Business

FTX’s Sam Bankman-Fried Is Arrested in the Bahamas

Observe our reside protection of the arrest of FTX founder Sam Bankman-Fried.

Sam Bankman-Fried, the disgraced founding father of the collapsed cryptocurrency change FTX, was arrested within the Bahamas on Monday after U.S. prosecutors filed felony prices.

“S.B.F.’s arrest adopted receipt of formal notification from america that it has filed felony prices in opposition to S.B.F. and is more likely to request his extradition,” the federal government of the Bahamas stated in an announcement.

The arrest was the most recent gorgeous improvement in one of the dramatic falls from grace in latest company historical past. Mr. Bankman-Fried, 30, was scheduled to testify in Congress on Tuesday concerning the collapse of FTX, which was one of the highly effective corporations within the rising crypto business till it imploded nearly in a single day final month after a run on deposits uncovered an $8 billion gap in its accounts.

Prosecutors for the Southern District of New York confirmed that Mr. Bankman-Fried had been charged and stated an indictment can be unsealed on Tuesday. Individually, the Securities and Change Fee stated in an announcement that it had approved prices “referring to Mr. Bankman-Fried’s violations of our securities legal guidelines.”

The felony prices in opposition to Mr. Bankman-Fried included wire fraud, wire fraud conspiracy, securities fraud, securities fraud conspiracy and cash laundering, stated an individual with information of the matter.

Mr. Bankman-Fried, who was the one particular person charged within the indictment, was taken into custody by the Bahamian authorities, the particular person stated. He was arrested shortly after 6 p.m. at his condo advanced within the Albany resort within the Bahamas, in response to an announcement from the Bahamian police. The timing of when Mr. Bankman-Fried is perhaps moved to america was unclear. Whereas the Bahamas has an extradition treaty with america, the method can take weeks, and generally far longer if a felony defendant contests it.

Mr. Bankman-Fried was cooperative in the course of the arrest, in response to an individual aware of the matter, and shall be held in a single day in a cell at a police station. He’s scheduled to look on Tuesday in Justice of the Peace Courtroom in Nassau, the capital of the Bahamas.

A spokesman for Mr. Bankman-Fried declined to remark. Nicholas Biase, a spokesman for the U.S. lawyer’s workplace, additionally declined to remark.

The Aftermath of FTX’s Downfall

The sudden collapse of the crypto change has left the business shocked.

“Earlier this night, Bahamian authorities arrested Samuel Bankman-Fried on the request of the U.S. authorities, based mostly on a sealed indictment,” Damian Williams, the U.S. lawyer for the Southern District of New York, stated in an announcement. “We count on to maneuver to unseal the indictment within the morning and could have extra to say at the moment.”

As soon as a golden boy of the crypto business and a significant donor to the Democratic Get together, Mr. Bankman-Fried has seen his huge enterprise and political empire collapse with gorgeous pace. His change filed for chapter final month, and his private fortune has dwindled to nearly nothing. Whereas he was hailed as a modern-day John Pierpont Morgan, he’s now extra typically likened to Bernie Madoff, who orchestrated the most important Ponzi scheme in historical past.

Legal professionals concerned within the case expressed shock on the suddenness of the arrest. Mr. Bankman-Fried had been broadly anticipated to face a felony indictment. However advanced white-collar fraud instances can take months to construct. Till the arrest, Mr. Bankman-Fried was slated to testify remotely concerning the FTX collapse in a listening to in entrance of the Home Monetary Providers Committee on Tuesday. The listening to continues to be set to go forward, simply with out Mr. Bankman-Fried’s testimony.

“The American public deserves to listen to instantly from Mr. Bankman-Fried concerning the actions that’ve harmed over a million individuals,” Consultant Maxine Waters, who chairs the committee, stated in an announcement. “The general public has been ready eagerly to get these solutions underneath oath earlier than Congress, and the timing of this arrest denies the general public this chance.”

A number of individuals aware of the investigation stated the pace with which the authorities moved in submitting felony and civil prices was a sign that prosecutors and regulators had acquired info from cooperating witnesses.

Mr. Bankman-Fried has been going through scrutiny from dozens of regulators internationally, together with the Justice Division, the S.E.C. and the Commodity Futures Buying and selling Fee. Prosecutors in Manhattan have been inspecting whether or not FTX broke the legislation by transferring billions in buyer funds to Alameda Analysis, a crypto hedge fund that Mr. Bankman-Fried additionally based and owned.

They’ve additionally centered on whether or not Mr. Bankman-Fried and his hedge fund engaged in market manipulation that will have helped trigger the failure of two outstanding cryptocurrencies final spring.

Ever since FTX collapsed, the S.E.C. and federal prosecutors have moved rapidly with requests for paperwork from varied events, together with a number of the large monetary corporations that invested as much as $2 billion within the crypto change starting final 12 months, stated two individuals briefed on the matter.

It’s unclear whether or not the federal authorities are taking a look at charging anybody else in reference to the collapse of FTX. It’s not unusual for an S.E.C. civil criticism to disclose extra details about the occasions that led to the submitting of prices than an indictment.

FTX’s collapse started early final month, when a run on deposits revealed an $8 billion gap within the firm’s funds. Mr. Bankman-Fried sought a lifeline from a rival firm, the enormous crypto change Binance, however the deal fell by means of after Binance examined FTX’s books.

Mr. Bankman-Fried rapidly grew to become a villain within the crypto business. A whole bunch of hundreds of consumers have funds trapped on FTX, with little prospect of getting them again anytime quickly.

Surprisingly for an government going through felony investigations, Mr. Bankman-Fried had given quite a few media interviews within the wake of FTX’s collapse. On the latest DealBook Summit, a New York Occasions occasion, he blamed “enormous administration failures” and sloppy accounting for his firm’s implosion, insisting that he “didn’t ever attempt to commit fraud” or knowingly dip into the funds of FTX prospects to finance different investments.

When FTX filed for chapter, Mr. Bankman-Fried stepped down as chief government. He was changed by John Ray, a seasoned company turnaround knowledgeable who oversaw the unwinding of the power buying and selling firm Enron after an accounting scandal in 2001.

In a chapter submitting final month, Mr. Ray stated that the administration of FTX mirrored a “full failure of company management.”

Mr. Ray was additionally scheduled to testify to the Home on Tuesday. In a ready assertion, he stated FTX had been a multitude.

The collapse stemmed “from absolutely the focus of management within the arms of a really small group of grossly inexperienced and unsophisticated people,” he wrote.

Business

Armed with venture capital, Skims and Kim Kardashian write their 'second chapter'

Kim Kardashian was already a successful celebrity businesswoman when she launched Skims five years ago.

But more often than not, she simply had attached her name to a string of existing companies: QuickTrim supplements, Carl’s Jr. salads, Skechers Shape-Ups, Sugar Factory confections, Midori liqueur, Silly Bandz bracelets, Beach Bunny swimwear, and so on.

“We did every product that you could imagine — from cupcake endorsements to a diet pill at the same time, to sneakers or things that I didn’t know enough about for them to be super-authentic to me,” the reality television star told The Times in 2019. “Like it all made sense a little bit, but it wasn’t my own brand.”

Skims, Kardashian’s homegrown apparel company built upon her famous curves and her love of body-cinching shapewear, was on brand — and, finally, her brand.

Kim Kardashian at a Skims pop-up at the Grove in 2021. The company pulled in nearly $1 billion in net sales last year and will open its first physical stores soon.

(Skims)

Its first years were marked by explosive growth. The start-up is now a retail juggernaut with around $1 billion in net sales and Kardashian has become a savvy entrepreneur with an eye for spotting and setting trends. Skims has made a huge dent in the shapewear market previously dominated by Spanx while adding several new categories to its merchandise mix.

This year Skims is aggressively moving into its next phase, one that will see the Hollywood company enter the competitive bricks-and-mortar space for the first time.

Underscoring Skims’ growth is the heightened interest the retailer is drawing from investors. Last year it raised $330 million in venture capital funding, ranking it second among companies in the greater L.A. area and the only retail brand in the top 10, according to a recent analysis by CB Insights.

That influx of cash was particularly notable given the tough investment climate locally: The region saw a steep decline in venture capital funding from 2021 to 2023, when the amount of investment dollars fell 74%, the analytics firm said.

Co-founded by Karadashian, who is chief creative officer, and Jens Grede, the company’s chief executive, Skims pulled in nearly $1 billion in net sales last year, according to Bloomberg, roughly double its 2022 total.

Kim Kardashian, center, in a Skims ad campaign starring Candice Swanepoel, Tyra Banks, Heidi Klum and Alessandra Ambrosio.

(Courtesy of Skims)

The company is reportedly eyeing an initial public offering this year. Kardashian and Grede declined to comment.

What began as a collection of undergarments designed to give women a more flattering, contoured silhouette has swelled into a comprehensive apparel giant: There’s underwear, bras, swimwear, dresses, tees and tanks, loungewear and pajamas. Inclusive sexy-meets-cozy clothing is the hook, with merchandise available in a wide range of sizes and skin tones.

In October, Skims launched a menswear line and became the official underwear partner of the NBA, WNBA and USA Basketball. It sells some accessories and clothing for kids, and this year will open bricks-and-mortar stores in several cities including a flagship location in Los Angeles.

“Skims has evolved into becoming a brand that can provide comfort for all audiences, not just for women,” Kardashian, 43, said when announcing the menswear line.

Usher in Skims. The brand launched menswear in October.

(Courtesy of Skims)

The company’s swift rise was undoubtedly fueled in part by Kardashian’s name and marketing prowess. She models the latest collections herself, posting glossy professional photos and casual at-home closet videos to her millions of social media followers, and has tapped her A-list friends to star in Skims ad campaigns including Lana Del Rey, Kate Moss, SZA, Cardi B, Sabrina Carpenter, Usher and Patrick Mahomes.

“Kim Kardashian’s visibility, I think, gives them a big leg up on marketing,” said Alex Lee, research editor at CB Insights, which compiled its data by analyzing companies in Los Angeles, Orange, Ventura, San Bernardino and Riverside counties.

But more than that, Lee said, Skims “is a really interesting example of the confluence of celebrity with technology and consumer trends.”

The rise of athleisure — stylish athletic clothing that can be worn at the gym or as everyday wear — was a game-changer in retail, said Simeon Siegel, managing director at BMO Capital Markets, who follows companies including Victoria’s Secret and Lululemon.

“That notion of comfort stretched to every possible category of apparel,” he said. “What we saw was a race among companies to figure out how to apply what Lulu revolutionized. Shapewear was a very logical category to go after with the new advancements in technology,” which includes improved fabrics and better fits.

Skims at first sold its products online only through its website before expanding to retailers including Nordstrom and Saks Fifth Avenue and hosting occasional pop-ups. Its foray into physical stores “marks the second chapter” for the company, Grede said in an interview with Bloomberg last year, and its ambitions are high.

Kim and I can envision a future where years from today there’s a Skims store anywhere in the world you’d find an Apple store or a Nike store.

— Jens Grede, Skims co-founder and CEO

In the fourth quarter, Skims is scheduled to open a 5,000-square-foot store on the Sunset Strip in West Hollywood. The company also plans to open stores in other U.S. cities and then target major international markets.

“Kim and I can envision a future where years from today there’s a Skims store anywhere in the world you’d find an Apple store or a Nike store,” Grede said.

Skims was most recently valued at $4 billion after a funding round last summer, a valuation that propelled Kardashian to sixth on Forbes’ list of the World’s Celebrity Billionaires 2024 with an estimated net worth of $1.7 billion.

“No one has cashed in on reality star fame more than Kim Kardashian, who has become a billionaire from her beauty and clothing brands,” the magazine said.

Business

Boeing Starliner launch delayed due to possibly faulty rocket valve

The launch of Boeing’s Starliner capsule to the International Space Station was scrubbed Monday evening due to a malfunctioning valve on the Atlas V rocket that would blast it into space. It was not immediately certain when it would be rescheduled.

The rocket is a reliable workhorse and is made by the United Launch Alliance, a joint venture of Boeing and Lockheed Martin. After years of delays in Boeing’s Starliner program, the launch with two astronauts aboard is considered crucial.

NASA said an oxygen relief valve on the rocket’s Centaur second stage was “buzzing,” or rapidly opening and closing, and would be closely examined to determine whether it needed to be replaced because of cycling too many times.

The space agency said the launch could be rescheduled as soon as Tuesday or possibly Friday or Saturday. NASA officials said that the crew was never in danger and that the launch might have proceeded if it were a satellite payload.

The decision to scrub the launch was made by NASA, Boeing and the United Launch Alliance.

Boeing’s new Starliner capsule was scheduled to blast off with a crew last summer, but a problem was discovered with its parachute system and the use of flammable tape in the craft, a mile of which was removed. It had been just the most recent of several delays prior to Monday.

This week’s flight plan called for NASA astronauts Barry Wilmore and Sunita Williams to spend a minimum of eight days testing the docked Starliner before returning to Earth as soon as May 15.

Boeing’s capsule is intended to provide NASA with a second U.S. vehicle to reach the space station — along with SpaceX’s Crew Dragon capsule. A prior unmanned Starliner test flight last year docked with the station, but the first flight in 2019 failed to reach it.

The stakes are high for Boeing, which received a $4.2-billion contract from NASA in 2014 to service the International Space Station, while rival SpaceX of Hawthorne received a smaller $2.6-billion contract to also provide the service — and has already sent eight crews to the station.

Boeing is counting on the Starliner to be a success, given the company’s tarnished reputation after two crashes of its 737 Max 8 jets and a door plug that blew out of a 737 Max 9 flight this year on its way to Ontario International Airport in San Bernardino County. The company also had to absorb a reported $1.5 billion in Starliner cost overruns.

NASA selected the companies to provide it with American launch services after having to rely on the Russian program since the space shuttle program ended in 2011.

Business

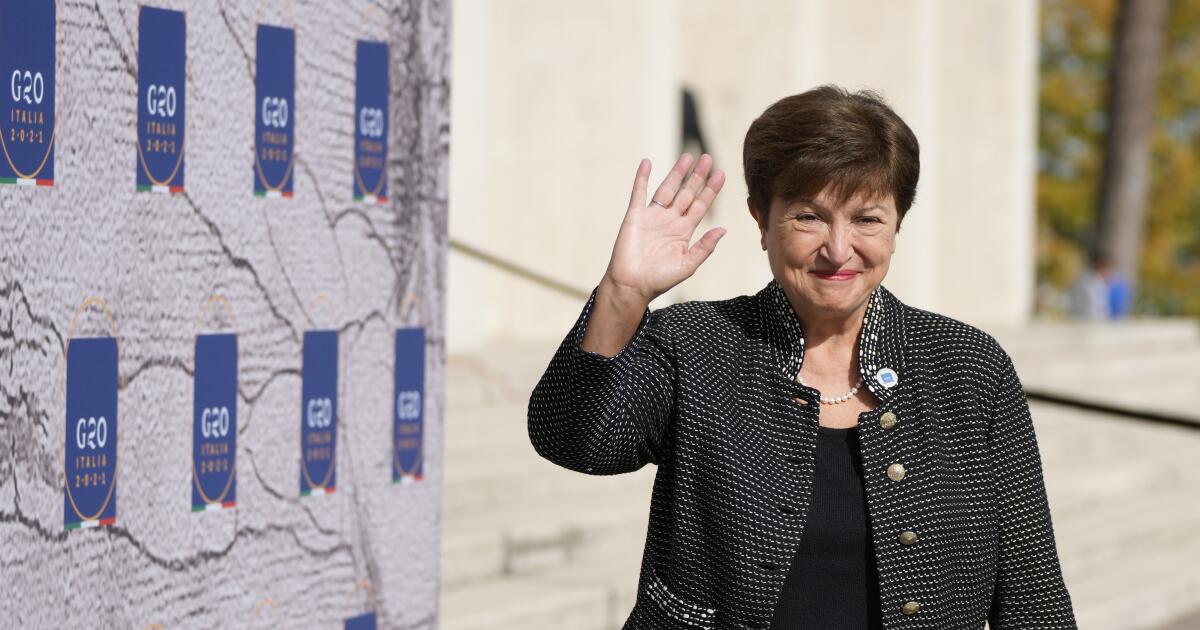

IMF chief Kristalina Georgieva calls U.S. debt load 'mind boggling'

International Monetary Fund Managing Director Kristalina Georgieva praised the strength of the U.S. economy but warned its current level of deficit spending was not sustainable and could crimp U.S. and global growth if it’s not brought under control, in remarks Monday at the Milken Institute Global Conference.

Servicing the U.S debt — now roughly $34 trillion — consumes more than 17% of federal revenue, compared to under 7% in 2015, Georgieva said in an interview that kicked off the annual conference at the Beverly Hilton, which draws thousands of businesspeople, investors and professionals from around the world.

“It cannot go like this forever, because the … burden on the U.S. is going to cripple spending that is necessary to make for servicing the debt. To pay 17-plus percent in debt service is just mind-boggling,” Georgieva said. “There is opportunity cost to this money … it doesn’t go to emerging markets where it can finance jobs and business opportunities for American companies.”

The IMF is composed of 190 member nations and is one of the leading global economic institutions, providing lending to economies in distress.

Georgieva said the U.S. needs to address its entitlement spending but said its economy is strong and remains a pillar of the world economy given its innovation, strong labor market and position as an energy exporter.

She also said she did not believe that the trend toward deglobalization was leading to the disintegration of the global economy, but warned that trade sanctions and industrial policies taken by many nations will only lead to lower growth rates — with the primary question being how much.

“We are measuring that just trade restrictions can cause the world economy to lose between 0.2% and 7% of GDP,” she said, comparing the high-end figure to removing Japan and Germany from the world economy. “So it is really costly.”

However, calling herself an “eternal optimist,” Georgieva said she expected “policymakers to take a course correction when they see that where they are headed is, you know, falling off a cliff.”

She envisioned that this decade will see advanced economies like the U.S. do well, while others will stagnate and lower-income countries continue to fall behind.

“So very likely we will have a world in which some economies transform, some economies stagnate and some parts of the world are in perpetual turbulence,” she said.

Milken Institute President Richard Ditizio introduced the IMF managing director, telling the audience that this year’s 27th annual conference, which ends Wednesday, will feature more than 200 sessions and more than 1,000 speakers.

The theme of this year’s conference is “Shaping a Shared Future,” a reference to finding common ground amid the complex issues that have arisen in the post-pandemic world, including war, the emergence of artificial intelligence and the need to create a sustainable economy amid climate change.

After the IMF managing director’s remarks, Brad Lightcap, chief operating officer of OpenAI, spoke about the San Francisco company’s artificial intelligence products — a technology that Georgieva said the world will need to rely on for growth and productivity gains.

Lightcap said that 92% of Fortune 500 companies are using the company’s ChatGPT enterprise product. He cited Moderna as an example of a business use: the Cambridge, Mass.-based maker of one of the leading COVID-19 vaccines is using the company’s AI for drug development. And the OpenAI chatbot of Swedish mobile-payments company Klarna is replacing the work of 700 customer support agents, he said.

However, Lightcap maintained that artificial intelligence will create job demand in areas that can’t be predicted, and that advancement of the technology is so rapid that in the next 12 months “the systems we use today will be like laughably bad.” He envisioned a not-distant future where “it’ll be foreign to anyone born today that you can’t talk to a computer the way you talk to a friend.”

All public panels are being livestreamed on the institute’s website. Argentina President Javier Milei and Elon Musk are scheduled to speak later in the day.

-

News1 week ago

News1 week agoBoth sides prepare as Florida's six-week abortion ban is set to take effect Wednesday

-

Politics1 week ago

Politics1 week agoGOP Rep. Bill Posey won't seek re-election, endorses former Florida Senate President as replacement

-

World1 week ago

World1 week agoRussian forces gained partial control of Donetsk's Ocheretyne town

-

Movie Reviews1 week ago

Challengers Movie Review

-

World1 week ago

World1 week agoZelenskyy warns of Russian nuclear risks on Chernobyl anniversary

-

Politics1 week ago

Politics1 week agoHouse Republicans brace for spring legislative sprint with one less GOP vote

-

World1 week ago

World1 week agoAt least four dead in US after dozens of tornadoes rip through Oklahoma

-

Politics1 week ago

Politics1 week agoAnti-Trump DA's no-show at debate leaves challenger facing off against empty podium