Business

How a Trump-Era Rollback Mattered for Silicon Valley Bank’s Demise

WASHINGTON — Silicon Valley Financial institution was rising steadily in 2018 and 2019 — and supervisors at its main overseer, the Federal Reserve Financial institution of San Francisco, had been getting ready it for a stricter oversight group, one by which specialists from across the Fed system would vet its dangers and level out weak spots.

However a choice from officers in Washington halted that transfer.

The Federal Reserve Board — which units the Fed’s requirements for banking regulation — was within the means of placing into impact a bipartisan 2018 legislation that aimed to make regulation much less onerous for small and midsize banks. Because the board did that, Randal Okay. Quarles, the Trump-appointed vice chair for supervision, and his colleagues additionally selected to recalibrate how banks had been supervised according to the brand new necessities.

In consequence, Silicon Valley Financial institution’s transfer to the extra rigorous oversight group could be delayed. The financial institution would beforehand have superior to the Massive and International Financial institution Group group after its belongings had averaged greater than $50 billion for a 12 months; now, that shift wouldn’t come till it persistently averaged greater than $100 billion in belongings.

The change proved fateful. Silicon Valley Financial institution didn’t totally transfer to the stronger oversight group till late 2021. Its belongings had practically doubled over the course of that 12 months, to about $200 billion, by the point it got here underneath extra intense supervision.

By that time, lots of the points that might trigger its demise had already begun festering. These included a buyer base closely depending on the success of the expertise trade, an unusually giant share of deposits above the $250,000 restrict that the federal government insures within the occasion of a financial institution collapse and an govt crew that paid little consideration to danger administration.

These weak spots seem to have gone unresolved when Silicon Valley Financial institution was being overseen the best way that small and regional banks are: by a small crew of supervisors who had been in some instances generalists.

When the financial institution lastly entered extra subtle supervision for large banks in late 2021, placing it underneath the purview of an even bigger crew of specialist financial institution overseers with enter from across the Fed system, it was instantly issued six citations. These flagged numerous issues, together with the way it was managing its capacity to boost money rapidly in instances of bother. By the subsequent summer time, its administration was rated poor, and by early 2023, intense scrutiny of the financial institution had stretched to the Fed’s highest reaches.

Huge questions stay about why supervisors didn’t do extra to make sure that shortcomings had been addressed as soon as they turned alarmed sufficient to start issuing citations. The Fed is conducting an inner investigation of what occurred, with outcomes anticipated on Might 1.

However the image that’s rising is one by which a sluggish response in 2022 was not the only real downside: Silicon Valley Financial institution’s difficulties additionally seem to have come to the fore too late to repair them simply, partly due to the Trump-era rollbacks. By deciding to maneuver banks into large-bank oversight a lot later, Mr. Quarles and his colleagues had created a system that handled even sizable and quickly ballooning banks with a lightweight contact when it got here to how aggressively they had been monitored.

That has caught the eye of officers from the Fed and the White Home as they kind by means of the fallout left by Silicon Valley Financial institution’s collapse on March 10 and ask what classes needs to be discovered.

“The best way the Federal Reserve’s regulation arrange the construction for strategy to supervision handled corporations within the $50 to $100 billion vary with decrease ranges of necessities,” Michael Barr, the Fed’s vice chair for supervision, advised lawmakers this week. By the point Silicon Valley Financial institution’s issues had been totally acknowledged, he mentioned, “in a way, it was already very late within the course of.”

About 5 individuals had been supervising Silicon Valley Financial institution within the years earlier than its transfer as much as big-bank oversight, in line with an individual acquainted with the matter. The financial institution was topic to quarterly evaluations, and its overseers might select to place it by means of horizontal evaluations — thorough check-ins that take a look at for a specific weak spot by evaluating a financial institution with corporations of comparable measurement. However these wouldn’t have been a regular a part of its oversight, primarily based on the best way the Fed runs supervision for small and regional banks.

Because the financial institution grew and moved as much as large-bank oversight, the dimensions of the supervisory crew devoted to it swelled. By the point it failed, about 20 individuals had been engaged on Silicon Valley Financial institution’s supervision, Mr. Barr mentioned this week. It had been put by means of horizontal evaluations, which had flagged critical dangers.

However such warnings typically take time to translate into motion. Though the financial institution’s overseers began mentioning large points in late 2021, banks sometimes get leeway to repair issues earlier than they’re penalized.

“One of many defining options of supervision is that it’s an iterative course of,” mentioned Kathryn Decide, a monetary regulation knowledgeable at Columbia Legislation Faculty.

The Fed’s response to the issues at Silicon Valley Financial institution appeared to be halting even after it acknowledged dangers. Surprisingly, the agency was given a passable liquidity score in early 2022, after regulators had begun flagging issues, Mr. Barr acknowledged this week. A number of individuals acquainted with how supervising operates discovered that uncommon.

“We’re attempting to know how that’s in keeping with the opposite materials,” Mr. Barr mentioned this week. “The query is, why wasn’t that escalated and why wasn’t additional motion taken?”

But the excessive liquidity score might additionally tie again to the financial institution’s delayed transfer to the big financial institution supervision group. Financial institution supervisors generally deal with a financial institution extra gently throughout its first 12 months of more durable oversight, one individual mentioned, because it adjusts to extra onerous regulator consideration.

There was additionally turmoil within the San Francisco Fed’s supervisory ranks across the time that Silicon Valley Financial institution’s dangers had been rising. Mary Daly, the president of the reserve financial institution, had referred to as a gathering in 2019 with quite a lot of the financial institution supervisory group’s leaders to insist that they work on enhancing worker satisfaction scores, in line with individuals with data of the occasion. The assembly was beforehand reported by Bloomberg.

Of all of the San Francisco Fed staff, financial institution supervisors had the bottom satisfaction rankings, with staff reporting that they could face retribution in the event that they spoke out or had completely different opinions, in line with one individual.

A number of supervision officers departed within the following years, retiring or leaving for different causes. In consequence, comparatively new managers had been on the wheel as Silicon Valley Financial institution’s dangers grew and have become clearer.

It’s exhausting to evaluate whether or not supervisors in San Francisco — and employees members on the Fed board, who would have been concerned in score Silicon Valley Financial institution — had been unusually sluggish to answer the financial institution’s issues given the secrecy surrounding financial institution oversight, Ms. Decide mentioned.

“We don’t have a baseline,” she mentioned.

Even because the Fed tries to know why issues weren’t addressed extra promptly, the truth that Silicon Valley Financial institution remained underneath much less rigorous oversight that won’t have examined for its particular weaknesses till comparatively late within the recreation is more and more in focus.

“The Federal Reserve system of supervision and regulation relies on a tailor-made strategy,” Mr. Barr mentioned this week. “That framework, which actually focuses on asset measurement, will not be delicate to the sorts of issues we noticed right here with respect to speedy progress and a concentrated enterprise mannequin.”

Plus, the 2018 legislation and the Fed’s implementation of it most likely affected Silicon Valley Financial institution’s oversight in different methods. The Fed would most likely have begun administering full stress exams on the financial institution earlier with out the modifications, and the financial institution might need needed to shore up its capacity to boost cash in a pinch to adjust to the “liquidity protection ratio,” some analysis has urged.

The White Home referred to as on Thursday for regulators to contemplate reinstating stronger guidelines for banks with belongings of $100 billion to $250 billion. And the Fed is each re-examining the dimensions cutoffs for stricter financial institution oversight and dealing on methods to check for “novel” dangers that won’t tie again cleanly to measurement, Mr. Barr mentioned this week.

However Mr. Quarles, who carried out the tailoring of the 2018 financial institution rule, has insisted that the financial institution’s collapse was not the results of modifications that the legislation required or that he selected to make. Even the best rung of supervision ought to have caught the plain issues that killed Silicon Valley Financial institution, he mentioned, together with a scarcity of safety towards rising rates of interest.

“It was the best danger conceivable,” he mentioned in interview.

Business

Sony warns tech companies: Don't use our music to train your AI

Sony Music Group is sending letters to 700 artificial intelligence developers and music streaming services warning them to not use its artists’ music to train generative AI tools without its permission.

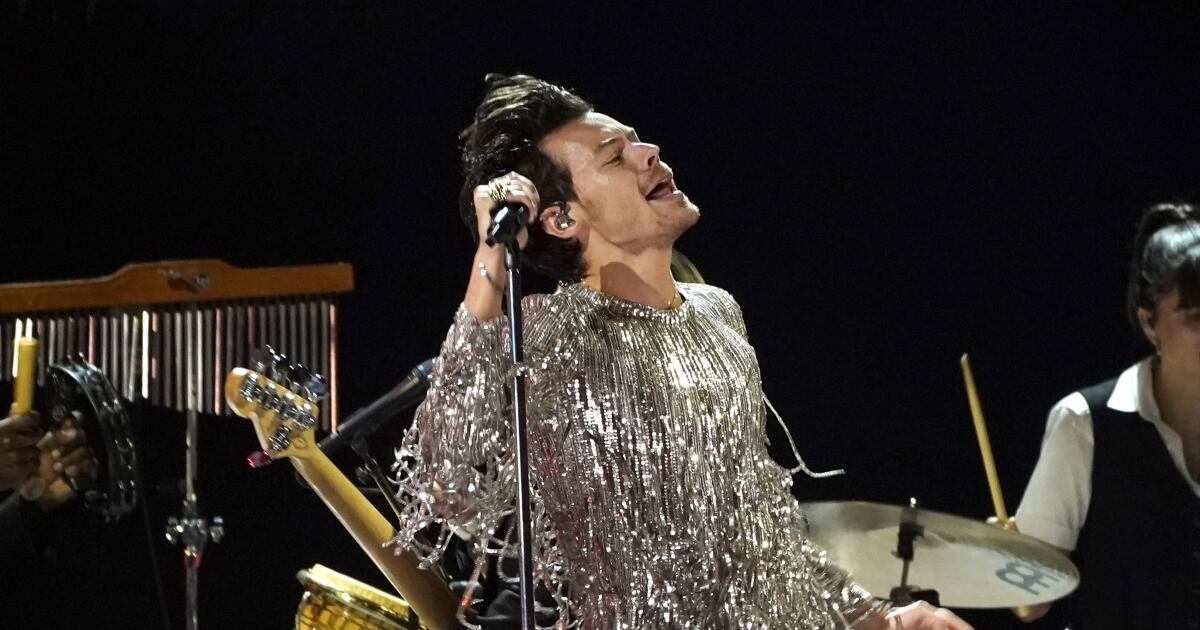

The company — one of the three largest recorded music firms — said it is explicitly opting out of the use of its music for training or developing AI models through text or data mining or web scraping as it relates to lyrics, audio recordings, artwork, musical compositions and images. Sony Music Group artists include Celine Dion, Doja Cat and Harry Styles.

“We support artists and songwriters taking the lead in embracing new technologies in support of their art,” Sony Music Group said in a statement on its website Thursday. “Evolutions in technology have frequently shifted the course of creative industries. … However, that innovation must ensure that songwriters’ and recording artists’ rights, including copyrights, are respected.”

The letters were sent to companies including San Francisco-based ChatGPT creator OpenAI and Mountain View-based search giant Google, according to a person familiar with the matter who was not authorized to speak publicly. OpenAI and Google did not immediately respond to requests for comment.

The move comes as the entertainment industry is grappling with rapid innovations in artificial intelligence technology. Writers and actors raised concerns last summer about whether leaving AI unchecked could threaten their livelihoods. Meanwhile, some creatives have marveled at the advancements that could allow them to pursue bold ideas with tight budgets.

This year, OpenAI unveiled its text-to-video tool Sora, which was used to create a four-minute music video for music artist Washed Out. The director of the video told The Times that Sora helped him depict multiple locations and visual effects that he otherwise couldn’t have.

But AI can also create chaos. Celebrities have dealt with “deep fakes” — false videos or audio depicting a celebrity endorsing certain brands or activities. To help protect their clients against unauthorized use of their voice and likeness, Century City-based Creative Artists Agency is helping talent create their own digital doubles.

On Thursday, two New York voice-over actors sued Berkeley-based AI voice generator business Lovo for unauthorized use of their voices. Lovo did not immediately return a request for comment. The lawsuit was filed in U.S. District Court for the Southern District of New York.

Some people in the entertainment industry have said they would like the AI companies to be more transparent about how they are training their tools and whether they have the appropriate copyright permissions.

OpenAI has said its large language models, including those that power ChatGPT, are developed through information available publicly on the internet, material acquired through licenses with third parties and information its users and “human trainers” provide.

The company said in a blog post that it believes training AI models on publicly available materials on the internet is “fair use.”

But some media outlets, including the New York Times, have sued OpenAI. The newspaper raised alarms about how its stories are being used by the tech company.

In Sony Music Group’s letters to AI businesses, the company said it has reason to believe its content may have been used to train, develop or commercialize artificial intelligence systems without its permission, according to a copy obtained by the Times. Sony Music Group asked the tech companies to provide information regarding that use and why it was necessary.

Sony Music Group, owned by Tokyo-based electronics giant Sony Corp., also wants music streaming providers to add language in its terms of service saying that third parties are not allowed to mine and train using Sony Music Group content, the person familiar with the matter said.

Business

A woman was dragged by a self-driving Cruise taxi in San Francisco. The company is paying her millions

General Motors’ autonomous car company, Cruise, has reportedly agreed to pay an $8-million to $12-million settlement to a woman who was hospitalized after getting dragged along the pavement by a self-driving taxi in San Francisco last year.

The woman, a pedestrian, was struck by a hit-and-run vehicle at 5th and Market streets and thrown into the path of Cruise’s self-driving car, which pinned her underneath, according to Cruise and authorities. The car dragged her about 20 feet as it tried to pull out of the roadway before coming to a stop.

She sustained “multiple traumatic injuries” and was treated at the scene before being hospitalized.

It’s unclear when the settlement was reached or the exact amount, sources familiar with the situation told Fortune and Bloomberg. The condition of the woman, whose name was not released by authorities, is unknown, but a representative of Zuckerberg San Francisco General Hospital told Fortune that she had been discharged.

Cruise initially said that its self-driving car “braked aggressively to minimize impact” but later said the vehicle’s software made a mistake in registering where it hit the woman. The car tried to pull over but continued driving 7 mph for 20 feet with the woman still under the vehicle.

“The hearts of all Cruise employees continue to be with the pedestrian, and we hope for her continued recovery,” Cruise said in a statement.

Cruise halted its driverless operations after its autonomous taxi license was suspended by California’s Department of Motor Vehicles. The company was also accused of lying to investigators and withholding footage of the car crash.

Cruise said this week that it would start testing robotaxis in Arizona with a “safety driver” behind the wheel in case a human needs to take control of the vehicle, according to a company news release.

“Safety is the defining principle for everything we do and continues to guide our progress towards resuming driverless operations,” according to the release.

Business

How YouTube became must-see TV: Shorts, sports and Coachella livestreams

When YouTube launched nearly two decades ago, its first clip was a grainy video of co-founder Jawed Karim speaking to the camera while standing in front of the elephants at the San Diego Zoo.

Not exactly must-see TV.

Since, then the online video giant has increasingly been the entertainment of choice for billions of people. And while the Google-owned service is still often thought of as being the destination for people watching funny short videos on their smartphones, the way that Americans watch it has changed in a big way.

People are increasingly choosing to watch YouTube on their connected TVs rather than on laptops and mobile devices, treating it more and more like a regular television destination.

The San Bruno, Calif.-based video giant said more than 150 million people in the U.S. are watching YouTube on connected TV screens every month, citing December 2022 data. That’s up 11% from 2021. YouTube is consistently the most watched streaming service in the U.S. on a TV in the U.S. every month, even beating Netflix and Amazon’s Prime Video since February 2023, according to Nielsen. The service accounts for nearly 10% of television viewing, the data firm said.

According to research firm Emarketer, U.S. adults spend 36 minutes each day watching YouTube, with 17 of those minutes on a connected TV, four minutes on a desktop or laptop computer and 15 minutes on a mobile device.

A variety of content is driving the company’s evolution. YouTube said TVs accounted for more than 50% of the watch time for its Coachella livestream this year, which is higher than ever before. Views of Shorts, clips that are 60 seconds or less, on connected TVs more than doubled last year, YouTube said.

“We’ve invested in making sure that YouTube really captures the totality of the experience that people want,” said Christian Oestlien, YouTube’s vice president of product management for connected TV. “What we hear from our users is they want to be able to watch their favorite creators but also highlights from their favorite sporting events, listen to their favorite artist and watch their favorite podcast and do it all in this one contained experience.”

At a time when consumers are choosing between multiple streaming services, YouTube has an advantage of having a wide variety of options, from live sports to user-generated videos. The company said the increase in TV watch time comes as connected TVs are becoming more widely available.

TV screen time can be helpful to streamers wishing to court more advertising dollars. This week, television networks and streaming services Amazon and Netflix made gala presentations to advertisers, showing off the programming they have coming up.

YouTube on Wednesday presented to advertisers new features such as branded QR codes and non-skippable assets on connected TVs.

“YouTube is wanting to position themselves not just as a digital advertising option, they want advertisers to see them on the same advertising footing as any other streaming service,” said Brett Sappington, founder of Dallas-based media and insights firm Sappington Media.

YouTube has introduced features to improve the television viewing experience, including the option to watch Coachella performances through a four-way split screen. The company also has shopping options.

“This isn’t my dad’s TV or my grandma’s TV,” Oestlien said. “This is TV rethought for a new generation.”

YouTube video creators have also embraced TV viewing, Oestlien said. In the last three years, the number of top YouTube creators who receive most of their watch time from TV screens has quintupled, YouTube said.

YouTube has also gotten a boost from its deal to become the home of pro football’s “NFL Sunday Ticket” game package. Fans will watch live games on YouTube on Sunday, then come back and watch clips through its video library or commentary from its creators, Oestlien said.

“It really becomes this surround-sound experience where, as a football fan, you can come to YouTube any day of the week,” he said.

YouTube and other streaming services have been competing for sports league rights in order to increase viewership. Amazon has the NFL’s “Thursday Night Football” games and has bid for a package of NBA matches. On Wednesday, Netflix announced it had secured two Christmas NFL games for 2024.

-

Politics1 week ago

Politics1 week agoBiden takes role as bystander on border and campus protests, surrenders the bully pulpit

-

Politics1 week ago

Politics1 week ago'You need to stop': Gov. Noem lashes out during heated interview over book anecdote about killing dog

-

Politics1 week ago

Politics1 week agoRFK Jr said a worm ate part of his brain and died in his head

-

News1 week ago

News1 week agoMan, 75, confesses to killing wife in hospital because he couldn’t afford her care, court documents say

-

World1 week ago

World1 week agoPentagon chief confirms US pause on weapons shipment to Israel

-

Politics1 week ago

Politics1 week agoHere's what GOP rebels want from Johnson amid threats to oust him from speakership

-

World1 week ago

World1 week agoPro-Palestine protests: How some universities reached deals with students

-

World1 week ago

World1 week agoConvicted MEP's expense claims must be published: EU court