Business

Column: This ballot measure promises help for taxpayers, but it’s actually a handout to real estate developers

One can’t actually blame large enterprise for launching yet one more anti-tax marketing campaign.

In spite of everything, it’s what they do: Complain incessantly in regards to the poor degree of public providers, whereas taking steps to make them even poorer.

One can blame them, nevertheless, for taking these steps deceitfully.

It might undermine voters’ rights and create main loopholes for firms to keep away from paying their justifiable share.

Nicolas Romo, League of California Cities

That brings us to the “Taxpayer Safety and Authorities Accountability Act,” a proposed initiative co-sponsored by the California Enterprise Roundtable. The Roundtable is accumulating signatures as we write to put the measure on November’s poll.

You won’t be shocked to study that the initiative wouldn’t do something like what its title suggests. It wouldn’t shield taxpayers, besides the large companies lurking behind it — significantly large actual property builders. It wouldn’t make authorities extra “accountable,” however much less so.

The initiative’s common aim is to make it tougher for native governments to impose or increase taxes and costs.

It might prohibit advisory votes on the spending of native taxes showing on the identical poll because the tax measure. That’s an underhanded manner of discouraging the passage of will increase in gross sales and use taxes: Many municipalities present for such nonbinding measures so voters can get a say on how they need their cash used.

Metropolis officers say that depriving voters of that voice makes them extra more likely to vote in opposition to the taxes. In fact, this provision is the antithesis of the transparency that the Roundtable says it values so extremely.

Each tax would require a sundown date, which means extra votes, extra administrative burden, extra expense. Native taxes that beneath present legislation could be handed by a majority would require a two-thirds vote.

Publication

Get the most recent from Michael Hiltzik

Commentary on economics and extra from a Pulitzer Prize winner.

You could often obtain promotional content material from the Los Angeles Instances.

“That is very, quite simple and really easy,” says Robert C. Lapsley, the president of the Roundtable.

He’s blowing smoke. The reality is that it’s hopelessly complicated and so imprecise in a lot of its provisions that it’s sure to foment authorized challenges that may land municipalities in court docket, on the expense of the taxpayers the measure purports to guard.

“Our concern is with the anomaly within the measure,” says John Gillison, town supervisor of Rancho Cucamonga. “Lots of issues are simply not clear, which creates a pathway to extra authorized challenges.”

Even penalties for wrongdoers — violators of housing codes and nuisance abatement orders, for instance — could possibly be topic to limitation and authorized problem.

Lapsley additionally assured me that the initiative would apply solely to “future taxes” — presumably these collected after election day, Nov. 8. Besides that it features a retroactivity provision that might apply to any taxes enacted beginning this previous Jan. 1 —that’s, current taxes.

A fiscal evaluation accomplished for the League of California Cities estimated that tons of of tens of millions of {dollars} in tax and bond measures beforehand enacted by native voters may fall beneath the supply.

The League is clear-eyed in regards to the goal of the initiative. “It might undermine voters’ rights and create main loopholes for firms to keep away from paying their justifiable share,” Nicolas Romo, a income and taxation knowledgeable on the League, informed me.

That’s as a result of the measure goes past what folks usually consider as “taxes,” and would apply to charges and expenses imposed by native governments for using municipal property or for contract providers by companies corresponding to waste haulers, cable corporations and utilities.

The measure would require that these expenses, that are typically set at market charges, be “cheap.” That customary is undefined by the textual content, which clearly makes it topic to authorized assault; in follow, it is going to imply “minimal” — successfully a lower in enterprise charges.

Earlier than delving deeper into the textual content, let’s check out who’s bankrolling this marketing campaign. Superficially, it’s the Enterprise Roundtable and the anti-tax Howard Jarvis Taxpayers Assn. They’re the key sponsors listed by Californians for Taxpayer Safety and Authorities Accountability, the marketing campaign committee, based on public filings.

They’re additionally the one contributors to date to the marketing campaign, which is operating mainly on $1.6 million from the Roundtable’s Points Political Motion Committee, or PAC.

The place did the Roundtable get the cash for its contribution? That’s the place the story will get fascinating.

The overwhelming majority of the PAC’s funding since final July got here from three large actual property corporations: In line with marketing campaign finance filings with the Secretary of State, they’re Los Angeles-based Kilroy Realty, Santa Monica-based Douglas Emmett Properties and Irvine-based Western Nationwide Group (principally by its chairman and CEO Michael Hayde).

Kilroy Realty contributed $1 million to the Enterprise Roundtable PAC in two installments of $500,000 every on Dec. 29 and Dec. 30. Douglas Emmett Properties and its affiliated entities contributed $1 million to the PAC in seven separate chunks, all dated Dec. 29. Hayde contributed $1,109,100, virtually all of it dated June 28.

Not one of the corporations responded to my requests for remark. However their funds constituted about 91% of the $1.76 million in contributions the Points PAC acquired from July 1, 2021, by Feb. 3. On that date, the PAC contributed $1.6 million to the tax proposition marketing campaign committee.

If you happen to’re adhering to the outdated investigator’s principle to “observe the cash,” it actually appears to be like as if the cash has flown from three large actual property builders to the initiative marketing campaign, with a short layover on the Enterprise Roundtable PAC.

A coalition of public worker unions alleges that this can be a subterfuge designed to hide who is de facto funding the initiative. In a criticism filed final month with the state’s Truthful Political Practices Fee, they name it “marketing campaign cash laundering plain and easy.”

State legislation requires the donors to an initiative marketing campaign be absolutely disclosed, a aim plainly confounded if marketing campaign donors can take refuge behind one other group.

This isn’t the primary time that the Enterprise Roundtable has been accused of serving to to hide the large cash behind an initiative marketing campaign.

The backers of Proposition 21, a 2020 hire management measure that was defeated after going through well-financed opposition by the Roundtable and different enterprise pursuits, alleged that the Roundtable’s Points PAC masqueraded as a “common goal” political motion committee whereas truly elevating tens of millions to defeat particular poll initiatives.

That constituted “a prima facie case of undisclosed earmarking,” based on the plaintiffs. In a tentative ruling issued Feb. 24, nevertheless, a Sacramento choose rejected that declare.

One may ask why actual property builders particularly have been so desirous to contribute to the Roundtable’s PAC in latest months. Lapsley intimated that the true property corporations simply occur to be displaying their public spirit sooner than different contributors.

“It’s an extended marketing campaign forward,” he informed me. “You’ll see a number of contributors to the marketing campaign — we’re simply getting began.” He added, “We make the most of our subject PACs appropriately.”

But an in depth have a look at the initiative might supply a clue why it could be a precedence for the true property business.

Amid all of the ambiguities the measure would inject into the revenue-raising course of for native governments, one particular prohibition stands out: “No levy, cost, or exaction regulating or associated to automobile miles traveled could also be imposed as a situation of property growth or occupancy.”

Automobile miles traveled, or VMT for brief, is a manner of calculating the environmental influence of latest developments that’s gaining new consideration from municipal planners.

The thought is to calculate the space of a brand new residential growth from city facilities or transit traces and impose a price to encourage extra building in already densely populated areas and fewer within the exurbs. Actual property corporations detest VMT as a result of it raises the price of constructing new developments out on the horizon.

The VMT provision is so particular, in actual fact, that it makes the proposed initiative look mainly like a tool to outlaw VMT, with lots of different anti-tax provisions tossed in for good measure.

The requirement of repeated voting on revenue-raising measures would make it far harder, maybe even inconceivable, to promote municipal bonds for infrastructure-building and enchancment, the consumers of which anticipate to be assured of a gentle stream of income to pay principal and curiosity.

Rancho Cucamonga, for instance, has began planning for its position because the Southern California terminus of a high-speed rail line to Las Vegas, scheduled to launch building subsequent 12 months.

New parking constructions, doable street widenings and different initiatives will likely be mandatory, which town hoped to finance by new assessments on property close to the positioning.

“This measure calls all that into query now,” Gillison says. “We’re undecided whether or not that’s going to be topic to problem now.”

Some communities might take a serious hit. Azusa officers calculate that town might lose $15.8 million a 12 months as a result of initiative. “That’s 30% of our finances,” says Metropolis Supervisor Sergio Gonzalez. “That will imply cuts to packages throughout the board—no division can be immune.” Meaning impacts on native roads, police, fireplace and emergency providers, and extra.

The promoters of this initiative assert that they’re simply making an attempt to shut loopholes opened in Proposition 13 by judges and politicians. Their pitch relies on the persistent declare that voters don’t have a say in how they’re taxed, that by some means these levies are concocted by shadowy unelected bureaucrats.

That is and has all the time been a lie. Taxes and costs are imposed by voters, both straight on the poll field or by the election of neighborhood leaders who could be voted out of workplace.

It’s the promoters of the brand new initiative who’re working within the shadows. They’re not telling you who their moneybags are. They’re actually not explaining how the measure will profit their large donors on the expense of residents, who anticipate first rate native providers and are susceptible to the siren music that they’ll get all of the providers they want with out paying for them.

The so-called Taxpayer Safety and Authorities Accountability Act is only one extra instance of how particular pursuits love to assert that they’re getting authorities off the backs of the folks, when their actual aim is to saddle up themselves.

Business

Sony warns tech companies: Don't use our music to train your AI

Sony Music Group is sending letters to 700 artificial intelligence developers and music streaming services warning them to not use its artists’ music to train generative AI tools without its permission.

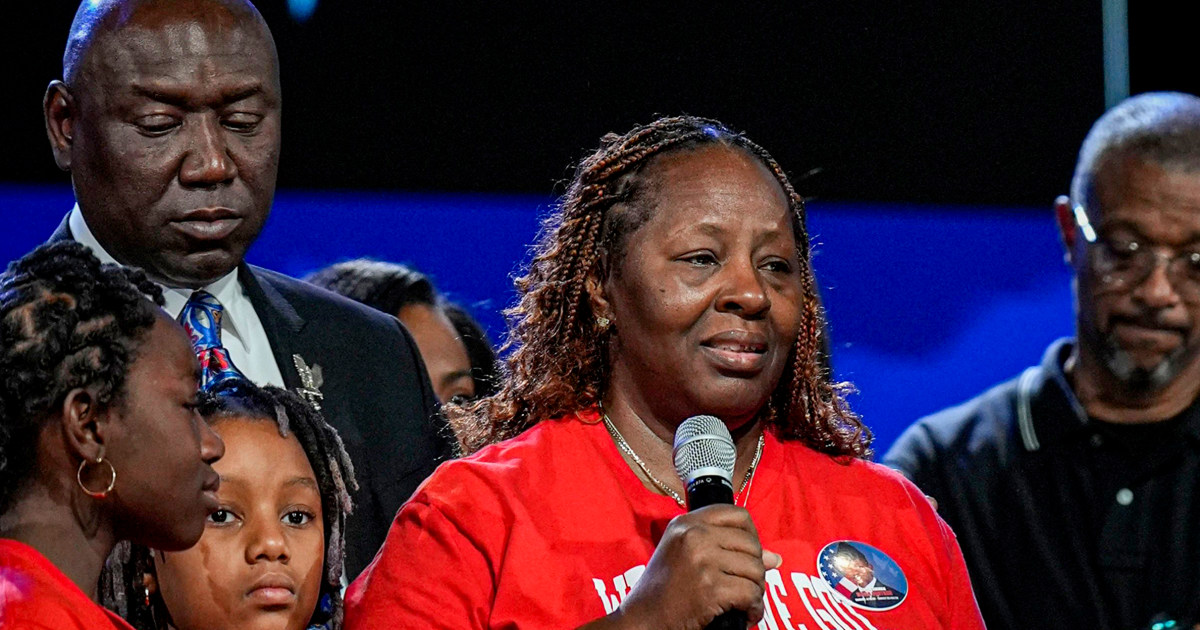

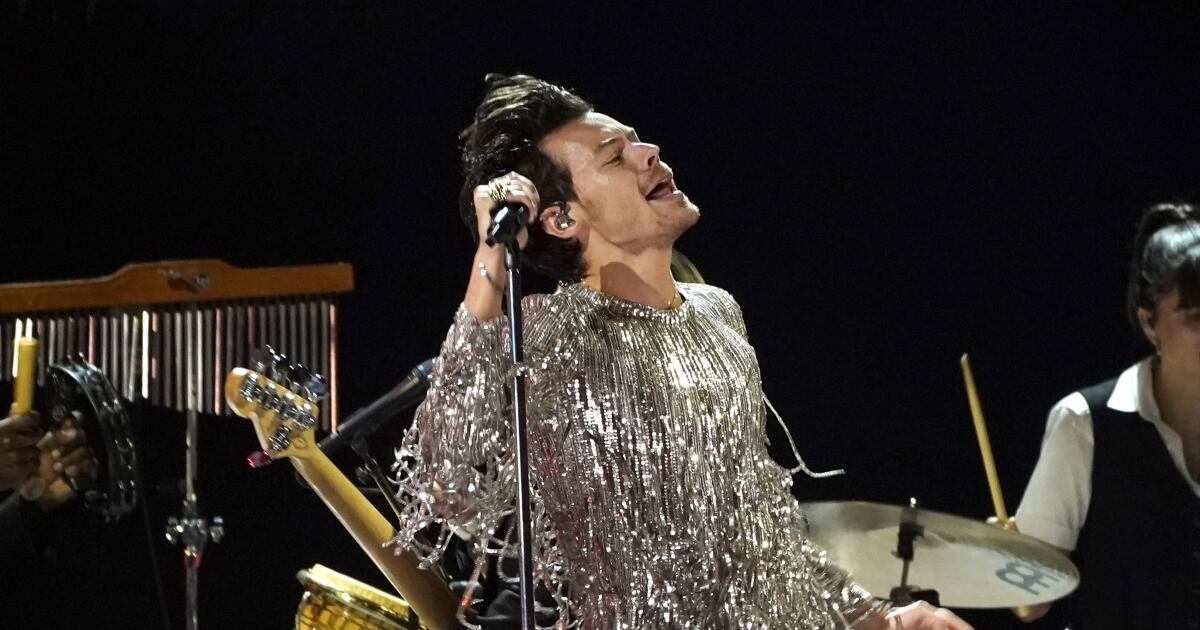

The company — one of the three largest recorded music firms — said it is explicitly opting out of the use of its music for training or developing AI models through text or data mining or web scraping as it relates to lyrics, audio recordings, artwork, musical compositions and images. Sony Music Group artists include Celine Dion, Doja Cat and Harry Styles.

“We support artists and songwriters taking the lead in embracing new technologies in support of their art,” Sony Music Group said in a statement on its website Thursday. “Evolutions in technology have frequently shifted the course of creative industries. … However, that innovation must ensure that songwriters’ and recording artists’ rights, including copyrights, are respected.”

The letters were sent to companies including San Francisco-based ChatGPT creator OpenAI and Mountain View-based search giant Google, according to a person familiar with the matter who was not authorized to speak publicly. OpenAI and Google did not immediately respond to requests for comment.

The move comes as the entertainment industry is grappling with rapid innovations in artificial intelligence technology. Writers and actors raised concerns last summer about whether leaving AI unchecked could threaten their livelihoods. Meanwhile, some creatives have marveled at the advancements that could allow them to pursue bold ideas with tight budgets.

This year, OpenAI unveiled its text-to-video tool Sora, which was used to create a four-minute music video for music artist Washed Out. The director of the video told The Times that Sora helped him depict multiple locations and visual effects that he otherwise couldn’t have.

But AI can also create chaos. Celebrities have dealt with “deep fakes” — false videos or audio depicting a celebrity endorsing certain brands or activities. To help protect their clients against unauthorized use of their voice and likeness, Century City-based Creative Artists Agency is helping talent create their own digital doubles.

On Thursday, two New York voice-over actors sued Berkeley-based AI voice generator business Lovo for unauthorized use of their voices. Lovo did not immediately return a request for comment. The lawsuit was filed in U.S. District Court for the Southern District of New York.

Some people in the entertainment industry have said they would like the AI companies to be more transparent about how they are training their tools and whether they have the appropriate copyright permissions.

OpenAI has said its large language models, including those that power ChatGPT, are developed through information available publicly on the internet, material acquired through licenses with third parties and information its users and “human trainers” provide.

The company said in a blog post that it believes training AI models on publicly available materials on the internet is “fair use.”

But some media outlets, including the New York Times, have sued OpenAI. The newspaper raised alarms about how its stories are being used by the tech company.

In Sony Music Group’s letters to AI businesses, the company said it has reason to believe its content may have been used to train, develop or commercialize artificial intelligence systems without its permission, according to a copy obtained by the Times. Sony Music Group asked the tech companies to provide information regarding that use and why it was necessary.

Sony Music Group, owned by Tokyo-based electronics giant Sony Corp., also wants music streaming providers to add language in its terms of service saying that third parties are not allowed to mine and train using Sony Music Group content, the person familiar with the matter said.

Business

A woman was dragged by a self-driving Cruise taxi in San Francisco. The company is paying her millions

General Motors’ autonomous car company, Cruise, has reportedly agreed to pay an $8-million to $12-million settlement to a woman who was hospitalized after getting dragged along the pavement by a self-driving taxi in San Francisco last year.

The woman, a pedestrian, was struck by a hit-and-run vehicle at 5th and Market streets and thrown into the path of Cruise’s self-driving car, which pinned her underneath, according to Cruise and authorities. The car dragged her about 20 feet as it tried to pull out of the roadway before coming to a stop.

She sustained “multiple traumatic injuries” and was treated at the scene before being hospitalized.

It’s unclear when the settlement was reached or the exact amount, sources familiar with the situation told Fortune and Bloomberg. The condition of the woman, whose name was not released by authorities, is unknown, but a representative of Zuckerberg San Francisco General Hospital told Fortune that she had been discharged.

Cruise initially said that its self-driving car “braked aggressively to minimize impact” but later said the vehicle’s software made a mistake in registering where it hit the woman. The car tried to pull over but continued driving 7 mph for 20 feet with the woman still under the vehicle.

“The hearts of all Cruise employees continue to be with the pedestrian, and we hope for her continued recovery,” Cruise said in a statement.

Cruise halted its driverless operations after its autonomous taxi license was suspended by California’s Department of Motor Vehicles. The company was also accused of lying to investigators and withholding footage of the car crash.

Cruise said this week that it would start testing robotaxis in Arizona with a “safety driver” behind the wheel in case a human needs to take control of the vehicle, according to a company news release.

“Safety is the defining principle for everything we do and continues to guide our progress towards resuming driverless operations,” according to the release.

Business

How YouTube became must-see TV: Shorts, sports and Coachella livestreams

When YouTube launched nearly two decades ago, its first clip was a grainy video of co-founder Jawed Karim speaking to the camera while standing in front of the elephants at the San Diego Zoo.

Not exactly must-see TV.

Since, then the online video giant has increasingly been the entertainment of choice for billions of people. And while the Google-owned service is still often thought of as being the destination for people watching funny short videos on their smartphones, the way that Americans watch it has changed in a big way.

People are increasingly choosing to watch YouTube on their connected TVs rather than on laptops and mobile devices, treating it more and more like a regular television destination.

The San Bruno, Calif.-based video giant said more than 150 million people in the U.S. are watching YouTube on connected TV screens every month, citing December 2022 data. That’s up 11% from 2021. YouTube is consistently the most watched streaming service in the U.S. on a TV in the U.S. every month, even beating Netflix and Amazon’s Prime Video since February 2023, according to Nielsen. The service accounts for nearly 10% of television viewing, the data firm said.

According to research firm Emarketer, U.S. adults spend 36 minutes each day watching YouTube, with 17 of those minutes on a connected TV, four minutes on a desktop or laptop computer and 15 minutes on a mobile device.

A variety of content is driving the company’s evolution. YouTube said TVs accounted for more than 50% of the watch time for its Coachella livestream this year, which is higher than ever before. Views of Shorts, clips that are 60 seconds or less, on connected TVs more than doubled last year, YouTube said.

“We’ve invested in making sure that YouTube really captures the totality of the experience that people want,” said Christian Oestlien, YouTube’s vice president of product management for connected TV. “What we hear from our users is they want to be able to watch their favorite creators but also highlights from their favorite sporting events, listen to their favorite artist and watch their favorite podcast and do it all in this one contained experience.”

At a time when consumers are choosing between multiple streaming services, YouTube has an advantage of having a wide variety of options, from live sports to user-generated videos. The company said the increase in TV watch time comes as connected TVs are becoming more widely available.

TV screen time can be helpful to streamers wishing to court more advertising dollars. This week, television networks and streaming services Amazon and Netflix made gala presentations to advertisers, showing off the programming they have coming up.

YouTube on Wednesday presented to advertisers new features such as branded QR codes and non-skippable assets on connected TVs.

“YouTube is wanting to position themselves not just as a digital advertising option, they want advertisers to see them on the same advertising footing as any other streaming service,” said Brett Sappington, founder of Dallas-based media and insights firm Sappington Media.

YouTube has introduced features to improve the television viewing experience, including the option to watch Coachella performances through a four-way split screen. The company also has shopping options.

“This isn’t my dad’s TV or my grandma’s TV,” Oestlien said. “This is TV rethought for a new generation.”

YouTube video creators have also embraced TV viewing, Oestlien said. In the last three years, the number of top YouTube creators who receive most of their watch time from TV screens has quintupled, YouTube said.

YouTube has also gotten a boost from its deal to become the home of pro football’s “NFL Sunday Ticket” game package. Fans will watch live games on YouTube on Sunday, then come back and watch clips through its video library or commentary from its creators, Oestlien said.

“It really becomes this surround-sound experience where, as a football fan, you can come to YouTube any day of the week,” he said.

YouTube and other streaming services have been competing for sports league rights in order to increase viewership. Amazon has the NFL’s “Thursday Night Football” games and has bid for a package of NBA matches. On Wednesday, Netflix announced it had secured two Christmas NFL games for 2024.

-

Politics1 week ago

Politics1 week agoBiden takes role as bystander on border and campus protests, surrenders the bully pulpit

-

Politics1 week ago

Politics1 week ago'You need to stop': Gov. Noem lashes out during heated interview over book anecdote about killing dog

-

Politics1 week ago

Politics1 week agoRFK Jr said a worm ate part of his brain and died in his head

-

News1 week ago

News1 week agoMan, 75, confesses to killing wife in hospital because he couldn’t afford her care, court documents say

-

World1 week ago

World1 week agoPentagon chief confirms US pause on weapons shipment to Israel

-

Politics1 week ago

Politics1 week agoHere's what GOP rebels want from Johnson amid threats to oust him from speakership

-

World1 week ago

World1 week agoPro-Palestine protests: How some universities reached deals with students

-

World1 week ago

World1 week agoConvicted MEP's expense claims must be published: EU court