen vegetables | 6% | $80 |

| 360 | Candles | 6% | $62 |

| 361 | Perfume plants | 6% | $29 |

| 362 | Processed fish | 6% | $116 |

| 363 | Scrap nickel | 6% | $22 |

| 364 | Yeast | 6% | $31 |

| 365 | Tool plates | 5% | $57 |

| 366 | Copper plating | 5% | $54 |

| 367 | Other paper machinery | 5% | $75 |

| 368 | Polyamide fabric | 5% | $16 |

| 369 | Other non-metal removal machinery | 5% | $14 |

| 370 | Large construction vehicles | 5% | $529 |

| 371 | Fruit juice | 5% | $189 |

| 372 | Other edible animal products | 5% | $1.1 |

| 373 | Plywood | 5% | $138 |

| 374 | Processed crustaceans | 5% | $148 |

| 375 | Unprocessed synthetic staple fibers | 5% | $36 |

| 376 | Confectionery sugar | 5% | $149 |

| 377 | Other animals | 5% | $15 |

| 378 | Radioactive chemicals | 5% | $324 |

| 379 | Metal-clad products | 5% | $2.7 |

| 380 | Nitrites and nitrates | 5% | $6.4 |

| 381 | Antiques | 4% | $36 |

| 382 | Coffee and tea extracts | 4% | $56 |

| 383 | Pianos | 4% | $4.5 |

| 384 | Reclaimed rubber | 4% | $4.5 |

| 385 | Metal finishing machines | 4% | $22 |

| 386 | Tapioca | 4% | $2.3 |

| 387 | Forging machines | 4% | $70 |

| 388 | Insect resins | 4% | $5.4 |

| 389 | Rubber tires | 4% | $760 |

| 390 | Photographic plates | 4% | $28 |

| 391 | Textile scraps | 4% | $4.5 |

| 392 | Other oily seeds | 4% | $16 |

| 393 | Processed mushrooms | 4% | $4.9 |

| 394 | Cranes | 4% | $66 |

| 395 | Tungsten ore | 3% | $1.6 |

| 396 | Animal extracts | 3% | $0.78 |

| 397 | Base metal watches | 3% | $160 |

| 398 | Paper pulp filter blocks | 3% | $0.65 |

| 399 | Felt machinery | 3% | $3.4 |

| 400 | Revolution counters | 3% | $49 |

| 401 | Curbstones | 3% | $2.7 |

| 402 | Other small iron pipes | 3% | $111 |

| 403 | Salt | 3% | $15 |

| 404 | Jewelry | 3% | $411 |

| 405 | Blank audio media | 3% | $504 |

| 406 | Pickled foods | 3% | $17 |

| 407 | Cobalt oxides and hydroxides | 3% | $0.90 |

| 408 | Other pure vegetable oils | 3% | $27 |

| 409 | Semiconductor devices | 3% | $557 |

| 410 | Aircraft parts for spacecraft, UAVs, and ground equipment | 2% | $384 |

| 411 | Iron blocks | 2% | $26 |

| 412 | Starches | 2% | $11 |

| 413 | Carded wool or animal hair fabric | 2% | $0.58 |

| 414 | Collector’s items | 2% | $7.3 |

| 415 | Utility meters | 2% | $41 |

| 416 | Densified wood | 2% | $0.65 |

| 417 | Linoleum | 2% | $0.69 |

| 418 | Copper pipes | 2% | $23 |

| 419 | Photographic paper | 2% | $0.46 |

| 420 | Metal lathes | 2% | $19 |

| 421 | Vegetable parchment | 2% | $7.5 |

| 422 | Coated flat-rolled iron | 2% | $102 |

| 423 | Spice seeds | 2% | $2.2 |

| 424 | Cars | 2% | $3,588 |

| 425 | Gas turbines | 2% | $497 |

| 426 | Gravel and crushed stone | 2% | $4.1 |

| 427 | Knotted carpets | 2% | $5.7 |

| 428 | Non-retail artificial staple fibers yarn | 2% | $0.32 |

| 429 | Synthetic reconstructed jewelry stones | 2% | $17 |

| 430 | Cigarette paper | 1% | $3.9 |

| 431 | Chlorates and perchlorates | 1% | $2.4 |

| 432 | Ground nut oil | 1% | $0.94 |

| 433 | Shaped wood | 1% | $19 |

| 434 | Cloves | 1% | $0.35 |

| 435 | Retail wool or animal hair yarn | 1% | $0.65 |

| 436 | Dolomite | 1% | $0.52 |

| 437 | Ferroalloys | 1% | $28 |

| 438 | Hydrochloric acid | 1% | $0.77 |

| 439 | Combed wool or animal hair fabric | 1% | $0.59 |

| 440 | Leather further prepared after tanning or crusting of animals (other than ovine) | 1% | $0.30 |

| 441 | Wood charcoal | 1% | $1.1 |

| 442 | Aquatic invertebrates, other than crustaceans and mollusks | 0.9% | $0.50 |

| 443 | Non-retail combed wool yarn | 0.9% | $0.42 |

| 444 | Other large iron pipes | 0.9% | $6.8 |

| 445 | Baked goods | 0.8% | $88 |

| 446 | Coin | 0.8% | $22 |

| 447 | Leather of other animals | 0.8% | $2.7 |

| 448 | Nutmeg, mace and cardamons | 0.8% | $0.37 |

| 449 | Other firearms | 0.8% | $5.4 |

| 450 | Perfumes | 0.8% | $45 |

| 451 | Preserved vegetables | 0.8% | $0.38 |

| 452 | Watch movements | 0.8% | $0.24 |

| 453 | Tissue | 0.7% | $4.1 |

| 454 | Aluminum wire | 0.6% | $5.7 |

| 455 | Cinnamon | 0.6% | $0.96 |

| 456 | Raw iron bars | 0.6% | $5.0 |

| 457 | Vaccines, blood, antisera, toxins and cultures | 0.6% | $618 |

| 458 | Hard liquor | 0.5% | $59 |

| 459 | Jams | 0.5% | $3.2 |

| 460 | Sawn wood | 0.5% | $38 |

| 461 | Stranded aluminum wire | 0.5% | $2.0 |

| 462 | Vehicle bodies for the motor vehicles | 0.5% | $3.8 |

| 463 | Biodiesel and mixtures thereof | 0.4% | $6.9 |

| 464 | Coconut and other vegetable fibers | 0.4% | $0.19 |

| 465 | Live fish | 0.4% | $0.34 |

| 466 | Natural cork articles | 0.4% | $0.66 |

| 467 | Chocolate | 0.3% | $15 |

| 468 | Frozen fruits and nuts | 0.3% | $3.8 |

| 469 | Hat forms | 0.3% | $0.14 |

| 470 | Metalworking transfer machines | 0.3% | $3.9 |

| 471 | Particle board | 0.3% | $7.3 |

| 472 | Pitch coke | 0.3% | $0.27 |

| 473 | Tractors | 0.3% | $48 |

| 474 | Zinc oxide and peroxide | 0.3% | $0.94 |

| 475 | Citrus | 0.2% | $3.2 |

| 476 | Coffee | 0.2% | $22 |

| 477 | Crustaceans | 0.2% | $13 |

| 478 | Cut flowers | 0.2% | $3.8 |

| 479 | Gypsum | 0.2% | $0.40 |

| 480 | Halogens | 0.2% | $0.67 |

| 481 | Linseed | 0.2% | $0.25 |

| 482 | Motor vehicle chassis fitted with engine | 0.2% | $0.39 |

| 483 | Other fermented beverages | 0.2% | $0.70 |

| 484 | Other vegetables | 0.2% | $11 |

| 485 | Precious stones | 0.2% | $4.7 |

| 486 | Processed cereals | 0.2% | $0.95 |

| 487 | Raw lead | 0.2% | $1.5 |

| 488 | Seed oils | 0.2% | $0.49 |

| 489 | Semi-finished iron | 0.2% | $5.6 |

| 490 | Stainless steel ingots | 0.2% | $1.1 |

| 491 | Uncoated paper | 0.2% | $3.7 |

| 492 | Wheat flours | 0.2% | $0.61 |

| 493 | Wheat gluten | 0.2% | $0.67 |

| 494 | Aircraft launch gear | 0.1% | $0.48 |

| 495 | Bananas | 0.1% | $1.7 |

| 496 | Beer | 0.1% | $3.9 |

| 497 | Cereal flours | 0.1% | $0.42 |

| 498 | Chromium ore | 0.1% | |

| 499 | Cocoa powder | 0.1% | $0.23 |

| 500 | Nitrogenous fertilizers | 0.1% | $2.3 |

| 501 | Other vegetable residues | 0.1% | $1.1 |

| 502 | Precious metal watches | 0.1% | $2.2 |

| 503 | Raw sugar | 0.1% | $2.5 |

| 504 | Raw zinc | 0.1% | $2.0 |

| 505 | Sulphur | 0.1% | $0.48 |

| 506 | Tropical fruits | 0.1% | $4.2 |

| 507 | Unglazed ceramics | 0.1% | $1.2 |

| 508 | Water | 0.1% | $0.67 |

| 509 | Ammonia | ||

| 510 | Asphalt mixtures | ||

| 511 | Borax | ||

| 512 | Bovine | ||

| 513 | Bovine, sheep, and goat fat | ||

| 514 | Bulbs and roots | ||

| 515 | Butter | ||

| 516 | Calcium phosphates | ||

| 517 | Casein | ||

| 518 | Cement | $0.52 | |

| 519 | Cocoa beans | ||

| 520 | Cocoa butter | ||

| 521 | Cocoa paste | ||

| 522 | Coconut oil | $0.52 | |

| 523 | Coconuts, brazil nuts, and cashews | ||

| 524 | Cucumbers | ||

| 525 | Delivery trucks | $12 | |

| 526 | Diamonds | $0.93 | |

| 527 | Electricity | ||

| 528 | Grapes | $0.20 | |

| 529 | Handguns | ||

| 530 | Honey | ||

| 531 | Horses | ||

| 532 | Hot-rolled iron bars | $0.25 | |

| 533 | Iron reductions | ||

| 534 | Legumes | $0.13 | |

| 535 | Manganese ore | ||

| 536 | Melons | ||

| 537 | Molasses | ||

| 538 | Newsprint | ||

| 539 | Non-fillet fresh fish | $0.92 | |

| 540 | Oats | ||

| 541 | Olive oil | ||

| 542 | Other animal fats | ||

| 543 | Other fruits | $2.9 | |

| 544 | Other precious metal products | $2.9 | |

| 545 | Palm oil | ||

| 546 | Peat | ||

| 547 | Phosphatic fertilizers | ||

| 548 | Pig iron | ||

| 549 | Pigs | ||

| 550 | Planes, helicopters, and/or spacecraft | $0.14 | |

| 551 | Platinum | $0.32 | |

| 552 | Potassic fertilizers | $0.28 | |

| 553 | Pure olive oil | ||

| 554 | Rapeseed oil | $0.56 | |

| 555 | Raw aluminum | $2.7 | |

| 556 | Raw nickel | $0.48 | |

| 557 | Raw tin | $0.11 | |

| 558 | Refined copper | $2.3 | |

| 559 | Rolled tobacco | $0.49 | |

| 560 | Rubber | $0.40 | |

| 561 | Rye | ||

| 562 | Self-propelled rail transport | ||

| 563 | Semi chemical woodpulp | ||

| 564 | Sheep and goat meat | ||

| 565 | Silver | $0.48 | |

| 566 | Steel bars | ||

| 567 | Steel ingots | $0.16 | |

| 568 | Sulfite chemical woodpulp | ||

| 569 | Sulfuric acid | ||

| 570 | Titanium ore | ||

| 571 | Tomatoes | ||

| 572 | Uranium and thorium ore | ||

| 573 | Vanilla | ||

| 574 | Vermouth | ||

| 575 | Wine | $0.12 | |

| 576 | Zinc powder |

About the data

We analyzed U.S. International Trade Commission data on goods imported for consumption in 2024. We used product descriptions from the Observatory of Economic Complexity to label the goods, and edited these descriptions lightly.

For the lists of major imports and exports, and the full searchable list, we grouped goods using the first four digits of their code in the Harmonized Tariff Schedule, which lists categories of products. For more specific lists of goods within these categories, we looked at the first six digits of the product code.

We excluded goods that are widely produced in the U.S., using export data to remove goods where the U.S. exports at least 50 percent of what it imports by value. (We did not do this for the critical minerals or imports by quantity data.)

Business

AI is changing shopping. Will consumers buy in?

Carolyn Bennett remembers flipping through a yellow telephone book in the 1980s to find carpet stores and workers who refinished wood to help renovate her home.

Today, the 67-year-old uses a chatbot to help her shop. Bennett has turned to ChatGPT, which she refers to as “Chat,” to find vendors for a kitchen renovation project, compare heat pumps and weigh in on whether she should buy a convection oven.

The San Francisco resident could have browsed websites on Google, but she prefers using ChatGPT to save time.

“Any product that has multiple features that you want to compare across different products, I think it’s super helpful,” she said.

The rising popularity of artificial intelligence-powered chatbots that can generate text and images is already changing the way people brainstorm ideas, write and research. Tech companies and payment services are also betting that AI will transform how people shop. They’re even experimenting with AI agents that can place orders on a customer’s behalf with their permission.

Google, Amazon and other major tech platforms envision a future where online shopping becomes even more personalized and proactive. But companies will also have to convince consumers to buy into the idea, ensuring them that they’re protecting their privacy and providing accurate results.

AI chatbots have spewed out incorrect or nonsensical information before. And shoppers might be reluctant to give control to AI agents, especially when it comes to handing them their credit card, some retail experts said.

“There’s a lot of concern about the reliability of these kinds of tools,” said Rachel Wolff, a retail and ecommerce analyst at eMarketer. “So you might not want to trust these agents fully to make decisions on your behalf.”

For now, AI shopping experiences are growing. Last month, OpenAI said it’s experimenting with new shopping features, including a way to see images and prices of several products along with links for people to buy the items.

Perplexity, which introduced a new feature last year that allows subscribers to buy items through its chatbot, also teamed up with Visa to help improve its shopping experience in the future.

“Visa knows a lot about its customers, and if customers opt in, there can be that anonymized data sharing, so that the recommendations you get in Perplexity are in line with your kind of purchase and transaction history so you can get better quality answers,” said Dmitry Shevelenko, Perplexity’s chief business officer.

(The Los Angeles Times partners with Perplexity to generate summaries of ideas expressed in opinion pieces.)

These efforts are still early, but AI companies are also trying to differentiate themselves from rivals such as Amazon and Google that also have chatbots and AI shopping features. Both Perplexity and OpenAI note the products shown within their chatbots are not ads. The chatbots cite websites that review and rate mattresses, coffee makers and other products.

Google also is stepping up its AI shopping features as it competes with OpenAI. Last week, the search giant said in the coming months people will be able to use AI mode, a tool where people can ask questions and get answers like they would to a chatbot, to find and compare products. The tool is powered by Google’s AI model Gemini.

Vidhya Srinivasan, who leads the Ads and Commerce teams at Google, said Monday in a press briefing before Google’s annual I/O developers conference that the company displays search results in AI mode based on what’s most relevant to questions people are asking.

Some of the results also highlighted reviews from websites, but Google has more than 50 billion product listings and that information gets refreshed.

“We’re doing even more personalization in this mode, where we get to personalize based on brands and styles,” Srinivasan said.

The Mountain View-based company is exploring and experimenting with ads in their AI shopping experiences. Google unveiled other AI shopping tools, including a way to try out clothes virtually and buy products when the price falls.

Visa executives say they envision a future in which AI agents will book plane tickets, hotel rooms and other services and products on behalf of the customer with their approval.

Rajat Taneja, president of technology for Visa, said that people will be able to set limits around what an AI agent could purchase like when someone hands over their credit card to a friend, family member or assistant, to help them shop.

The San Francisco-based payment company, partnering with such AI companies as OpenAI, Perplexity and Anthropic, unveiled a new initiative in late April to enable AI agents to shop and buy products for people but that work is still being tested.

Product recommendations, he said, will only get more personalized in the future.

“They’re going to be different ways in which this will manifest itself, much like the analogy of the internet has evolved in so many different ways,” Taneja said. “The most important thing is we are all unique, in our likes, in our dislikes, in what we gravitate towards and what we buy.”

Consumers are already using generative AI for shopping, research shows. Adobe Analytics, which surveyed 5,000 U.S. consumers, said that 39% reported using generative AI for online shopping and 53% planned to do so this year. Shoppers used generative AI for research, product recommendations, deals and other shopping tasks, according to the survey.

Capgemini Research Institute, which surveyed 12,000 adult consumers across 12 countries, found that 24% of consumers used generative AI in shopping experiences. The use was higher among Gen Z and millennials compared to Gen X and boomers. But the survey also found that consumer satisfaction with generative AI also fell.

Elliot Padfield, a 21-year-old growth marketing consultant in San Francisco, uses AI for other tasks but he says the shopping experience has fallen short. As a result, he doesn’t always trust a chatbot’s recommendations.

When he tried out shopping on Perplexity for the first time, his order never arrived but he was able to get a refund.

And while chatbots can provide a comparison of four types of wireless headphones, for example, he wants more information about how the recommendations fit his needs and priorities.

“I still have to guide the AI through supporting me in the way that I need it to,” he said. “I actually find it easier at that point to then just go to the retailer.”

From going to the mall to shopping on websites or through social media, retail experts see generative AI as just another option for consumers.

Retailers will have to learn how to navigate chatbots that might not recommend their products. But AI could also level the playing field for small businesses, experts say, if the results aren’t based on optimizing for a search engine or buying a ton of ads.

Caroline Reppert, director of AI and Technology Policy at the National Retail Federation, said she thinks generative AI is here to stay. Ultimately retailers will meet consumers where they are, she said.

“The trend is kind of still emerging and we’ll see if it ends up being an enduring one,” Reppert said.

Business

Apple is back in Trump's crosshairs over where iPhones are made

Apple Chief Executive Tim Cook can’t seem to catch a break.

Last month, Apple appeared to secure a major win when the Trump administration agreed to remove tariffs on certain electronics imported from China following concerns that the prices of smartphones and computers could rise.

But Trump threw Apple another curveball this week when he expressed frustration about the tech giant producing the iPhone in other parts of Asia.

“I have long ago informed Tim Cook of Apple that I expect their iPhone’s that will be sold in the United States of America will be manufactured and built in the United States, not India, or anyplace else. If that is not the case, a Tariff of at least 25% must be paid by Apple to the U.S.,” Trump said in a post Friday on the social network Truth Social.

Apple didn’t respond to a request for comment about Trump’s remarks.

The public spat underscores the fine line businesses are trying to walk as they try to navigate Trump’s tariffs. Tech companies in particular have to work with the new administration, while also trying to find ways to offset the costs of potential tariffs.

Trump has pushed for companies to build and manufacture products in the United States as part of an effort to strengthen national and economic security.

But shifting production to the United States would take years and result in price hikes for consumers who are already watching their spending, economists and analysts have said.

“We believe the concept of Apple producing iPhones in the U.S. is a fairy tale that is not feasible,” Wedbush Securities analyst Dan Ives said in a note Friday about Trump’s remarks.

However, Trump told reporters later Friday that he believes Apple can build an iPhone in the United States.

The tariffs are expected to start in June and would also impact Samsung and other smartphone makers “otherwise it wouldn’t be fair,” he added.

“I had an understanding with Tim that he wouldn’t be doing this. He said he’s going to India to build plants. I said, ‘That’s OK to go to India, but you’re not going to sell into here without tariffs.’ And that’s the way it is,” Trump told reporters in the Oval Office.

Apple makes most of its iPhones in China, but in recent years has expanded production in India, Vietnam and other countries.

In the June quarter, Apple expects to source the majority of iPhones sold in the United States from India, Cook said in Apple’s quarterly earnings call in May.

And Foxconn, a Taiwanese electronics contract manufacturer that assembles Apple’s products, is planning to build a $1.5-billion plant in India, the Financial Times reported, citing two anonymous government officials. A representative of Foxconn could not be reached for comment.

Ives said it would take at least five years for Apple to shift production to the U.S. and the prices of iPhones could reach $3,500 if the smartphone was made in America. Depending on the model, the current cost of an iPhone can start from $599 but go over $1,000.

Tariffs would also make it more expensive to repair an iPhone because the smartphone includes parts that come from suppliers in other countries including China, Taiwan, South Korea and Japan, according to iFixit, an ecommerce website focused on repairs. For example, the display for the iPhone 16 Pro comes from South Korea; the battery comes from China.

In total, the iPhone 16 Pro is made up of roughly 2,700 parts sourced from 187 suppliers in 28 countries, according to an April report from TechInsights.

Apple isn’t alone in navigating the potential impact of tariffs. Other U.S. companies including Walmart have said they would raise prices as they face political pressure to eat the costs of tariffs.

Apple is in a tricky spot because if the Cupertino, Calif.-based company raises the prices of iPhones, consumers could just delay buying new electronics, which would also cut into the company’s profits at a time when it is facing heavy competition from rivals in the burgeoning market for AI.

On top of that, Trump has also criticized companies such as El Segundo toy maker Mattel, which is considering raising prices, and Amazon, which considered showing the cost of tariffs next to some of its products, but didn’t approve the idea.

Cook has previously said that while there’s a popular conception that companies go to China for low labor costs, the reason Apple depends on China is for the skill of its workforce.

“In the U.S., you could have a meeting of tooling engineers and I’m not sure we could fill the room. In China, you could fill multiple football fields. It’s that vocational expertise that is very deep,” Cook said at the Fortune Global Forum in 2017.

For a time, it seemed that Apple was in Trump’s good graces. The company has garnered praise from Trump when the smartphone maker announced in February that it planned to invest $500 billion in the United States, hire 20,000 people and open a new manufacturing factory in Texas over the next four years.

Trump’s on-again, off-again tariffs have meant that businesses such as Apple are also facing economic uncertainty.

Last week, the U.S. struck a deal with Chinese officials to roll back most tariffs for 90 days. The U.S. agreed to drop the 145% tax Trump imposed on Chinese goods to 30%.

Apple has been monitoring the potential impact of tariffs. In May, Apple estimated that tariffs could add $900 million to the company’s costs, but that assumed new tariffs weren’t added.

On Friday, Apple’s stock dropped roughly 2% to $195.98 per share after Trump’s announcement.

-

Technology1 week ago

Technology1 week agoLove, Death, and Robots keeps a good thing going in volume 4

-

Technology1 week ago

Technology1 week agoMeta asks judge to throw out antitrust case mid-trial

-

World1 week ago

World1 week agoCommissioner Hansen presents plan to cut farming bureaucracy in EU

-

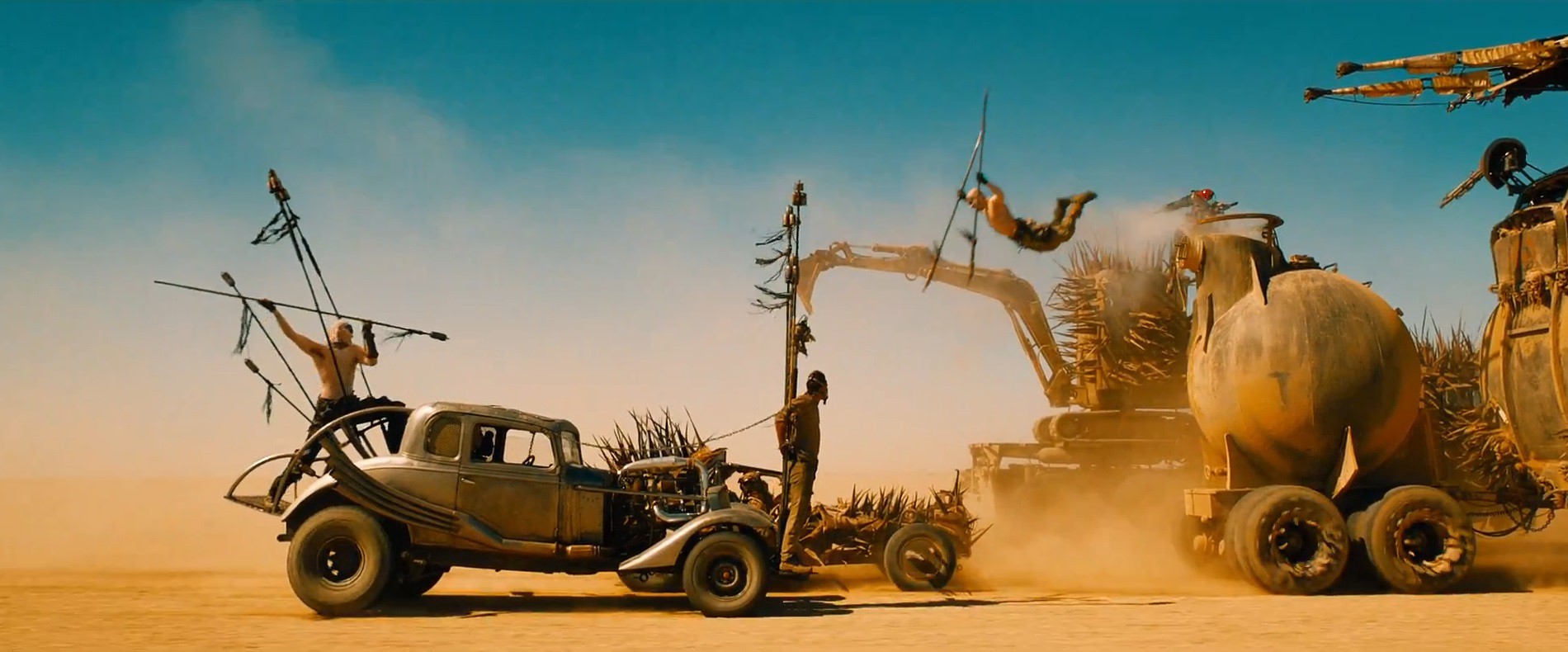

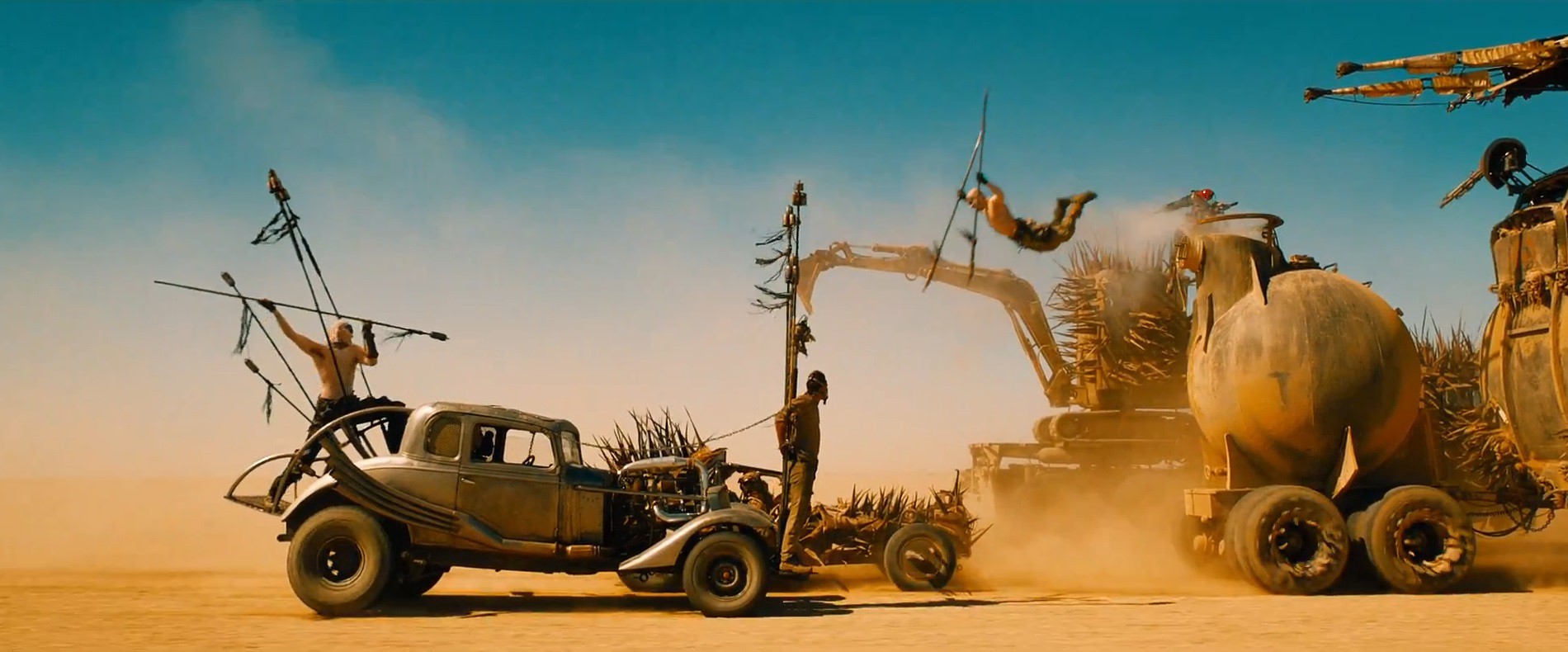

Movie Reviews1 week ago

Movie Reviews1 week agoClassic Film Review: ‘Mad Max: Fury Road’ is a Lesson in Redemption | InSession Film

-

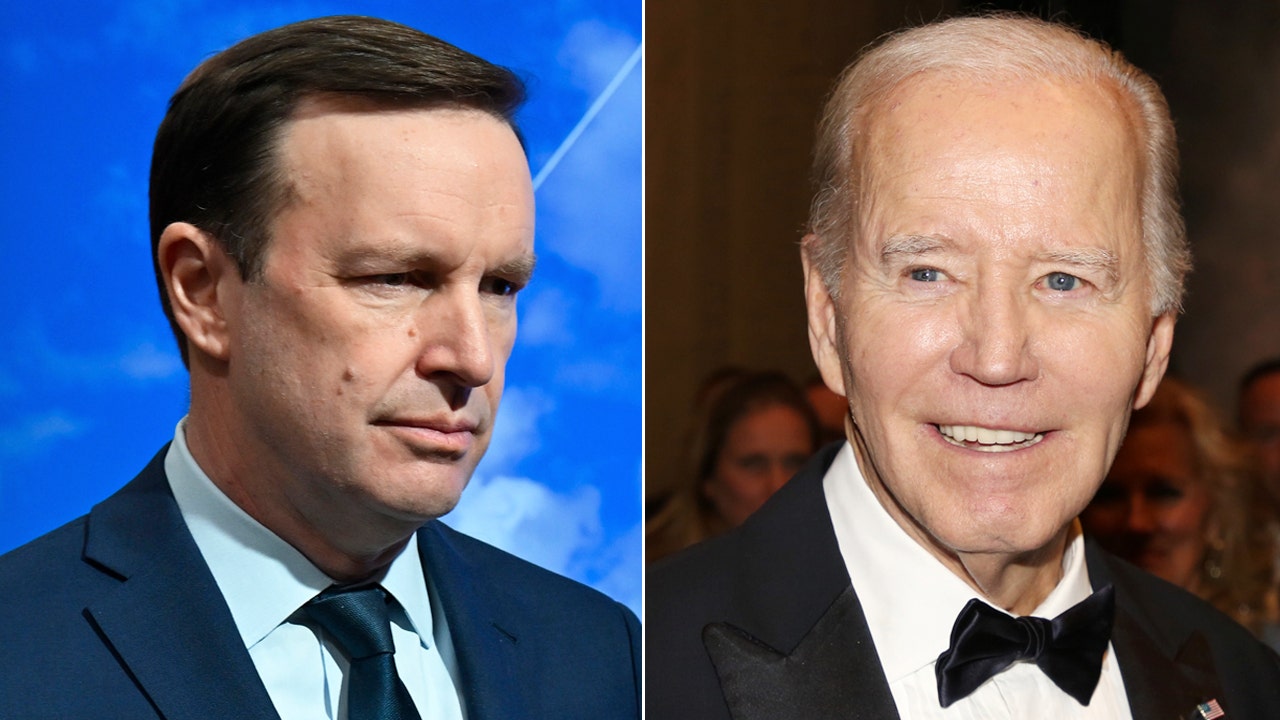

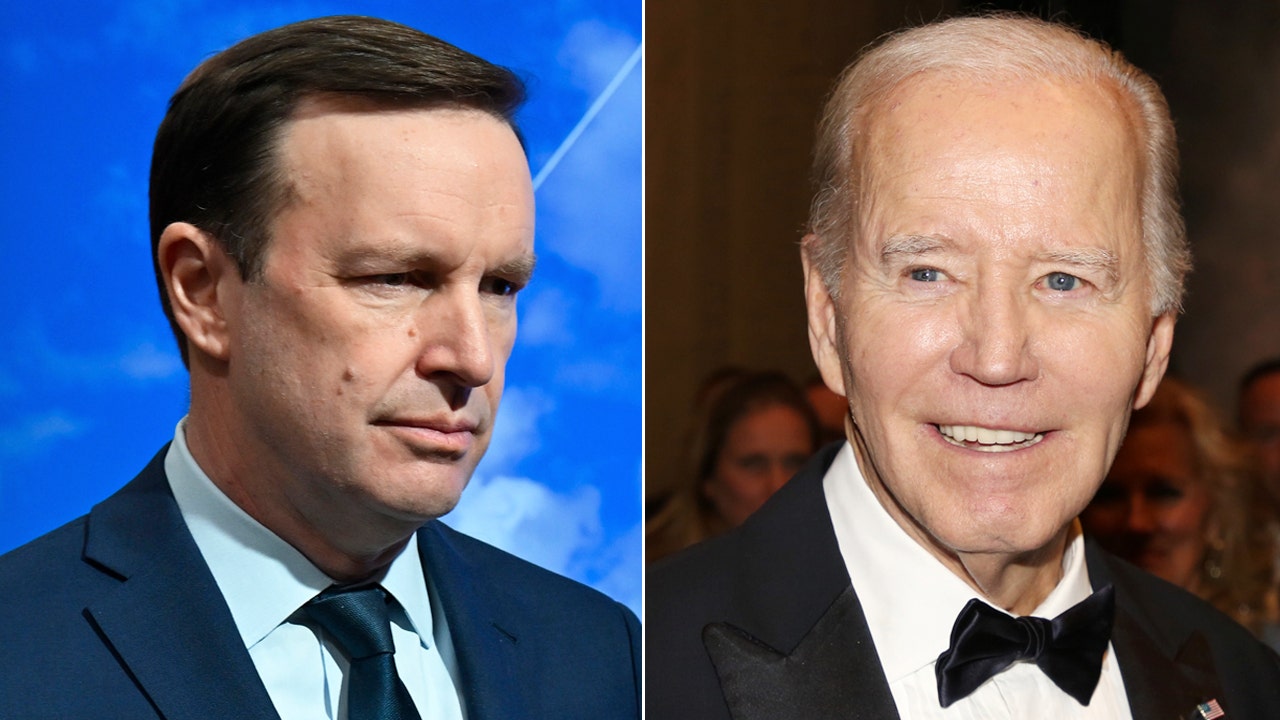

Politics1 week ago

Politics1 week agoDem senator says 'no doubt' Biden declined cognitively during presidency

-

News1 week ago

News1 week agoVideo: Doctors Heal Infant Using First Customized-Gene Editing Treatment

-

News1 week ago

News1 week agoNew Orleans jailbreak: 10 inmates dug a hole, wrote ‘to easy’ before fleeing; escape plan found

-

World1 week ago

World1 week agoLeak: Commission to launch PFAS clean-ups in water resilience strategy